Pantera Capital: The “dial-up” era of blockchain is coming

Original author yuaane: Franklin Bi, Jonathan Gieg, Nihal Maunder

Original compilation: Deep Chao TechFlow

The “dial-up” era of blockchain has arrived.

The early Internet was slow, clunky, and often broke. When broadband replaced dial-up connections, new activities and products emerged on the Internet. Massive upgrades in bandwidth unleash the full potential of global information networks. Today, the same upgrade is happening on the blockchain network.

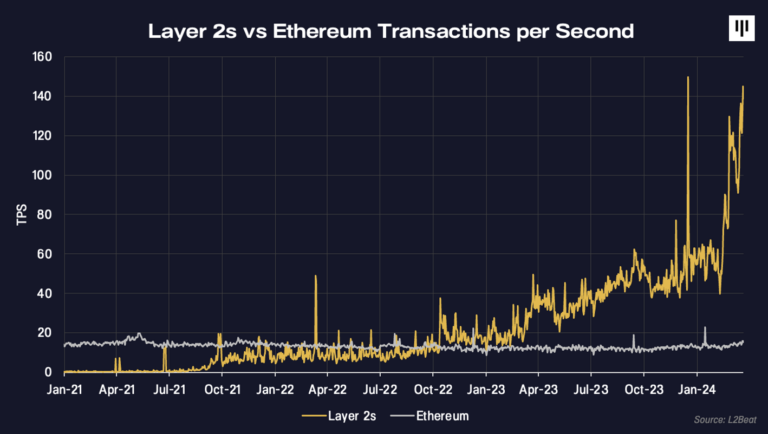

In the past two years, the Ethereum ecosystem has achieved approximately 10x expansion through the L2 blockchain. L2 achieves higher speeds and lower costs by batching transactions and settling them on a separate blockchain, a scaling method known as a rollup chain.

The total transaction throughput of Ethereum-based Layer 2 currently exceeds 140 TPS (transactions per second), compared to 14 TPS for Layer 1 (see chart).

The leading L2 today is Arbitrum. Since its launch in 2021, Arbitrum has led the L2 space in all important metrics, from transaction volume and developer activity to on-chain fee revenue. The L2 protocol was designed with compatibility with Ethereum as a top priority. The user and developer experience with Arbitrum is nearly the same as on Ethereum, but cheaper and faster.

The result is a huge step forward for Ethereum’s scalability. Over the past 30 days, the Arbitrum network has processed four times the transaction volume of Ethereum. L2s seven-day transaction volume increased by more than 850%, from 18.6 million to 163 million transactions. The “broadband moment” for blockchain networks has arrived.

Arbitrum, launch day

At the second Pantera Blockchain Summit in 2015, we invited a small group of industry friends to a lakeside cabin in Lake Tahoe. One of them is Princeton University professor Ed Felten. Dr. Felten is an accomplished computer scientist and technology policy advisor known for his pioneering work in cybersecurity and digital content protection. But it was his growing interest in Bitcoin that drew him west.

At the time, Ed was actively researching Bitcoin, often collaborating with other academic colleagues, including two postdoctoral fellows, Steven Goldfeder and Harry Kalodner. The three of them had been researching the security of Bitcoin wallets until they turned their attention to the industrys most pressing problem: how to scale blockchain for mass adoption. The key insight was an idea conceived by Ed a decade ago that now defines an entire category of expanded solutions: “Interactive Fraud Proofing.”

In 2018, Steven, Harry, and Ed publicly shared a research paper titled: “Arbitrum: Scalable Private Smart Contracts.” The proposal is clear and concise. But implementing this important work will require a greater effort, so we reunited with Ed, Steven and Harry, who are now co-founders of Offchain Labs.

When we met with the founding team of Offchain Labs, we discovered that their strengths extend far beyond technical talent. They brought:

Passion for blockchain to build a better world

A strong commitment to open source development and community

Focused on creating the best developer experience for Web3 creativity to flourish

From that point on, it became an easy decision to write their first check and eventually lead their seed round in late 2018, kicking off the journey to day one of scaling Ethereum.

Arbitrum Ecosystem

Since its launch in 2021, Arbitrum appears to have become the L2 of choice for leading Web3 projects and developers. Much of its early growth came from DeFi activity. Arbitrum’s transaction volume ranks third among all blockchains, behind Ethereum and Solana.

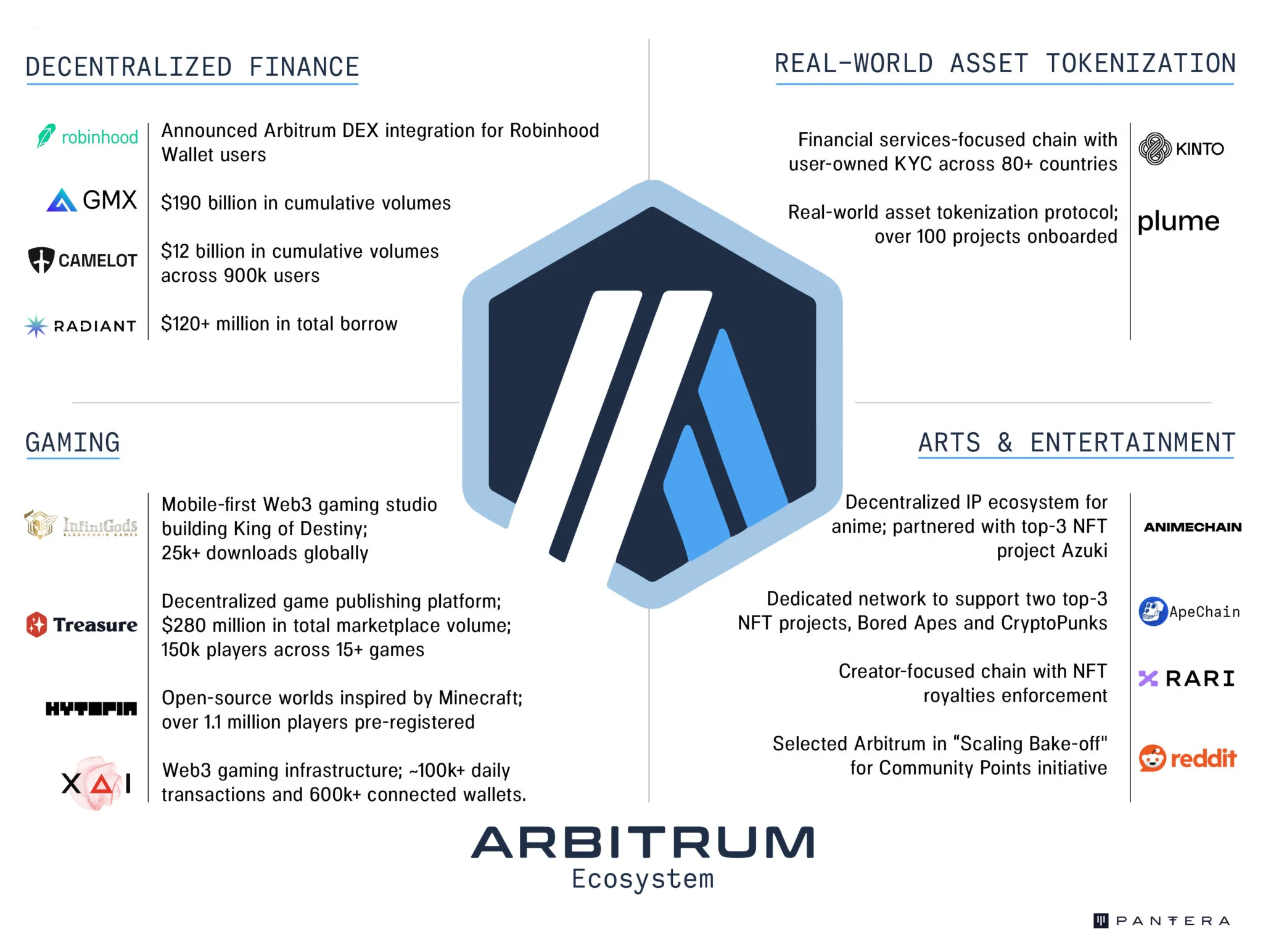

Today, the rapidly growing Arbitrum ecosystem includes:

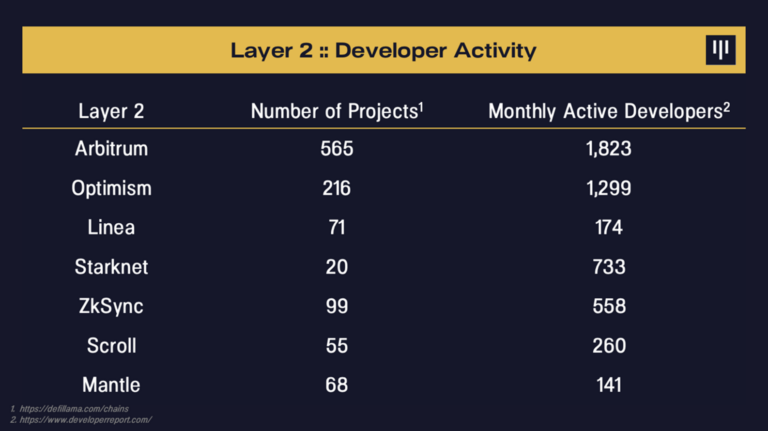

500+ projects (more than any other L2)

1800+ monthly active developers (more than Solana)

$16 billion in assets bridged from other chains (tops among all L2s)

DeFi deposits on Arbitrum are worth $3 billion (3x the nearest L2)

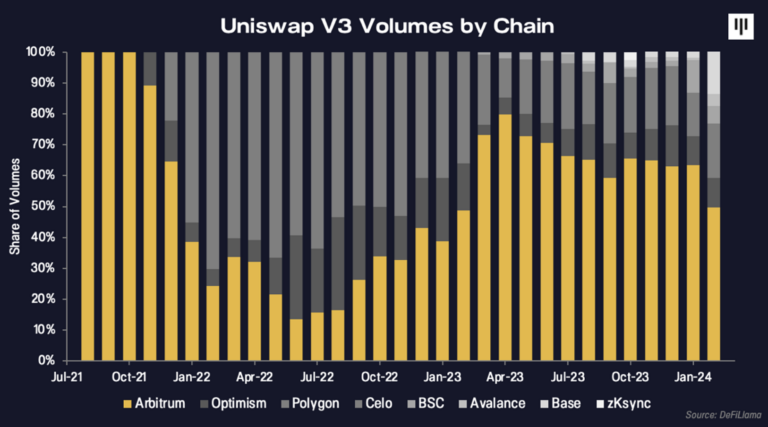

Many established teams have expanded from Ethereum and other L2s to Arbitrum, more successfully than any previous chain. For example: Uniswap, the market-leading decentralized exchange, now handles the majority of layer 2 trading volume on Arbitrum, despite being originally built on Optimism. Uniswap’s Arbitrum instance recently became the first instance on Tier 2 to hit $1 billion in daily trading volume.

One of Arbitrum’s most remarkable qualities is its homegrown talent. From DeFi to gaming, the Arbitrum-first team has achieved impressive growth across multiple verticals. Here are some of the leading projects in the Arbitrum ecosystem:

Decentralized Finance:

Robinhood: Investment platform announces Arbitrum DEX integration for Robinhood Wallet users

GMX: Decentralized sustainable exchange with a cumulative trading volume of US$190 billion

Camelot: Decentralized spot exchange, cumulative transaction volume 12 billion US dollars, 900k users

Radiant: Cross-chain lending protocol, with cumulative borrowing amount exceeding US$120 million

game:

InfiniGods: A mobile-first Web3 game studio that developed King of Destiny with more than 25k downloads worldwide

Treasure: Decentralized game distribution platform; total market transaction volume 280 million US dollars; 150,000 players in 15+ games

Hytopia: An open source world inspired by Minecraft; over 1.1 million players pre-registered

XAI: Web3 game infrastructure; daily transaction volume is approximately 100,000+, and connected wallets exceed 600,000+

Tokenization of Real World Assets:

Kinto: A financial services-focused chain with KYC for users in 80+ countries

Plume Network: Real-world asset tokenization protocol that has been introduced to over 100 projects.

Arts Entertainment:

AnimeChain: Decentralized IP ecosystem for anime; partnering with Azuki, one of the top three NFT projects

ApeChain: a private network built to support two of the top three NFT projects, Bored Apes and CryptoPunks

RARI Chain: Creator-centered chain implementing NFT royalty enforcement

Reddit: Previously Selected Arbitrum for Community Points Program in Scaling Bake-off

As Arbitrum continues to attract top teams and projects, we believe its ecosystem growth will accelerate further. The roadmap includes key developments to expand its developer base and attract new builders, including:

Arbitrum Stylus: A custom programming environment for writing smart contracts in Rust, C and C++, minimizing the need for Web3 developers to learn new languages such as Solidity

Arbitrum Bold: An improved, permissionless fraud-proof technology that speeds up transaction processing

Arbitrum’s journey from a cornerstone of DeFi to a thriving blockchain ecosystem reflects the strength of its technology and the rapid growth of the high-quality community behind it.

Data Display

Active community engagement, top-notch developer experience, and technological breakthroughs make Arbitrum a leading contender in the L2 space. The numbers back this up.

Let’s look at the fundamental metrics driving L2 adoption:

Total Value Locked (“TVL”) measures the value of assets deposited on the blockchain to support liquidity or lending activities. In L2 Rollup, 39% of TVL is located in Arbitrum. Arbitrum holds $4 billion in its DeFi protocol, while closest competitor Blast has $1.4 billion locked. This metric is significant because TVL serves as an indicator of trading activity, liquidity, and the overall health of the project. A high TVL indicates that users are engaged and confident in the platform.

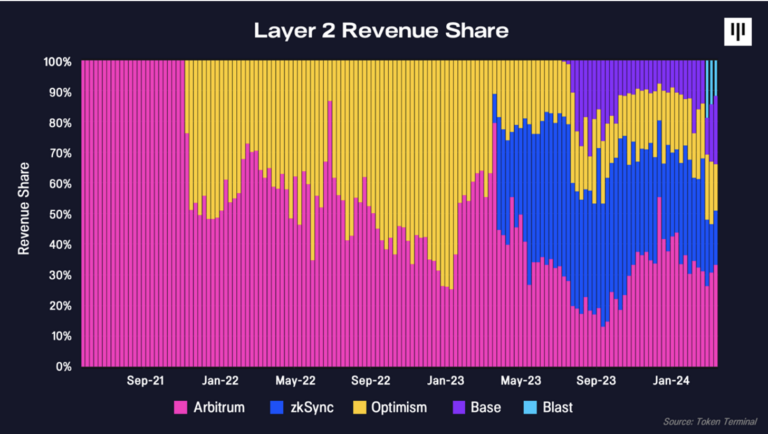

Arbitrum has been the largest revenue generator compared to other L2 scaling solutions. While other chains fee-generating capabilities fluctuate, especially in anticipation of token airdrops (like zkSync currently does), the organic activity of the Arbitrum community ensures predictable revenue regardless of external dynamics. Arbitrum does this by carving out niches like DeFi, where they nurture protocols like GMX and Uniswap, so they are able to cultivate becoming the go-to chain for DEX exchange and perpetual trading.

Looking ahead to its current dominance, we believe the reason Arbitrum can continue to be the preferred scaling solution for Ethereum is its focus on developer activity. As the table above shows, Arbitrum has built the most attractive platform for developers looking to deploy decentralized applications. Users will ultimately gravitate to the ecosystems where the best apps exist, and by doubling down on its developer community, we believe Arbitrum is ensuring its long-term sustainability.

We hosted a webinar on blockchain scalability with two experts in the field, whose projects are paving the way for blockchain’s mass adoption.

Here are some key points from the discussion:

Steven Goldfeder, co-founder and CEO of Offchain Labs believes: “The Arbitrum ecosystem has a strong focus on sustainability, which will be what differentiates it from other projects in the long term. The system has to run, it has to work, and it has to be self-sustaining. It Short-term growth cannot be prioritized solely through unsustainable mechanisms.”

Eli Ben-Sasson, co-founder and CEO of StarkWare said: “I prefer to call the technology we are building an ‘integrity network’ rather than a ‘blockchain’ because that really emphasizes that it is a ‘network’ , just like the World Wide Web. But this technology also provides integrity, and integrity means doing the right thing even when no one is there.