SignalPlus Volatility Column (20240411): Hong Kong officially approved BTC and ETH spot ETFs, and the price of the currency rebounded from the low point

Recently, as expectations for the Federal Reserve to cut interest rates have faded and the escalating situation in the Middle East has prompted investors to shift to safe-haven assets, the three major U.S. stock indexes have fallen by about 1.5%. The U.S. dollar index once rose above 106, and U.S. bond yields fell away over the weekend. It has rebounded again after the high point, and the current two-year/ten-year yields are 4.94%/4.577% respectively.

Source: SignalPlus, Economic Calendar

The conflict brought about by geopolitics has also affected digital currencies. Bitcoin plunged from $69,000 to $59,000 on Friday, causing more than $1 billion in futures long liquidations in 48 hours. The market attributed the subsequent rebound in part to the boost to market confidence brought about by the Hong Kong Securities and Futures Commission (SFC) officially announcing the approval of Bitcoin and Ethereum spot ETFs. Not only did it approve the Ethereum spot ETF earlier than the United States, it even allowed physical exchange Subscription and redemption of ETFs.

Source: SignalPlus & TradingView

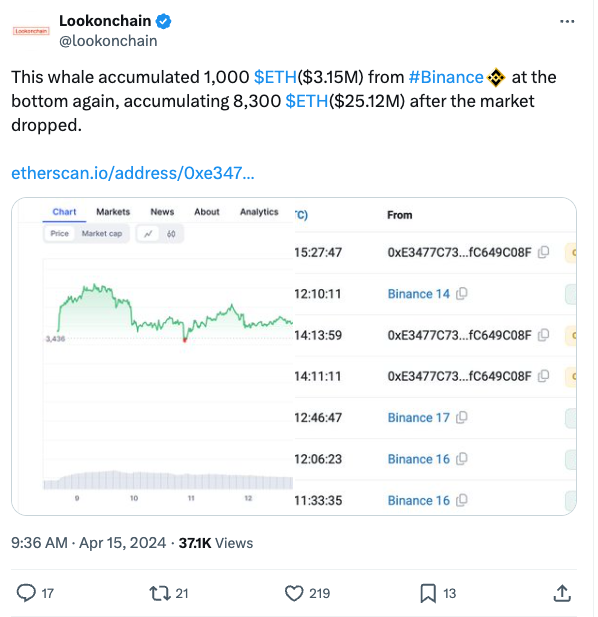

During this price drop, the giant whales of digital currency bought and opened positions in large quantities at the low point of ETH. For example, an address starting with 0x E 34 chose the right time to increase the value of the position at the lowest point. With 1000 ETH at 3.15 $M, the overall position reached 8300 ETH.

Source: Twitter

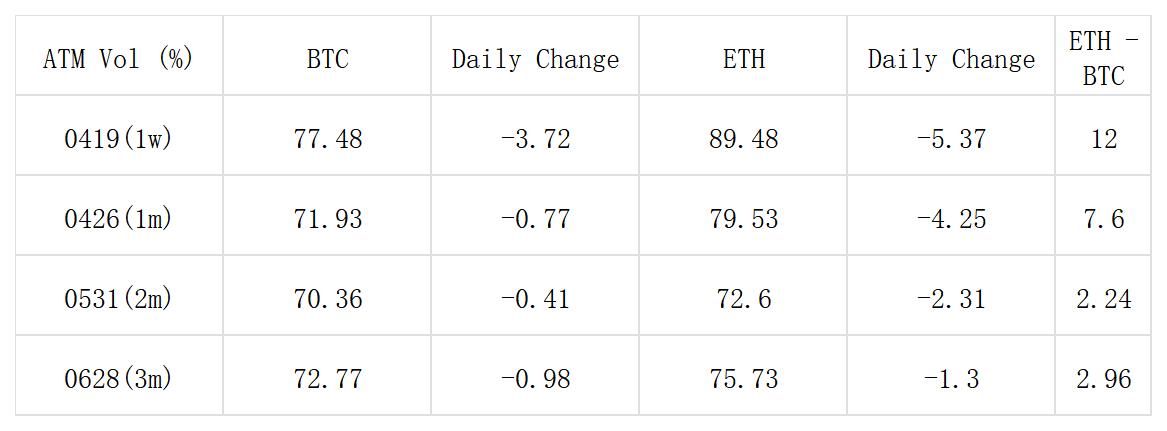

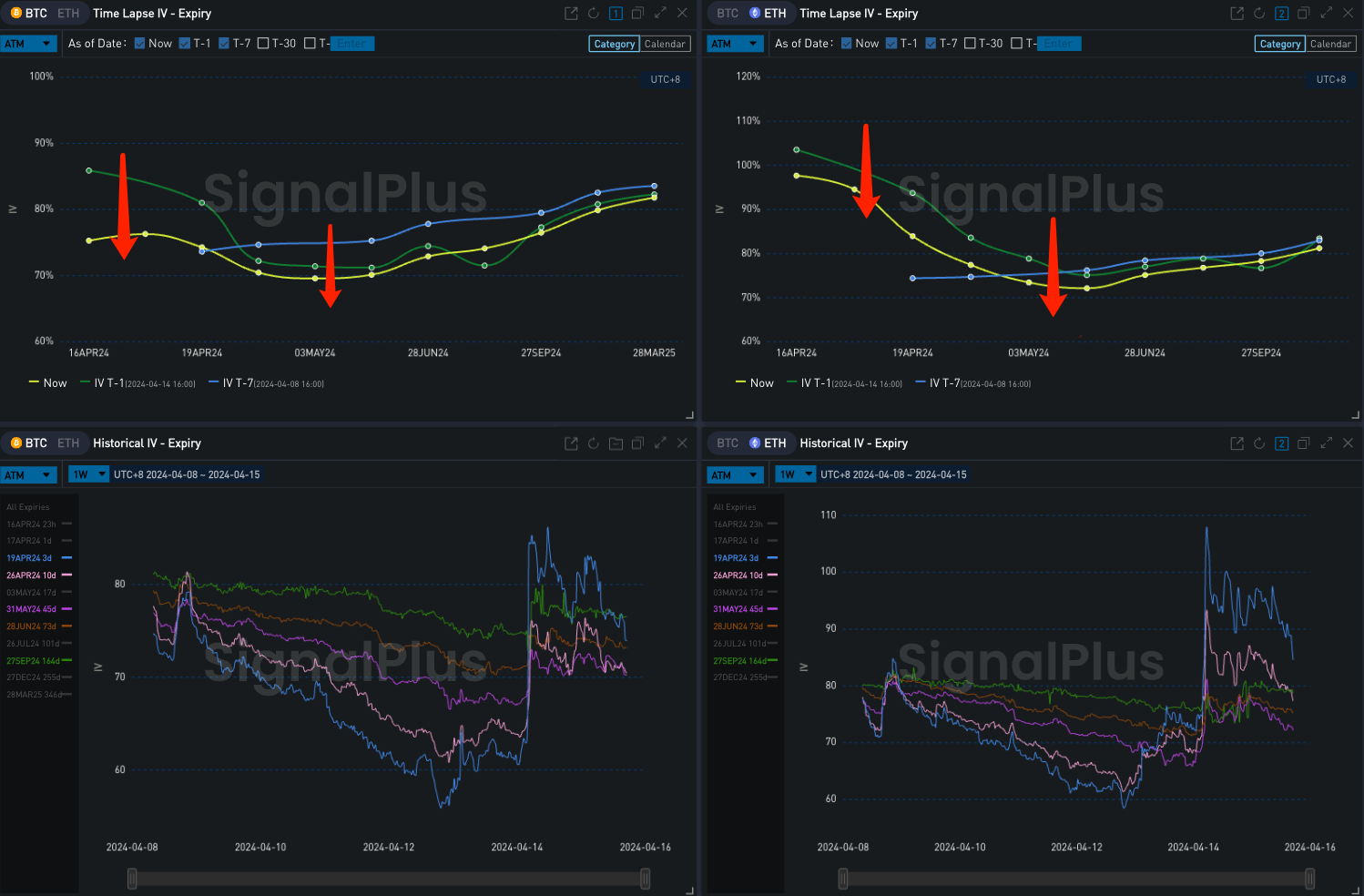

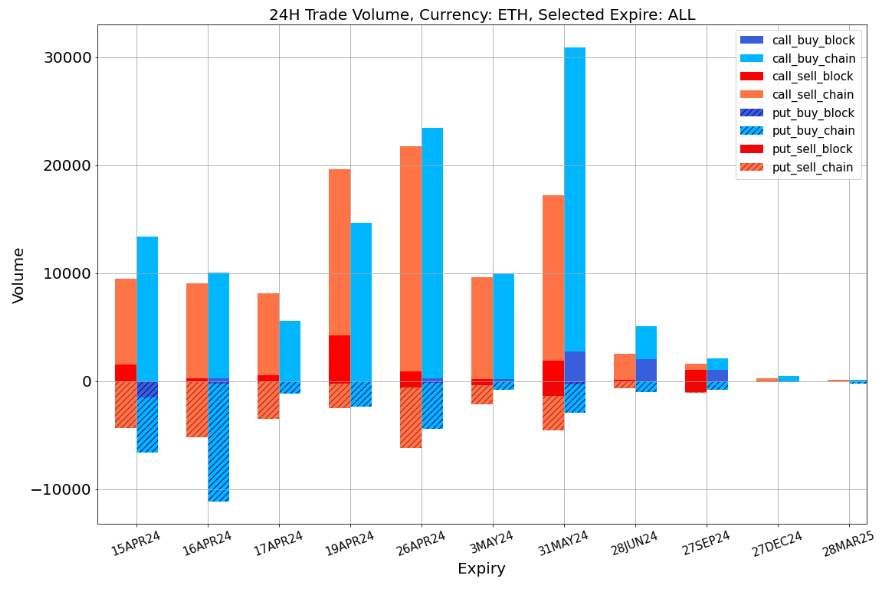

In terms of options, although the currency price has recovered nearly half of its losses, the implied volatility is still at a high level, with ETH being about 10% Vol higher than BTC on the front end. The term structure remains inverted, with the Vol Skew at its lows (25% quantile) of the past three months.

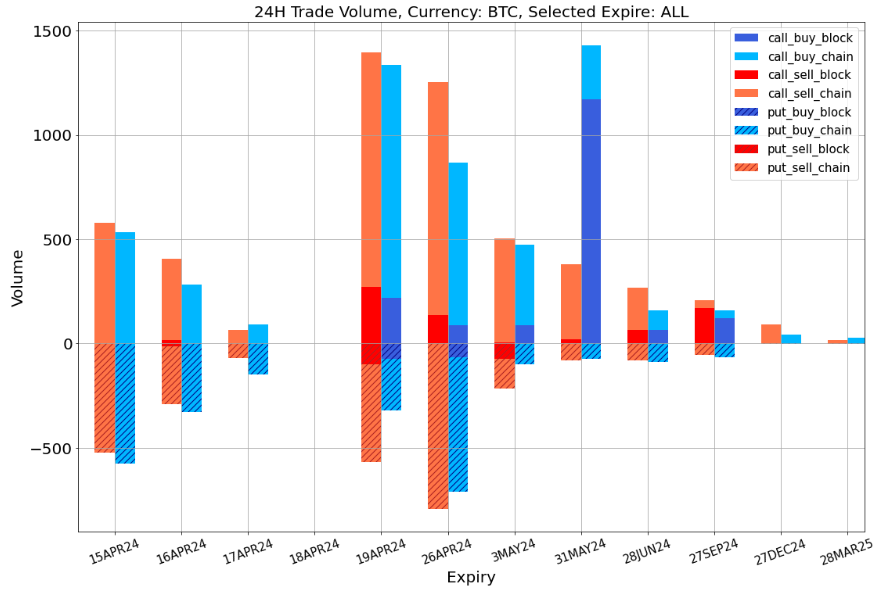

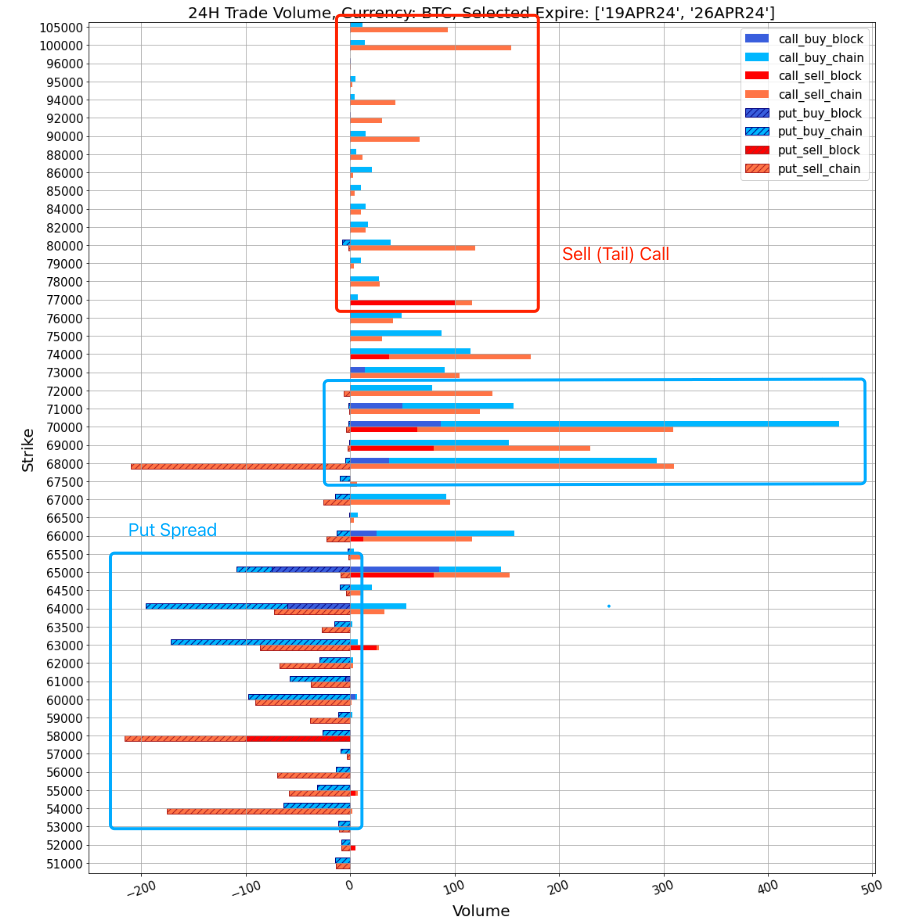

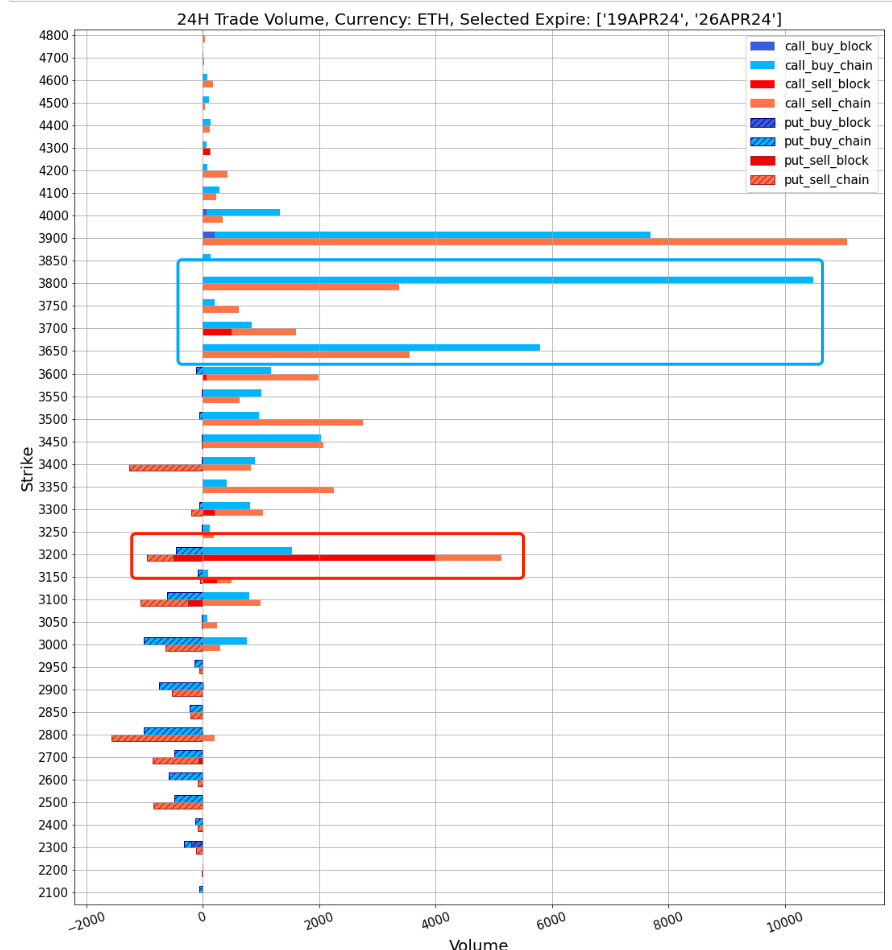

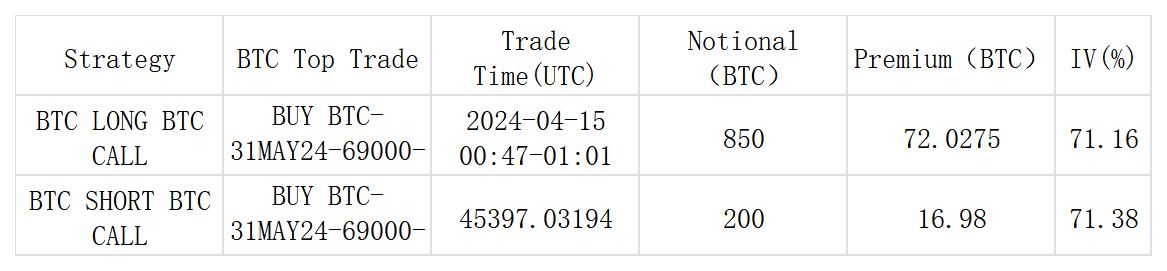

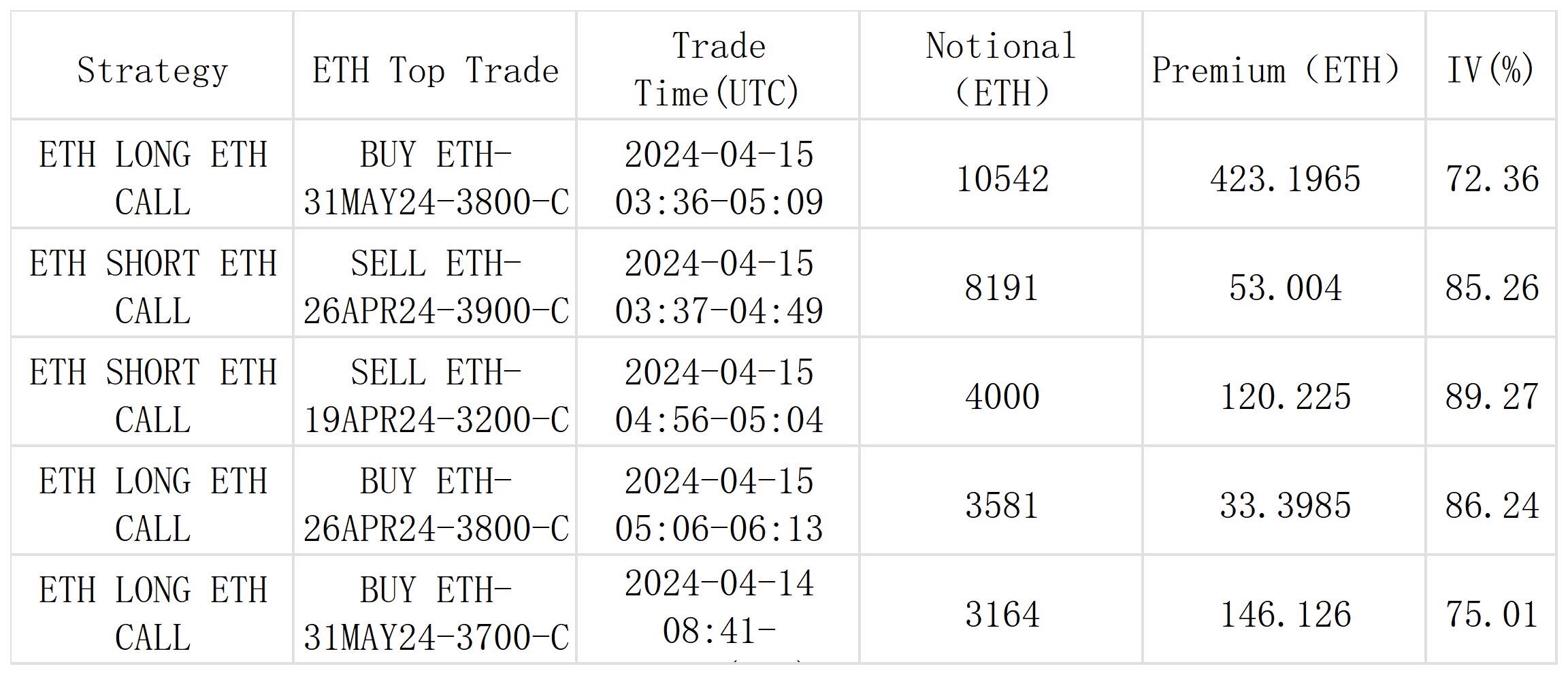

In terms of trading, BTC saw a considerable amount of Long Put Spread at 19 APR and 26 APR, which may provide further protection against the fluctuations caused by the halving event on April 18-20. On the other hand, the price adjustment also attracted traders to buy on dips, especially at the end of May, when call option openings represented by Buy BTC 69000-C (850 BTC) and ETH 3800-C (10542 ETH) became the market focus.

Source: Deribit (as of 12 APR 16:00 UTC+8)

Source: SignalPlus,ATM Vol continues to decline

Data Source: Deribit, BTC transaction distribution

Data Source: Deribit, ETH transaction distribution

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com

Welcome to join Odaily official community

Telegram subscription group:https://t.me/Odaily_News

Telegram communication group:https://t.me/Odaily_CryptoPunk

Twitter official account:https://twitter.com/OdailyChina