Take stock of popular projects worthy of attention on Stacks

Cryptocurrencies are currently in a bull market. Driven by many innovations such as Ordinals/BRC-20 surrounding Bitcoin, it is not unreasonable to remain optimistic about the development of Bitcoin.

However, only inscriptions and Meme cannot change the current weak status of Bitcoin’s ecosystem as a whole. For the Bitcoin ecosystem to further develop, related liquidity, DeFi and similar products common in other ecosystems also need to appear on a large scale.

Therefore, building a prosperous DeFi application layer based on the current Bitcoin ecosystem has become another hot narrative, and it is also a new expectation of Bitcoin supporters.

Specific to this field, Stacks, which is committed to building the second-layer Bitcoin network, is in a leading position.

According to data from DefiLlama, the current TVL of Stacks is $34.49M, and there is still a lot of room for growth relative to Ethereum L2.

As the second layer of Bitcoin, Stacks is anchored on the Bitcoin blockchain, but it is also an independent protocol that introduces smart contract functions similar to Ethereum, opening up new possibilities for applications such as DeFi and NFT. .

Therefore, new projects built on Stack can make Bitcoin more than a simple store of value.

As the market pays more attention to the Bitcoin ecosystem, especially the inscription system, we should continue to examine whether new financial-related applications are also running on Stacks.

This article investigates the current popular projects on Stacks and provides the latest information reference for everyones investment research and judgment.

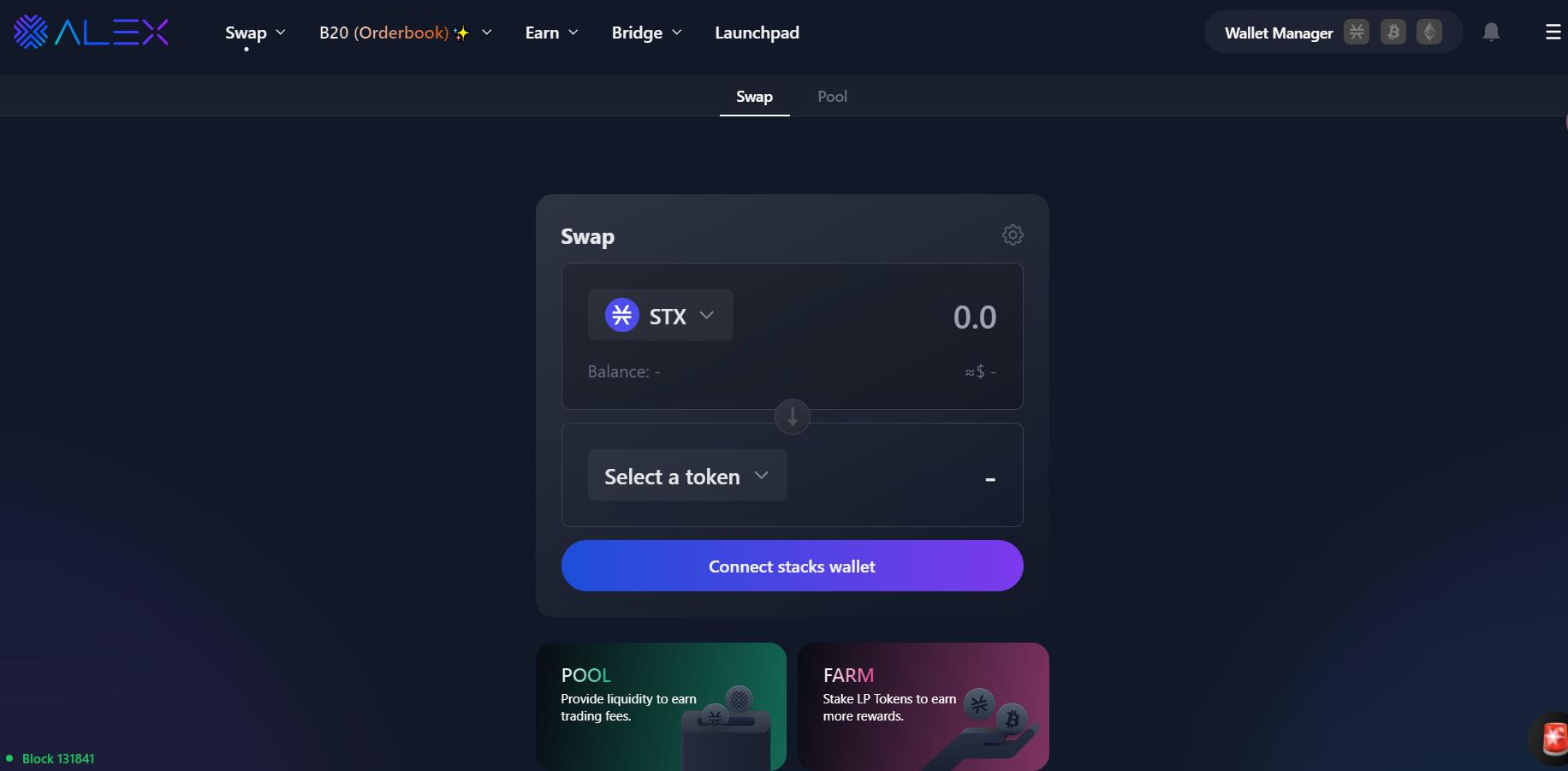

Alex: Bitcoin DeFi Platform

Project Description

ALEX is a Bitcoin DeFi platform based on the Stacks blockchain, dedicated to activating the multiple uses of Bitcoin. ALEX mainly provides the following services: project launch of its tokens, fixed-rating and fixed-term lending without liquidation risk, DEX (decentralized exchange) with AMM mechanism, depositing tokens to earn interest and obtain high returns through yield farming .

ALEX aims to break down the barriers between Bitcoin Layer 1 (L1) and Layer 2 (L2) to provide a seamless Bitcoin DeFi experience.

Project latest news:

On December 11, 2023, ALEX launched the Alpha version of the Bitcoin oracle, and is expected to complete testing by the end of the first quarter of 2024. This version was developed in collaboration with partners including Domo, BIS, Hiro, UniSat, Xverse and Xlink. The oracle is designed to provide a critical layer of security and efficiency for assets on Bitcoin while maintaining decentralization and high transparency.

Project official website:https://app.alexlab.co/swap

Official Twitter:https://twitter.com/alexlabBTC

Alex token

$ALEX is the platform’s participation token, providing protocol and platform governance benefits to governance participants who hold $ALEX. $ALEX is also the medium that incentivizes participants in platform activities (i.e. providing liquidity and staking on Alex’s DEX). $ALEX can be obtained through DEX, LP participation and staking, and has three main functions:

Incentives: The primary use of $ALEX is as a medium to incentivize participants in platform activities (i.e. providing liquidity and staking on the DEX).

Staking: $ALEX can be locked to earn $ALEX as rewards. 50% of the initial token supply is allocated for staking, where $ALEX or liquidity tokens can be locked, earning $ALEX as rewards.

Voting: $ALEX holders have, but are not limited to, voting rights in the following aspects: future platform development, transaction fee rebates for liquidity providers, reserve allocation policy, $ALEX token supply policy (including repurchase and additional issuance)

Token Distribution: The total initial supply is 1, 000, 000, 000 $ALEX. The foundation accounts for 20%, community pledges account for 50%, and the founding team and early investors account for 30%.

Currently, $ALEX market cap is $116M.

As the Stacks platform continues to improve and Bitcoin technology continues to evolve, it is expected that more projects will choose to launch on Stacks. In this process, ALEXs range of services will serve as an important starting point for these projects. This service is not only highly forward-looking, but will also greatly promote the continued development of the ALEX platform.

StakingDAO: Improve capital efficiency for STX token stakers

Project Description

StackingDAO is a project aimed at improving capital efficiency for STX token stakers. The advantage of StackingDAO is that it enables stakers to simultaneously enjoy staking rewards and the benefits of using their assets in other DeFi applications without locking assets in a staking contract.

Through StackingDAO, users put STX tokens into the protocol, receive stSTX in return, and earn Bitcoin income in this way, while also using stSTX in other Stacks DeFi applications. Currently, the project is undergoing private testing on the testnet and is undergoing code review.

As of this writing, nearly 400 million $STX are staked on StackingDAO, with an average annualized rate of 7.65%.

Project official website:https://stackingdao.com/

Official Twitter:https://twitter.com/StakingDao

STK token

StackingDAO will have a governance token, $STK, which will be earned by platform users by participating in the ecosystem and staking in the DAO.

The total supply of $STK tokens will be fixed at 150,000,000 tokens, token issuance will be limited to 5% of the total supply, and the founding team of StackingDAO will each receive 1% of the total supply. Regarding the more detailed token distribution mechanism of the token $STK, the white paper has not been disclosed for the time being.

The functions of holding the governance token $STK are mainly governance, voting and staking rewards. More detailed functions are not introduced.

The project token $STK is not listed yet. You can actively follow the latest developments on the official website and Twitter.

Arkadiko Protocol: Decentralized Liquidity Protocol

Project Description

Arkadiko Protocol is a decentralized liquidity protocol based on the Stacks ecosystem. It allows users to mint Arkadiko’s own stablecoin USDA using Stacks’ native token $STX as collateral. The focus of this project is to provide a decentralized stablecoin for the Stacks ecosystem to enhance the liquidity and functionality of the ecosystem.

Compared with other DeFi protocols, Arkadiko is characterized by providing a dedicated stablecoin solution for the Stacks ecosystem and enabling users to obtain liquidity while maintaining asset exposure through the PoX consensus mechanism. Arkadikos goal is to promote the development of USDA in the Bitcoin second-layer network and improve the liquidity of assets on the Stacks network.

Key features and functions:

Decentralized stablecoin $USDA: Users can mint USDA by staking $STX. USDA can be used in the Arkadiko protocol, such as participating in farms, repaying loans, etc.

Swap and lending: Arkadiko supports currency exchange (Swap) and lending services, increasing the flexibility of user operations.

Staking and income: Users can obtain deposit interest by pledging assets, and can also obtain additional income by participating in Stacks consensus mechanism PoX.

DEX (Decentralized Exchange): DEX built on Stacks provides users with trading services, increasing liquidity and ways for users to participate.

Governance Token DIKO: The DIKO token is used for the governance of the protocol. Holders can participate in the decision-making process and obtain DIKO by adding assets to the liquidity pool.

Self-repaying loans: Users can borrow USDA by pledging STX tokens, and these USDA can be pledged in the PoX consensus mechanism to obtain rewards, which can be used to automatically repay USDA borrowings.

Project latest news:

October 27, 2023 Working with PythNetwork to implement their price oracle within Arkadiko.

On November 3, 2023, Arkadiko Protocol partnered with asigna, a non-custodial multi-signature wallet for Bitcoin, Stacks, and Ordinals, and users can now use Arkadiko directly from asigna multi-signature.

Project official website:https://arkadiko.finance/

Official Twitter:https://twitter.com/ArkadikoFinance

DIKO token

$DIKO serves as the governance token of the Arkadiko protocol. The main functions are as follows:

Voting: DIKO holders can choose to stake their DIKO, converting their DIKO into stDIKO during the staking period. stDIKO provides voting weights that can be used to vote on governance proposals.

Incentives: By staking stDIKO to participate in the security module, users will be able to receive a fair share of the corresponding protocol rewards.

Token distribution: The total number of tokens is 100, 000, 000. The team accounts for 21%, strategic financing accounts for 12%, the Arkadiko Foundation accounts for 17%, and the ecosystem reward pool accounts for 50%.

Currently, $DIKO has a market cap of $8M.

Velar Protocol: A DEX inspired by Uniswap

Project Description

Velar Protocol is a Bitcoin-based DeFi platform whose main goal is to unlock liquidity locked on the Bitcoin network. The protocol is heavily inspired by Uniswap v2, with plans to introduce governance, cross-chain bridges, and permanent derivatives exchanges in future updates.

Key features and functions:

Multi-faceted DeFi platform: Velar provides a variety of functions including a decentralized exchange (DEX), a trading platform, and an initial coin offering (IDO) launchpad.

Dharma Mainnet: This is a major milestone for Velar, which introduces the first automated liquidity protocol on Bitcoin, providing a seamless and efficient DeFi experience.

Innovation in Bitcoin DeFi: Velar aims to unlock more than $500 billion in potential liquidity value of Bitcoin, enabling individuals to issue and trade tokens on the Bitcoin network while receiving rewards for providing liquidity.

Velar is currently in the testing phase. In the future, Velar plans to launch governance, a temporary DEX focused on liquidity, a permanent derivatives exchange with leverage up to 20 times, and a cross-chain bridge for moving assets between different L2 networks.

Project latest news:

Velar will be launched on the testnet on June 14, 2023. All testnet users from June 14th to July 14th will receive $VELAR airdrops

On September 28, 2023, Velar integrated xverseApp wallet (Bitcoin wallet) on web and mobile platforms

On December 7, 2023, the official Twitter posted that a roadmap will be released next week. As of writing, the roadmap has not yet been released, and readers can actively follow it.

Project official website:https://velar.co/

Official Twitter:https://twitter.com/VelarBTC

VELAR token

The Velar token ($VELAR) is the core of the protocol economy. The uses of the token are:

Incentives: Provide rewards for liquidity providers

Wider ecosystem partnerships (e.g. discounts on third-party dApps)

Improve IDO allocation

Token distribution: The total supply of tokens has not been announced yet. Community rewards account for 35%, treasury accounts for 20%, founders and teams account for 20%, consultants account for 5%, investors account for 15%, and airdrops account for 5%.

The token $VELAR is not listed yet, but from June 14th to July 14th, all Velar testnet users will receive $VELAR airdrops, accounting for 5% of the airdrops.

Zest Protocol: Decentralized Lending Platform

Project Description

Zest Protocol is a Bitcoin-based decentralized lending platform focused on solving a key problem in the Bitcoin economy: Bitcoin’s underutilization. Often large amounts of Bitcoin sit idle in cold storage, hampering economic growth. Zest Protocol, as an on-chain open source lending platform built on the Bitcoin blockchain, provides a solution by increasing transparency and auditability through smart contracts.

The protocol has two different pool types:

Yield Pools: Users can earn rewards by depositing Bitcoin into these pools.

Borrowing Pool: Allows users to borrow and borrow with their Bitcoin holdings.

This design allows Bitcoin holders to securely access liquidity without selling their assets, reducing reliance on centralized financial platforms (CeFi) or custodians.

Zest Protocol has been developed since June 2022 and has undergone multiple audits and testnet operations. It is planned to launch the mainnet in Q2 2024.

Project latest news:

On October 10, 2023, Zest Protocol passed LeastAuthority’s second smart contract audit, which is enough to ensure that users can experience the highest level of security and reliability through the Zest Protocol

Project official website:https://www.zestprotocol.com/

Official Twitter:https://twitter.com/ZestProtocol

Currently, the project has not issued coins, but the plan to launch the mainnet in Q2 of 2024 deserves further attention. Readers can follow the official Twitter and official website to learn more about the developments.

Uwu Protocol: Lending protocol based on the protocol’s own stablecoin

Project Description

UWU is a lending protocol based on the UWU Cash stablecoin built on the Stacks chain. It mainly contains two core parts: UWU Cash (UWU Cash) and UWU Shares (xUWU).

Key features and functions:

Lending mechanism: Users can deposit STX as collateral and lend UWU Cash up to 66% of the value of their deposited STX. Currently, no interest is required and there is no fixed repayment date.

Stability: The UWU protocol maintains the stability of the UWU Cash stablecoin through liquidation and arbitrage mechanisms.

Risk: Since STX, the backing asset of UWU Cash, is highly volatile, there is a risk that a rapid price drop may lead to large-scale liquidation or decoupling of the stablecoin.

Unique features: The UWU protocol attempts to introduce a protocol-independent stability module that allows users to exchange UWU Cash for sUSDT at low fees.

Currently, the UWU protocol is still in the testing phase and is seeking early users for testing.

Project latest news:

On June 9, 2023, users can use the xverseApp mobile wallet to interact with the UWU protocol.

On July 19, 2023, UWU launched a new historical analysis dashboard that allows users to easily explore past data and focus on key metrics related to UWU protocols.

On July 28, 2023, UWU Swap was launched, the first DEX aggregator on Stacks.

Project official website:https://uwu.cash/

Official Twitter:https://twitter.com/uwuprotocol/

Uwu token

The UWU protocol issues two tokens:

UWU Cash

UWU Cash is an over-collateralized stablecoin issued by the protocol. It is priced at $1.00 on a “soft peg” basis and is backed by $1.50 worth of STX tokens, ensuring its stability and partial resistance to volatility. This means that each UWU Cash is backed by at least $1.50 worth of STX collateral, maintaining a collateralization ratio of at least 150%.

UWU Share (xUWU)

UWU Share (xUWU) is a utility token in the protocol that is responsible for capturing and distributing 100% of the protocol’s revenue to its holders. This allocation is achieved through a fee claim smart contract, allowing holders to claim their fees each cycle. Unclaimed charges can be rolled over to the next cycle. This mechanism provides holders with a way to share profits.

Token Distribution: The entire supply of xUWU tokens will be distributed to users of the UWU protocol. There will be no pre-allocation of tokens to any individual or entity, including core contributors.

Currently, the project has not issued coins, but the project is actively running the test network and developing new functions. Readers can actively follow the official Twitter and official website to learn about subsequent developments.

Hermetica Finance: an options strategy protocol that adds value to BTC

Project Description

Hermetica Finance is a BTC structured product designed to provide users with new ways to earn income by providing a platform for users to participate in various activities to earn, trade and increase their Bitcoin holdings while maintaining control over their digital assets. Unmanaged control.

Main features and functions

European Reverse Elimination (ERKO) Options Strategy: The core appeal of Hermetica is the innovative strategy it employs. This strategy generates profits by setting specific price barriers, and when Bitcoin’s closing price falls within these barriers, profits are realized.

Price Fluctuation Range: This strategy ensures profit if Bitcoins price fluctuates within a range of 1% to 20% above or below the predetermined execution price.

Non-custodial structured products protocol: Hermetica Finance is a non-custodial structured products protocol for Bitcoin.

Fund Protection: The design emphasizes fund protection, limiting the maximum risk of each transaction to 1% per month, effectively managing downside risks.

Project latest news:

On November 3, 2023, Hermetica launched the testnet, the first non-custodial Earn product fully powered by Bitcoin.

On December 8, 2023, the Hermetica Leverage Bull vault was launched on the Hermetica testnet. This feature allows users to use BTC leverage without the risk of liquidation

Project official website:https://www.hermetica.fi/

Official Twitter:https://twitter.com/HermeticaFi

Hermetica Token

Currently, the project has not issued coins, but the project is actively running the test network and developing new functions. Readers can actively follow the official Twitter and official website to learn about subsequent developments.

Bitflow Finance: A highly transparent DEX that aggregates BTC liquidity

Project Description

Bitflow Finance is a decentralized exchange (DEX) designed for Bitcoin enthusiasts. The main purpose of this platform is to centralize the liquidity and trading activities of the Bitcoin economy in one unified place while providing a secure and transparent environment.

Main features and functions

Trade Bitcoin and Stablecoins: Bitflow supports trading of Bitcoin and stablecoins from second-layer Bitcoin solutions such as Stacks and Rootstock. This provides users with a decentralized way to trade BTC products like sBTC and xBTC.

No custody risk: The design of the platform ensures that users do not need to bear custody risks during the transaction process.

Optimized Liquidity: Bitflow supports Bitcoin-based stablecoin trading and provides optimized liquidity that helps reduce transaction slippage and fees.

Earn income: Users can earn real income by depositing Bitcoin and stablecoins. Additionally, the platform allows for unilateral provision of liquidity.

Open source and transparent: Bitflow is an open source project, including its smart contracts and front-end interface, which enhances the platform’s transparency and promotes community engagement.

Replace traditional middlemen: Bitflow uses PSBT (Partially Signed Bitcoin Transactions), atomic swaps, second-layer smart contracts, and decentralized liquidity pools to replace traditional middlemen.

Project official website:https://www.bitflow.finance/

Official Twitter:https://twitter.com/Bitflow_Finance

Project latest news:

On August 2, 2023, Bitflow Finance released a waiting list. Join the waiting list to try out the stable swap pool and earn Bitcoin income.

November 29, 2023, sBTC Swap Now Live on Bitflow Testnet

The project is supported by the Stacks Foundation and the Bitcoin Frontier Fund and is currently in the testing phase.

Bitflow Finance Token

Currently, the project has not issued coins, but the project is actively running the test network and developing new functions. Readers can actively follow the official Twitter and official website to learn about subsequent developments.

Overall, these projects on Stacks are trying to bring the three major DeFi items (stablecoins, lending, and DEX) on Ethereum and other public chain ecosystems into the Bitcoin ecosystem, making the entire Bitcoin ecosystem more Available.

Whether Bitcoin itself should be used as a single value storage object or whether it should start from Ethereum and become a platform that supports more applications, we cannot predict the answer.

But at the moment, any new attempt in any direction deserves our attention. The market looks at the new rather than the old, and sometimes attempts that everyone thinks are unnecessary may eventually explode with huge potential.

Stacks is the current market leader in the Bitcoin Layer 2 field, and the DeFi projects built in its ecosystem may also have such potential.

Exploring before the ecology matures and becomes known to the public often yields greater rewards.