Gate Research Institute: From general to special, how does Game Chain reshape the Web3 gaming ecosystem?

Preface

In the early narrative of the Web3 industry, GameFi is second only to DeFi, and is the second independent narrative that has reached industry consensus and established logic. In the early days, the public game chain was not an independent concept, and the game distribution platform dominated the development of chain games. Before 2020, most Web3 games used Ethereum's smart contracts to realize the purchase and sale of NFT equipment. Play-to-Earn is the first demand of most players, so the game experience is often put second.

In Web2 games, game performance will drive the upgrading of personal console performance. In 2017, PlayerUnknown's Battlegrounds led gamers to upgrade their console graphics cards to RTX 1050 or above, and in 2021, Cyberpunk 2077 allowed players to upgrade their game graphics cards to RTX 3060 or above. In the Web3 game industry, the increase in the number of active game players will force game project owners to consider improving the performance of the public chain. The popularity of Axie Infinity in the second half of 2021 has led a large number of players to choose to spend time Play-to-Earn, but due to the bottleneck of Ethereum's parallel transactions, players' NFT trading experience is poor. Therefore, the Sky Mavis team developed the Ronin side chain, which not only greatly improved the player experience, but also gradually built its own game ecosystem.

Compared to the DeFi industry, which can quickly clone the code of open source projects (such as PancakeSwap, UniSwap), it is difficult for the GameFi industry to quickly develop products with in-depth gameplay. Because the ecological chain of GameFi is longer, from game studios, to the selection of public chains, to platform promotion, and then to player communities, each link is crucial. DeFi products often make model innovations on the original product form, which makes it easier to reuse codes. Therefore, for general public chains, quickly establishing a DeFi ecosystem is almost a must, while establishing a GameFi ecosystem is an optional option. Game-specific public chains can make up for the lack of ecological resources for general public chains. Game public chains are often initiated by industry veterans with certain game studio resources, focusing on the experience of game players, and at the same time attaching importance to the distribution of benefits with studios and promotion channels.

1. Game Chain Chronicles

2017-2019: Technology verification and concept exploration

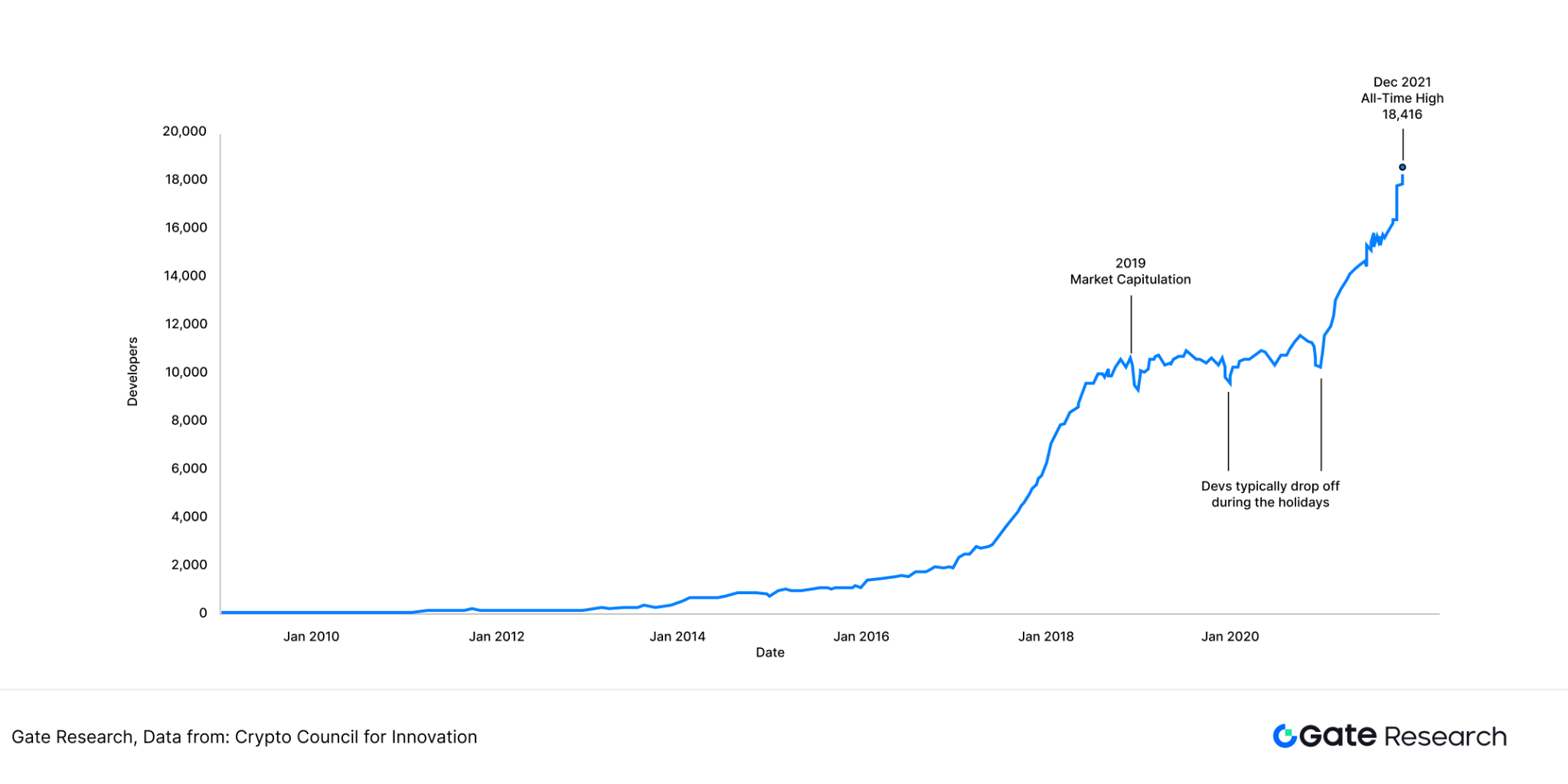

Before 2020, the crypto industry was in a relatively barren stage in terms of applications. Entrepreneurs had many advanced concepts, but the user base was small and there were few applications with commercial value. In 2017, Gamechain System, initiated by veteran game developer Ling Lianwei, was the earliest dedicated game public chain that the author found. The public chain proposed a decentralized game asset circulation framework and pioneered the use of NFT standards and DPoS consensus mechanism to provide a technical prototype for game asset rights confirmation. In 2018, the first game on the Gamechain System chain, Candy Shooter, was launched. Due to its early establishment, Gamechain System was like a meteor passing by in the professional game public chain. Although it was the first to propose the concept of a dedicated game public chain, the number of active developers in the entire Web3 industry in 2017 was less than 4,000, and the developer community had not been built. [1]

Figure 1: Number of active developers in the Web3 industry from 2009 to 2020

WAX public chain was also established in 2017. It is also a vertical public chain in the field of games and NFTs. The main network was launched in June 2019, which is later than GameChain System. The game-specific public chain ImmutableX was established in 2018 to solve the problem of NFT expansion.

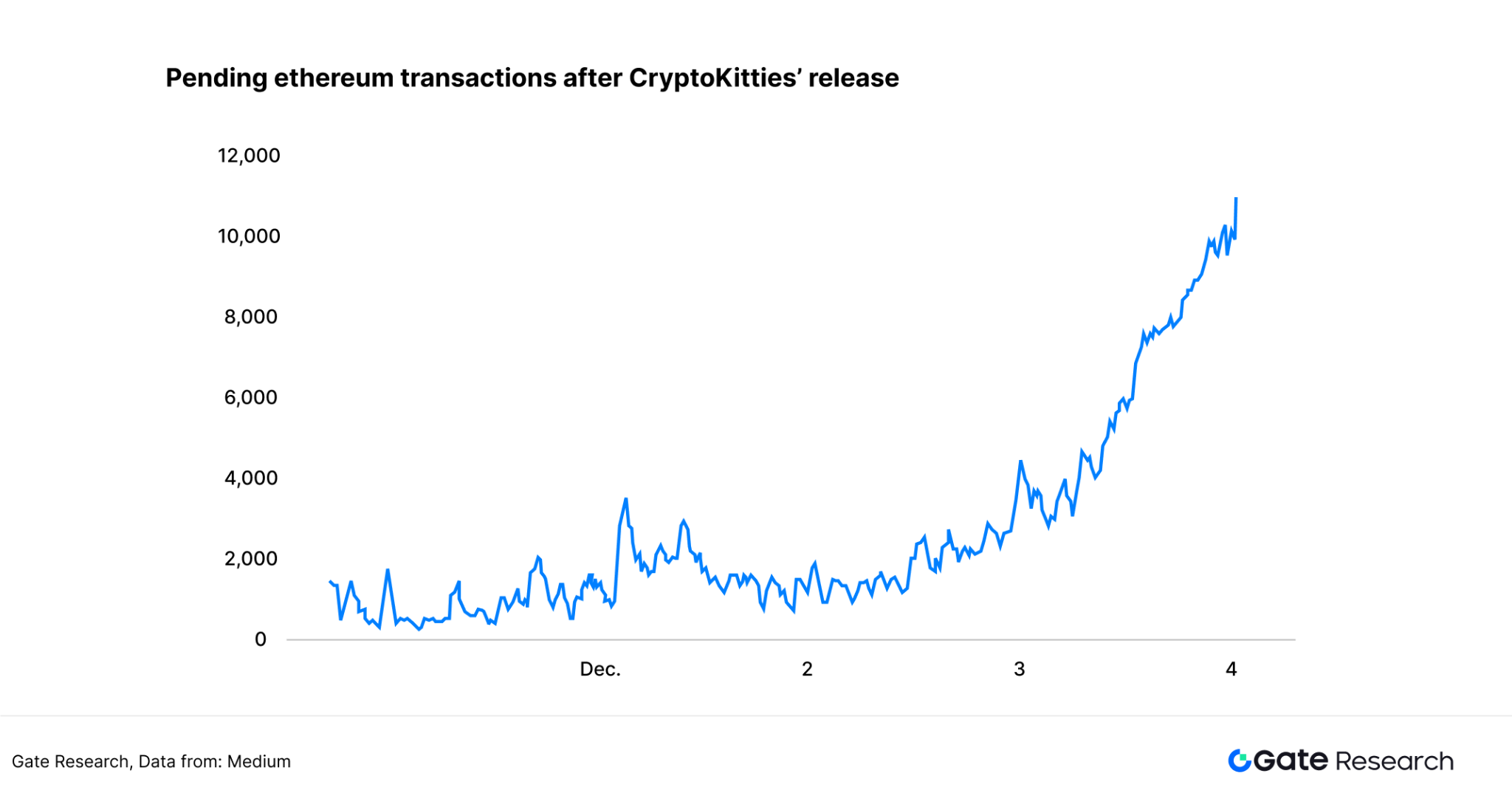

During this period, the most disruptive product in Web3 games was CryptoKitties, which was released in 2017. It is a cat-raising game developed by Canadian studio Dapper Labs on Ethereum smart contracts. In the CryptoKitties game, each cat is an independent NFT (the concept of NFT was not born in 2017, and CryptoKittiy pet cats are widely regarded as the origin of the NFT concept). Players can purchase NFTs on third-party platforms, and two NFT cats can breed to create new cat NFTs. After players hatch high-quality cats, they can sell their NFTs and earn profits. The unexpected popularity of the CryptoKitties game caused the number of unconfirmed transactions in the Ethereum memory pool to soar to 12,000. [2]

Figure 2: Ethereum network transaction volume trend after the release of CryptoKitties

Axie Infinity, a Web3 game that became popular in the future, was officially launched in 2018. It is a card game developed by Sky Mavis that allows players to breed, raise, fight and trade Axie creatures. It is a combination of Pokémon and CryptoKitties gameplay.

2017-2019 is the early stage of the development of the blockchain game industry. Web3 games in this stage are relatively homogeneous, with financial attributes far greater than their game attributes, and the life cycle of games is relatively short. Games do not have an urgent need for dedicated Game Chains, and the construction of the Web3 game industry chain will also take many years.

2020-2021: The formation of technical framework and the rise of vertical public chains

2020 to 2021 is the main stage for the popularization of blockchain games and the rise of vertical public chains. With the further popularization of the Play-to-Earn model, more game studios have begun to develop blockchain games, and the user scale has also shown explosive growth.

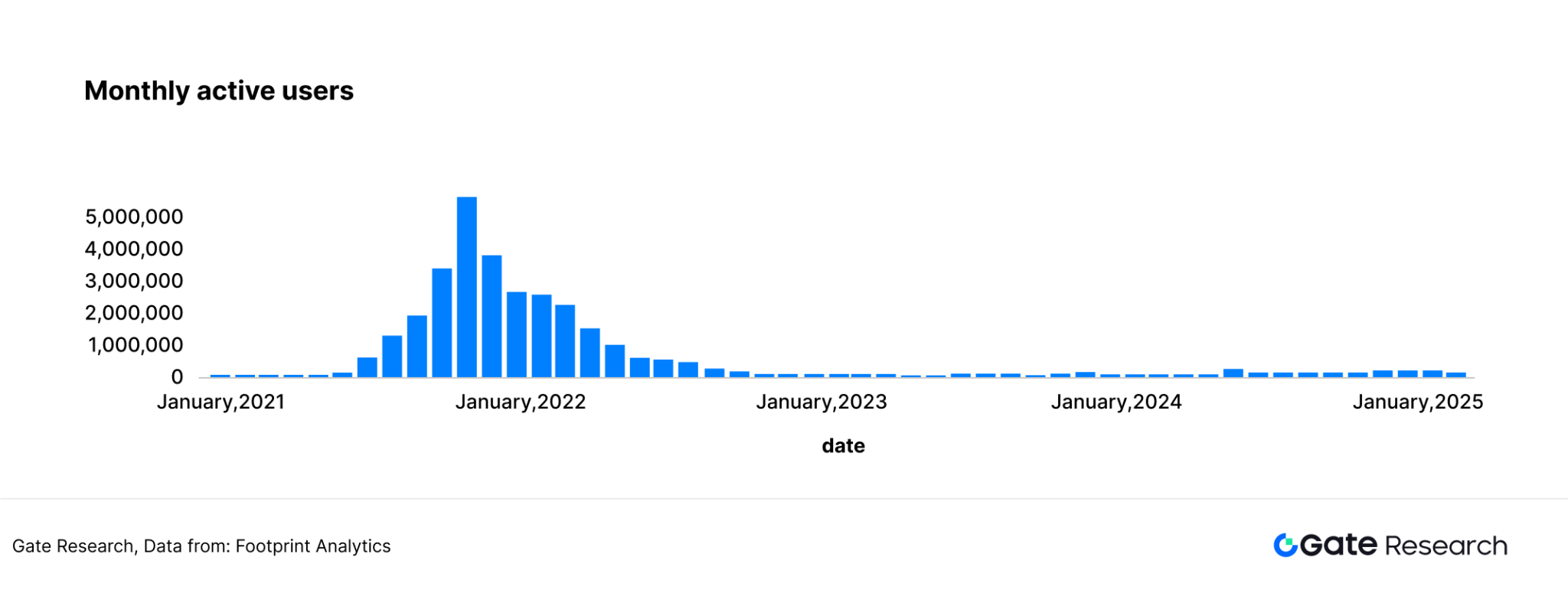

The breakthrough of the economic model is the core driving force of this stage. In 2021, Axie Infinity caused a boom in the Southeast Asian market with its dual token mechanism (AXS governance token and SLP utility token). Its average daily revenue once surpassed traditional mobile games, and the incentives brought by tokens can bring a positive growth flywheel. This model not only attracted millions of users to participate, but also formed a Discord gold farming community, which promoted the migration of user structure from speculators to real players. In November 2021, Axie Infinity reached the peak of popularity, with 5.59 million monthly active players and a total transaction volume of 64.86 million times. Although the data is still not as good as Web2 classic online games such as Dota, CSGO, and World of Warcraft, to this day, no Web3 game can reach the number of players and transaction volume of Axie Infinity in 2021. Due to the continuous gold farming transactions between players and unions, the performance bottleneck of the Ethereum mainnet began to emerge. In order to optimize the game player experience, Sky Mavis developed the Ronin sidechain, which greatly improved the TPS of the public chain and became a benchmark case for vertical public chains in terms of performance and scenario adaptation. The Ronin Network mainnet was officially launched in February 2021. [3]

Figure 3: Ronin Network mainnet is officially launched

Figure 4: Axie Infinity game monthly active players and monthly transactions

At the same time, ImmutableX also made efforts in this stage and completed the construction of the game ecosystem. It provides technical support for the development of subsequent 3A-level blockchain games. For example, the open world RPG blockchain game Illuvium chose ImmutableX as the underlying architecture in the early development stage to achieve an efficient combination of complex game logic and on-chain assets.

In general, the technological breakthroughs and model innovations at this stage have laid two major foundations for the industry: first, vertical public chains represented by Ronin have solved performance and scenario adaptation problems through customized architecture; second, vertical public chains represented by ImmutableX have made efforts in 3A game masterpieces, a field that chain games have rarely touched before; expanding the boundaries of blockchain games, and also laying the groundwork for ecological reconstruction and technological integration after 2022.

2022-2023: Market Adjustment and Ecosystem Reconstruction

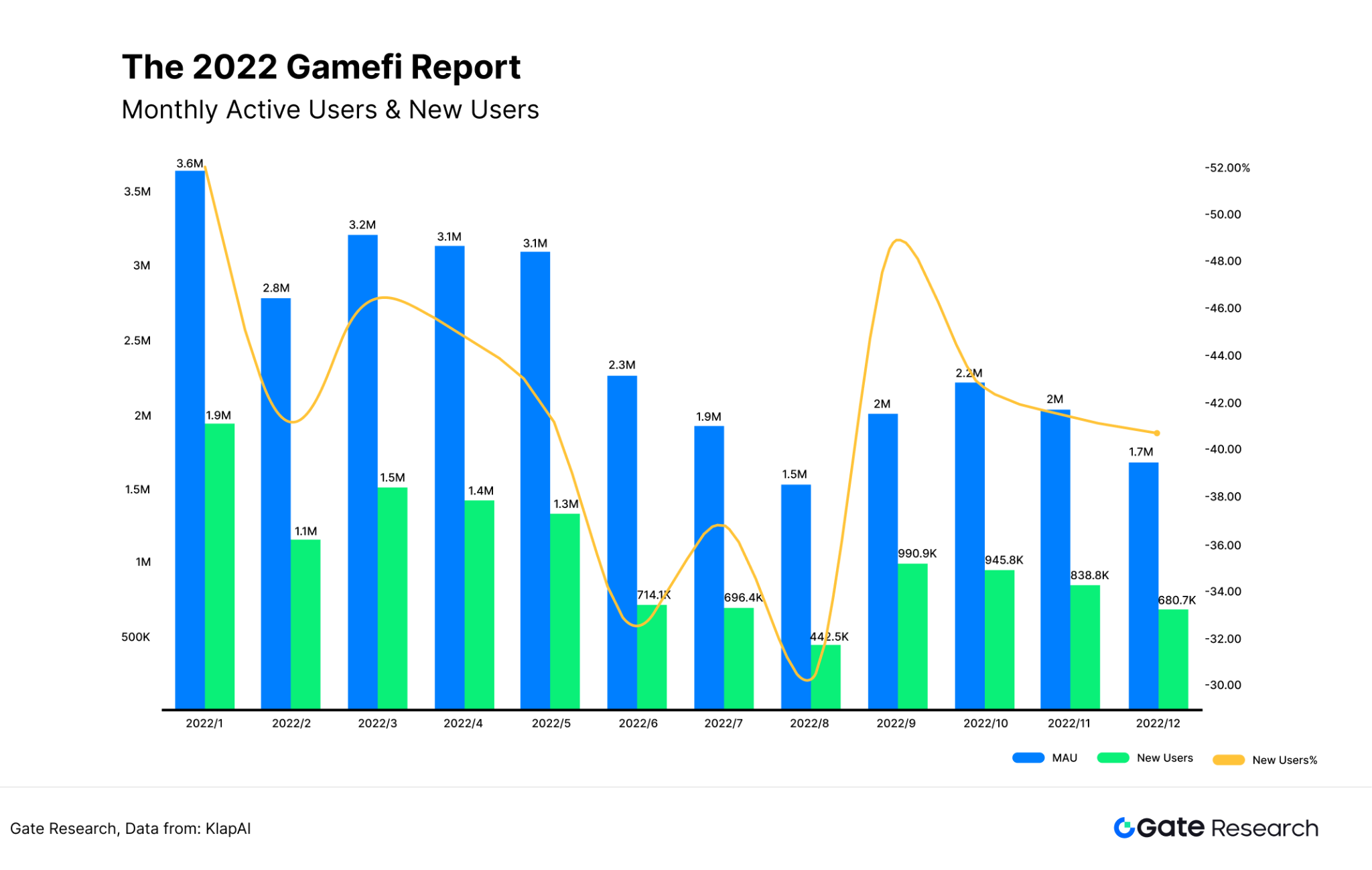

Since 2022, the entire cryptocurrency industry has entered a period of adjustment. The significant decline in the total market value of cryptocurrencies has also seriously affected the Web3 gaming industry. The rapid decline in token assets (FT and NFT) has caused a large number of gold-making studios to be unable to maintain a balance between income and expenditure. Games including Axie Infinity, Big Time, and CryptoBlades have experienced significant user loss during this period. The destruction of the gaming ecosystem has then spread to the gaming public chain, and its gas fee income has rapidly declined. [4]

Figure 5: The number of active GameFi players continued to decline in 2022

Based on data from the Big Blockchain Game List, more than 30% of blockchain games announced in 2023 have been reported as discontinued or cancelled. As of January 2024, the list contains 911 games, of which 334 are currently in operation and 577 are still in development. Since the launch of the program in 2021, a total of 1,318 blockchain games have been included, of which 407 games are now classified as discontinued or abandoned. [5]

Figure 6: Blockchain games classified as discontinued or abandoned in 2023

On the bright side, after a capacity clearance, the pattern of Web3 game public chains has been completely formed, and ImmutableX, WAX, and Ronin have gradually formed the first echelon of game-specific public chains. The construction of the ecosystem has given the vertical game public chain a strong moat. It takes a lot of energy for the general public chain to rebuild the ecosystem, and the game public chain has also become an important paradigm in the GameFi field.

Games such as Lumiterra, Dark Seraph, and Sharpnel have also become some of the few bright spots in the crypto bear market. What these games have in common is that they focus on the player’s gaming experience, have relatively complete game mechanics, and will not quickly enter a death spiral.

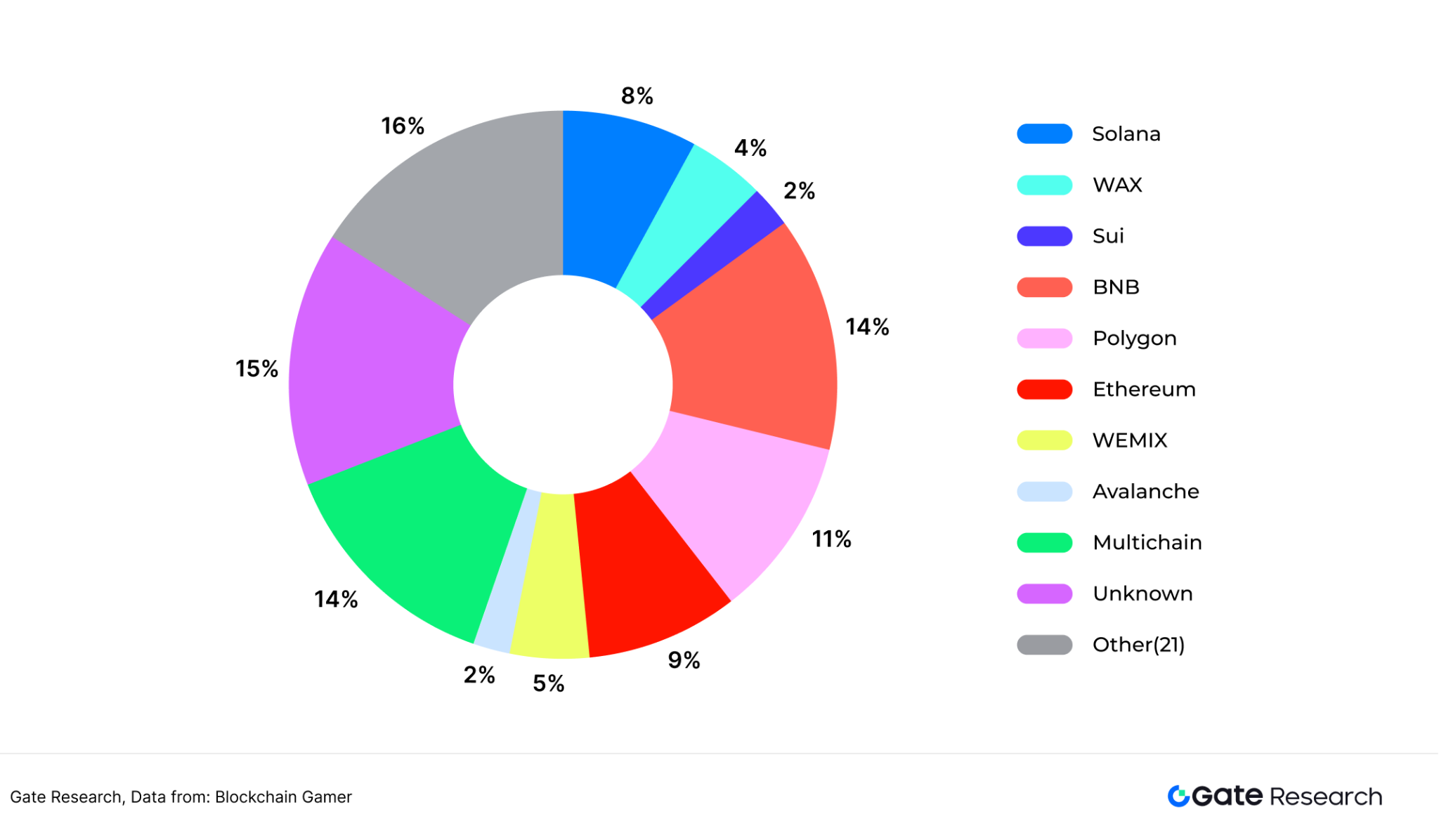

2024-2025: Ecosystem competition and technological iteration

In the first quarter of 2025, the number of active addresses and transaction volume of game projects have not returned to the level of the third quarter of 2021. From the overall external environment, the trend of Ethereum ecology in 2024 is far less than that of Solana ecology; the overall performance of game projects on Ethereum is poor, and most of the transactions of popular chain games such as Axie Infinity, Bigtime, and Lumiterra are executed on Ethereum expansion public chains opBNB, Polygon, Ronin and ImmutableX.

Among Ethereum's main competitors, Solana's original gaming ecosystem is relatively weak, and game studios have fewer resources. At this time, Solana Layer 2, which is specially designed for games, and Sonic SVM mainnet have been launched. In the future, Solana's gaming ecosystem will compete head-on with Ethereum's gaming ecosystem. In addition, the TON public chain has emerged as a dark horse in the TAP to Earn mini-game category. Although this type of game is also common on Ethereum, with more than 1 billion monthly active users on the Telegram App, the TON gaming ecosystem has attracted a large number of game developers. In the third quarter of 2024, the number of games on the TON public chain increased by more than 320% year-on-year. [6]

In terms of technology, more and more game-specific public chains are using zero-knowledge proof (ZK) technology, such as Immutable X's Validium solution, to increase transaction speed and reduce fees while enhancing security. Ronin Network has significantly improved its decentralization by upgrading to the DPoS consensus mechanism, expanding the number of verification nodes from 9 to 22, and attracted multiple game studios to move in, driving its ecological recovery. In addition, emerging public chains such as Xai (Layer 3 based on Arbitrum) and Oasys (Ethereum sidechain using Optimistic Rollup) have further lowered the entry barrier for players by optimizing gas fees and transaction speeds.

In terms of games, World of Dypians, a metaverse sandbox game launched in November 2024, has achieved 1 million UAWs (unique wallet addresses) within 2 months of its launch, becoming the most popular GameFi project at this stage.

2. Game Chain Competition Landscape

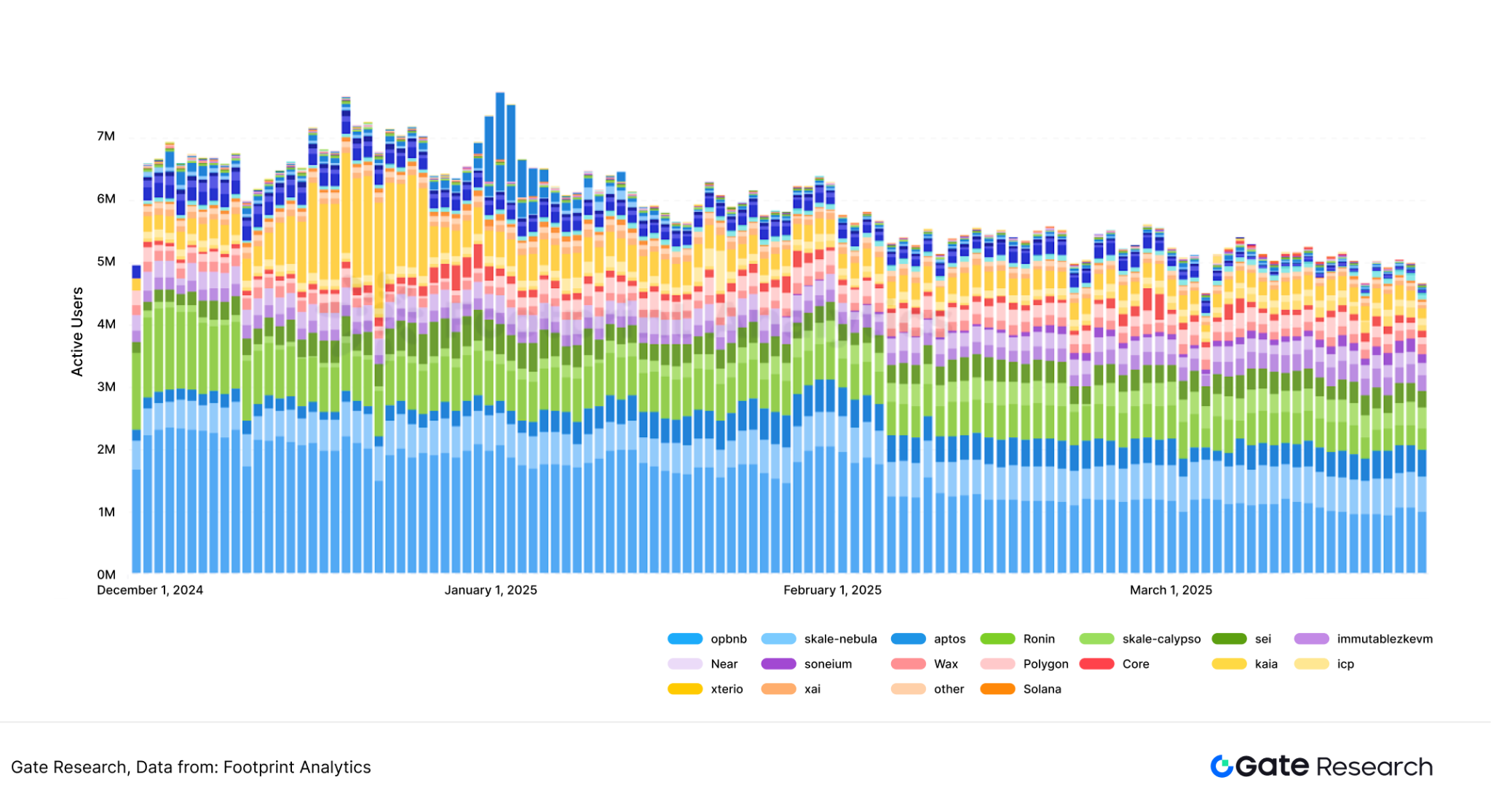

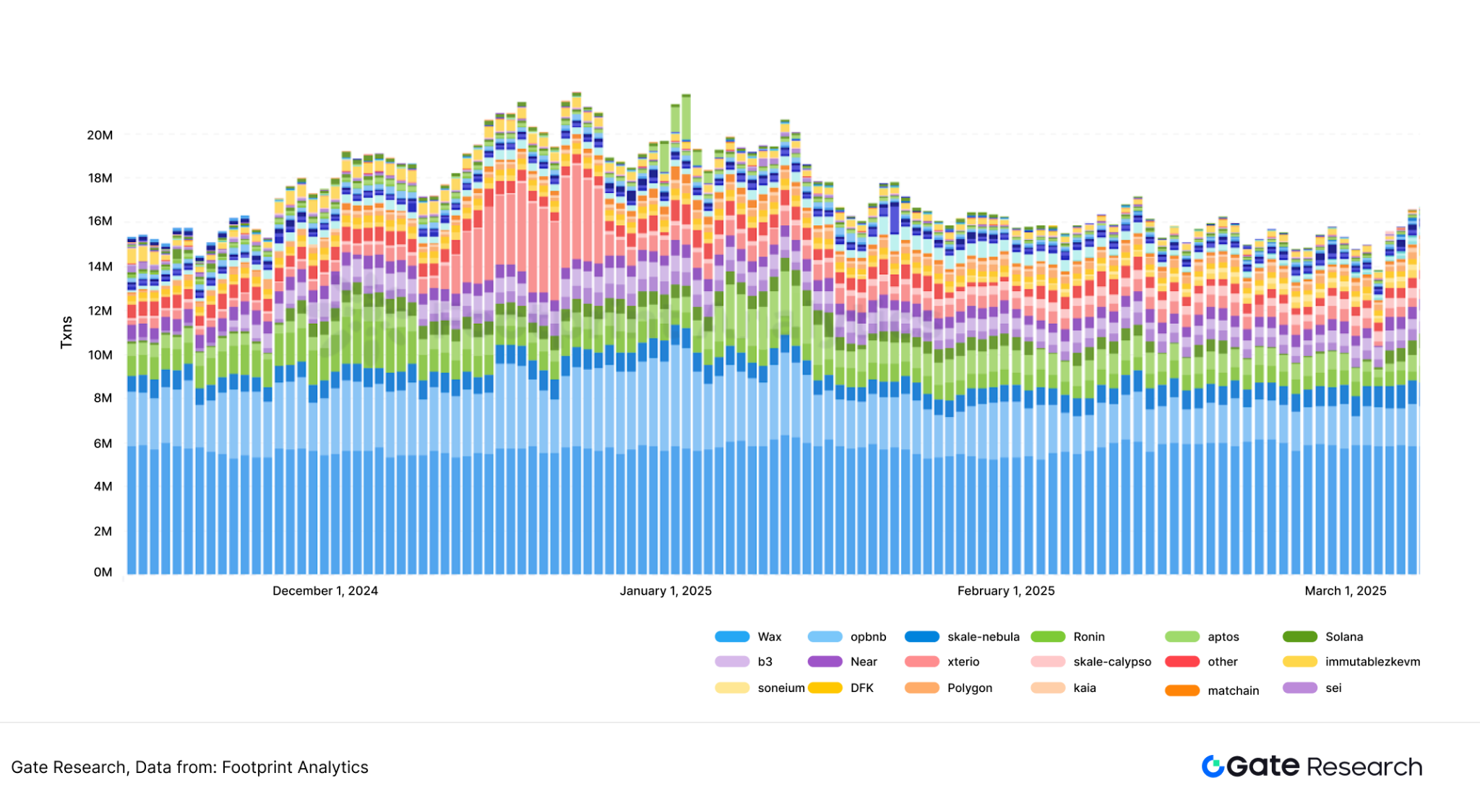

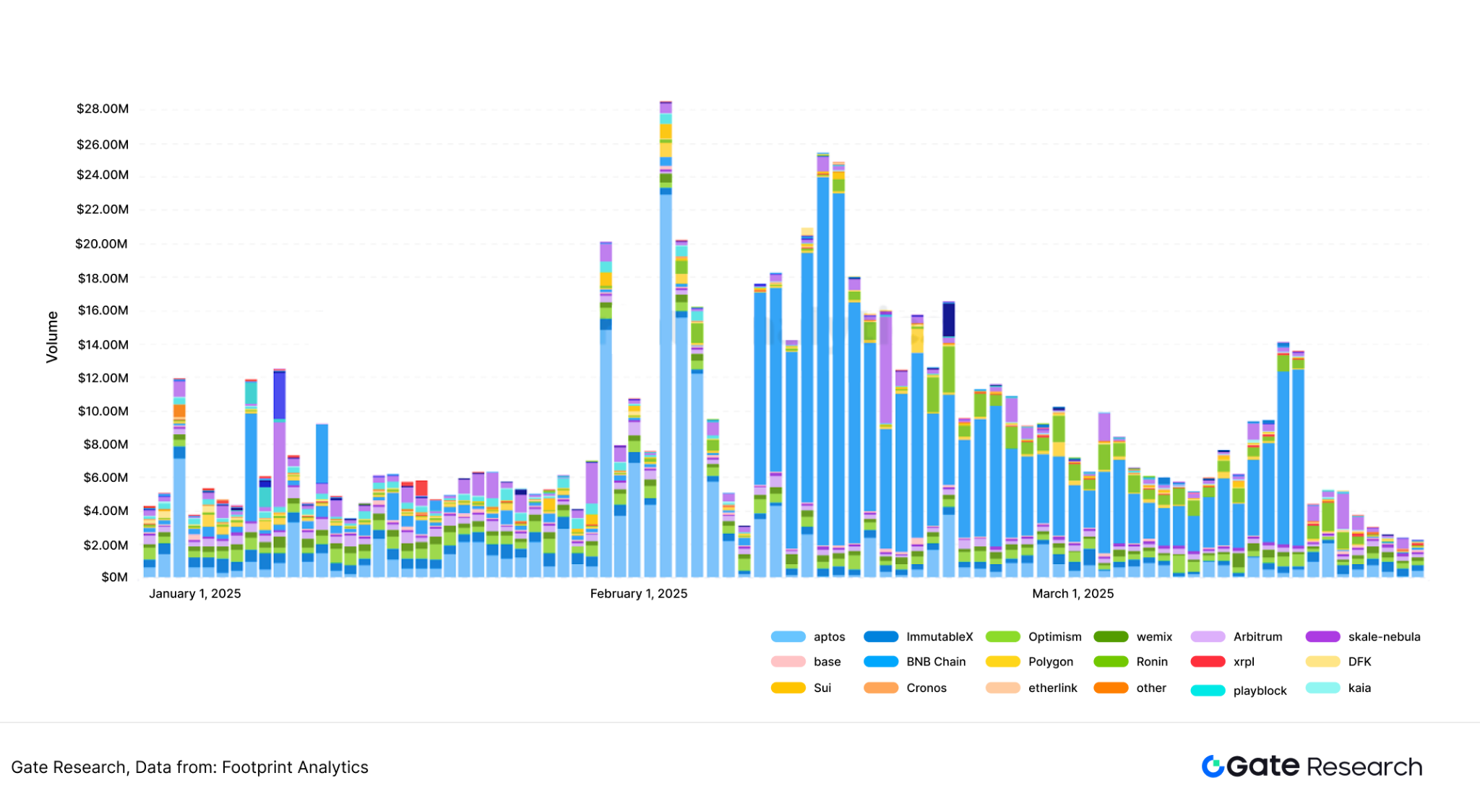

The main public game chains currently include WAX, Ronin, ImmutableX, and Immutablezkevm. This chapter will analyze the current competitive landscape of Game Chain from the dimensions of active address number, transaction volume, and transaction amount.

First, from the perspective of daily active addresses, the number of active game addresses of the Ronin public chain ranks first among the game-specific public chains. In March 2025, its daily active addresses stabilized at around 500,000. The number of active addresses of Immutablezkevm and WAX both fluctuated around 200,000. Xterio Chain, jointly created by the game distribution platform Xterio and AltLayer, is the game-specific public chain with the largest data fluctuations in recent times. Since Xterio launched a large-scale $XTER points reward event in December 2024, its active addresses once exceeded 1.6 million at the end of December, but after the event ended, its active addresses had dropped to around 100,000 in March 2025. [7]

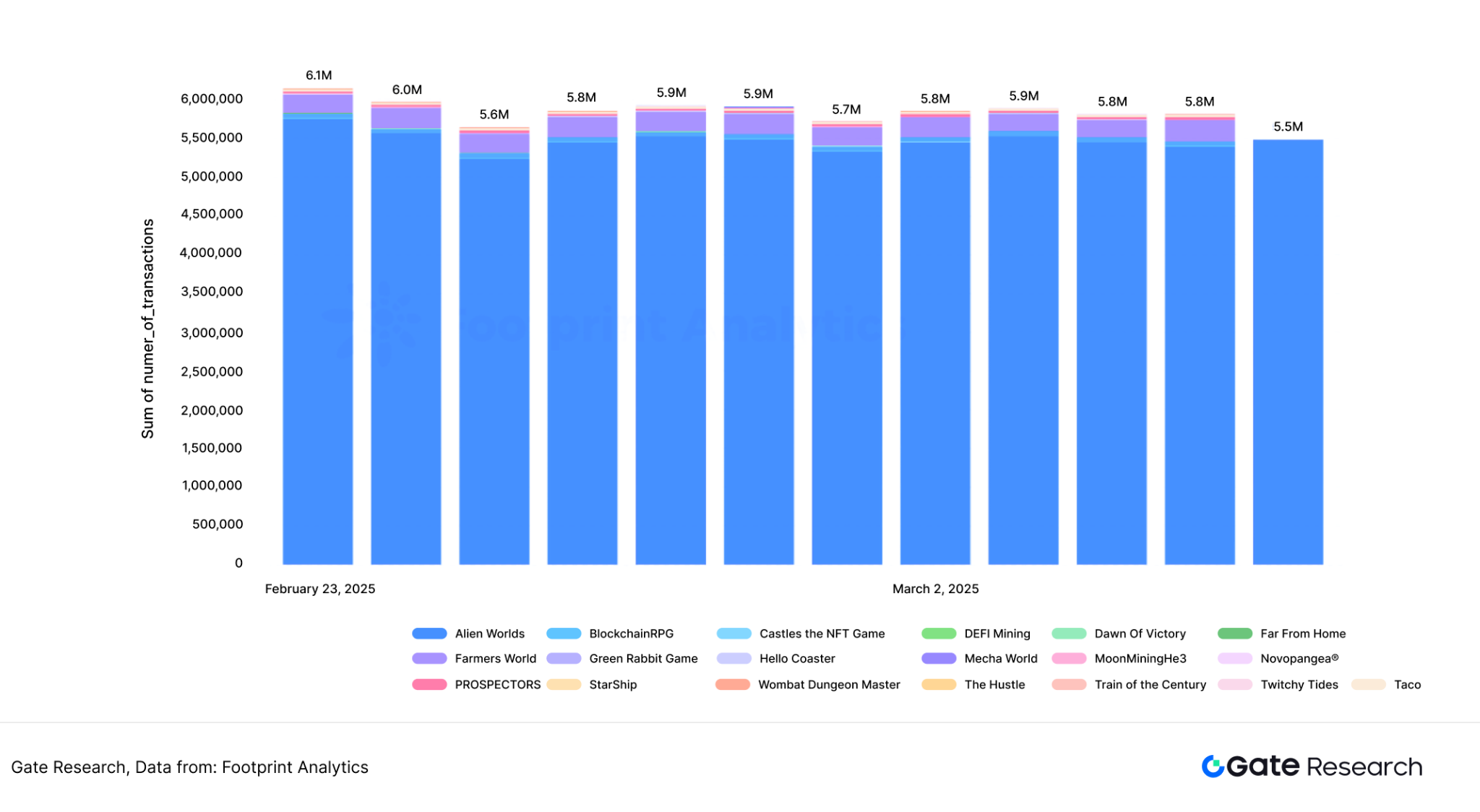

Figure 7: Daily active address data of games on various public chains

Secondly, in terms of transaction count, WAX public chain has been ranked first (including other general public chains) for the past three months, with a stable transaction count of 5 million per day. The second is Ronin public chain, whose transaction count fluctuates greatly. Currently, there are about 500,000 transactions per day. Its peak data is in December 2024, with more than 2 million transactions per day. Immutablezkevm's transaction count is relatively low, basically maintaining at 200,000 transactions per day. [8]

Figure 8: Game transaction data for each public chain

Finally, in terms of transaction amount, Ronin is currently the gaming-specific public chain with the highest transaction volume, with a daily transaction amount that is stable at $800,000 to $1.5 million. ImmutableX is second, with a transaction amount between $300,000 and $1 million. Although WAX has always maintained its leading position in terms of transaction volume, its average daily transaction amount is unlikely to exceed $100,000. [9]

Figure 9: Transaction amounts of game projects on various public chains

Overall, the current game public chain does not show a clear advantage in the competition with the comprehensive public chain. In terms of active addresses, the two public chains of Aptos and opBNB have a significant advantage. In terms of transaction amount, BNB and Aptos are also several times that of several game-specific public chains. The game public chain dominates the entire Gamefi market, and more blockbuster exclusive games are needed.

3. Game Chain Typical Case

3.1 WAX

WAX was founded in 2017 by cryptocurrency pioneer William Quigley (founder of Tether). The WAX chain is also known as the "King of NFTs" because it has successfully promoted NFT sales from many well-known partners, including: Major League Baseball, Street Fighter, Atari, etc. WAX is based on EOS and follows its DPoS (delegated proof of stake) consensus mechanism to support the high throughput required for games.

3.1.1 WAX public chain core mechanism

The consensus mechanism of the WAX public chain is DPoS, which evolved from the current mainstream PoS mechanism of the public chain. DPoS was first proposed by Dan Larimer (former CTO of the EOS public chain). In short, the difference between this mechanism and PoS is that the nodes of PoS are one person one vote (to become a qualified node, you must stake 32 ETH), while the nodes of DPoS are "people's congress representatives" system, which is an indirect election. The holders of the currency select 21 guilds (GUILDs), which confirm the block generation of the blockchain. The advantage of DPoS is its fast speed, with a TPS of more than 3,000; the disadvantage is that it has a low degree of decentralization and guilds are prone to form oligopoly. [10]

The WAX blockchain generates a block every 0.5 seconds, and only one WAX guild node is authorized to produce blocks in each period. If a node fails to generate a block within the scheduled time, the block in that period will be skipped. When one or more blocks are missing, the blockchain will have a time gap of 0.5 seconds or more. To prevent passive work, WAX implements a reward and penalty mechanism for guild nodes with a block production rate ≤ 50%. As an independent public chain, WAX does not have an independent Rollup layer and DA layer of a modular public chain.

WAX implements Byzantine Fault Tolerance (BFT) through a rule that strictly prohibits WAX Guild nodes from signing two different blocks at the same block height or timestamp. The role of BFT is to prevent major failures and suppress the influence of malicious nodes. If any WAX Guild node attempts to sign two blocks at the same height or timestamp, the coin holders will vote to expel it from the network. The finality of the block is confirmed by the joint signature of 15 Guild nodes. Once confirmed, the block cannot be tampered with and is permanent.

3.1.2 WAX public chain economic model

WAXP is the governance token of the WAX public chain. WAXP holders can earn income through staking. The public chain will reserve a fixed number of tokens every day as rewards to be distributed to holders. Personal daily reward = personal staking weight / total network staking weight × total reward for the day. In addition, as a public chain that emphasizes joint governance, staking rewards are also linked to the number of votes of coin holders. Personal staking weight = the number of WAX tokens currently staked × voting intensity. Voting intensity is a coefficient between 0 and 1. If the coin holder participates in the voting of community proposals every week, his voting intensity is high; otherwise, the voting intensity is low.

The 21 guilds selected by the token holders can receive WAX Guild Rewards by producing blocks. The amount of the reward is directly linked to the number of blocks each guild actually produces. In addition, the Standby Guilds, as "alternate operators", can also receive a corresponding proportion of the reward if they can successfully process blocks when randomly called.

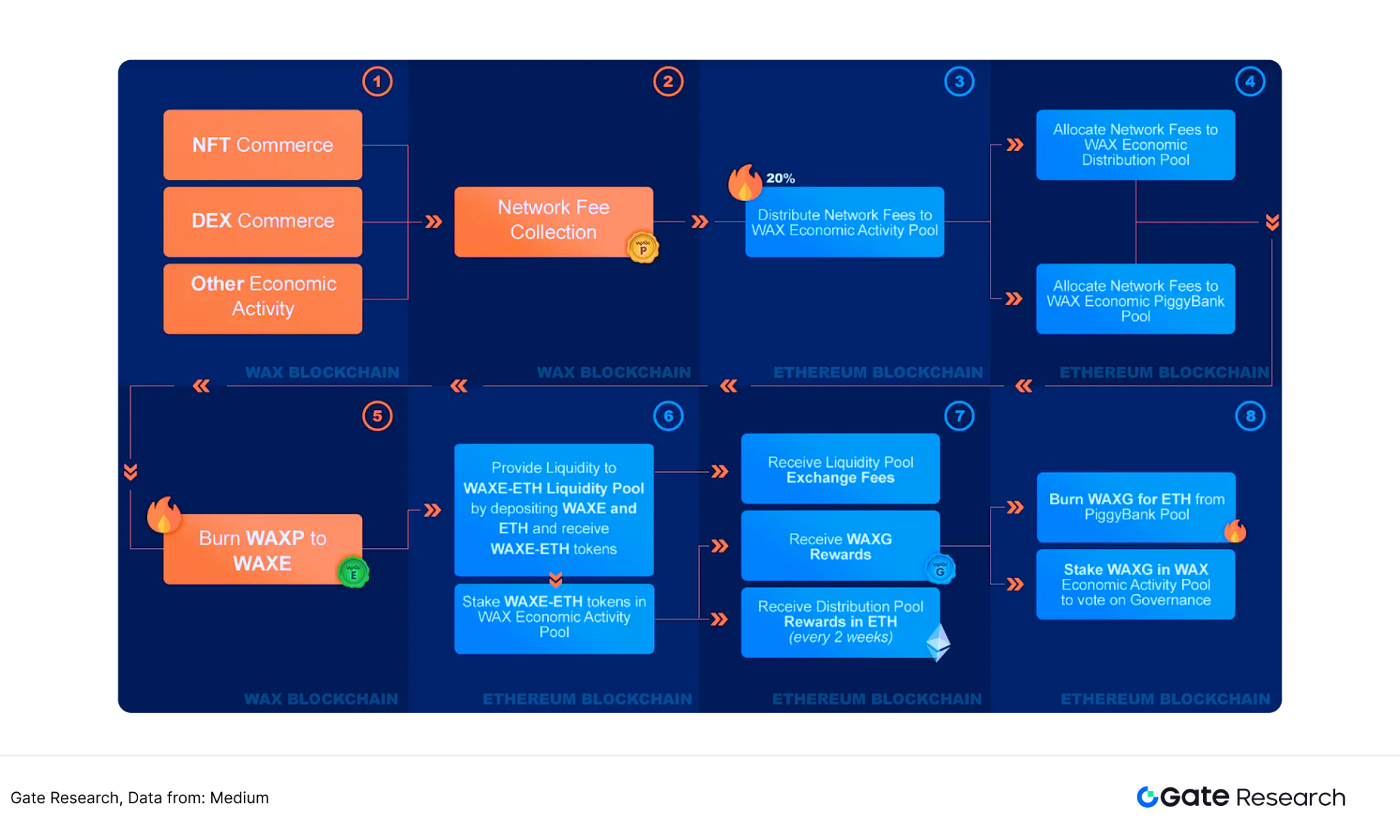

In order to better be compatible with Ethereum, WAX created three new tokens: WAXE, WAXE-ETH, and WAXG. WAXE is an ERC-20 token that is pegged to WAXP at a 1000:1 exchange rate (WAXP will be destroyed after exchange). In addition to WAXP exchange, 80% of the on-chain NFT transaction fees are also rewarded in the form of WAXE and stored in the WAX Economic Activity Pool (WEAP). WAXE-ETH is the token obtained by LP (liquidity provider) in the liquidity pool after injecting liquidity into the pool. WAXG is obtained by staking WAXE-ETH in WEAP. These tokens give holders additional governance rights and other rights within the ecosystem. The WAXG mechanism further incentivizes user participation while deepening the connection between the WAX native chain and Ethereum-based DeFi activities. [11]

Figure 10: WAX economic model flow chart

3.1.3 WAX public chain game ecosystem

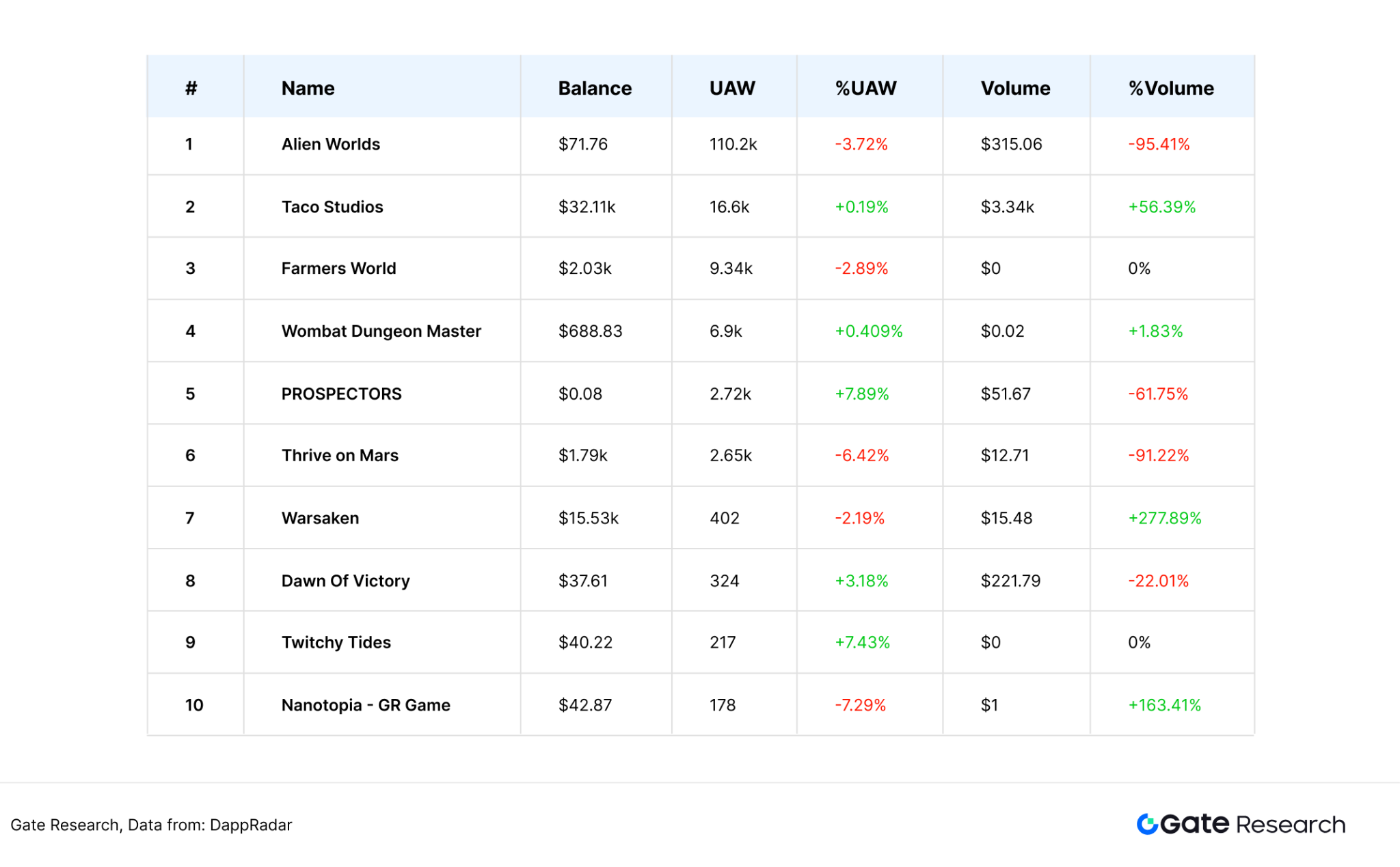

Since WAX is one of the earliest established public chains dedicated to games, after more than five years of ecological development, there are more than 5,000 games on the WAX public chain, making it one of the public chains with the most game projects. [12] [13]

Figure 11: Top 10 WAX public chain games displayed by DappRadar

Figure 12: Transaction count of each game on the WAX chain

In the WAX public chain's gaming ecosystem, Alien Worlds leads in multiple data gaps, with a UAW of more than 110,000 (nearly 24 hours), while the second-place Taco Studios' UAW is only 16,000 (nearly 24 hours). At the same time, the daily transaction volume on the game chain exceeds 5 million times, accounting for more than 80% of the total number of transactions on the WAX public chain.

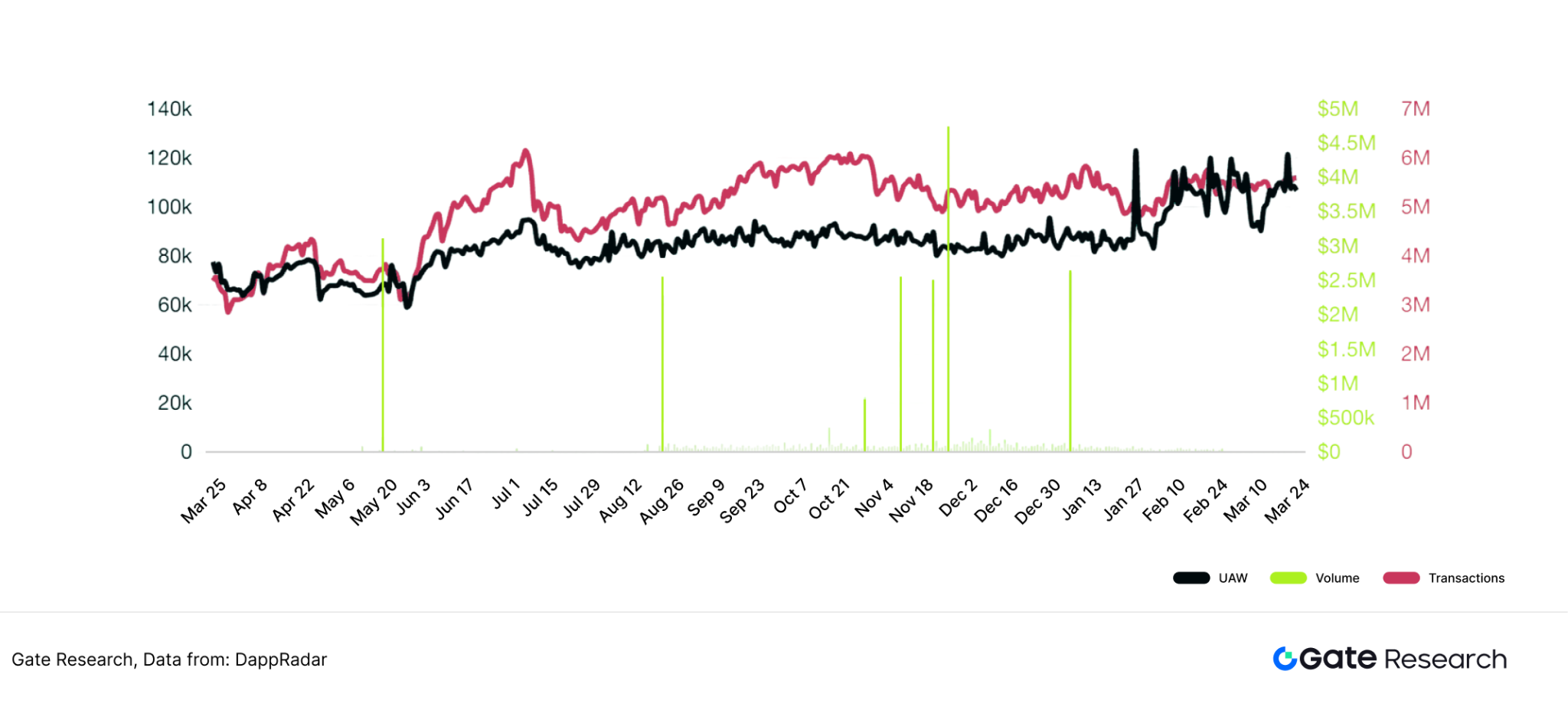

Alien Worlds is a space exploration game developed by Dacoco GmbH based on the WAX public chain. Alien Worlds can provide players with land ownership, deployment tools, soldiers and weapons, and customized exclusive game characters. Since Alien Worlds was launched at the end of 2022, its data has remained stable, which is inseparable from its mature gameplay. Land construction gameplay is a relatively successful gameplay in the current Play-to-earn model. Players can obtain considerable economic benefits by purchasing land NFTs and mining various resources. [14]

Figure 13: Alien Worlds game core data for the past year

In addition to Alien Worlds, several other games on the WAX chain, including TACO Studios, Farmers World, and Thrive on Mars, are also land construction games with similar underlying logic. This shows that the main games on the WAX public chain are NFT-based games with strong financial attributes.

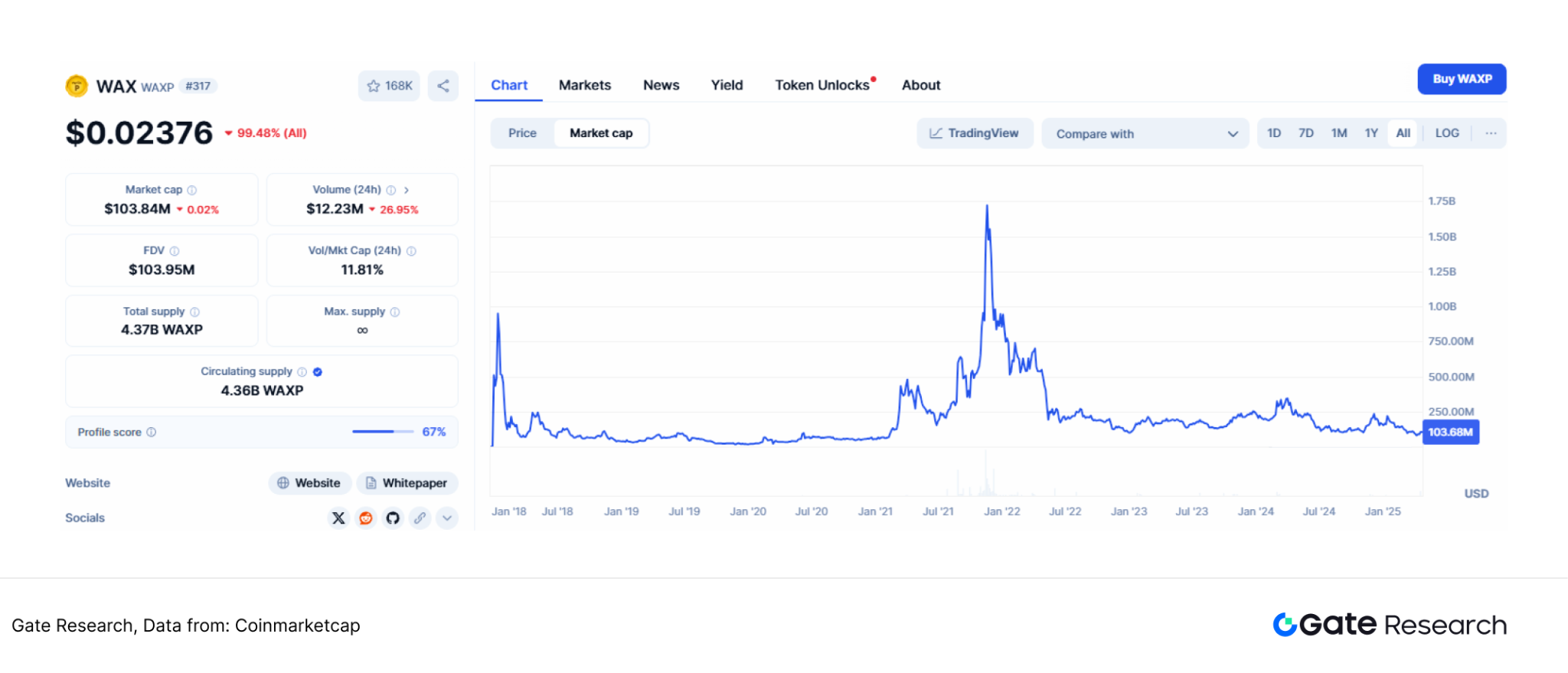

3.1.4 Overview of WAX public chain strategy and development

From the perspective of WAXP's market value, the core team of the WAX public chain has not taken any action on market value management. WAXP's market value has been falling since November 2021, when it was $1.7 billion, and by March 2025 it was less than $100 million (the lowest point since March 2021). In the 2024 cryptocurrency bull market, its market value still fell by more than 32%, underperforming the market. If market value is used as the basis for judging whether a project is successful or not, the result of the strategic decision-making of the WAX public chain in the past three years has been a failure. [15]

Figure 14: Changes in market value after WAX completed TGE

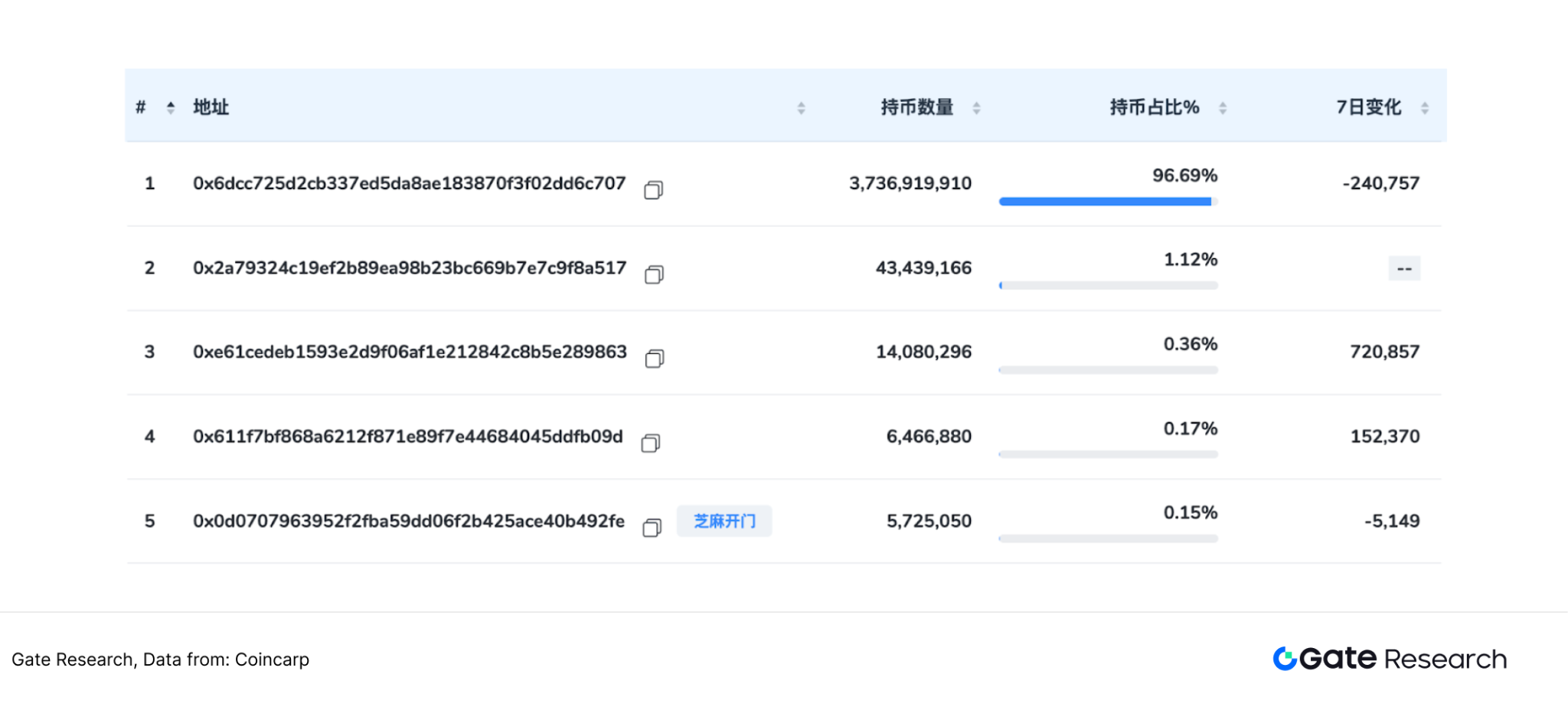

From the changes in WAXP's holding addresses, both Coincarp and Arkham data show that WAXP tokens are highly centralized. More than 96% of the tokens are held by the address 0x6dcc. Such a centralized holding distribution can lead to a conclusion: the decline of WAXP is not caused by the project party selling off the tokens after unlocking them. The core reason is that the core team of the public chain did not regard WAXP as the value embodiment of the WAX public chain and neglected market value management. [16]

Figure 15: Top five WAXP holding addresses

Overall, WAX's current situation is a true reflection of many older generation application-based public chains (EOS, ICP, Conflux, etc.). After experiencing a huge drop, the token has fallen into a situation of declining trading volume and low price consolidation. There are not many new games released in the game ecosystem. Alien Worlds and Farmer Worlds are both early game projects, and these two projects contribute to the main transaction volume on the WAX chain. Land-based NFTs have strong financial attributes and do not have a high development threshold. There are few new games, and the ecosystem lacks the influx of fresh blood.

In terms of resource endowment, William Quigley is one of the veterans of the Crypto industry. WAX has significantly more resources than other public chains in issuing NFTs for classic IPs. Many brands such as DC, Marvel, and Street Fighter have chosen to cooperate with WAX.

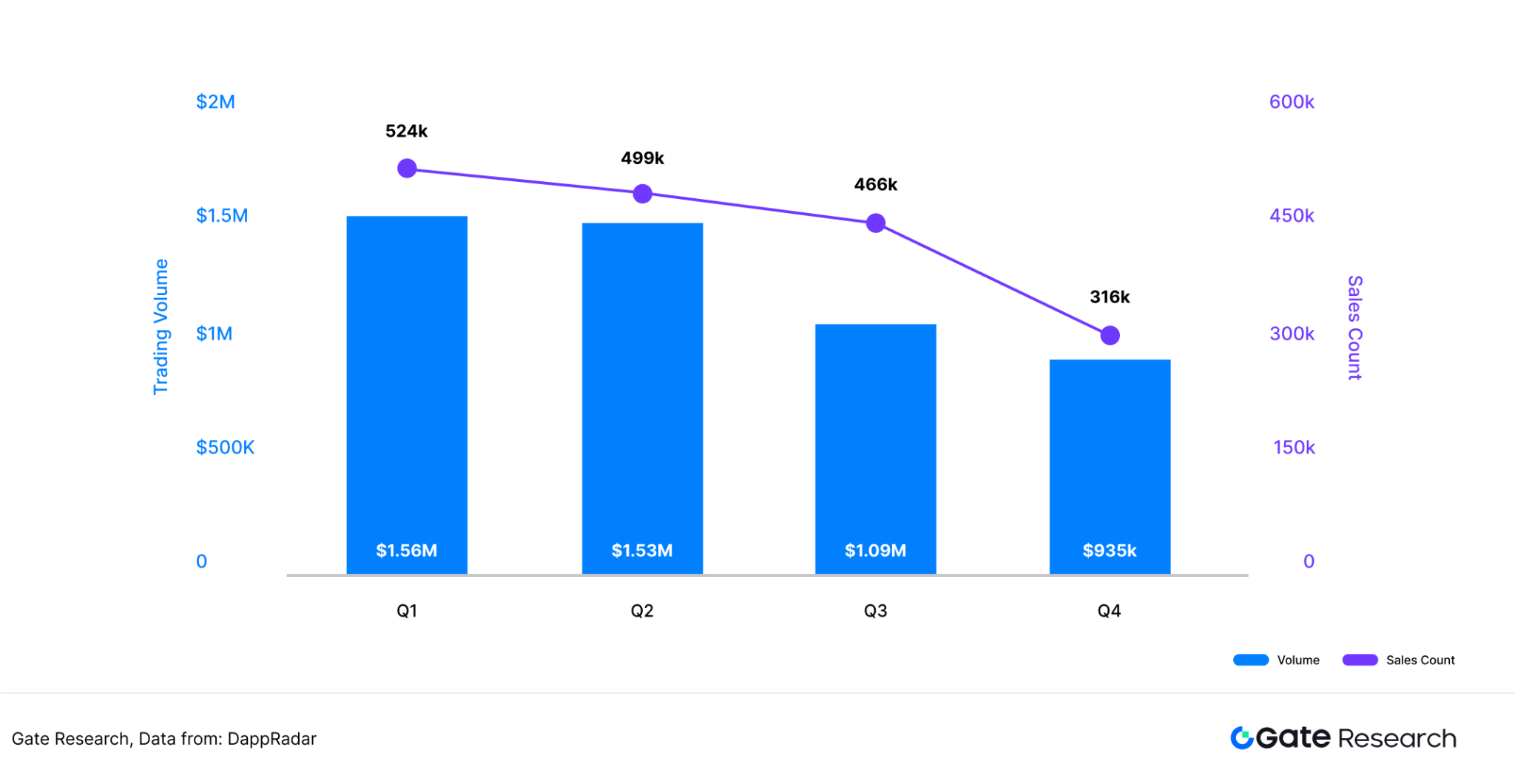

As of the end of 2022, the total sales of NFTs on the WAX chain have exceeded US$400 million, and the main distribution channel is the Atomic Hub platform under the WAX public chain. The Atomic Hub platform will charge a 2% fee for NFT transactions. In the NFT boom of 2021-2022, the core team of the WAX public chain has made a lot of money. Therefore, from an operational perspective, the team has shown obvious signs of "lying flat" in the past three years, and the annual NFT sales in 2024 will be only US$5 million. [17]

Figure 16: WAX public chain NFT sales in 2024

3.2 Immutable

Immutable was officially established in 2018. The founders are brothers Robbie Ferguson (CEO) and James Ferguson (CTO), both of whom are veterans in the blockchain and gaming industries. ImmutableX Layer 2 (based on StarkEx) was launched in 2021, focusing on high-performance expansion of NFTs and games. Immutable zkEVM (based on the Polygon technology stack) was launched on the mainnet in January 2024, further optimizing Ethereum compatibility and scalability.

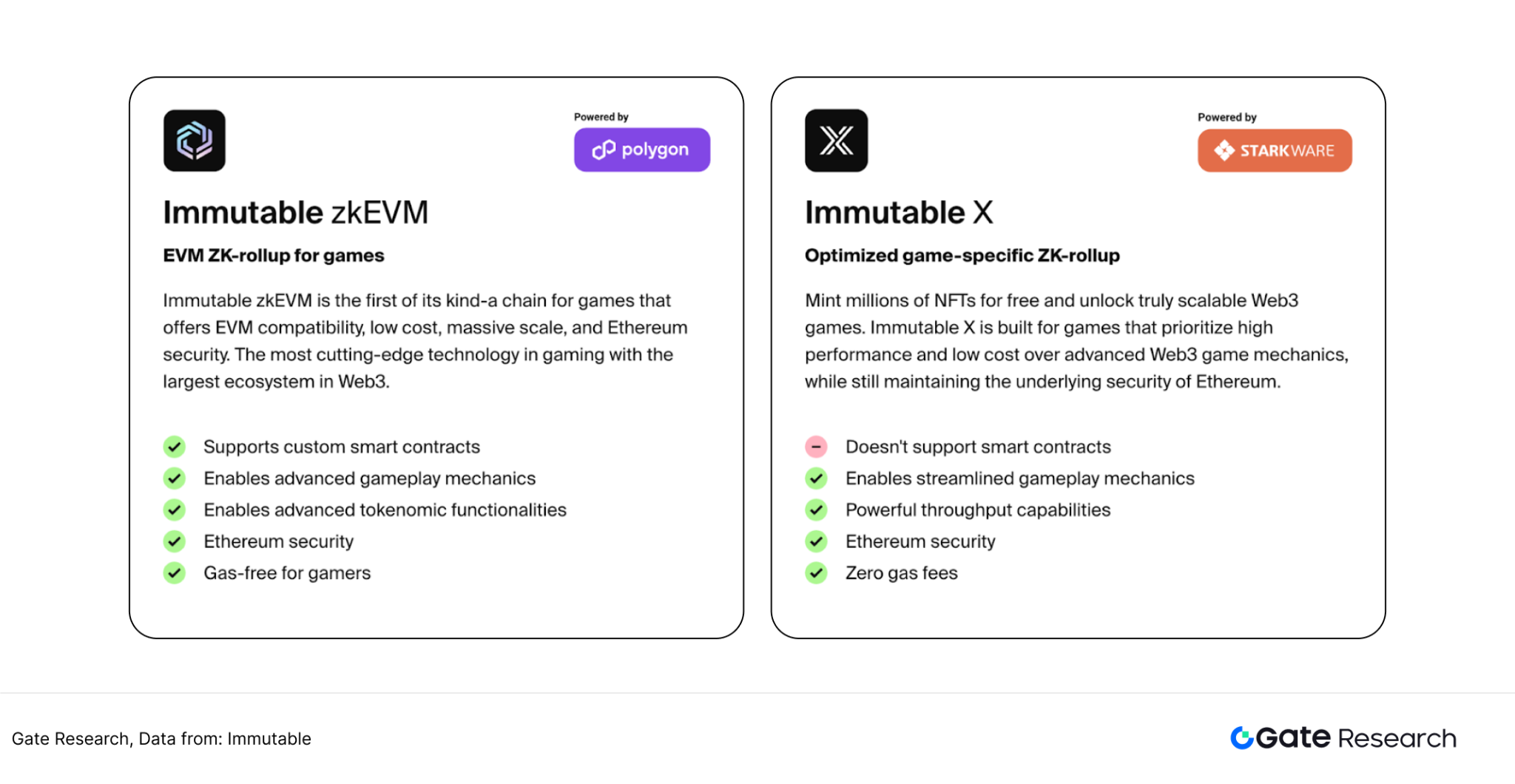

3.2.1 Core Mechanisms of ImmutableX and Immutable zkEVM Public Chain

Both ImmutableX and Immutable zkEVM use the ZK-Rollup packaging method. The difference is that the former uses the ZK-Stark proof system developed by Starkware to optimize the NFT trading experience, while the latter uses the ZK-SNARK proof system based on Polygon and fully supports smart contracts. In terms of consensus mechanism, both ImmutableX and Immutable zkEVM use the most commonly used PoS mechanism.

● ImmutableX consensus mechanism

ImmutableX uses a vault Merkle tree to manage asset status. Each leaf node in this data structure represents an asset vault, and non-leaf nodes are hash values of child nodes. Its operating mechanism consists of two core components: one is the on-chain smart contract validator, which ensures state security by storing the root hash and only allowing valid proof updates. It currently uses a time-locked upgradeable design but plans to be immutable in the end; the other is the L2 proof logic written in the Cairo language, which is responsible for verifying the legitimacy of state transitions such as asset transfers. This dual verification architecture not only ensures asset security, but also retains flexibility for system upgrades. [18]

Immutable X uses STARK proof technology instead of the more common SNARK proof. As a new generation of zero-knowledge proof technology, STARK solves the three core flaws of the SNARK solution: the need for a trusted setup ceremony, lack of post-quantum security, and reliance on overly complex cryptographic implementations that are prone to errors. Although STARK proofs are larger in size and more expensive to publish on the chain, the team believes that this is a reasonable price to pay for stronger user security.

In terms of DA (data availability), Immutable X supports two modes: Rollup and Validium. In the Rollup mode, each batch of state changes will be published to L1, which will add a small linear cost to each transaction while retaining the security of L1; in the Validium mode, each batch of data is signed by the Data Availability Committee (DAC). As long as there is an honest member in the committee, the user can successfully withdraw assets. The current DAC members include 8 institutions such as Immutable and StarkWare.

● Immutable zkevm consensus mechanism

Immutable zkevm, developed by Immutable and Polygon, is basically the same as ImmutableX in the underlying settlement layer and DA layer. The difference is that the ZK-SNARK proof system used by the former fully supports smart contracts and is compatible with the Ethereum development tool chain (such as Hardhat and Truffle), reducing the migration cost of the game.

Figure 17: Comparison between ImmutableX and Immutable zkevm

3.2.2 Immutable Economic Model

Although ImmutableX and Immutable zkEVM are two different public chains, their governance tokens are both IMX and they use the same economic system. IMX is an ERC-20 token whose core functions include voting, staking, and payment.

In terms of payment, 20% of the Immutable protocol fees must be paid in IMX tokens. This fee can be paid directly in IMX, or Immutable will automatically convert the actual payment currency (such as ETH) into IMX on the open market. This means that users do not need to hold IMX tokens specifically to trade on the protocol.

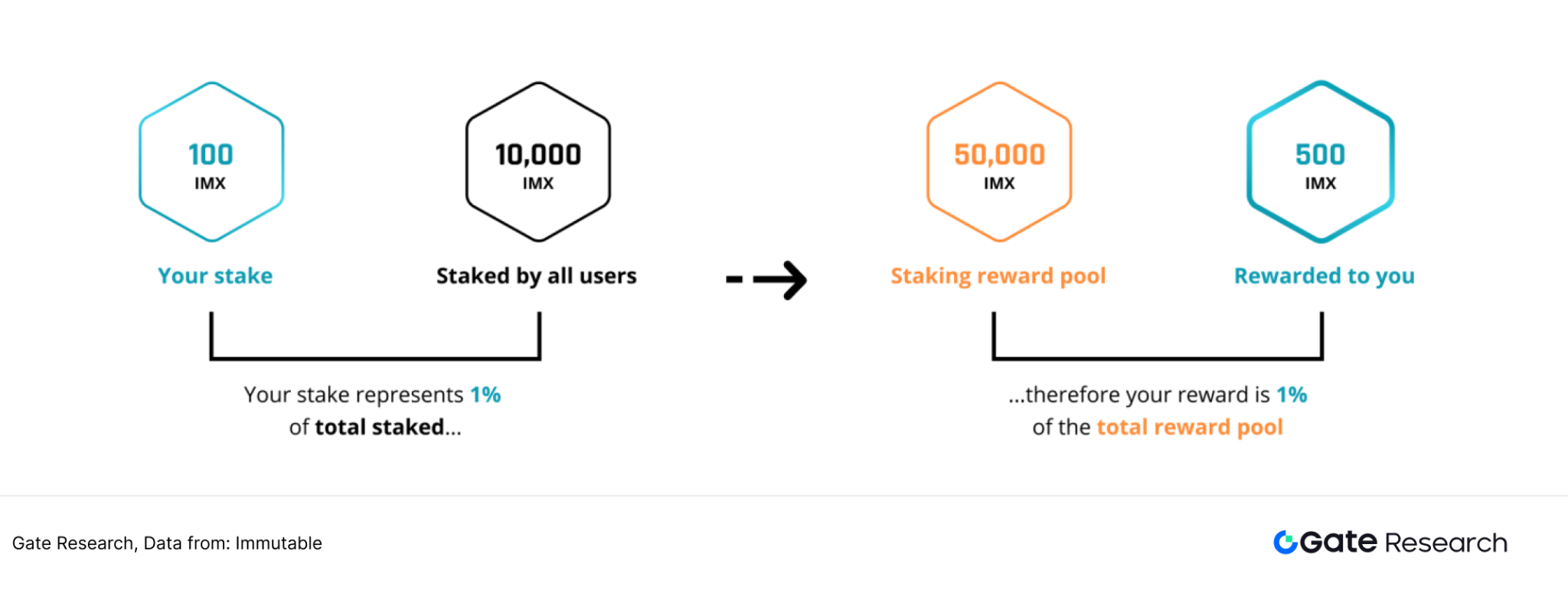

In terms of staking, the gas fees of game players trading on the two chains of Immutable will be put into the reward pool. After staking IMX tokens, coin holders can obtain IMX tokens in the gas fee reward pool. The reward amount for each user is proportional to the proportion of the number of IMX staked in the month to the total amount of staked in the entire network. Similar to the mechanism of WAX, Immutable also has requirements for staking to participate in community governance. Only those who have voted on governance proposals in the last 30 days can become qualified pledgers. In addition, Immutable also requires pledgers to complete a transaction within 30 days or hold an NFT to become qualified pledgers. The author believes that the staking model of IMX provides a good deflation mechanism for the entire system. The lock-up of pledgers can reduce market selling pressure and prevent the entire economic system from having a high inflation rate.

Figure 18: IMX token staking mechanism

In terms of community governance, token holders will be able to vote on token-related proposals through a decentralized governance mechanism. The scope of proposals includes: (1) token reserve allocation plan; (2) developer funding project voting; (3) daily reward mechanism activation; (4) token supply adjustment.

3.2.3 ImmutableX and Immutable zkEVM Game Ecosystem

● ImmutableX gaming ecosystem

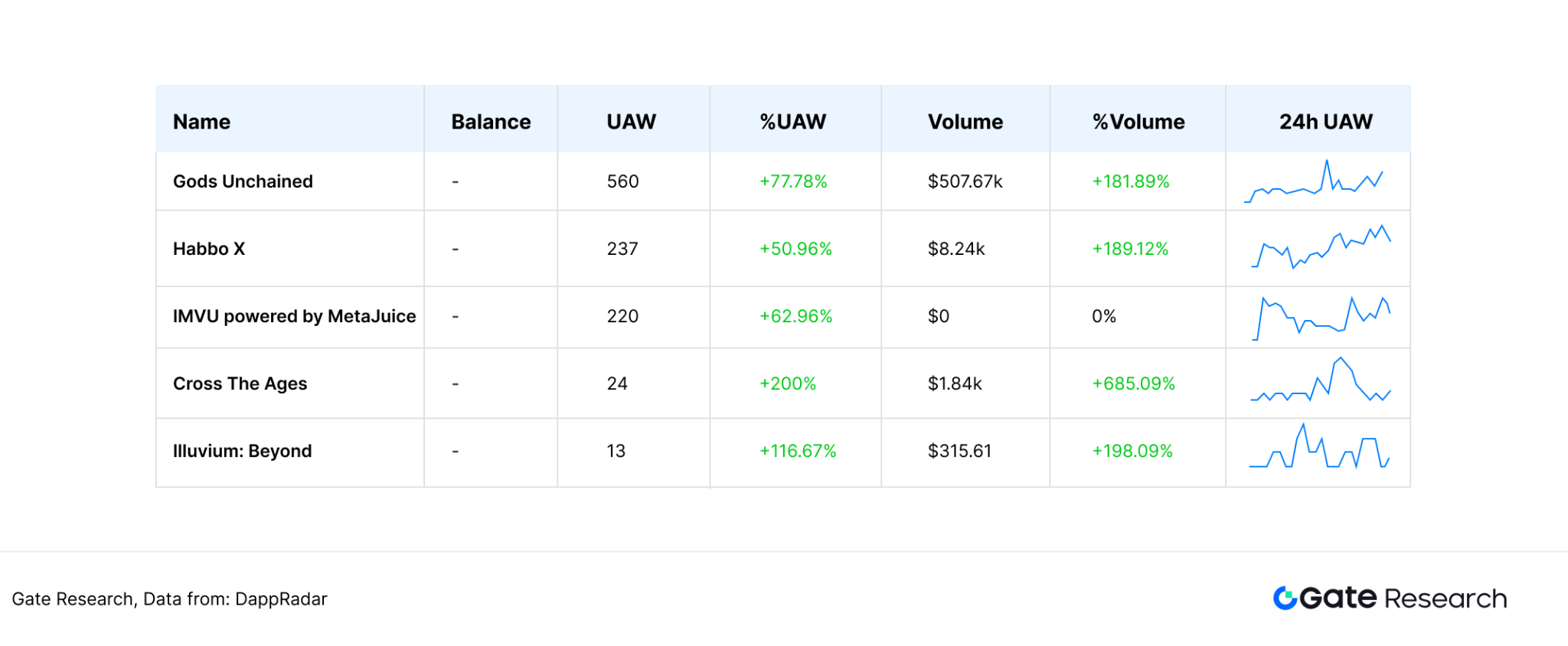

ImmutableX’s games cover a wide range of game types, including the card game Gods Unchained, the pixel-style mini-game Habbo X, and the AAA game Illuvium. However, the UAW of the ImmutableX ecosystem is relatively small. The game with the highest UAW is Gods Unchained, whose 24-hour UAW is only 560, far less than the UAW of games on the WAX ecosystem. This phenomenon indirectly reflects that although ImmutableX’s games pay more attention to the player’s gaming experience, their play-to-earn attributes are relatively weak, and their appeal to gold farmers is relatively low. [19]

Figure 19: Top 5 games on the ImmutableX public chain as displayed by DappRadar

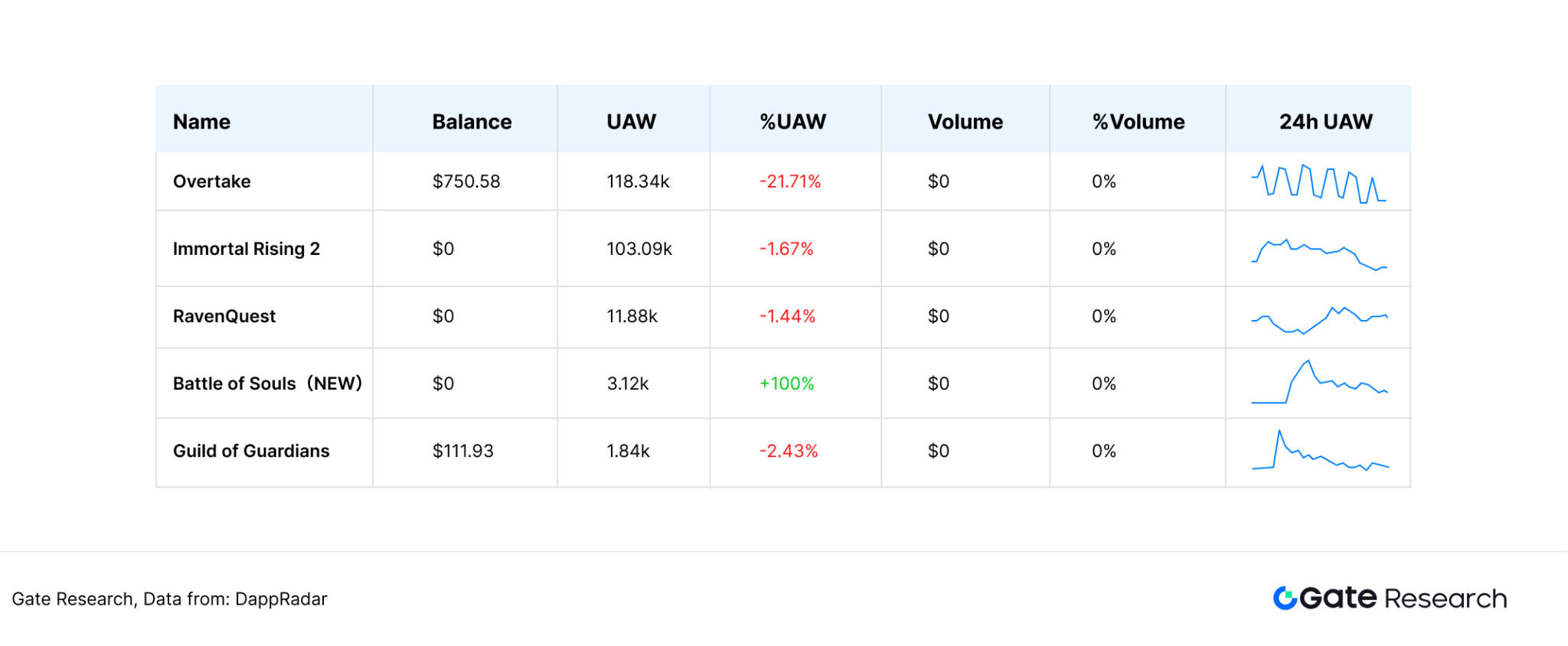

● Immutable ZkEVM gaming ecosystem

Immutable ZkEVM, developed in cooperation with Polygon, allows games originally on Ethereum and Polygon chains to migrate to the Immutable ecosystem at a lower cost. Currently, Immutable ZkEVM's exclusive game Immortal Rising 2 has a UAW of up to 103,000, ranking first among exclusive games. This game is an MMORPG mobile game that has made significant optimizations to the map and game based on the first generation of Immortal Rising and has a high popularity. Compared with the low activity of its twin public chain ImmutableX, Immutable ZkEVM has gradually found a balance between game experience and financial attributes. [20]

Figure 20: Top 5 games on the Immutable ZkEVM public chain displayed by DappRadar

3.2.4 Immutable Strategy and Development Overview

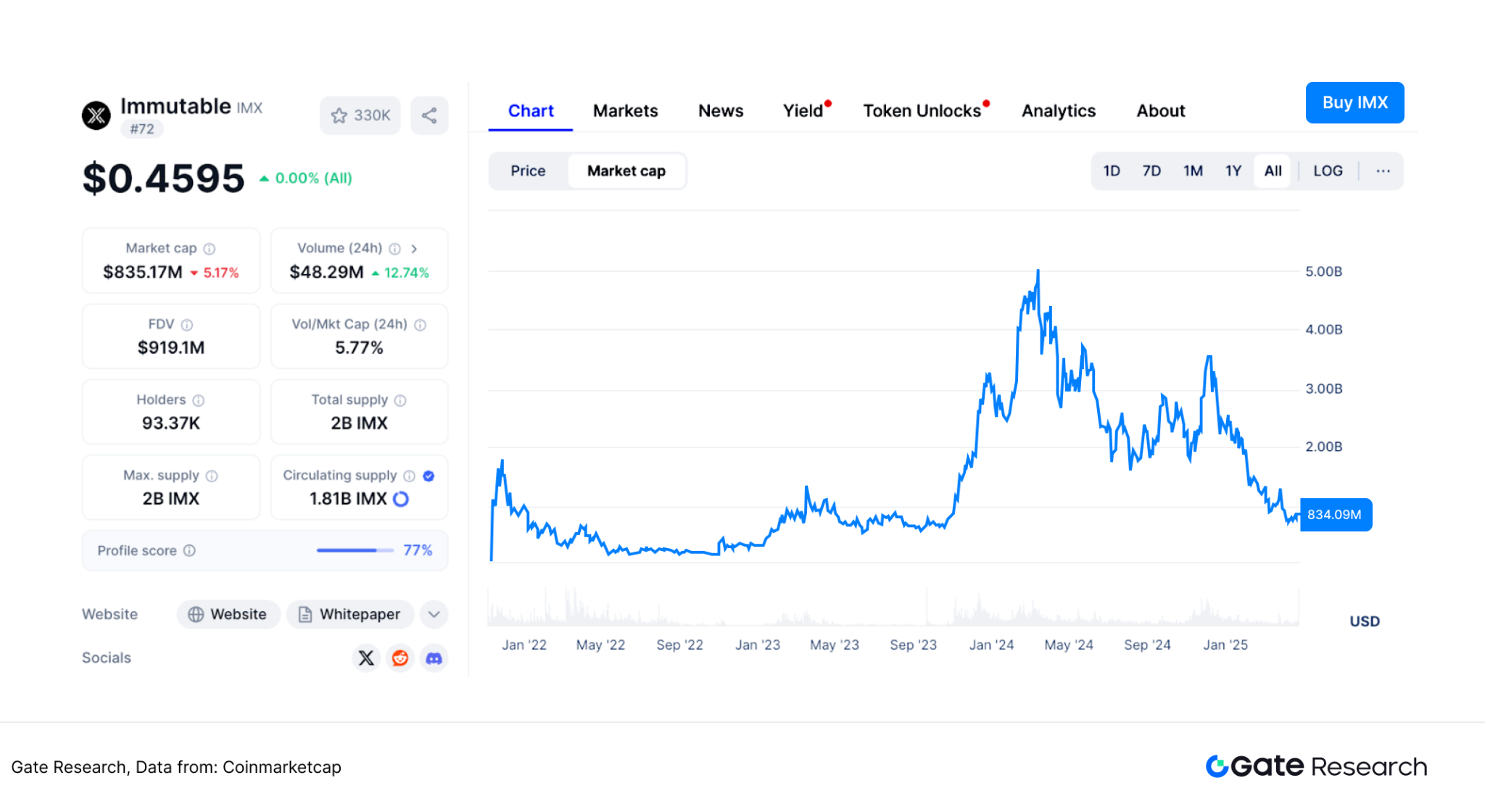

Since IMX was launched on multiple exchanges at the end of 2021, its coin price has experienced a significant roller coaster ride. Due to the investment of several well-known VC funds including Naspers Ventures, Digital Galaxy, and SBF, IMX was valued at $1 billion when it completed its TGE in November 2021. In March 2024, the market value of IMX tokens exceeded $5 billion, setting a record high. However, the overall market value of the token has since declined, and by March 2025, its market value has fallen to $800 million.

【 twenty one 】

Figure 21: Changes in IMX token market value

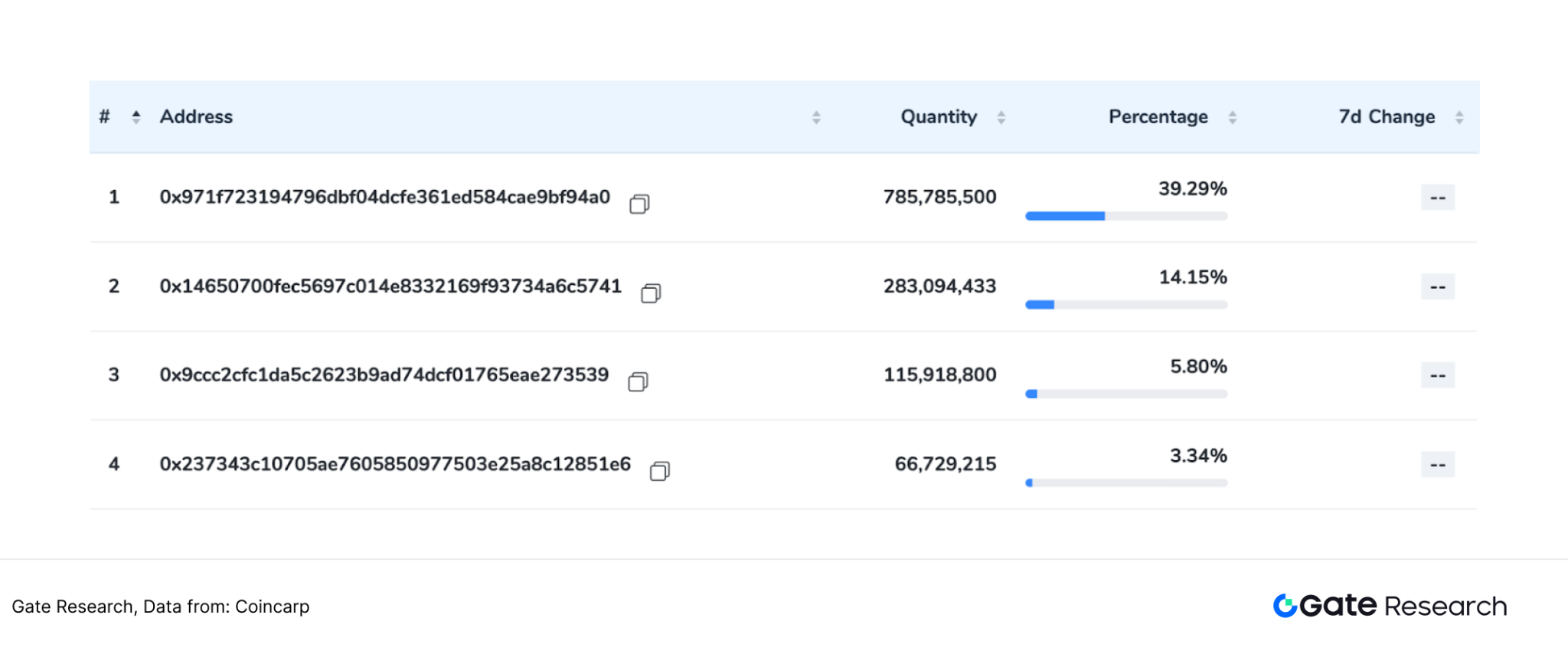

After the completion of TGE, the project party's contract address will sell tokens and cash out every time the unlocking time is reached. IMX Foundation Treasury CA (0x 237) has cashed out more than 1 billion tokens, and IMX Dev Treasury CA (0x 9 cC) has cashed out more than 300 million tokens. However, in order to stabilize the price of the currency, the other two contract addresses of IMX bought a total of 1.06 billion tokens during the sell-off period. As of March 2025, the four addresses hold a total of 1.25 billion tokens, accounting for 62.5% of the total number of issued tokens. [22] [23]

Figure 22: Top four IMX currency holding addresses

In terms of resource endowment, Immutable, as a star project, has already won the favor of capital and industry in the start-up stage. Throughout the game development chain, Immutable has established strategic partners. In terms of game development, top game studios including Mineloader, Ubisoft Innovation Lab, and Planetarium Labs have chosen to put their games on the Immutable public chain. In order to ensure that game players can trade props in real time on the chain, Immutable has reached a strategic cooperation with AWS, and AWS servers can support 9,000 transactions per second. In terms of distribution platforms, many of Immutable's games have landed on the Epic distribution platform, and Immutable has reached a cooperation with game retailer Gamestop. In addition, in terms of reaching players, Immutable has reached cooperation with game guilds such as YGG and Merit Circle to promote guild players to participate in Immutable chain games. [24]

Figure 23: Immutable Game Core Ecosystem

In summary, the Immutable project, led by the Ferguson brothers, senior game professionals, has always adhered to the development path of "high input and high output". Although the current market value of IMX is at a historical low, the launch of new games in the ecosystem has maintained a steady rhythm, and the global cooperation map continues to expand. Faced with the pressure of the decline in active addresses (UAW) on the ImmutableX chain, the team quickly launched a deep technical integration with Polygon, upgraded Ethereum compatibility through Immutable zkEVM, and successfully migrated 15 Polygon chain games to expand the ecosystem. From the perspective of strategic execution, the team's agile response to market changes and the efficiency of the implementation of the top IP chain reform plan have verified its pragmatic and efficient operational genes.

3.3 Ronin

As mentioned at the beginning of this article, Ronin is a very representative professional game public chain. Unlike other public chains that first build the underlying infrastructure and then build the game ecosystem, Ronin is a high-performance public chain built by the Axie Infinity team after the Ethereum transaction bottleneck. The Ronin mainnet was launched in 2021. In addition to its core game Axie Infinity, Ronin has also reached cooperation with multiple game studios to expand its game ecosystem.

3.3.1 Ronin public chain core mechanism

In terms of consensus mechanism, Ronin adopts the DPoS mechanism used by EOS public chains such as WAX to improve the speed of node processing transactions. In terms of settlement, Ronin adopts the modular approach of ZkEVM to improve performance while ensuring the transaction security of the public chain.

3.3.1.1 Ronin Consensus Mechanism

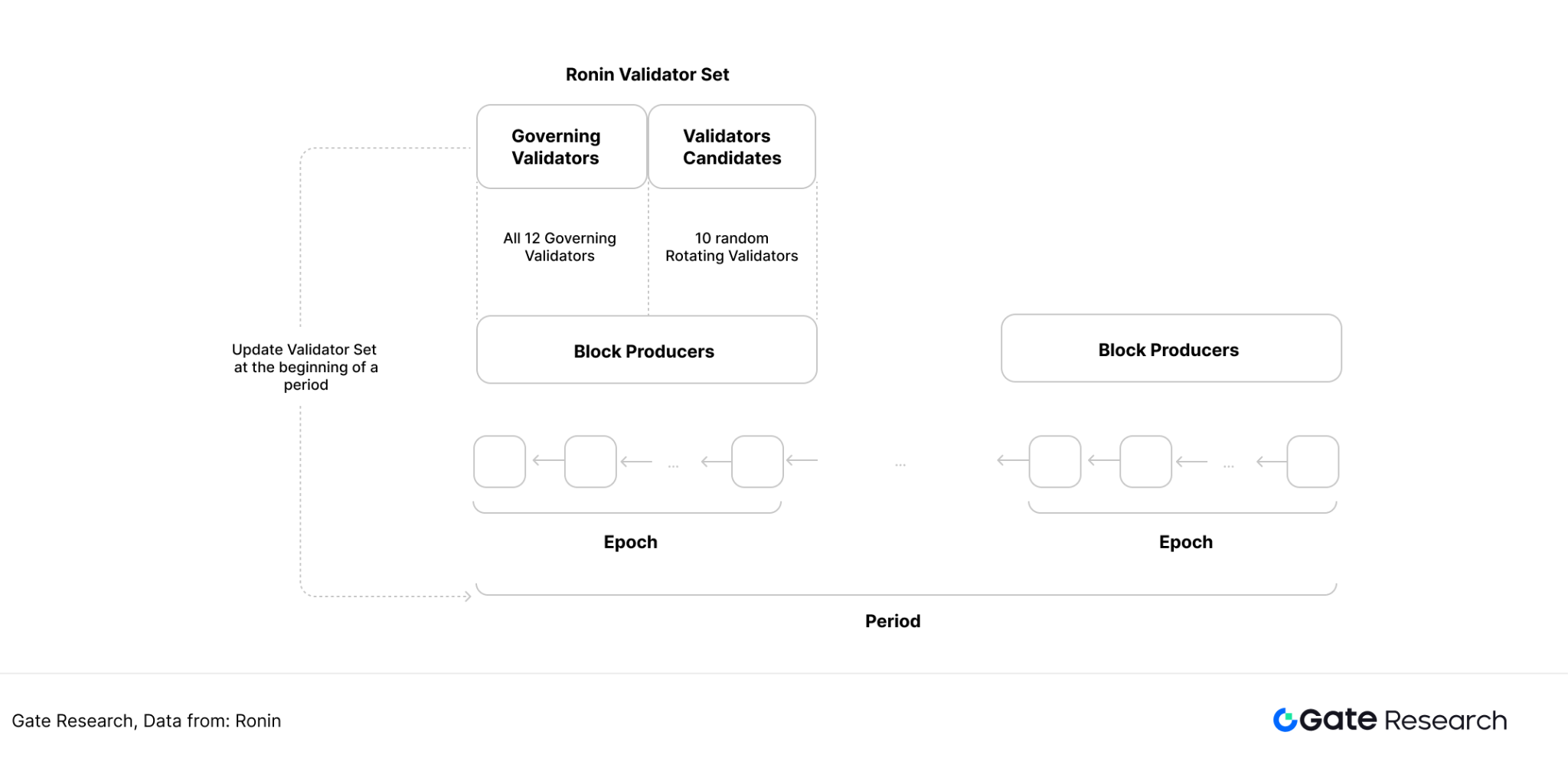

Ronin's DPoS mechanism is divided into four core modules: governance validators, blockchain generation, final voting, and delegators. Among them, the governance validators are similar to the guilds in the WAX mechanism and are elected by the community. [25]

● Governing Validators

The validator selection process through staking may bring new attack risks. If an attacker controls more than 51% of the tokens, they can take over the entire blockchain. For this reason, a group of governance validators elected by the community will help prevent such attacks. In addition to governance validators, any token holder can register as a validator candidate.

● Blockchain generation

Every cycle (or approximately every 10 minutes), a group of block producers are randomly selected to produce blocks, 12 of which are reserved for governance validators. The remaining 10 block slots are selected based on the staked amount of the validator candidate.

● Final vote

All validators can participate in the finality vote. The voting weight of a validator is proportional to the amount of stake.

● Client

Delegators delegate their stake to any validator of their choice, thereby increasing the chances of the validator being selected as a standard validator and gaining block production access.

Figure 24: Ronin consensus mechanism

3.3.1.2 Ronin Settlement Mechanism

In order to improve the scalability of the public chain, Ronin uses Zk Rollup to package transactions and upload them to quickly achieve settlement on the main network. The ZK prover is seamlessly integrated into the Ronin protocol, enabling validators to build their own ZK-EVM. Validators can start ZK-EVM by submitting a transaction containing the information required for the new ZK-EVM chain. Once started, the validator must maintain its state and cannot choose to exit the validator set.

3.3.1.3 Ronin cross-chain bridge

Since Ronin is an EVM-compatible public chain, Ronin interacts with the Ethereum mainnet by creating a cross-chain bridge. Ronin Bridge was hacked in March 2022, resulting in losses of more than $600 million. To enhance the security of the cross-chain bridge, the bridge between Ronin and Ethereum is currently managed by 22 bridge operators to ensure secure and reliable cross-chain transactions. For each transaction, each bridge operator is responsible for verifying its validity and voting to approve or reject it. To ensure a high level of security and consensus, transactions can only be executed with the approval of at least 70% of the bridge operators.

3.3.2 Ronin public chain economic model

RON is the governance token of the Ronin public chain, which includes a series of functions such as staking, payment, and governance:

● Pledge

Users can stake RON in the Delegated Proof of Stake consensus. Validators stake RON to run validator nodes and verify blocks to earn rewards. Users delegate RON to validators to further improve economic security and earn a portion of the rewards.

● Governance

Holders will be able to participate in network governance decisions in the future and influence the use of the Ronin Treasury, which receives fees from decentralized applications such as DEXs and NFT marketplaces.

● Payment

Games built on the Ronin public chain often use RON as a payment currency for key revenue streams, such as game item purchases, NFT minting, and token trading.

● Exclusive Opportunities

RON stakers and holders have been provided with airdrops, whitelisting opportunities, and launchpad allocations for token sales of projects built on Ronin.

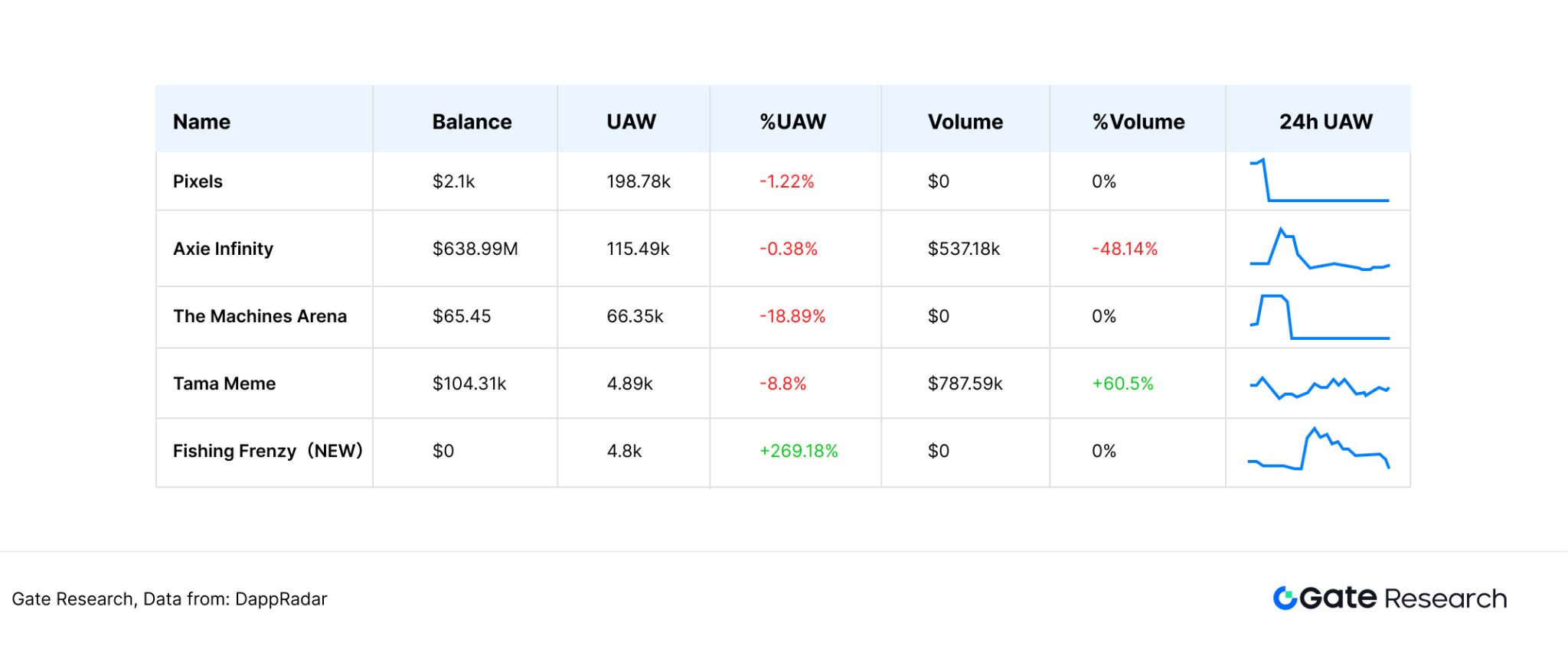

3.3.3 Ronin public chain game ecosystem

From the perspective of game data, Ronin is currently the public chain with the most hit games, including Pixel, Axie Infinity, The Machine Arena, and many other games, with UAW exceeding 50,000. From the perspective of game style, the game ecosystem of the Ronin public chain also includes MMORPG, RTS, turn-based, simulation management and other types of games. The author believes that even compared with BNB and Polygon, which have a stronger game ecosystem among general-purpose public chains, Ronin is one of the public chains with the best game ecosystem construction, thanks to its many exclusive games with in-depth gameplay. [26]

Figure 25: Top 5 games on the Ronin public chain as displayed by DappRadar

3.3.4 Overview of Ronin’s Strategy and Development

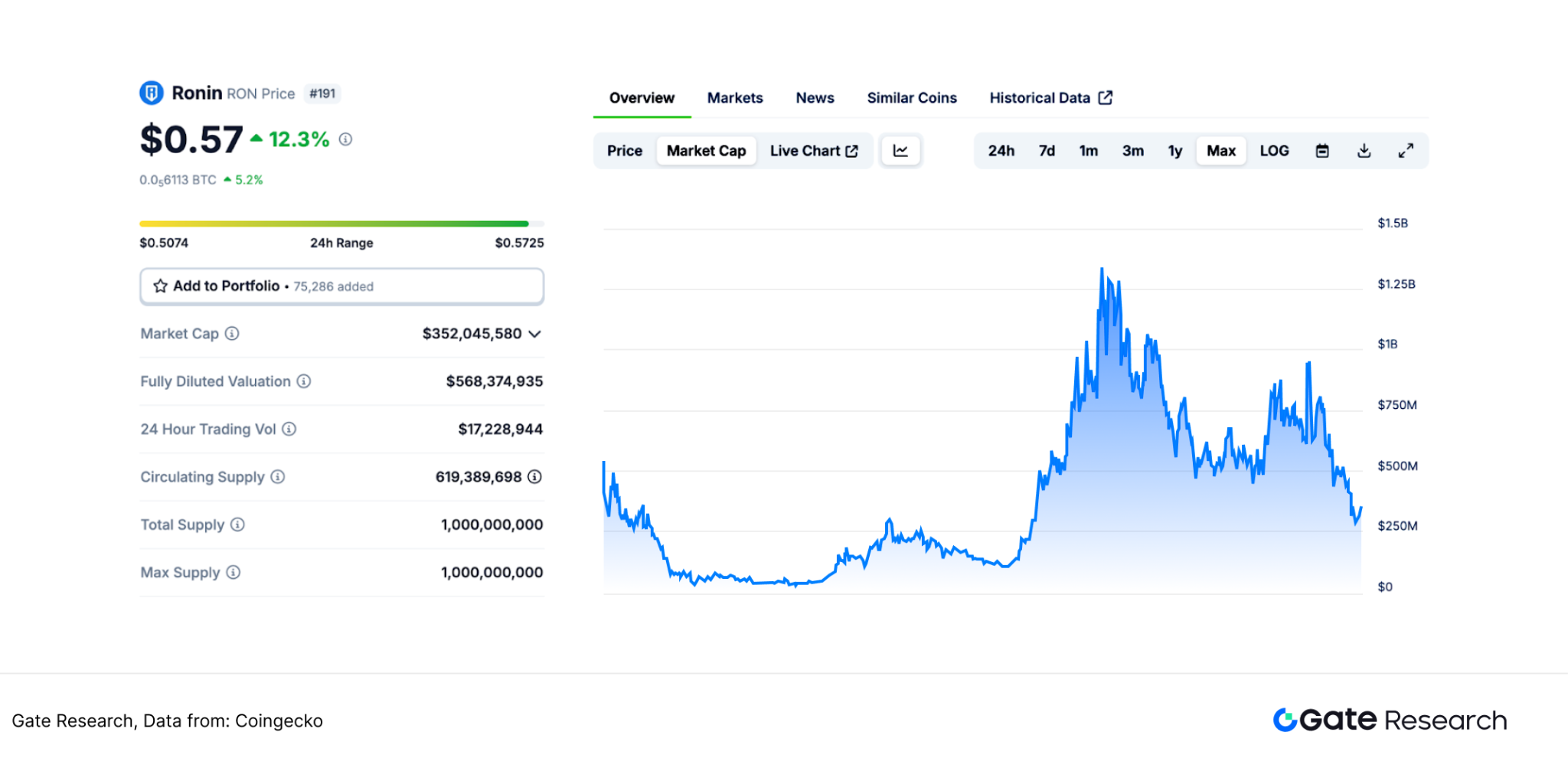

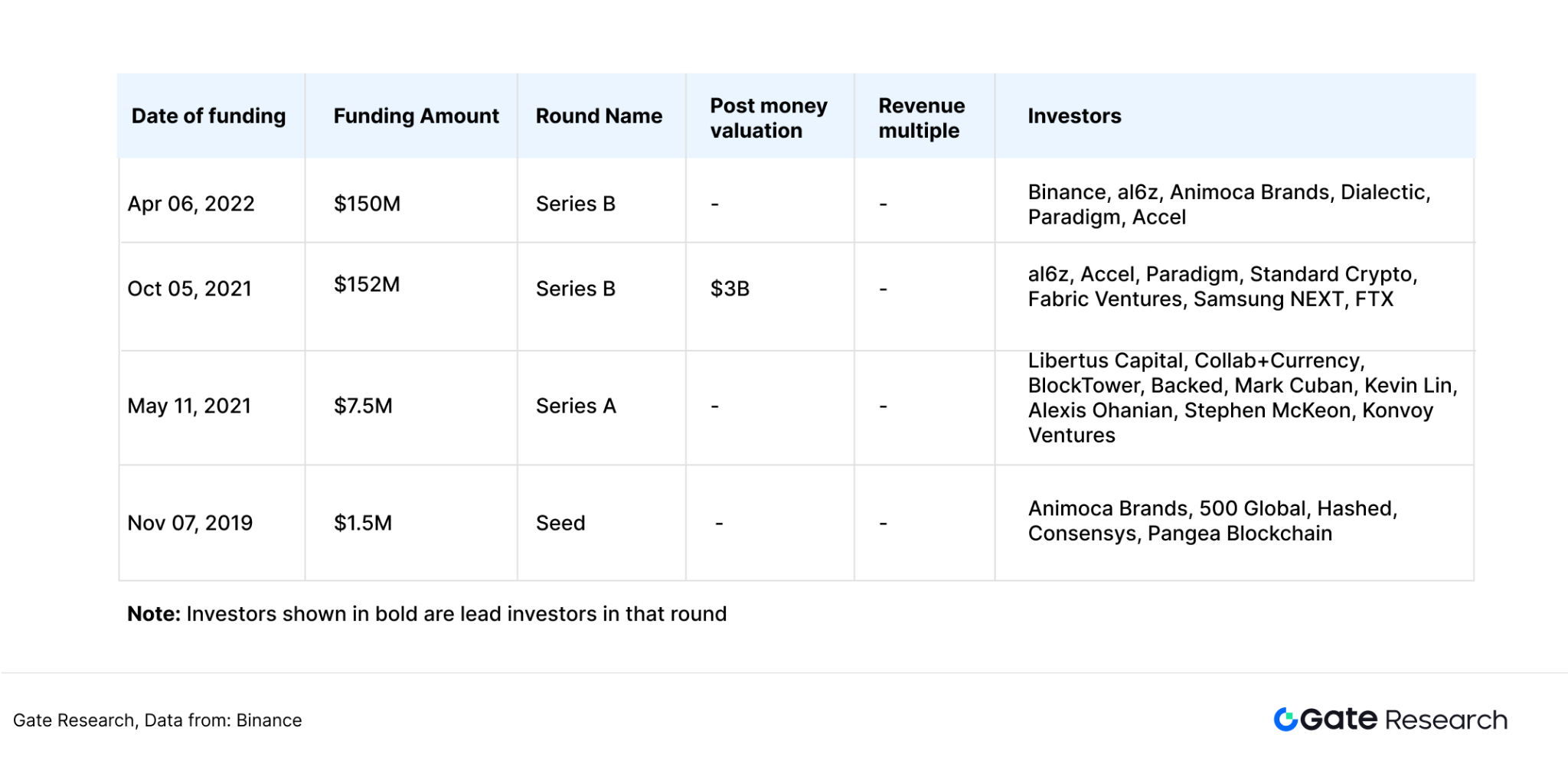

From the perspective of token market value, RON has experienced two rapid growths in market value since 2024, in March 2024 and December 2024. Its rise and fall cycles basically coincide with the cycles of the cryptocurrency market. Unlike other vertical game public chains that use public chains as the main financing, Ronin team Sky Mavis uses game studios as the main financing. After Axie Infinity successfully broke out, Sky Mavis Studio received investment from top funds such as a16z and Animoca Brands. [27] [28]

Figure 26: Changes in RON token market value

Figure 27: Sky Mavis Investor List

Since Sky Mavis itself is a game studio with rich development experience, Ronin Network itself has a lot of resources for exclusive games. In April 2024, the MOBA game The Machines Arena has completed public beta, and its UAW data has long been ranked third in the Ronin ecosystem, second only to Axie and Pixel. 2024 is a year of transition for the Ronin game ecosystem. The Machines Arena, Lumiterra, and Apeiron were all launched on the Ronin chain this year, with impressive data performance, maintaining the popularity of the Ronin ecosystem. If WAX has rich IP resources to issue NFTs, Immutable is good at integrating the entire game chain, and Ronin is good at game development itself. Continuously outputting high-quality exclusive game content is Ronin's core competitiveness.

4. Conclusion

Games are a relatively new industry, and Web2 online games have only a history of more than 50 years. From the development history of Web2 games, high-quality game studios will have the opportunity to grow into monopoly industry oligarchs (such as Blizzard Entertainment and Game Science), and Internet companies with strong financial strength will also expand their business into the game field and become leaders in the game industry (such as Tencent and NetEase). There is a similar situation in the Web3 field. Sky Mavis has gradually advanced from a game studio to a Ronin game ecosystem giant with the hit game Axie Infinity; and general public chains such as Polygon and OpBNB have also released many influential games with strong financial strength.

Game Chain has become a traffic portal for competing for game resources, and several game distribution platforms including Xterio have also transformed and developed game-specific public chains. In the future, dedicated game public chains will occupy a larger share of the game market, and more complete infrastructure and more influential games will become the core competitiveness of game-specific public chains.

Data Source

1. Medium, https://medium.com/electric-capital/electric-capital-developer-report-2021-f37874efea6d

3. Footprint Analytics, https://www.footprint.network/@Vent/Axie-infinity

4. Klapai, https://klapai.io/research-detail/dqqz0aas

5. blockchaingamer, https://www.blockchaingamer.biz/features/29764/31-percent-blockchain-games-discontinued-canned/

6. Blockchaingamer, https://www.blockchaingamer.biz/news/34600/ton-320-percent-growth-q3-2024/

7. Footprint, https://www.footprint.network/chart/Daily-Active-Users-Stacked-by-chain-Chain-stats-Duplicate-fp-52242?on_date=past12months

8. Footprint, https://www.footprint.network/chart/Daily-Tnx-Stacked-by-chain-Chain-stats-Duplicate-fp-52243

9. Footprint, https://www.footprint.network/chart/Daily-Volume-Stacked-by-chain-Chain-stats-Duplicate-fp-52244?on_date=past12weeks

11. Medium, the king of NFT public chains - can it regain its former glory? - Wax 10,000-word analysis

12. DappRadar, https://dappradar.com/narratives/gaming/games/chain/wax

13. Footprint, https://www.footprint.network/chart/Gaming-Transactions-on-Wax-Chain-by-Games-fp-33492

14. DappRadar, https://dappradar.com/dapp/alien-worlds/analytics?range-ha=1y

15. Coinmarketcap, https://coinmarketcap.com/currencies/wax/

16. Coincarp, https://www.coincarp.com/currencies/wax/

17. Dappradar, https://dappradar.com/blog/wax-dapp-ecosystem-q4-2024-report

18. Immutable Whitepaper, https://support.immutable.com/hc/en-us/articles/9405590951055-Immutable-Whitepaper

19. DappRadar, https://dappradar.com/rankings/protocol/immutablex?range=24h

20. DappRadar, https://dappradar.com/rankings/protocol/immutablezkevm

21. Coinmarketcap, https://coinmarketcap.com/currencies/immutable-x/

22. Arkham, https://intel.arkm.com/explorer/token/immutable-x

23. Coincarp, https://www.coincarp.com/currencies/immutablex/richlist/

24. gam 3 s, https://gam3s.gg/news/immutable-major-milestones/

25. Ronin Whitepaper, https://docs.roninchain.com/basics/white-paper

26. DappRadar, https://dappradar.com/chain/ronin

27. Coingecko, https://www.coingecko.com/en/coins/ronin

28. Binance, https://www.binance.com/ar/square/post/8351263239746

Gate Research Institute

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot spot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of the assets and products purchased before making any investment decisions. Gate is not responsible for any losses or damages resulting from such investment decisions.