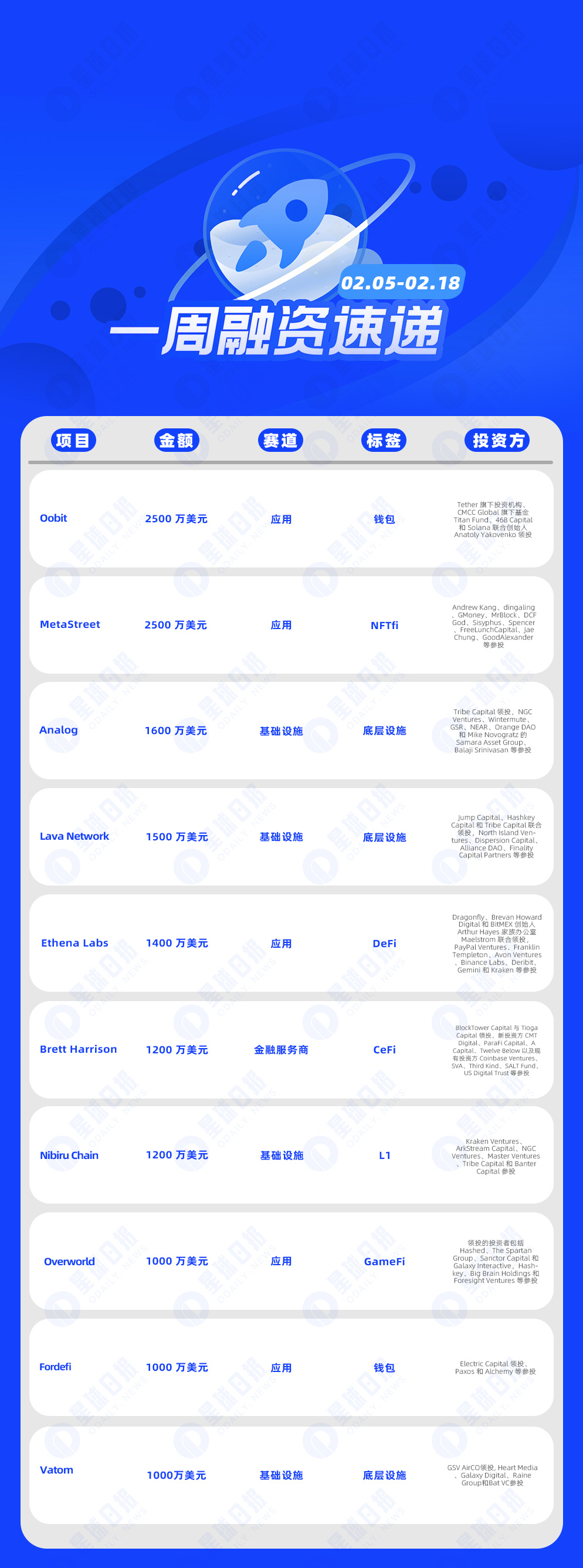

双周融资速递 | 39家项目获投,已披露融资总额约2.5亿美元(2.5-2.18)

According to incomplete statistics from Odaily, a total of 39 blockchain financing events at home and abroad were announced from February 5 to February 18, with the total disclosed financing amounting to approximately US$250 million.

The project with the largest amount of investment is the crypto payment application Oobit (USD 25 million); the NFT mortgage lending platform MetaStreet is also close behind (USD 25 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some businesses involve blockchain):

Crypto payment app Oobit completes $25 million in Series A funding

On February 15, the encrypted payment application Oobit announced the completion of a $25 million Series A financing, led by Tether’s investment institutions, CMCC Global’s Titan Fund, 468 Capital and Solana co-founder Anatoly Yakovenko, but this Singapore-based company declined to disclose the specific valuation figure for the investment. Oobit revealed that the company plans to open cryptocurrency payment capabilities to third-party wallets, which may enable Oobit to transform into a non-custodial crypto payment application.

On February 15, the NFT mortgage lending platform MetaStreet announced the completion of US$25 million in financing on the Following $24 million in seed and venture rounds in 2022, MetaStreets total funding reaches $49 million.

On February 13, cross-chain interoperability protocol Analog announced the completion of US$16 million in financing at a valuation of US$120 million. Tribe Capital led the investment, NGC Ventures, Wintermute, GSR, NEAR, Orange DAO and Mike Novogratz’s Samara Asset Group, Balaji Srinivasan Waiting for participation. Victor Young, founder of Analog, said that this round of financing began in October last year and ended in December, through SAFT.

On February 15, modular blockchain infrastructure developer Lava Network completed a $15 million seed round of financing, with Jump Capital, Hashkey Capital and Tribe Capital co-leading the investment, North Island Ventures, Dispersion Capital, Alliance DAO, Finality Capital Partners, etc. Participate in investment. Executives from Celestia, Cosmos, StarkWare, Filecoin and other blockchain ecosystems also participated in this round.

Ethena Labs completed a strategic round of financing of US$14 million, led by Dragonfly and others

On February 16, Ethena Labs announced the completion of a US$14 million strategic round of financing with a valuation of US$300 million. Dragonfly, Brevan Howard Digital and BitMEX founder Arthur Hayes family office Maelstrom jointly led the investment, PayPal Ventures, Franklin Templeton, Avon Ventures, Binance Labs, Deribit, Gemini and Kraken participated in the investment.

On February 14, Architect Financial Technologies, an encryption startup founded by former FTX.US President Brett Harrison, completed a new round of financing of US$12 million, led by BlockTower Capital and Tioga Capital, with new investors CMT Digital, ParaFi Capital, A Capital, Twelve Below and existing investors Coinbase Ventures, SVA, Third Kind, SALT Fund, US Digital Trust, etc. participated in the investment.

The new financing brings Architects total funding since its founding in January 2023 to $17 million. It is reported that Architect is committed to building trading software to make centralized and decentralized crypto markets more accessible to large investors such as institutions.

On February 14, L1 blockchain Nibiru Chain announced that it had completed a new round of financing of US$12 million, with participation from Kraken Ventures, ArkStream Capital, NGC Ventures, Master Ventures, Tribe Capital and Banter Capital.

It is reported that Nibiru Chain completed a US$8.5 million seed round last year at a valuation of US$100 million, with Tribe Capital, Republic Capital, NGC Ventures and Original Capital jointly leading the investment; in early February, it also completed a strategic round of financing with the participation of Oddiyana Ventures.

Chain gaming studio Overworld completes US$10 million in seed round financing

On February 15, blockchain game studio Overworld announced today that it had raised US$10 million in seed round financing. Investors leading the round include Hashed, The Spartan Group, Sanctor Capital and Galaxy Interactive, with participation from Hashkey, Big Brain Holdings and Foresight Ventures. The funding will go directly toward the creation of the game, and Overworld is currently hiring for a number of roles at the studio. The studio is developing its first game, tentatively titled Overworld, a free-to-play action role-playing game for Web3 powered by the Xterio token, with anime-style art design.

MPC wallet company Fordefi completes US$10 million in financing, led by Electric Capital

On February 13, MPC wallet company Fordefi announced the completion of US$10 million in financing, led by Electric Capital, with participation from Paxos and Alchemy. It is reported that Fordefi is expanding its self-hosted MPC wallet products to service platforms for retail investors, such as trading platforms and financial technology platforms, and further reducing the risk of interaction with DeFi applications.

Web3 SaaS engagement platform Vatom closes $10 million Series B at $125 million valuation

On February 16, Vatom, a Web3 SaaS engagement platform based on the Metaverse, announced the completion of a $10 million Series B round of financing at a valuation of $125 million. GSV AirCO led the investment, and Heart Media, Galaxy Digital, Raine Group and Bat VC participated.

Vatoms Web3 Metaverse engagement solution helps businesses better connect with customers, employees and stakeholders through seamless immersive experiences, with clients including Google, PepsiCo, PG, Deloitte, Verizon, iHeart Media, State Farm, WPP, among others, will use the new funding to expand support for its customer base and expand its marketing and product teams.

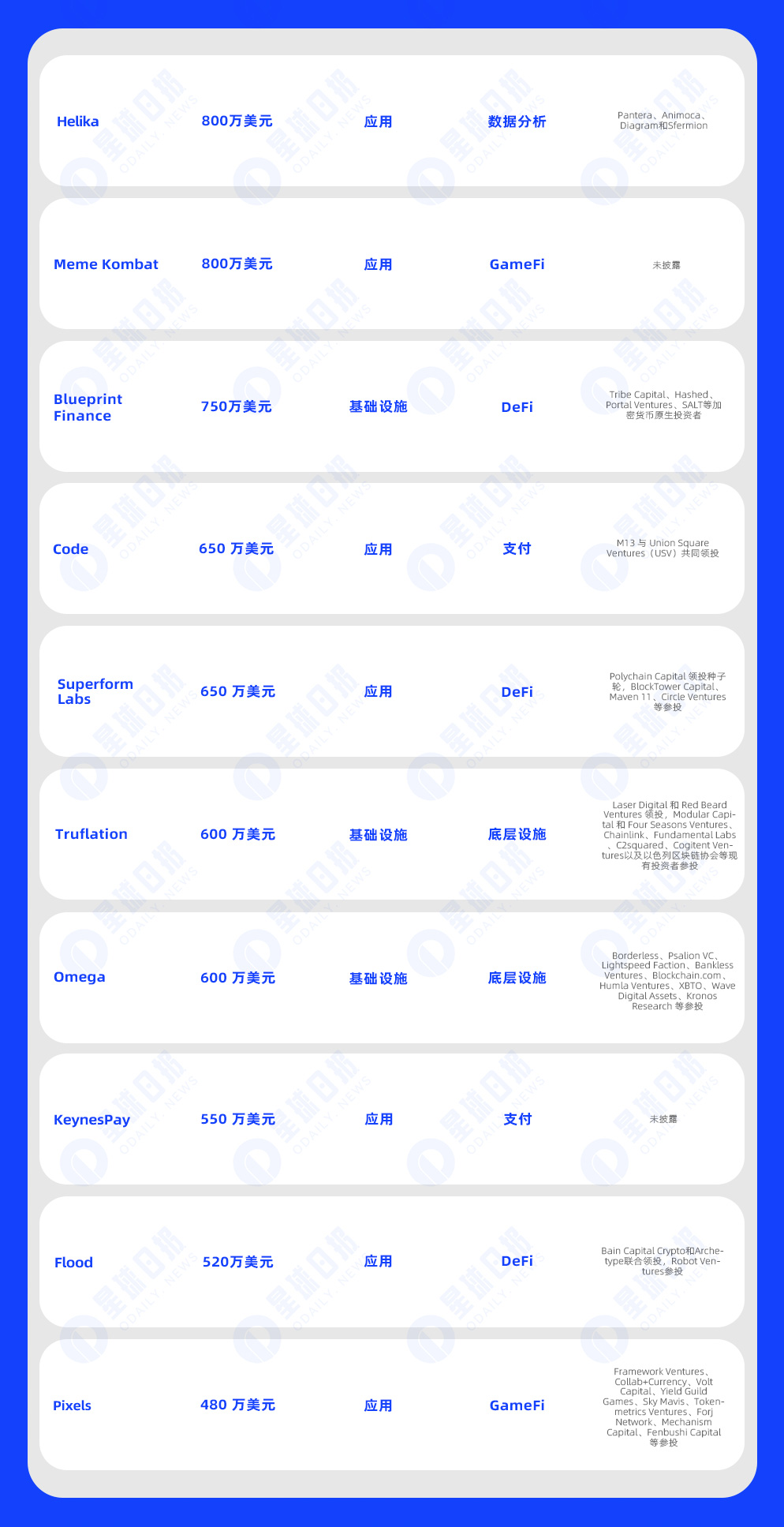

Web3 game data analytics provider Helika completes $8 million in Series A financing

On February 16, Helika, a data analytics and infrastructure provider for traditional and Web3 games whose clients include Animoca Brands and Yuga Labs, announced the completion of an $8 million Series A round of financing from Pantera, Animoca, Diagram and Sfermion.

Web3 gaming platform provider Meme Kombat has completed nearly $8 million in financing

On February 15, Web3 gaming platform provider Meme Kombat has completed nearly $8 million in financing in its latest fundraising campaign, with a hard cap target of $10 million. It is reported that the total token supply of Meme Kombat is 120, 000, 000, of which 30% is used for staking and battle rewards, 10% is used for community rewards, and 10% is used for decentralized exchange liquidity.

Blueprint Finance secures $7.5 million in financing

On February 16, Blueprint Finance announced that it had received $7.5 million in funding from native cryptocurrency investors such as Tribe Capital, Hashed, Portal Ventures, SALT and other cryptocurrency investors to solve the liquidation problem of cryptocurrency.

Crypto payment solution Code completes US$6.5 million in seed funding, led by M 13 and USV

On February 6, crypto payment solution Code completed a US$6.5 million seed round of financing, with M 13 and Union Square Ventures (USV) co-leading the investment.

According to reports, Code has launched today and has developed an application to enable online micropayments. In addition, the team has launched a developer platform and is about to launch a new blogging tool that will allow anyone to get paid for writing.

On February 8, cross-chain revenue market Superform Labs announced that it had completed a total of US$6.5 million in financing through angel and seed rounds. Polychain Capital led the seed round, and BlockTower Capital, Maven 11, Circle Ventures, etc. participated. Superform is a permissionless cross-chain yield marketplace that allows DeFi protocols to list their vaults or asset pools into which crypto users can deposit funds and earn yield.

Oracle Truflation completes US$6 million in financing, led by Laser Digital and Red Beard Ventures

On February 10, the on-chain oracle project Truflation announced the completion of US$6 million in financing, led by Laser Digital and Red Beard Ventures, Modular Capital and Four Seasons Ventures, Chainlink, Fundamental Labs, C 2 squared, Cogient Ventures and Israeli Blockchain Existing investors such as associations participated in the investment.

On February 7, Bitcoin Web3 infrastructure provider Omega announced the completion of US$6 million in financing, with participation from Borderless, Psalion VC, Lightspeed Faction, Bankless Ventures, Blockchain.com, Humla Ventures, XBTO, Wave Digital Assets, Kronos Research, etc.

Payment platform KeynesPay completes US$5.5 million in Pre-Seed round of financing

On February 16, digital asset financial services group Keynes Group announced that its third-party payment platform KeynesPay completed a $5.5 million Pre-Seed round of financing at a pre-investment valuation of over $50 million. New investors include large institutional investors and Web3 institutions. and strategic partners. This round of financing will be used to deepen KeynesPays payment ecological layout in the virtual asset industry, accelerate the diversification of payment licensed business products, and promote the groups compliance and innovative development on a global scale.

On February 8, DEX aggregator Flood completed a $5.2 million seed round of financing, with Bain Capital Crypto and Archetype co-leading the investment, and Robot Ventures participating. Flood is a DEX aggregator currently live on Arbitrum One, with plans to expand to Ethereum, Base, and Optimism in the coming months.

On February 9, according to official news, Ronin ecological chain game Pixels announced the completion of a strategic round of financing of US$4.8 million from Framework Ventures, Collab+Currency, Volt Capital, Yield Guild Games, Sky Mavis, Tokenmetrics Ventures, Forj Network, Mechanism Capital, Fenbushi Capital and others participated in the investment.

On February 12, L2 startup LightLink announced the completion of a US$4.5 million seed round of financing, led by TB Media Global and MQDC, with participation from JellyC, Aweh Ventures, Blue 7 and B 3 V. LightLink said the new funding will support its Translucia multiverse project, which aims to merge the virtual and real worlds.

Filecoin ecological liquidity staking protocol Glif completes US$4.5 million in seed round financing

On February 6, Filecoin ecological liquidity staking protocol Glif announced the completion of a US$4.5 million seed round of financing, led by Multicoin Capital and others. The new funds will expand its services to users and launch a points program to reward users. According to people familiar with the matter, the The points program may be related to subsequent token airdrops.

On February 1, 4, AI-driven one-stop Web3 gaming platform Ultiverse completed a strategic round of financing of US$4 million, led by IDG Capital, Animoca Brands, Polygon Ventures, MorningStar Ventures, Taiko, ZetaChain, Manta Network, DWF Ventures and Jacob KO (Superscrypt partner) and others participated in the investment. The financing brings Ultiverses valuation to $150 million.

On February 6, Web3 startup Startale Labs completed US$3.5 million in financing, with participation from UVM Signum Blockchain Fund, Sony Network, and Samsung Next Ventures. The post-financing valuation was US$63.5 million.

It is reported that Startale Labs was established in January 2023 and is headquartered in Singapore. It focuses on Web3 infrastructure development. Startale Labs also has a subsidiary in Japan that provides research, development and consulting services to Web3 companies in the country.

On February 16, Witness, a provider of blockchain digital ownership solutions, announced the completion of a US$3.5 million seed round of financing, led by Haun Ventures and participated by Coinbase Ventures. Witness mainly uses blockchain technology to build digital ownership and provides users with clear data proof. It aims to redefine the paradigm of application use in the encryption field on the basis of reducing gas fees. Its team members mainly come from companies such as Paradigm, Google and Facebook. .

On February 10, Great Big Beautiful Tomorrow, a Web3 game studio based on the Polygon blockchain, announced the completion of a US$3 million seed round of financing, led by Shima Capital, Sfermion, GSR Markets, Arca, Lyrik Ventures, Flying Falcon, Press Start Capital, 32-Bit Ventures and Polygon Labs participated in the investment.

On February 16, Exverse, a Web3 gaming service provider headquartered in Dubai, United Arab Emirates, announced the completion of US$3 million in financing, led by Cogitent Ventures, Cointelligence and Moonrock Capital, with participation from KuCoin Labs, Epic Games, Seedify and ChainGPT. Exverse is currently focused on developing first-person shooter Web3 games using Epic Games Unreal Engine 5 game engine, and the new funds will be used to expand operations and accelerate development progress.

Security and analytics company FuzzLand completes US$3 million in seed round financing, led by 1kx

On February 9, security and analytics company FuzzLand completed a $3 million seed round of financing, led by 1kx, with participation from HashKey Capital, SNZ, and Panga Capital. FuzzLand said the funding will help accelerate the development of automated solutions for smart contract analysis using dynamic analysis and distributed computing software. FuzzLand was founded by Shou, Jeff Liu, and Koushik Sen to provide cutting-edge vulnerability detection and analysis capabilities that go beyond traditional solutions.

On February 14, WATCHES.IO, a luxury watch trading platform based on encryption technology, announced the completion of a $1.9 million pre-seed round of financing. This round of financing was led by Lemniscap and included Builder Capital, Soft Holdings, Darkside Capital, Big Brain Holdings, Marin Ventures and Many angel investors participated in the investment, and it is reported that Web3 users can buy, trade and invest in watches on the platform.

On February 13, derivatives trading protocol IntentX completed a strategic financing of US$1.8 million, led by Selini Capital, with participation from Orbs, Mantle, Mirana Ventures, Kronos Research and Manifold Trading.

On February 16, the automated security protocol Drosera announced the completion of US$1.55 million in financing from Anagram, Arrington Capital, UDHC, Comfy Capital, Bodhi Ventures, Metamatic, BaseDAO, Asymmetric, Zeal Capital, Everstake, 01 Node, Marin Ventures, Infinite Capital, NxGen Waiting for participation. It is reported that Drosera is an automated security protocol used to detect vulnerabilities and reduce financial losses.

On February 18, Web3 digital identity startup Metropolis announced the completion of a new round of financing of US$1.2 million from Cointelegraph Accelerator, Lamina 1 Ecosystem Fund, ACS, Outlier Ventures, Protocol Labs, Primal Capital, Zephyrus Capital, Cluster Capital, EthLizards, Acacia Digital , Block Consult, IBC and a number of strategic angel investors participated in the investment.

Blockchain mobile game development company Ginger Joy completes £1 million in financing

On February 12, Ginger Joy, a blockchain mobile game development company, announced the completion of 1 million pounds in financing, approximately US$1.26 million. The company plans to build interconnected Web3 games native to mobile devices and gradually develop mass-market Web3 mobile games. Game ecosystem.

On February 9, Merlin Chain, a second-layer Bitcoin solution, announced the completion of financing, with participation from 24 institutions including OKX Ventures, ABCDE, Foresight Ventures, and Arkstream Capital.

Merlin Chain focuses on Bitcoin-native solutions, integrating key modules such as the ZK-Rollup network, decentralized oracle network, and fraud proof on the Bitcoin chain, aiming to empower Bitcoins native assets, protocols, and applications. Ecology, allowing it to continue to innovate and amplify asset potential on the second-layer network.

Web3 and social game publisher Carry 1 st receives strategic investment from Sony Innovation Fund

On February 15, Web3 and social game publisher Carry 1 st announced that it had received strategic investment from Sony Innovation Fund. The specific amount has not yet been disclosed. Since its inception, Carry 1 st has received more than $60 million in financing.

It is reported that Carry 1 st is the first investment in the recently established Sony Innovation Fund: Africa, a US$10 million fund launched by Sony in 2023 to support and invest in African entertainment startups.

On February 6, LN Markets, a Bitcoin instant settlement trading platform, announced the completion of a seed round of financing, with Lemniscap participating. The specific financing amount has not yet been disclosed.

In addition, the two parties have also reached a cooperation to provide DLC Markets, a trustless OTC derivatives trading platform for financial institutions. The Discreet Log Contract (DLC) built by LN Markets enables DLC Markets to provide a wide range of applications to manage OTC derivatives transactions to reduce counterparty risk.

DeFi protocol Folks Finance completes strategic round of financing, Algorand Ventures participated

On February 7, DeFi protocol Folks Finance announced the completion of a strategic round of financing, with Algorand Ventures participating in the investment. Folks Finance has previously received support from Borderless Capital, Jump, Parafi and Coinbase Ventures, and the latest financing will enable users to expand its product suite of technologies and expand the reach of the Algorand ecosystem through cross-chain bridges and assets.

On February 8, the fashion metaverse platform LightCycle recently announced that it has received strategic investment from a number of institutions including Bybit, HashKey Capital, Web3port Foundation, and Vertex Labs. This round of financing will mainly be used to promote the platform’s application scenario expansion, team growth and marketing activities.

OKX Ventures participates in UniSat Pre-A round of financing

On February 9, UniSat officially issued a statement stating that OKX Ventures participated in UniSat Wallet’s Pre-A round of financing. UniSat Wallet and OKX have been deeply collaborating in the Bitcoin ecosystem since 2023. In addition, SWC Global, Vitalbridge Capital and ABCDE are also participating.