The APR is as high as 70.4%. This article summarizes 7 stablecoin mining income opportunities.

Original author: Jiang Haibo, PANews

As markets recover and volatility increases, demand for stablecoins increases. In DeFi, opportunities to earn income through liquidity mining have also increased. In this issue, PANews has compiled several opportunities for you to gain income through stablecoin mining, with the highest annualized income of 70.4%. The following data are updated as of November 23.

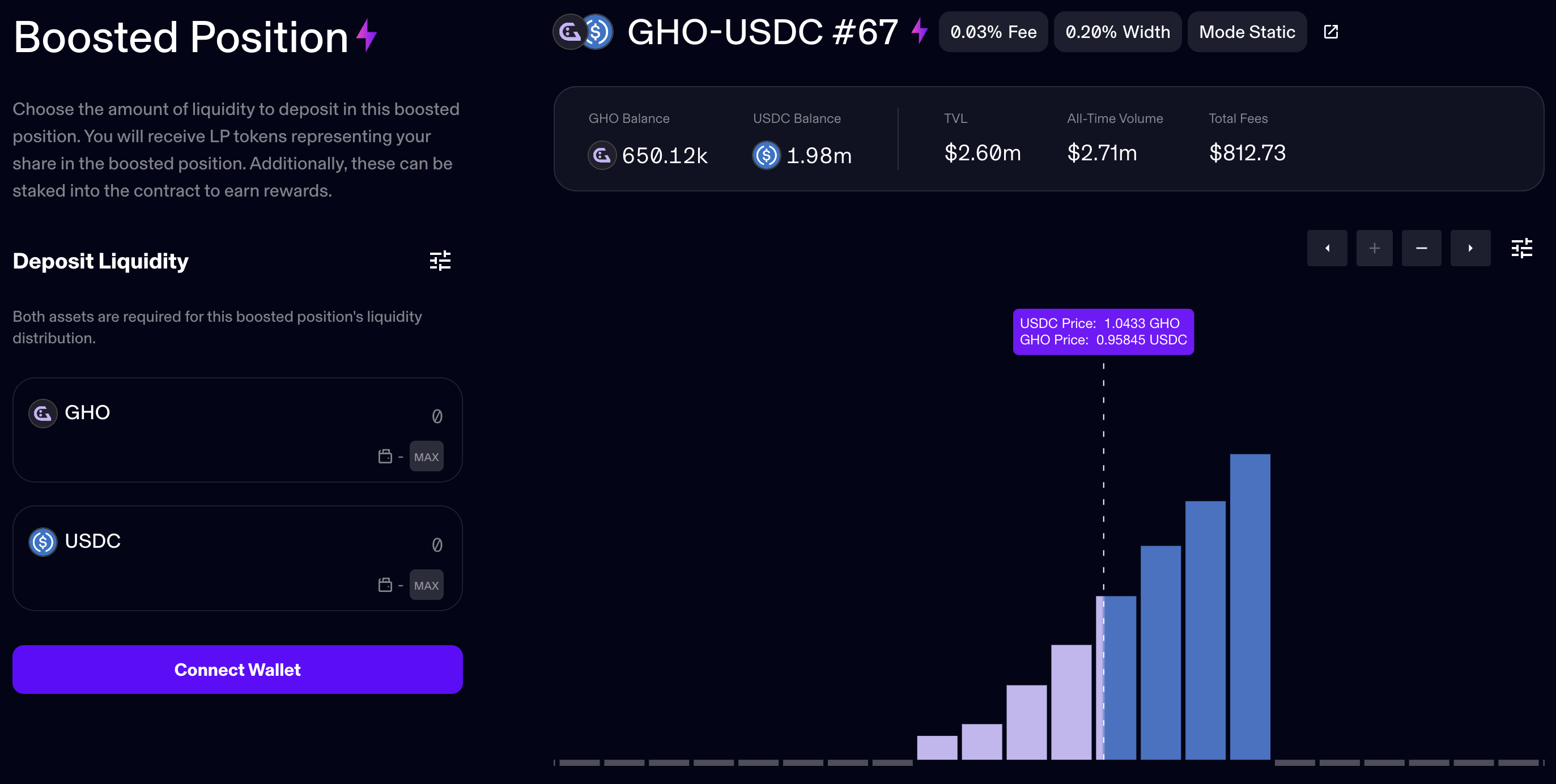

Maverick

Trading pair: GHO-USDC APR 70.4%

Maverick is a decentralized exchange supported by leading institutions such as Founders Fund and Binance Labs. The stablecoin GHO is issued by over-collateralized positions in Aave.

However, due to the lack of application scenarios, the price of GHO has been below $1 for a long time, so Aave has taken a series of measures to incentivize the liquidity of GHO in the hope of bringing the price back to $1.

The GHO-USDC pool with the highest liquidity in Maverick on Ethereum adopts the static mode (Mode Static), with a total liquidity of 2.6 million US dollars. An incentive of 5,000 GHO is issued to the pool every day, with a mining APR of 67.11% and transaction fees. The resulting APR is 3.29%, for a total of 70.4%.

In addition, there is a GHO-USDC pool on Maverick that adopts two-way mode (Mode Both), which means that liquidity will move with the price of GHO. The pool’s liquidity is $1.04 million, the mining APR is 47.89%, and the APR generated from transaction fees is 18.65%, for a total of 66.54%.

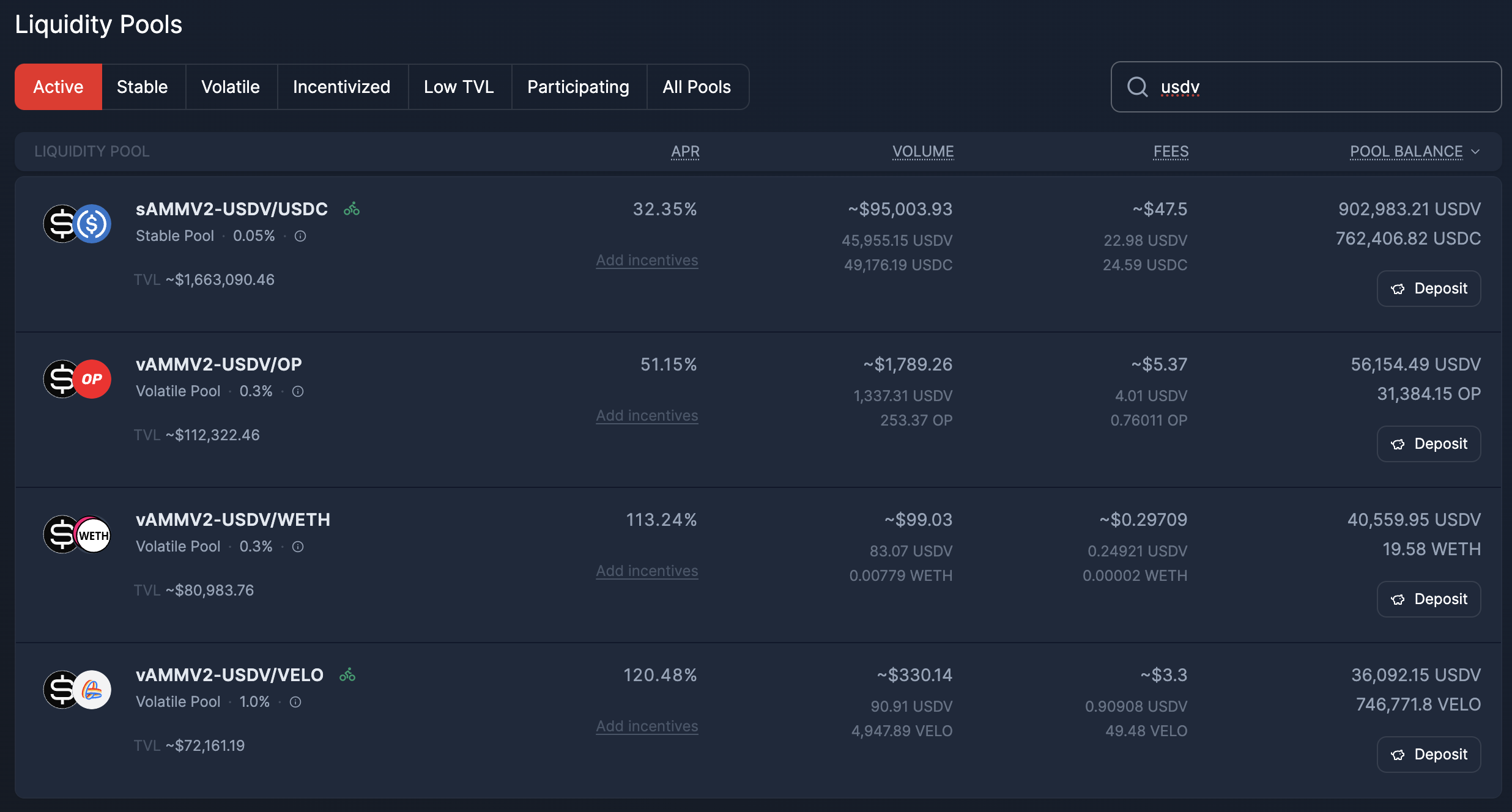

Velodrome

Trading pair: USDV/USDC APR 32.35%

Velodrome is the leading DEX on Optimism. USDV (Verified USD) is a unique stable currency. Its underlying asset is STBT, which is an independent special purpose vehicle (Special Purpose Vehicle) passed by Matrixdock (the parent company is Matrixport). SPV) structure issued. The underlying asset of STBT is U.S. Treasury bills, but it is designed for accredited investors and follows the ERC-1400 standard. Only accredited investors can purchase and hold it on the chain. As a result, USDV that is compatible with the ERC-20 standard emerged and was built based on LayerZero’s Omnichain Fungible Token (OFT) standard, eliminating the problems of unofficial wrapper/bridge versions and liquidity splits.

Related Reading:Community-driven stablecoin USDV, a new choice for win-win cooperation

USDV is the first stablecoin to reward “Verified Minters” based on the token’s contribution to active circulation. Since the underlying asset generates revenue, it uses a ColorTrace Algorithm to label each stablecoin a unique color by tracking the mintage of each color token and the total supply of all colors in the vault. amount to distribute benefits to minters.

For users, USDV can be understood as a stable currency, and the underlying asset is tokenized U.S. Treasury bills. However, ordinary holders cannot directly obtain the income generated by the underlying assets, but need to verify the mint to incentivize some usage scenarios. USDV has reached cooperation with many DeFi protocols, such as Curve, Maverick, Trader Joe, Abracadabra, Velodrome, Wombat, SushiSwap, etc.

On Velodrome, the USDV/USDC trading pair has $1.66 million in liquidity and an APR of 32.35%.

On the BNB chain, Wombat shows that the average total APR of USDV in the USDV pool is 62.49%, with a base APR of 23.4%, but the pool has less liquidity. In addition, there is also the USDV/USDC trading pair on Trader Joe, with an APR of 27.73%, and you can receive both ARB and USDV rewards.

Canto

Trading pair: cNOTE / USDC APR 22.43%

Canto is moving from a general blockchain platform and DeFi ecosystem to a blockchain solution tailored for real assets, and it is in this context that cNOTE was launched.

NOTE is the unit of account in Canto, minted with over-collateralization in USDC and USDT. It is now also possible to provide NOTE deposits to the Canto lending market and receive the deposit token cNOTE. Due to deposit interest, the exchange ratio of cNOTE relative to NOTE will continue to increase.

Current liquidity for the cNOTE/USDC trading pair on Canto is $4.41 million, with an APR of 22.42%. You can directly purchase NOTE, make a deposit to obtain cNOTE, and provide liquidity together with USDC; or you can mortgage USDC or USDT to mint NOTE yourself and then perform subsequent operations.

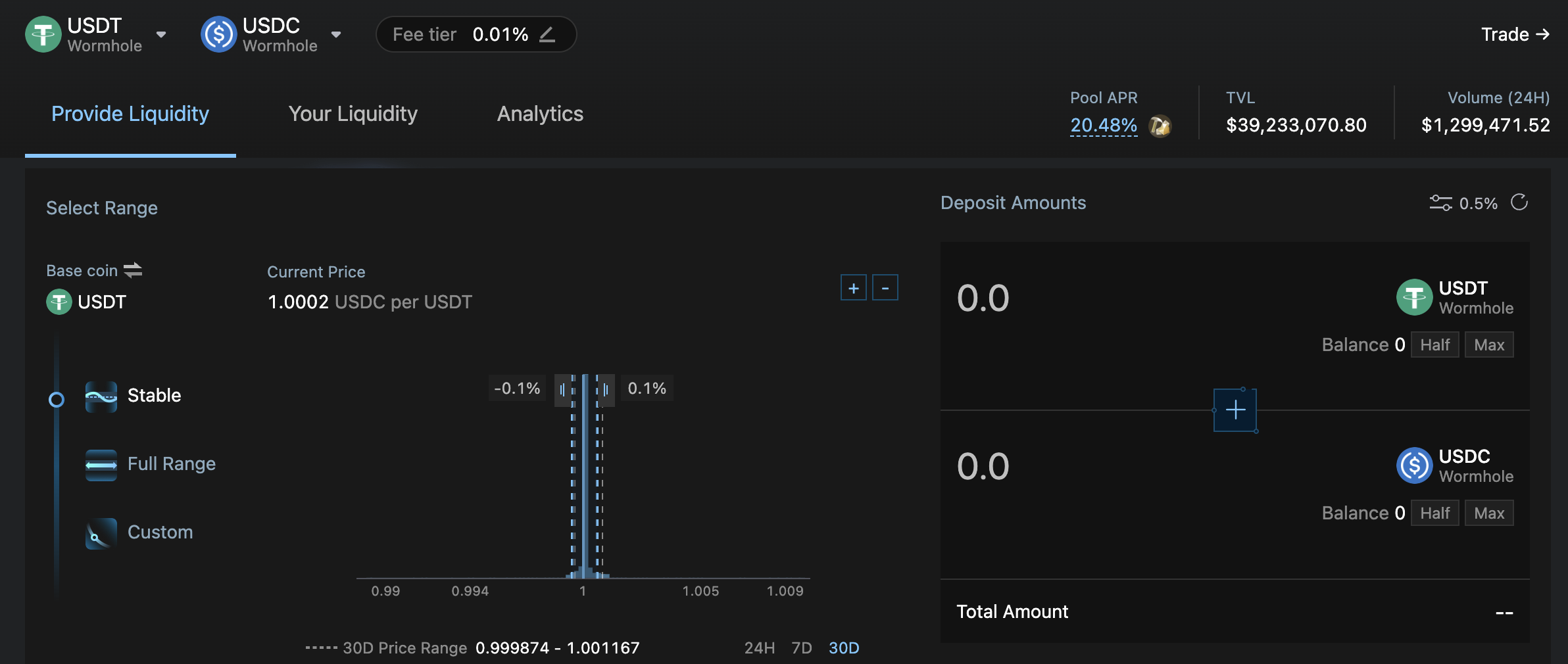

Cetus

Trading pair: USDT/USDC APR 20.49%

Cetus is the head DEX on the public chain Sui. The USDT and USDC here are obtained cross-chain from Ethereum by Wormhole. You can also directly purchase the cross-chain version of USDC in DEX on chains such as Solana, and then cross-chain to Sui. superior.

The trading pair has $39.23 million in liquidity on Cetus. However, it should be noted that Cetus allows concentrated liquidity. In order to obtain higher returns, liquidity providers basically concentrate liquidity within a relatively narrow range. If the price of USDC/USDT fluctuates, adjustments may be needed.

What is obtained here are mainly SUI tokens distributed by the public chain Sui. Similarly, SUI rewards can also be obtained in other DEXs of Sui. For example, the APR of USDT/USDC on Turbos is 28.02%, and the APR of wUSDC/wUSDT on FlowX is 33.74%.

Thala

Trading pair: MOD/USDC APR 20.53%

Thala is the leading DEX on Aptos and has developed products such as DEX, stablecoins, liquidity staking and Launchpad. MOD is an over-collateralized stablecoin minted in Thala that can also be directly exchanged and redeemed with USDC through the pegged stable module, with a 0.25% fee.

Thala has $2.97 million in liquidity in its MOD/USDC pool with an APR of 20.5%, but be aware that earned MODs take a month to unlock.

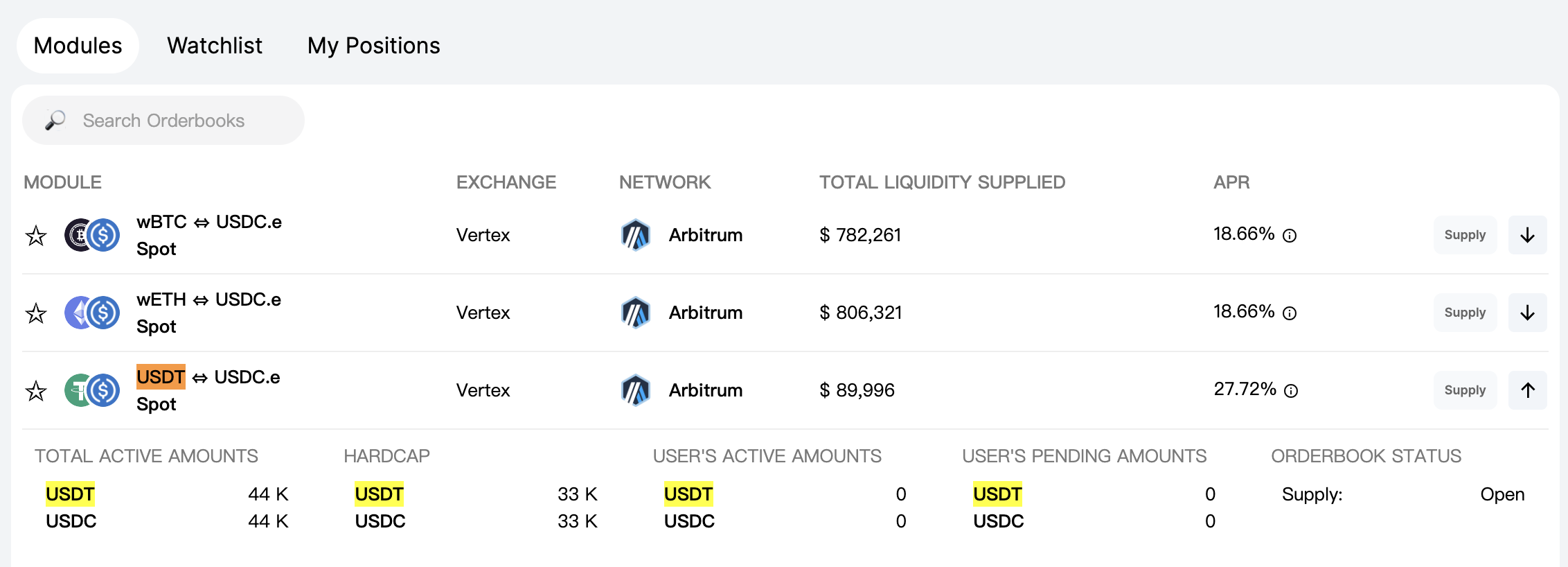

Elixir

Trading pair: USCT/USDC APR 27.72%

Elixir Finance is a decentralized and algorithmically driven market making protocol whose trustless algorithmic model allows a wide range of participants to provide liquidity for trading pairs on decentralized and centralized platforms. For example, all current liquidity on Elixir will be used in Vertex.

The USDT/USDC spot trading pair on Elixir currently has an APR of 27.72% and liquidity of only $90,000. But 15% of the APR is ARB rewards, and all trading pairs are calculated together, that is, increasing the liquidity of this trading pair will not cause this part of the reward to be significantly diluted, and the remaining part of the reward is locked VRTX.

The project has been funded at a valuation of US$100 million and has not yet issued coins. Early use may also result in airdrops.

Convex

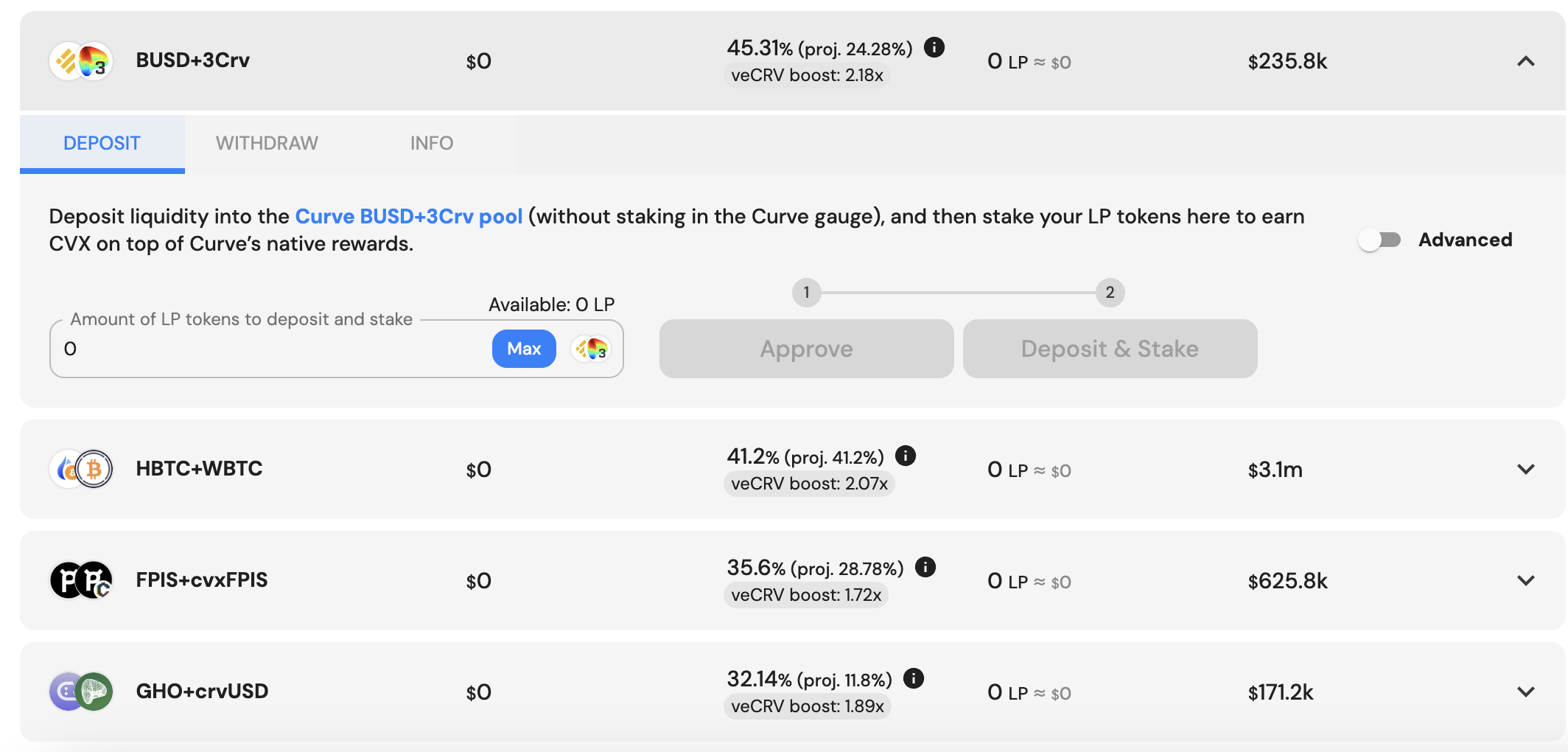

Trading pair: BUSD/3 Crv APR 45.31%

Convex and Curve are DeFi projects that everyone is familiar with, and BUSD, DAI, USDT, and USDC are also stable coins that everyone often comes into contact with.

You can provide liquidity in Curve in one or more of BUSD, DAI, USDT, and USDC, and then stake the liquidity tokens in Convex to receive rewards. The trading pair has $236,000 in liquidity and the rewards are mainly CRV with a small amount of CVX and trading fees remaining. However, please note that the deadline for Binance and Paxos to support BUSD is February 2024.