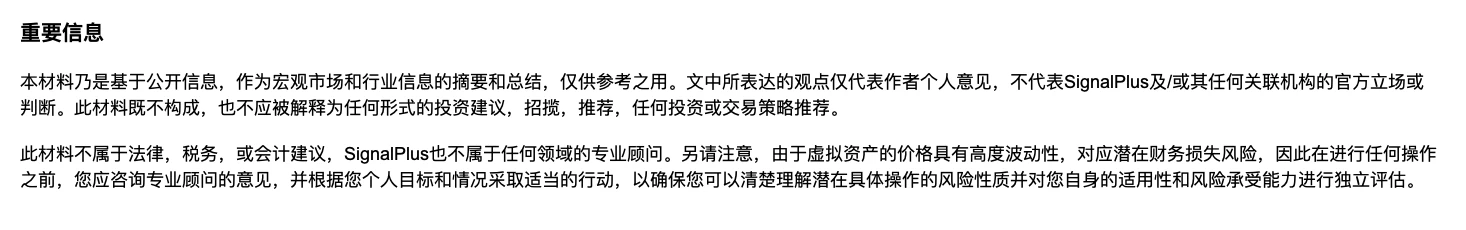

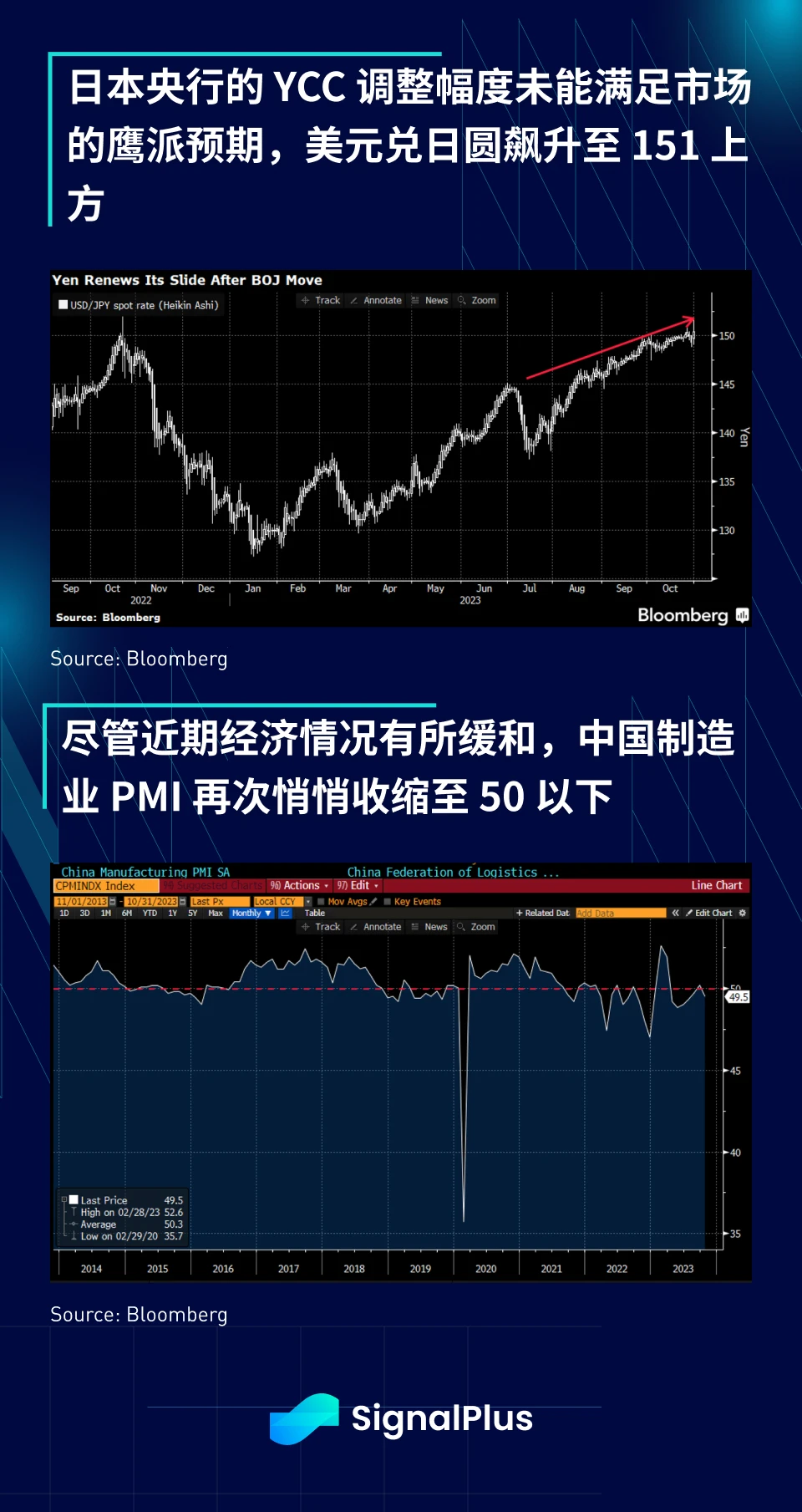

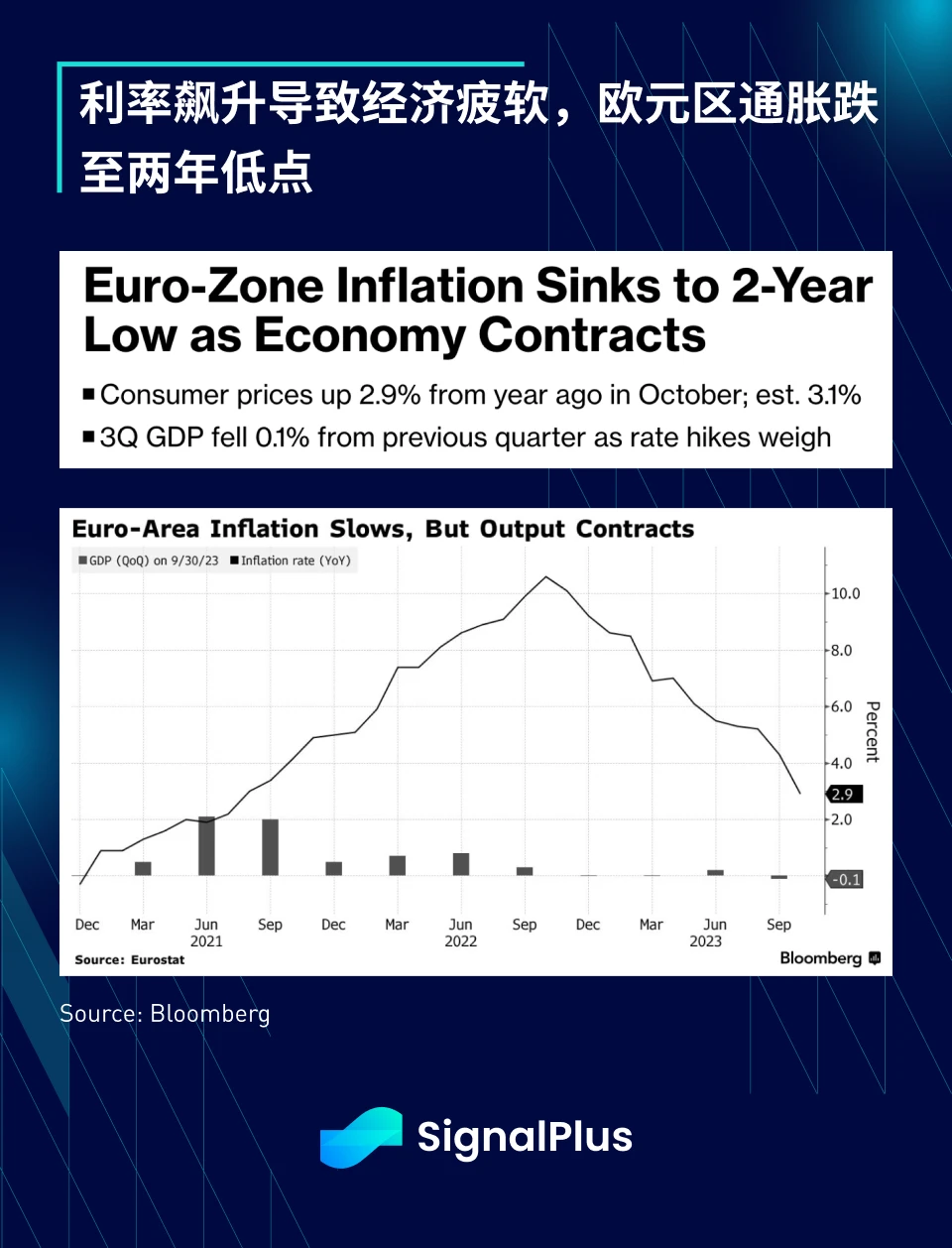

The much-anticipated adjustment of the Bank of Japans YCC failed to meet the markets hawkish expectations. Chinas manufacturing PMI once again fell below 50. Economic conditions in the Eurozone are faltering due to rising interest rates, and inflation fell to a two-year low. .

The Bank of Japan decided to add flexibility to fixed interest rate operations and officially set the 1% level as a reference target. However, Governor Ueda stated that it will still maintain large-scale repurchase operations to ensure that there is a scale under changes in the yield target. Supported by a larger balance sheet, the impact of the YCC adjustment is neatly cushioned; incidentally, this is very similar to the way other central banks manage currency prices against the US dollar or FX prices against a trade-weighted basket of currencies, and because of Japanese government bonds 95% is held by domestic investors, and the funds come from domestic sources. This approach has worked well for Japan.

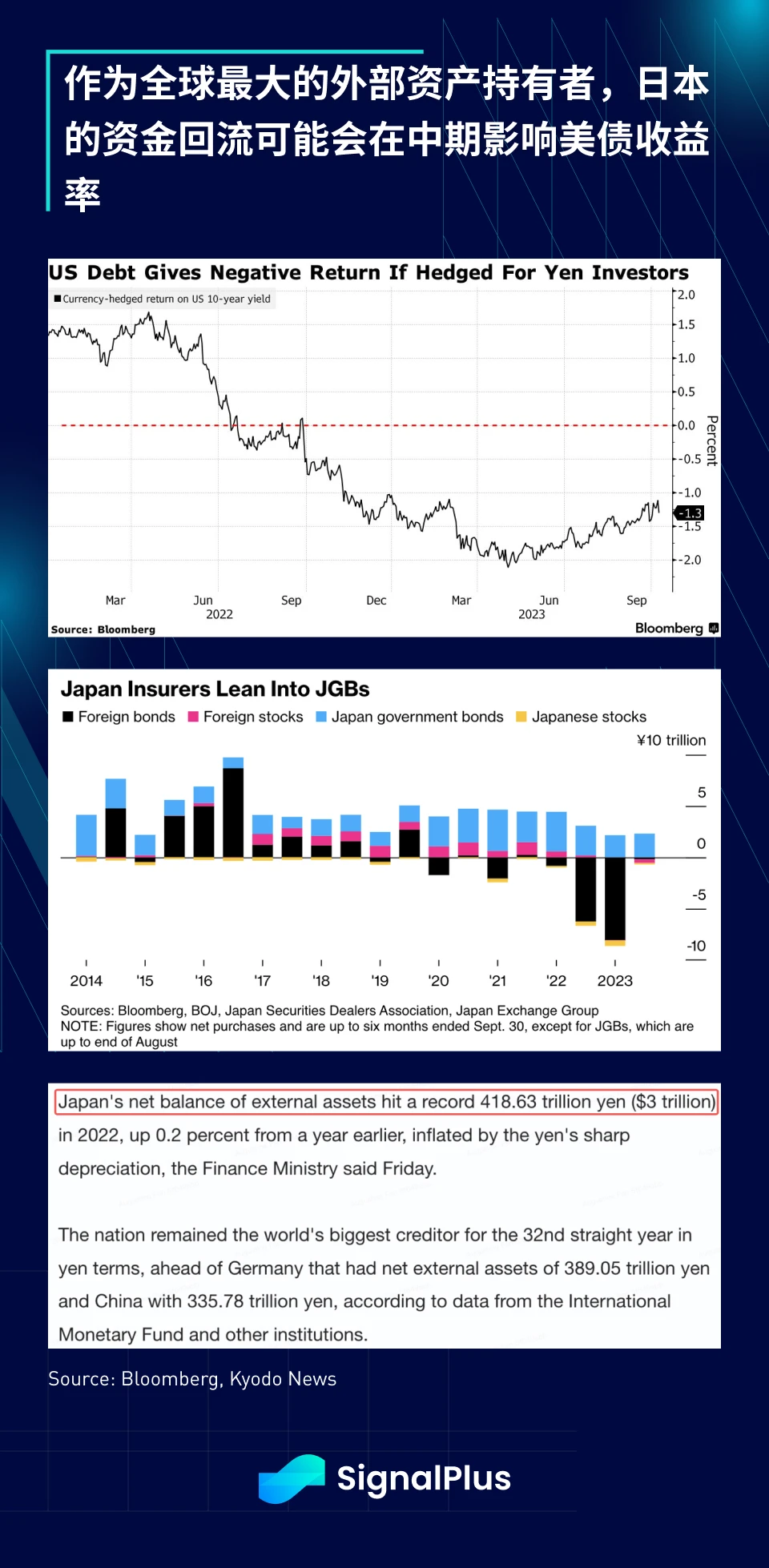

With the Bank of Japan still 6 months to 1 year away from fully exiting its zero interest rate policy, the yen interest rate differential may continue for a while, and the market has responded to this, with the dollar against the yen soaring above 151; but there is more urgency The concern is that given Japans status as the worlds largest external asset holder (creditor), the slow return of Japanese capital may have a negative impact on U.S. asset prices, especially U.S. debt and large technology stocks.

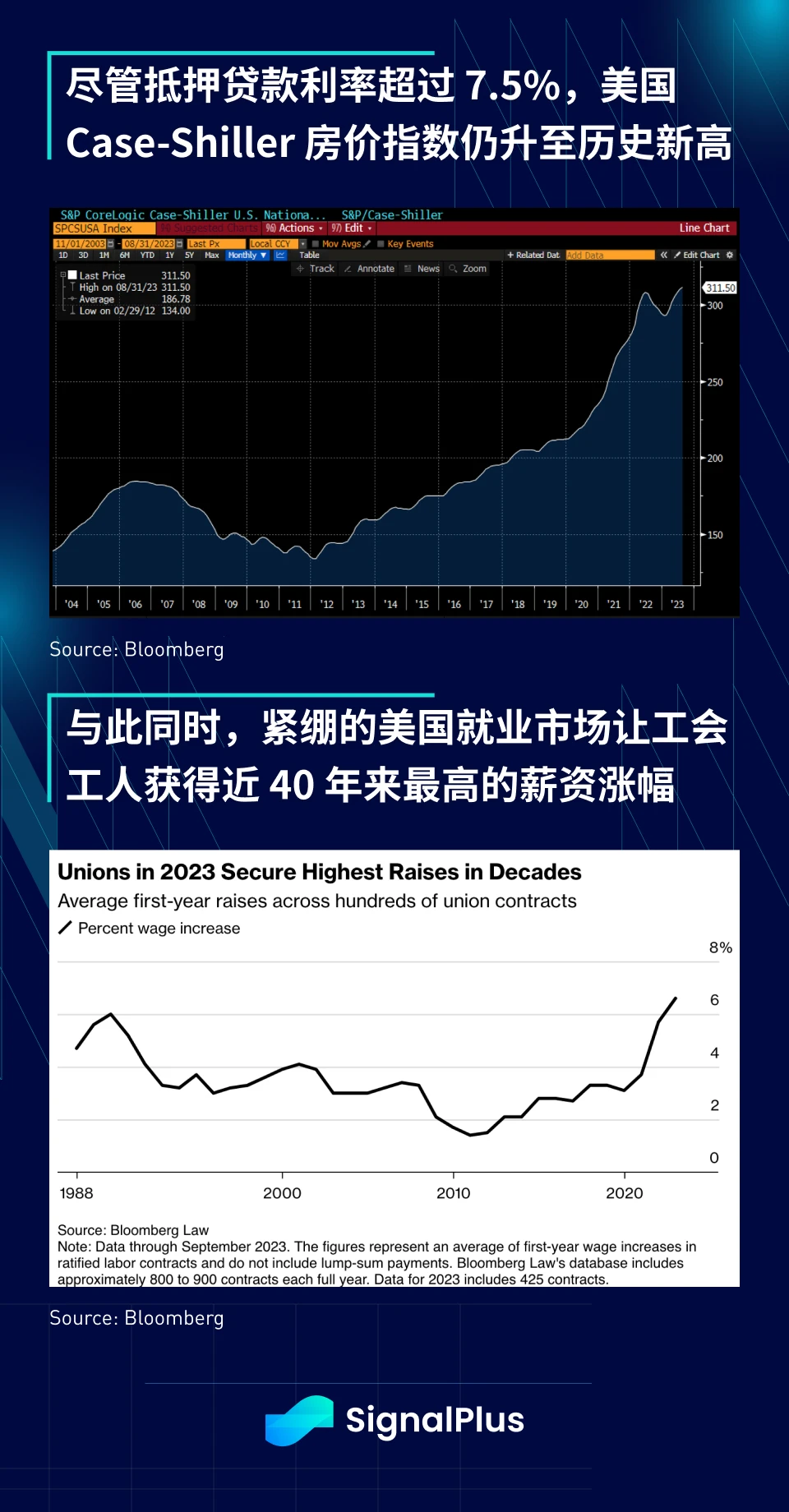

U.S. markets remained stable heading into the end of the month, with rebalancing funds helping index gains and interest rates only edging higher. Strong U.S. housing data offset weaker Chinese PMI (<50), European GDP (down 0.1% qoq), Eurozone CPI (two-year low) and German retail sales (down 4.6% y/y), although mortgage lending Despite extremely high interest rates and falling global real estate prices, the SP/CS 20 house price index has risen to a record high over the past month; despite challenging capital markets, the U.S. consumer has remained resilient (as the Fed has mentioned many times), and the recent labor union The win that gave blue-collar workers the largest wage increase in nearly 40 years is another reminder that market conditions do not equal economic conditions.

In terms of financial reports, Caterpillars latest financial report shows that global equipment demand may have peaked, which is a bad omen for the global economic outlook. Its backlog of orders decreased by US$2.6 billion from the previous quarter, which was the first decline since the epidemic in 2020. Caterpillar shares plunged nearly 7% yesterday.

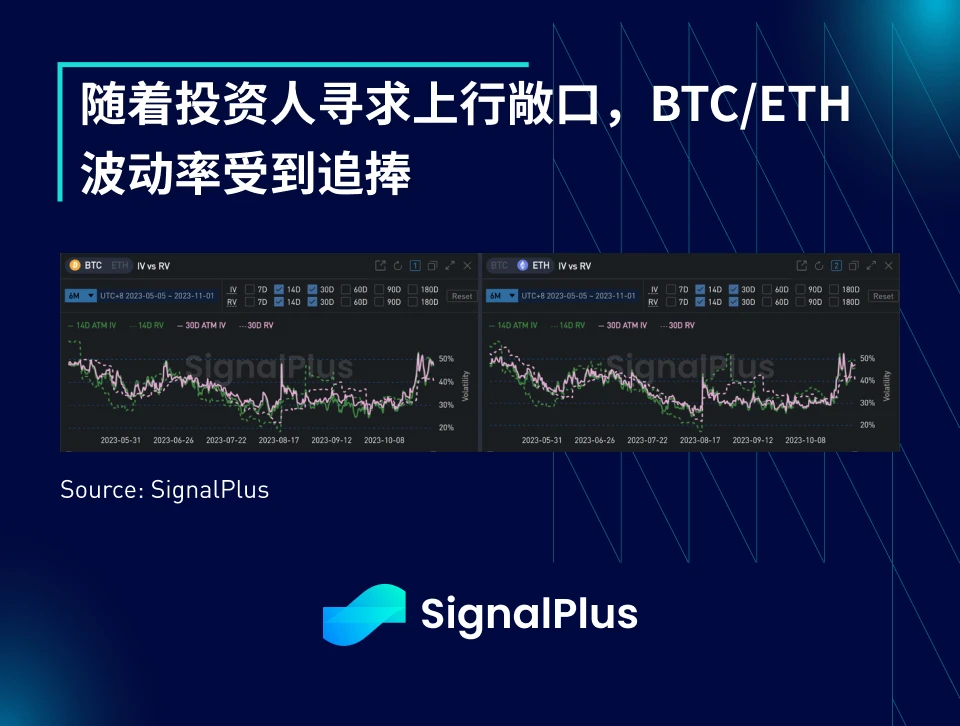

On the crypto side, overall investment sentiment has improved significantly over the past month, prices have continued to rise, and volatility looks expensive compared to actual recent moves as an under-owned market looks for cheap upside exposure; price momentum appears to be Already primed for bigger gains, just waiting for one catalyst - will the Fed tonight provide the catalyst the market is waiting for? Lets pay close attention...

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com