BTC Weekly Report - BRC-20 is about to update a new version; the currency price rises to a high of 37,000 (11.6-11.12)

Organize - Odaily

Edit - 0xAyA

1. Market transactions

1. Spot market

The price of BTC continued to perform well last week, breaking through the key range of 34,000-35,000 US dollars and once reaching the gate of 38,000 US dollars. Market sentiment is still high. As of press time, BTC was temporarily trading at $36,988, with an increase of 5.86% in the past week.

Currently, the BTC price is in a state of sideways adjustment after moving up and down within the 4-h level window, and the market is waiting for further news to push.

The strong performance of BTC price last week has been impressive. The move above the key $34,000-$35,000 range and briefly breached the key resistance at $38,000 showed strong buying support and positive sentiment in the market. The current sideways adjustment of BTC price within the 4-hour window rather than a heavy-volume correction also means that the market has enough funds and sentiment to digest the increase. The market seems to be waiting for further news driven by factors such as macroeconomic data or industry dynamics to attack the door of $40,000.

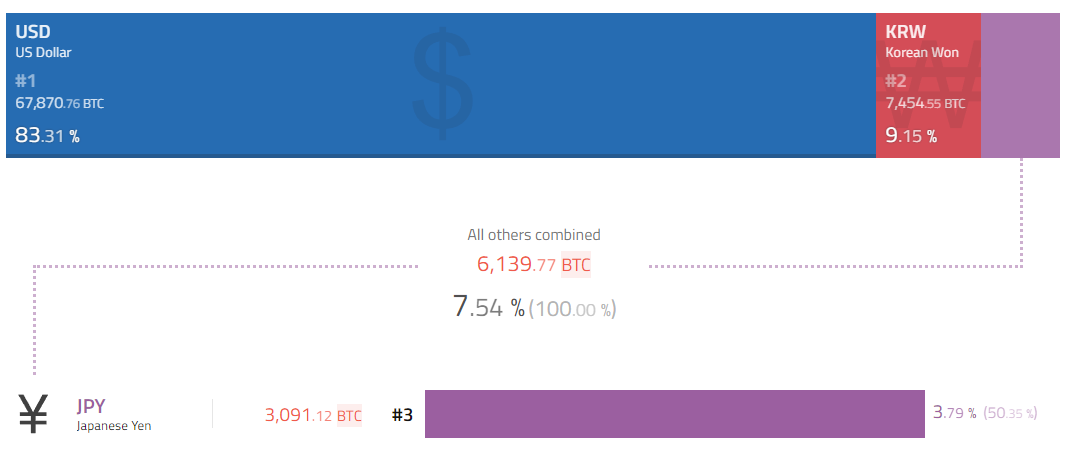

in this weeksBTC to fiat currency tradingAmong them, the US dollar still ranks first, occupying 83.31% of the entire trading market, a decrease of 3% from last week; the Korean won ranks second, occupying 9.15% of the market share, a month-on-month increase of 2.32%; the remaining legal currencies are against BTC The total amount of transactions accounted for 7.54%, with the Japanese yen ranking third.

2. GBTC performance

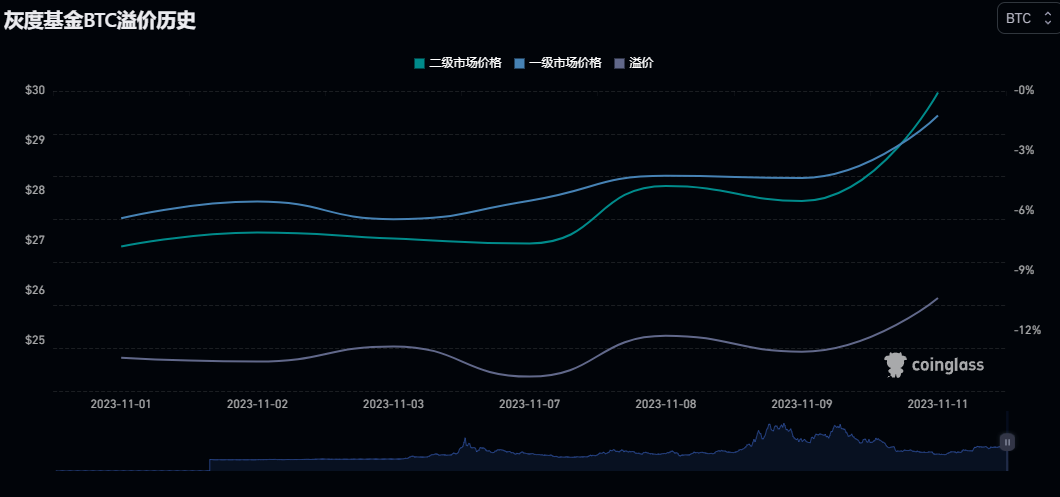

this weekGBTCThe discount is still narrowing, with the primary market price at $33.43 per share and the secondary market price at $29.97 per share. The discount level narrowed from 12.77% last week (November 3) to 10.35% (November 13) . The most critical news is whether the application for spot ETF can be successfully passed next week, and OTC funds are more willing to buy Bitcoin through GBTC.

3. Futures

In terms of BTC perpetual contract funding rates, the USDT contract funding rate on HTX is the highest at 0.0891%, and Binance is the lowest at 0.0114%. The quarterly delivery price continues to maintain a positive premium, ranging from 37,600 to 38,000 US dollars. The delivery order price of 240927 on Deribit has reached 39,600 US dollars, indicating that investors in the market are very optimistic about the trend of Bitcoin in the next year, and their positions remain Stay bullish on BTC. In terms of BTC contract holdings, CME surpassed Binance for the first time to rank first, with a holding of $4.18 billion; followed by Binance, with a holding of $3.89 billion; Bybit ranked third, with a holding of 2.72 billion Dollar.

4. Options

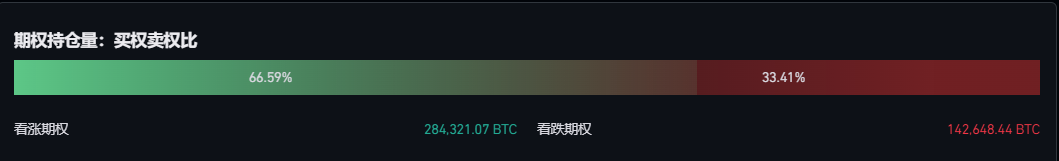

Total BTC holdings this weekIt was US$101.217 billion, a decrease of 6.90% compared with the same period last week. In terms of option holding ratio, call options account for 66.59%, while put options account for 33.41%. Compared with last week, the proportion of call options has decreased, but it still does not affect the markets bias towards bullish BTC. In terms of specific positions, the total position of call options is 284,321.07 BTC, while the total position of put options is 142,648.44 BTC. The dominance of call options in the market remains unchanged.

2. Mining

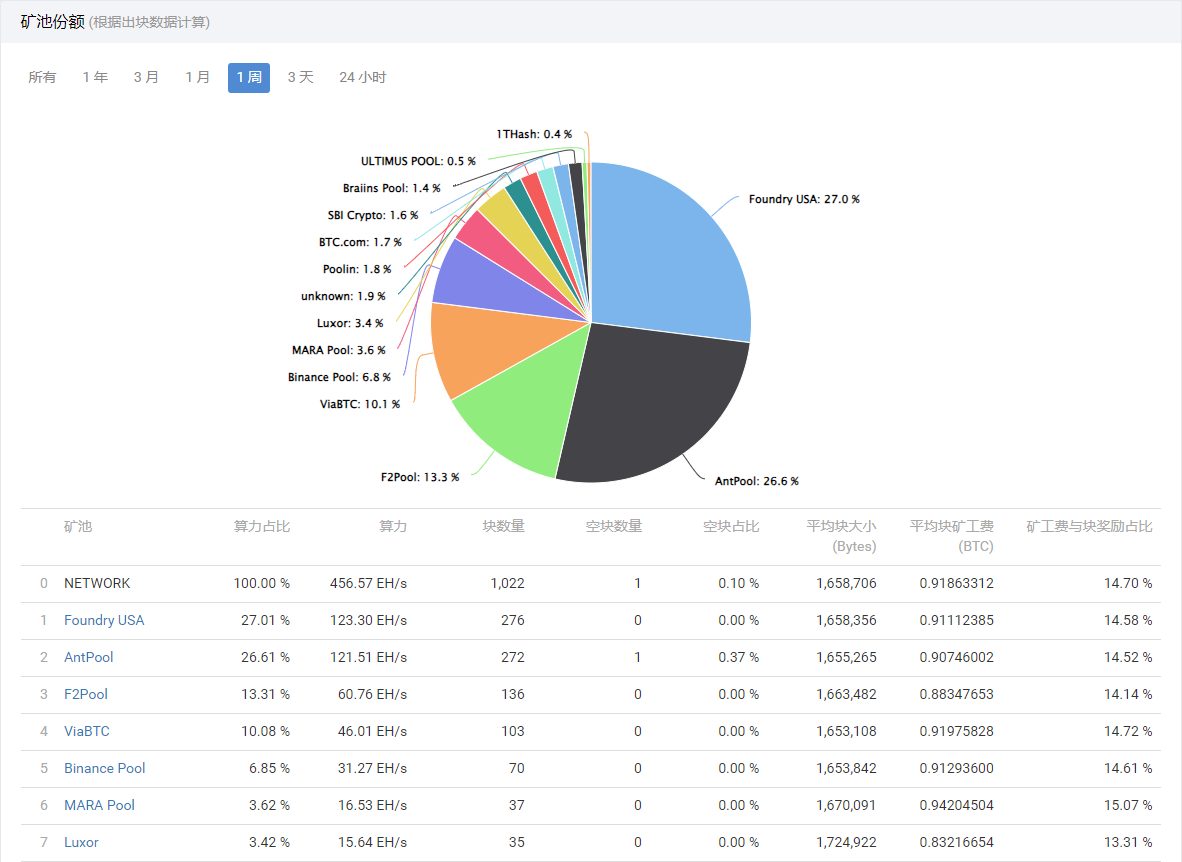

according toBTC.comAccording to the data, the BTC network computing power this week was 456.57 EH/s, a decrease of 3.74% from last week. 7 days ago, the difficulty of the entire BTC network increased by 3.55%. In 6 days, the difficulty of the entire network is expected to decrease by 0.20%, as shown below:

The top three mining pools are still Foundry USA, AntPool and F 2 Pool, accounting for 27.01%, 26.61% and 13.31% respectively. As follows:

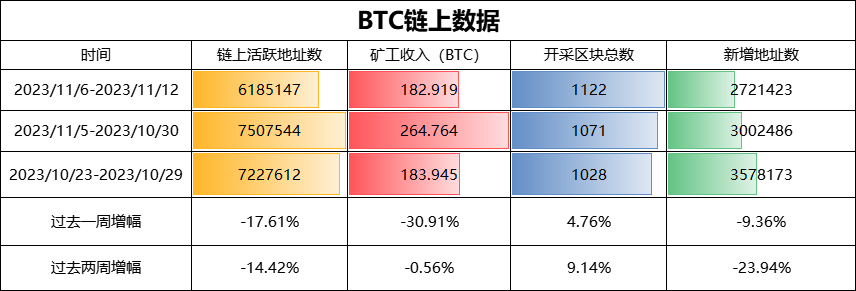

glassnodeData shows that the number of active addresses on the BTC chain in the past week was 6,185,147, a year-on-year decrease of 17.61%; miners income was 182.919 BTC, a year-on-year decrease of 30.91%; the total number of mined blocks was 1,122, a year-on-year increase of 4.76%; the number of new addresses was 2,721,423 , a year-on-year decrease of 9.39%. As follows:

Taken together, the data performance on the chain has experienced a large-scale retracement this week, and the overall performance of each data has decreased compared to last week. Whether the Inscription ecology can continue to be hot in the future and drive the overall increase in data on the chain remains to be seen. is unknown.

3. Ecological Progress

(1)Oridnals

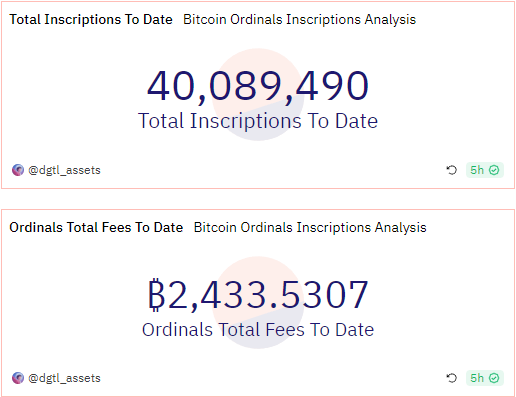

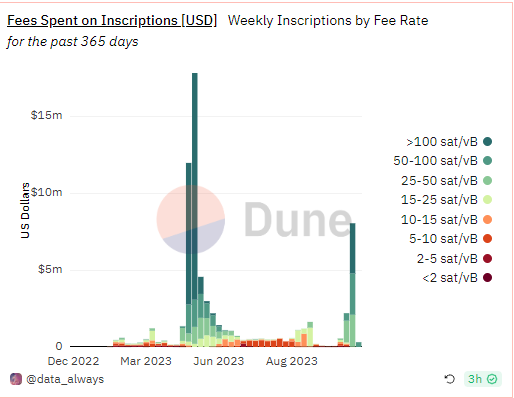

Data Display, the total number of inscriptions minted by Oridnals has reached 4.008 million, and the total fees incurred so far have reached 2,433.5 BTC, equivalent to approximately US$90.28 million.

inscriptionOn the other hand, the BRC-20 ecosystem continues to develop. This week, inscription revenue and expenses reached a high of US$8.057 million, a year-on-year increase of 265.4%.

BRC-20 founder domo posted on the X platform that version 0.9 Freeze will be updated to the BRC-20 document at block height 816000. This is the first update in seven months, highlighting the importance of simplicity and trust in maintaining consensus. . According to the official documentation Proposal page, The Freeze is a standardization of the indexer taking into account past issues in older versions of Ord and anticipated major updates to ensure consistent inscription validity and state stability in BRC-20.

DWF Labs: Looking for BRC 20 projects, wallets and markets, interested parties can chat privately

DWF Labs co-creator Andrei Grachev posted on the X platform that he is looking for BRC 20 projects, wallets and markets. Interested parties can chat privately.

UniSat Wallet: Addresses with 1000+ UniSat points now have access to brc 20-swap

UniSat Wallet posted on the X platform that addresses with 1,000+ UniSat points can now access brc 20-swap through unisat.io/swap. Additionally, brc 20-swap withdrawal functionality is now enabled.

(2) Lightning Network

ZeroSync leader proposes decentralized file hosting system incentivized by Bitcoin payments

Robin Linus, leader of the ZeroSync project and BitVM developer who aims to introduce zero-knowledge proofs to Bitcoin, released the document BitStream: Decentralized File Hosting Incentivized by Bitcoin Payments, proposing a decentralized file hosting incentive system that does not require Rely on trust or heavyweight cryptography. The client and server perform atomic swaps of coins using the optimistic protocol. The server responds with a file that it says is properly encrypted. The client pays for the decryption key through the Lightning Network. If the file cannot be decrypted correctly, the client can financially punish the cheating server, which has a strong incentive for the server to act honestly.

(3) Other projects:

Liquidity aggregator protocol Orion: Scorpio Ethscriptions Relayer launched

Decentralized liquidity aggregator protocol Orion said that Scorpio Ethscriptions Relayer has been launched to bring DApp applications from the traditional Ethereum ecosystem into the Ethereum inscription system by bridging dumb contracts and smart contracts. In addition, Scorpio has released the Ethscriptions inscription token scop as the only token in its ecosystem.

4. Other news

10,000 BTC transfer is organized by Binance’s internal wallet

Arkham data shows that at 17:06:08 on November 9, Beijing time, 10,000 BTC were transferred from Binance cold wallet to Binance hot wallet. Another 30041.05 BTC were transferred from the Binance cold wallet to the address starting with 3 F 9 CG.

CZ: Last year, the price of Bitcoin today was $15,588. Buying at that time was considered “lucky”

CZ posted an article on the BTC is temporarily trading at 36763.6 USDT, with an increase of 0.41% in the past 24 hours.

Bitwise CIO: The impact of spot Bitcoin ETF has not yet been digested by the market

Matt Hougan, chief investment officer of Bitwise, said: “The impact of the (spot) Bitcoin ETF has not been digested by the market because people who intend to buy this ETF do not know that it will come, or is likely to come; as a natural audience for BTC ETF, the majority Most advisors dont expect it to arrive until 2025 or later; if people who are going to buy this ETF dont think its going to be approved in the next two months, then I dont see how its going to be priced into the market. He It is also claimed that the ETF will play an important role in opening up cryptocurrency investment exposure to a wider range of investors, especially financial advisors who manage the majority of wealth in the United States.

MicroStrategy co-founder Michael Saylor recently gave a comprehensive outlook on the future development trajectory of BTC at the 2023 Australian Cryptocurrency Conference. He talked about the BTC halving event in 2024 and predicted that next year will be crucial for BTC, and it will become a mainstream asset in its adolescence stage by the end of next year. Looking forward to 2024-2028, Saylor expects BTC to enter a high-growth stage, and it is expected that the global large technology industry and large banks will widely adopt BTC and integrate it into their respective products and services. In addition, he also pointed out that major financial institutions such as JPMorgan Chase, Morgan Stanley, Goldman Sachs, Bank of America, and Deutsche Bank may be involved in activities such as issuing loans, providing mortgages, customizing, and buying and selling Bitcoin. From a long-term perspective of approximately 25 years, Saylor predicts that BTC will dominate among all high-quality assets, highlighting its potential to outpace the growth of the SP 500 and diversified portfolios.