LBank drives Meme asset resonance and value reshaping

In the crypto world, consensus is value, and Meme is the most communicative and emotionally penetrating consensus carrier. In the early days of the industry, the industry experienced a period of competition among CEXs for liquidity and users, and then entered an era dominated by technical narratives. The market has long been guided by elite narratives constructed by VCs, KOLs, and project parties. However, the subsequent collapse of FTX and Luna shook this system, and the market began to reflect and reconstruct.

The launch of Bitcoin ETF in 2024 symbolizes the formal integration of cryptocurrencies into mainstream finance, but it is still a victory for institutions. What really breaks the barriers is the meme assets that first exploded under the emotional recovery in 2025 - driven by the community, priced by culture, challenging the old order, and reshaping the value logic.

As the first trading platform with a strategic focus on Meme, LBank seized the opportunity of the main upward trend and built a complete investment closed loop with the three major strategies of "fastest coin listing, first in depth, and transaction compensation", forming a positive flywheel from traffic capture to asset retention.

Behind the Get Rich Effect: LBank Breaks Through the Traffic Critical Point

True Alpha comes from accurate prediction of market pulse.

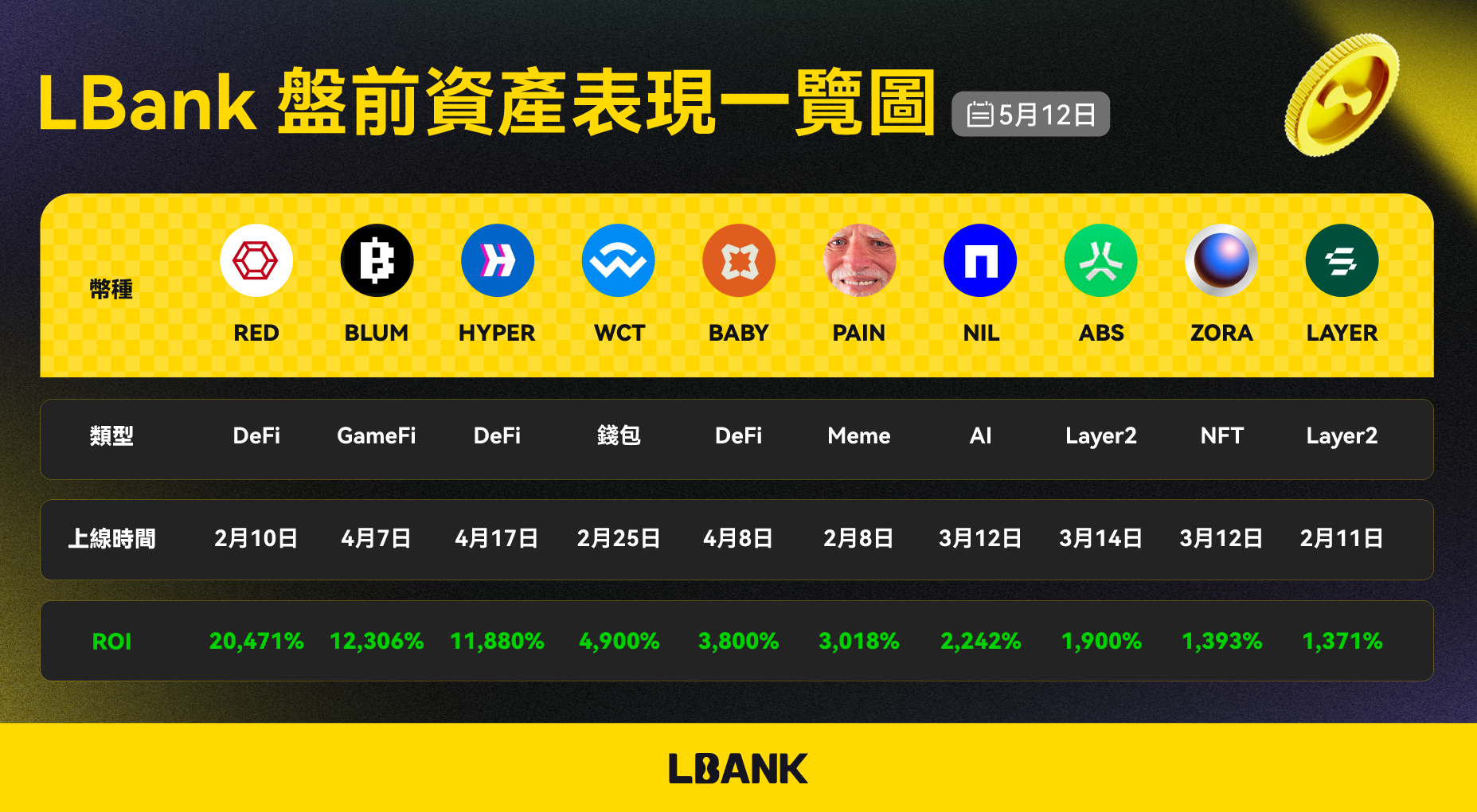

According to CoinGecko data, in April 2025, LBank achieved a phased leap in the Meme asset track, which not only continued to consolidate its platform position, but also once again verified the forward-looking nature of its strategic layout. LBank's average daily spot trading volume is stable at around US$4 billion, and its derivatives business is growing rapidly, ranking among the top 5 global exchanges, demonstrating strong market carrying capacity. More importantly, there are many highlights in the asset performance level - the average increase of the top 5 Meme assets launched on the platform is 3,166%, far exceeding the industry's performance during the same period, showing a strong ability to screen assets and capture trends.

Among them, LBank first captured and launched projects such as RFC, TROLL, and HOUSE before they became popular. As the market heats up, these projects have increased by 5,650%, 1,614%, and 3,759% respectively in a single month, which once again verifies the platform's foresight and accuracy in identifying potential assets and the pace of investment. From the perspective of investment returns, the average rate of return of LBank's newly launched assets is more than 80% higher than that of other mainstream CEXs, further consolidating its image as a first-time platform in the minds of investors.

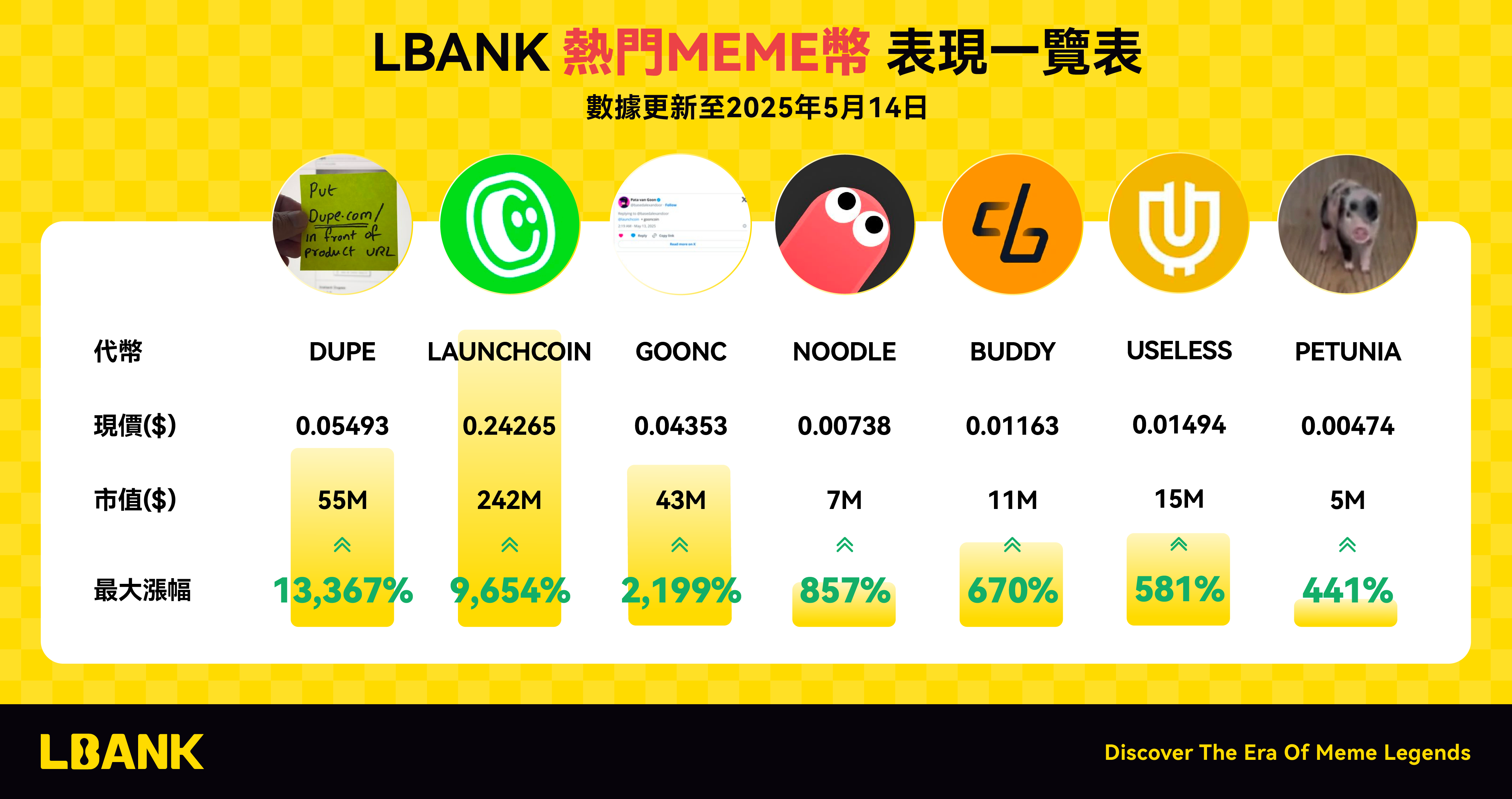

In May, LBank continued to lead in the Meme asset field, especially in the stage of intensified competition among new forces. The platform's rapid response to LetsBook and Believe projects was significantly faster than other mainstream platforms. With precise control of the layout rhythm and delivery window, the two major projects, DUPE and LAUNCHCOIN, achieved the maximum increase of 13,367% and 15,194% respectively (data as of May 15) with the help of extreme community communication and platform-level linkage support. They not only became the star assets in this round of market, but also once again confirmed LBank's industry-leading position in the identification and cashing efficiency of hot products, and its image as a "hot product incubator" was further consolidated.

This series of achievements is not accidental, but the result of LBank's comprehensive efforts in strategy, rhythm and execution. By strengthening the asset screening mechanism, optimizing the liquidity structure, and improving the trading experience, the platform has successfully created a Meme asset screening channel with both "speed advantage" and "quality assurance", taking the lead in seizing the dual high ground of traffic and trust in the new cycle.

Depth is heat: LBank builds a liquidity hub for Meme assets

In the highly volatile Meme asset market, liquidity depth has become a core indicator for measuring the competitiveness of trading platforms. Through systematic and in-depth construction, LBank has successfully solved the problems of drastic price fluctuations, large transaction slippage, and poor user experience caused by insufficient liquidity, effectively ensuring the stability of asset prices and the reasonable release of market sentiment. The platform occupies a leading trading share in core Meme projects, maintains active trading volume, forms a virtuous cycle of price discovery and sentiment amplification, and creates a stable and efficient investment environment.

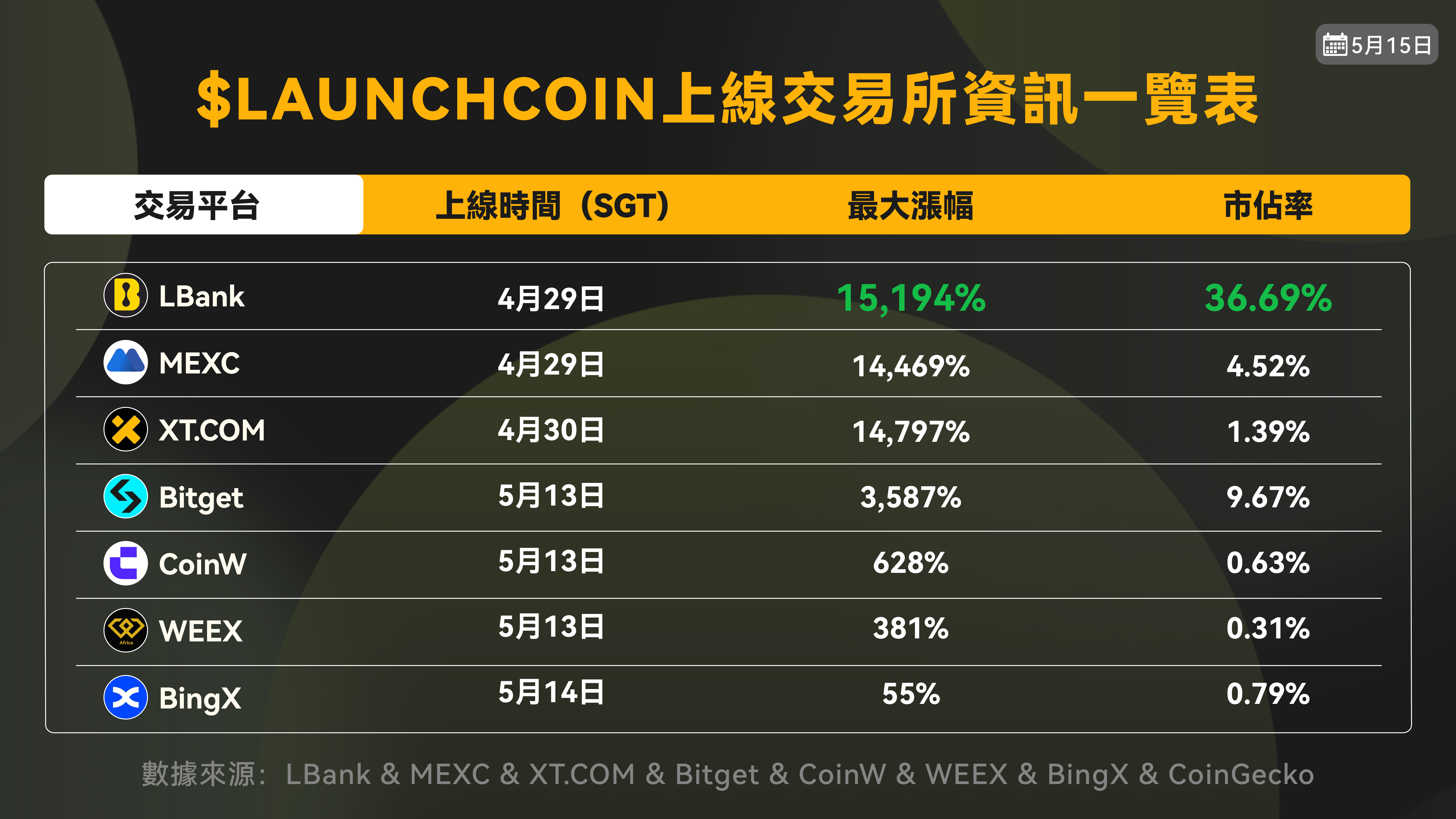

Among them, LAUNCHCOIN's trading performance is particularly outstanding, becoming a typical embodiment of the platform's depth advantage. Its market share in the platform is as high as 36.69%, far exceeding other exchanges. It not only ranks first in daily trading volume, but also forms a closed loop of price discovery and sentiment amplification. This depth advantage enables LBank to always maintain a trading advantage during the life cycle of hot projects and become the preferred channel for Meme capital inflows.

For Meme assets, depth is not only a guarantee of liquidity, but also the basis for consensus realization. Without a sufficiently deep market, no matter how strong the sentiment is, it will only be short-lived. During the outbreak of Believe assets, LBank has formed a feedback mechanism of "strong consensus + strong depth", enabling users to trade in fluctuations and advance and retreat in the rise. The stronger the depth, the longer the vitality of the Meme; the more stable the market, the greater the intensity of FOMO - this is the liquidity logic that LBank constantly verifies.

From project selection, launch rhythm, to transaction depth and user growth, LBank uses a set of coordinated strategies to implement "depth first" into the details and transform it into a deterministic expectation of win-win for the platform and users.

LBank adds a layer of “certainty” to Meme investments

The essence of the meme market is high volatility and high uncertainty driven by emotions. Faced with the high-speed rotation of the market and the fierce competition for the first-time position, most retail investors need tools with higher professional thresholds and a sense of trust and security brought by a "bottom-line mechanism".

LBank is the first to launch the "trading compensation" mechanism. For users who suffer losses due to non-user subjective reasons when participating in specific projects on the platform (such as pre-market), the platform will provide compensation in proportion to the situation. This mechanism not only lowers the risk threshold for retail investors to participate in early assets, but also turns "first-time buy" from a high-risk game into an investment strategy with controllable costs. In essence, it is a reflection of LBank's confidence in its own screening mechanism, project quality and liquidity capabilities, and it is also a true commitment of the platform and users to "share risks".

But compensation is not the end, risk control is the premise. LBank's industry-leading risk control system has become the underlying cornerstone of platform users' trust. Throughout 2024, the platform successfully intercepted more than $1.2 billion in suspicious transactions through intelligent risk control, of which 45% were malicious withdrawals, effectively protecting the security of user assets. In order to further enhance risk resistance, LBank has also established a $100 million risk protection fund dedicated to dealing with unforeseen risks under extreme market conditions, building a final asset defense line for the platform.

More than compensation, more importantly, prevention. LBank has evolved from a single transaction matching platform to a multi-layered structured transaction ecosystem with high fault tolerance, active risk control and asset protection mechanism. Especially under the characteristics of the violent fluctuations in the sentiment of the Meme track and the extremely short window for boarding, this mechanism effectively improves the user's confidence in holding coins, and further strengthens the trust structure of the platform as the preferred venue for Meme assets.

Beyond Meme, LBank’s “Long-termism”

In this transformation from consensus to culture, from stories to emotions, LBank did not choose to follow, but took the initiative to define the trading standards of the Meme era. From "the fastest coin listing" to "the first in depth", and then to the "compensation for transactions" mechanism, the platform has built a replicable, sustainable, and highly alpha overflow investment closed loop with a more offensive and secure combination. Behind this is the strategic result of a deep understanding of user behavior, asset life cycle, and market cycle.

For LBank, Meme is just an entrance, not an end. When depth becomes an extension of emotion and trust becomes a guarantee of transactions, the platform's capabilities are continuously expanding. No matter how the market changes in the future, LBank has laid a solid foundation at the mechanism and cultural level, and built a bearing system for a wider range of consensus assets.

It is foreseeable that as Meme assets gradually move towards "assetization", "scale" and "institutionalization", the competition between platforms will no longer be just a contest of speed and traffic, but a deep game of trust, risk control and ecological power. LBank has completed the transition from narrative drive to mechanism precipitation in the Meme wave, and has taken the lead in building a closed loop of value under the new paradigm.