Organize - Odaily

Edit - 0xAyA

1. Market transactions

1. Spot market

The price of BTC has been soaring last week, climbing all the way to the key range of $34,000-35,000. However, BTC prices have fluctuated and consolidated within this range this week. As of press time, BTCs quotation has temporarily stabilized at around $35,100, with an increase of 1.42% in the past week

Currently, the BTC price is still in a state of sideways adjustment within the 4-h level window, and the market is waiting for further emotional fermentation.

This weeks price fluctuations show the markets uncertainty about the future trend of BTC, and funds on and off the market are still waiting for key information such as the passage of spot ETFs. Although the price fluctuates within the key range, we can also see that the market remains optimistic about the overall trend of BTC. This fluctuation and consolidation is the market balancing between finding a reasonable positioning of the price and the buying and selling power of market participants. process.

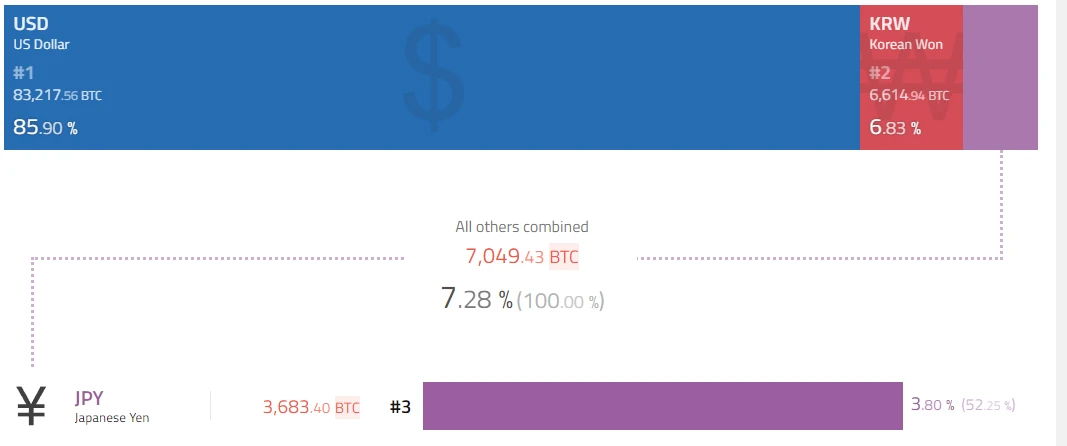

in this weeksBTC Trading against fiat currencyAmong them, the US dollar still ranks first, accounting for 85.9% of the entire trading market, while the Korean won ranks second, accounting for 6.83% of the market share, showing the rising trend of Korean investors interest and participation in BTC. The total amount of transactions between other legal currencies against BTC accounted for 7.28%, among which the Japanese yen ranked third.

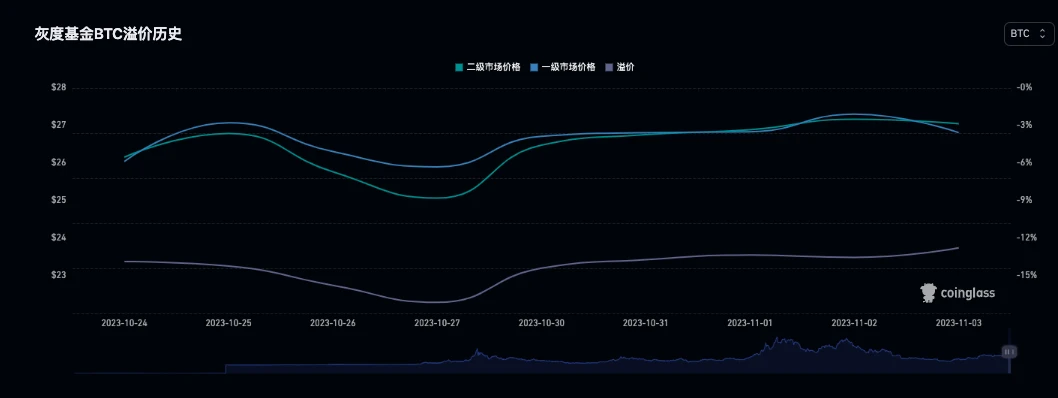

2. GBTC performance

this weekGBTCStill maintaining a low negative premium level, the primary market price was reported at $25.84 per share and the secondary market price was reported at $22.45 per share. The discount level narrowed from 17.22% last week (October 27) to 12.77% (November) 3 days). The slowdown in macro-level conflicts and the news of spot ETFs have given GBTC a shot in the arm, which is why the market chose to buy GBTC.

3. Futures

In terms of BTC perpetual contract funding rates, the USDT contract funding rate on dYdX is the highest, reaching 0.04%, while Binance and OKX have the lowest funding rates, only 0.01%; BitMex’s currency-based funding rate is the highest, reaching 0.021%, and OKX’s lowest is only -0.0021%.

Quarterly delivery prices generally show a positive premium, with prices ranging from the 35,300-35,000 line, showing that investors in the market remain optimistic about future trends, and most positions are still bullish on BTC.

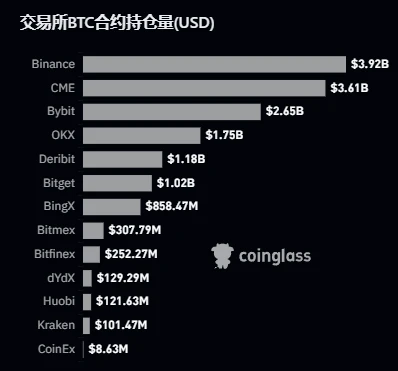

In terms of BTC contract holdings, the top three exchanges are:Binance ranks first with a holding of $3.92 billion; followed by GME with a holding of $3.61 billion; Bybit ranks third with a holding of $2.65 billion.

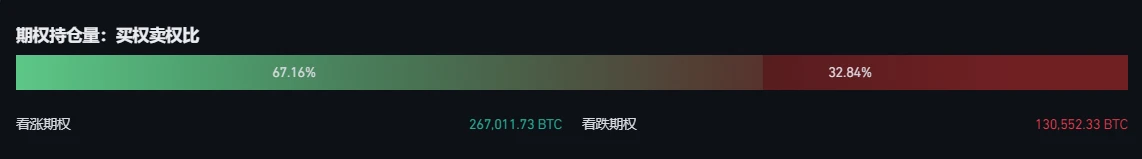

4. Options

this week BTC Total positionsIt was US$108.726 billion, a decrease of 2.60% compared with last week. In terms of option holding ratio, call options accounted for 67.16%, while put options accounted for 32.84%. This shows that investors’ expectations for the future price of BTC are still bullish. In terms of specific positions, the total position of call options is 267,011.73 BTC, while the total position of put options is 130,552.33 BTC, which further confirms the dominance of call options in the market.

2. Mining

according toBTC.comAccording to the data, the BTC network computing power this week is 474.33 EH/s. 7 days ago, the difficulty of the entire BTC network increased by 2.35%. After 6 days, the difficulty of the entire network is expected to continue to increase by 2.55%, as shown below:

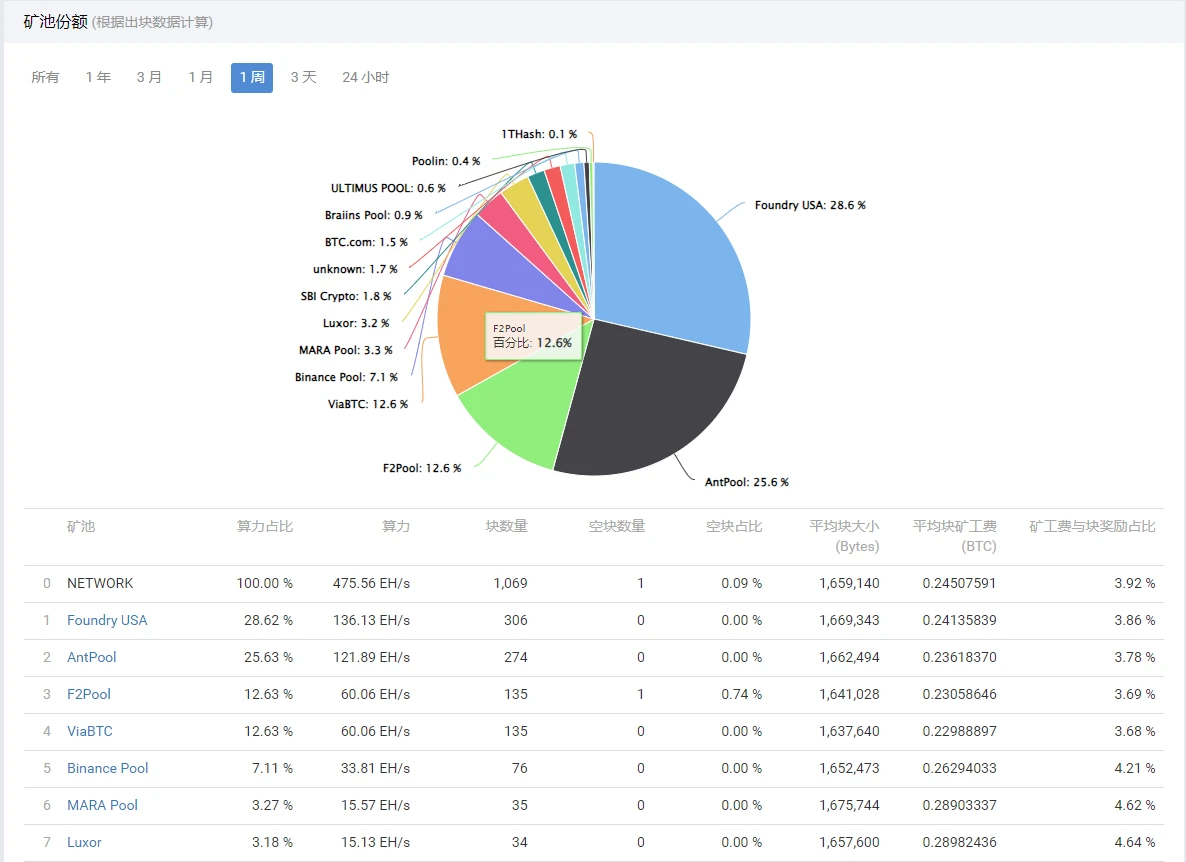

The top three mining pools are Foundry USA, AntPool and F 2 Pool, accounting for 28.62%, 25.63% and 12.63% respectively. As follows:

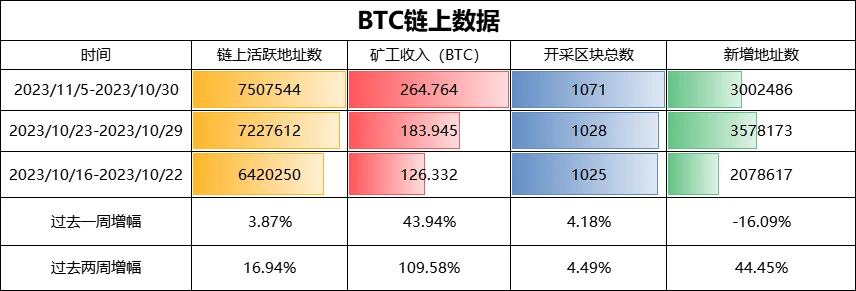

glassnodeData shows that the number of active addresses on the BTC chain in the past week was 7,507,544, a year-on-year increase of 3.87%; miners received 264.764 BTC, a year-on-year increase of 43.94%; the total number of mined blocks was 1,071, a year-on-year increase of 4.18%; the number of new addresses was 3002486, a year-on-year decrease of 16.09%. As follows:

Taken together, the performance of on-chain data this week is still very strong. Although the number of new addresses has declined, the popularity of the Inscription ecology and the rise of the market have caused miners income to skyrocket. In the past two weeks, miners income has increased by 109.58%, and it can The growth momentum of miners income will remain strong in the foreseeable period.

In terms of mining companies, BTC mining company Cipher Mining Inc. recently released its October operational update. The companys attack produced approximately 428 BTC, with an average daily output of 15 BTC, an increase of approximately 3% from last month. Meanwhile, the average monthly network hashrate increased by approximately 9% in October compared to the previous month. In addition, Cipher sold approximately 466 BTC in October, with a balance of approximately 516 BTC at the end of October, and was running a computing power of 7.2 EH/s at the end of the month.

3. Ecological Progress

(1)Oridnals

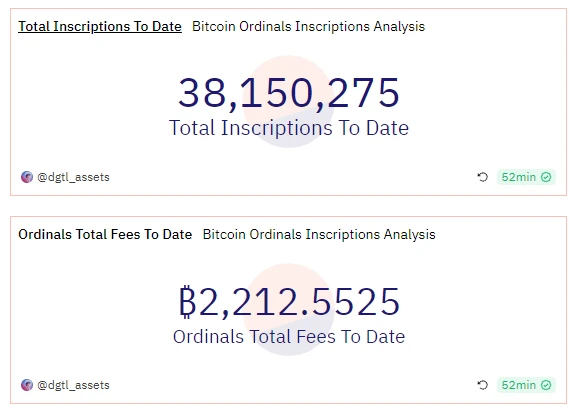

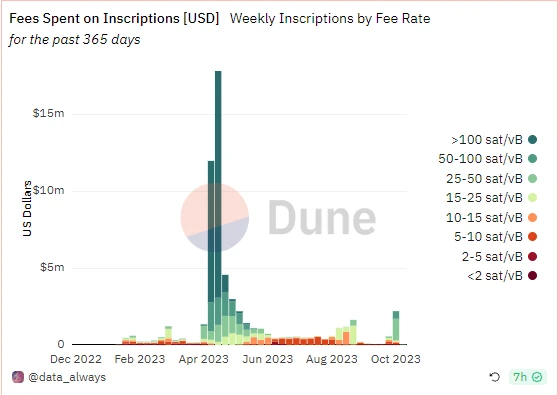

Data Display, the total number of inscriptions minted by Oridnals has reached 3.815 million, and the total fees incurred so far have reached 2,212.5 BTC, equivalent to approximately US$77.26 million.

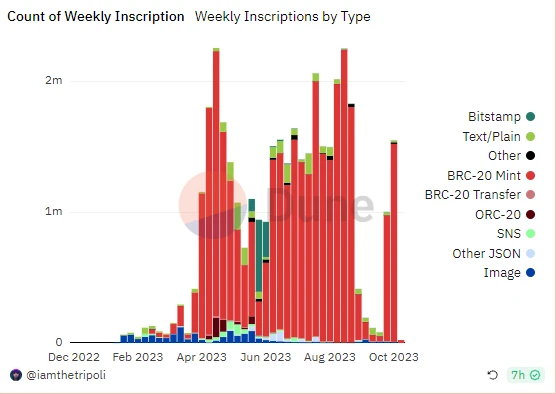

inscriptionOn the other hand, the surge in the number of inscriptions this week is mainly concentrated on the casting of BRC-20, and compared with the data two weeks ago, there is a very considerable surge. The rise of the market has also driven the prosperity of the inscription ecology to some extent, and this week Inscription revenue and expenses also reached US$2.204 million, a year-on-year increase of 396.3%

UniSat Wallet: brc 20-swap mainnet has been launched

UniSat Wallet posted on the X platform that the brc 20-swap mainnet has been launched. Previously, UniSat Wallet issued a statement stating that after careful study, it has decided to include 14 inscription assets in the first batch of support lists for the brc 20-swap mainnet launch. The 14 inscription assets are .sats, .ordi, .trac, .oshi, .btcs, .oxbt, .texo, .cncl, .meme, .honk, ..bit, .vmpx, .pepe and .mxrc. UniSat said that in the initial stage of the brc 20-swap mainnet launch, an on-demand transaction model will be implemented: only when new users deposit related assets into brc 20-swap, withdrawal requests can be used.

(2) Lightning Network

Strike, a crypto payments app built on the BTC Lightning Network, has announced new features such as direct deposits, wire transfers, and card payments. Specifically include: 1. Support wire transfer, allowing Strike customers to transfer unlimited funds and purchase any amount of BTC, and all BTC can be withdrawn immediately; 2. Direct deposit, users can receive any part of their salary paid in BTC through Strike; 3. Expansion Supported payment methods, including debit cards and enhanced bank connection support; 4. Some customers can use Strike with its associated payment methods, no longer need to pay a deposit first, use debit cards for lightning payments, and use bank accounts Send BTC to cold wallet etc.

(3) Other projects:Atomicals

The Atomics Protocol is a simple and flexible protocol for minting, transferring and updating digital objects (traditionally known as NFTs) for Unspent Transaction Output (UTXO) blockchains such as BTC. Simply put, the Atomics Protocol is the first A protocol that uses the POW process to mine token inscriptions, everyone can personally use the CPU to mine tokens/fields/NFTs.

4. Other news

BTC15th anniversary of the white paper

On October 31, 2008, Satoshi Nakamoto published the genesis paper of BTC: BTC: A Peer-to-Peer Cash Payment System. It has been 15 years since then.

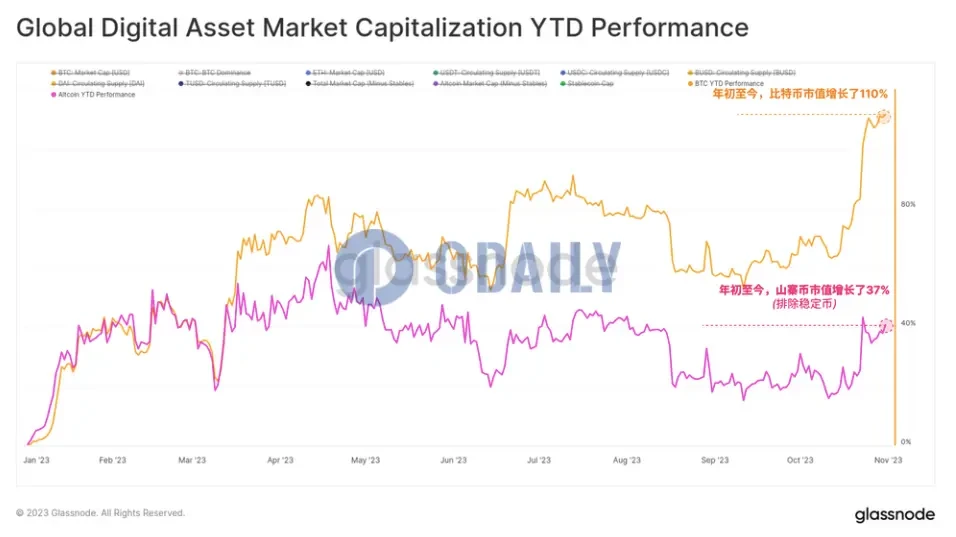

Glassnode’s latest chain weekly report shows that the digital asset market has achieved impressive returns in 2023, with BTC’s performance having significantly exceeded the performance of traditional assets, with its performance exceeding gold by 93% at its peak. The major digital asset’s market correction has been significantly smaller than in previous cycles, indicating investor support and positive capital inflows. The Altseason indicator shows the first significant appreciation against the US dollar since the highs of this cycle. However, it is worth noting that this is happening against the backdrop of continued rise in BTC dominance, which has risen from the cyclical low (38%) reached in late 2022, with BTC’s market cap increasing by 110% year-to-date, while Altcoin market capitalization (excluding stablecoins) increased by 37%.

SynFuturesLianchuang: BTC is expected to reach 47,000 USDT by the end of November

Rachel Lin, co-founder of decentralized derivatives protocol SynFutures, said that BTC is expected to reach 47,000 USDT by the end of November. Rachel Lin said: “Last week the ‘Uptober’ statement for October was confirmed, with BTC rising nearly 29%. What’s even more interesting is that when we look back at historical data, November tends to be better than October, with BTC’s average return More than 35%. If similar returns are achieved in November this year, we could see BTC reaching around $47,000. Rachel Lin pointed out: Particularly noteworthy is the surge in spot trading volume, and the increase in block trades exceeding $100,000. The significant increase is a clear sign of increased institutional interest as large players appear to be consolidating their positions in digital assets, particularly BTC.”

CoinbaseChief Operating Officer: Already ready to operate the BTC spot ETF after approval to enhance market liquidity and stability

Coinbase Chief Operating Officer Emilie Choi said in a conference call on Thursday: The BTC spot ETFs are ready to operate after approval. They should add credibility to the market and we should see liquidity and market stability. increase, as we have seen in other assets such as gold ETFs.