Kickstarter once received a secret investment of $100 million from a16z. Why is it so difficult for its encryption dream to come true?

Original author: Leo Schwartz, Jessica Mathews, Fortune Magazine

Original compilation: Luffy, Foresight News

In early December 2021, employees of the crowdfunding startup Kickstarter received news about a windfall: an investment institution wanted to buy some of their shares. The news caused quite a stir within the company, and although employees had been accumulating stakes in the company for years, many had given up hope of selling.

The Kickstarter theyre working on now is very different from the hot startup of 2009, which launched viral projects like Cards Against Humanity and Peloton. For a time, Kickstarter was praised by entrepreneurs and the public alike, and even achieved a coveted entrepreneurial achievement: its name became a noun, because people regarded Kickstarter as synonymous with Internet crowdfunding activities.

At the time, the companys anti-corporate leanings and grassroots spirit attracted celebrity investors and helped shape the early New York tech scene. Its events, from movie premieres to rooftop festivals and viral fundraisers, are proof that creative business ideas can find funding outside of Silicon Valley, and artists can gain support from fans.

But more than a decade after its launch, Kickstarter has lost its former glory and has seen a series of CEO changes. Kickstarter in 2021 offers little to potential investors but rather a headache. Growth has flattened for the startup, which makes money by taking a small commission when a project on the platform reaches funding thresholds. After the fierce union movement, the culture that the company once felt good was gone, replaced by a cultural atmosphere that was not conducive to the companys development. Many believe the new shareholders will inherit ownership of a brand that has become outdated.

For Kickstarter employees and early investors, the unexpected funding felt like an opportunity to start anew. After all, this wasnt a small grant to keep the lights on, but a staggering $100 million investment that valued the startup at $400 million. But theres a catch, the investment comes in anticipation of Kickstarter trying to pivot into the blockchain space as its new donor, venture capital giant Andreessen Horowitzs crypto fund, seeks to ride the latest hype cycle.

This windfall could be the boost the company needs to recalibrate and get on a path to relevance. Instead, the transition to blockchain triggered a sharp response from the community of creators and fans the company relied on, resulting in the loss of major projects and a reputational hit. The turmoil shows how even the most promising startups can lose their way, while also highlighting the challenges of pursuing a do-good mission on a venture-funded basis.

trouble in paradise

When Kickstarter launched in 2009, it was at the vanguard of a group of New York startups like Etsy or Foursquare that challenged their West Coast counterparts by focusing on arts and culture, as opposed to the developer-first approach of Bay Area projects like Google and Facebook. feelings.

The idea for Kickstarter (where an artist or creator asks the public to fund their new album, board game, or comic book) came from Perry Chen, a former DJ who started it after struggling to raise funds to perform a concert during the New Orleans Jazz Festival of this company. The companys most high-profile venture investor is Fred Wilson, who made early investments in companies like Tumblr and Twitter and whose Union Square Ventures is perhaps New Yorks most iconic venture capital firm .

The Kickstarter started in a stylish tin-ceilinged loft on Manhattans Lower East Side, with a front door covered in graffiti and a sticker that read Eat Shit. The company brings users together through events, hosting its first annual film festival in 2010 on the rooftop of the Old American Cannery in Gowanus, Brooklyn. Clips from projects funded by the platform played on the screen, including choreographed dances imitating endangered plants and animals, while a Kickstarter-backed brass band entertained guests who lined up to buy pies and craft sodas from the crowdfunded food project Performance.

Early employees remember a company that valued creativity and a socially conscious ethos rather than the growth-at-all-costs ethos of a typical Silicon Valley startup. Rather than taking the typical venture capital path of losing money to achieve hockey-stick growth, the Brooklyn startup takes a 5% discount and fee from projects that are successfully funded, a model that helped Kickstarter grow in second place. Achieved profitability within the year.

The model attracted widespread attention on the Internet and achieved breakout success, including in Phoebe Waller-Bridges BBC comedy Fleabag (which went on to win an Emmy), and the VR headset Oculus Rift (later released as 20 Sold to Facebook for $100 million). After the popular series was canceled by Hulu in 2013, Veronica Mars showrunner Rob Thomas turned to Kickstarter to raise $5.7 million for a movie. It’s the most funded project on Kickstarter to date and a testament to its mission of putting authority back into the hands of creators.

“Art for art’s sake is really important,” one former Kickstarter employee told Fortune. “Whether a project generates returns for investors shouldn’t just depend on whether the project is successful.”

Kickstarter made it clear early on that it wasnt a path to wealth, but investors still poured money in, including a $10 million round in 2011. Early backers include Meetup co-founder Scott Heiferman, Vimeo co-founder Zach Klein, and Arrested Development actor David Cross. Chris Dixon (currently the founder of a16z crypto) also joined as an angel investor.

Everyone seems to understand that Kickstarter isnt built for huge returns. In a 2013 blog post, Wilson noted that Kickstarter didnt need help from venture capital firms (although they still contributed): It has never had to accept outside funding, nor has it done much to optimize its profitability. Lots of things. Another early investor told Fortune that they put money in because they just liked the concept, never expecting it to deliver a financial return.

However, those early good feelings on Kickstarter were quickly replaced by another emotion: a general sense of chaos. The company began rotating CEOs when Kickstarter co-founder Yancey Strickler succeeded Chen in 2014, although the latter will retain a management role in the coming years.

Then in 2015, Kickstarter took the rare step of becoming a public benefit corporation, a type of corporation where a for-profit organization agrees to meet social and environmental standards. The employee-produced podcast describes a public benefit corporation as a legal structure that protects Kickstarter from investors trying to exit or sell the company. “Reorganizing into a public benefit corporation blurs the line between personal values and company values,” one employee said on the podcast. “Our founders often describe a public benefit corporation as a structure that allows a company to act like a company driven by more than just profits. It operates like a driven organization.

Chen reinforced that message when he returned as CEO in 2017, reiterating previous statements that Kickstarter would never go public or be acquired. The posturing of company priorities has begun to irritate employees. I do feel an extreme level of exhaustion and burnout, and I dont think employees have a lot of confidence in Perry, one employee said.

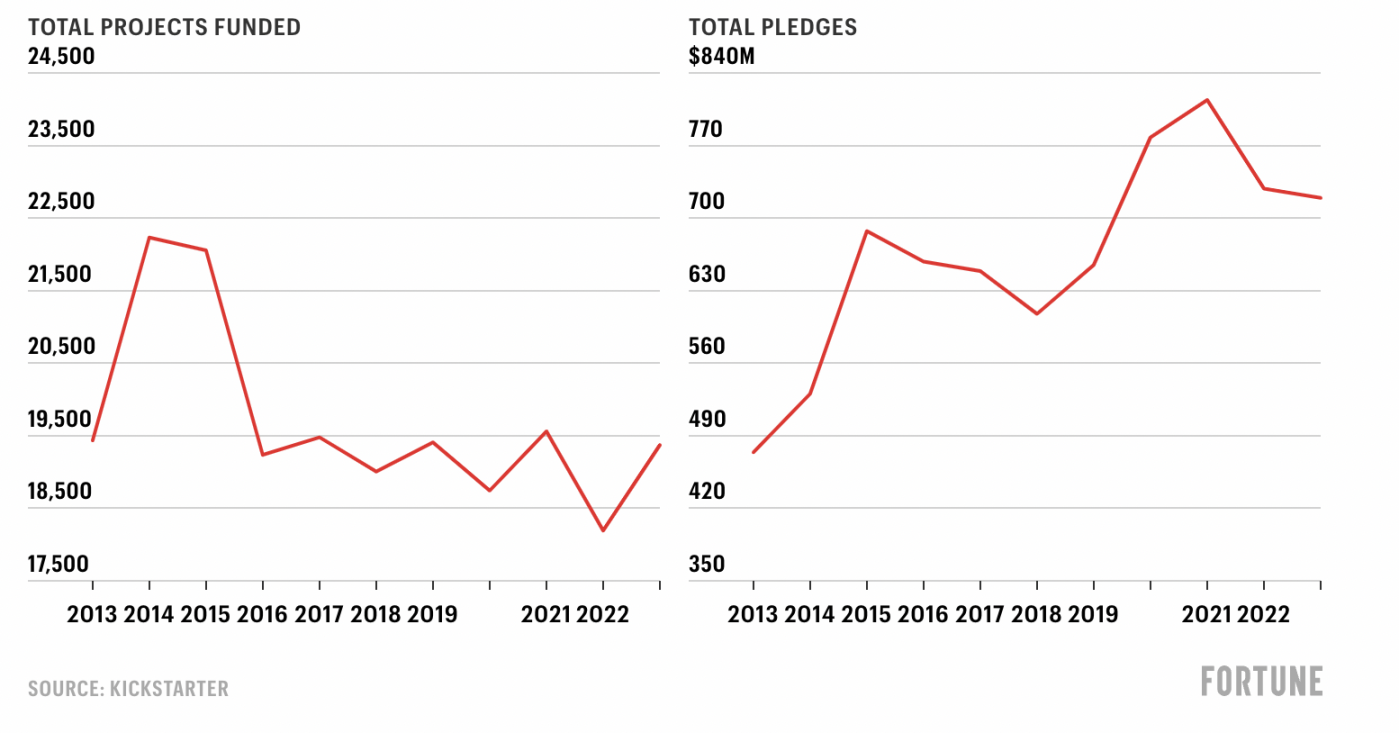

Although Kickstarter figured out how to make money early on, the company never seemed to take off. In 2016, the number of crowdfunding projects on the platform remained stable at around 19,000 per year, with no signs of growth. The amount of fundraising from which Kickstarter takes a cut fluctuates from year to year, peaking during the pandemic at nearly $814 million.

Number and amount of projects funded on Kickstarter over the past decade

One early investor told Fortune that Kickstarter has never been able to find a balance between growth and adhering to a new charter that requires it to assume valuable but expensive obligations to society. Despite their noble mission, employees struggled to find career paths due to dysfunction caused by competing company priorities.

In 2012, Kickstarter spent $7.5 million on a building owned by a pencil company in Brooklyns trendy Greenpoint neighborhood, which quickly became a template for mid-2010s tech offices, complete with rooftop gardens, sunrooms and movie theaters. . Employees would come over with friends late Saturday night and still find people hanging out. Another aspect is the unrestrained work culture, with projects stalled and some employees working only a few hours a day.

Meanwhile, the company continues to struggle with its growth strategy. In 2016, it acquired a startup called Drip as a response to the fast-growing crowdfunding subscription platform Patreon, but the move failed and Kickstarters plans to respond to its rising rival were scrapped.

“It’s not the easiest task to come up with something that doesn’t conflict with some of their mission,” one investor said. “It does feel like this has been going on for several years.”

Dissatisfaction began to emerge among employees, with many joining the company because of its mission, which one described as a dreamy, sublime atmosphere. They knew their stake in the startup would never increase because of Chens promise never to sell the company.

In March 2019, tensions in Kickstarters work culture erupted in the form of a union movement, an unprecedented step at the time for full-time employees at the tech company. New CEO Aziz Hasan, the other leader who succeeded Chen, summoned employees to respond and said the company would not voluntarily recognize the union. Kickstarter fires two employees who led union campaign. The pair immediately sued, accusing the startup of unlawful retaliation.

Kickstarters botched union push shattered the illusion that it was a different kind of startup. The move drew condemnation from Kickstarter creators, including David Cross, who took to Twitter to urge fans to support the union. Supporters of progressive projects funded through the platform, such as Current Affairs magazine, have threatened to withdraw funding. The company laid off 18% of its 140 employees soon after recognizing the union, which Hasan said was due to a drop in new projects on the platform.

In early 2020, the pandemic forced Kickstarter employees to leave their Green Point headquarters and begin working remotely. During this time, the platform saw a brief surge as people stuck at home looked for ways to support creators. Meanwhile, venture capital has flowed into other startups at record levels and valuations, while cryptocurrency prices have soared to all-time highs, with Bitcoin soaring to $69,000 in November 2021. Just a month later, Kickstarter announced its blockchain plans and made a $100 million acquisition offer.

Blockchain Gamble

Kickstarter was just the kind of company that would catch the attention of budding venture capitalist Chris Dixon. Dixon, who ran a referral startup called Hunch in the early 2010s, writes regularly on his widely read blog about his desire to return to a more egalitarian web. He and colleagues at Founder Collective, a small venture fund founded by New York tech founders, had already invested in another company called 20×200, which aimed to “democratize art” by sharing revenue with artists.

Dixon and his co-founder at Hunch, Caterina Fake, both invested in Kickstarter in 2011, helping the startup become a darling of the New York tech scene. Soon after, Dixon joined Andreessen Horowitz, where he became fascinated with blockchain and saw the technology as a way to bring the Internet back to the open source era. The company will establish an independent department called a16z crypto in 2018 to focus on blockchain investments.

In his new role as head of a16z crypto, which has raised a whopping $2.2 billion from his third fund, Dixon remains in touch with Chen. Kickstarter board members, including Chen, approached Dixon in the summer of 2021 about a new investment in Kickstarter and proposed the proposed blockchain transformation as a driving force for the deal, according to a person familiar with the matter. For Dixon, the prospect of bringing a familiar name like Kickstarter into the promised land of Web3 was too tempting to pass up.

Rather than pumping money into Kickstarter to purchase new equity, the deal will be conducted as a tender offer, meaning all the new cash will be used to purchase outstanding shares owned by other shareholders, and none of the cash will go directly to Kickstarter . Instead, it allows employees and early investors to cash out.

The confidential round, which totals $100 million, was led by a16z crypto and included a number of other smaller investors, including Yes VC, an early-stage venture led by Dixon’s former co-founder Fake, according to people familiar with the matter. Fake is also the co-founder of the photo site Flickr.

While this is a huge check for a company with very little revenue, this deal is not unusual for a16z crypto. Dixon has made other fanciful bets to realize his vision for crypto networks, such as co-leading two deals in 2018 for a startup called Dfinity that totaled more than $160 million. (Dfinity was mired in controversy shortly after launch, with its token plunging 95%.)

In return for a16zs generous funding, Kickstarter will attempt to become a Web3 company. The ambitious but unlikely plan calls for moving its entire platform to a blockchain called Celo, another a16z portfolio company. Kickstarter will operate as an open source protocol, not a technology company.

At the same time, users will be able to create their own mini-platforms around niche interests such as anime, attract more people and share profits through Kickstarter. This structure echoes other models like Farcaster, which does not require donors to pay in cryptocurrency, but requires Kickstarter to create a new open source version of existing software that will be built on a block that has never been tested with a large number of consumer applications. on the chain.

Few in the crypto industry view Celo as a top blockchain project, but it does have a negative carbon footprint, which also allows Kickstarter to adhere to its environmentally friendly mission statement. Sepandar David Kamvar, co-founder of Celo, joined the Kickstarter board of directors in August 2022.

This deal does not require a Kickstarter to follow. Still, an employee who worked at Kickstarter at the time of the tender offer said the company made it clear through internal communications that a16z was involved, and that the venture giant invested in Kickstarter because of the companys willingness to move into Web3.

Information about the tender offer arrived in employee inboxes on December 8, 2021, the same day Kickstarter revealed its blockchain plans. They can sell up to 32.49% of their shares for $7.41, a significant increase from what employees paid for it, and they also have the option to sell more shares if others dont participate. Kickstarter will even cover the costs.

For some employees, the acquisition was a surprise after years of turmoil. This is a once-in-a-lifetime opportunity, one employee recalled thinking after receiving the takeover offer.

Taylor Moore, one of the union organizers who was fired, reacted to the news with trepidation.

“Kickstarter leadership talks about Perry Chen and some of his sycophants like the classic story of the emperor’s new clothes, completely out of touch with reality,” he told Fortune. “And people who actually work know it’s a stupid idea. .”

Despite Chens new enthusiasm for blockchain, the announcement provided few specific details and set a timeline for the transition of less than a year. This raised concerns among the Kickstarter community, who feared that the plan would turn their beloved project platform into a get-rich-quick scam amid the hype in the cryptocurrency market. Some users have expressed concerns about the environmental impact of switching to blockchain, which could have a huge carbon footprint, although Kickstarter chose Celo for climate-friendly reasons.

“Almost all we see in the cryptocurrency space is rampant fraud, theft, and financial losses,” Isaac Childres, founder of a popular tabletop gaming company, wrote in a June 2022 newsletter announcing that future projects would Turn to other platforms for crowdfunding.

Much of the communitys anger was focused on employees, who expressed their disbelief in group chats. Meanwhile, the companys decision to hire outside consultants to announce its move into blockchain meant many employees were unprepared for the sudden influx of vitriol from users. Given Kickstarters checkered history of launching new initiatives, doubts have arisen about its ability to achieve major technological transformations. This is unbelievable, one employee said.

Blockchain plans seemed elusive, and that quickly proved to be the case. Within months, executives stopped mentioning the issue, and no part of the platform has been moved to run on the blockchain. It felt like Drip, said one former employee, referring to ill-fated competitor Patreon. I announced the matter and then it ended with nothing.

In 2022, Kickstarter hired another CEO, Everette Taylor, the companys fifth leadership change in a decade, after a series of changes including union organizing, a blockchain rollout and the company parting ways with about 40% of its employees. Take over Kickstarter after the event. Chen quietly resigned as board chairman and last year began a transition plan to leave the board entirely, according to a Kickstarter spokesperson.

New CEO Taylor immediately made it clear that blockchain was no longer a priority for the company, telling TechCrunch on October 4, 2022 (one week after taking office), “We are not committed to moving Kickstarter to the blockchain.

Although Dixon and a16z crypto declined to comment for this article, Dixon made it clear during a recent press conference for his new book, Read Write Own, that despite the public’s apparent aversion to the technology, blockchain is a long-term play. Kickstarter, meanwhile, isnt rejecting it outright. After announcing the news in 2021, it formed an independent public benefit company called Creative Crowdfunding Protocol and staffed it with two employees, including Kickstarters former operations manager. Today, its website lists two software engineer job openings in Bangladesh, and Celo still lists Kickstarter as an ecosystem partner.

The switch didnt hurt Kickstarter, and a16zs funding certainly helped the company build some goodwill with its employees and investors. But employees say its yet another distraction preventing the company from emerging from the downturn. The blockchain collapse ultimately alienated users and employees, and it was widely believed that Kickstarters glory days were behind it.

In an interview hosted by Celo in late 2022, Kickstarter COO Sean Leow insisted that the company still believed in the agreement. The interviewer asked him if he saw any gaps in the vision. Leow replied, I would say 95% of it is a gap right now.

Kickstarter declined to make Leow, Taylor and other executives available for interviews.

The road of exploration

Kickstarter may have achieved the rare distinction of becoming a noun for a startup, but the company has lost its former luster. When I say I work at Kickstarter, everyones instinctive reaction is, Oh, is that still a company? said a former employee who joined in 2022.

Today, Everette Taylor continues to find new revenue streams, launching initiatives like programs to help creators with things like shipping logistics and taxes. The CEO has also tried to reintroduce Kickstarter to the public, including through magazine interviews and conference appearances, emphasizing his role as a black CEO and the companys commitment to diversity in its executive ranks.

A year after Taylor joined, Kickstarter hired a new chief financial officer to help boost revenue. Revenue has declined since 2019, even as fundraising totals have increased, according to company data and an internal email sent by the chief financial officer. “They talked about it all the time,” said one former employee. “It felt like every all-hands meeting was an emergency.” A spokesperson declined to provide Kickstarter revenue figures.

Ultimately, the new product doesnt solve Kickstarters fundamental problem: Over the past decade, the number of projects the platform funds each year has stopped growing. Taylors more corporate approach to a company whose internal motto was once Fuck monoculture drew criticism from five former employees who spoke to Fortune. In early 2023, Taylor became the face of a Chevrolet ad campaign and in February joined the board of directors of a publicly traded online luxury marketplace.

“A lot of people are frustrated that the CEO is producing sponsored content,” one employee said. “It feels like a betrayal of the company’s values.”

The prevalence of fraud on the platform is another ongoing concern. The Better Business Bureau has received more than 100 complaints against the company in the past three years, many of which involved scams or users never getting the products they backed. Last year, the Ohio attorney general reached a settlement with a fraudulent Kickstarter user who purportedly raised money for a sea turtle conservation charity but instead invested the funds in cryptocurrency. The scammers agreed to repay defrauded donors and refrain from conducting crowdfunding campaigns in Ohio for five years.

Due to Kickstarters mechanics, projects can be fully funded without having to be launched, and Kickstarter will get a cut of the proceeds. Fortune has learned that an internal estimate puts as much as 18% of revenue from fraudulent projects, a concern that echoes past actions by state attorneys general and the Federal Trade Commission who have investigated cases of fraud on Kickstarter. (Kickstarter itself is not accused in those lawsuits or complaints.) A spokesperson denied that estimate and said the company has taken extensive steps to address fraud, including new detection software and processes.

Now that cryptocurrencies are experiencing a resurgence in popularity due to skyrocketing prices, open source protocols can still provide solutions to Kickstarters vexing problems. As Leow mentioned in an interview in late 2022, blockchains immutable ledger and its traceable address and transaction history can help solve the platforms difficulties with fraud and trust.

Perhaps the biggest problem with Kickstarter, though, is that time has passed. I think theyre outdated, one former employee told Fortune. Why would people go to Kickstarter when there are so many other more viable ways to raise money, like becoming a TikTok influencer?

Kickstarter does provide a niche for independent creators who want to create a board game with a detailed set of instructions, or a clock that uses artificial intelligence to write a new poem every minute.

Since its launch in 2009, Kickstarter has seen $8 billion committed to creative projects, the spokesperson said in a statement. Going forward, we will continue to put the community at the center of our work.

The spokesperson said the companys position in the creator economy is different from platforms like TikTok. They point to recent projects funded by social media influencers, as well as Kickstarter-funded films that recently screened at the Sundance Film Festival.

However, competitors like BackerKit have attracted disgruntled users in the wake of blockchain scandals, while Kickstarter continues to lose top creators. In February of this year, fantasy author Brandon Sanderson, who launched the largest campaign in Kickstarter history, announced that his next project would be on BackerKit.

Ultimately, Kickstarter failed to reinvent the rules of investor and community support, instead tripping over its own idealism every time it tried to leap to the next level.

People want it to become a marketplace and become a household name again, said one recently departed employee. I feel like were stagnating because our reputation is getting worse.

After the pandemic, Kickstarter never moved back to its 33,000-square-foot brick headquarters in Greenpoint, choosing instead to sell it for $29.5 million. After months of searching, Kickstarter is in talks with a potential buyer.