Bitget Research Institute: Bitcoin spot ETF has experienced net outflows for two consecutive days, and PEPE has entered the top of the Smart Money list

According to Farside Capital data, the U.S. spot Bitcoin spot ETF had a net outflow of $217 million yesterday, achieving two consecutive days of net outflow. As the U.S. SEC issued a "Wells Notice" to Ethereum infrastructure development company ConsenSys and accused MetaMask of operating as an unlicensed broker, ETH fell for a short time, but quickly recovered the losses and is now basically the same as yesterday. Among them:

Sectors with strong wealth-creating effects are: cross-chain track and new generation popular MEME sector;

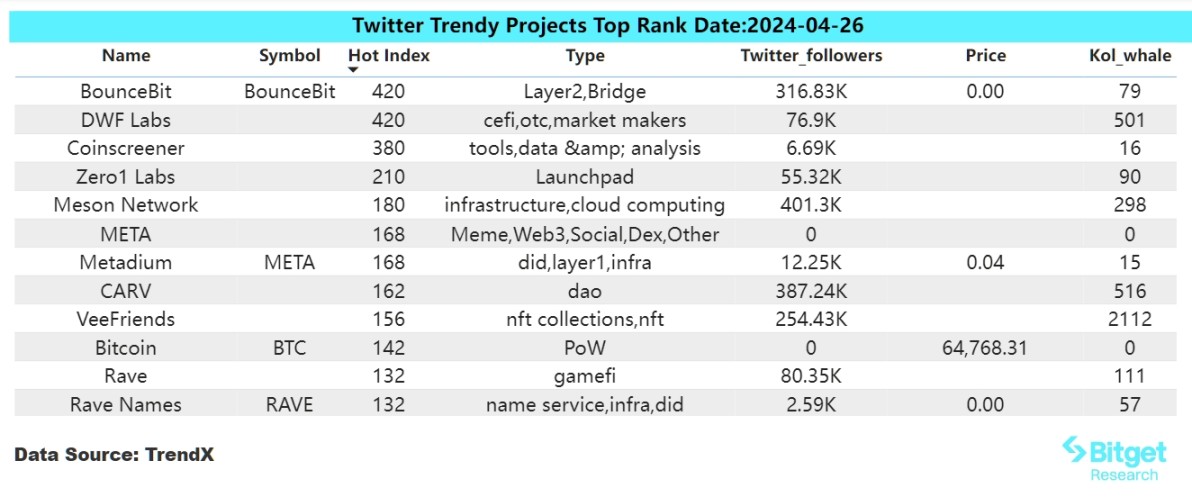

The most searched tokens and topics by users are: Movement Labs, BounceBit;

Potential airdrop opportunities include: Elixir, Grass;

Data statistics time: April 26, 2024 4: 00 (UTC + 0)

1. Market environment

According to a research report by CICC, the annualized growth rate of real GDP in the first quarter of 2024 in the United States is 1.6%, which is lower than the market expectation of 2.4% and lower than the 3.4% in the fourth quarter of last year. The agency reiterated its previous judgment that the Federal Reserve may only cut interest rates once this year, in the fourth quarter. At the same time, according to Farside Capital data, the net outflow of US spot Bitcoin spot ETFs yesterday was US$217 million, achieving net outflows for two consecutive days.

In the crypto market, the US SEC issued a "Wells Notice" to ConsenSys, an Ethereum infrastructure development company, and accused MetaMask of operating as an unlicensed broker. ETH fell for a short time, but quickly recovered the losses and is now basically the same as yesterday. At the same time, PEPE entered the top of the Smart Money list, which means a high winning rate or potential institutional internal address purchases, and the subsequent trend of PEPE is optimistic.

2. Wealth-making sector

1) Sector changes: cross-chain track (W)

main reason:

According to on-chain data statistics, the total number of transactions conducted by users using the cross-chain interoperability protocol Owlto Finance on Bitcoin ecosystem Layer 2 and other networks has reached 1,549,313, and users are distributed in 206 countries and regions; at the same time, the Wormhole project is also continuously updated. According to the official announcement, the native W token is now available on Solana, Ethereum, Arbitrum, Optimism and Base through Wormhole Native Token Transfers (NTT). The good news caused the price to rise in the short term.

Rising situation: W rose + 17.32% in the past 24 hours;

Factors affecting the market outlook:

The subsequent roadmap of W indicates that W has become a native multi-chain token and has completed the second phase of the W release roadmap. This release will bring the first multi-chain governance system MultiGov and W staking governance, which is expected to absorb tokens in the market. If the W staking growth effect is good, the selling pressure in the market will further decrease.

2) Sector changes: New generation of popular MEME (SLERF, MEW, MANEKI)

The main reason is that the new generation of popular meme coins that emerged in the recent Meme Season rebounded from oversold prices amid market upheavals. During the market crash, whale wallets and smart money bought the bottom and rose strongly during the rebound. After MANEKI issued airdrops to solana saga phone holders, the price continued to rise.

Increase: In the past 24 hours, SLERF increased by 9.72%, MEW increased by 0.32%, and MANEKI increased by 20.32%.

Factors affecting the market outlook:

The new generation of popular MEMEs are all characterized by strong market control and high market attention. SLERF and BOME have whales absorbing enough chips during several sharp price fluctuations; MEW issued an airdrop worth up to 4 million US dollars in the post-TGE market, and the project party has not yet made a profit on this asset. Therefore, many strong market makers of the new generation of popular MEMEs have enough motivation to pull the market for these assets that have already received huge attention in the market. The market's enthusiasm for the entire Meme track and the timing of the market makers' pull will be the most critical factors for making profits in this track.

3) Sectors that need to be focused on in the future: AI sector

Main reason: The market started to fluctuate this week. With the breakthrough growth of BounceBit TVL and the launch of Runes, the crypto market paid more attention to the second layer of BTC.

Specific currency list:

ARKM: Arkham is a blockchain analysis platform that uses artificial intelligence to analyze blockchains and on-chain data. The secondary market price rebounded sharply;

NEAR: Recently, many AI projects in the NEAR ecosystem have been raising funds, and NEAR is expected to become the AI hub of the future.

3. User Hot Searches

1) Popular Dapps

Movement Labs:

Blockchain development team Movement Labs was founded in 2022 and previously completed a $3.4 million seed round of financing in September 2023. In addition to its flagship product Movement L2, Movement Labs will also launch Move Stack, an execution layer framework compatible with rollup frameworks such as Optimism, Polygon and Arbitrum.

Yesterday, Movement Labs completed a $38 million Series A financing, led by Polychain Capital, with participation from Hack VC, Foresight Ventures, Placeholder, Nomad Capital, Bankless Ventures, OKX Ventures, dao 5 and many other institutions. This funding will support the company to introduce Facebook's Move virtual machine into Ethereum, solve smart contract vulnerabilities and increase transaction throughput.

2) Twitter

BounceBit:

BounceBit is a Bitcoin re-staking and CeDeFi protocol. Currently, BounceBit TVL has reached a new high, with a maximum supply of 2.1 billion BBs and an initial circulation of 409.5 million. It is a Binance Lab investment project. Binance Megadrop's first project, BounceBit (BB), is now open. Users can participate in BounceBit Megadrop at 08:00 on April 26, Beijing time. They can apply for BNB regular products on the platform and/or complete tasks in the Binance Web3 wallet to obtain BounceBit airdrop rewards. At the same time, Binance will launch BounceBit (BB) on May 13, Beijing time.

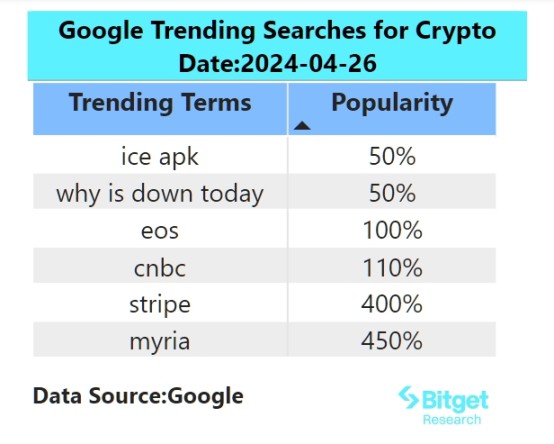

3) Google Search & Region

From a global perspective:

Why is Down Today: Yesterday, the crypto market continued to fall across the board, BTC ETF continued to experience net outflows, and the crypto market generally pulled back. Bitcoin fell by about 3.2% during the day. A large number of users and KOLs continued to ask on Twitter "why crypto is down today". There are currently many unstable factors, which have dealt a heavy blow to the confidence of investment risk market funds.

From the hot searches in each region:

(1) Yesterday’s hot searches in various regions of Asia were mainly focused on Meme

Solana's new Meme coins WIF and BOME also rose to varying degrees, and some leading Meme coins including SHIB and PEPE appeared in the region's top 3 hot searches. MEME has always been the embodiment of the attention economy in the crypto market. During the adjustment of the market, the wealth effect of MEME is generally better than other altcoins. Yesterday, Bloomberg reported that hedge funds are succumbing to the incredible returns of MEME coins, which means that some hedge funds on Wall Street have begun to pay attention to the unique narrative of MEME coins in the crypto world.

(2) AI Crypto topics appear more frequently in Africa, Europe, and CIS

The AI track is a sector with strong resilience and rapid recovery in this round of market decline, and it is also a track that VCs are collectively optimistic about and betting on. For example, NEAR, AR and RNDR are all leaders in the sub-sectors of the AI track. The rise yesterday was relatively objective. Influenced by this, there was a certain amount of traffic heat on Twitter hot searches in some regions.

4. Potential Airdrop Opportunities

Elixir

Elixir is a modular liquidity network that enables anyone to provide liquidity directly to the order book, bringing liquidity to long-tail crypto assets. It has currently received US$17.6 million in financing, including from Hack VC, Mysten Labs, Arthur Hayes, etc., and has a strong background.

How to participate: Open the following activity link to bind Twitter DC, select ETH wallet to log in, Little Fox will do, the network is ETH main network, activity address: www.elixir.xyz/refer/wisozk 1828, click mint elxeth in the lower right corner, enter the deposit page, deposit at least $100 worth of ETH or USDC, select the corresponding network with GAS, provide liquidity, and get points.

Grass

Grass is the flagship product launched by Wynd Network, which allows users to profit from Internet connections by selling unused network resources. To individuals, it will appear as a network extension that is downloaded, retained, and forgotten. It will do the work behind the scenes to help others obtain public network data in exchange for payment in the protocol's native token. Grass focuses on transforming public network data into AI datasets, making it easier for open source AI projects to access public network data.

Wynd Network has completed a $3.5 million seed round of financing, led by Polychain Capital and Tribe Capital, with participation from Bitscale, Big Brain, Advisors Anonymous, Typhon V, Mozaik, etc. Wynd's total financing amount has reached $4.5 million.

Specific participation method: After registering as a user on the Grass official website, install the web plug-in, wait for the network connection to be completed, click opendashbord, enter your own control panel to see your connection status, and hang up to contribute broadband. On the control panel page, you can see your daily idle points income and network status.

More information about Bitget Research Institute: https://www.bitget.fit/zh-CN/research

Bitget Research Institute focuses on "focusing on on-chain data and mining valuable assets". It mines cutting-edge value investments through real-time monitoring of on-chain data and regional hot searches, and provides institutional-level insights for crypto enthusiasts. So far, it has provided Bitget's global users with early-stage valuable assets in multiple popular sectors such as [Arbitrum Ecosystem], [AI Ecosystem], and [SHIB Ecosystem]. Through in-depth data-driven research, it creates a better wealth effect for Bitget's global users.

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk.