Starting from Equaiton, we see the possibility of the AMM model occupying the future of the derivatives track.

Original source:EquationDAO

Market introduction

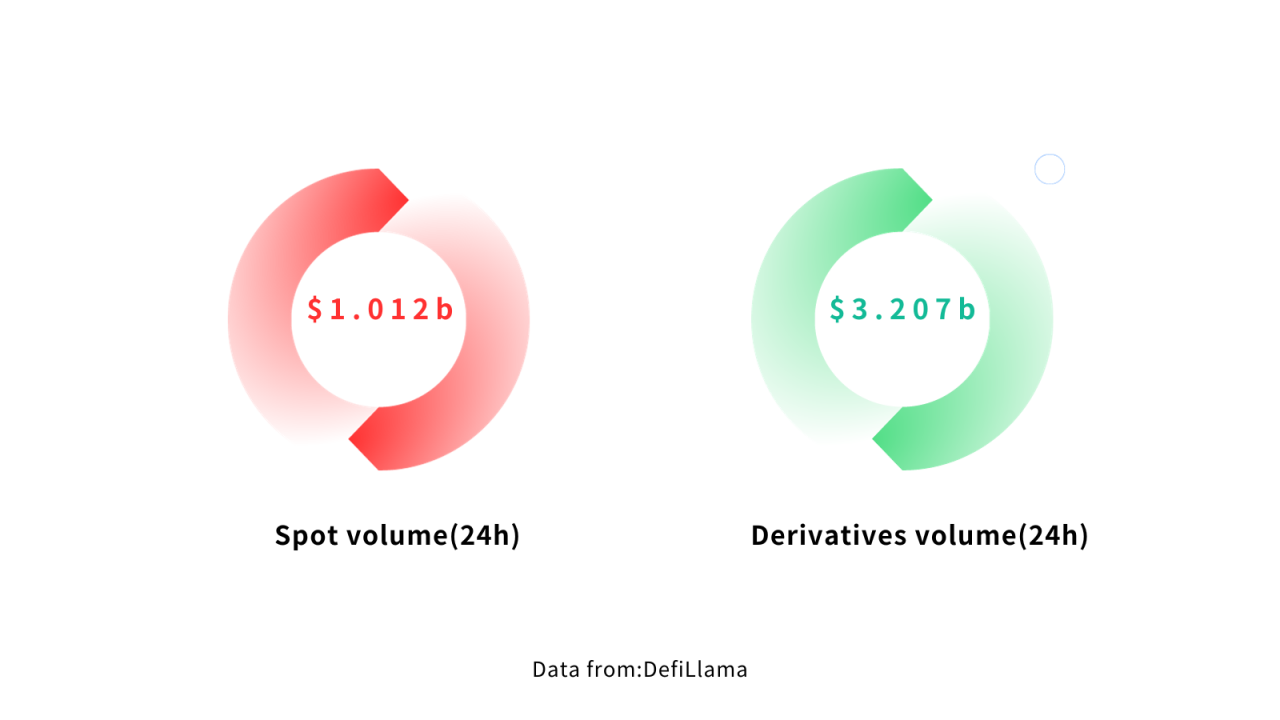

Derivatives trading has become an integral part of the crypto field, with perpetual contracts overwhelmingly occupying the largest share of the derivatives circuit, even in the on-chain world.

The development of on-chain derivatives trading protocols mainly follows two development directions. One is to follow the CEX order book model. Its development dilemma is whether to sacrifice decentralization to obtain the trading experience, that is, whether to store the order book in a centralized server or Put the order book on the chain. The other is the GLP fund pool model represented by GMX. In essence, GMX is a lending model, that is, LP lends funds for users to open positions, and users make profits while LP loses money. Although this model gives users a simple trading experience, its shortcomings are also very prominent: the traders opening size is limited by the LP capital pool, rather than the real perpetual contract, where the opening limit only depends on the opponents order; for LP Generally speaking, the market is in a unilateral market, and the risk of LP losses is high.

Here, we will introduce a new derivatives trading protocol, which continues the same decentralization, efficiency, transparency and other advantages of spot AMM, and can perfectly realize the price discovery function in the field of perpetual contract products, greatly improving capital utilization rate.

Introduction to Equaiton

Equation is a decentralized perpetual contract protocol based on Arbitrum, which has been audited by the third-party audit agency ABDK. With its innovative BRMM model, Equation allows traders to establish larger and unlimited positions with leverage of up to 200x at a lower risk of liquidation (MMR = 0.25%). At the same time, liquidity providers can also use leverage to improve capital efficiency in Equation.

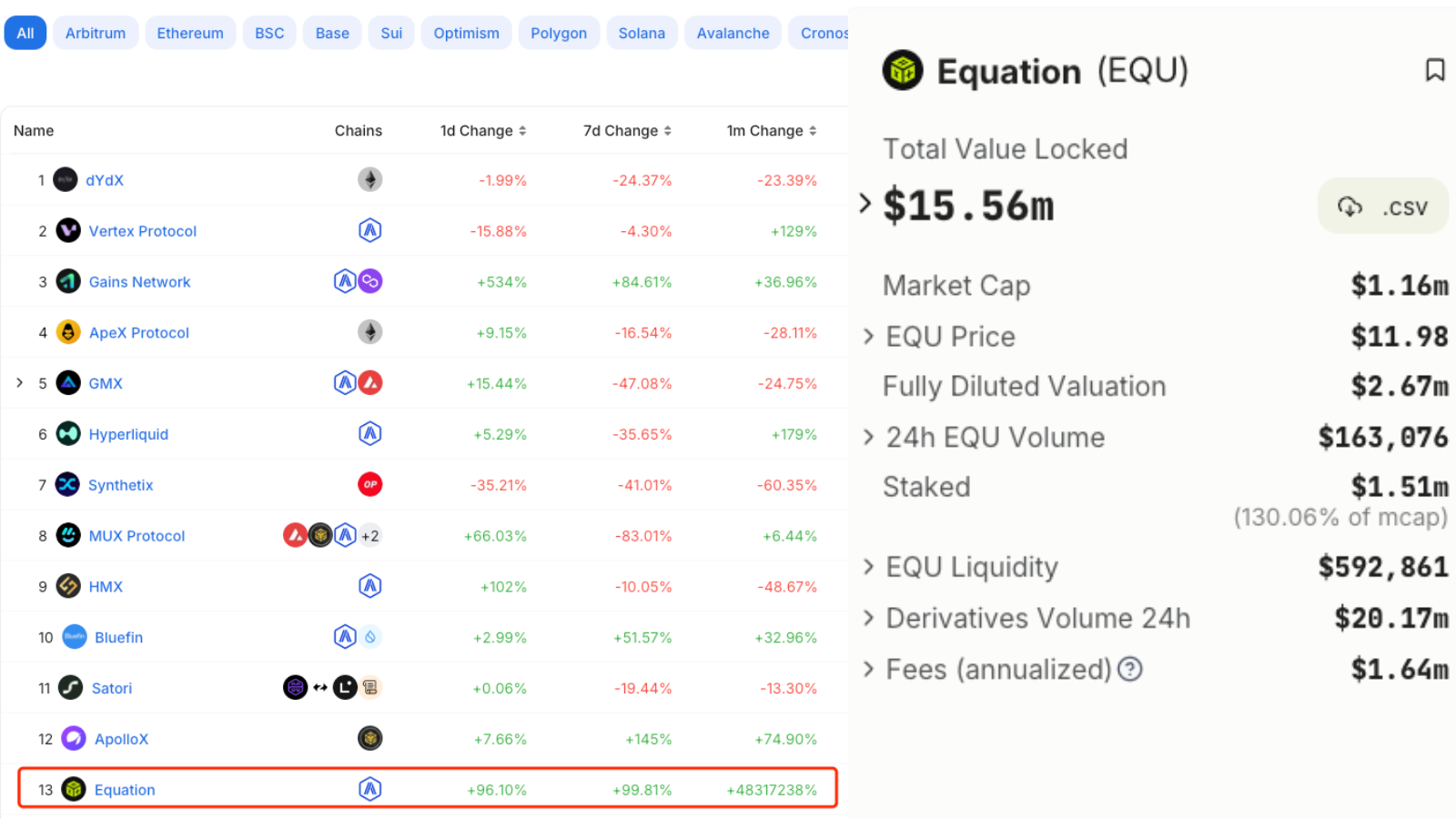

Equation will be officially launched on the Arbitrum mainnet on October 28, 2023. According to DefiLlama data on the day this article was written, Equaiton ranked 13th out of 162 on-chain derivatives exchanges.

Mechanism advantage

The concept of BRMM (Balance Rate Market Maker) is derived from the AMM mechanism (Automatic Market Maker) of the spot market. The difference is that the balance rate of the liquidity pool is calculated based on the proportion of temporary positions held by the liquidity provider, and the balance rate is used to calculate the balance rate of the liquidity pool. rate to calculate the premium rate of the contract price relative to the index price, thereby realizing the contract price discovery function. What this brings about is that since the BRMM mechanism is a true perpetual contract mechanism, the size of a users opening position is not limited by liquidity. Like the perpetual contract of a centralized exchange, it only depends on the size of the counterparty. The liquidity provided by LP is only a temporary counterparty, so it also faces temporary position risks.

This advantage became particularly obvious after the mainnet went online. According to Equation’s official website, on the 24th day after the mainnet went online, the leveraged liquidity within the Equation protocol was $596, 584, 794, and its perpetual contract trading volume had reached 2.96 billion, with open interest at $76, 183, 194.

Fair Launch and Destruction Mechanism

EQU is the native token of Equation, with a maximum supply of 10 million, 100% of which is generated through staking mining, liquidity mining and recommendation mining, and is rewarded to community users. At the time of writing, Arbiscan shows that 224,877 EQU have been mined, and EQU is currently only tradable on Uniswap, with a current price of $11.88.

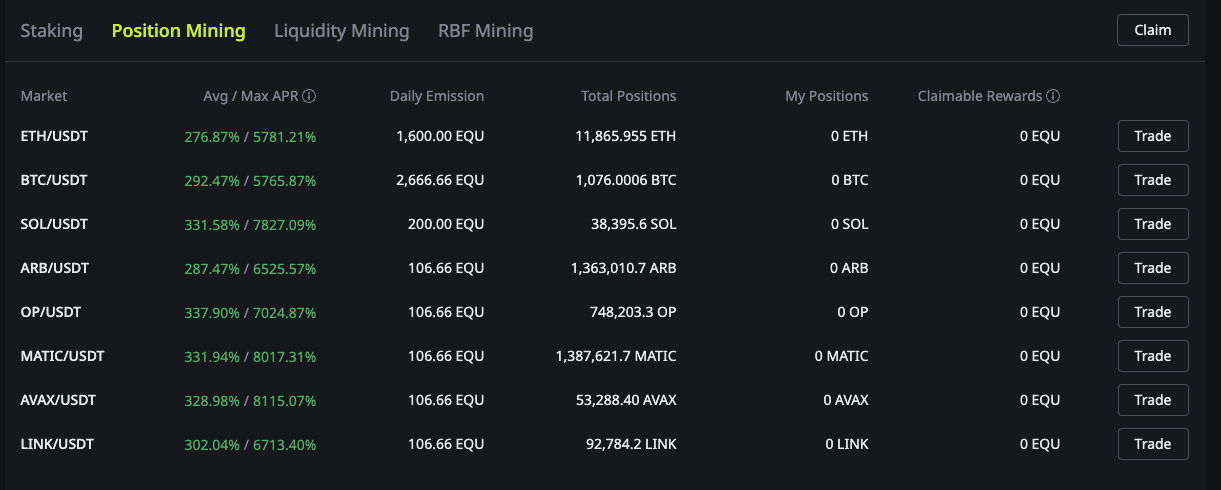

Different from other competitors, in terms of token allocation, Equation allocates 50% of the tokens to traders in the form of position mining. However, because LP can use leverage to greatly increase the utilization rate of funds, it captures more Transaction fees, so LP is also happy to see the results. (Traders can enjoy extremely high token returns by holding positions in Equation)

Equation provides two modes for staking mining using EQU: EQU/ETH LP NFT staking mining and EQU single-coin mining. Both mining modes require varying degrees of lock-up periods, and there are currently 159,872 EQUs staked. The pledge of tokens illustrates the holder’s confidence in the development of the project to a certain extent. There is often a positive correlation between the time the token is held and the positive view of the project.

Recently, Equation DAO has passed a proposal. The main content of the proposal is to destroy a portion of EQU that is not used for long-term staking in proportion according to the pledge lock-up time. The strategy is designed to further benefit EQU holders by potentially increasing the value of their holdings, thereby encouraging and rewarding long-term investment in the ecosystem.

71% of EQU are currently locked, which is bound to be a good thing for the long-term development of the Equation protocol.

Summarize

Obviously, in the field of decentralized perpetual contracts, Equation does better than its DEX competitors. For traders, factors such as transaction costs, position opening restrictions, liquidity pool depth, and maintenance margin rates directly determine trading experience. Equation allows traders to experience more cost-effective trading services through measures such as funding rates, handling fee discounts, and position mining. For liquidity providers, the difference in capital utilization efficiency provided by DEX directly determines which basket they will put their eggs in. Since Equation does not directly make LP the counterparty of the transaction, LP can also leverage Using less funds to obtain more transaction fees and token (EQU) sharing, it is understandable that LPs favor Equation.

Under all these positive influences, BRMM has successfully solved the problems of low capital utilization and poor trading experience that the AMM model has shown in the application of decentralized perpetual contract products, and is expected to occupy the entire decentralized perpetual contract market in the future. .

About Equation

EquationIt is a decentralized perpetual contract protocol based on Arbitrum and has been audited by the third-party audit agency ABDK. With its innovative BRMM model, Equation allows traders to establish larger and unlimited positions with leverage of up to 200x at a lower risk of liquidation (MMR = 0.25%). At the same time, liquidity providers can also use leverage to improve capital efficiency in Equation. Restoration as an advocate"fair start"As one of the DeFi protocols, Equation is using practical actions to let the world see how community-driven innovation can shape the future of decentralized finance. It puts security and transparency first and aims to provide traders with a reliable and safe perpetual contract trading environment.