After Poloniex, Heco and HTX were also attacked, causing losses of over 100 million

Original - Odaily

Author - Nan Zhi

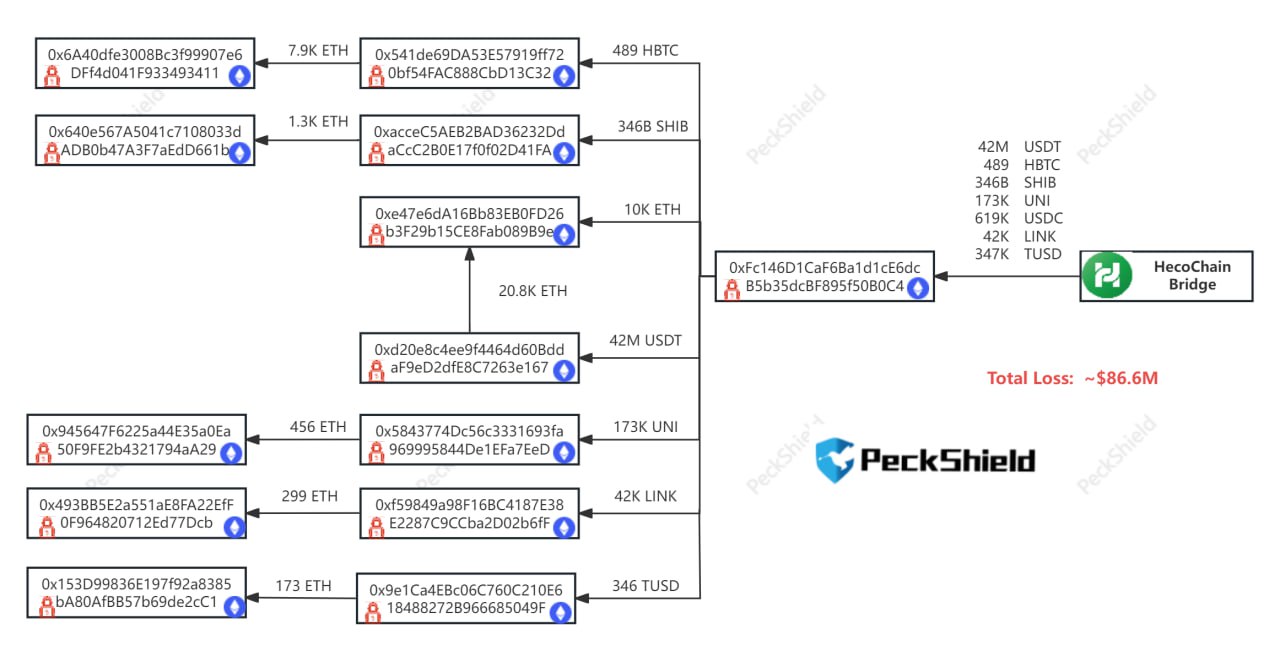

Data on the chain shows that a withdrawal operation of 10,145 ETH occurred on Heco Bridge at 18:00 today. According to Paidun monitoring,The operation was performed by a compromised operator。

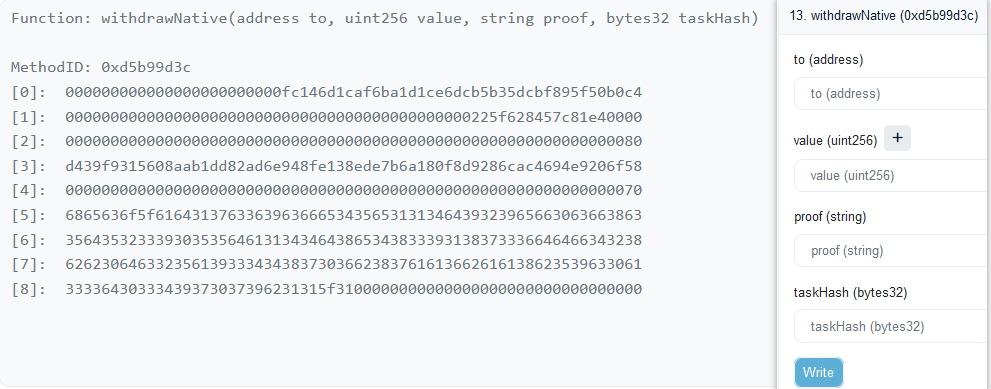

The Heco Bridge contract code interacted by the attacker shows that the function withdrawNative used by the attacker can transfer the specified amount to the specified address, but requires a series of verification codes.

Then other assets continued to be transferred out. As of 20:05 (UTC+ 8), a total of assets worth US$86.6 million had been transferred.Including 42 million USDT, 489 HBTC and a series of assets. Paidun further stated that the compromised operator has been operating since October 8, 2022.

Additionally, according to The Block,Outside of the HECO Bridge, there are other expected vulnerabilities at cryptocurrency exchange HTX, which saw $23.4 million in suspicious transfers.

At present, in addition to the transfer operation from Bridge, the attacker only performed a series of exchange operations and exchanged the stolen currency for 31,281 ETH. Adding the original 10,145 ETH, the attacker held a total of 41,426 ETH.

At around 8:30 p.m., Justin Sun responded to the attack by posting on the Funds are safe. We are investigating the specific cause of the hack. Once we complete our investigation and identify the cause, we will restore service.

According to Cyvers Alerts AI system monitoring, HTX has transferred the remaining assets to the Houbi Recovery address. Cyvers Alerts disclosed HTX losses of approximately $12.4 million.

Poloniex’s case of 100 million stolen has not yet been settled

Just 12 days ago,Justin Sun’s Poloniex had hundreds of millions of dollars stolen. Last Friday (November 17), Poloniex announced that it would resume deposit and withdrawal functions this week, but it has not been enabled yet.

Four days ago, Justin Sun said he had identified the actual identity of the Poloniex attacker. Justin Sun left a message on the Poloniex attacker chain: Weve confirmed your identity, Chinese, American and Russian police have also intervened. All stolen funds have been marked for tracking and cannot be used, and the counterparty will be frozen.Return (funding) by November 25, 2023,We’re offering a $10 million white hat bounty. If it is not returned by then, police forces in several countries will take action.

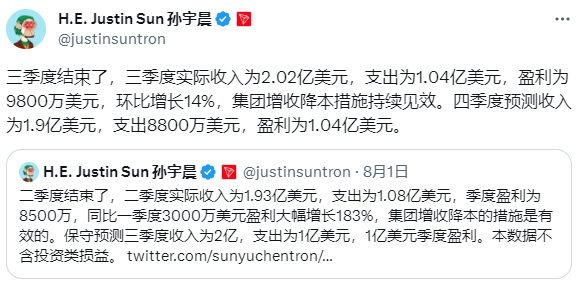

The total amount stolen far exceeded HTX’s quarterly revenue

Last month, HTX released its third-quarter financial report. Its third-quarter operating income was $24.75 million, a far cry from the amount stolen.

also,Justin Sun announced the overall profitability of all his companies on October 26: Revenue in the third quarter was $202 million, expenses were $104 million, and profit was $98 million, a 14% increase from the previous quarter.

Calculated from this, the sum of the two stolen amounts has exceeded the groups business income in the third quarter.

Odaily will continue to follow up on the subsequent progress of the attack.