MakerDAO大象转身:详解Spark、subDAO和Maker「终局」

Original author: Reflexivity Research

Translated by: Frank, Foresight News

Maker, with over 8 billion dollars TVL, is one of the largest and most successful narratives in crypto history, and has been a spokesperson for DeFi since its inception, still maintaining a dominant position. Despite countless successes, Maker and MakerDAO have always been seeking continuous evolution, and the "Maker Endgame" proposal is one of the boldest moves taken by a DeFi protocol in crypto history.

Before delving into the Maker subDAO, Endgame proposal, Maker's RWA layout, and the complexity of Spark, it is necessary to go back to the past and learn more about the origins of Maker and how it has reached this point in such a short period of time.

Early Days of Maker

Going back to 2017, we find ourselves in an era where DeFi was just another buzzword propagated through cryptocurrencies, a new realm for sending digital currencies, conducting on-chain transactions, and participating in a decentralized variation of the traditional financial system. Maker was born in 2014, with its founder, Rune Christensen, envisioning the idea of supporting traditional financial systems at scale with blockchain.

A permissionless, decentralized financial system for everyone.

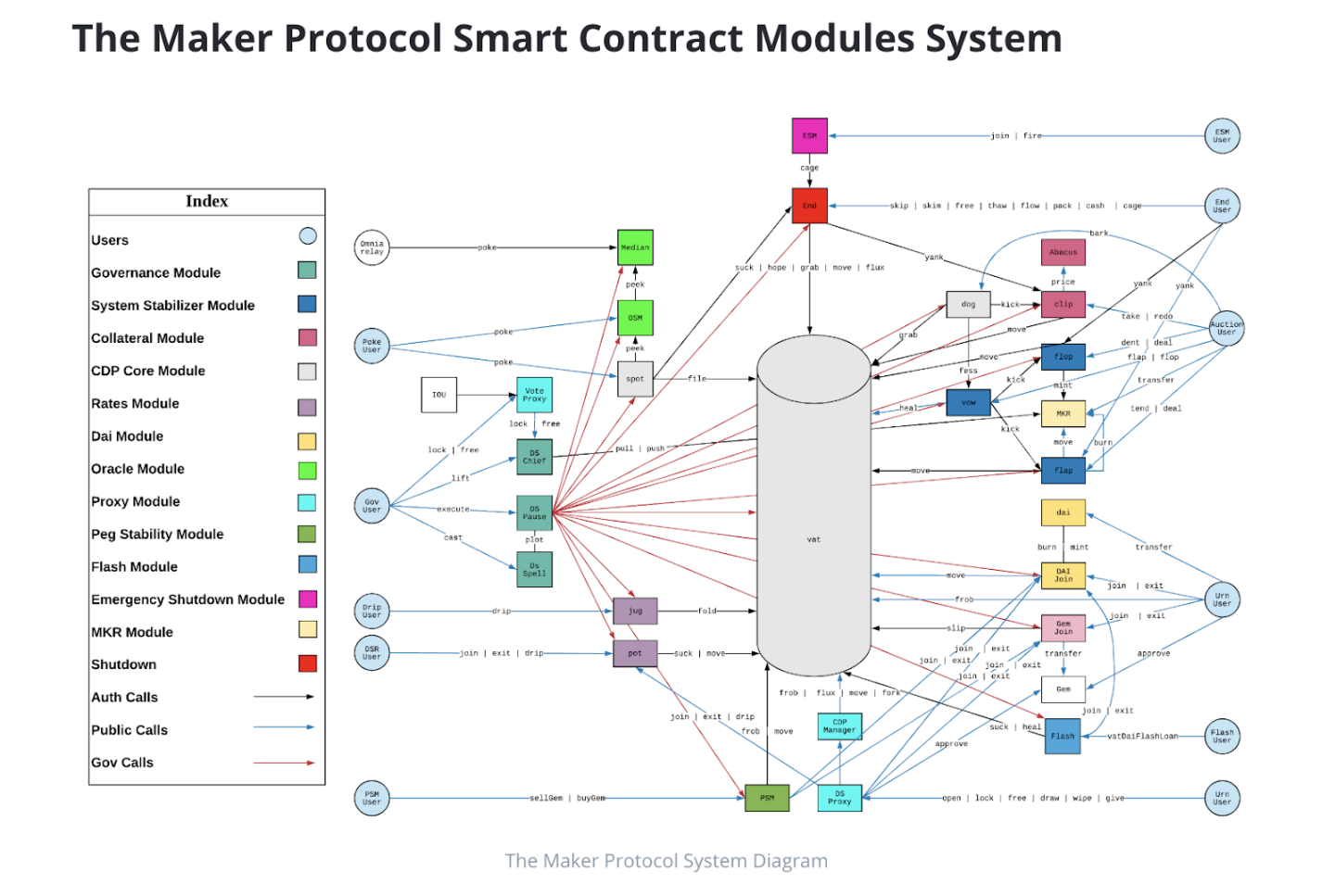

The core of MakerDAO combines a decentralized autonomous organization (DAO) with a credit protocol and the decentralized stablecoin DAI.

The main function of Maker is to manage the stablecoin DAI, which is a stablecoin pegged to the value of the US dollar, similar to Tether's USDT or Circle's USDC, but with differences. The peg of DAI is maintained through a dynamic system of collateralized debt positions (CDPs), stability fees, and decentralized governance, ensuring the stability and reliability of DAI as a stablecoin.

The foundation of the MakerDAO system is CDP, which is a smart contract mechanism where users can lock collateral assets (such as Ethereum) to generate DAI. This process is crucial as it introduces DAI into circulation while maintaining its supply. The amount of DAI that users can generate is determined by the collateral-to-debt ratio, ensuring that the system always holds more collateral value than the DAI it has issued. This mechanism ensures the value of DAI, especially in times of market volatility. Unlike stablecoins like USDC and USDT, which are backed 1:1 by reserves, DAI's mechanism provides greater flexibility and has become one of the pillars of DeFi.

MakerDAO adopts a dual-token model, DAI and Maker token (MKR). MKR holders are an integral part of the MakerDAO system governance, with voting rights on key decisions such as stability fees (interest rates charged for generated DAI from CDPs) and other risk parameters.

The decentralized governance model allows for collective decision making and risk management, contributing to the system's resilience and adaptability as the DeFi space has experienced various changes since its inception. By striking a balance between immutable smart contracts and decentralized governance, MakerDAO demonstrates the potential that the financial system can unleash in the near future.

DAI Overview

DAI stands out in the stablecoin world due to its unique stability and decentralization. As mentioned earlier, DAI presents a distinct model compared to other stablecoins, particularly those collateralized by fiat currencies. USDC and USDT maintain their peg to the US dollar by holding an equivalent amount of fiat reserves. This approach provides a direct stability mechanism but relies on centralization and traditional financial systems. Maker sets out to address the question: What are the benefits of a decentralized financial system led by centralized participants?

These stablecoins are typically issued and regulated by centralized entities that hold fiat reserves, exerting significant control over token issuance and redemption. While this isn't a barrier for many, as it doesn't introduce any external risks to the stablecoin's value stability (the maximum value stablecoins can provide is stability), it does present a choice for those who favor decentralization.

On the other hand, DAI is fully decentralized and operates without the need for centralized institutions.

Its stability is achieved not by holding fiat reserves but through over-collateralization with various cryptocurrencies. The MakerDAO ecosystem and its governance model allow for community-driven decision-making, making the system more resilient and able to adapt to market fluctuations. If users and governance participants wish to have more forms of collateral or different weights of DAI collateral, the governance mechanism allows for a fair and transparent modification process.

Naturally, this degree of decentralization may inadvertently lead to complexity in understanding and interacting with the system, potentially making it less accessible to those unfamiliar with cryptocurrencies.

Compared to other decentralized stablecoins, DAI stands out with its mature ecosystem, Maker's strong track record, and one of the most focused and active governance forums in all of DeFi.

Other decentralized stablecoins, such as Synthetix's sUSD, employ different mechanisms to maintain their peg. For example, sUSD is backed by the Synthetix network token, SNX, and other assets within the Synthetix ecosystem, which is independent of Maker and DAI. This system has its own advantages and challenges, particularly in terms of scalability and resilience in extreme market conditions.

A more cautionary tale about decentralized stablecoins comes from Terra's UST, whose decoupling led to the collapse of Terra and the evaporation of billions of dollars. Building decentralized stablecoins is one of the most challenging tasks in the cryptocurrency field, and DAI's resilience is a true success story, highlighting the importance of cautious use of decentralized systems.

DAI maintains its peg to the US dollar through a dynamic debt collateral position (CDP) system, now called the Vault in the Maker protocol. Users lock collateral assets (such as ETH or other supported cryptocurrencies) into these smart contracts to mint DAI. The system ensures that the value of the collateral always exceeds the value of the minted DAI, thus maintaining a secure overcollateralization level. If the value of the collateral falls below a certain threshold, the CDP is automatically liquidated to ensure the system's solvency.

In addition to collateral, the MakerDAO system uses stability fees (similar to interest rates) and a DAI Savings Rate (DSR) mechanism to maintain the peg of DAI. Stability fees are paid by users who generate DAI, and the fee rate can be adjusted through governance decisions by MKR token holders to respond to market conditions. On the other hand, the DSR provides an incentive for holding DAI as users can lock their DAI in the smart contract to earn additional DAI, reducing its circulating supply and contributing to stabilizing its value.

While DAI may not have the simplicity of fiat-backed stablecoins or some of the novel mechanisms of decentralized stablecoins, it combines decentralization, community-driven governance, and validated stability mechanisms, making it a significant player in the stablecoin space. Its approach strikes a balance between decentralization ideals and the practical needs of stablecoins, making it a cornerstone of the DeFi ecosystem.

Latest Developments

MakerDAO and its stablecoin DAI have become an integral part of the broader DeFi ecosystem, playing a crucial role in its growth and development. The success and influence of MakerDAO can be attributed to several key factors and strategic decisions that have allowed it to thrive in the rapidly evolving DeFi landscape.

-

Providing stability in turbulent markets: In the inherent volatility of the crypto world, DAI provides the much-needed stability element. As a stablecoin pegged to the US dollar, DAI offers a reliable medium of exchange and store of value, crucial for various DeFi applications. This stability is particularly valuable for users looking to hedge the volatility of other cryptocurrencies, engage in liquidity mining, or participate in decentralized lending platforms;

Decentralized governance and community participation: A key factor in the success of MakerDAO is its decentralized governance model supported by the MKR token. MKR holders have voting rights, allowing them to participate in critical decision-making regarding system parameters such as stability fees, debt ceilings, and adding new collateral types. This community-driven approach fosters a sense of ownership and aligns the interests of stakeholders, contributing to the protocol's adaptability and resilience;

Innovation and adaptability: MakerDAO has consistently demonstrated its ability to innovate and adapt to the evolving needs of the DeFi market. For example, the introduction of Multi-Collateral DAI (upgrading from Single-Collateral DAI) allows various cryptocurrencies to be used as collateral, not just Ethereum. The diversification of collateral types enhances the robustness of the system and increases its appeal to a broader user base;

Proven resilience: MakerDAO's system has shown resilience under various market conditions, including periods of market downturn and high volatility. This resilience enhances trust in the system, attracting more users and integrations. For example, during the cryptocurrency market crash in March 2020, despite facing challenges due to extreme market conditions, MakerDAO persisted and made necessary adjustments through its governance processes to strengthen the protocol;

Basics of other DeFi protocols: DAI has become the underlying asset for many DeFi protocols, and its integration across various platforms showcases its versatility and utility. For example, DAI is widely used in popular DeFi applications such as Compound and Aave for lending, used for liquidity provision on decentralized exchanges like Uniswap, and in liquidity mining protocols where users can earn rewards from their holdings of DAI. This wide adoption highlights its importance as a cornerstone in the DeFi ecosystem;

Let's take a look at some specific examples of the impact of MakerDAO:

Decentralized lending: Platforms like Compound and Aave have integrated DAI, allowing users to borrow this stablecoin, showcasing its utility in the decentralized lending market;

Liquidity mining: DAI has been a popular choice for liquidity mining strategies, providing stable returns for users' investments in various DeFi protocols;

Payment and remittance services: DAI's stability makes it an excellent choice for digital payments and remittances, reducing the volatility risks for users looking to transfer value across borders;

In summary, the success of MakerDAO in the DeFi field can be attributed to its innovative approach to maintaining stable cryptocurrencies, integration with numerous DeFi applications, and its powerful and decentralized governance model. These factors not only contribute to its own success but also play an important role in shaping the broader DeFi ecosystem.

Spark, SubDAO, and Maker's Endgame

Now that we have covered the basics of Maker and its current position in DeFi, we can explore some interesting aspects of the Maker ecosystem, specifically Spark, SubDAO, and Maker's Endgame.

Overview of Spark

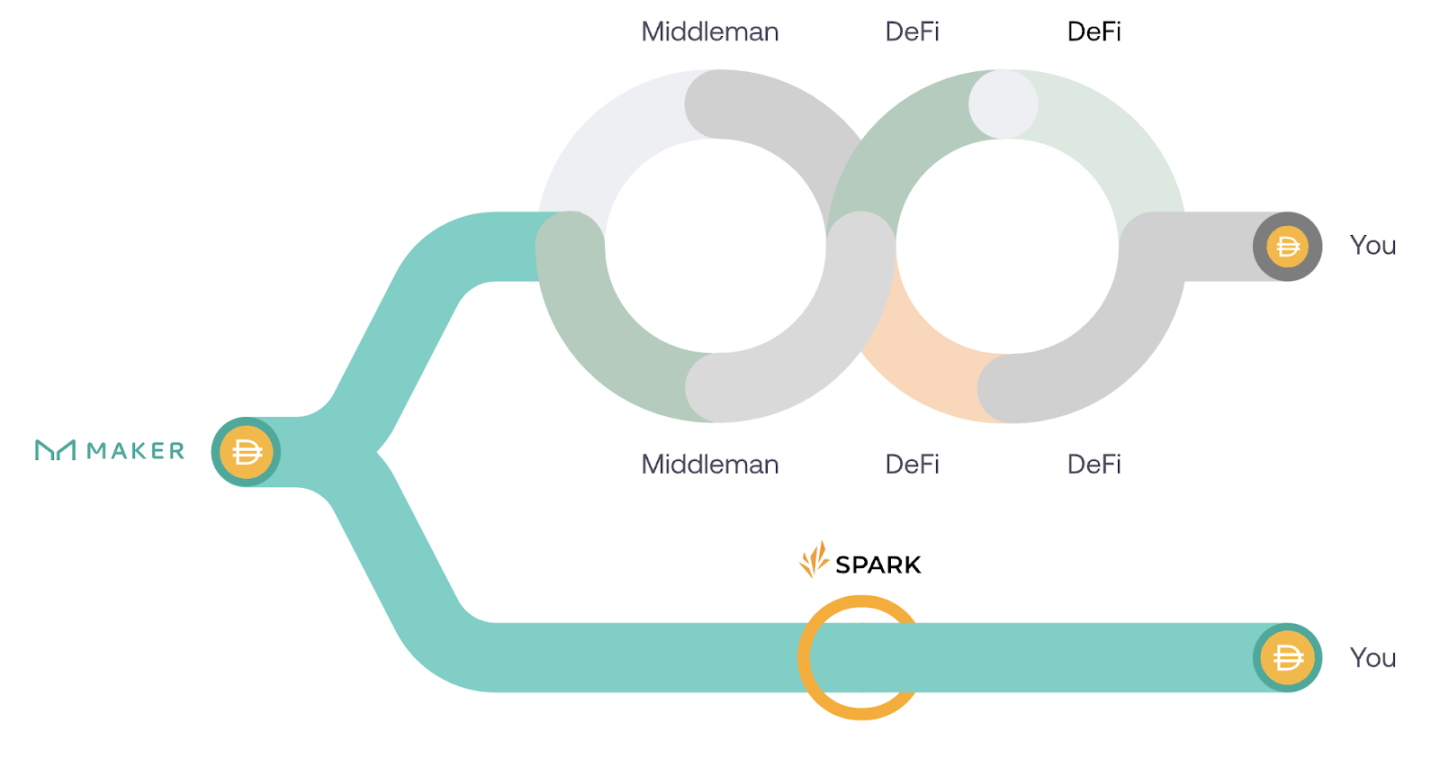

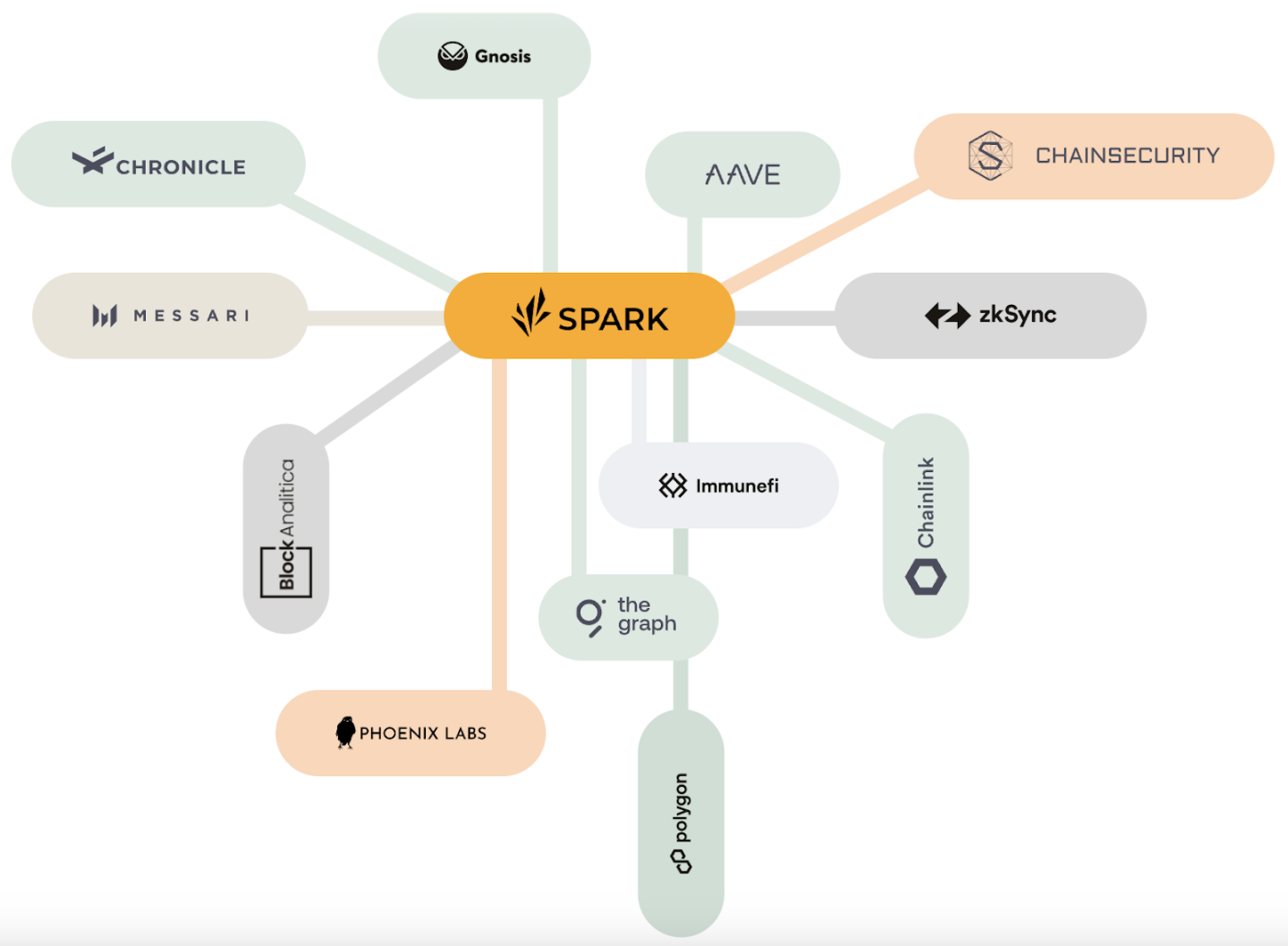

Since its inception, Spark has accumulated over 1 billion dollars of TVL. The protocol aims to facilitate the development of the Maker ecosystem while allowing for more innovation outside of the traditional Maker governance structure.

Spark focuses on enhancing the DAI ecosystem within the MakerDAO community, and here is a detailed overview:

1. SparkLend: DAI-centered money market protocol

SparkLend is designed as a decentralized, non-custodial liquidity protocol where users participate as lenders, borrowers, or liquidators. It directly integrates liquidity from Maker and other DeFi protocols, ensuring optimal liquidity management;

Lenders in SparkLend provide liquidity to the market and earn interest from their crypto assets. Borrowers, on the other hand, can obtain loans through over-collateralization, including options for single-borrow transactions without the need for over-collateralization (flash loans).

2. sDAI and SparkConduits

sDAI (Savings DAI) is introduced as an interest-bearing stablecoin that represents DAI in the DAI Savings Rate (DSR) module, which redistributes income from the Maker protocol to DAI holders;

SparkConduits, as part of the Maker allocation system, is another key feature that facilitates direct liquidity management from Maker to various protocols;

3. Efficiency and Risk Management of SparkLend

SparkLend has introduced efficiency modes (eMode) and isolation modes to optimize asset yield generation and lending capability. eMode allows borrowers to maximize their lending capacity using relevant assets, enabling high leverage trading and efficient liquidity mining;

The isolation mode is designed to list new assets in a controlled environment. Borrowers can only use isolated assets as collateral and are limited to borrowing certain stablecoins as specified by Maker Governance;

Isolated borrowing is introduced for assets with potential manipulative oracles, limiting borrowing to a single asset to reduce risk;

4. Advanced Risk Parameters and Governance Features

SparkLend implements advanced risk parameters set by Maker Governance, such as supply and borrowing limits, to regulate asset borrowing and supply and reduce bankruptcy risk;

The protocol allows for fine control over lending capacity and can flexibly reduce it to as low as 0% without impacting existing borrowers;

Risk administrators can be granted the authority to dynamically update risk parameters, ensuring system responsiveness to market changes;

5. Decentralization and Accessibility

SparkLend adopts a decentralized governance model with roles such as ASSET_LISTING_ADMIN_ROLE to manage the asset listing;

The Spark interface is hosted on IPFS, ensuring decentralized access. Users can connect to the Spark interface through various IPFS gateways, ensuring reliability and security;

Savings DAI (sDAI) allows users to deposit DAI and earn yields from the Maker protocol, further enhancing the liquidity and utility of DAI in the ecosystem;

Spark Protocol represents an important step forward in the DeFi space, aiming to optimize capital efficiency, strengthen risk management, and promote a more decentralized governance structure within the MakerDAO ecosystem. By providing innovative lending mechanisms and tight integration with MakerDAO, Spark is poised to make significant contributions to the development and growth of the DAI ecosystem.

The Endgame

MakerDAO's "Endgame" proposal is an ambitious and comprehensive roadmap designed to improve the efficiency, resilience, and participation of the MakerDAO ecosystem. The proposal outlines a multi-phase transformation process aimed at significantly increasing DAI supply and nurturing a strong organization capable of effective scalability. The following is an overview of how it works and its potential impact:

Phase 1: Testnet Release

The initial phase of Maker's Endgame revolves around rebranding and unifying the MakerDAO ecosystem, which involves introducing a new brand and website that aligns with the vision of Endgame i.e., AI-assisted governance and enhanced stablecoin security.

Of course, key elements such as DAI and MKR remain unchanged, but users have the option to upgrade to updated, slightly modified versions - NewStable (the new ERC 20 wrapper for DAI) and NewGovToken (renamed version of MKR). These, of course, are placeholder names specified in Maker's governance proposal and will undergo significant adjustments in due course.

NewStable introduces some new features such as native farming of NewGovToken and other subDAO tokens, as well as an allocation system for deploying liquidity on major exchanges as needed. An accessibility rewards system for NewStable will incentivize platforms integrating NewStable to further expand Maker's influence in the DeFi space. NewGovToken provides functionalities like smart burn engine and access to governance AI tools for enhanced governance processes.

Phase 2: subDAO Launch

This phase introduces the first six Maker subDAOs, which serve as decentralized specialized departments within MakerDAO. These subDAOs are responsible for user acquisition, decentralized front-ends, and governance.

The subDAOs are divided into FacilitatorDAO (focused on governance processes) and AllocatorDAO (dedicated to allocating NewStable collateral and managing operational efficiency).

The launch of subDAOs aims to streamline MakerDAO's governance, reduce operational complexity, and focus on risk reduction. More information about the subDAOs will be covered in the next section.

Phase 3: Governance AI Tools Release

The launch of the Governance AI Tool and Atlas is a comprehensive governance rulebook designed specifically for Makers, aimed at further democratizing governance participation and expanding access for those with economic limitations. These tools enable all stakeholders to effectively participate in governance decisions. The immutable files in Atlas ensure the permanence of core principles, protecting the ecosystem from centralization or misalignment.

Phase 4: Governance Participation Incentives Initiation

The Sagittarius Lockstake Engine (SLE) incentivizes NewGovToken holders to participate in governance by locking tokens and delegating voting power. SLE participants receive rewards in NewStable or subDAO tokens, promoting active involvement in governance.

Phase 5: NewChain Launch and Endgame Status

The final phase involves the launch of NewChain, a blockchain dedicated to supporting the token economics of subDAO and ensuring governance security. NewChain allows for the use of hard forks as a governance mechanism to recover from catastrophic disputes and ensure ecosystem resilience.

Implications and Implementation:

The Endgame proposal is impactful as it aims to significantly expand the MakerDAO ecosystem while maintaining decentralization and resilience. Maker's phased approach allows for gradual implementation and adjustments, ensuring stability and community support at each step.

By introducing AI tools and advanced token economics, Endgame positions MakerDAO at the forefront of DeFi innovation, potentially setting new standards for DAO governance and operations.

The focus on decentralized governance, public interest, and scalability may make MakerDAO a leading example in the DeFi space, influencing how other projects handle governance and growth.

In conclusion, Endgame demonstrates foresight, aiming to develop MakerDAO into a more efficient, resilient, and scalable ecosystem. Its successful implementation could have a lasting impact on the broader DeFi field, setting new benchmarks for decentralized governance and innovation.

subDAO

Within the MakerDAO ecosystem, subDAO represents a novel and decentralized governance and innovation approach in the broader Maker protocol. These semi-independent entities have their unique characteristics and roles, while being associated with the governance of creators. An overview is as follows:

1. General Characteristics of subDAO

subDAO is a dedicated DAO that operates semi-independently but is still connected to Maker Governance. Each subDAO has its unique governance token and governance process, reflecting its autonomous values and desires. While they operate largely independently, subDAOs aim to reduce the complexity and risk of Maker Core through sandbox operations. Their governance processes are built on the MakerCore governance infrastructure, with MKR holders retaining control over many subDAO assets.

2. Types of subDAO

subDAOs are divided into three types: FacilitatorDAO, AllocatorDAO, and MiniDAO, each with different functions.

FacilitatorDAO

These entities manage the internal mechanisms of MakerDAO, AllocatorDAO, and MiniDAO, with responsibilities including interpreting and facilitating specific governance-related processes. FacilitatorDAO can hire Facilitators who have direct access to governance processes and smart contracts related to their duties. They operate based on scoped work artifacts and are rewarded through a tokenomic system based on their responsibilities and performance.

AllocatorDAO

AllocatorDAO is responsible for generating DAI directly from MakerDAO and distributing it to the entire DeFi ecosystem. They serve as public entry points for the Maker ecosystem and have the ability to detach from MiniDAO. Their allocation of DAI is guided by broad goals defined within a stable scope and is subject to Maker governance constraints. AllocatorDAO has specific capitalization requirements and may face penalties if those requirements are not met.

MiniDAO

MiniDAO is an experimental entity spun off from AllocatorDAO. Due to their experimental nature, MiniDAOs may be transient, especially if they fail to achieve product-market fit. They focus on exploring innovative concepts and products to further drive the development of the Maker protocol. They represent the most diverse and dynamic aspects of the subDAO structure, allowing for rapid testing and iteration of new ideas.

3. Impact and Significance

The introduction of subDAOs in the MakerDAO ecosystem signifies a shift towards more decentralized and experimental forms of governance and innovation.

By dividing responsibilities among specialized entities, subDAOs aim to simplify governance processes, reduce cognitive load, and promote faster growth and experimentation.

This structure allows for a balance between maintaining the stability and security of the core MakerDAO system and achieving flexibility and adaptability through subDAOs.

This model may set a precedent in the DeFi space, demonstrating how large and complex protocols can manage growth, innovation, and risk in a decentralized and scalable manner.

subDAO represents an innovative step in decentralized governance within the MakerDAO ecosystem, providing a structured and flexible approach to managing various aspects of protocol operations and growth strategies. This model demonstrates how large-scale DAOs can effectively decentralize and distribute power and responsibilities while maintaining a cohesive overall governance structure.

Next Steps for Maker and RWA

With all of this in place, we can now take a look at Maker's real-world assets (RWA) and discuss the potential of this promising new industry. Real-world assets (RWAs) in the cryptocurrency space, especially those related to MakerDAO, are an important and evolving aspect of DeFi. RWAs are tangible assets such as real estate, corporate debt, or other revenue-generating assets that are typically integrated into the blockchain ecosystem through tokenization.

In the context of MakerDAO, these RWAs provide a path to diversify collateral beyond traditional cryptocurrencies, thereby reducing overall risk and volatility associated with crypto-backed loans. By integrating RWAs, MakerDAO enhances the stability and attractiveness of its platform, offering DeFi participants exposure to more traditional assets.

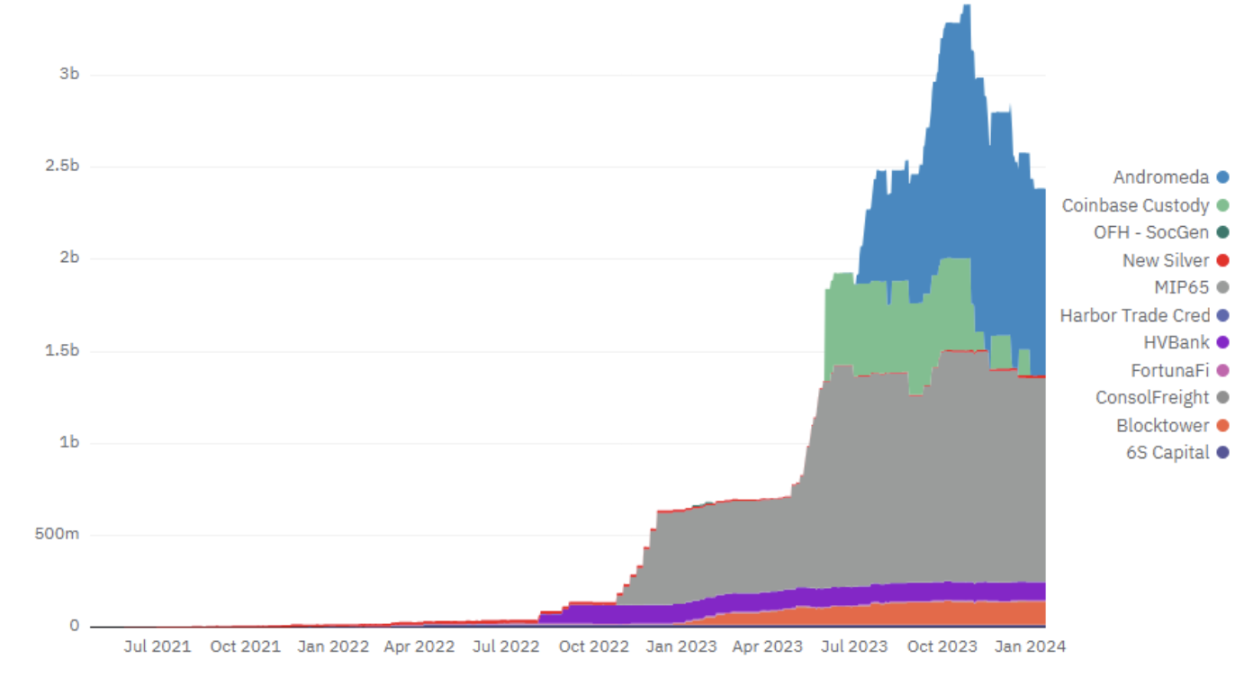

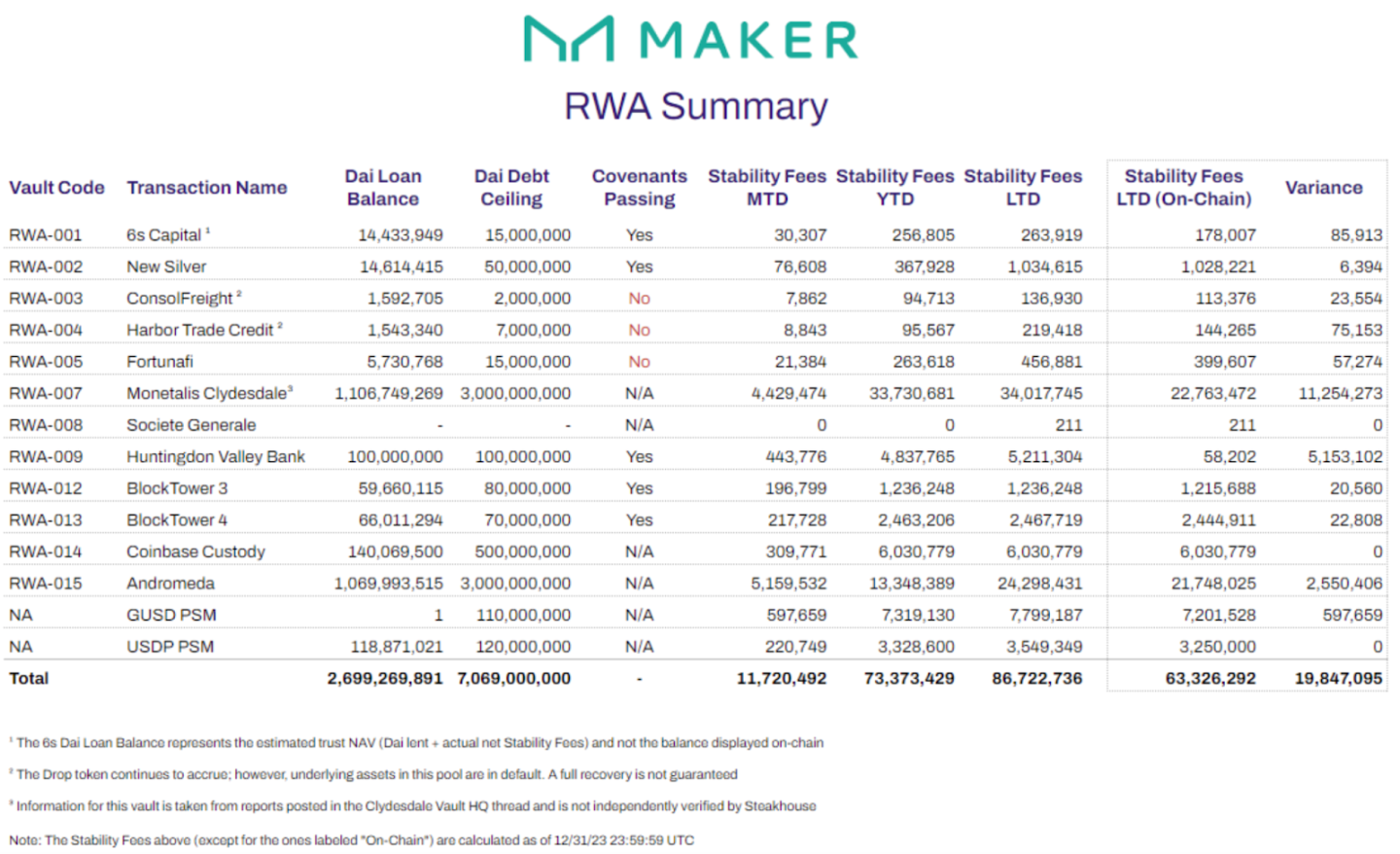

As of December 2023, MakerDAO's RWA investment portfolio has experienced significant growth, reflecting the dynamic nature of the DeFi space and the specific challenges and opportunities inherent in integrating RWAs into decentralized protocols.

Portfolio Changes and Stability Fee Contributions:

MakerDAO's RWA risk exposure (excluding the peg-stabilizing module PSM) decreased by approximately $222 million. This decrease is primarily due to withdrawals from Clydesdale, Andromeda, and Coinbase Custody to support USDC-PSM liquidity;

Despite the decline, RWAs continue to make significant contributions to Maker's stability fees, accounting for approximately 48% of all stability fees generated by the protocol in December 2023. This contribution highlights the growing importance of RWAs in the Maker ecosystem and the continued reliance on RWAs as a sustainable and highly robust source of revenue for Maker;

Specific updates:

Fortunafi Challenge: Fortunafi Centrifuge's liquidity pool encountered a minor issue that led to the artificially low redemption of Drop tokens. Although Centrifuge largely resolved this situation, the incident highlighted the complexity involved in managing RWA and the potential issues that can arise when dealing with large decentralized systems;

Harbor Trade default: As of December 2023, Harbor Trade's default situation is still ongoing, and the process of recovering value from defaulting assets is still underway. The default began in April 2023 and is currently being addressed through legal and negotiation strategies, with further progress being made;

ConsolFreight Paydowns: ConsolFreight has received multiple payments, accounting for 21% of the restructured assets. This development signifies positive progress in recovering the value of problematic loans, an issue that demonstrates foresight in both traditional and decentralized finance.

Vault-specific developments:

Monetalis Clydesdale (RWA-007): Monetalis' latest report indicates adjustments to the estimated cost of Clydesdale;

BlockTower Andromeda (RWA-015): Andromeda has reduced its holding of government bonds and returned stability fees to the DAO;

Huntington Valley Bank (RWA-009): Notice has been issued to terminate future loan acquisitions and transition to a new exchange agent;

BlockTower Credit (RWA-012 & RWA-013): BlockTower has increased its vault positions and meets all contracts through ongoing monitoring;

6s Capital Partners (RWA-001): No new loan activities reported, and the current loan balance remains at $12.8 million;

In summary, the update on MakerDAO's RWA portfolio in December 2023 highlights the ongoing efforts to integrate real-world assets into the DeFi ecosystem. These efforts have not been without challenges, as demonstrated by events such as Fortunafi's pricing error and Harbor Trade default. However, the significant contributions of RWA to Maker's Stability Fees and the positive management of these assets reflect the potential of RWA to provide stable and diversified collateral sources for DeFi platforms like MakerDAO.