BitMEX Alpha: Trader's Weekly Report

Quick Facts

● Cryptocurrency markets fell sharply this week, with Bitcoin quickly falling to the $92,000 level. The sell-off was driven by three main factors: the overall stock market correction, rising inflation concerns after Trump's inauguration, and most importantly, the US Department of Justice was allowed to liquidate $6.5 billion worth of Bitcoin seized from the dark web market "Silk Road".

● Artificial intelligence-related tokens suffered the heaviest sell-off, and early holders took profits. Similar to the previous meme coin craze, late buyers were caught in a "musical chairs" game, and the number of marginal buyers continued to decrease.

● In our trading strategy section, we will analyze the market positioning strategy for the first quarter of 2025 based on Arthur Hayes' latest article " Sasa ". Hayes believes that the cryptocurrency bull market will continue in the first quarter due to continued liquidity injection, but the second quarter may face liquidity and political uncertainties.

Data Overview

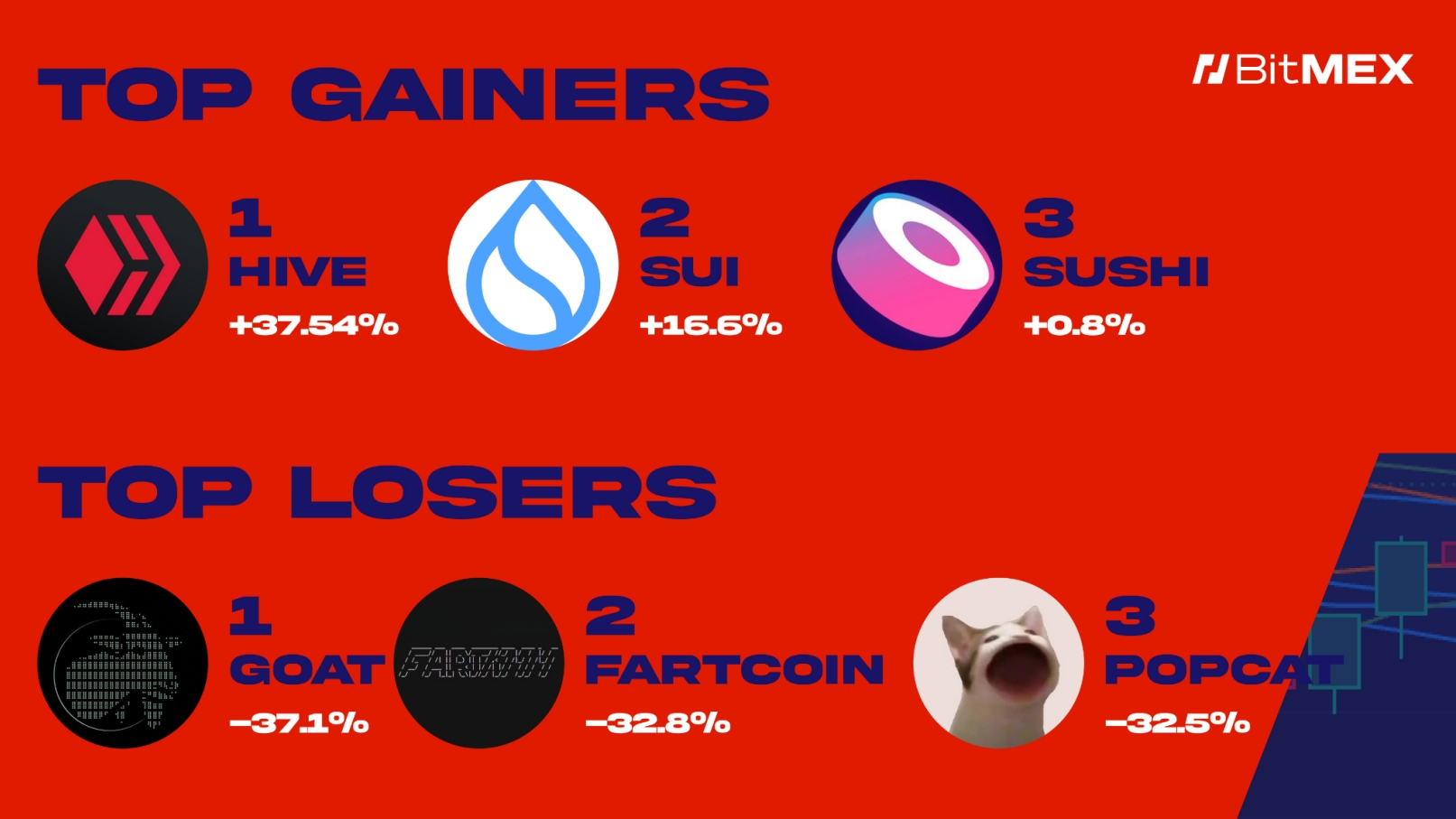

Best Performer

● $HIVE (+37.5%): As an alternative L1 platform that provides free gas to users, HIVE rebounded strongly this week and became the best performing token on BitMEX.

● $SUI (+16.6%): SUI continues to maintain its strong momentum and exceeds market expectations

● $SUSHI (+ 0.8%): SUSHI remains strong despite the overall market decline

Worst performance

● $GOAT (-37.1%): As one of the earliest AI concept tokens, GOAT continues to fall under pressure.

● $FARTCOIN (-32.8%): FARTCOIN also performed poorly, and the AI token sector seems to be repeating the decline of meme coins. Is the market of this sector over?

● $POPCAT (-32.5%): As one of the best performing meme coins in 2024, POPCAT is currently falling

This week's news

Macro dynamics

● ETH ETF outflows this week: $117.5 million ( source )

● BTC ETF net inflows this week: $462 million ( source )

● UK regulator: Ethereum and SOL staking are no longer classified as collective investment schemes ( source )

● Cleanspark’s holdings surpassed 10,000 BTC, becoming the fourth largest corporate holder ( source )

● Block is expected to become the first Bitcoin reserve company to enter the S&P 500 index ( source )

● Circle donates 1 million USDC to Trump’s inaugural committee ( source )

● US court schedules Do Kwon jury trial for January 2026 ( Source )

● Former FTX executive acquires FTX European business, plans to expand Backpack exchange ( source )

Project News

● UK financial regulator announced: Ethereum and Solana staking are no longer considered collective investment schemes ( source )

● Ripple and Chainlink reach strategic cooperation: enhance RLUSD stablecoin functionality through secure data feed ( source )

● Solana considers adopting a scalability solution based on lattice cryptography: aimed at coping with the threat of quantum computing and surpassing Ethereum ( source )

● Bitcoin Layer 2 solution Stacks suffered a 5-hour network outage: all transactions were suspended ( source )

● Ethena announces 2025 roadmap: plans to launch Telegram payment app ( source )

● Polymarket forecasts that the probability of Solana ETF being approved by the SEC in 2025 has increased significantly ( source )

Trading ideas

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news and it is recommended that you do your own research before making any transactions. We are not responsible for any transaction results and do not guarantee returns.

Arthur Hayes' 2025 Cryptocurrency Market Cycle Prediction

TL;DR:

1. **Risk assets will continue to be supported:** As long as the RRP balance continues to decline, funds will flow into risky assets such as government bonds or cryptocurrencies. Short-term traders can seize this trend in Q1.

2. **Watch for the turning point in mid-March:** If TGA usage slows or Fed policy shifts, the market may peak or go sideways. It is recommended to remain flexible and tighten stop losses at the end of Q1.

As we head into 2025, the central question facing crypto investors is: Can the "Trump rally" continue? In his previous article "Trump Truth," Arthur Hayes pointed out that the market's overly high expectations for the Trump administration to introduce favorable crypto policies could lead to a short-term price correction. This risk still exists, but it needs to be weighed against another key factor: US dollar liquidity. Currently, BTC (and risk assets as a whole) still fluctuates with changes in the supply of US dollars, which is mainly dominated by the "monetary masters" such as the Fed and the US Treasury.

Current Market Conditions

● BTC 2022 bottom BTC hit bottom in Q3 2022, just as the Fed's RRP peaked. When Yellen shifted long-term Treasury bonds to short-term Treasury bonds, more than $2 trillion flowed out of the RRP. This actually injected a lot of liquidity into the global market, driving a surge in crypto and US tech sectors.

● Disappointment VS Liquidity Push The key question for Q1 2025 is whether continued USD liquidity injections can offset the disappointment caused by the Trump administration's slow progress in crypto and business reforms. If the supply of funds remains ample, the market may remain strong, prompting traders to increase their positions. At Maelstrom Fund, Arthur Hayes is closely watching the interaction between policy outcomes and liquidity flows.

Below, Arthur explains why the Fed's impact in Q1 may be relatively small, and the Treasury's move on the debt ceiling is key. If the political deadlock continues, the Treasury will be forced to use its TGA at the Fed to inject liquidity into the system - which will provide a favorable environment for crypto prices. For the specific details of the RRP/TGA mechanism, readers can refer to his earlier article "Teach Me Daddy".

Disadvantages: Fed remains a concern

1. QT continues The Fed is still shrinking its balance sheet at a rate of $60 billion per month. There are no major changes in forward guidance, which means that Q1 (January-March) will tighten by about $180 billion.

2. RRP balance declines RRP is close to zero. To accelerate the zeroing process, the Fed lowered the RRP rate by 0.30% in December 2024 (slightly higher than the benchmark rate adjustment). This accelerated the shift of MMFs to higher-yielding Treasury bonds.

○ Trader Implications: Pay attention to the remaining $237 billion RRP balance. As it approaches zero, this amount of money will flow into the market, offsetting the $180 billion contraction brought by QT. The net result is that $57 billion of liquidity will be injected in Q1.

3. Long-term outlook If yields soar or TGA needs to be replenished after it is exhausted, the Fed may face pressure to turn around - it may stop QT or even restart QE. This will have little impact on Q1, but it will be important for the second half of 2025. Arthur expects this to happen between May and June, when the TGA balance will be completely exhausted.

Positive factors: The Treasury may inject up to $612 billion in liquidity in Q1

1. Debt Ceiling Impasse Yellen is expected to launch "extraordinary measures" to fund the government in mid-January (14-23). Because the total debt is limited, the Treasury must use its TGA instead of issuing new debt.

2. TGA: $722 billion If Congress fails to raise the debt ceiling, this fund will be exhausted. As the Treasury uses the TGA, the market will receive a positive liquidity shock. A decline in the TGA balance usually pushes up stocks and crypto. This pattern may continue throughout Q1, supporting market prices.

3. Timing of debt ceiling increase Politically, the Trump administration has weak support in Congress. Trump failed to force a debt ceiling measure through the end-2024 spending bill. The Democrats will not easily cooperate. So expect the stalemate to continue. The TGA may support daily government spending until May/June, when a deal may be reached under the threat of default or shutdown. The key point is March. By then, the TGA may have been exhausted by 70-80%. If the market perceives that the TGA funding pool has bottomed out and the debt ceiling issue remains unresolved, panic may occur. Conversely, if a solution is imminent, the market may rise on optimism - until the liquidity contraction brought about by the TGA replenishment.

What happens after Q1?

1. TGA supplement after debt ceiling is raised: Once the ceiling is raised, the Ministry of Finance will issue new bonds to rebuild TGA. This will cause liquidity to shrink.

2. Tax Day (April 15): Tax payments reduce the amount of money in circulation, which is another liquidity-contracting factor.

3. **Historical pattern:** In 2024, BTC peaked in mid-March (near $73,000), then fell after going sideways in April. History may repeat itself: Q1 rise followed by Q2 weakness.

Trading inspiration

1. **Rise at the beginning of the year, pullback in spring: **Many traders planned to take advantage of liquidity in Q1 and then exit before TGA replenishment and tax loss.

2. **Profit taking strategy:** If holding crypto or high beta stocks, consider reducing or hedging in late March/early April.

3. **Planning for the next round of liquidity cycle: **After the mid-year liquidity dry up, pay attention to a new round of liquidity - which may appear in Q3 or when the Fed/Treasury turns again.

Other factors besides US dollar liquidity

Of course, no single indicator or measure of liquidity is completely reliable. Other important macro variables include:

● China's credit expansion or contraction: RMB credit expansion could push up global risk assets, while contraction would put pressure on them.

● Bank of Japan policy shift: The Bank of Japan's unexpected interest rate hike may trigger the appreciation of the yen, affect the global foreign exchange market, and may slow down the flow of funds to US dollar assets.

● Trump and Bessent’s sudden devaluation strategy: If the government attempts to significantly devalue the dollar against gold or major currencies, it could immediately change the global financial landscape.

● The speed and effectiveness of Trump's policy agenda: If pro-crypto legislation progresses slowly or is weakened, the "Trump rally" may lose momentum. If it exceeds expectations, it may lead to greater gains.

Despite these uncertainties, data on RRP and TGA liquidity changes since the end of 2022 show strong reliability: even in a rising interest rate environment, crypto and stock markets have risen as US dollar liquidity has expanded. This is why Maelstrom pays close attention to these mechanisms when assessing risks.

Actionable trading strategies

1. Short term: Increased risk appetite: Thanks to the potential $612 billion liquidity injection in Q1, Arthur Hayes and the Maelstrom team see an opportunity window. They are adding to their positions across the board.

2. DeSci: Arthur has established positions in low-profile projects such as $BIO, $VITA, $ATH, $GROW, $PSY, $CRYO, and $NEURON, believing that they may be revalued as the DeSci narrative heats up. For detailed analysis, please refer to " Degen DeSci ".

3. Exit at the right time: If the market continues to rise until March, Maelstrom is ready to lock in profits and may turn to short selling or transfer into stablecoins to cope with the expected Q2 volatility.

4. Stay flexible: Market narratives change rapidly. The "Trump rally" really fades by the end of December 2024, so keep an open mind. New data can quickly change expectations. The key is not to cling to outdated views.

Risk Management Tips

No one can accurately predict the future. Good traders know how to adjust their strategies according to new circumstances, knowing when to take profits and how to stop losses when their strategies deviate from expectations.

Summarize

The short-term risk for Q1 2025 is that Trump's pro-crypto policy rollout may be disappointing. However, the liquidity wave driven by the Fed and the Treasury Department may continue to support the market, which is an important positive. By the end of March, Arthur Hayes and Maelstrom expect to reduce risk exposure and begin to reduce positions to cope with the impact of TGA exhaustion and the next wave of political deadlock or liquidity contraction.

That's the nature of trading: sometimes you can predict it correctly, sometimes you can't - but the market rarely moves exactly when and how you expect it to. Arthur Hayes' strategy is to take advantage of the wave when it is forming and get out before it breaks. The goal is to ensure that there are more winning trades than losing trades, ensuring that the fund can continue to play the game when the market turns next.