Binance’s daily increase was 300%, but there was no splash in the Chinese area. What is AMP?

Original - Odaily

Author-husband how

Recently, the increase of AMP token has made everyones eyes bright. The market shows that in the past two days, AMP has rapidly risen from 0.005 USDT to a maximum of around 0.024 USDT, and now it has fallen back to 0.014 USDT. The highest single-day increase exceeds 300%, and the two-day increase More than 4 times. However, the reasons for AMPs rise are only hotly discussed in overseas communities. On the other hand, no one cares about it in the Chinese community, and there are almost no reports.

As an old token that was launched in 2020 and has been listed on trading platforms such as Binance, AMP’s “fraudulent” rise has aroused everyone’s curiosity. What kind of project is this? To this end, Odaily has conducted multiple inquiries and this article introduces the reasons for the rise of AMP and analyzes whether there is long-term value support for readers reference.

In the past and present of AMP, the governance role has been weakened but has skyrocketed.

Before talking about AMP, you need to first understand the Flexa project. Founded in 2018, Flexa is a network that provides fully digital transactions and ensures security. Unlike traditional payment methods, Flexas payment process does not involve sending sensitive customer account information, but instead pays using virtual tokens. This digitization makes payments with Flexa fast and secure, with payment amounts transferred instantly from the customer’s account and converted by Flexa on demand. Settlement of every transaction is 100% guaranteed, providing consumers and merchants with a convenient and reliable payment solution.

From the introduction of Flexa, the vision is very similar to domestic Alipay and WeChat Pay, but the two are essentially different. The former uses cryptocurrency for direct payment, while the latter uses withholding on behalf of others. The two differ in terms of asset ownership. But how can Flexa guarantee its so-called 100% safety?

This brings us back to AMP. As the native token of the Flexa network, AMP not only functions as governance and staking, but also acts as collateral for the Flexa network to pay for related cryptocurrencies.

For example, user A pays merchant B through an application integrated with the Flexa network. Assume that the payment is made using BTC. Before making the payment, the user needs to pledge AMP tokens equal to the value of the goods as a deposit, and then pay through BTC. Assume that the payment is not successful. The AMP deposit will be compensated to Merchant B.

This move can ensure the basic trust of both parties. Because the payment network has a certain delay and cannot complete transactions as quickly as VISA at the time, AMP as collateral can maintain the security and stability of transactions to a certain extent.

However, with the development of time, the AMP project has not entered the Chinese area too much, and can only be seen in stores and applications in a few countries. For example, in March 2021, Amp and leading decentralized projects such as Cream Finance Chemical lending platform has established key partnerships to enhance its liquidity provision.

However, on February 28 this year, the AMP Foundation Ampera announced the launch of two new projects:

Ampera: The Ampera project will be an underlying payment protocol powered by the AMP mortgage token. AMP remains Flexa’s underlying collateral asset, and Ampera will continue to support projects focused on decentralizing trading risk. But AMP’s on-chain governance will gradually be lost.

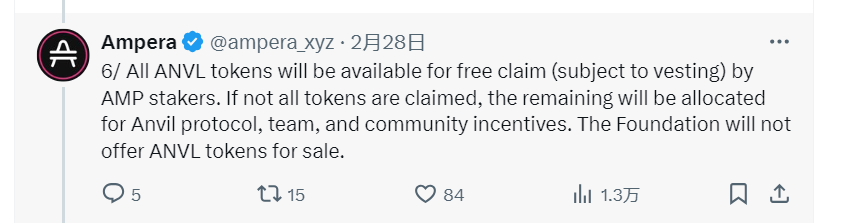

Anvil: Anvil is a new mortgage protocol for issuing digital letters of credit, governed by the ANVL token. The core Anvil contract has been audited to ensure the highest security and reliability standards. To provide more immediate integration opportunities, Anvil has been deployed on a private test network. A final audit to incorporate remaining protocol changes will begin soon; all audit results will be publicly released before mainnet goes live. Additionally, the Anvil interface will be open source to allow developers and project teams in the ecosystem to use Anvil contracts most effectively.

It can be seen that the Ampera Foundation has removed AMPs original Flexa network governance function. Although it retains its role as Flexas collateral, it has broken away from the binding of Flexa and may gradually extend its role from collateral to payment tokens. As can be seen from the Flexa official website, in addition to some conventional tokens, such as 99 cryptocurrencies such as BTC and ETH, AMP will also be used as a payment token on the Flexa network.

The above are the development changes of the AMP project in the past four years, but they are indeed not enough to drive the short-term rise of AMP. Odaily went deep into foreign communities and found that there are two factors behind the surge of AMP in the past two days.

Reason for news:On March 12, the Winklevoss brothers, the founders of Gemini, used Gemini Pay integrated with the Flexa network to buy coffee at Starbucks. For this reason, AMP, as Flexa’s mortgage token, rose by nearly 300% on March 12. This incident should be the superficial reason for the rise of AMP. The founder of a well-known exchange used the Flexa network for offline payments, which greatly aroused the enthusiasm of overseas investors from the news.

root cause:As mentioned above, although the Ampera Foundation has deprived AMP of its governance function, in the token airdrop standards of the new project Anvil, Flexa network’s AMP token pledge is eligible for airdrops. This news was announced on Twitter by the Ampera Foundation on February 28 this year, and stated that the snapshot time will be announced soon and will be announced 30 days in advance. Unclaimed tokens will be distributed to the protocol, team and community incentives.

But on February 4 this year, according to Scopescan monitoring, three whale addresses each pledged more than $1 million in AMP. These three whale addresses withdrew a total of 970 million AMPs (approximately $3.5 million) from Coinbase and then staked them on the Flexa network.This move makes people suspect that the news of AMP staking to obtain the Anvil airdrop has been leaked, and there is a certain risk of rat warehouse.

Odaily reminds everyone that due to the uncertainty of the airdrop snapshot time of the new Anvil project, there is a certain FOMO sentiment with the rise of AMP tokens. It is also uncertain whether you can get Anvil tokens by pledging AMP tokens. Those who are interested in pursuing higher prices must choose carefully. .