The revelation of the Ponzi model of blockchain games over the generations

Original | Odaily Planet Daily

Author | Nanzhi

A Ponzi scheme is a financial fraud that promises high returns to investors but has no real external investment profit-making methods. Instead, it uses the funds of later investors to pay the returns of earlier investors.

Axie Infinity triggered a craze for GameFi in 2021. Various GameFis that "return the investment in N days" began to emerge. In the third quarter of 2021, several GameFis appeared that made a group of users quickly rich, but also caused heavy losses to the last users who entered the market. Disassembling the underlying economic models of these GameFis, they are all Ponzi models.

Therefore, at the end of 2021, some people suggested that the two definitions of GameFi and chain games should be distinguished. The former is a (Ponzi) DeFi model that applies the game shell, while the latter is a game that introduces blockchain technology, and the subjects of focus are different.

In this article, Odaily Planet Daily will dismantle the Ponzi economic model of some mainstream GameFi from 2021 to 2022, showing readers the details of bubble generation, regulation and termination throughout its life cycle, and also serving as a reference for the current GameFi economic sector.

Participants and process deconstruction, key definitions

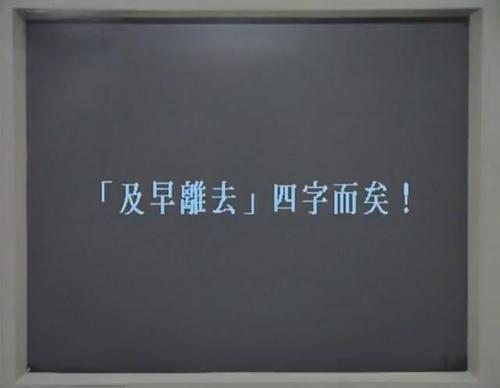

The parties involved in a GameFi life cycle are as follows:

Game participants: users who invest their assets into the GameFi economy and earn profits by generating tokens through game props;

Token investors: buy project tokens but do not participate in the GameFi economy and profit through secondary sell-offs;

Project Party: Responsible for the operation of the GameFi economy. Profits are made through entry and exit taxes, trading market taxes, etc. The main responsibilities include attracting new users to join and controlling the pace of joining; controlling the intensity of user selling; and eliminating certain bubbles as much as possible.

The process of GameFi economy is simplified as follows:

Users invest money to purchase game asset output props ( mining machines );

Users produce game assets through mining machines, which can be reinvested in the game or exchanged for hard currency (USDT, etc.). The daily output of all users is recorded as instantaneous expected income;

The funds invested by users minus the transferred funds constitute the real fund pool;

The instantaneous profit expectation ÷ the real capital pool is recorded as the bubble rate , which measures the degree of bubble development of the Ponzi economy. As players continue to enter the market and the number of mining machines continues to increase, the real capital pool continues to lose, and the value continues to increase, which means it is closer to collapse.

Eventually, due to lack of confidence : the number of reinvesting users decreased, and most users turned to withdrawing funds from the funding pool; insufficient funds : the rate of incoming users was lower than the output rate of mining machines; capital outflow : due to various mechanisms, incoming funds did not enter the real funding pool, resulting in the fragility of the economy; excessive bubble : the bubble rate was too high to be supported, etc., under the influence of multiple factors, the bubble burst and the economy collapsed.

Other key definitions are as follows:

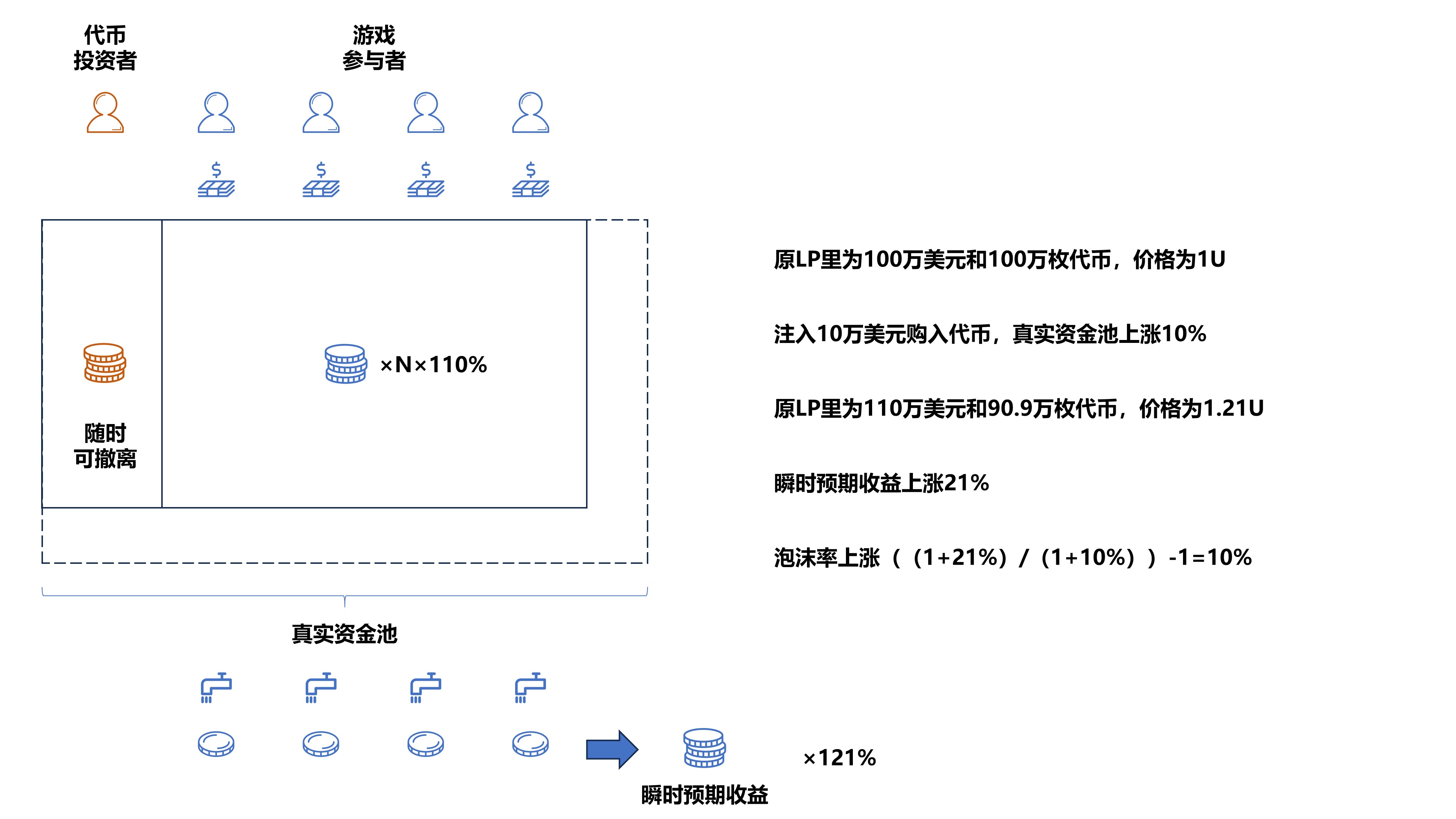

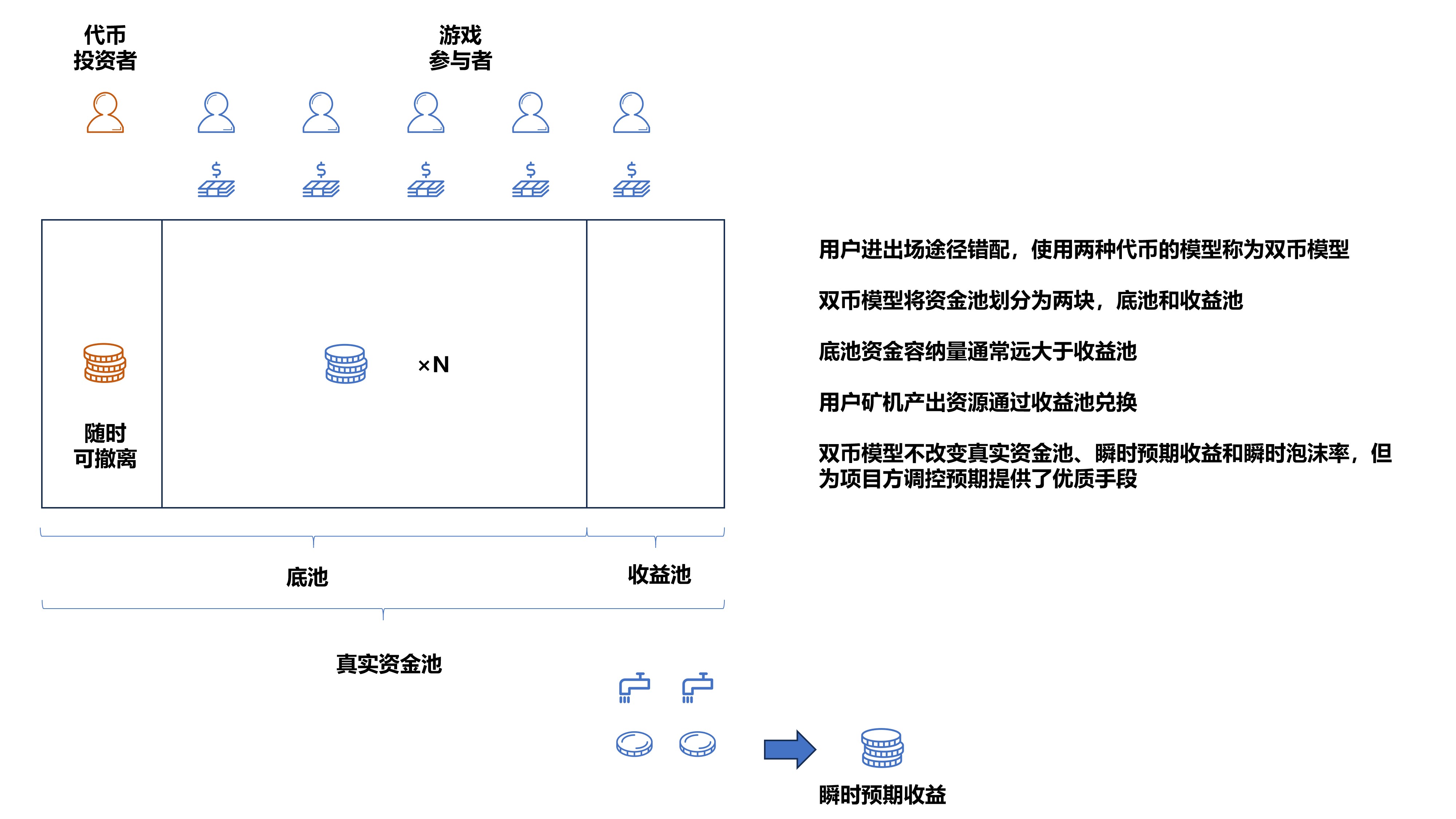

Dual-currency model : A model that uses two tokens and has mismatched entry and exit paths for user funds is called a dual-currency model. A model that has governance tokens and game tokens but governance tokens that basically do not participate in the economic cycle does not belong to the dual-currency model.

Single-coin model : only one token is used for capital inflow and outflow.

Currency-based : The amount of game tokens produced by users is a specific number.

U standard : also known as the gold standard, the amount of stablecoins produced by users is a specific amount and does not change with the fluctuations of game tokens.

Card drawing model : As long as you have enough specific assets, you can get unlimited mining machines.

Reproduction model : Miners produce through existing mining machines, usually with quantity restrictions and a mechanism in which the reproduction cost increases with the number of times.

Basic mode: single currency + currency standard model + card drawing

First of all, it started with the purest single currency + currency-based model + card drawing. CryptoZoon was launched on July 28, 2021. The game token is ZOON. Players need to consume ZOON to buy Eggs, and then hatch the mining machine ZOAN , and the mining machine then produces the token ZOON .

The model and operation process are very simple. The basic structure mentioned above is shown on the left side of the figure below, and the GameFi shell is shown on the right side of the figure below.

Key reasons for the bubble burst

At the beginning, we mentioned the four major factors that lead to the collapse of a bubble: lack of confidence, insufficient funds, capital outflow, and excessive bubbles. What is the main reason for the collapse of CryptoZoon? The main reasons are excessive bubbles, problems with the project design, and a small part of the reasons are due to a certain amount of capital outflow.

The bubble is too big: CryptoZoon’s mining machine sales model is a card-drawing model, which means that users can quickly enter the market. As the first batch of GameFi on BSC after Axie became popular, the mining machine sales were too fast, causing the instantaneous expected return and bubble rate to quickly reach the peak.

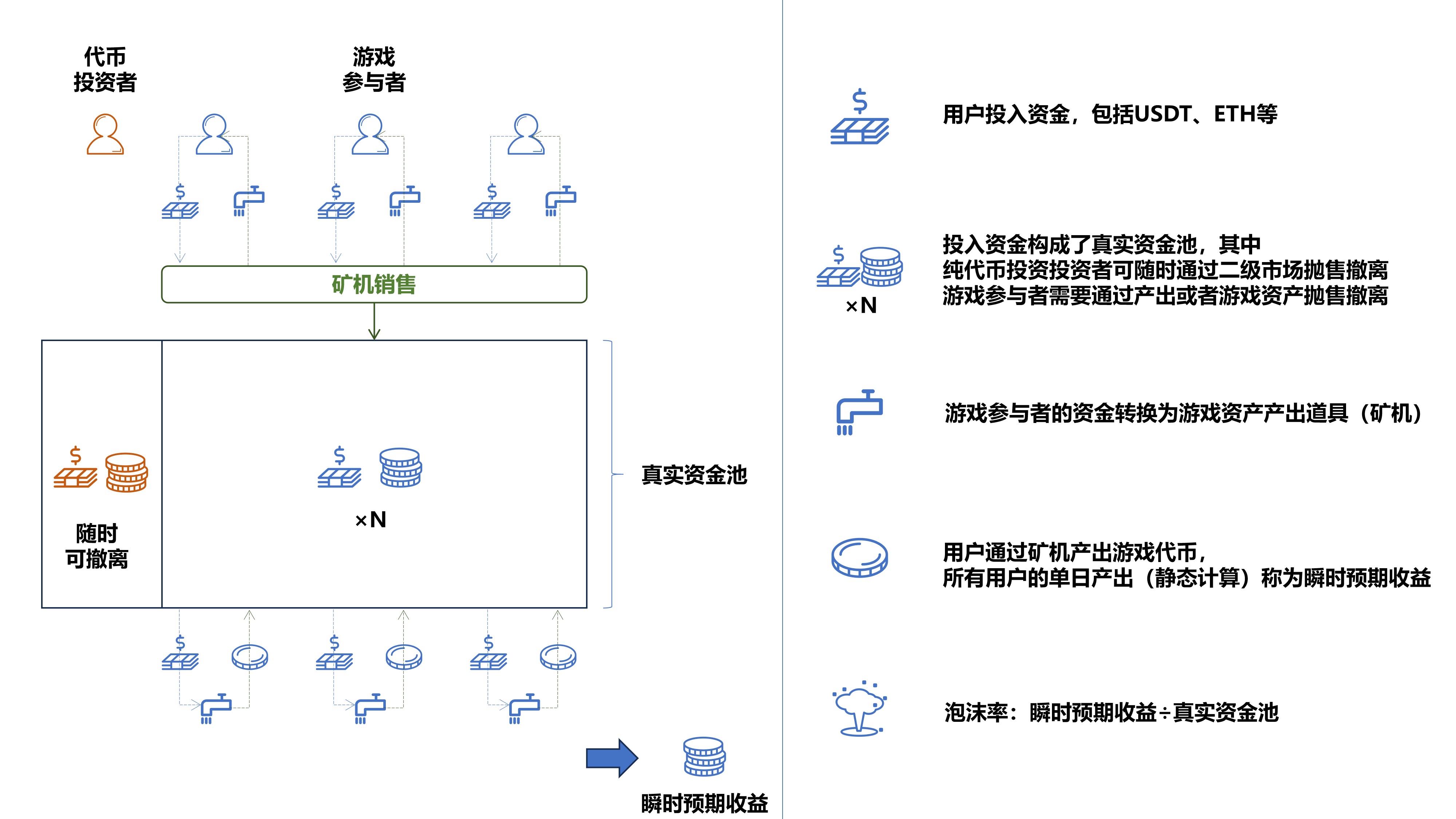

Here, let’s first consider a question. Without considering the exit of token investors and game output, what is the relationship between capital entry and bubble rate under static conditions?

Due to the AMM mechanism, the token price has a quadratic relationship with the inflow of funds. If the capital pool increases by 10%, the token price will increase by 21%.

For static calculations, the user's instantaneous expected return is also quadratically related to the funding pool, also increasing by 21%;

The bubble rate rises accordingly, showing a linear relationship with the entry capital.

In summary, the more money flows in under static conditions, the higher the bubble rate. Why is this so? Because it is assumed that the mining machine can use the inflated price to extract the real capital pool (the more cash is extracted, the bigger the bubble is). But what is the difference in actual conditions?

After the token price rises, token investors tend to sell for profit, and the real capital pool shrinks. However, it is worth noting that the impact is usually not too obvious under the single-coin model.

The selling of token investors and game participants will affect the AMM price curve, and the actual instantaneous expected return expansion rate will not grow quadratically.

In short, because of the AMM curve, profit-taking, and the entry of funds will lead to an increase in the bubble rate.

Capital outflow : The figure below is a price chart of the game token ZOON. Based on the closing price one hour after the token was launched, the maximum increase was about 6.5 times.

The real fund pool of the token in the single-coin model is its LP pool. The steep V-shaped trend means that the funds purchased to participate in the game during this period were earned by token investors, and did not effectively enter the fund pool to maintain the economy. On the other hand, the CryptoZoon project set a cap on the sale of mining machines, which led to the bubble rate quickly reaching its peak, and there was no channel for funds to flow in significantly, which eventually led to a collapse.

Dual Currency Model: Give me a fulcrum and I can leverage the million-dollar pool

The model in which the user funds enter and exit the market through mismatched channels and two tokens are used is called a dual-currency model . A model in which there are governance tokens and game tokens, but the governance tokens basically do not participate in the economic cycle does not belong to the dual-currency model. For example, although Axie Infinity has two tokens, the governance token AXS is only consumed in a small amount during the reproduction process, and is essentially still a single-currency model.

The dual-currency model has the following characteristics:

BinaryX

BinaryX is the epitome of the dual-currency model. There are two tokens in the game, BNX and GOLD. Its economic operation process is as follows:

Users purchase BNX to participate in the hero draw (get mining machines);

Users spend GOLD to upgrade heroes (to advanced mining machines);

Users stake heroes to produce GOLD (the main output of mining machines and transfer funds from the revenue pool);

Users use heroes to fight BOSS and obtain BNX, GOLD and equipment (secondary output of mining machines).

BinaryX matches the dual-currency model features as follows:

Mismatched entry and exit paths: Users need to purchase BNX and GOLD at the same time, but the output is mainly GOLD, which causes the BNX price and the pool to rise slowly, while GOLD is under pressure and has a smaller increase;

Pot and income pool: BNX is the pot, with more funds and less volatility, while GOLD is the income pool, which is much smaller and more volatile;

The dual-currency model does not change the real funding pool (BNX+GOLD), instantaneous expected returns (calculated according to the GOLD price) and instantaneous bubble rate, but it provides a high-quality means for project parties to regulate expectations.

What kind of regulatory measures do the characteristics of the dual-currency model bring to BinaryX’s economic operations?

Small-cap stocks control large-cap stocks

Since the user's profit expectations are calculated through the GOLD price, and the GOLD LP pool is extremely small, about hundreds of thousands of dollars, it only takes a small amount of money to adjust the user's expectations, thereby driving the large pool of BNX up. In the single-coin model, it is necessary to face a pool of millions of dollars, which makes it difficult to perform "regulation" operations.

Secondary speculation

Due to the separation of the two pools, funds entered from BNX and GOLD, but mainly flowed out through GOLD, making BNX more likely to rise and the secondary speculation more obvious. In extreme cases, the pool may have no output, which is the unilateral rise model of BNBH that appeared later.

At the same time, this also limits the secondary users from speculating on the output of tokens, because an extremely small pool of funds can easily lead to the token price being raised too high, which will become the profit of the game users.

In summary, the dual-currency model with separate base pool and revenue pool provides the project party with an effective means of economic regulation, while at the same time intensifying the speculation of the parent currency and suppressing the speculation of the child currency.

In addition to the inherent features of the dual-currency model, BinaryX also adds a certain degree of randomness, providing a potential means for regulating the gaming economy:

Controllable mining machine properties

Miners in BinaryX are called heroes. They are produced by consuming BNX to draw cards. They have different properties, and the properties will greatly affect the output of the miners. Therefore, by adjusting the probability of the miner's properties, the outflow rate of funds can be affected in the long term.

Random copy

In BinaryX, users can consume BNX to enter dungeon battles, and the output includes BNX, GOLD and equipment. There is a possibility of obtaining high returns in a single battle, but not every battle will generate positive returns. The project owner can adjust the overall difficulty and output to achieve a certain degree of bubble elimination.

The dual-currency model does not change the Ponzi property, but leaves ample means for adjusting user expectations. BinaryX operated effectively for about three months, making it a long-lived Ponzi scheme among GameFi, but it eventually died due to excessive bubbles and insufficient entry funds.

U-standard model: It only takes 8.8 seconds to jump from the Empire State Building

In addition to the single-currency and dual-currency models mentioned above, GameFi at that time also distinguished between the coin-based and gold-based (U-based) models. The coin-based model used tokens to price both entry and output, while the U-based model used fixed stablecoin prices. This model can be considered to have been first promoted by Valk (Valkyrie), and further developed by CryptoMines (Spaceship), and has become extinct due to its extreme nature.

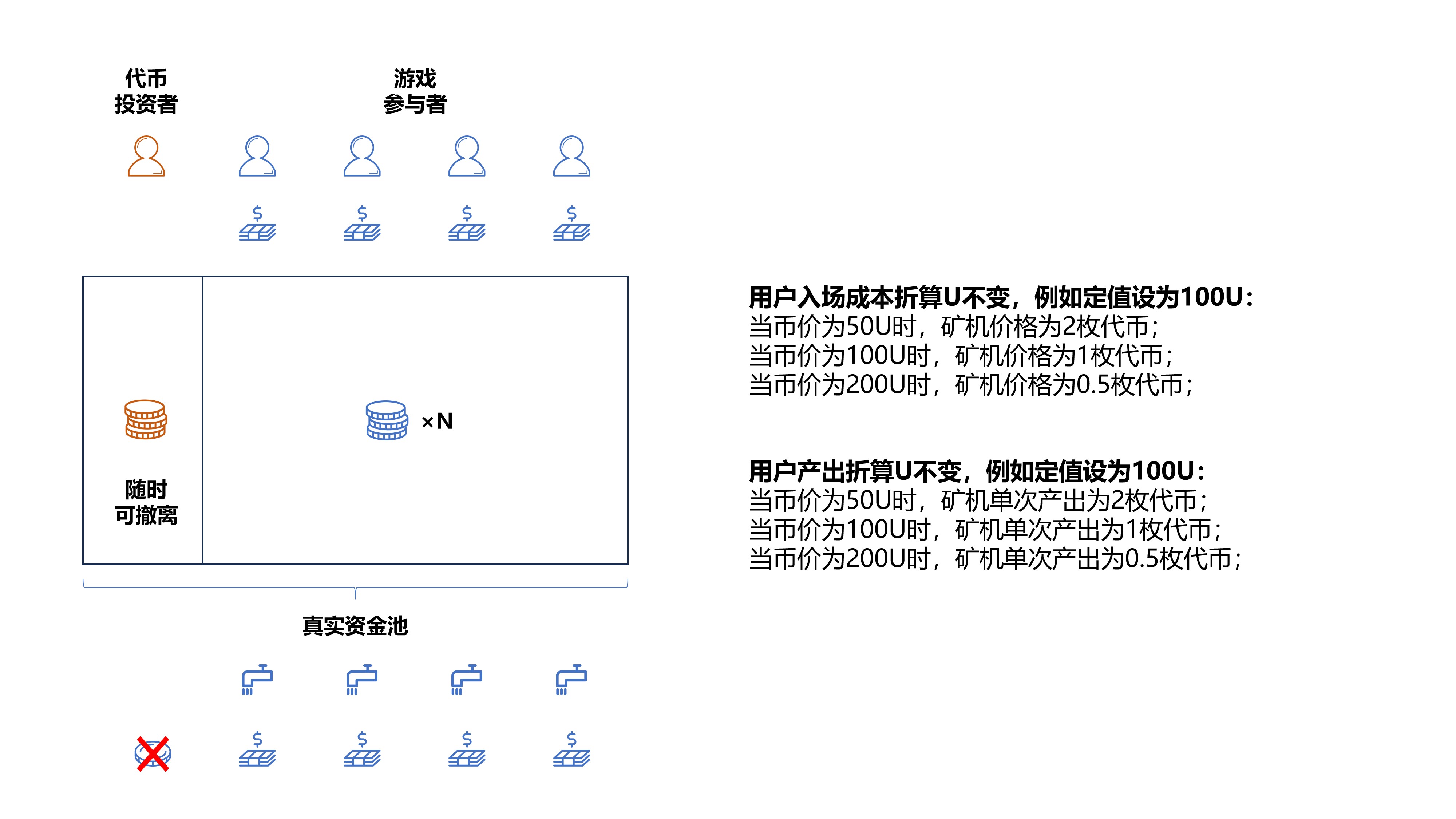

Under the U-based model, the user entry cost converted into stablecoin remains unchanged. For example, the fixed value is set to 100 U:

When the coin price is 50 U, the mining machine price is 2 tokens;

When the coin price is 100 U, the mining machine price is 1 coin;

When the coin price is 200 U, the mining machine price is 0.5 tokens;

Under the coin-based model, the purchasing power of a token is fixed and will not change with changes in the token price.

Similarly, the user's output is also converted into a specific stablecoin. If the output at any time is sold immediately, the amount of stablecoin exchanged remains unchanged.

Extreme positive and negative feedback

By using a fixed amount of stablecoin to convert input and output, will the Ponzi properties be reduced?

The answer tends to be no. Although this model weakens the selling pressure from mining assets, it greatly enhances the expansion and bursting of the bubble.

Asset sales are small

In the coin-based model, the number of tokens required to purchase a mining machine will not change. Therefore, as the price of tokens rises, the price of mining machines will also rise. Especially in the dual-coin model, by pulling up the price of the small pool, the expected return of the mining machine will also rise, causing a rapid rise in prices.

In the absence of signs of a collapse and with sufficient market liquidity, mining machine holders can sell a large number of mining machine assets to realize profits.

Under the U standard, no matter how much the price rises, the price of mining machines will remain unchanged. Therefore, users will not choose to sell mining machines, but continue to produce tokens.

Rapid bubble expansion and bursting

In the absence of selling pressure from mining machines, the only pressure comes from the sale of tokens. Under the U-standard model, the positive and negative spiral effects are obvious, and the market will basically end with only one unilateral rise and one unilateral fall.

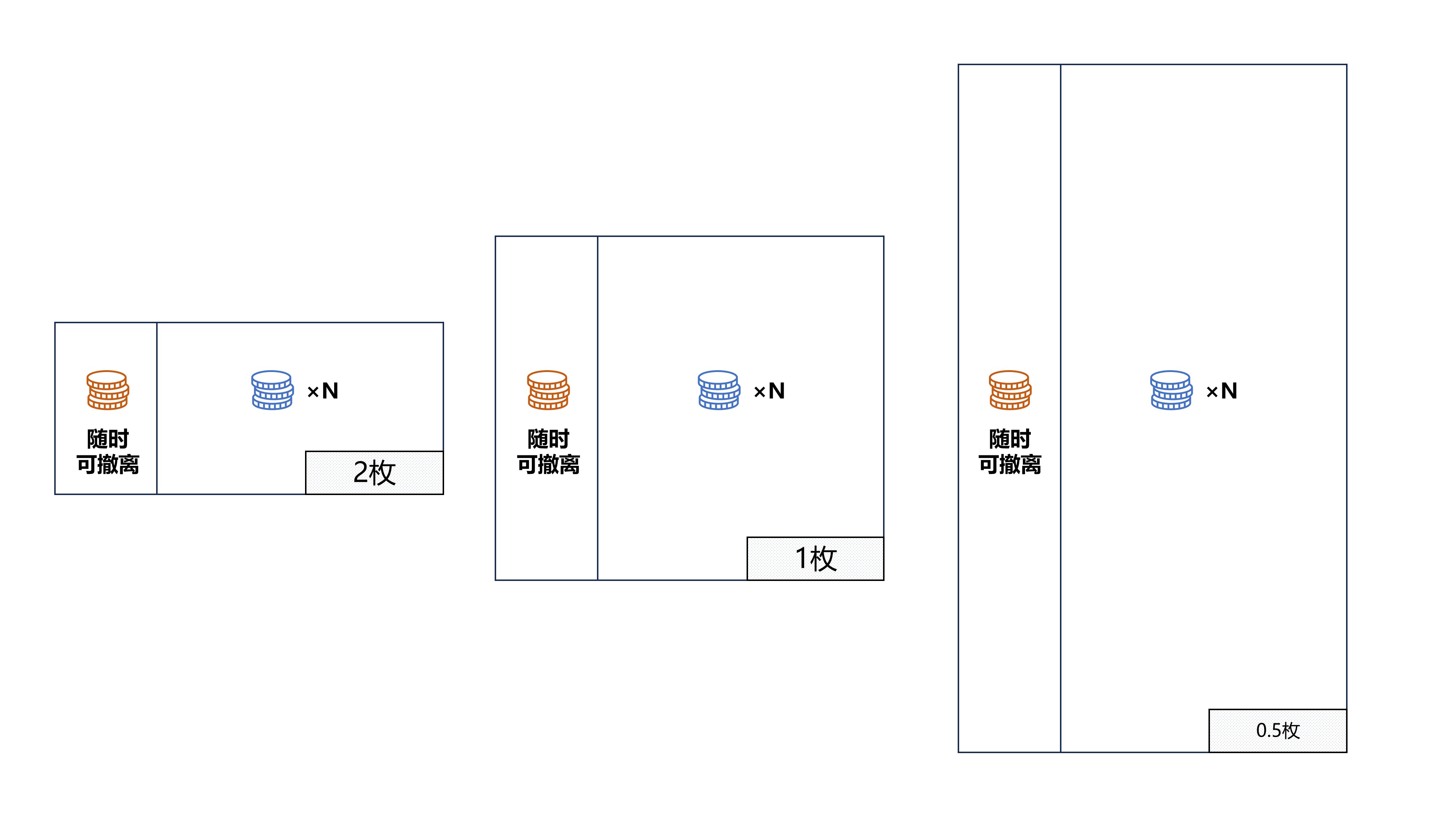

During the rising process, the output of tokens will decay as the price rises. Users will find that if they hoard the output tokens, their book assets will expand rapidly .

For example, if the rated value of the U standard is 100 U, the user can produce 1 token worth 100 U. When the token reaches 200 U, the output is only 0.5 tokens. Therefore, compared with users who enter the market later, the number of tokens and the price have doubled, which has a very obvious advantage. Therefore, during the rise, users have a clear reluctance to sell, and the token selling pressure is small and the price is spiraling upward.

Similarly, during the decline, the number of tokens produced continued to increase. If they were not sold first, subsequent users would produce more tokens, and the price would be relatively lower. Therefore, the selling pressure continued to increase and the spiral downward was consistent with the bubble bursting process of LUNA.

CryptoMines experienced a round of unilateral rise and fall. Its token price rose from 1 USDT to more than 800 USDT in two months, and the LP pool exceeded 30,000 BNB at its peak. However, it collapsed in less than a week, with the token price falling by more than 50% every day. In the end, due to excessive token issuance, the total amount of tokens exceeded the upper limit, and the liquidity was exhausted and users were completely unable to exit.

Token investors are bleeding

As mentioned in the previous section, users who participated in the game were reluctant to sell the generated tokens, which led to a sharp rise in the token price. CryptoMines also imposed restrictions on the withdrawal of generated tokens, with a 15-day cycle. If the tokens are withdrawn in advance, there will be a quantity penalty.

The above situation allows token investors to make huge profits and have the advantage of being able to exit at any time. They can withdraw large amounts from high points at any time, causing the capital pool to bleed quickly and massively.

As shown in the figure below, without increasing the number of mining machines, the share of output by game participants decreases as prices rise, but the selling power of coin holders does not decrease. When it rises to a certain level, it becomes a potential huge selling pressure force.

In the end, for GameFi, a U-based model, more and more users chose to just hold coins and not participate in the game process, which resulted in the game life cycle becoming shorter and shorter, and it became pure secondary speculation, and the model died out.

Reproduction Model: Ineffective Market Regulation

In addition to the above single-currency and dual-currency models, and coin-based and U-based models, there is another key difference in the way mining machine assets are sold, which this article calls the card drawing model and breeding model:

The card drawing model means that the mining machine comes from the direct sales of the game system, the price is constant, and there is usually no limit on the quantity.

Under the breeding model, the offspring mining machines come from the synthetic output of other users’ mining machines. The price is determined by the market, and the quantity is controlled by the number of parent mining machines and market sentiment.

Jiuzang Cat (DNA×CAT)

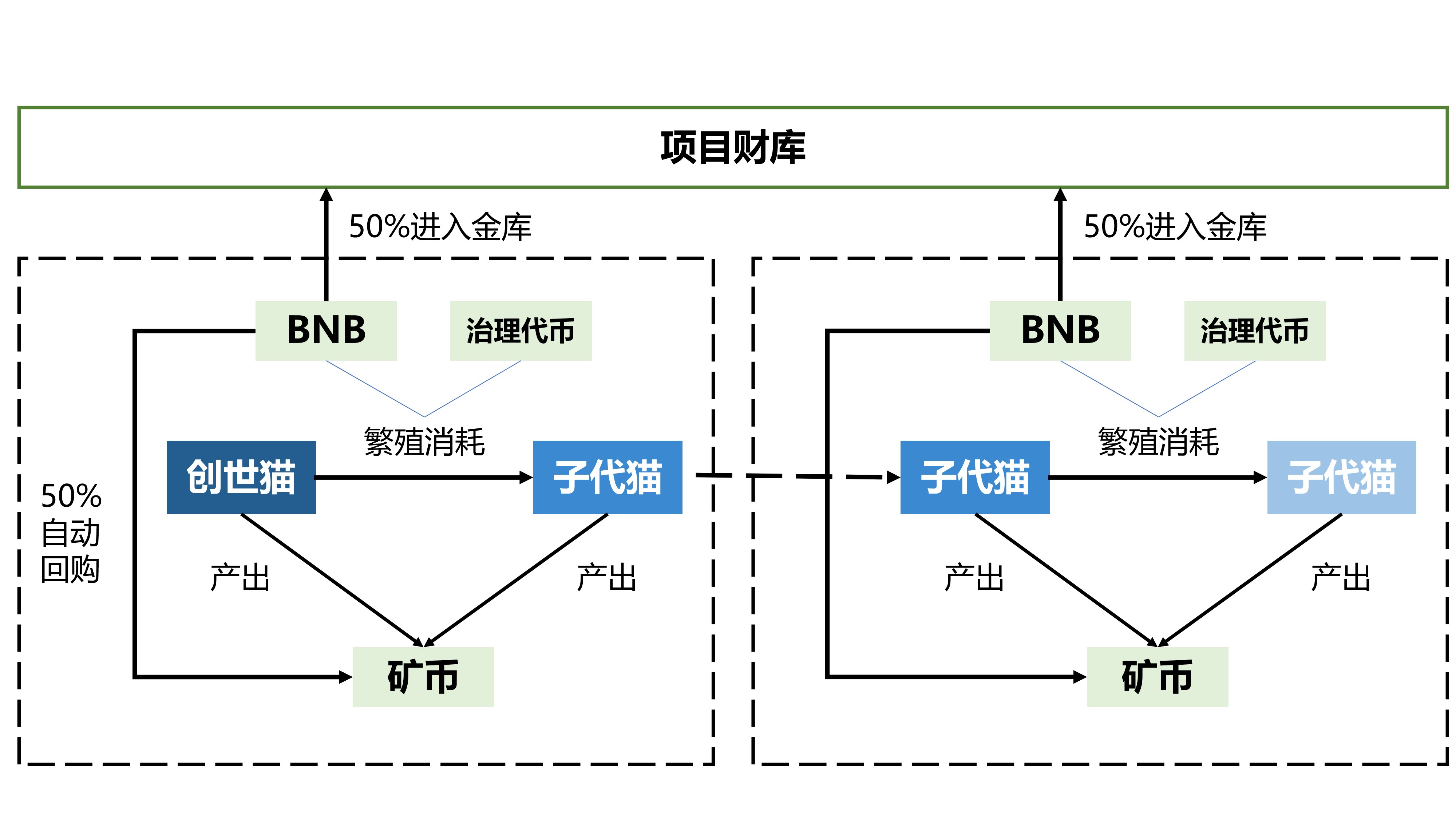

All offspring cats come from breeding of the previous generation. During breeding, users need to consume BNB and a very small amount of governance tokens DXCT. 50% of BNB will automatically repurchase SFC, and the rest will enter the treasury and be operated by the project party.

Among them, SFC is the only token of the game economy. Miners produce SFC by participating in game activities, and the BNB consumed during incubation serves as its carrying force.

In the reproduction model, the quantity and price are determined by the market. Can this mechanism reduce the Ponzi property through market self-regulation to achieve longer-term operation? The answer is still no.

The prices are high and the profits are completely captured by early players:

In the breeding model, the number of assets in the early stages of the game is extremely scarce, so the price will be extremely high. On the other hand, since the mining machines are directly produced and sold by players, the difference between the selling price and the cost is directly obtained by early players.

How is the price difference calculated? In Jiuzangmao, it takes 5 days to hatch a single offspring cat, so the price difference can be considered as the output of a single mining machine for 5 days. Assuming that the mining machine pays back in 20 days in static calculation, it means that 25% of the profit flows directly into the hands of the incubator. Under the card drawing model, user funds enter the LP pool and are extracted from the overall ecological output. It can be seen that the breeding model greatly reduces the thickness of the capital pool.

Exponential growth, rapid expansion of bubbles

In the breeding model GameFi from 21 to now, usually a pair of mother mining machines can produce 7 child mining machines, which will lead to the holders continuing to produce mining machines as long as there is any profit margin until the profit is zero, causing assets and bubbles to rise exponentially.

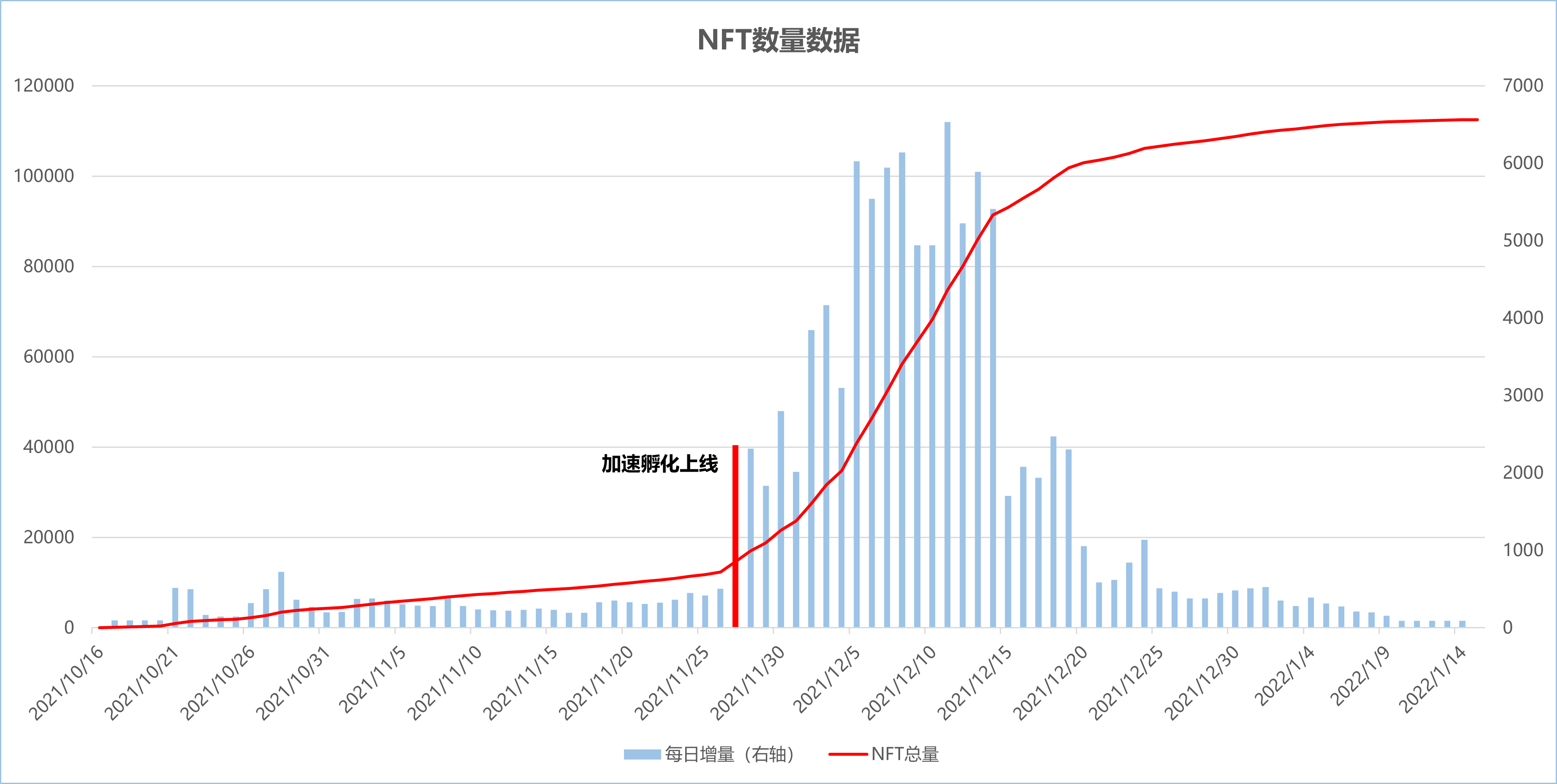

The figure below is a statistical chart of the number of Jiuzangmao NFTs in 2021. At the beginning, the production of offspring required a five-day incubation period. After the accelerated incubation function was turned on (tokens can be spent to directly complete the incubation), the number began to soar, and the token output doubled rapidly. The supply and demand relationship of the number of mining machines changed, which eventually led to an explosive increase in the difficulty of capital acceptance, and it only lasted for 18 days before it collapsed.

From Jiuzangmao in 2021 to Gas Hero in 2024, once the popularity is too high before the game is launched or in the early stage of its official launch, the first-generation assets are often over-hyped and prices soar. Then the number of mining machines increases exponentially and the price declines, leading to a rapid collapse in the end.

in conclusion

The above economic design is summarized as follows:

Single-currency model: It is relatively stable for all parties, but it is also more difficult to adjust expectations and control the market;

Dual-currency model: Volatility is divided into two pools, which can achieve expected regulation more easily;

Currency-based model: relatively stable, without self-feedback effect, prone to value-added selling pressure on the asset side;

U-standard model: extremely unstable, with significant positive and negative spiral effects, and prone to selling pressure from speculators;

Card drawing model: can be combined with other designs to control the flow of funds, but it is prone to excessive influx in a single day;

Reproduction model: It is easy to cause excessive FOMO at the opening, and is suitable for situations where the project party can effectively control the operation rhythm and regulate market supply and demand.

In addition to the above basic models, many effective mechanism innovations have also emerged. For the project side, the fundamental goal is to expand the bubble and delay the collapse time, which specifically involves the coordination of economic model design and operation rhythm, encouraging users to lock/reinvest, creating emotions and events, and controlling the entry and exit funds in the whole cycle.

However, at present, there are very few pure Ponzi models GameFi, but the financial attributes as the natural attributes of Web3 cannot be ignored.

And what are the key points for users?

The first is that it is the time to exit when there is a lot of buzz. It does not matter how high or low the price is, but the exit liquidity issue of valuation. GameFi, a Ponzi model, claims to recover its investment in N days as a basic element, but it often cannot sustain N days. The time when there is a lot of buzz is when you can exit and cash out at the highest valuation, without having to take the risk of continuing to dig and sell for N days.

On the other hand, GameFi market assets are mainly P2P, which requires counterparties to take over. The bustling market means the best exit liquidity. When the downward trend begins, the P2P market will face the problem of liquidity collapse and difficulty in exiting.

What users need to realize most is that the design of the economic model can only affect the general development process and method. For the Ponzi model, the rise and fall of the economy is not caused by the quality of the economic model design, but is determined by the inflow and outflow of funds. In essence, it is a negative-sum game between people. Rational investment and risk control are the fundamental elements.