新形态的BTC L2是昙花一现,还是枯木逢春?

Author: YBB Capital Researcher Zeke

Preface

Since the official birth of Bitcoin in 2009, the exploration of asset issuance and expansion solutions has been an area that few people have dared to challenge. There are three reasons for this: First, BTC OG insisted on treating Bitcoin as digital gold in the past is a pure means of value storage and excludes all expansion plans that may have security risks; secondly, because Bitcoin was originally conceived as an electronic payment system, security and stability are the cornerstones of the entire systems operation. Therefore, Satoshi Nakamoto adopted the most minimalist design method. The Bitcoin script language only gave Bitcoin the most basic payment function. The non-Turing complete characteristics made it impossible to perform arbitrary calculations or loops. By sacrificing scalability, it ensured The security and stability of the Bitcoin network; third, the EVM (Ethereum Virtual Machine) conceived by Vitalik makes the Turing-complete public chain a reality. The more friendly development environment attracts the retention of a large number of developers, and also creates the block In addition to Bitcoin, the chain ecology is flourishing.

However, today, with the continued popularity of Inscription and the maturity of the modular concept, Layer 2 projects that build new expansion solutions on Bitcoin (similar to Ethereum Rollup, but the actual construction methods are full of tricks) have also exploded recently. situation, and the purpose of this article is to analyze two questions: What are the ways to achieve BTC expansion, and is this type of BTC L2 a flash in the pan due to popularity, or is it a dead tree that is the oldest public chain?

The key to Pandoras box

As mentioned in the preface, BTC was originally designed to abandon scalability. However, the reason why a large number of expansion plans have been introduced today actually stems from BTC’s own limitations (expensive transaction fees, slow speed, and inability to handle complex intelligence). contracts, etc.).

SegWit (Segregated Witness)

SegWit is a Bitcoin expansion improvement proposal jointly proposed by Bitcoin Core developer and Ciphrecx CTO Eric Lombrozo, Bitcoin technology enthusiast Johnson Lau and BlockStream co-founder Pieter Wuille in December 2015, namely BIP 141. The upgrade was implemented in 2017 and was introduced as a soft fork of the Bitcoin network. Its main purpose was to solve the transaction congestion problem of the network at that time. The block size played a crucial role in determining the number of transactions that could be confirmed in each block. The main idea of SegWit focuses on reorganizing block data. By applying SegWit, signatures can be separated from transaction data, thereby increasing the number of transactions that can be confirmed in each block.

One of the most significant advantages brought by the SegWit upgrade is the increased block capacity. By removing signature data from transaction inputs, the effective block size increases from 1 MB to approximately 4 MB, allowing more transactions to be stored in a single block. On the other hand, it repairs the transaction malleability of Bitcoin (and also paves the way for the implementation of the Lightning Network). By separating the signature from the transaction data, it prevents the tampering of the signature and effectively prevents invalid transactions from being permanently stored in the block. On-chain possibilities.

Taproot

The Taproot proposal was originally proposed by Bitcoin Core developer Greg Maxwell in January 2018. In October 2020, Pieter Wuille initiated a code pull request to merge Taproot into the Bitcoin Core code base. In order to fully deploy the upgrade, node operators must adopt Taproot’s new consensus rules. The proposal was ultimately supported by 90% of miners and was officially activated in block 709, 632 on November 14, 2021. Taproot is a major upgrade since SegWit and is designed to improve privacy, simplify and improve transaction verification, and handle more complex smart contracts. The upgrade consists of three different BIP proposals: BIP 340, BIP 341, and BIP 342.

BIP 340: Introducing Schnorr signatures, a cryptographic signature scheme introduced by Claus Schnorr in 2008 to optimize the verification process on the Bitcoin network. Prior to the Taproot upgrade, Bitcoin used the Elliptic Curve Digital Signature Algorithm (ECDSA). Although the creator of Bitcoin, Satoshi Nakamoto, once believed that ECDSA was more popular, Schnorr signatures have been upgraded in aspects such as signature aggregation, batch verification and privacy, effectively improving efficiency and privacy;

BIP 341: The Taproot protocol is introduced to improve the privacy and flexibility of Bitcoin transactions. Taproot improves transaction privacy by hiding multi-signature (multisig) and smart contract transactions under a single public key hash, making multi-party transactions and complex smart contracts look like single-party transactions on the blockchain;

BIP 342: Introducing Tapscript. Tapscript is an upgraded version of the original Bitcoin Script (the programming language of the Bitcoin protocol that determines how to lock and unlock transactions). It can also be called a language, but it actually comes with commands. A collection of opcodes that facilitate the implementation of the other two BIPs. Tapscript also removes the 10,000-byte script size limit, providing a better environment for creating smart contracts on the Bitcoin network. (This upgrade also laid the foundation for the later birth of Ordinals, because the Ordinals protocol uses Taproots script-path spend scripts script to implement additional data)

The upgrades based on SegWit and Taproot have also led to the rapid development and birth of two expansion solutions: Lightning Network and Inscription Ecosystem (BRC-20, ARC-20, etc.). On the other hand, in order to make up for the shortcomings of being unable to implement complex smart contracts, various Execution layers with different implementation methods began to pour into the BTC ecosystem.

Overview of expansion plan:

It is different from the unity of Ethereum Layer 2 (although Vitalik did not specify which solution is Layer 2, but currently it generally refers to Rollup, and the implementation methods are relatively similar, usually only in the verification method of data validity. Big difference), BTC Layer 2 does not have a unified definition and plan. If the expansion plan can be called Layer 2 as the standard, then judging from the current implementation methods that need to be used, it can be roughly divided into the following five types. (Some of the project introductions in the category are excerpted from our past articles Thousands of Pear Blossoms on Trees, an Overview of Bitcoin Ecology and New Journey of Digital Gold: Exploration of Bitcoin Ecological Diversification and Protocol Innovation, read Full text available for details.)

1. Sidechains:

Overview: The first complete technical paper on the Bitcoin sidechain solution was written by a researcher at Blockstream and published in 2014, but the solution was later abandoned. Until 2016, Blockstream once again proposed pegged sidechains as a possible way to expand Bitcoin. Sidechains often refer to trust-minimized blockchains, generally independent blockchains connected to the main chain through a two-way cross-chain bridge. , allowing payments with foreign cryptoassets (native assets of another blockchain), the most meaningful benefits that can be achieved through sidechains are user asset issuance, stateful smart contracts that support DeFi solutions, commitment chain extensions, Faster settlement finalization and greater privacy.

Verification: Sidechains usually use their own consensus mechanism and have an independent set of verification nodes. Transferring assets from the main chain to the side chain requires locking, and returning assets from the side chain to the main chain requires unlocking. During this process, the verification node is responsible for ensuring the legality of the transfer.

Disadvantages: Too few nodes may lead to centralization, failure to inherit the security of the main chain, etc.

Stacks

Stacks, although it does not directly call itself a side chain, whether it can be included in a side chain is still controversial, aiming to use its unique transfer proof consensus mechanism Proof of Transfer (PoX) to It is linked to the Bitcoin chain to achieve a high degree of decentralization and scalability without adding additional environmental impact.

Stacks is an open source Bitcoin second-layer blockchain that introduces smart contracts and decentralized applications to Bitcoin. Stacks was originally named Blockstack, and its basic work began as early as 2013. Stacks’ technical architecture includes a core layer and a subnet. Developers and users can choose between the two. The difference is that the mainnet is highly decentralized but has low throughput, while the subnet is less decentralized but has higher throughput. high.

Liquid

The topic comes to Liquid. It is not only a Bitcoin side chain, but also an exchange settlement network that can connect cryptocurrency exchanges and institutions around the world. Its core functions include: fast settlement, strong privacy, Digital asset issuance and pegging to Bitcoin, enabling faster Bitcoin transactions and digital asset issuance, allowing members to tokenize fiat currencies, securities and even other cryptocurrencies.

What Liquid shares with RSK is that both rely on consortium multi-signatures to lock the Bitcoins issued in the side chain as the native currency of the side chain, but the actual peg design is still quite different. Both sidechains currently have 15 functional authorities in operation, with Liquid requiring 11 signatures to issue bitcoins and RSK requiring 8. Liquid seems to prioritize security over usability, while RSK prioritizes usability over security.

Overall Liquid is a sidechain platform designed to provide shared liquidity to exchanges, focusing on protocol simplicity, security, and privacy.

RSK:

RSK is also a side chain whose native token is RBTC, aiming to become the cornerstone of financial inclusion and focusing on decentralized finance (DeFi). RSK is a stateful smart contract platform secured by Bitcoin miners that increases the value of the Bitcoin ecosystem by expanding the use of the Bitcoin currency. Decentralized applications can be written using the Solidity compiler and Web3 standard library, enabling Ethereum compatibility. In addition, it can expand Bitcoin payments through more on-chain space and off-chain transactions provided by the RIF Lumino payment channel network.

RSK aims to address a broader set of use cases, improves openness and programmability by adopting a stateful VM, is compatible with Ethereum to port Ethereum dApps and tools to RSK, and Liquid is focused on being an extremely efficient Tool of.

Drivechain

Drivechain is a Bitcoin open sidechain protocol that can customize different types of sidechains according to different needs. BIP-300/301 proposes to allow developers to add features to the Bitcoin world without actually modifying the Bitcoin core code. and functionality” concept. By creating a Bitcoin Sidechain that is secured by Bitcoin miners, various scalable use cases of Layer 2 can be implemented in the Sidechain on the premise of using Bitcoin as the Layer 1 guarantee of security. It should be noted that BIP-300 Hashrate Escrows compresses 3-6 months of transaction data into 32 bytes through Container UTXOs, and BIP-301 Blind Merged Mining Like RSK, the security of the network is maintained through federated mining.

BEVM (Emerging Project)

BEVM is a decentralized Bitcoin L2 compatible with EVM, using BTC as Gas. It allows all DApps that can run in the Ethereum ecosystem to run on Bitcoin L2.

In terms of technical solutions, BEVM introduces the concept of Bitcoin light nodes. These light nodes synchronize the complete Bitcoin block header and are used to prove the finality of BTC network data. At the same time, BEVM synchronizes cross-chain related transactions and transaction Merkle proofs, and realizes the decentralized bridging of Bitcoin assets in Layer 2 through the consensus confirmation of these data.

Secondly, in order to realize the decentralized cross-chain transfer of assets and data on BEVM back to the Bitcoin main network, BEVM uses the BTC threshold signature and POS consensus node implemented by Taproot technology. The POS consensus node has three private keys, which are responsible for block generation, management and BTC threshold signature. The BTC threshold signature private key generates N threshold contract private keys, which are responsible for hosting the assets and data on the interactive BTC network. These consensus nodes form a ⅔ threshold custody contract through BFT consensus, thereby realizing a safe and decentralized process of assets and data crossing back from BEVM to the Bitcoin main network. Compared with other side chain solutions, BEVM is currently a more decentralized and secure solution.

2. State Channels:

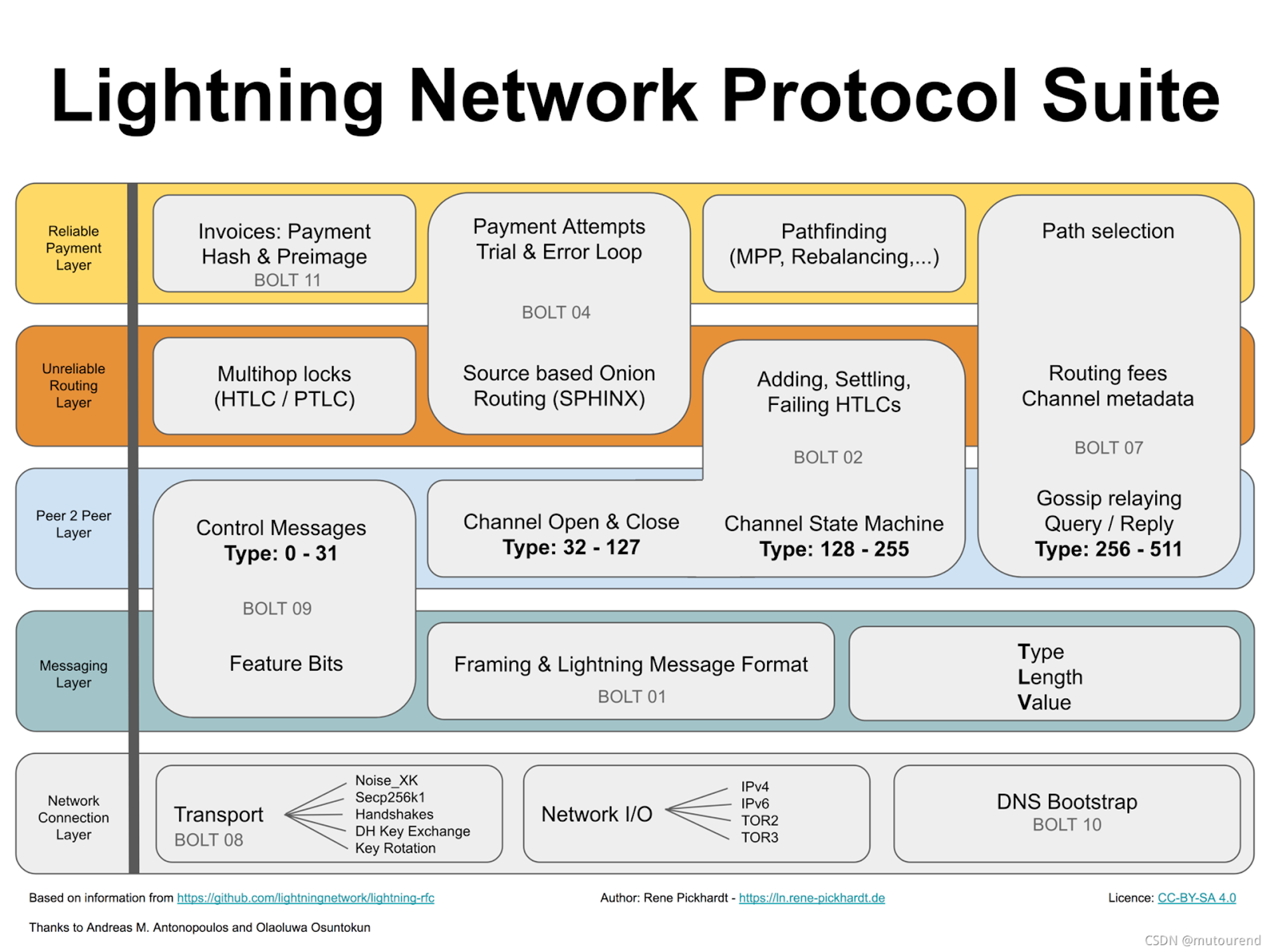

Overview: The concept of state channels can be traced back to the Lightning Network protocol proposed by Joseph Poon and Thaddeus Dryja in 2015. It is a payment channel-based technology that achieves low-cost, high-speed and highly scalable transaction confirmation by conducting transactions off-chain.

Verification: Transactions in state channels occur off-chain and are only submitted to the Bitcoin main chain when the channel is closed. This reduces the burden on the main chain while maintaining security. Transactions within the channel are signed by the participating parties and submitted to the chain, requiring on-chain verification only for dispute resolution.

Disadvantages: Slow development progress and complex channels may lead to uncertainty, etc.

Taproot Assets

On October 18, 2023, Lightning Labs released the UTXO-based Taproot Assets mainnet Alpha version. With the completion of the mainnet version, the Bitcoin Lightning Network will become an upright multi-chain asset network, mainly for institutions and asset issuance, and can Create instant, low-fee, high-volume transaction application protocols via the Lightning Network.

It allows all participants to deposit funds into an off-chain common wallet address (smart contract) and then send the funds to another participant on the same contract as soon as the payment is completed. Only the final transaction result is confirmed on the chain. The Lightning Network is a major upgrade to the Bitcoin protocol, but it also brings a new problem, namely the liquidity of fund recipients among participants.

3. Client Verification Single-use-seals:

Overview: In traditional blockchain systems, such as Bitcoin or Ethereum, verification of transactions and smart contracts is completed by nodes across the entire network, the so-called full node verification. In 2016, Bitcoin core developer Peter Todd published a paper proposing a new paradigm of client verification. By simulating the traditional contract signing method, it ensures that only both parties know the privacy premise of the contract content, without any third party participation, achieving complete decentralization. . Also introduced is the concept of disposable sealing, which will be mentioned in the RGB protocol below.

Verification: off-chain data storage, on-chain commitment, client verification.

Defects: Development has been slow for several years, smart contracts cannot interact, etc.

RGB protocol

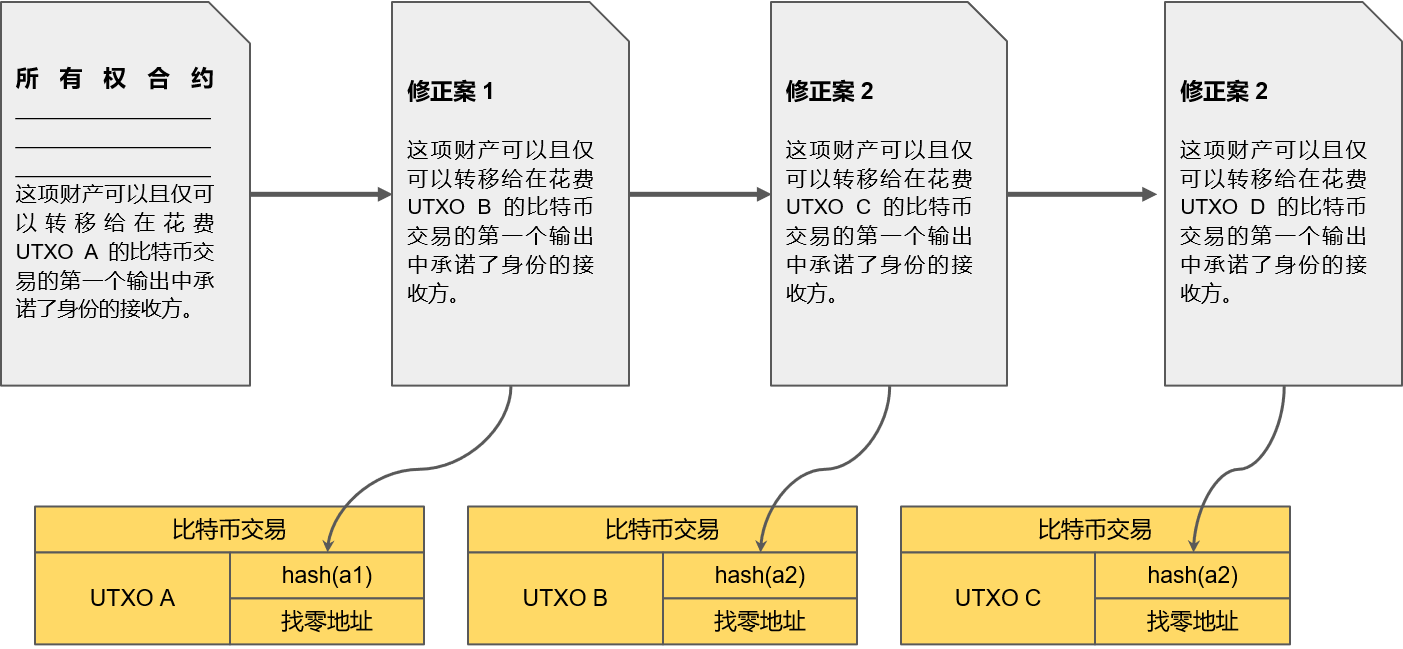

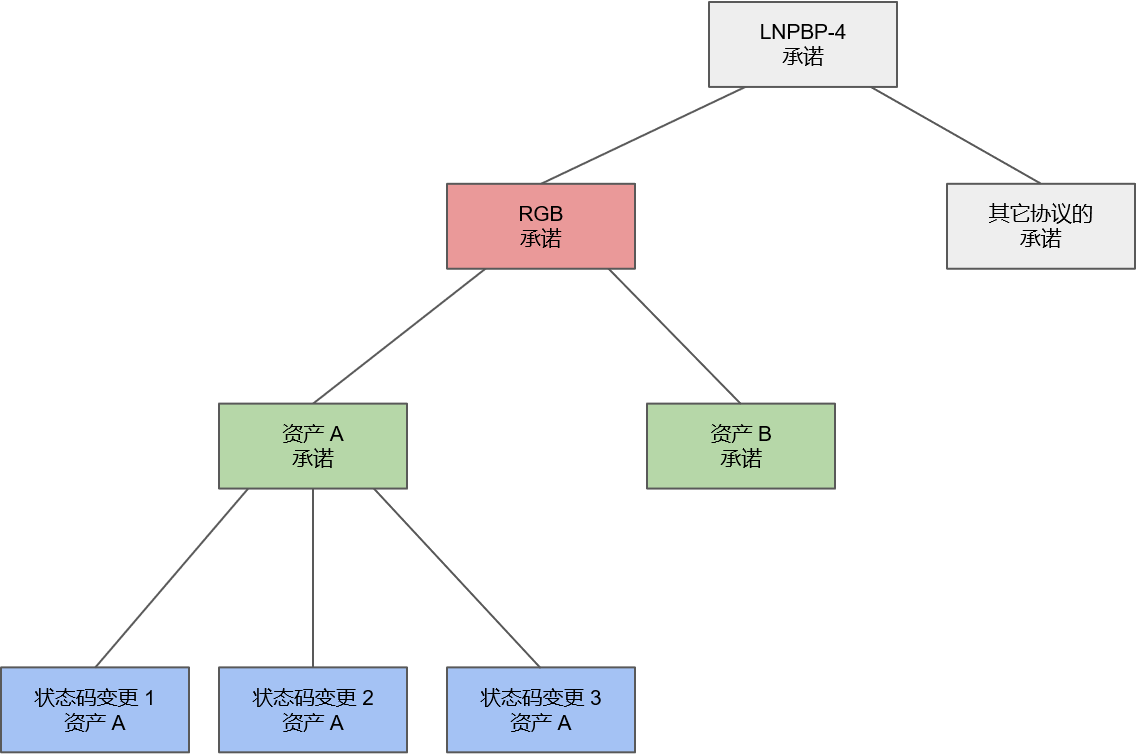

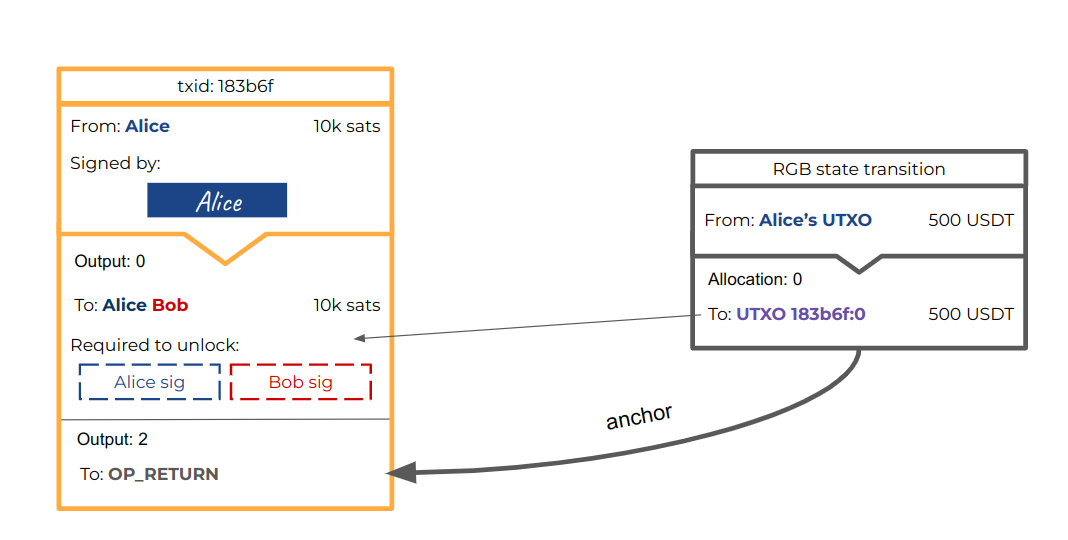

RGB is the LNP/BP Standard Association (Lightning Network Protocol/Bitcoin Protocol: Bitcoin Protocol/Lightning Network Protocol). The association is a non-profit organization that oversees the development of all layers of Bitcoin, covering the Bitcoin Protocol, Lightning Network Protocol and RGB Wait for smart contracts. The RGB protocol is suitable for scalable and private Bitcoin and Lightning Network smart contract systems. Its purpose is to run complex smart contracts on UTXO and introduce it into the Bitcoin ecosystem. The official description is: A scalable and confidential smart contract protocol suite for Bitcoin and the Lightning Network that can be used to issue and transfer assets and rights more broadly. The protocol is based on the concepts of client verification and one-time sealing proposed by Peter Todd in 2016, and runs on Bitcoin’s second layer, or off-chain, client verification and smart contract system. Understanding the RGB protocol requires understanding the following four key elements:

1. Single-use-seals:

To put it simply, it is as literal as it sounds. It is to add a layer of disposable sealing strip to the object that needs to be protected so that it can only have two states: open and closed. This ensures that the content is only used once to prevent double spending. Compared with Ethereum accounts, there are only wallet addresses in the Bitcoin network, in which the Unspent Transaction Output (UTXO) can be used as a seal.

Therefore, before understanding one-time sealing, you need to understand what UTXO is. It is a ledger model that generates input (Input) and output (Output) in every transaction. The output of a transfer transaction is the recipient’s Bitcoin address and transfer The amount, and these outputs are stored in the UTXO collection to record unspent transaction outputs. At the same time, an input points to an output of the previous block, so these transactions can be traced, so here are the Bitcoin transactions The output can be used as a disposable sealing strip.

According to the explanation of RGB official documentation, a UTXO can be regarded as a seal: when it is created, the seal is locked; when it is spent, the seal is opened. According to Bitcoin’s consensus rules, an output can only be spent once. Therefore, if we use it as a seal, then the incentives to ensure that the Bitcoin consensus rules are enforced will also ensure that such a seal can only be opened once [2];

2. Client-side verification and deterministic Bitcoin promises:

In Bitcoins PoW consensus, state verification does not require global execution by all parties participating in the decentralized protocol but requires verification of all aspects of specific conversions. Instead, it is converted into a short determination by using cryptographic hash functions and other methods. Bitcoin commitment requires some kind of Proof-of-Publication and has three main characteristics: proof of receipt, proof of non-publication, and proof of membership. All in all, OpenTimeStamps can be considered the first protocol in this field, and RGB is the second protocol. Other protocols can also exploit and use these themes and form a client verification protocol series for these protocols [3].

RGB leverages the Bitcoin blockchain to prevent the double-spend problem by committing to an RGB state transition and spending the UTXO currently holding the rights to be transferred in a specific Bitcoin transaction. In this way, multiple state transitions can be committed to a single Bitcoin transaction and each state transition can only be committed to one Bitcoin transaction (otherwise there will be a double-spending problem);

3. Lightning Network Compatibility:

When a state transition is committed to a Bitcoin transaction in the RGB website, such a transaction does not need to be settled immediately on the blockchain, as it can become part of a Lightning Network payment channel and then derive security from it , and at the same time, it uses the payment channel of the Lightning Network to bring a lot of digital asset circulation to RGB;

4.RGB v 0.10 version update:

According to Waterdrip Capital’s interpretation, its upgrade changes are mainly reflected in its flexibility and security upgrades, and the following summary is listed:

The concept of RGB was proposed as early as 2016, but after several years of development, it has still not received widespread attention and application. The main reason may be due to the relatively limited functions of early versions and the high learning threshold of developers. With the development of RGB With the arrival of v 0.1, we can look forward to whether RGB can bring us more room for imagination in the future.

4. Inscription:

Overview: In January 2023, Bitcoin developer Casey Rodarmor released the Ordinals protocol, an asset issuance protocol based on Bitcoin that contains two core components: Ordinals ordinal theory and Inscription. Casey, the author of the Ordinals protocol, carries the content on UTXO through inscription, and the ordinal number assigns a unique identifier to the smallest unit of Bitcoin - 2100 trillion Satoshis. Inscription is the process of associating content with unspent transaction outputs (UTXOs). The asset issuance process of the Ordinals protocol is like writing information into the witness data and recording the token information in JSON format in the form of BRC 20.

Validation: Inscription requires an indexer to extract JSON information from the inscription and record the balance information in an off-chain database. Validating an inscription involves extracting the JSON data and ensuring compliance with the rules stated in its documentation.

Disadvantages: The indexer has various centralization problems (even causing errors in exchange balances), takes up main network space, and is too fragmented.

Ordinals protocol (BRC-20):

1.BRC-20 Token

BRC-20 is a Bitcoin experimental token standard created by Domo on March 8, 2023. Its core concept is to utilize JSON data in Ordinal Inscriptions. Through the BRC-20 standard, users can easily implement key functions such as the creation of Token contracts (Deploy), the casting of Tokens (Mint), and the transfer of Tokens (Transfer). Statistics as of December 18, 2023 show that the total market value of the BRC-20 track has reached US$640 million, highlighting the important position of this token standard in the Bitcoin ecosystem and opening up new opportunities for the development of digital assets. New possibilities.

2.BRC-100

BRC-100 is a Bitcoin DeFi protocol built on Ordinals. In addition to its own token attributes, BRC-100 is also an application protocol. Developers can also design DeFi and other application products based on the BRC-100 protocol. According to developer MikaelBTC, BRC-100 introduces protocol inheritance, application nesting, state machine models and decentralized governance, bringing computing power to the Bitcoin blockchain, making it possible to build AMM DEX, lending and other Bitcoin-native solutions. Centralized applications are possible.

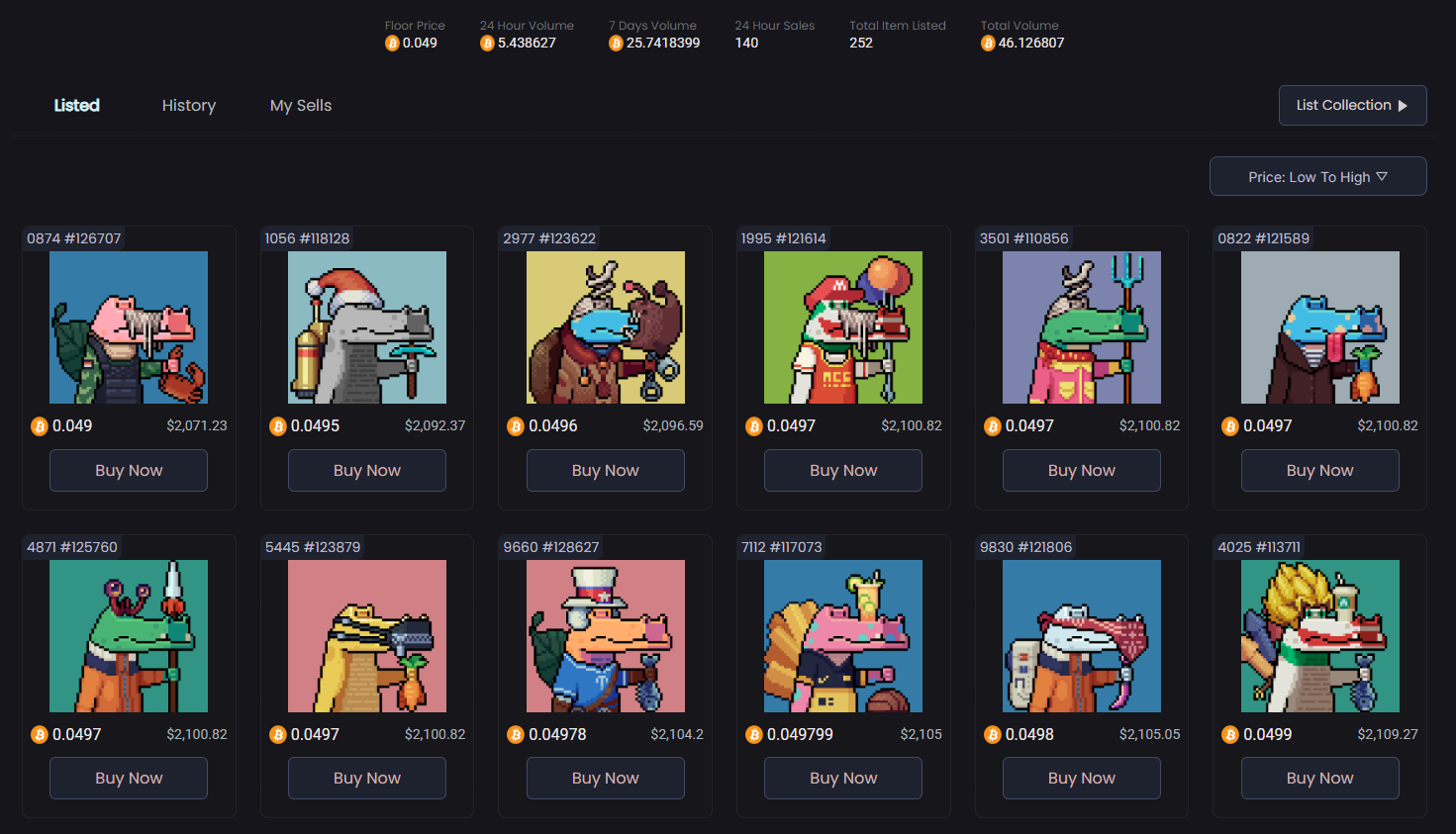

3.Ordinals NFT

Software engineer Casey Rodarmor launched the Ordinals NFT protocol on the Bitcoin blockchain, which has officially gone live. Now, users can create and own their own NFTs on Satoshi (SAT), the smallest unit of Bitcoin, using a random but logical ordering system that makes each Satoshi unique. According to reports, there are three main differences between Ordinals NFT and Ethereum NFT:

Relevant data are stored in the Bitcoin network and do not rely on external storage such as IPFS and AWS S 3;

Permissionless: Transactions can be completed in a decentralized manner through PSBT without the need for authorization;

The cost of minting coins is directly proportional to the transaction volume.

4.BRC-420

According to the RCSV official Gitbook, BRC-420 focuses on modularizing on-chain inscriptions, including the two key parts of the Metaverse Standard and the Royalty Standard, which respectively define an open and flexible format for assets in the Metaverse and a set of standards for creators. The economy sets specific on-chain protocols. Different from Ordinals other protocols which are all single inscriptions, the BRC-420 protocol uses multi-inscription recursive combination.

Atomics protocol (ARC-20):

Atomics, also known as Atomic Protocol, covers multiple asset types, including the fungible token ARC 20 standard, NFTs, Realms, and Collection Containers. As a blockchain asset issuance protocol based on the UTXO type, Atomics provides two casting methods, namely decentralized casting and direct casting. The decentralized minting method introduces Bitwork Mining, a minting method based on the PoW (Proof of Work) model. The protocol uses Satoshi, the smallest unit of Bitcoin, as the smallest unit of issued assets. The current minimum divisible unit of ATOM is 546, and a minimum of 546 ATOM can be sold or transferred.

The difference between the Atomics protocol and Ordinals in terms of asset transaction ordering is that it does not rely on third-party orderers and can be used to create (mint), transfer and upgrade various digital items, including native NFTs, games, digital identities, domain names and social networks . In addition, the protocol also supports the creation of fungible tokens with the token name ATOM (different from Cosmos’ ATOM, only with the same name).

Recently, founder Arthur shared his views on Meta-Protocols in an interview on December 13. He sees meta-protocols as a completely new approach that allows developers to create their own data structures and rules without being restricted to using pre-existing strict structures. Protocols that represent meta-protocols, such as the Atomics Protocol, are constantly emerging, providing developers with the opportunity to create entirely new structures using smart contracts. This trend allows creators to focus their efforts more specifically on the Atomicals Virtual Machine (AVM). The launch of this virtual machine enables developers to build smart contract programs on the Bitcoin network, giving them unprecedented ways to create experiences. This means that creators can focus more on implementing smart contracts in the Bitcoin ecosystem and promoting the process of digital innovation.

Atomics asset types:

ARC 20: It is a token format standard similar to BRC 20 on Ordinals;

Realm: A new concept proposed by Atomics, which aims to subvert traditional domain names and will be used as a prefix;

Collection Containers: This is a data type used to define NFT Collections, mainly used to store readable NFTs and related metadata. According to data on December 20, 2023, TOOTHY, which currently ranks first in terms of market capitalization, has a total market value of 46.12 BTC and a seven-day trading volume of 25.74 BTC.

5. Rollup:

Overview: Rollup is a Layer 2 scalability solution for improving the performance and throughput of blockchain networks, especially for smart contract platforms like Ethereum. Rollup reduces the burden on the main chain and improves overall performance by migrating most of the transaction data and calculations to the Off-Chain, and only recording summaries or summaries of transactions on the chain. The core idea of Rollup is to combine on-chain security with off-chain efficiency.

Verification: The underlying blockchain only needs to calculate the proof submitted to the smart contract to verify the activities in the Layer 2 network (in the case of OptimisticRollup, verification is only required when a disagreement occurs), and use the unexecuted original transaction data as Calldata is stored. However, since the Bitcoin network itself cannot verify DA (data availability), the current DA verification methods are all completed through some special methods, such as burning DA with inscriptions to the main network, and then verifying it with your own scheme, or BitVM implements various program instructions similar to binary circuits through the Taproot address matrix or Taptree, replicating the verification process similar to the Rollup of the Ethereum main network, so the architecture of such projects is always strange.

Disadvantages: There is currently no project that can perfectly reproduce the Rollup verification method on Ethereum. It is either in the theoretical stage or has made a choice between the impossible triangle. The projects currently on the market are also mixed.

BitVM (Emerging Projects New Ideas)

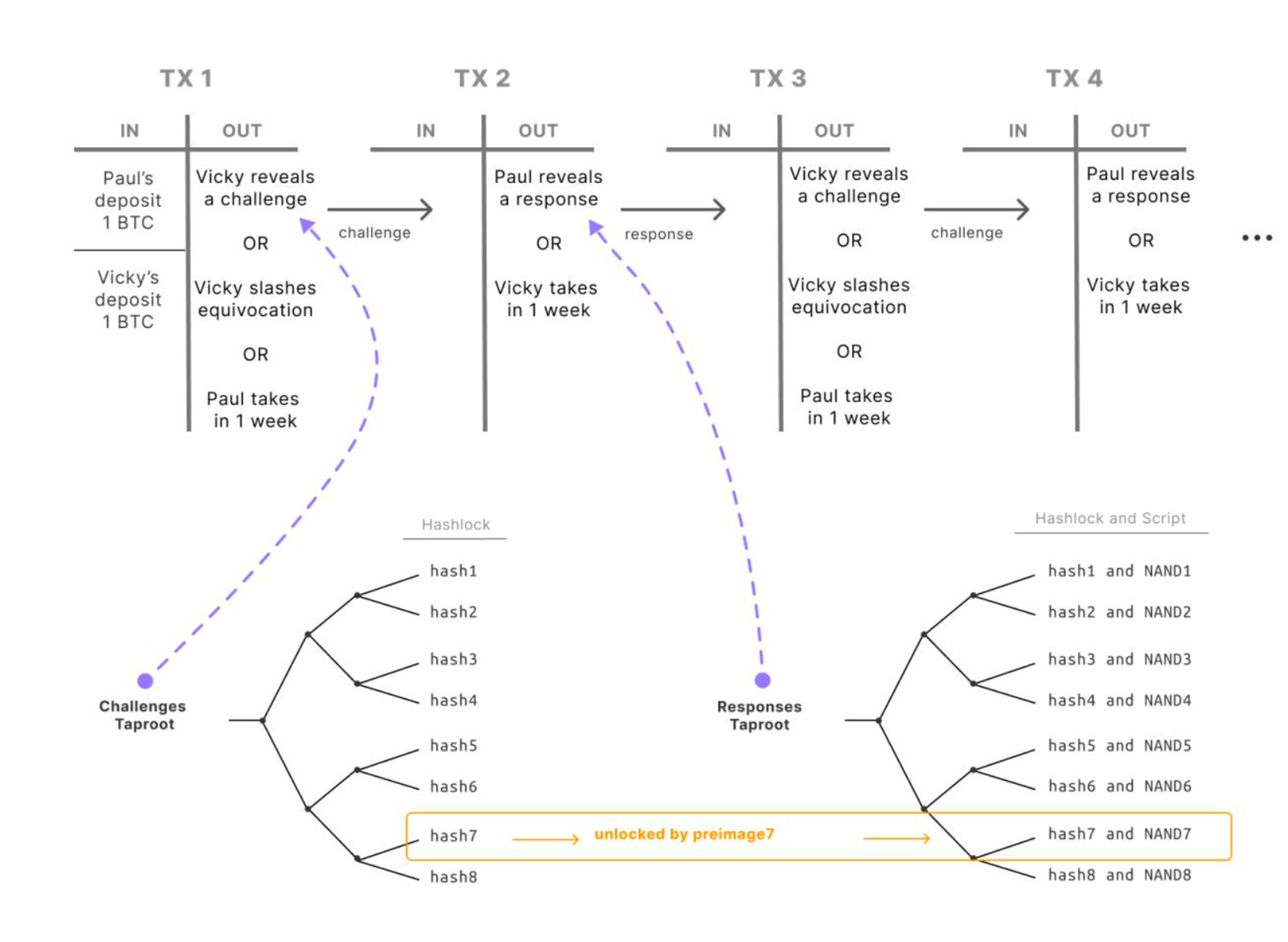

BitVM originated from a white paper titled BitVM: Compute Anything On Bitcoin published by ZeroSync project leader Robin Linus. BitVM is the abbreviation of Bitcoin Virtual Machine. It proposes a Turing-complete Bitcoin contract solution without changing the Bitcoin network consensus, allowing any computable function to be verified on Bitcoin, allowing developers to run on Bitcoin Complex contracts.

BitVMs system is similar to the Optimistic Rollup and MATT proposals. It is based on fraud proof and challenge response protocols, does not require changes to Bitcoins consensus rules, and is mainly based on hash locks, time locks and large Merkle trees. The core idea of this method is that the prover claims that a specific input can be calculated through a given function to obtain a specific output. If the provers claim is wrong, the verifier can propose a concise fraud proof and punish the prover. (Similar to Optimistic Rollups). In this system, the prover commits to the correctness of the program bit by bit, and the verifier succinctly refutes the provers false claims through a series of carefully crafted challenges. Both parties would pre-sign a series of challenge and response transactions to resolve potential disputes. Implementation of the protocol begins with the prover and verifier compiling the program into a giant binary circuit, which the prover submits at a Taproot address containing the leaf scripts for each logic gate in the circuit. They pre-sign a series of transactions for use in challenge-response games. The key part of this system is the bit value commitment, which allows the prover to determine that a specific bit has the value of 0 or 1, and can force the prover to make a decision within a specific time through a time lock.

BitVM delivers on the promise of logic gates by leveraging simple NAND gates, proving that any circuit can be expressed. Express any circuit by writing gate promises and combine the execution of each step in the same taproot address. To refute incorrect claims, verifiers can challenge the provers claims using a series of transactions they pre-signed. Provers can set input values by revealing the corresponding bit commitments, and in the absence of cooperation, verifiers can force provers to reveal their inputs on-chain.

BitVM is currently the closest solution to reproducing ETH Rollup. It can indeed form a Turing-complete virtual machine through infinitely superimposed binary circuits (Taproot addresses), but its implementation process is too difficult. It can be imagined that it has to be implemented on an ordinary calculator. The process of large computer programs. Although it is just a beautiful idea at the moment, it can still provide some ideas for the latter.

ARC-20 AVM (Emerging Project)

December 13, 23 Atomics founder Arthur said in an interview that meta-protocols are a new way for developers to create their own data structures and rules without being restricted by existing strict structures. Meta-protocols such as the Atomics Protocol are emerging to enable developers to create entirely new structures using smart contracts. This allows creators to focus on the Atomicals Virtual Machine (AVM), which enables developers to build smart contract programs on the Bitcoin network.

Bison (emerging project)

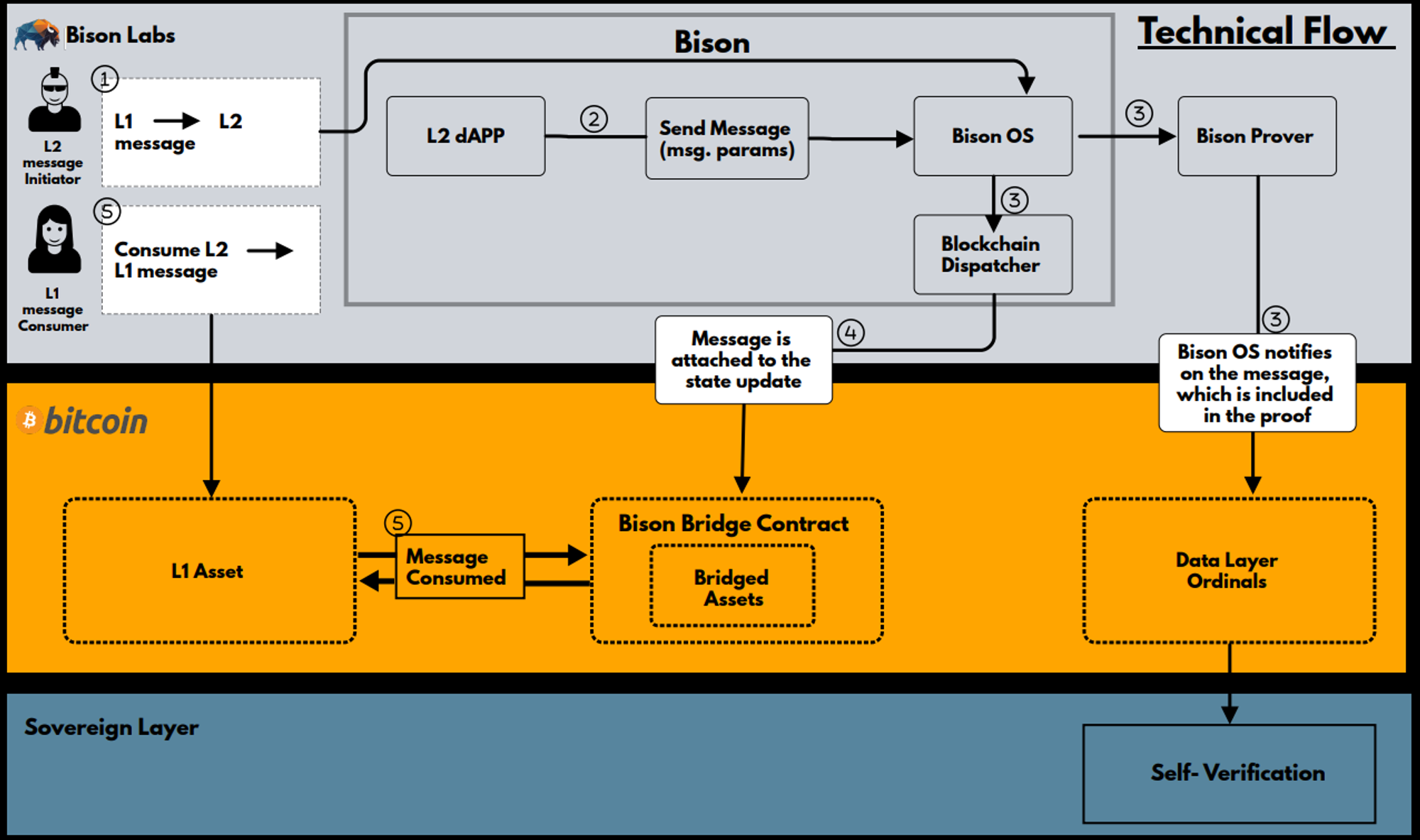

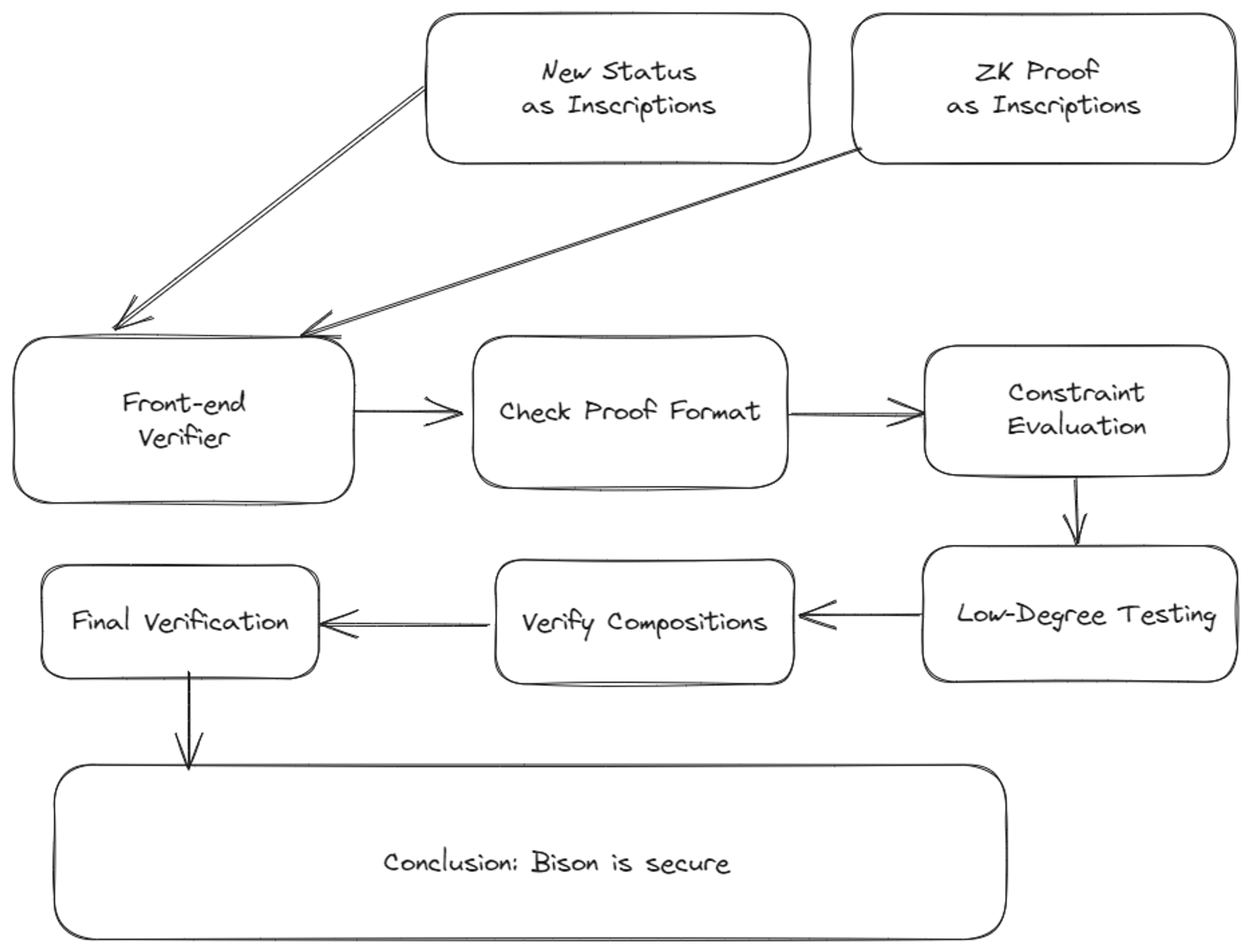

Bison is a Bitcoin-native ZK Rollup that increases transaction speed while enabling advanced features on native Bitcoin. Developers can use ZK Rollup to build innovative DeFi solutions, such as trading platforms, lending services, and automated market makers. Different from the EVM compatibility used by other L2 solutions, Bison uses Cario VM (the same model as StarkNet) and is mainly built ecologically around inscriptions.

In terms of technical solutions, Bison is similar to most Rollups in Ethereum. They are all execution layers built on the underlying blockchain, but what is special is the verification.

Bison burns the state and Zk proof into an inscription and uploads it to Ordinals, which is then proven through the verifiers front-end client. First, the verifier receives the Zk proof and public input, where the public input is a publicly known value in the calculation. The verifier then checks the correctness of the proof format and evaluates the constraints without constructing polynomials. Use a low-degree testing algorithm to ensure the low degree of the polynomial, and then verify the combined polynomial to confirm its correctness. Finally, the verifier checks cryptographic commitments and other cryptographic primitives such as Merkle proofs to ensure they are consistent with the proof and public input. If all steps pass verification, the verifier accepts the proof as valid; otherwise, it rejects it. From the perspective of implementation, Bison is essentially a sovereign rollup, verified by its own nodes, while DA is only saved and announced to the BTC main network in the form of inscriptions, and cannot fully inherit the value of BTC.

B² Network (emerging projects)

B² Network is an EVM-compatible ZK Rollup based on Bitcoins zero-knowledge proof verification commitment. Transaction data and Zk proof verification commitments are recorded on the Bitcoin mainnet and finally confirmed through the challenge-response mechanism. However, the only problem is still in the main network. The network cannot verify the DA.

The technical architecture of B² Network includes two basic layers and a challenge mechanism: Rollup layer and DA layer. In the Rollup layer, B 2 uses ZK Rollup, combined with the zkEVM solution, to execute user transactions in the Layer 2 network and output related proofs. Users transactions are submitted and processed in the ZK Rollup layer, and the users state is also stored in this layer. The batch proposals and the generated Zk proof are then forwarded to the DA layer for storage and verification.

The DA layer includes decentralized storage, B2 nodes and the Bitcoin network. This layer is responsible for permanently storing a copy of the Rollup data, verifying the Zk proof, and finally burning these data into inscriptions and uploading them to the main network. At the same time, the verification system performs decentralized verification and generates Bitcoin Commitment. Finally, because the main network cannot verify DA, the Bitcoin Committer Module writes the Zk proof Commitment to the main network and sets a time-locked challenge to allow challengers to dispute the Zkp verified Commitment. If no challenger appears within the time lock period, or the challenge fails, the Rollup will eventually be confirmed on Bitcoin. Instead, if the challenge succeeds, the Rollup will be rolled back. The reward for those who succeed in the challenge is to take away the assets locked in the BTC main network as a reward. In the case of failure, the node will retrieve the assets. The concept of the project is commendable, but it still cannot fully inherit the decentralization and security of BTC.

Conclusion

For many years, BTC has been playing a role in value storage in the form of digital gold, and todays ecological explosion has also given the Rollup project the opportunity to escape the rule of the Four Kings of Ethereum (OP, ARB, Zks, Stark) and transform BTC into a productive asset. Opportunity. But unfortunately, the similarity is only the appearance. No matter which solution can fully inherit the value of BTCs decentralization and security, the reason is that it still cannot break through the difficulty of BTCs inability to verify. The entire market is currently in chaos. Recently, some people have even directly forked other peoples plans (SatoshiVM) and used the banner of BTC L2 to defraud and raise funds. Under the wave of BTC gold rush, everyone also needs to carefully screen projects and not fall into a deep pit due to temporary fomo.

references

1. From BTC Script to Subscript: Analysis of Smart Contract Language:https://www.sohu.com/a/439259721_120969128

2. This article reviews the advantages and disadvantages of five types of Bitcoin expansion plans:https://www.odaily.news/post/5190588

3. Off-chain transactions: The evolution of the Bitcoin asset protocol:https://www.btcfans.com/zh-tw/article/107183

4. Is the RGB protocol the ultimate form of smart contracts? :https://www.techflowpost.com/article/detail_15076.html

5. Bitcoin’s programmability:https://www.btcstudy.org/2022/09/07/on-the-programmability-of-bitcoin-protocol/#二-Basic modules and features

6. Bitcoin = Panda? An in-depth discussion of the investment methodology of the Bitcoin ecosystem:https://www.odaily.news/post/5191166

7. At the first ring of the bull market, BTC L2 will create the alpha king:https://twitter.com/blockpunk2077/status/1748652961436492288

8.Haotian:https://twitter.com/tmel0 211/status/1749322402079887551

9. What is Taproot and how does it benefit Bitcoin? :https://academy.binance.com/zh/articles/what-is-taproot-and-how-it-will-benefit-bitcoin