7天募集超2.4亿美元,贝莱德基金BUIDL的获利者竟是Ondo

Original - Odaily

Author - Husband How

As the worlds largest asset management company, BlackRock successfully launched a Bitcoin spot ETF at the beginning of the year, raising more than US$13 billion in funds. It is currently among the forefront of Bitcoin spot ETFs, and its total Bitcoin holdings are second only to Grayscale. The success of the Bitcoin spot ETF has BlackRock continuing to set its sights on the crypto industry.

On March 20, BlackRock announced that it would cooperate with Securitize to launch the tokenized asset fund BlackRock USD Institutional Digital Liquidity Fund (BUIDL). It has only been launched for a week and successfully attracted more than 240 million US dollars in funds. Among them, Ondo, a well-known project in the RWA sector, is also involved.

After BlackRock announced the launch of tokenized fund BUIDL,According to CoinGecko related data, RWA-related issued currency projects in the encryption market have experienced significant increases, among which the Ondo project token ONDO has increased by more than 130%, and the XDC Network project token XDC has increased by more than 28.5%.

Why would the launch of BlackRock’s tokenized fund BUIDL have such a clear lift for the RWA sector?

To this end, Odaily will introduce the overview of BUIDL, relevant developments since its launch, and its impact on the future RWA sector.

Overview and recent developments of BlackRock Tokenization Fund BUIDL

The tokenized fund BUIDL is issued by BlackRock and Securitize based on Ethereum and is personally operated and managed by BlackRock Financial Management, Inc. BUIDL invests primarily in cash, U.S. Treasury rolls, and repurchase agreements. Fund investors need to meet the qualifications of qualified investors. Investors will receive equivalent BUIDL tokens, and each BUIDL token is worth US$1, and the tokens will be transferred to other verified entities by Securitizes encryption wallet. address, but if the investor transfers the token BUIDL, the recipient needs to meet its review conditions.

Carlos Domingo, founder and CEO of Securitize, a partner of this fund, believes that the tokenized fund BUIDL mainly serves three use cases.

For crypto companies looking to manage their funds on the blockchain;

Become the underlying asset of the RWA project;

An alternative to stablecoins that can be used as collateral for lending and trading.

Its important to note that income earned from holding BlackRocks U.S. Dollar Institutional Fund is not registered with the U.S. Securities and Exchange Commission (SEC). Therefore, interest generated from staking BUILD may not be listed on any cryptocurrency trading platform. Domingo responded that the SEC has not yet issued relevant recommendations on tokenization in the blockchain.

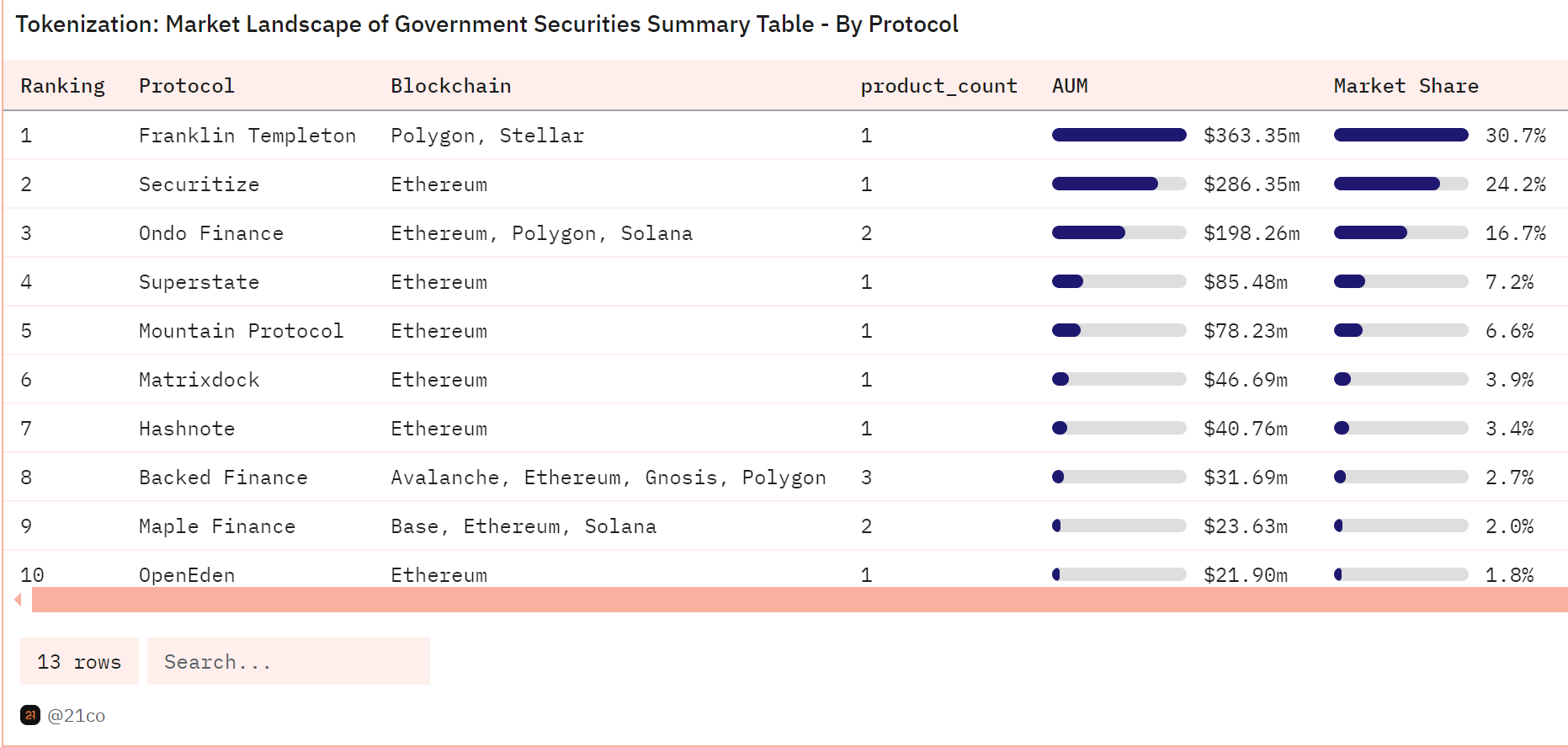

Currently, the BUIDL Fund has been launched for nearly a month. According to data analysis by 21.co on Dune, the BUIDL Fund has attracted US$286.35 million, only lower than the Stellar chain-based tokenization fund BENJI launched by FOBXX.

As you can see from the chart above, Ondo Finance also holds $198 million in the tokenized U.S. bond market, ranking third in market share. It is worth mentioning that less than a week after BlackRock launched the tokenized fund BUIDL, Ondo Finance announced an investment of more than US$95 million in it, accounting for more than 33% of the BUIDL fund share and is currently the largest holding in the BUIDL fund. By.

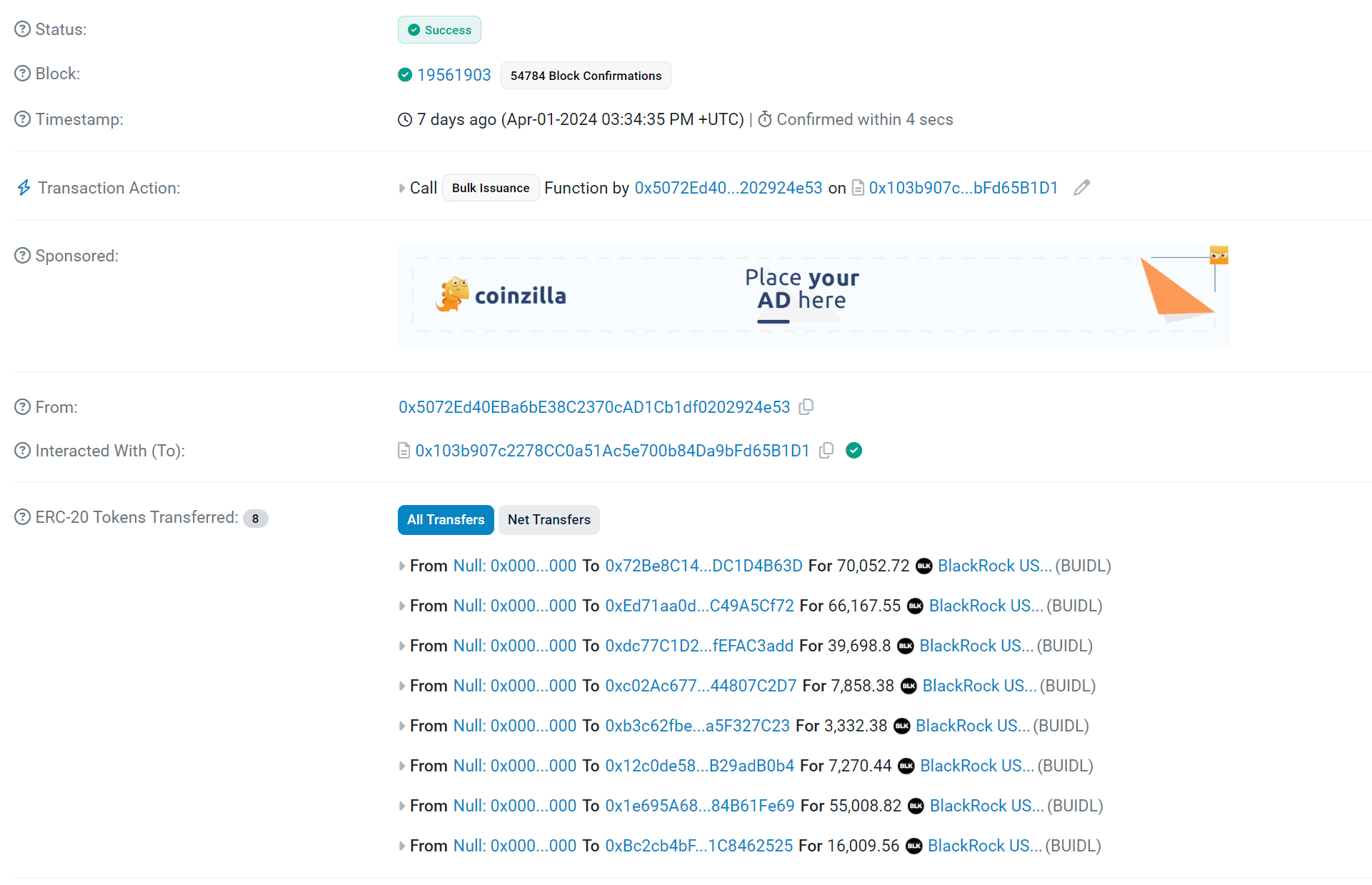

According to the transaction records of the block explorer, on April 1, the tokenized fund BUIDL made its first dividend payment to 8 investors, of which Ondo address 0x 7 2B... 6 3D received more than 70,000 BUIDL tokens .

Subsequently, according to the transaction records of the address on the Ondo chain, on April 3, Ondo Finance was suspected of conducting the first redemption test of the BUIDL fund, transferring 250,000 BUIDL tokens to the Securitize address 0x 878...200, and then Transfer to the black hole through this address for destruction.

Since the launch of the BUIDL fund, most of the funds operational processes have been completed, including issuance, dividend distribution, and repurchase. Although the official annualized rate of return of the BUIDL fund has not been marked, based on the amount and time of its dividend distribution, it is estimated that the APY is about 5.3%, which exceeds the yield of U.S. bond products of most RWA projects.

ONDO may become the “last opportunity” for most investors in the RWA sector

The RWA sector has been gaining momentum since last year, and there are more and more voices discussing RWA at many Web3 industry summits. However, compared to foreign communities, the Chinese community has not responded much to this. The most important point is that most RWA projects The product imposes restrictions on Chinese-speaking investors. From a certain perspective, purchasing RWA products is no easier than purchasing U.S. stocks in reality.

However, is the RWA sector, which may reach trillions in the future, out of reach of ordinary retail investors? Odaily analyzed from the launch of the tokenized fund BUIDL by BlackRock that the ONDO token may become one of the few targets for retail investors who are unable to purchase RWA products to participate in the RWA wave.

In the past, most RWA projects used to establish independent SPVs to manage the funds invested by users, but purchase and redemption required certain time limits, which was not conducive to attracting most Web3 investors. However, BlackRocks launch of the tokenized fund BUIDL has opened a door to connect traditional finance and Web3 to a certain extent, but this is not for investors, but for most RWA projects.

Judging from BlackRocks BUIDL operating rules, after investing in the fund, investors will receive equal amounts of BUIDL tokens and daily dividends, and can transfer them if conditions permit. This move optimizes the complicated purchase and redemption mechanism of the RWA project. Ondo Finance also exchanged most of the underlying assets of OUSG (tokenized U.S. Treasury bonds) into BUIDL less than a week after its issuance.

In addition, you can refer to the previously released OdailyDetailed explanation of Ondo Finance: Successful transformation, TVL jumped into the top three in the RWA trackAccording to an article, although ONDO has experienced considerable gains in this round, the ONDO token was issued before the transformation and essentially has little to do with the current RWA. The ONDO token has satisfied the relevant narrative and still has some room for growth. As the current leader of the RWA sector, the rise of ONDO tokens also marks the development of the RWA sector to a certain extent. Combined with the psychology of most investors who are rejected by RWA products, Ondo Finance may become the last chance .