BTC时隔27个月重返6万美元,再成全球最受瞩目资产

Original - Odaily

Author - Nan Zhi

After a long 27 months, Bitcoin returned to $60,000, a new high since December 2021. Bitcoin has reached new highs against a series of legal currencies such as the Chinese yuan, Japanese yen, and Korean won. It can be said that only the US dollar people are still waiting for unwinding.

The OKX market shows that BTC briefly exceeded 60,000 USDT. As of the time of publication of this article, it was quoted at 60,500 USDT, with a 24-hour increase of 6.4%. It exceeded the highest point of 59,048 USDT in December 2021, and is only a short run away from the highest point of 69,000 USDT in November 2021. . ETH broke through 3300 USDT and is now trading at 3345 USDT, an increase of 2.4% in 24 H.

However, except for BTC, altcoins lack momentum and the market differentiation is more obvious. BTC’s total market value reaches a maximum of 51.85%. The Meme sector and the Inscription sector led the gains today. PEPE rose 50% today, FLOKI rose 22%, ORDI rose 14.5%, and sats rose 11.5%.

Affected by the upward trend of the overall market, the total market value of cryptocurrency has also grown rapidly. CoinGecko data shows that the total crypto market value currently exceeds US$2.34 trillion, up 2.7% in 24 hours.AlternativeData shows that crypto users’ trading enthusiasm has also increased significantly.Todays Panic and Greed Index has reached 82, yesterday was 79, and last month was only 55, with a rating of extreme greed。

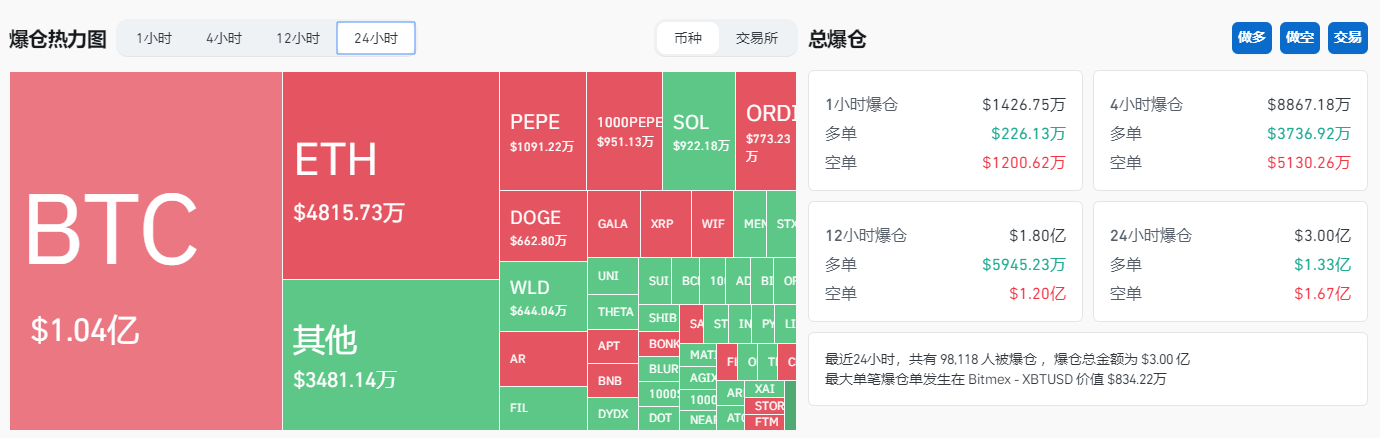

In terms of derivatives trading,CoinglassData Display,In the past 24 hours, the entire network liquidated US$300 million, of which short orders liquidated US$167 million, long orders liquidated US$133 million; BTC liquidated US$104 million, and ETH liquidated US$48.15 million.。

American users are still buying, buying, buying

Bitcoin spot ETFs continue to see inflows

According to data from Farside Investors, since its launch on January 11, the cumulative net inflow of Bitcoin spot ETF has exceeded US$6.7 billion, including:

IBIT’s cumulative net inflow is US$6.441 billion;

FBTC’s cumulative net inflow is US$4.476 billion;

The cumulative net outflow of GBTC was US$7.591 billion.

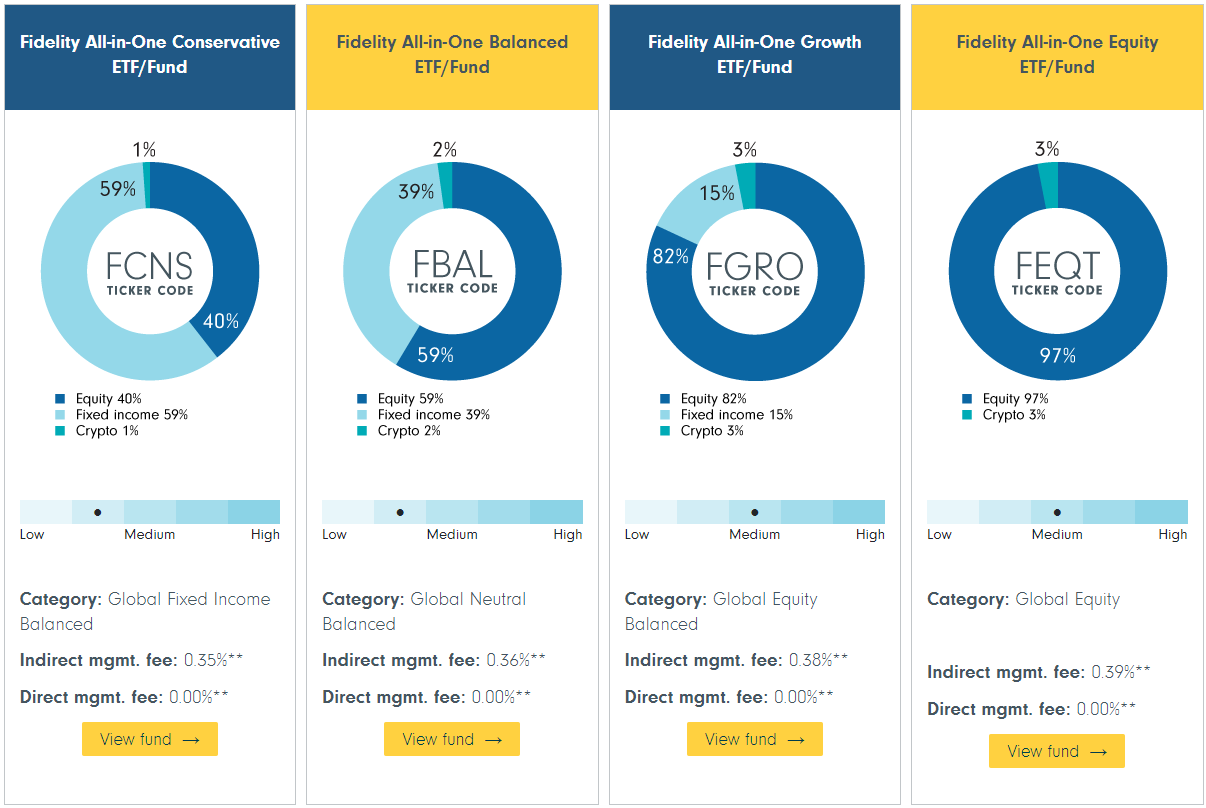

DuneData shows that as of the time of publication, the total number of BTC held by 10 spot Bitcoin ETFs (including GBTC) has reached 746,571, and the corresponding total asset management scale has increased to US$44.25 billion. Fidelity pointed out in the investment portfolio recommendations on its official website that it recommends that users add 1% -3% of Bitcoin to their asset allocation.The inflow trend continues, with no signs of slowing down yet.

On the other hand, trading activity has also exploded, highlighting investor enthusiasm. According to a CoinShares research report, the average daily trading volume of Bitcoin ETP has increased from US$34 million in 2023 to US$2 billion in 2024.

MicroStrategy posts $5.5 billion profit

On February 26, according to data disclosed by Tree News, between February 15 and February 25, 2024, MicroStrategy and its subsidiaries purchased approximately 3,000 Bitcoins for approximately US$155.4 million in cash. Also on this day,BTC ends sideways and starts rising mode, rising from 51731 USDT to 54471 USDT that day, a single-day increase of 7.77%.

On February 13, MicroStrategy CEO Michael Saylor said in an interview with CNBC,The buying demand of Bitcoin spot ETF is far greater than the supply of mining companies, and more Bitcoin will be purchased。

Analysts at TD Cowen said in a report that they expect MicroStrategys Bitcoin deal to prove to be accretive to shareholders over time, with MicroStrategy representing a new type of company that generates revenue through enterprise software and cloud services. USD-based cash flows, and then converts its excess cash flows into Bitcoin on an effective leverage basis. Originally a defensive strategy to protect the value of reserve assets,has become an opportunistic strategy aimed at accelerating the creation of shareholder value”。

As of the time of publication, MicroStrategy holds a total of 193,000 BTC, with an average purchase price of 31,544 USDT per coin, calculated based on US$60,000.Floating profit of approximately US$5.5 billion。

There are still mining companies that continue to increase their investment

On February 28, Bitcoin mining company Riot Platforms purchased 31,500 Shenma mining machines for US$97.4 million. This purchase will increase the self-mining computing power of the companys Rockdale mine by the end of July. Previously increased from 12.4 EH/s to15.1 EH/s。

Riot revealed in December that it had spent $290.5 million to purchase 66,000 mining rigs and said it may choose to purchase an additional 265,000 MicroBT mining rigs on the same terms in the long term.This will help increase its computing power to over 100 EH/s。

According to CryptoQuant analysis, large entities continue to increase their holdings, while the selling activity of Bitcoin mining companies remains sluggish. The average daily number of Bitcoin sold in the past few weeks is less than 100 BTC, which is consistent with the 1,000 BTC and above from November to December 2022. The levels are in sharp contrast.

Michael Saylor once pointed out that after the halving, the selling ability of mining companies will be reduced from US$12 billion to US$6 billion, which will help Bitcoin’s rise. And Riot Platforms continues to increase its mining machine plans,Demonstrates its long-term optimistic expectations for Bitcoin prices。

$69,000 is no longer far away

That’s in addition to continued buying power from the Bitcoin spot ETF. The ecological development of each chain will also inject impetus into the rise. In the past two months, the number and TVL of Bitcoin ecological projects have exploded. For example, the Merlin Chain mainnet TVL has exceeded 2 billion US dollars, the Bitcoin pledge L1 project BounceBit TVL has exceeded 500 million US dollars, and ORDI, the representative of BRC-20 tokens, also once It touched 83.1 USDT and is about to break through the previous high. There are also many anticipated events in the Ethereum ecology. Ethereum will be upgraded in Cancun on March 13. In terms of L2, Starknet has fired the first shot of the 24-year airdrop. The Restaking track is also expected to be launched this year, which will provide Ethereum with more opportunities. Bring a new growth path.

Bitcoin will be halved on April 21, $69,000 is no longer far away, and Americans are about to unwind. Perhaps a new round of bull market has just begun.