LD Capital宏观周报(1.29):抢筹中国,挑剔的投资者遇上科技股,万亿新债计划出炉

Summary

The Chinese market deserves the most attention last week, with a series of policies/rumors supporting the Chinese stock market and commodity prices, and the yuan also appreciating sharply. This seems to have changed the negative sentiment towards Chinese assets.

Global stock funds and emerging market funds saw substantial net inflows last week, with Chinese stock fund inflows hitting a record high. However, institutional positions in Chinese stocks remain low.

U.S. fourth-quarter GDP data, manufacturing PMI data, and personal consumption expenditure data were better than expected. However, both the SP 500 and U.S. Treasury yields rose slightly, indicating that the market values economic growth more than interest rates.

Intels main performance figures exceeded expectations, but its stock suffered a heavy hit, reflecting investors picky attitude towards high-valued stocks.

China increased its holdings of U.S. debt in November, possibly due to the reconciliation of Sino-U.S. relations and rising U.S. bond prices.

This week, attention will be paid to the financial reports of many U.S. technology giants, and volatility may increase. Also pay attention to the policy trends of various central banks and the impact of the U.S. government bond issuance plan in the first quarter.

Chinese market

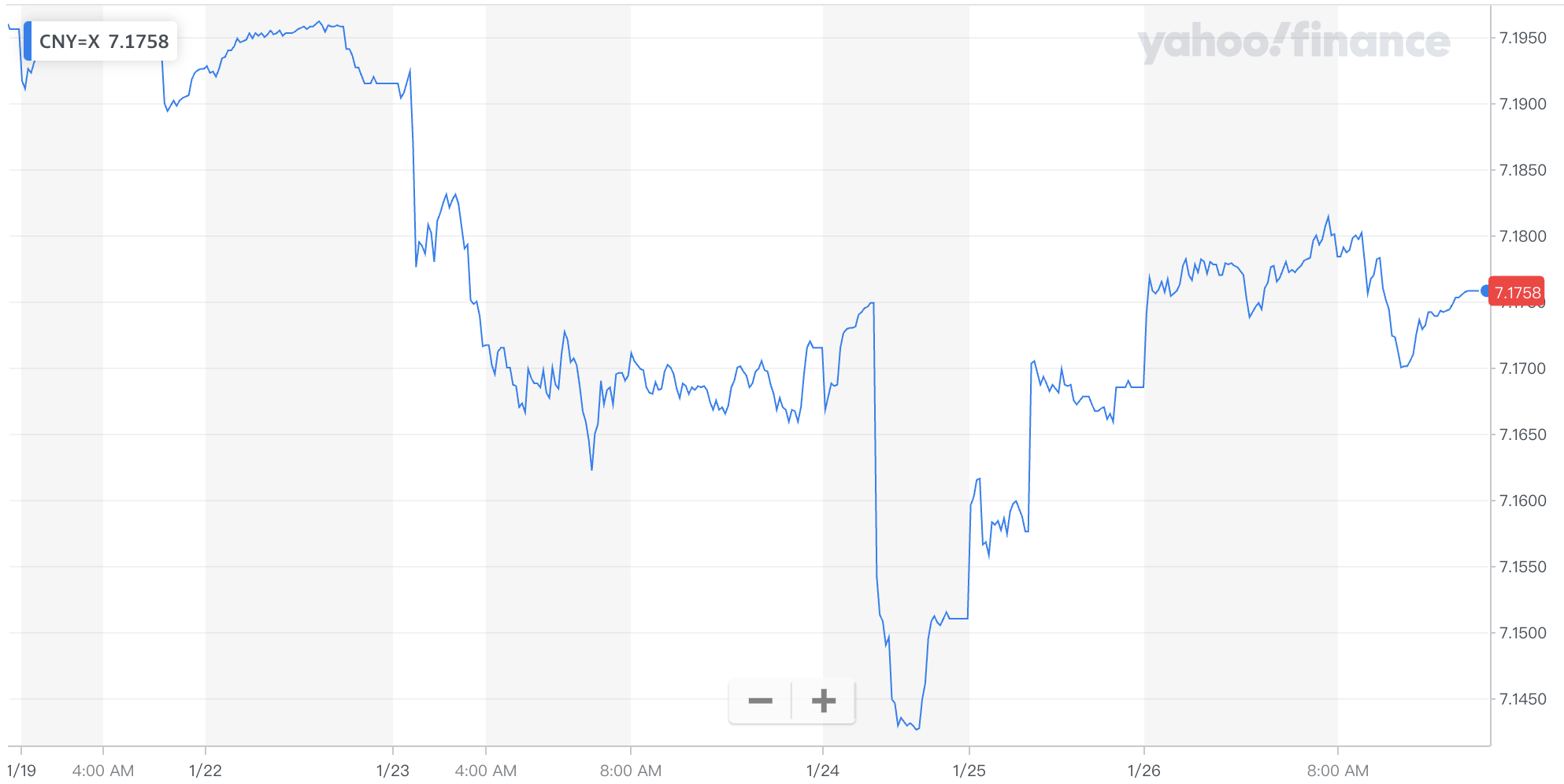

The most noteworthy thing last week was the Chinese market. A series of policies/rumors supported the Chinese stock market and commodity prices. The RMB also appreciated sharply by 500 points against the US dollar in the first half of the week (7.19-7.14 also closed up for the first time in three weeks). The mood for the Chinese stock market to bottom out is rising. The K-line has fallen rapidly and then emerged from three consecutive positives, which is also a bottom pattern that technical analysts like to see.

background

Rumors on Tuesday about a potential $2 trillion stock market rescue plan, if realized, are expected to change sentiment on sluggish yuan assets. The funding, which is likely to use cash parked overseas by state-owned enterprises, is equivalent to about 8% of the free-floating market capitalization of mainland Chinas stock market.

Pan Gongsheng, governor of the Peoples Bank of China, unexpectedly announced on Wednesday that he would lower the deposit reserve ratio by 0.5 percentage points on February 5 = providing RMB 1 trillion in long-term liquidity to the market, as well as a targeted interest rate cut of 25 bp. The governor of the Peoples Bank of China suddenly announced major news such as reserve requirement ratio and interest rate cuts at the press conference, and the announcement was made before the market close. This is very rare in Chinas financial history. It highlights that Chinas regulations have boosted global investment at a time when Chinas assets have continued to plummet. The confidence is very urgent. (Since the market has been expecting the central bank to cut interest rates, previous expectations were dashed, leading to a stock market crash and heavy regulatory pressure.)

On Wednesday, the State-owned Assets Supervision and Administration Commission of the State Council said it would further study the inclusion of market value management in the performance evaluation of heads of central enterprises and guide the heads of central enterprises to pay more attention to the market performance of the listed companies they control. This means that the central enterprises’ increase in market-oriented holdings, buybacks, dividends and other real money operations will become a political task, and it is expected that it will also be transmitted to local listed companies in the future. Against this background, “China-prefixed” stocks set off a surge on Thursday In the rising tide, companies with high dividends and low valuations have become hot spots for buying.

As the economy and stock market struggled, policymakers took a series of actions, none of which was deemed sufficient. Investors betting on bazooka-style stimulus measures - like those seen during the global financial crisis - have been left out in the cold. Measures such as state fund purchases of ETFs, lower stamp duties on stock transactions and restrictions on new listings have provided, at best, a short-lived rebound.

But authorities have recently stepped up support, raising hopes that this time might be different. Stocks posted a rare three-day winning streak this week. This is not the first time that the Chinese government has launched a massive bailout when the stock market plummeted. China has also used various state-controlled funds to invest heavily in the stock market in 2015, most recently buying into Chinese stock ETFs.

Strategy

Regarding investment strategies, in addition to the concepts of state-owned enterprises and index concepts, one type of investors believe that they should stick to sectors such as electric vehicles and semiconductors, because these industries already have sufficient development potential regardless of whether the government introduces large-scale stimulus policies.

There is also a view that one should go to Hong Kong stocks to find bargains, where there are more targets that are wrongly killed by emotions. For example, Li Ka-shing’s investment company CK Hutchison is a good example: about half of the company’s revenue comes from Europe, involving Various industries such as ports and telecommunications. Sales from mainland China and Hong Kong only account for 14% of the companys total sales, so the downturn in the mainland and Hong Kong economies will have little impact on the company, and the dividend yield is 7.2%, but CK Hutchisons share price is currently The P/E ratio is only five times.

Persistent

Given the low valuations of Chinese stocks, a short-term rebound makes perfect sense. But whether this rebound can be sustained ultimately depends on whether the government is willing to use more fiscal and monetary easing policies to boost the real economy. Compared with Europe and the United States, it is not just the problem of the tool itself, but also the problem of the ZZ environment. For example, last year The central bank was placed under the control of the Central Financial Commission, reducing the power of government agencies such as the Peoples Bank of China and the China Securities Regulatory Commission. Therefore, even if everyone knows that there are only these few tricks, if the confidence in whether they can be implemented cannot be maintained, the sustainability of the rebound will be very poor.

Now the government has successively relaxed housing purchase restrictions in some cities and slightly lowered interest rates, but this still disappoints most market participants. A considerable number of people believe that the rapid slowdown of Chinas economy requires strong medicine, just as governments of various countries have done in the past. Do that. However, it is understandable why the top management does not want to use strong stimulus. Although such measures will boost growth, they will also push up debt, contribute to long-term instability, uneven distribution, slowed industrial transformation, and sharp depreciation of the exchange rate. .

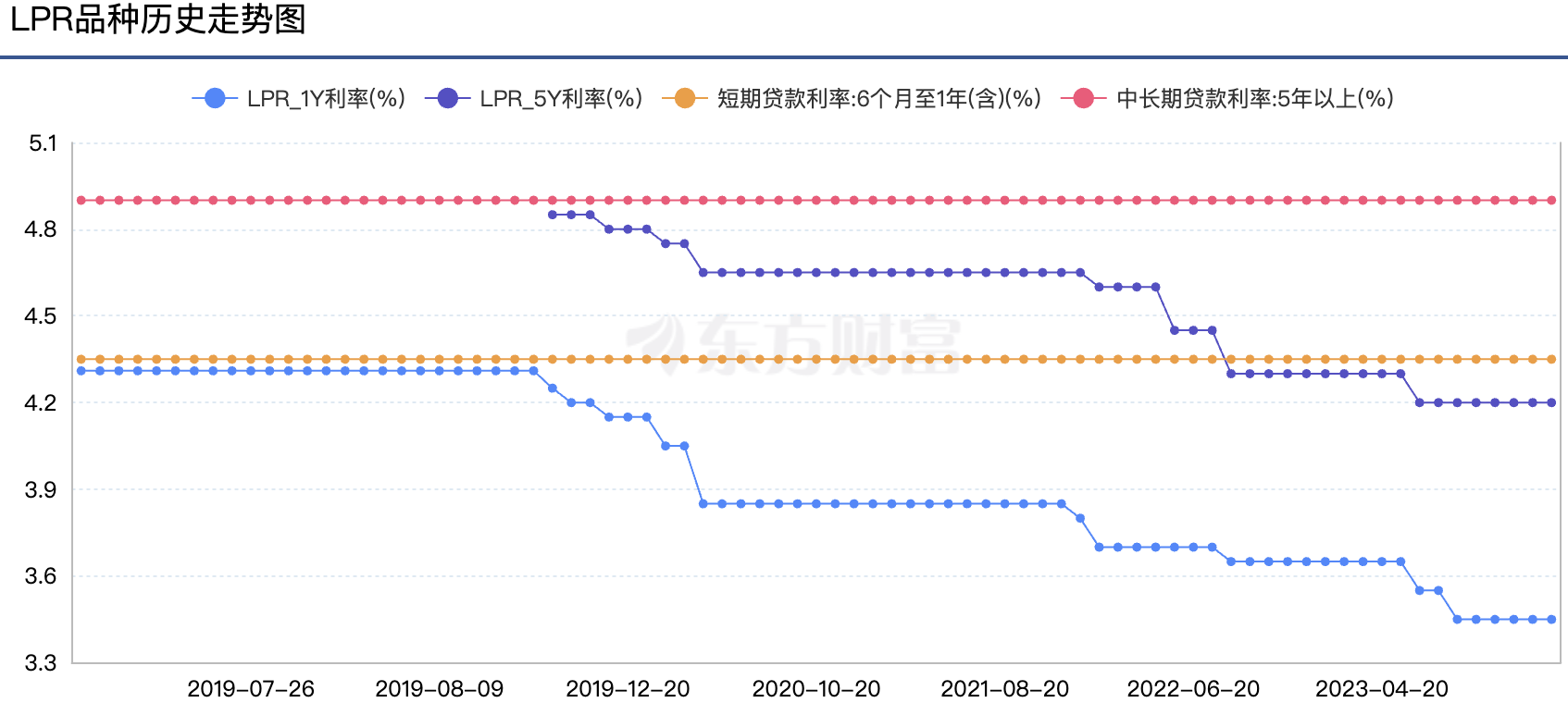

As shown in the chart below, Chinas benchmark interest rate LPR has remained unchanged for the fifth consecutive month since September last year. The 1-year and 5-year or longer LPRs reported 3.45% and 4.2% respectively, but Chinas CPI is close to 0 or negative. , which makes such interest rates appear very restrictive, which is unreasonable in an economic downturn environment. Compared with countries such as the United Kingdom and the United States whose economies are still expanding, interest rates have only been higher than inflation in recent months.

But while the yuan strengthened when the RRR cut was announced (along with comments supporting FX stability), it failed to sustain those gains in subsequent trading, likely due to rising expectations of further easing. Overall, this is a very interesting game. If loose monetary policy can lead RMB assets out of a negative cycle, it may not lead to a weakening of the exchange rate:

My personal view on the future is optimistic, because developed countries have generally ended their interest rate hike cycle. If they start an interest rate cut cycle as early as March, it will leave room for China to implement more easing measures.

US market

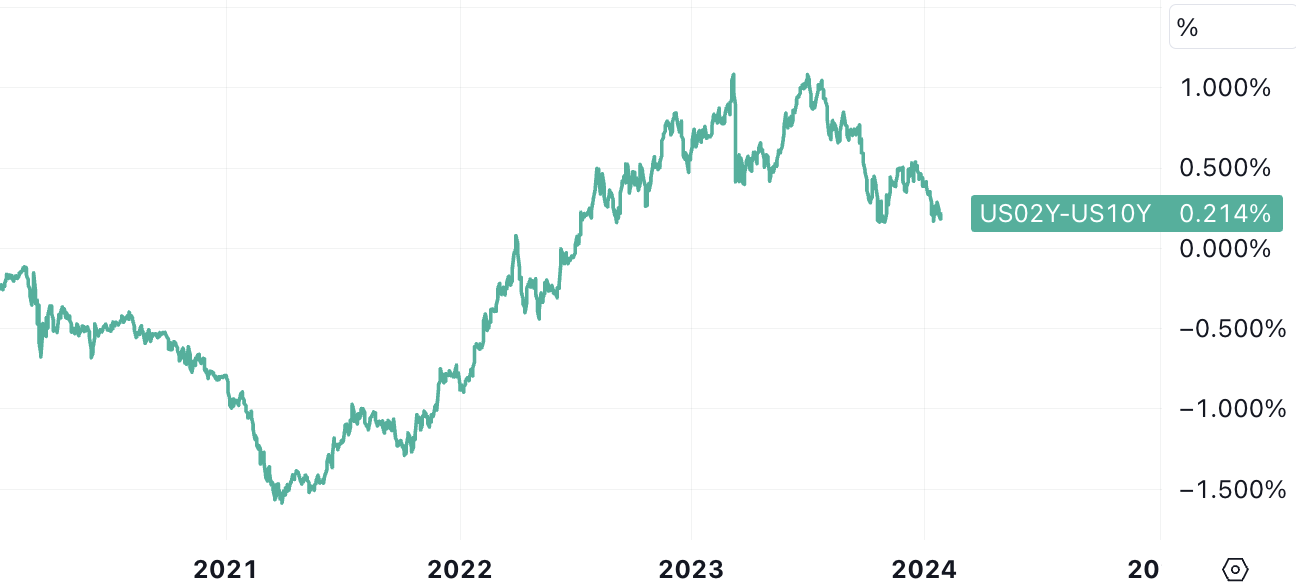

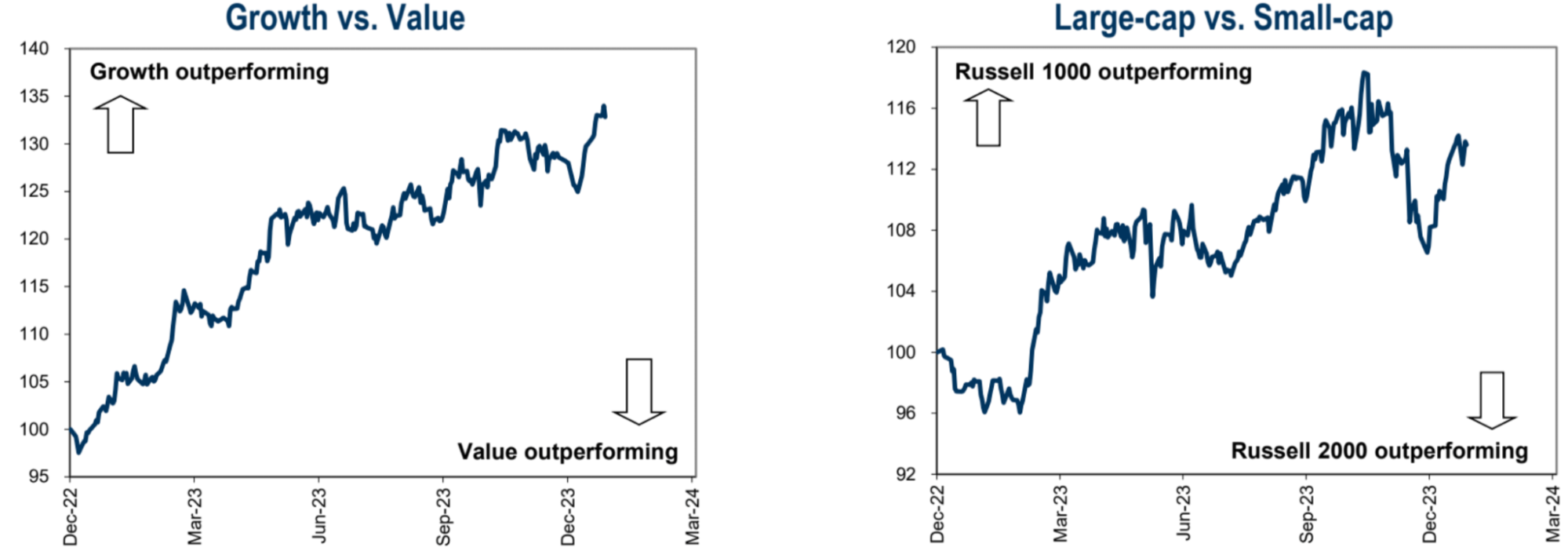

Last week there was much stronger than expected fourth quarter GDP data (3.3%), while personal consumption expenditures (PCE) softened (core 3M 2%, overall 3M 1.7%), initial jobless claims rose more than expected, and durable goods data Lower than expected, the manufacturing PMI returned to above 50 (the weakest link also resumed expansion). As a result, the U.S. dollar strengthened slightly. 10 U.S. bond yields first fell and then rose and basically flatlined, and the short-duration yield fell even more. , 2-10 The interest rate inversion has narrowed from a maximum of 1% last year to 0.21%, and the normalization of the yield curve has become a hot topic in the market.

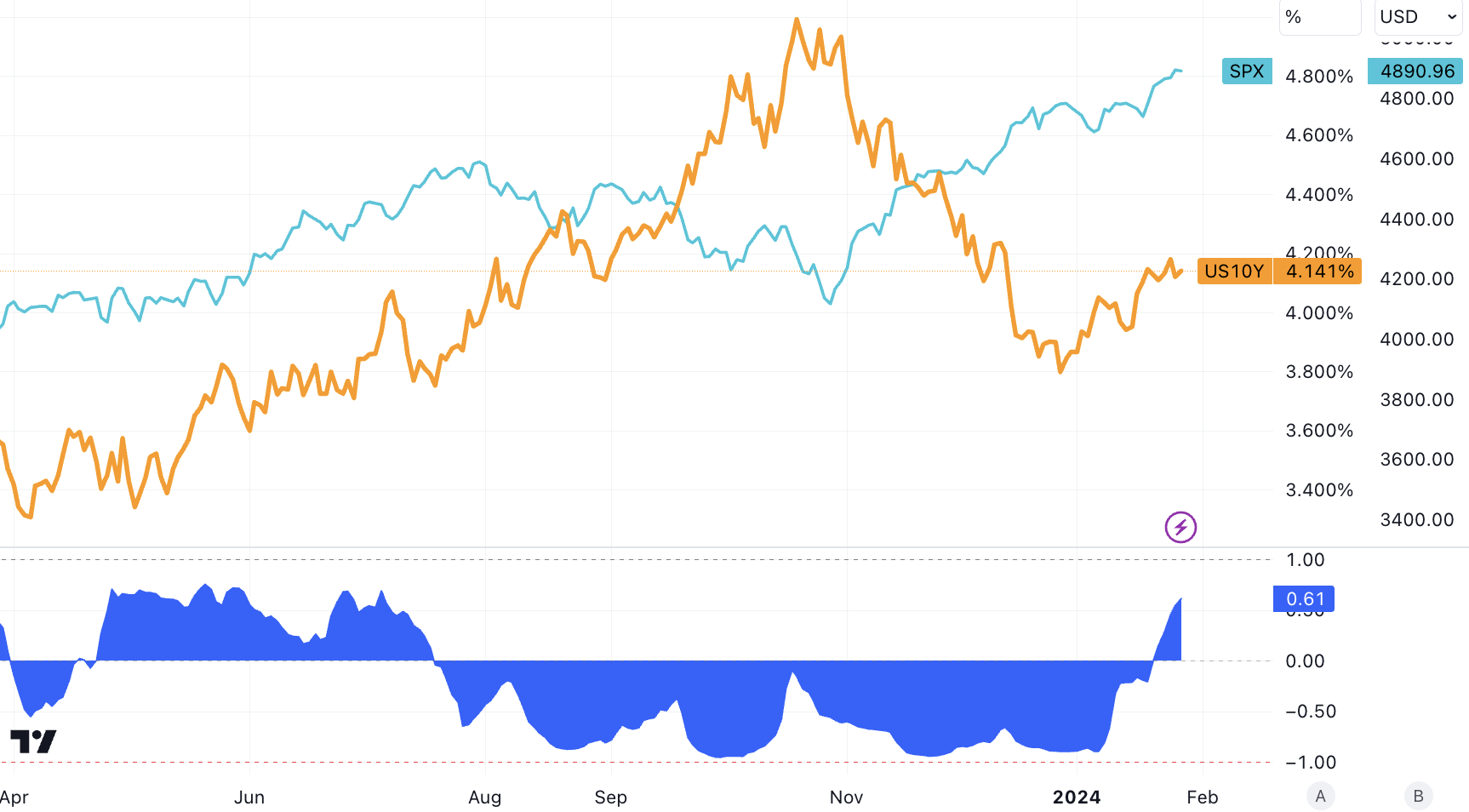

The SP 500 continued its run to new all-time highs last week, with the 10-year Treasury yield virtually trading sideways around 4.14. The 10 Y has gained 27 basis points this year after opening at 3.87%, and the SPX is also up 2.4% this year despite higher yields. This is the first reversal in the correlation between interest rates and stocks in half a year. This situation shows that the market is now more concerned about growth than interest rates:

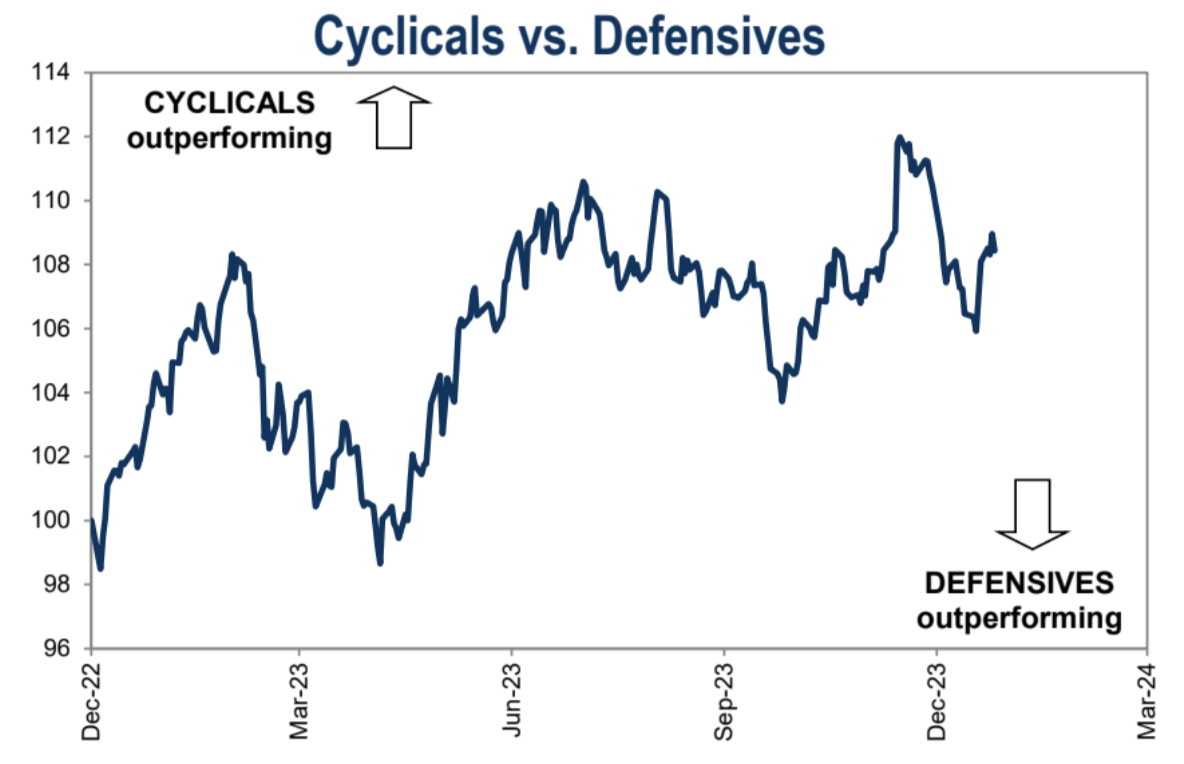

U.S. stocks have been positive in the past two weeks, trending toward cycles, growth, and the broader market:

There has been some buzz in the market lately about how yield curve normalization could impact stocks, especially given the recent negative correlation between stock and bond yields. However, economic growth has a more important impact on stock returns than shifts in the yield curve. During periods of strong economic growth, stocks typically provide the greatest returns regardless of whether the yield curve is steep or flat. As long as the U.S. economy avoids recession, even a normalized yield curve will deliver positive returns.

Goldman Sachs currently predicts that the Federal Reserve will implement five 25 basis point interest rate cuts this year, the 2-year yield will drop to 3.7% at the end of the year, and the 10-year yield will remain at the current level of 4.0% at the end of 2024. If this comes true, the interest rate curve Normalization will return, and on this basis, if you are a bond long, the certainty of short-duration bonds will be higher.

The Bank of America strategy calls any decline in U.S. bonds a buying opportunity. It recommends increasing duration (i.e. buying Treasury bonds) when the 10-year Treasury yield exceeds 4.1-4.15%, and reducing holdings when interest rates are around 3.85-3.9%. .

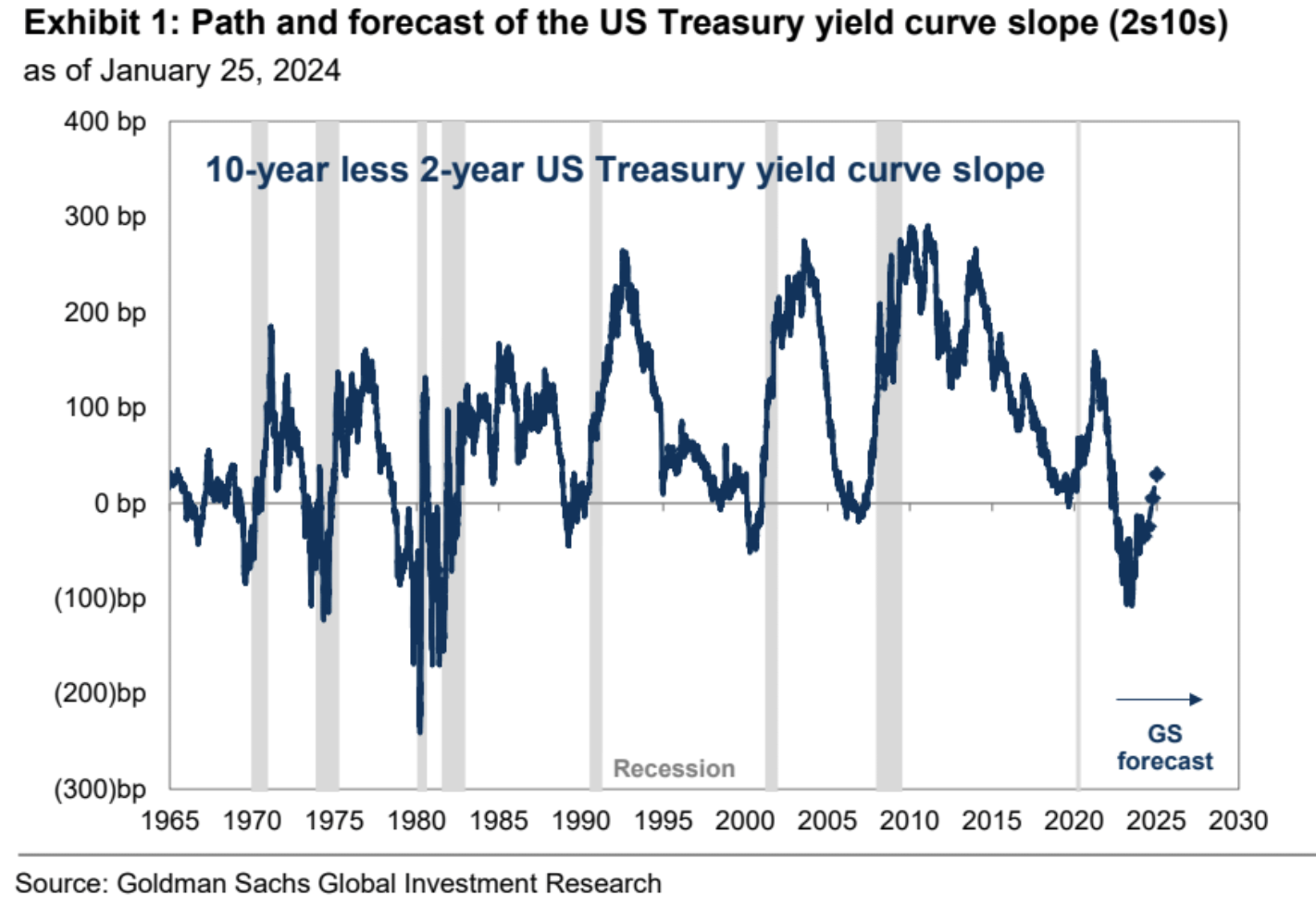

In terms of star companies, Intels main performance figures exceeded expectations, but its first-quarter performance guidance was far less than analysts expectations. In particular, the much-watched data center business fell short of expectations, showing that Intel is unable to defend its position as the industrys number one. The poor financial forecast caused Intel to fall more than 10% after the market closed on Thursday, which also reflects the current picky attitude of investors in the face of highly valued companies:

Specifically:

Earnings per share were $0.63, beating expectations by $0.45

Revenue of $15.41 billion beat expectations by $15.17 billion

Adjusted operating income of $2.58 billion, $2.1 billion higher than expected

Adjusted operating margin was 16.7%, beating expectations of 13.9%

Adjusted gross profit margin was 48.8%, also exceeding expectations of 46.5%

However, Intel forecast first-quarter revenue in a range of $12.2 billion to $13.2 billion, well short of analysts average forecast of $14.25 billion. Adjusted earnings per share are expected to be 13 cents in the first quarter, missing analysts estimates of 34 cents.

Intel expects first-quarter gross margin to be 44.5%, slightly lower than analysts expectations of 45.5%, showing the inefficiency of Intels chip factories. By comparison, prior to 2019, Intels gross margins regularly exceeded 60%.

China increases its holdings of U.S. debt

The November 2023 International Capital Flows Report (TIC) released by the U.S. Department of the Treasury shows that as of the end of November 2023, China’s holdings of U.S. debt reached $782 billion, an increase of $12.4 billion from October. This means that China has ended its seven-month selling trend of U.S. debt, causing the total holdings of U.S. debt to recover from the lowest value since May 2009.

According to industry insiders, China’s increase in U.S. debt holdings may be affected by two major factors. First, the Sino-U.S. president’s meeting that month led to an improvement in Sino-U.S. relations. Second, in November 2023, the Federal Reserve issued a clear signal that the interest rate hike cycle has ended. The sharp drop in U.S. bond yields (and rising U.S. bond prices) has attracted many countries to snap up U.S. debt to make profits.

It is worth noting that TIC data shows that among the top ten countries and regions holding U.S. debt, except for the Cayman Islands, which reduced its holdings of U.S. debt by $4.7 billion in November 2023, other countries and regions have chosen to increase their holdings of U.S. debt.

Financial markets generally believe that the end of the Feds interest rate hike cycle may become the most important driving force for many countries to increase their holdings of U.S. debt.

Cash flow

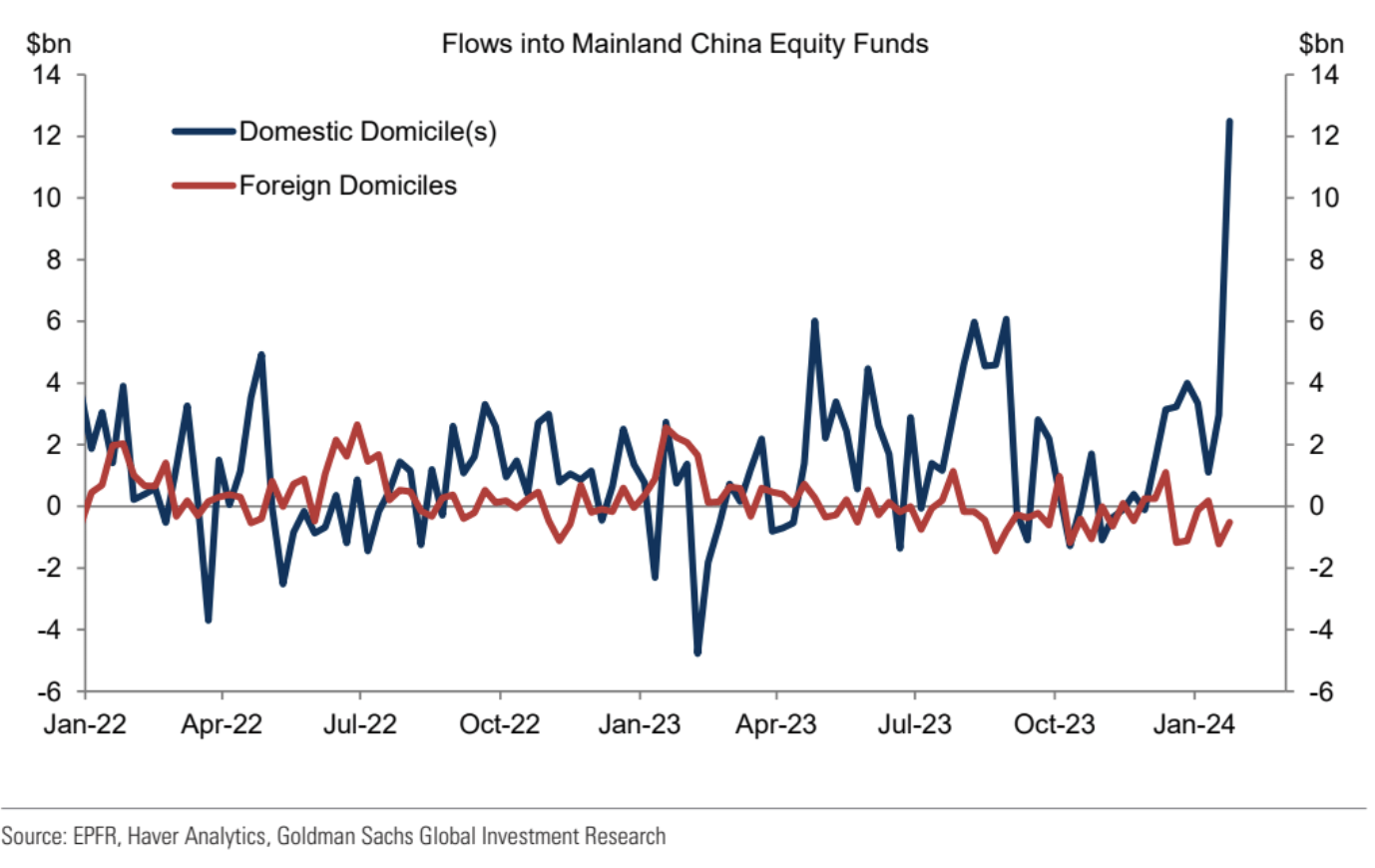

Net inflows into global equity funds were strong in the week ended January 24 (up $18 billion compared with the previous week, which was negative $0.9 billion), according to EPFR data. U.S. equity funds continue to drive net positive inflows into G 10 equity funds. Among emerging markets, inflows into mainland China reached historic levels, totaling about $12 billion, the largest weekly inflow since 2015. Notably, these inflows were driven almost entirely by domestic investors, suggesting support from the “national team”:

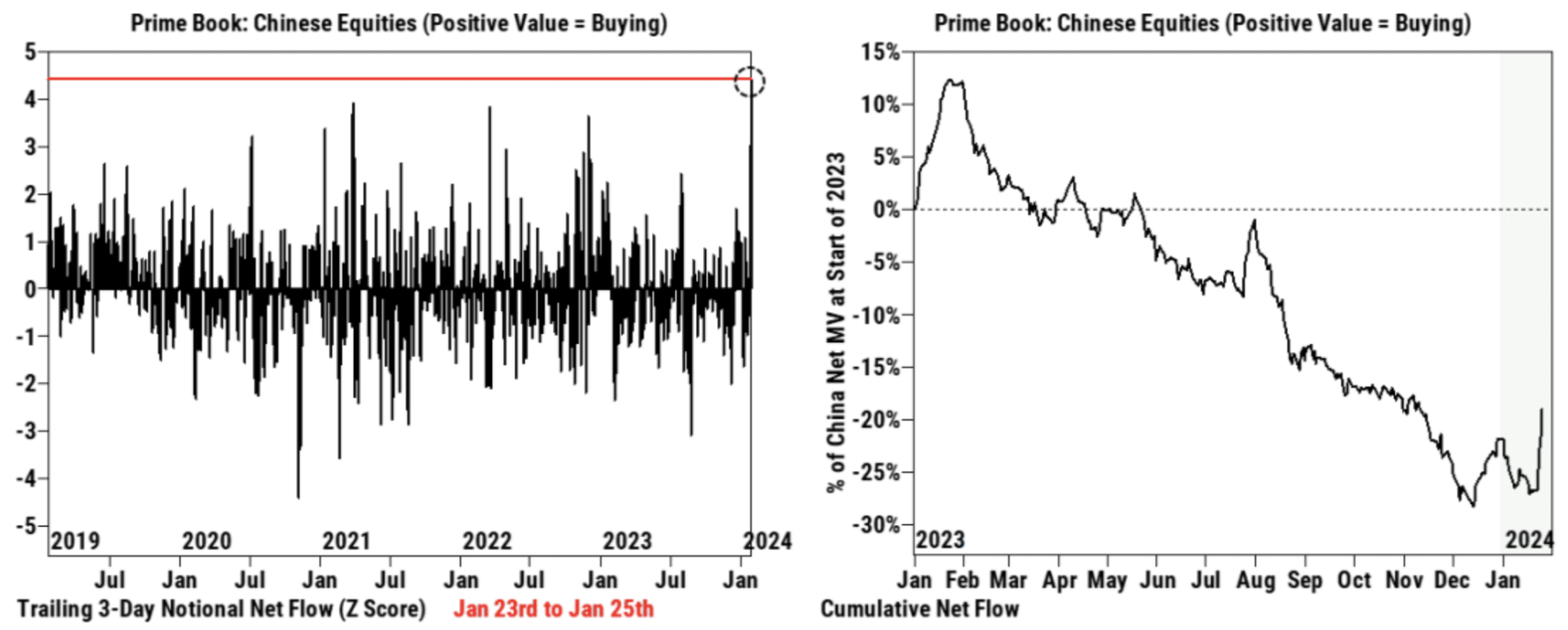

China stocks saw massive net buying on Tuesday amid news of the market rescue plan, and continued to see net buying of Chinese stocks on the Prime book on Wednesday and Thursday, according to Goldman Sachs client data, although purchases in nominal terms The pace has slowed down relative to Tuesday. From January 23 to January 25, cumulative net purchases of Chinese stocks exceeded any rolling 3-day period in the past five years (+4.4 Z score), driven by buying from long parties.

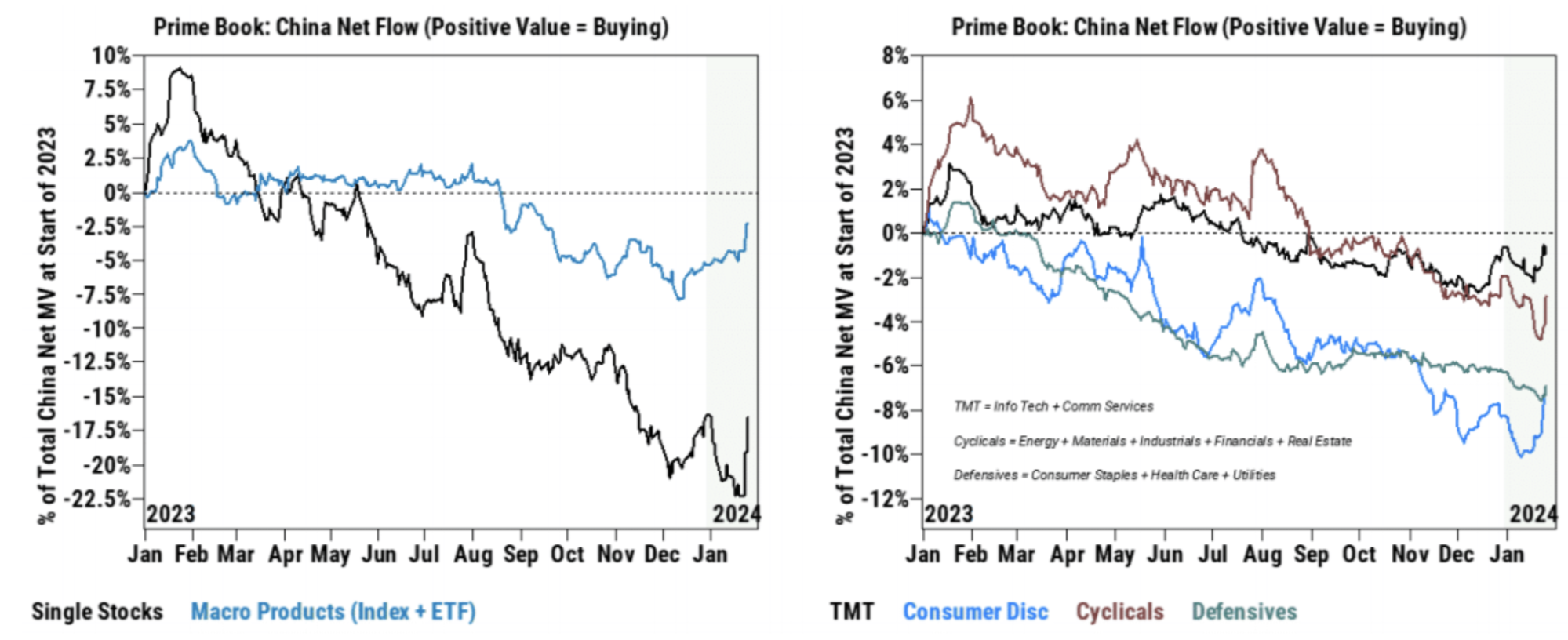

More than 70% of recent net buying activity has been driven by individual stocks, suggesting it may have staying power. All 11 Chinese sectors saw net buying from Tuesday to Thursday, led by consumer durables, industrials, communications services and financials.

Overall, the overall positions of both hedge funds and mutual funds in the Chinese stock market are still at a very low level. Despite recent net buying, both gross and net allocations to Chinese stocks on the Goldman Sachs Primebook are at near 5-year lows. Meanwhile, mutual funds globally had a 5.5% allocation to China at the end of 2023, the lowest level in the past decade, according to EPFR data.

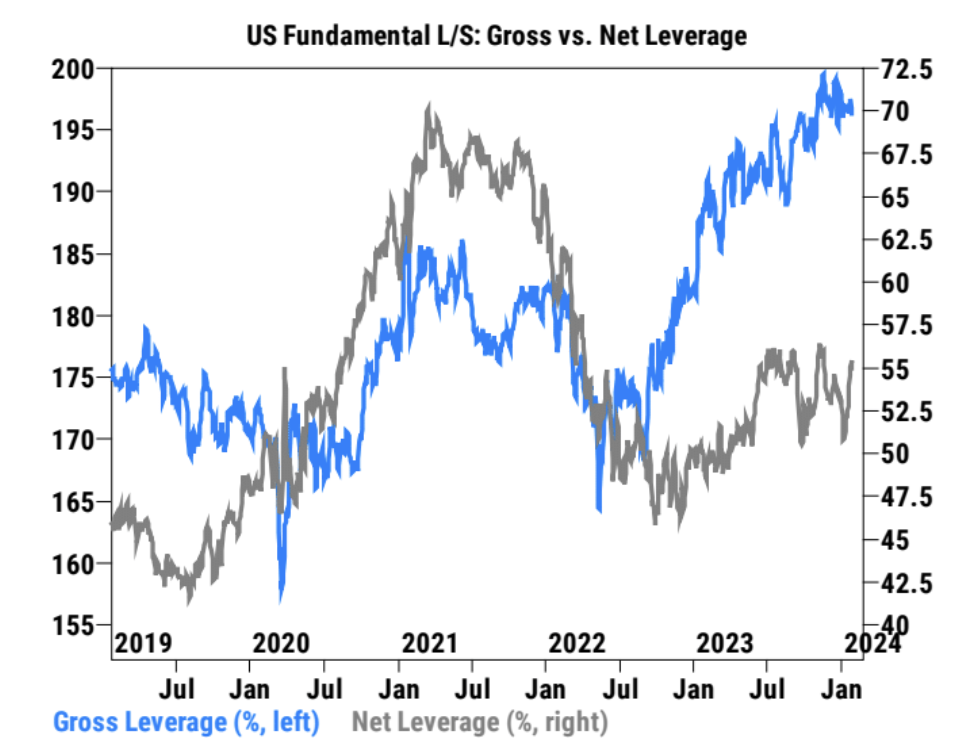

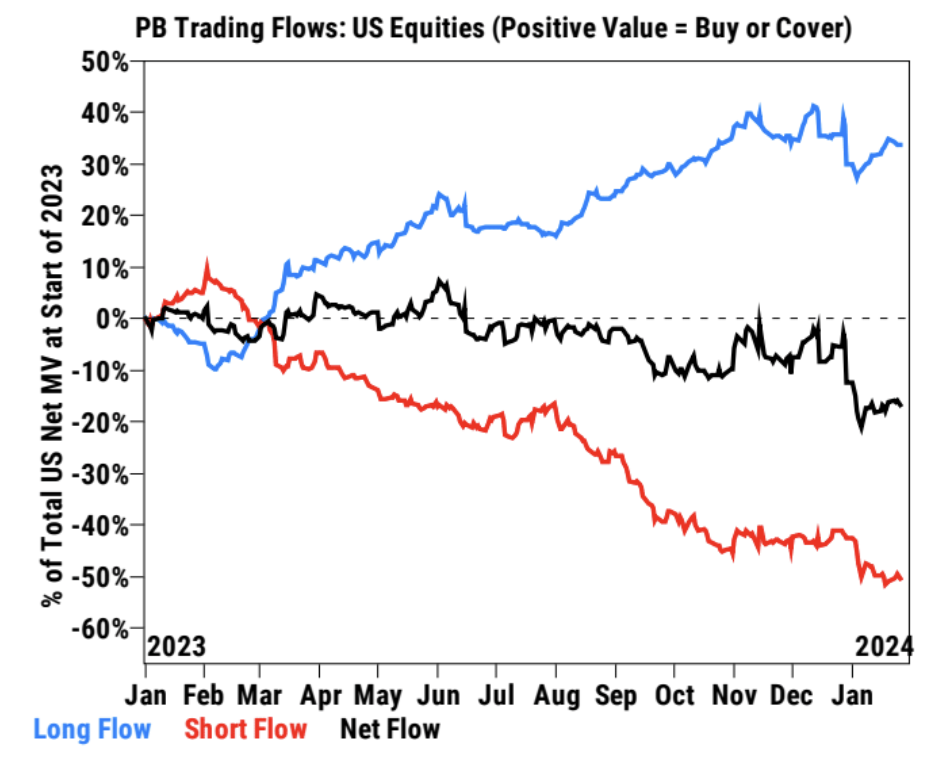

In terms of U.S. stocks, the net leverage ratio of Goldman Sachs clients has increased rapidly recently:

There is little change in financial flows:

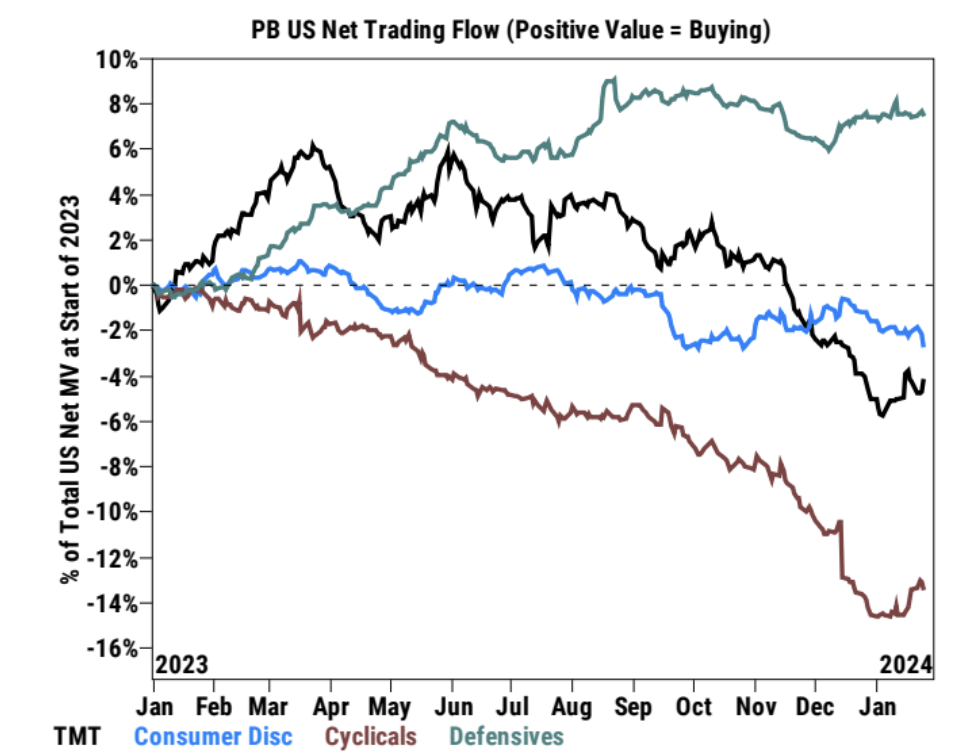

Fund outflows by industry include optional consumption, inflows into TMT and cycles:

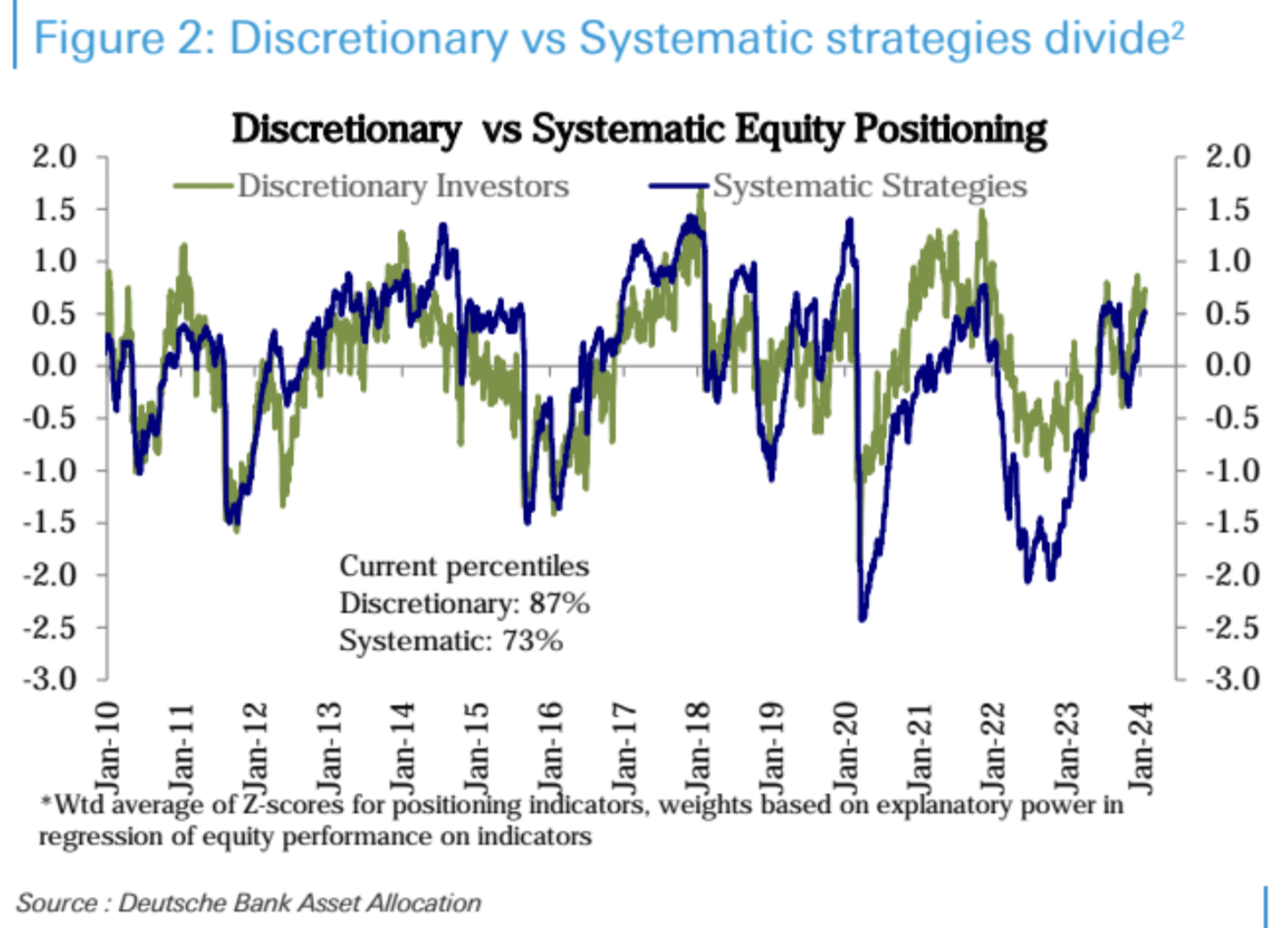

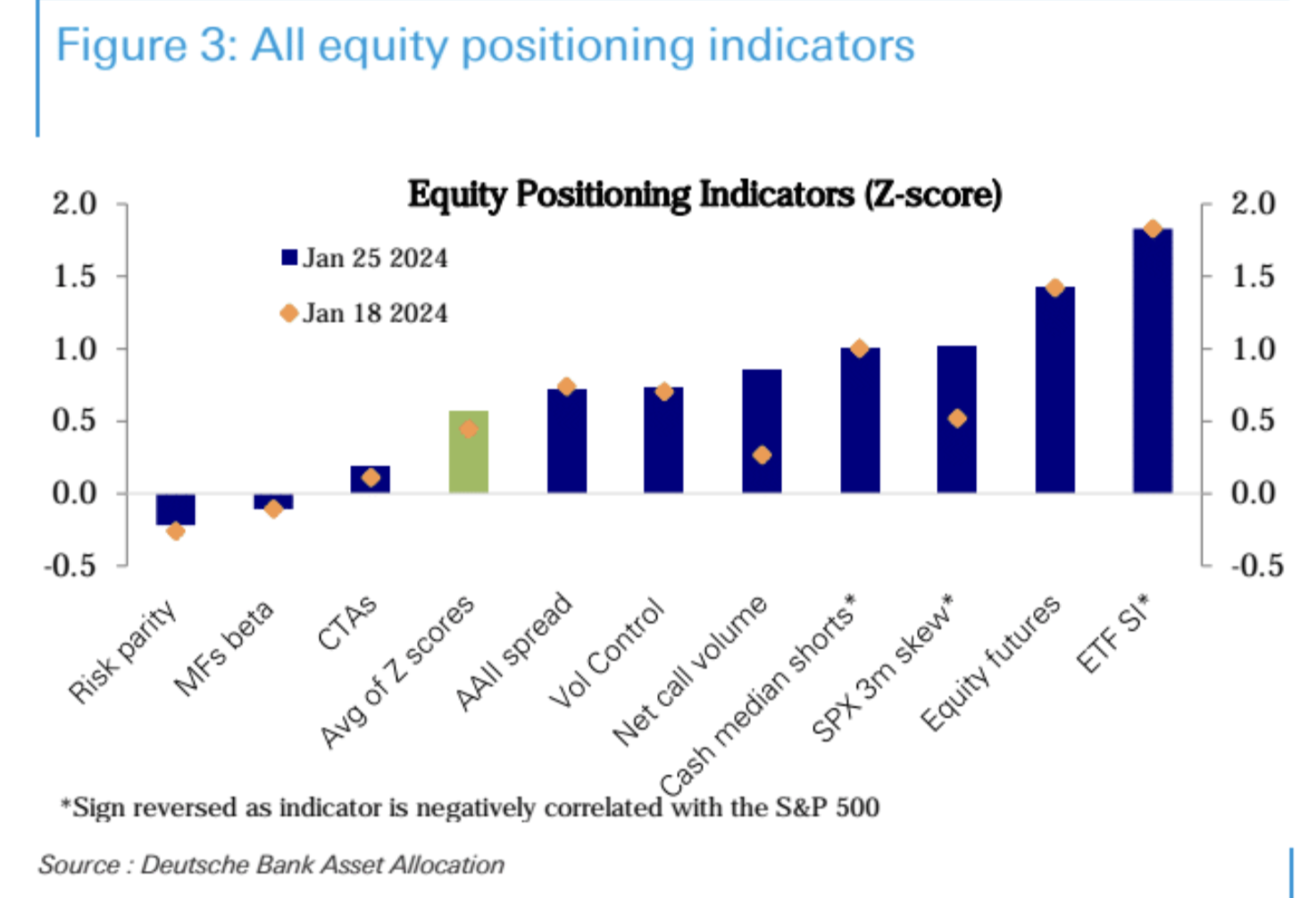

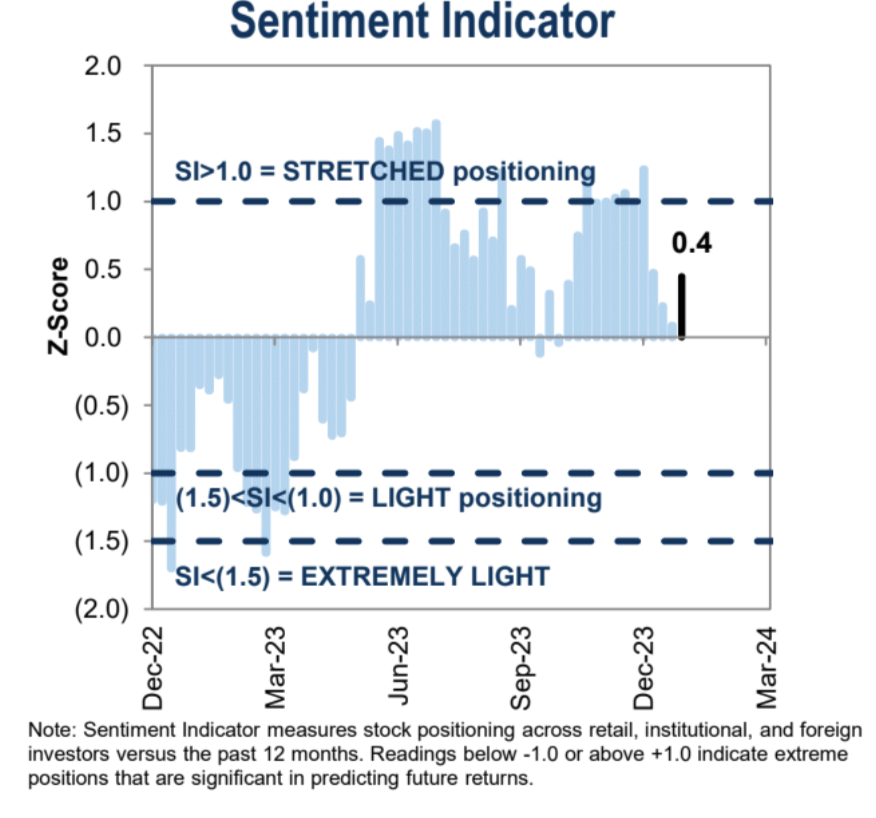

According to Deutsche Bank statistics, overall stock position levels rose sharply last week to the highest level in six months (79th percentile), after having been fluctuating in a narrow range since mid-December. Although positioning is clearly on the high side, it has not yet reached extreme levels.

By investor type, subjective investor positions have risen significantly recently, rising to the 87th percentile, while systematic strategy positions continue to climb steadily to the 73rd percentile. Across sectors, Technology (73rd percentile) saw further gains in positioning and was the only sector to significantly exceed its historical average.

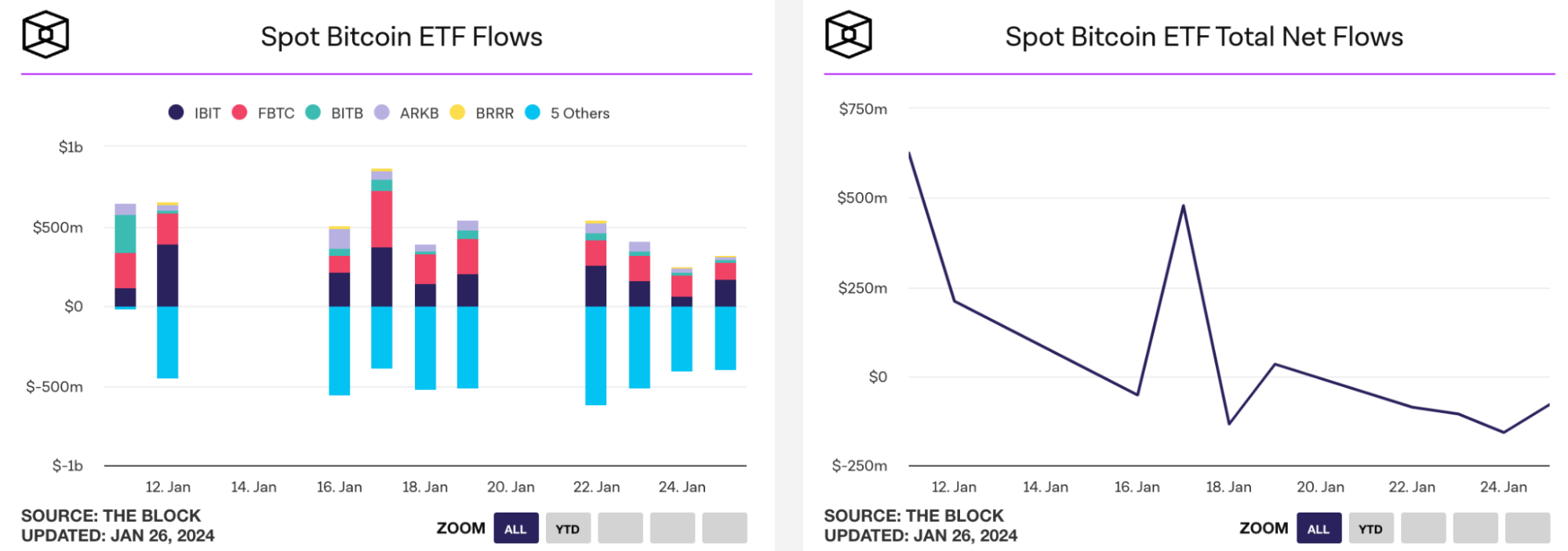

Bitcoin spot ETFs experienced net outflows every day last week. Funds flowing into funds such as BlackRocks IBIT and Fidelitys FBTC failed to keep up with the markets exit from Grayscales GBTC. The total net inflow in the two weeks since its listing was 8 That’s about 170 to 20,000 US dollars, which is 17,000 to 20,000 BTC. Considering the selling pressure of GBTC, there can still be an overall inflow of 800 million. This is already a quite positive signal. The price of BTC also rose by 5% last week:

market sentiment

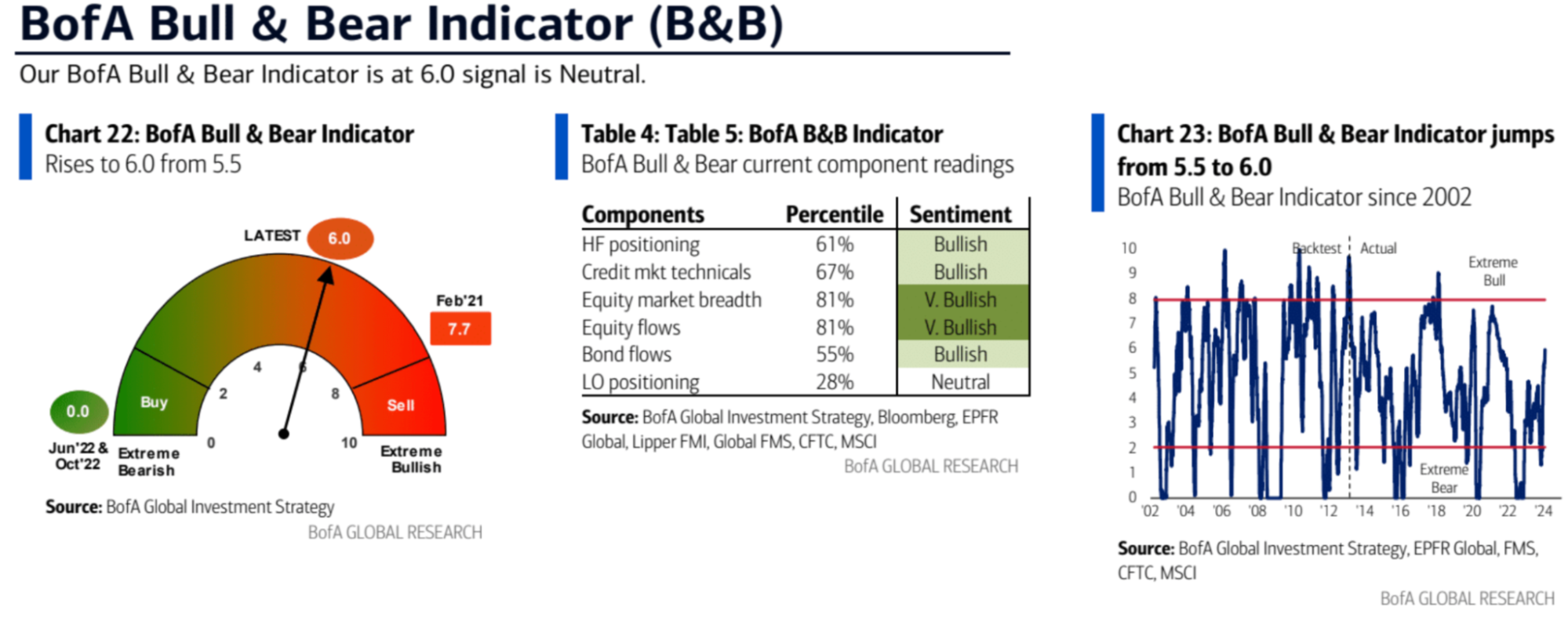

BofA Bull/Bear Indicator: rose to 6.0 from 5.5, the highest since July 2021, on strong equity inflows, strong equity breadth (up 7% to 44%) and strong credit markets.

Institutional sentiment at Goldman Sachs is rising again after three consecutive weeks of decline:

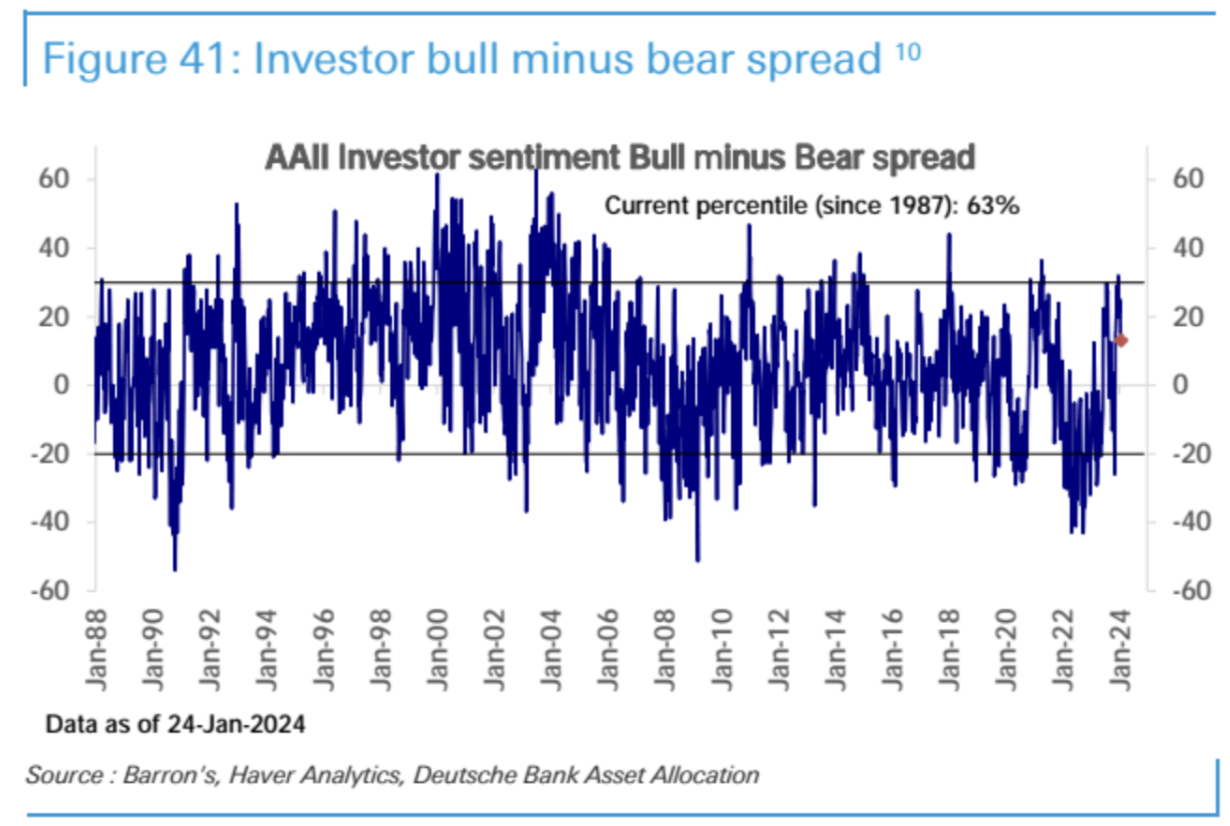

AAII bull-bear differential falls back from extreme values:

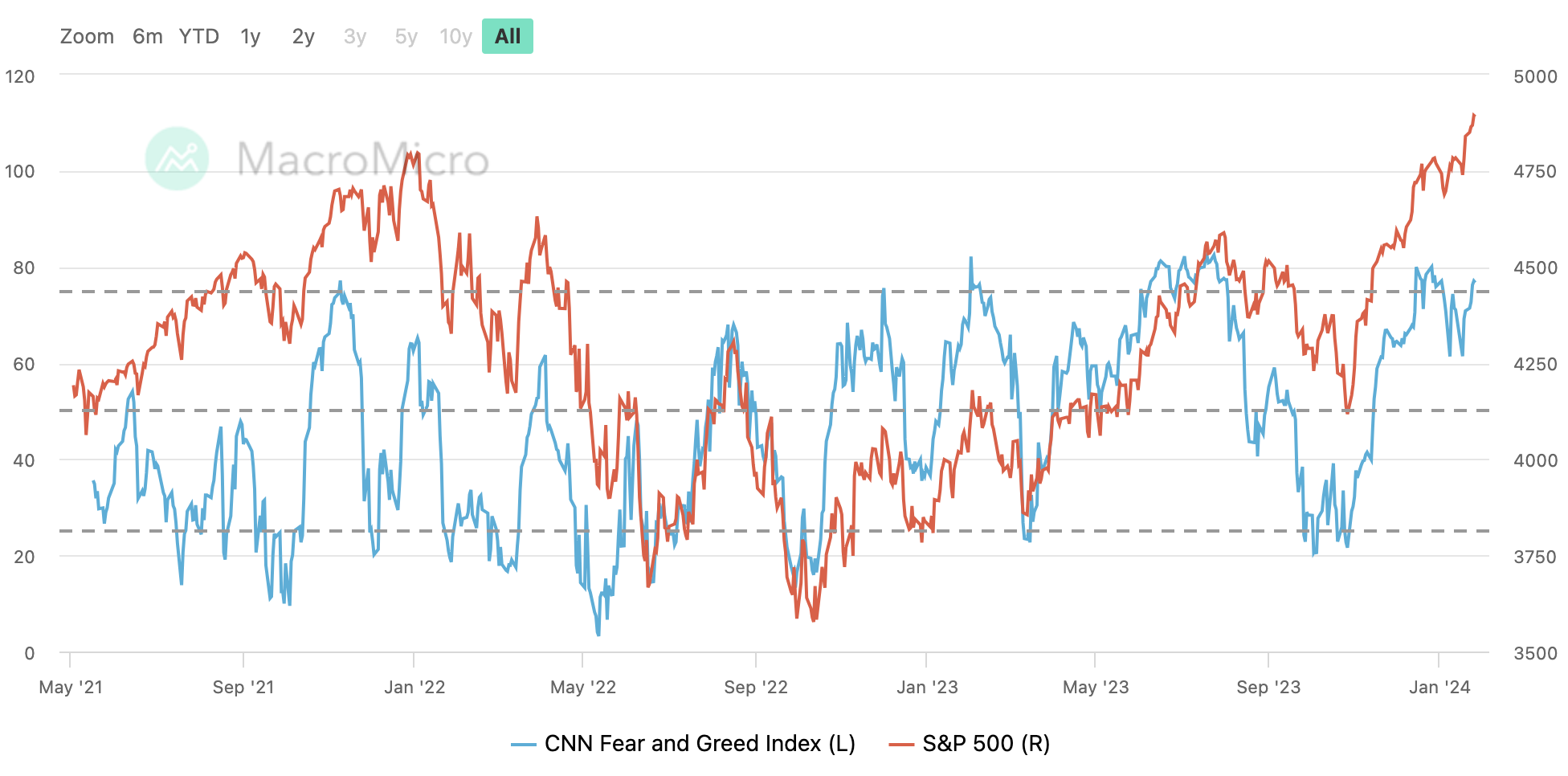

The CNN Fear and Greed Index returns to the extremely greedy range:

Follow this week

financial report

This week 32% of the companies in the SP 500 will release financial reports. Investors will pay attention to which companies have brought actual benefits to AI, including the financial reports of AMD, Alphabet, Microsoft (Tuesday) and Meta, Amazon and Apple (Thursday). Volatility is set to increase, and INTELs dive has shown us just how picky investors are these days.

central bank

Continue to pay attention to the movements of central banks this week. The Federal Reserve will announce its resolution on Wednesday, and the Bank of England and the Riksbank will announce their resolutions on Thursday. On Tuesday, the Bank of Japan will also release a summary of its opinions from this weeks meeting.

Given that 3-month and 6-month annualized inflation are already below the 2% target, the central bank may also remove some hawkish language (additional policy firming) from the statement and remove some dovish language (inflation is close to the target). Acknowledge this progress.

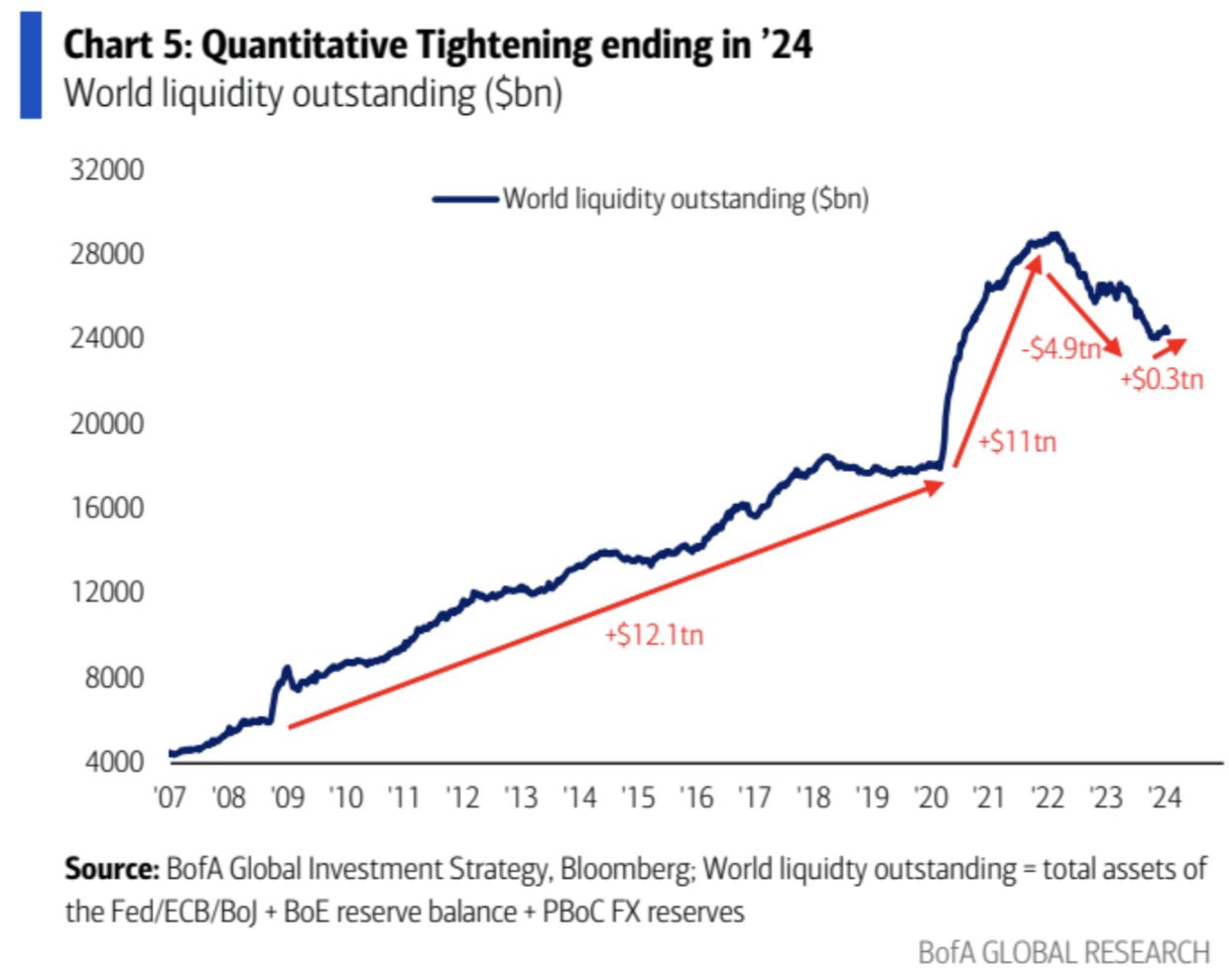

At the press conference, Powell is likely to be asked whether he will cut interest rates in March. It will be seen if he can answer this question clearly at that time. If he categorically refuses (it is more likely to wait and see), it may suppress the market. Also likely to be asked about the substantial easing of financial conditions since the December meeting, the fall in inflation and changes in QT policy, with particular attention to whether expectations of QT cuts will be confirmed by Powell - i.e. officials are not just talking about it but In making a plan, historically it takes at least 2 meetings to come up with a specific plan, and the balance of the RRP tool may be exhausted in March.

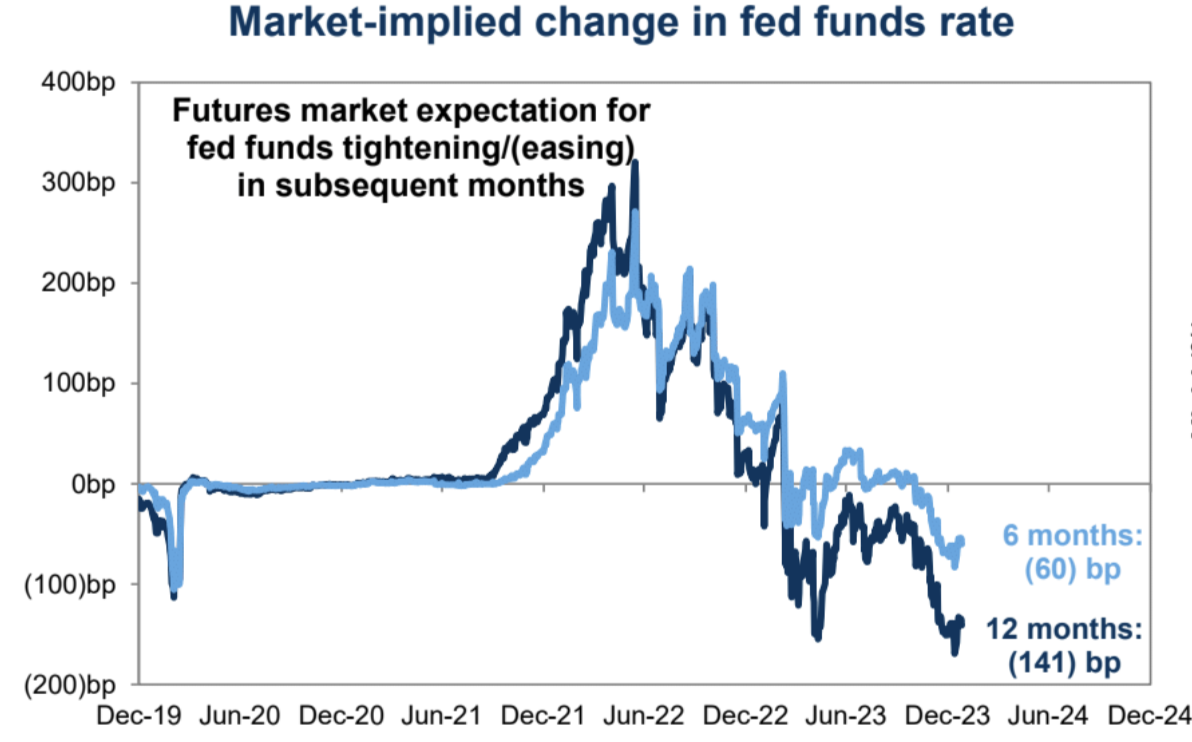

Overall, expectations for rate cuts are somewhat split at the moment, with economist surveys predicting a June rate cut and the market pricing in March. The FOMC may need to do some work to shift away from the hawks who cut rates “only” 3 times at the December meeting. The tendency is to shift to a situation that is more consistent with market expectations, otherwise the market may take the opportunity to anticipate it through a pullback.

Although prices in foreign exchange and interest rate markets other than equity markets have corrected in recent weeks, the risk remains towards overpricing:

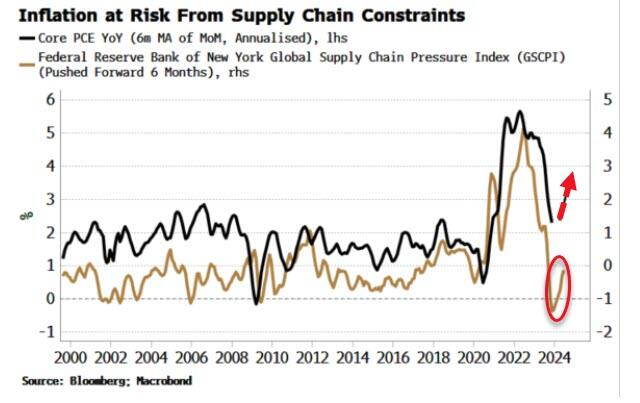

The other is the leading inflation indicator - supply chain cost pressure has continued to rise. This indicator leads the annualized core PCE by about six months. If China can also start to recover, the pressure on supply chain prices will only be greater, and inflation will occur later this year. The specter of a counterattack still lingers, with Bloomberg strategist Simon White writing that PCE may justify the Feds rate cut in March, but that would be foolish.

The strength in the U.S. dollar and U.S. Treasury yields so far this year is mainly due to the markets overconfidence in the last month of last year and the fact that the Fed finally confirmed its turn, and the market has some selling facts. This trend of correction may still be likely to continue this week, because it seems that the attitude of FOMC officials has not yet progressed as the market is pricing in. In addition, U.S. data continues to lead other developed countries, which means that the market is likely to be unable to infer a clearer easing tendency like the European Central Bank, and the U.S. dollar still has no worthy opponent.

Non-agricultural

Fridays U.S. non-farm payrolls report for January is not about the latest employment numbers, and seasonal adjustments may have a greater impact on the market because past numbers have been revised sharply downwards in a row.

Treasury bond issuance plan

The Treasury will publish funding estimates for the next two quarters on Monday and provide details on the size of the auction on Wednesday. The Treasurys own forecast last quarter was $816 billion, Bank of America forecast U.S. net borrowing at $970 billion, and Deutsche Bank forecast $797 billion. If the debt supply number needs to exceed $1 trillion it will have an impact on the upward momentum in U.S. Treasuries. The U.S. Treasury Departments quarterly refinancing report has been in the spotlight since last July, when the government announced higher-than-expected third-quarter borrowing needs, triggering a sell-off in U.S. Treasury bonds.

However, the results of the U.S. debt auctions in the past two weeks have been surprisingly good. After the Treasury Department received widespread criticism for its last over-issuance, it also expressed that it is fully aware of the markets concerns about additional issuance and is willing to take actions to appease the market. In this auction plan It is unlikely that there will be any surprises on the supply side. Some analysts expect that the Ministry of Finance may announce plans to launch a repurchase program this time, involving the repurchase of less liquid debt and increasing the issuance of the most liquid current bonds, aiming to improve market liquidity. In addition, attention should be paid to whether this additional issuance is more inclined to the issuance of short-term treasury bonds rather than long-term, because the current performance of the long-term treasury bond market is relatively poor.