With the Golden Shovel attribute, how high can TIA go?

Original - Odaily

Author - Azuma

The hot streak continues for Celestia (TIA).

The OKX market shows that as of the time of publication, TIA is temporarily trading at 19.23 USDT, maintaining a strong performance despite the general decline in the market.

The modular narrative may be the fundamental value supporting Celestia, but the recent crazy investment sentiment surrounding TIA is more likely to stem from its golden shovel attribute - in other words, in the eyes of many users who are buying TIA , what I purchased was not just the TIA token, but also the additional income that may be airdropped to the TIA staking group in the future.

TIA staking craze

In the past period of time, multiple Cosmos ecological projects, including Dymension, Saga, etc., have officially announced referendum plans, and have invariably included TIAs pledged users in the scope of proposed airdrops; in addition to the above-mentioned airdrop allocations, there are also There are many non-Cosmos ecosystem projects such as Manta, Movement, and U Protocol that use Celestias data availability (DA) solution. There are also rumors (some of which have been officially announced) that they intend to airdrop to TIA stakers.

Regarding the value of these potential airdrops, we can take a brief look at Dymension, which has launched pre-lanuch contract trading on Aevo, as an example.

Dymensions airdrop rule is that you can get an airdrop reward of 205 DYM by pledging 1 TIA. The current price of DYM on Aevo is around 4 US dollars, which also means that you can pledge 1 TIA with more than 10 US dollars on only one Dymension project. Earn at least hundreds of dollars in additional DYM airdrop earnings. The reason why at least is particularly emphasized is because Dymension has announced that it will allocate airdrop shares belonging to unclaimed addresses to claimed addresses, and will focus on large TIA and ATOM stakers, so it can be expected that TIA stakers will The actual benefits that can be obtained after the Dymension airdrop ends will be further increased.

Odaily Note: The pre-lanuch contract on Aevo has large fluctuations and small trading volume. It has certain reference significance, but it cannot fully represent the real market price after TGE.

Under such a promising trend of expected income, a large number of users have begun to choose to purchase and pledge TIA.

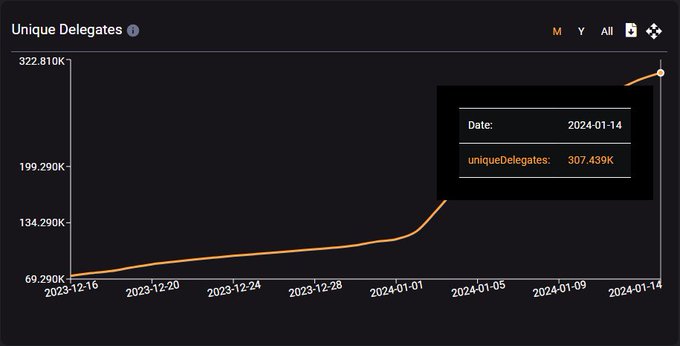

Smart Stake data shows that TIA’s current network-wide pledge rate has reached 48%. Considering that TIA was founded just over two months ago, this figure is already considerable, even exceeding many established PoS networks (such as Polygon’s 35% , 34% of Harmony); at the same time, the number of independent addresses staking TIA is also growing rapidly, and has exceeded 300,000 as of January 14. The two pieces of data intuitively demonstrate the enthusiasm of current TIA holders for staking.

In order to obtain more potential airdrops, some TIA holders have even begun to try staking with different addresses. However, this approach obviously has pros and cons. The pros are the opportunity to earn more minimum guarantee income, but at the same time, as With the expansion of TIAs pledge scale, there is also the risk of being screened out due to the pledge threshold.

As for whether we can continue to purchase TIA at the moment, we cannot predict the trend of the secondary market. However, if we look at the general pledge rate of the mainstream tokens in the Cosmos ecosystem (SEI 68%, ATOM 64.9%, OSMO 55.3%), TIA There still seems to be room for growth in the size of the pledge.

Cosmos ecological collective shovel

In addition to TIA, in fact, the tokens of mainstream projects in the entire Cosmos ecosystem have recently been shoveling. However, compared to Celestia, which can cover more ecological scope through DA solutions (such as other ecological rollups that adopt Celestia DA), the potential revenue that can be mined by other project tokens is still concentrated in the Cosmos ecosystem to be launched. on the project.

Among the many mainstream tokens in the Cosmos ecosystem, Cosmos’ own token ATOM and the token OSMO of the ecological liquidity hub Osmosis have the strongest “shovel” attributes for the time being. Although the former has been criticized for its insufficient value capture ability, it is still an ecological token. The token with the strongest consensus within the ecosystem, which is the initial liquidity gathering place for new coins in the ecosystem after they are launched. Therefore, it is not difficult to understand why the newly launched Cosmos ecological project chooses to regard the ATOM and OSMO staking groups as potential community users.

In the past few months alone, Celestia, Namada, Dymension, and Saga have officially announced airdrops to ATOM and/or OSMO stakers. Considering that in the next period of time, the Cosmos ecosystem will still have Berachain, Nibiru, Penumbra, etc. A large number of projects are about to go online, and the Cosmos ecosystem may usher in a wave of airdrops.

The attraction of the wealth effect cannot be underestimated. Although the airdrop strategy is a bit simple and crude, perhaps this is the key to opening a new situation for the Cosmos ecosystem.