What signals did the new SEC chairman’s first Crypto-themed speech reveal?

Source: SEC

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Editor's Note: On May 12, local time in the United States, the Crypto Asset Task Force under the U.S. Securities and Exchange Commission (SEC) held the fourth cryptocurrency roundtable. The theme of this meeting was "Tokenization: Assets on the Chain - The Intersection of Traditional Finance and Decentralized Finance."

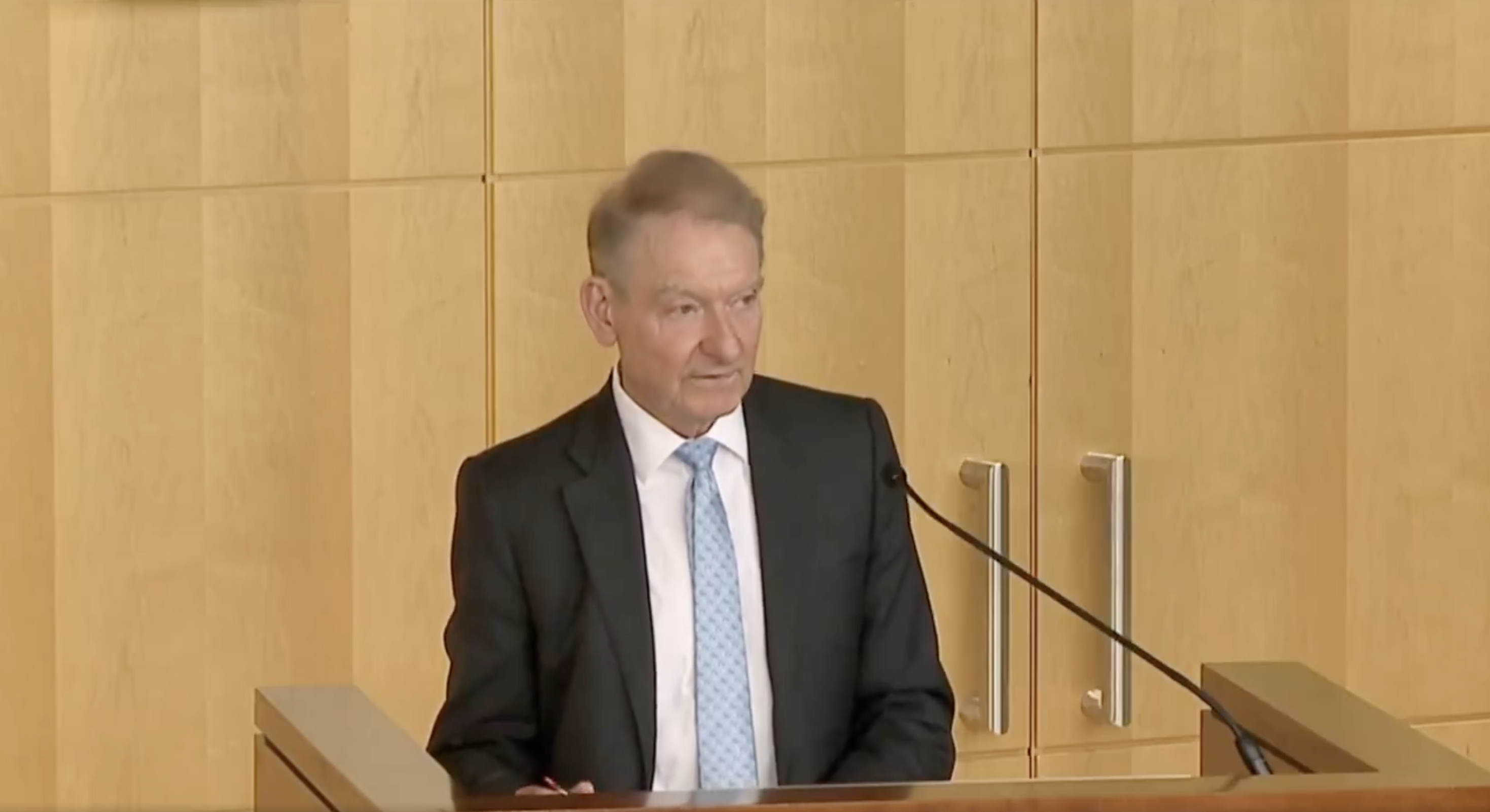

It is worth mentioning that Paul Atkins, who officially assumed office as SEC Chairman on April 22, attended the roundtable meeting and gave a long speech on cryptocurrency for the first time as SEC Chairman (Note: At the third meeting, Paul Atkins, who had just taken office for four days, delivered an opening speech, but it was only a few words).

In his speech, Paul Atkins mentioned that "securities are increasingly migrating from traditional (off-chain) databases to blockchain-based (on-chain) ledger systems. The core priority during his tenure is to establish a reasonable regulatory framework for the crypto asset market, formulate clear rules for the issuance, custody and trading of cryptocurrencies , and continue to curb illegal activities. In addition, the SEC's regulation of cryptocurrencies will no longer rely on controversial law enforcement actions, but will use existing rule-making powers, interpretation powers and exemptions to set precise and applicable standards for market participants.

The following is the full text of Paul Atkins’ speech, translated by Odaily Planet Daily.

Thank you, and good afternoon. It is my honor to speak to such distinguished guests today at this roundtable on tokenization. Thank you to the panelists for joining us.

This afternoon's discussion comes at an opportune time as securities are increasingly migrating from traditional (or "off-chain") databases to blockchain-based (or "on-chain") ledger systems.

The migration of securities from off-chain systems to on-chain systems is comparable to the evolution of audio recording from vinyl records to cassette tapes to digital software decades ago. Encoding audio into digital file formats that can be easily transferred, modified, and stored has unlocked tremendous innovation potential for the music industry. Freed from the shackles of static, fixed formats, audio is suddenly compatible and interoperable across multiple devices and applications. It can be combined, split, and programmed to create entirely new products. This has also spawned new hardware devices and streaming business models that have greatly benefited consumers and the U.S. economy.

Just as the digital audio revolution reshaped the music industry, securities on the blockchain are expected to transform the securities market through new ways of issuing, trading, holding and using securities. For example, on-chain securities can use smart contracts to distribute dividends to shareholders transparently and regularly; tokenization can also transform relatively illiquid assets into liquid investment opportunities and promote capital formation. Blockchain technology is expected to open up a large number of innovative application scenarios for securities and cultivate new market activities that are not yet covered by current SEC regulations.

To realize President Trump’s vision of “making the United States a global crypto asset hub,” the SEC must keep pace with innovation and assess whether the existing regulatory framework needs to be adjusted to accommodate on-chain securities and other crypto assets. Regulations designed for off-chain securities may not be compatible or necessary for on-chain assets, which could inhibit the development of blockchain technology.

A core priority during my tenure is to establish a reasonable regulatory framework for the crypto-asset market, with clear rules for issuance, custody and trading, while continuing to deter illegal activities. Clear rules are essential to protect investors from fraud - especially to help them identify illegal scams.

The SEC has entered a new era. Policymaking will no longer be achieved through ad hoc enforcement actions, but rather through the use of existing rulemaking, interpretation, and exemptions to set precise and applicable standards for market participants. Enforcement will return to the original intent of Congress - focusing on combating violations of statutory obligations, especially those involving fraud and market manipulation.

This work requires collaboration across the SEC, so I am pleased that Commissioners Uyeda and Peirce have come together to form the Crypto Assets Task Force. The SEC has long been plagued by policy silos, and this task force shows how we can break down departmental barriers and provide the public with long-awaited policy clarity and certainty.

Next, I will describe the three key areas of focus for cryptoasset policy – issuance, custody, and trading.

issued

First, I will push the SEC to develop clear and reasonable guidance for the issuance of crypto assets that are securities or investment contracts. Currently, only four crypto asset issuers have completed financing through registered offerings or Regulation A exemptions. Issuers generally avoid this type of offering, in part because it is difficult to meet the corresponding disclosure requirements. If the issuer does not intend to issue ordinary securities such as stocks, bonds or notes, it is also difficult for the issuer to determine whether the crypto asset constitutes a "security" or is subject to an investment contract.

Over the past few years, the SEC has first adopted what I call an “ostrich policy” response—they imagined that crypto assets would disappear on their own—and then switched to a “shoot first, ask questions later” enforcement and regulatory model. Although they have claimed to be willing to communicate with potential registrants (“welcome to consult”), this has proven to be short-lived at best and even misleading at most—because the SEC has not made the necessary adjustments to registration forms to adapt to new technologies. For example, the S-1 form still requires detailed disclosure of executive compensation and use of funds, information that may be neither relevant nor important to crypto asset investment decisions. Although the SEC has adjusted registration forms for asset-backed securities and real estate investment trusts, it has not taken the same measures for crypto assets, which have attracted increasing attention from investors in recent years. We cannot encourage innovation by “cutting the feet to fit the shoes.”

I am committed to pushing the SEC to develop new guidelines. The SEC staff recently issued a statement on certain registered offerings and disclosure obligations clarifying that certain offerings of crypto assets are not subject to federal securities laws. I expect the staff to continue to follow my instructions to provide clarification on other types of offerings and assets. However, existing registration exemptions and safe harbors may not fully apply to certain offerings of crypto assets. I believe this reliance on staff statements is extremely temporary - action at the SEC level is critical and necessary, and I have asked the staff to evaluate whether additional guidance, registration exemptions, and safe harbors are needed to open up new avenues for the issuance of crypto assets in the United States . I believe the SEC has sufficient discretion under the securities laws to accommodate the crypto industry, and I will certainly push for implementation.

Hosting

Second, I support giving registrants more autonomy to choose how to custody crypto assets . Staff recently removed a significant barrier to companies offering crypto custody services by revoking Staff Accounting Bulletin No. 121 (SAB-121). The bulletin was a major mistake—staff had no authority to replace Commission action with such a broad scale without notice and comment on the rulemaking process. This move not only creates unnecessary confusion, but also has an impact far beyond the SEC's authority. But in addition to repealing SAB-121, we can do more to promote competition in the compliant custody services market.

It is necessary to clarify the identification standards for "qualified custodians" under the Investment Advisers Act and the Investment Company Act, and to set reasonable exemptions for common operations in the crypto asset market. Many advisors and funds use self-custody solutions, which are more advanced than the technology used by some custodians on the market and can more effectively protect asset security. Therefore, the custody rules may need to be updated to allow advisors and funds to conduct self-custody in certain circumstances.

In addition, the current "special purpose broker" framework may need to be abolished and a more reasonable system established. There are currently only two special purpose brokers in operation, which is obviously due to the significant restrictions imposed by the model. Brokers have never been prohibited from custodial non-securities crypto assets or securities crypto assets, but SEC action may be needed to clarify the application standards of the customer protection rule and the net capital rule to such activities.

trade

In addition, I support allowing registered institutions to trade a wider variety of products on the platform based on market demand - these businesses were previously prohibited by previous SECs. For example, some brokers have attempted to launch "super applications" that integrate securities, non-securities and other financial services. Current securities laws do not prohibit registered brokers with alternative trading systems from providing non-securities trading services, including "paired trading" of securities and non-securities. I have asked staff to study how to modernize the ATS regulatory system to better accommodate crypto assets, and to evaluate whether further guidance or rules are needed to support the listing and trading of crypto assets on national securities exchanges.

As the SEC builds a comprehensive regulatory framework, securities market participants should not be forced to go overseas to innovate in blockchain. I will explore whether conditional exemptions can be granted to registered and unregistered firms that attempt to launch new products and services—innovations that may not fully comply with existing regulatory requirements.

I look forward to working with my colleagues in the Trump Administration and Congress to make the United States the best place to participate in the global crypto-asset markets.