How to make money in cycles: Understanding and judging cycles (1)

Overview

Shenyu once said, There are generally two types of money in the currency circle, cyclical money and emotional money. You must distinguish what kind of money you make. Catch the bottom in the bear market and hold until the bull market sells. This should be the simplest way everyone in the currency circle knows to make money, but many people still chase the rise and kill the fall and become leeks.

Why is it that everyone knows the method but few people can actually practice it? The main reason is that most people want to make quick money, fantasize about getting rich overnight, and do some high-risk transactions with poor profit-loss ratios. They lose their chips before the bull market arrives. If we only focus on the K-line and the time-sharing chart, we will not be able to gain insight into the cycle from a transcendent perspective and find certainty in uncertainty.

The ability to understand market cycles and adapt to/anticipate economic cycles basically determines how long investors can survive in the market. In order to enable readers to reduce the cost of trial and error and deepen their understanding of cycles, we will start a serial on How to make money from cycles. There are four articles in this series. We will introduce the cycle and how to make profits from it from multiple angles. The main contents include the following parts: BTC halving narrative, judging the cycle from multiple angles, how to allocate funds at different stages, and the next round The track where the bull market may break out, how to buy the bottom and escape the top, etc.

Bull and bear cycle definition

To put it simply, a cycle is something that reoccurs. The bull and bear markets in the capital market also reoccur, so there is a bull and bear cycle. How are bull and bear markets defined? We will focus on the definition of a bull market. Once you know the definition of a bull market, the definition of a bear market will be obvious.

How should a bull market be defined?

Not long ago, a group of influencers started arguing on Twitter about which stage of the bull-bear cycle we were in. Some people think that we are at the beginning of the bull cycle, but I am skeptical about this. To demonstrate this, we first need to define a bull market.

What exactly counts as a bull market? Isn’t it considered a bull market as long as it doesn’t exceed the all-time high? Obviously this is not the case. Take Japan as an example. After the economic bubble burst in the 1980s and 1990s, the Japanese stock market never returned to its highest point. Could it be that the Japanese stock market has not had a bull market in the past few decades? Obviously, it is not a bull market that exceeds the all-time high.

Moreover, rising prices are not exclusive to bull markets. Can’t prices rise in bear markets? Bulls and bears are not only different in price, but the difference in trading volume is also an important way to judge bulls and bears. Moreover, many people only look at the rise and fall of the price of Bitcoin to judge whether it is bullish or bearish. This is also a misunderstanding. During the bear market, Bitcoin often has a blood-sucking market. At this time, if Bitcoin rises, the copycats will not follow suit, and if Bitcoin falls, the copycats will not follow suit. Following the decline, this is a manifestation of insufficient market liquidity.

Therefore, one criterion for judging a bull market is: over a long period of time, the overall market value of the crypto market is growing, and there is an increase in the entry of funds. At present, interest rates remain at a high level, and liquidity is constantly being withdrawn, resulting in less upward and downward momentum. Any good or bad news will cause large price fluctuations. My understanding of the bull market: The entry of incremental funds caused by the release of water caused the overall increase in the crypto market, rather than price changes caused by emotions and consensus brought about by good or bad news. Bulls and bears themselves are cyclical changes, and many people interpret them as price changes. This is a big misunderstanding. Using price changes caused by emotions to explain changes caused by cycles is wrong in itself.

To put it simply, the bear market is a game of existing funds, while the bull market is a win-win situation brought about by incremental funds. The price rise in a bear market relies on emotions, and the price rise in a bull market relies on the growth and sentiment of on-site funds.

BTC halving narrative

When the Bitcoin blockchain was born in 2009, the reward for creating a block was 50 BTC, and the reward was automatically halved every 210,000 blocks.

Every 2016 blocks (about two weeks), the system will adjust the mining difficulty according to the block time of the previous cycle, so that the block time is stable at about 10 minutes. It is not difficult to conclude that the reward halving cycle is about once every 4 years.

Bitcoin will usher in its fourth halving in 2024, and the reward for creating a block will drop to 3.125 BTC. Since the smallest unit of Bitcoin is Satoshi (SAT), which is 0.00000001 (one hundred millionth) Bitcoin, the block reward will be lower than 1 Satoshi for the first time after the 33rd halving in 2140, and the Bitcoin block reward will end.

Use history as a mirror to understand the rise and fall: a historical review of Bitcoin halving

Based on the statistical information, we can draw the following conclusions:

The maximum retracement in each bear market was around 80%, while the increase declined each time. According to this rule, we can predict that this bear market has most likely bottomed out, and the bull market increase may be between 4 and 6 times, that is, between US$62,388 and US$93,582.

The time to reach all-time highs after the halving is lengthening.

Based on the magnitude of the retracement from the last high, we can predict that there is a high probability that the price of this bear market has bottomed out.

The halving is expected to occur on April 27, 2024, reaching a historical high three to seven months after the halving, that is, between Q3 and Q4 next year.

Will halving definitely bring about a bull market?

In everyones opinion, the Bitcoin halving is a deterministic event that causes the price to rise, but correlation does not equal causation. So is there causality between Bitcoin halving and price rise?

Before discussing the Bitcoin halving, let’s first take a look at the situation of LTC that was halved not long ago. On August 2, the LTC block height reached 2,520,000, the block reward was halved, and the mining reward was reduced from 12.5 LTC to 6.25 LTC. After that, the price of LTC has been falling all the way. Although it can be interpreted as the good is all bad, the price of LTC did not rise much before, and more followed the fluctuations of the market. The halving narrative has failed to drive up the price of LTC, so is there still a chance for Bitcoin to halve next year?

The price depends on both supply and demand. After three Bitcoin halvings, the impact of Bitcoin halving on supply is becoming smaller and smaller. After the Bitcoin halving in 2024, the single Bitcoin block reward will be from 6.25 becomes 3.125. Then, what really determines the price of Bitcoin will be demand, that is, whether there will be new external capital inflows.

Looking back at the Bitcoin bull market that started after the 2020 halving, you may think that the reason is not the Bitcoin halving, but the epidemic and the Federal Reserves massive release of water. Under the extremely loose flow, US stocks soared, and a large number of Funds entered the Grayscale Bitcoin Trust, and Grayscale continued to buy Bitcoin. After that, Tesla also bought Bitcoin, driving the entire market into madness. Therefore, where the money comes from is what really determines whether a crypto bull market is going to happen or not.

Does that mean that the Bitcoin halving event is not important? No, the Bitcoin halving still has a strong narrative and expected value. In a crypto market with almost no fundamentals, price rises and falls are often driven by narratives and expectations. It turns out that narrative value is often effective. When everyone is willing to believe that the Bitcoin halving will bring about a bull market, then everyone will rush to buy it, which will really bring about a bull market. So only when most people believe that the Bitcoin halving can bring about a bull market, maybe the bull market will really come. This is what Soros calls reflexivity.

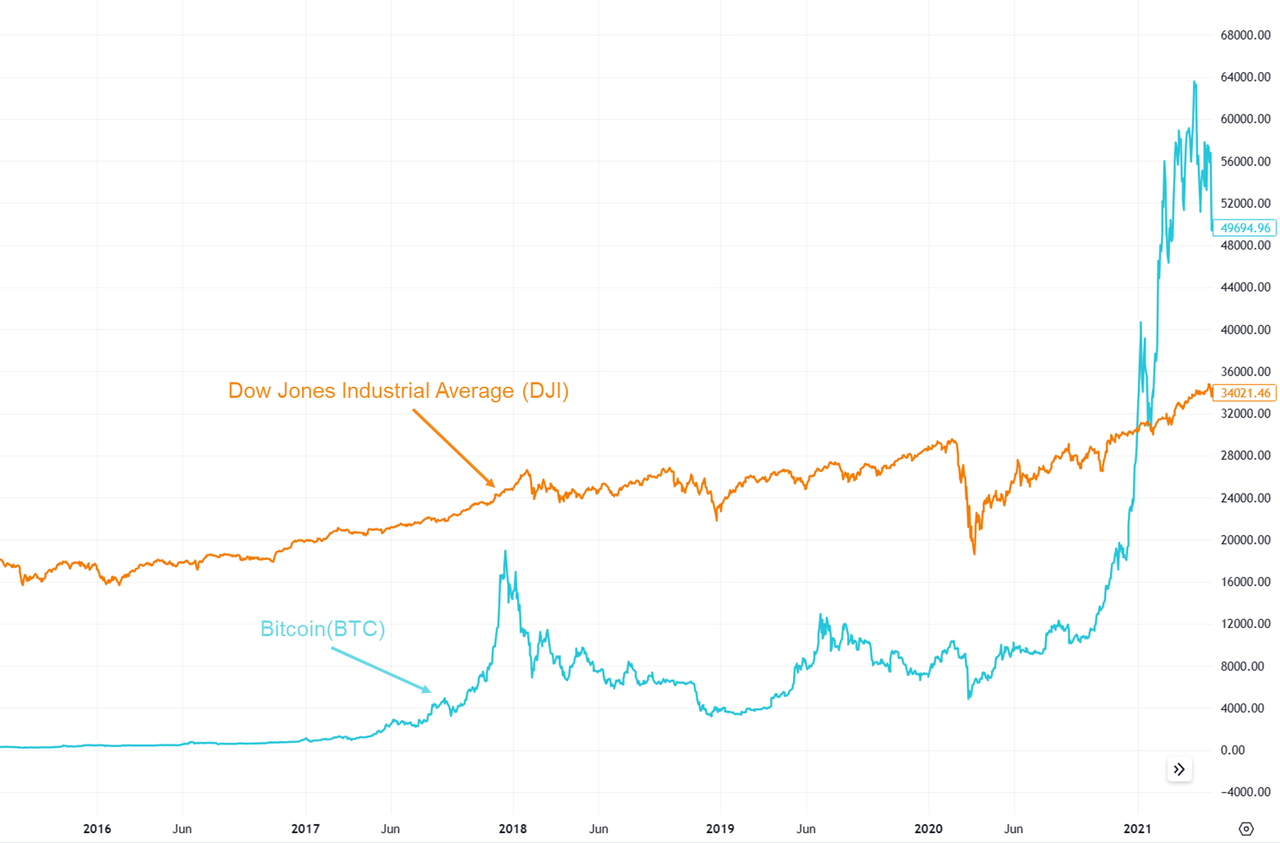

From the historical review of Bitcoin halving, we know that the time span between Bitcoin block rewards after halving and hitting new historical price highs is getting longer and longer. In contrast, between 2017 and 2020, the time span between the highs and lows of Bitcoin and the Dow Jones Industrial Average became smaller and smaller, and the two followed similar trends. The reason why we remain skeptical about the 4-year bull market cycle of Bitcoin halving is because the price trend is actually more closely integrated with the Dow Jones Industrial Index, which means that Bitcoin and U.S. stocks have a higher correlation within a certain period, and the Bitcoin block The reward halving might just be a lucky moment.

Another supporting argument is that Bitcoin was born after the 2008 economic crisis, coincidentally at the end of a Kitchin cycle. Whether it is Satoshi Nakamoto’s ingenious design or an amazing coincidence, the Bitcoin halving cycle happens to be every four years, corresponding to the 3-4 year Kitchin cycle.

Bitcoin mining companies also played a certain role in promoting the previous rounds of the bull market. In the previous bull markets, the market value of Bitcoin was still relatively small and the price was relatively easy to control. Therefore, in order to make up for the reduced profits caused by the Bitcoin halving, Bitcoin mining companies will push the price of Bitcoin. Now, as the market value of Bitcoin continues to rise, the difficulty and cost of manipulating prices are increasing.

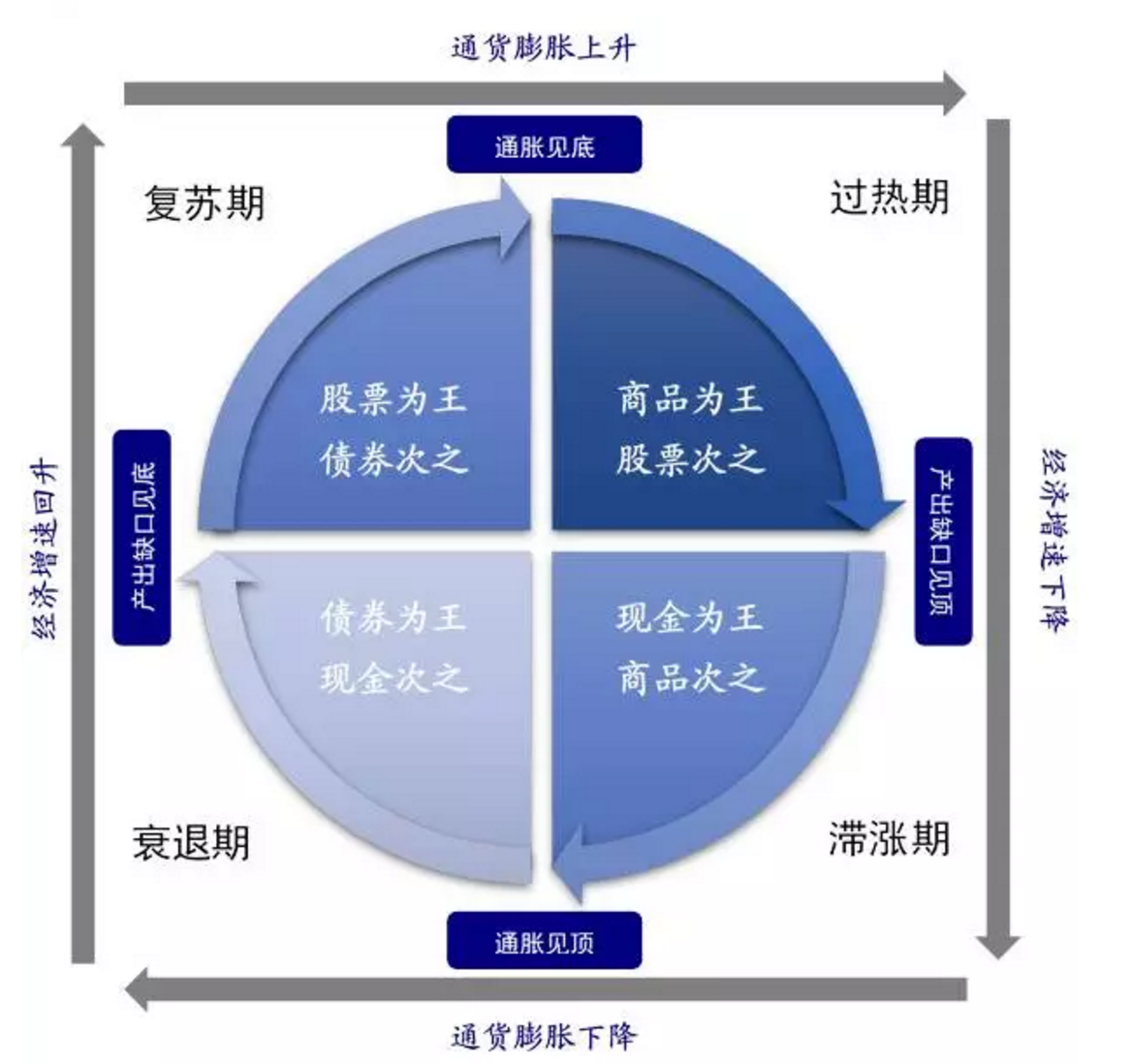

The Cyclical Trader’s Artifact: Merrill Lynch Clock

concept

Merrill Lynch Clock is an investment theory invented by Merrill Lynch in 2004. It is a classic cyclical investment methodology based on historical financial data and mature financial analysis framework. The Merrill Lynch Clock will guide us on what assets we should invest in at different stages.

It divides the financial cycle into 4 stages:

Stocks in the recovery period (high GDP + low CPI) are the best

During the overheating period (high GDP + high CPI), bulk commodities are optimal

During the stagflation period (low GDP + high CPI), it is best to hold cash

Bonds are optimal during recession (low GDP + low CPI)

How to take advantage of the Merrill Lynch Clock

The cycle point we are at now: Stagflation ==> Recession

According to the latest U.S. economic data, we are in a period of slow transition from low GDP + high CPI to low GDP + low CPI. The major investment opportunity at this stage is cash. This is why dollars are scarce now and it is difficult for startups to raise funds.

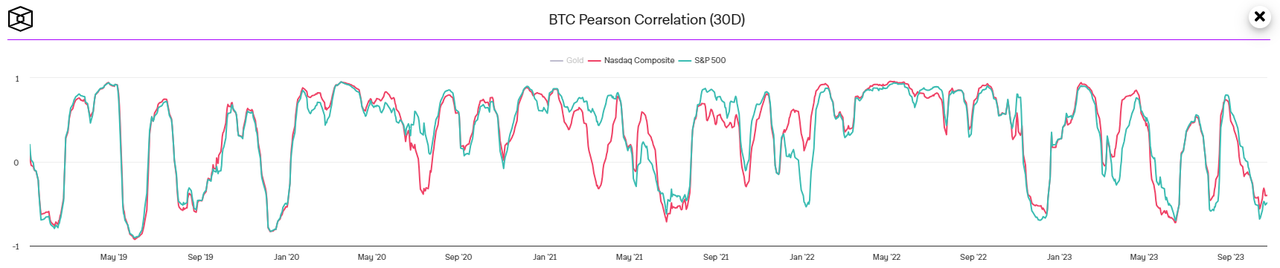

To determine at what stage we can invest in crypto-assets, we first need to classify them into asset types. Bitcoin has dual characteristics of risk and hedging. Bitcoin can be classified as a risk asset due to its large fluctuation range, and it has hedging properties due to its decentralization and censorship resistance. Since the trend of Bitcoin is highly correlated with the trend of U.S. stocks, we discuss Bitcoin as a risk asset here.

According to the Merrill Lynch clock, the Bitcoin bull market will reach the recovery period or overheating period of the Merrill Lynch clock.

Of course, this does not mean that there are no periodic investment opportunities. We just analyzed the coming bull market in the crypto market from the perspective of the Merrill Lynch clock cycle.

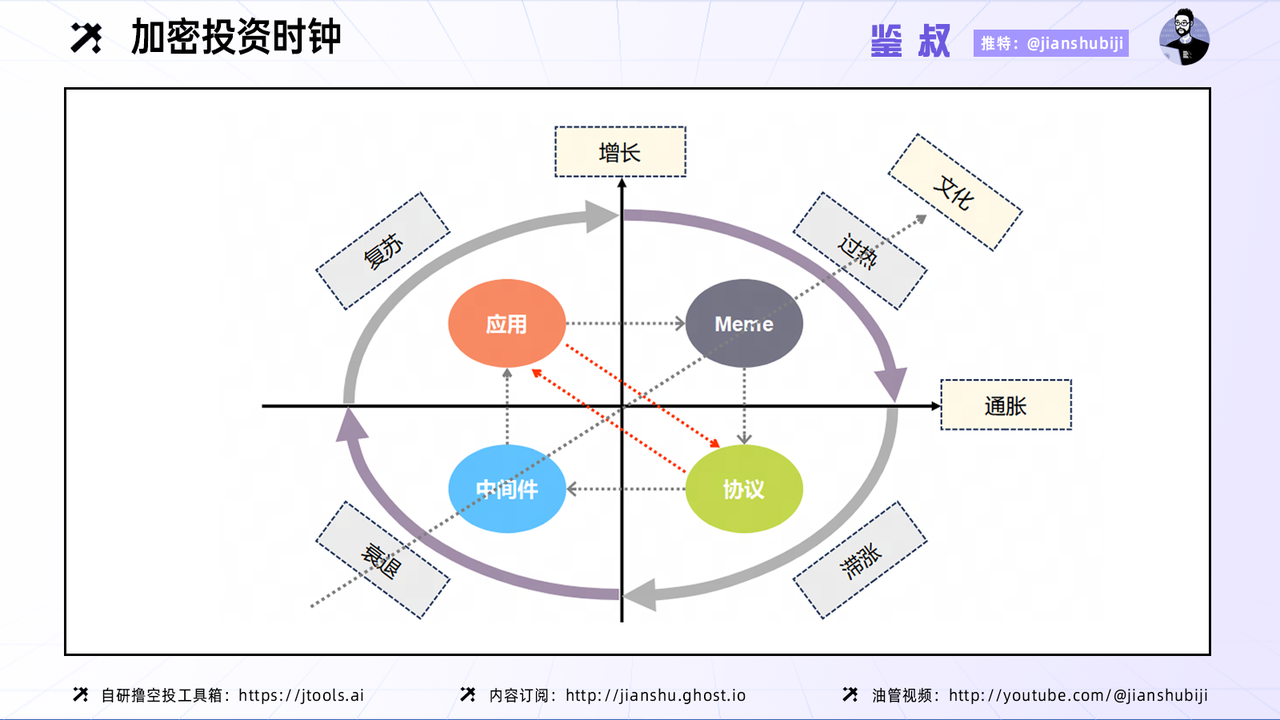

Crypto Merrill Lynch Clock

Based on the Merrill Lynch Clock, we created the Merrill Lynch Clock for the crypto market, designed to help investors make crypto asset choices at different stages.

In addition to inflation and growth, we identified a third factor influencing crypto markets that we believe is a unique dimension to measure in the cryptocurrency space: culture. There is no doubt that Meme has the most cultural attributes, while at the other end of the axis, tool middleware is the least cultural. Whether it is the public chain itself or the protocols on the public chain, we can more or less feel the differences in development and user experience brought about by different cultural attributes. Therefore, we venture to speculate that the invisible hand of culture is also subtly influencing cryptocurrency cycles.

The following is an introduction to each period:

Recovery period: low inflation → medium inflation, medium growth → high growth. The accumulation of underlying technologies and the iteration of middleware during the long bear market have prepared us for the explosion of the application layer. In addition, inflation has bottomed out and the expected improvement in the economy will also attract more funds and users to enter, making applications that are easier to use and understand logically become the most outstanding asset class at this stage.

Overheating period: medium inflation → high inflation, high growth → medium growth. As inflation continues to intensify and market enthusiasm gradually reaches its peak, the market has overdrafted the technology accumulation + application explosion brought about by high growth expectations, and lacks sufficient innovation reserves to drive the market forward in the short term. Capital has reached a bottleneck under the narrative of fundamental analysis. The reason why Meme assets can shine is because their unique cultural narrative attributes carry the continuous inflow of capital and ignite the enthusiasm of investors.

Stagflation period: high inflation → medium inflation, medium growth → low growth. The carnival of a bull market often ends after inflation peaks. The bubbles caused by excessive growth are also fully released at this stage. The capital market will slowly return to rationality, and the prices of bubble assets will retrace sharply. At the same time, the market is also looking forward to finding new ones. Growth point, brewing the next narrative cycle. This moment should be sorted out after the wave recedes, leaving the core technology behind and standing on the shoulders of the infrastructure needed to nurture the next cycle outbreak.

Recession period: medium-term inflation → low inflation, low growth → medium growth. This will be the most difficult stage of the bear market, when the infrastructure as the next bull market growth engine is maturing, but due to the inactivity of the capital market, economic growth is still unable to be directly reflected on the market. Therefore, at this stage, we should pay more attention to the middleware that connects applications and protocols, and take the signs of middleware maturity and large-scale application as one of the signals for the start of the bull market.

To sum up, the encryption market will continue to experience the above four cycles, and the core links in the cycle will repeat the rotation of application-meme-protocol-middleware. The dominant applications of the previous cycle will gradually expand the ecosystem and become the infrastructure of the next cycle, and the infrastructure of the next cycle will breed new leading applications, and so on.

The market is still in the transition stage from stagflation to recession, and it is also a stage where blockchain infrastructure and protocols are constantly accumulating. When we invest, we should not only pay attention to prices, but also keep a close eye on the development trends of the industry. Alpha is always bred in the development of the industry.

Summarize

We cannot predict when the bull market will arrive, but we can always find some precursors to the arrival of the bull market from the clues in history. From the discussion in our previous article, it can be seen that whether the Bitcoin halving can bring about a bull market is an uncertain event. Although the halving reduces the supply from the supply and demand relationship, it is consistent with the fact that the price of LTC does not rise but falls after the halving. Yes, what really brings about the bull market is the confidence brought by the halving narrative rather than the halving itself.

There are always some news in the market that releases smoke bombs that affect our judgment, and the Merrill Lynch clock is an important tool for us to objectively analyze the market environment. Merrill Lynchs clock is not just a simple tool for judging cycles, it also contains the laws of market ups and downs. Only by following the laws and calmly analyzing the objective environment can we accurately control the market.

Looking at the cycle objectively, understanding and adapting to the cycle, and adapting to the utilization cycle are the keys to our survival in the dark forest of the encryption market.

Reference article:

3. Use 20 pictures to shatter the “Bitcoin halving cycle theory”