MT Capital analyzes Jito: reshaping the Solana staking market pattern

Author: Severin Ian, MT Capital

Jito has performed exceptionally well in this wave of Solanas recovery. As the first LSD protocol on Solana that combines MEV income and staking income, Jito is expected to reshape Solanas LSD market competition.

TL;DR

Jito is the first liquidity staking protocol on Solana that combines MEV income and staking income. TVL has increased by nearly 70% in the past 30 days, which is expected to reshape the Solana staking market structure.

Jito is about to launch the governance token JTO. There are few JTOs circulating in the early market, and the main selling pressure comes from airdrop users. JTO has limited usage scenarios and poor value capture capabilities. Jito needs new incentives and ecological expansion to stimulate the continued growth of Jito TVL, thereby alleviating the selling pressure of airdrop users to a certain extent and maintaining the stability of JTO value.

Backed by Solanas new assets, the influx of new users, the increase in transaction volume, and Solanas extremely low liquidity staking ratio, the LSD protocol represented by Jito is expected to capture a higher staking TVL. Solanas potentially huge MEV value gives Jito a higher imagination. .

Compared with Marinade, the gap between Jito in terms of ecological combination, degree of decentralization, and single staking model will continue to narrow with the development of Jito. Jitos core competitive advantage in the capture and distribution of MEV value will continue to expand as the Solana network prospers. Therefore, we have very optimistic future expectations for Jito. Jito is expected to replace Maridane and become the largest LSD protocol in the Solana ecosystem.

The stability and improvement of Jitos fundamentals will also drive the price of JTO secondary tokens to rise. Referring to the price trend of the LSD protocol token in the past month, we believe that JTO will also have a stronger secondary market performance.

Jito: The first liquidity staking protocol on Solana with both MEV returns

Jito Labs is deeply involved in Solana MEV field

Jito Network is launched by Jito Labs team. The Jito Labs team worked in the infrastructure field of Solana MEV in the early days. In July 2022, Jito Labs launched Solana MEV DashBoard, which conducted MEV classification analysis of more than 36 billion transactions on Solana since January 2022. Subsequently, in August 2022, Jito Labs announced the completion of a $10 million Series A round of financing led by Multicoin Capital and Framework Ventures. The funds raised will continue to be used to build infrastructure that optimizes MEV.

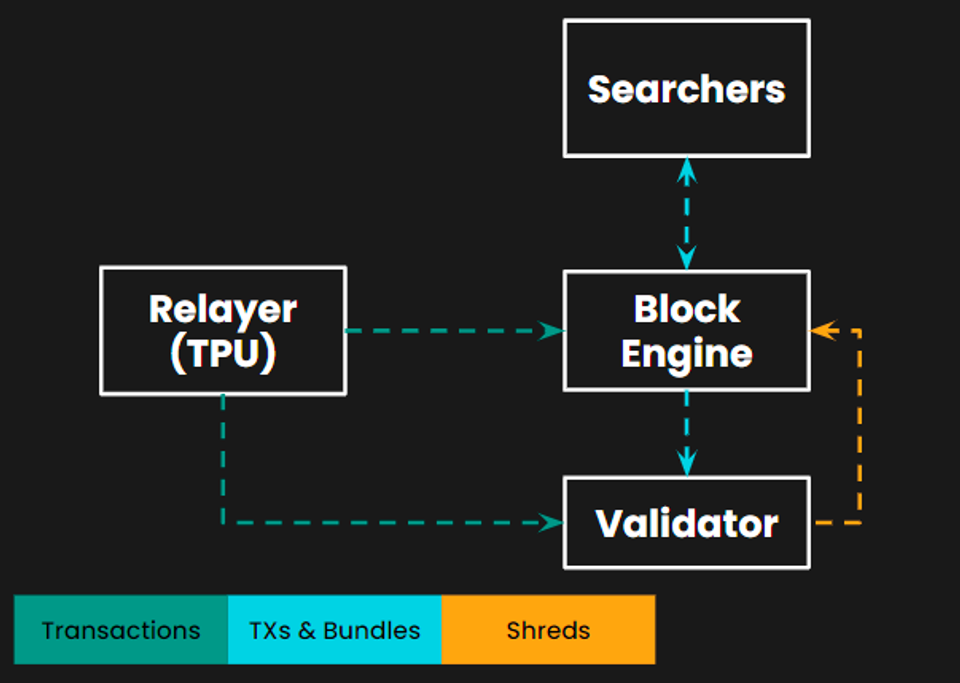

Immediately afterwards, Jito Labs successively launched Jito-Solana validator client, Jito Block Engine and other product services that optimize MEV extraction and distribution, becoming another important infrastructure service provider in the Solana MEV field. Jito Block Engine solves the MEV problem by linking relays, searchers and verifiers in the network through off-chain auctions.

First, Jito Block Engine will receive the transaction order from the relay and forward it to the searcher.

The searcher then submits a deal bundle containing the bid.

Finally, Jito Block Engine simulates each transaction combination and finds the best transaction combination bundle and forwards it to the validator for processing.

According to the Validator Health Report: October 2023 launched by the Solana Foundation, currently about 31.45% of Solana verification nodes choose to use the Jito-Solana validator client launched by Jito Labs, which also demonstrates the technical level of Jito Labs in the MEV field. .

As the Jito-Solana validator client is continuously adopted, more and more MEV rewards are captured based on Jito-Solana, which also lays a solid foundation for Jito to launch the LSD module with MEV rewards.

The first Solana LSD with MEV benefits

The untimely development has made it difficult for JitoSOL to make progress in the long term: In November 2022, on the eve of the FTX thunderstorm, looking at the development of the LSD protocol that was in the limelight, Jito Labs also officially announced the launch of Jito staking service. Similar to the liquidity staking logic of other LSD protocols, users will receive JitoSOL as a liquidity certificate after delegating SOL to the verification node. The price of JitoSOL will continue to increase to reflect the node validation rewards earned. Thanks to Jito Labs early deployment in the Solana MEV field, Jito can also distribute MEV income to pledgers, further increasing users staking income. Unfortunately, as soon as Jito announced the launch of LSD staking service, FTX collapsed due to misappropriation of customer funds. Solana, which is closely related to FTX, was not immune and experienced a huge loss of liquidity. Therefore, after Jito launched the staking module, Jitos TVL has been in a tepid state due to the lack of sufficient market confidence and liquidity demand.

Points incentive plan boosts Jitos recovery: With the recovery of the Solana ecosystem in the second half of this year, Jitos TVL has also begun to gradually grow. At the same time, in August this year, Jito also launched its own points incentive campaign to promote the large-scale adoption of JitoSOL. Users can earn points by participating in Jito staking, holding JitoSOL, using JitoSOL to participate in DeFi activities, and inviting friends. Points represent users contributions to the Jito community and are also regarded as an important criterion for future airdrops. The introduction of the points incentive plan has made Jito TVLs growth curve significantly steeper.

Lido withdraws, and Jito takes over the market share of Lido Solana: At the same time, in October this year, Lido DAO decided not to support new SOL staking after a community vote, and node operators will gradually withdraw from the SOL staking market starting in November. . Lidos withdrawal requires stSOL, which is worth close to 6M, to find a new staking venue. Jito, which has both staking and MEV rewards as well as point incentives, has taken advantage of the trend to undertake a large number of stSOL, causing Jitos TVL to further soar, becoming the top two LSD protocols on Solana.

A more decentralized Jito - StarkNet

In order to make the underlying verification node pool and the process of managing changes in the pledge pool amount more decentralized, Jito proposed the future development plan of Jito StarkNet. Jito StarkNet is a self-sustaining, transparent, decentralized smart management protocol for validator node pools. Jito StarkNet mainly consists of three modules: Keepers, Validator History Program and Steward Program.

The Validator History Program will store the historical data records of each verification node in the past 3 years, including the participation and correctness data of the verification node in the consensus process, commission collection ratio, MEV extraction value, total pledge value, pledge ranking and other data.

The Steward Program will calculate the score of each verification node and the appropriate pledge delegation amount based on the historical data records on the chain of each verification node.

Keepers Network will distribute the pledge entrustment amount based on the calculation results of the Steward Program.

In the Jito StarkNet network, the historical behavior of the verification nodes will be used as the only reference standard for allocating the pledge commission amount, thereby encouraging healthy competition among the underlying verification nodes to give users a better staking experience. At the same time, the management of pledged entrusted funds no longer relies on the centralized management of the protocol. Instead, the Steward Program and Keepers Network automatically execute changes to the entrusted amount, making the operation process more decentralized.

Token economy

On November 28, the Jito Foundation announced the launch of the governance token JTO. The launch of JTO is an important part of Jitos development. JTO will be used to reward early contributors for airdrops and give users the ability to govern the protocol.

Token distribution: The total supply of JTO is 1 billion, of which

10% will be used for airdrops to early users;

24.3% is controlled by DAO governance and used for community growth;

24.5% and 16.2% of the tokens belong to the Jito team and early investors respectively. These tokens will have a one-year lock-up period and a three-year unlock period;

25% of tokens will be used for ecosystem development;

Token utility: JTO holders can make decisions on important parameters and governance initiatives of the protocol, including but not limited to:

Set the fees for the JitoSOL staking pool;

Adjust the key parameters of Jito StarkNet to deploy the pledge fund delegation strategy;

Manage the JTO tokens held by the DAO and the fees captured by JitoSOL;

Token airdrop incentives: Early adopters of Jito will have the opportunity to receive JTO token airdrops. in,

80% of the tokens will be airdropped to JitoSOL holders and users;

15% of the tokens will be airdropped to verification nodes running the Jito-Solana client;

5% of tokens will be airdropped to Jito MEV searchers;

Judging from the distribution of JTO tokens, there were fewer JTOs circulating in the market in the early days, and the main selling pressure came from airdrop users. From the perspective of token empowerment, JTO has relatively limited usage scenarios and poor value capture capabilities. Jito needs new incentives and ecological expansion to stimulate the continued growth of Jito TVL, thereby alleviating the selling pressure of airdrop users to a certain extent and maintaining the stability of JTO value.

Jito’s future expectations: Explosive growth of Solana

After experiencing the bankruptcy of FTX, Solana, which had been dormant for a long time, finally ushered in recovery. Since September, TVL on Solana has begun to increase in volume and is currently close to 700M. And in this rising cycle, the monthly growth rate of TVL of the top ten public chains is only 14.8%, while the monthly growth rate of Solana TVL is as high as 85%, far exceeding other public chains. From the asset side, the massive influx of assets is expected to drive an increase in SOL pledge demand.

In addition to the sharp increase in TVL, the number of daily transactions on Solana also reached a peak of nearly 400M. The increase in the number of transactions will not only drive the increase in Solana network fees, but also promote the increase in MEV fees, which will drive the demand for pledges represented by Jito.

In addition, the number of new and reactivated users of Solana is also continuing to pick up, further broadening the audience of the LSD protocol represented by Jito.

Solana LSD still has huge room for growth

Although the current pledge rate of SOL has reached 70.07%, the proportion of liquidity pledges is only 3% -4%, and there is still a lot of room for development of liquidity pledges. Compared with other staking methods, liquidity staking can provide users with liquidity token certificates, allowing users to enjoy staking benefits while also participating in other DeFi activities, making the use of funds more efficient. As shown in the figure below, with the gradual recovery of the Solana ecosystem, liquidity staking has also experienced explosive growth. We expect that liquidity staking on Solana will replace the larger general staking market due to its higher capital efficiency in DeFi activities.

Solana MEV has huge value potential

Since Jito will distribute MEV rewards to JitoSOL holders together, the higher the MEV value in Solana, the greater the JitoSOL staking reward distribution will be. The increase in APR will further enhance JitoSOLs appeal to users. In the past year, Solana MEV Profit has reached 14 M, and the value of MEV that can be optimized is huge.

As the Solana network prospers, the cumulative value of MEV captured by Jito is also increasing. We expect this trend to continue, with Jito accruing more MEV value and distributing it to JitoSOL holders amid Solanas surge in network activity.

Compared with Marinade, Jito has unique competitive advantages

Marinade is the earliest LSD protocol in the Solana ecosystem. It has subverted TVL by 1.7 B and is also one of Jitos biggest competitors. Compared with Marinade, Jito’s main competitive disadvantages are as follows:

The ecological network of Marinade LST will be richer than that of Jito LST;

Marinade has more verification nodes and is more decentralized than Jito;

Marinade is also able to offer other staking options besides LSD;

Regarding competitive disadvantage 1, as shown in the figure below, JitoSOL is constantly expanding its ecological use cases and has been integrated by 10+ mainstream DeFi protocols. And Jito has the support of Multicoin, which is deeply involved in the Solana ecosystem, and will be able to expand more ecological partners more easily in the future.

Regarding competitive disadvantage 2, Marinade currently has about twice the number of nodes as Jito, and its degree of decentralization is significantly better than Jito, which is difficult for Jito to surpass in the short term. But Jito itself is also transitioning to Jito-StarkNet, and the decentralization of the protocol is expected to be further improved in the future.

In addition to competitive disadvantages, compared to Marinade, Jito also has the following competitive advantages:

JitoSOL is able to capture additional MEV rewards, and the staking rewards are slightly higher than Marinade;

With the same incentive plan, Jito can capture more active users in this wave of Solana’s recovery;

Jitos capture and distribution of MEV value is Jitos core competitiveness in long-term competition. The more active Solana network activity is, the greater the value of MEV, and the more obvious Jitos competitive advantage will be. Jitos ability to capture more active users also shows that Marinade has not yet formed a monopoly on the LSD market, and LSD protocols like Jito still have a lot of room for development.

To sum up, compared with Marinade, the gap between Jito in terms of ecological composition and degree of decentralization will continue to narrow with the development of Jito. Jitos core competitive advantage in the capture and distribution of MEV value will continue to expand as the Solana network prospers. Therefore, we have very optimistic future expectations for Jito. Jito is expected to replace Maridane and become the largest LSD protocol in the Solana ecosystem.

The stability and improvement of Jitos fundamentals will also drive the price of JTO secondary tokens to rise. Referring to the price trend of the LSD protocol token in the past month, we believe that JTO will also have a stronger secondary market performance.

Reference

MT Capital

MT Capital, headquartered in Silicon Valley, is a crypto-native fund focusing on Web3 and related technologies. We have a global team, and our diverse cultural backgrounds and perspectives allow us to have an in-depth understanding of the global market and to seize investment opportunities in different regions. MT Capitals vision is to become the worlds leading blockchain investment firm, focused on supporting early-stage technology companies that can generate significant value. Since 2016, our investment portfolio covers Infra, L1/L2, DeFi, NFT, GameFi and other fields. We are not just investors, we are the driving force behind the founding team. Official website:https://mt.capital/Twitter:https://twitter.com/MTCapital_USMedium:https://medium.com/@MTCapital_US