Not only did Santa arrive early this year, but he seemed to be staying for a long time.

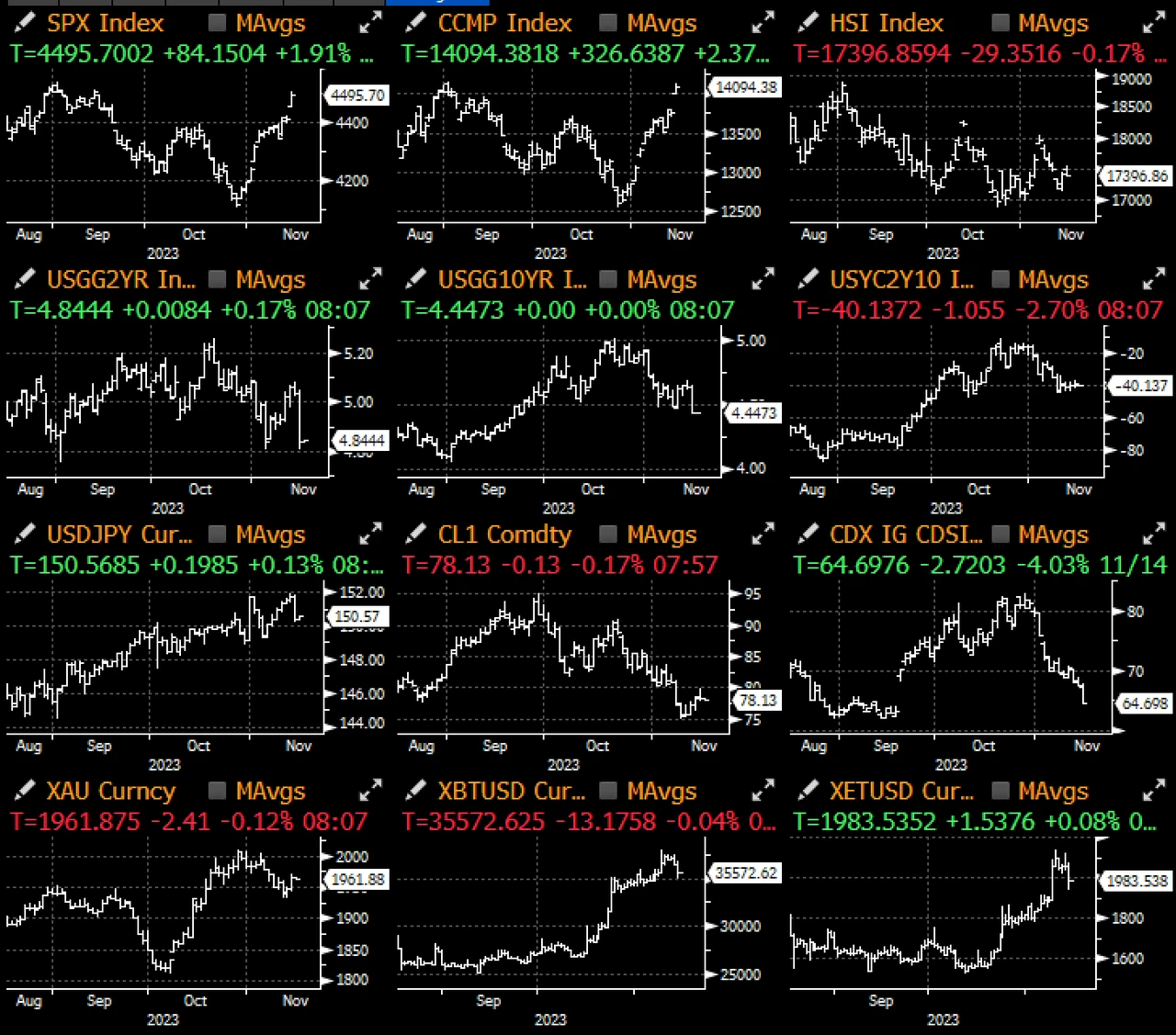

Much milder-than-expected CPI drove gains in markets yesterday, with the SPX up more than 2% and short-dated bond yields falling more than 20 basis points (!!), the biggest one-day move since the March banking crisis.

Core CPI increased by 0.23% month-on-month, lower than market expectations of 0.34%. There were even market forecasts of up to 0.4%. Among them, the owners equivalent rent and housing prices slowed more than expected, with a month-on-month increase of 0.4%, lower than expected. 0.6%, and the super core CPI (core services except housing) growth also fell from the previous value of 0.57% to 0.37%. In addition, the market had almost no expectations for the slowdown in CPI data, pushing risk assets throughout the The trading day has been trending higher.

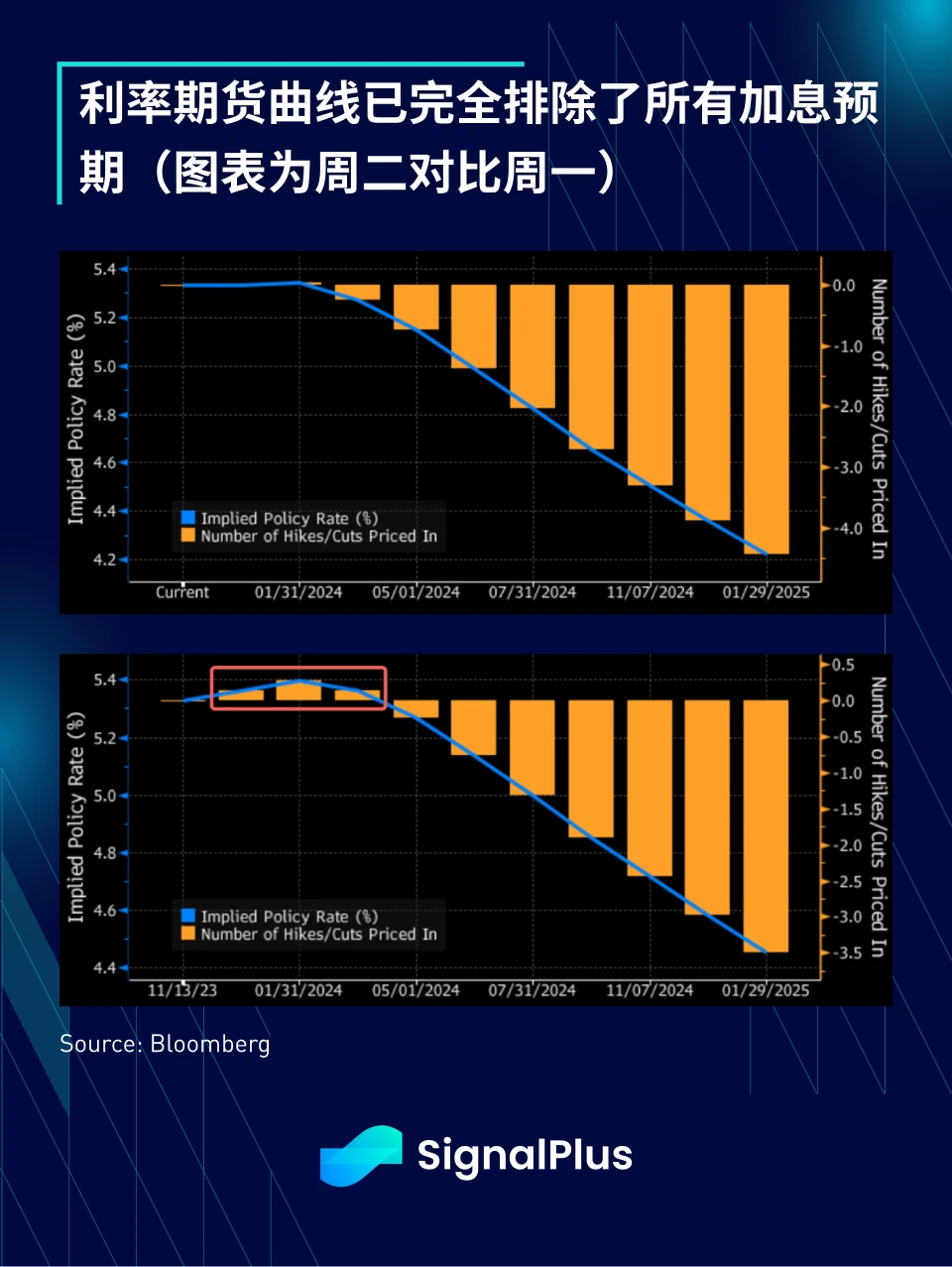

Although the Fed remains cautious about the stickiness of inflation, bond traders have immediately removed all rate hike expectations from the futures curve, leaving the only question remaining as to when and how much a rate cut will be in 2024.

After the 2-year U.S. Treasury yield plunged about 20 basis points at the close, the largest one-day drop since the March banking crisis (yields fell, prices rose), the fixed income market rebounded relentlessly yesterday, with U.S. investment grade CDS also narrowed sharply, retracing almost all of Septembers movement and returning to its narrowest level all year.

As expected, the stock market rose following interest rate trends. In particular, home builders are expected to benefit from the decline in capital costs. In addition, the real estate market remains tight. The U.S. home builder index experienced the largest increase of the year, rising by more than 5%. .

Other sectors joined in the celebration, with the overall SP 500 up 2% and 93% of its components rising, with every sector posting gains, even the beleaguered health care and energy sectors. Additionally, with interest rates appearing to have peaked and concerns about Treasury supply being pushed into next year (thanks, Secretary Yellen!), the traditional 60/40 portfolio has gained 5% over the past month, spanning Asset classes rose in tandem.

Finally, speaking of delays, the U.S. House of Representatives passed a last-minute continuing resolution to extend government funding at current levels through January/February 2024 without other policy changes, and the Senate will likely also pass this Friday. passed the bill before the deadline, once again delaying the possibility of a government shutdown until January next year.

In a scenario where inflation is slowing, corporate earnings are growing (albeit with a weak outlook), policy rates are peaking, there is a strong consensus for a soft landing for the U.S. economy, trading technicals are strong, there are no concerns about a government shutdown by the end of the year, and there is hope for improving U.S.-China relations Next, the market may continue to maintain a buy-on-the-dip status, and the stock market rally may be a bit excessive in the short term. However, there are not many catalysts to trigger a large-scale sell-off. We expect the positive macro sentiment to continue this year, at least for a long time. Until U.S. fiscal worries resurface.

In terms of cryptocurrency, this week has entered the critical window period for BTC ETF approval. Prices have ignored macro trends and major currencies have retraced about 3% from their highs. We have no expectations for the time of approval and prefer to hold on to the current situation. Be cautious, even if approved, ETF-led inflows will still take several quarters to materialize, and in any case, hope that the market’s Santa Claus will be as generous and friendly to cryptocurrencies as he has been to TradFi.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com