The ticket pattern is reversed, but the considerations behind the opposition to Uniswap’s proposal to invest in Ekubo are worthy of further study.

Original - Odaily

Author - Nan Zhi

Yesterday,Uniswap community votes to approve temperature check proposal for “Invest in Ekubo Protocol”, whereas previously the voteThe opposition rate once exceeded 60%, including market makers Wintermute and Keyrock, have expressed strong opposition. StableLab Lianchuang even stated that “If this proposal is passed, I think the Uniswap governance organization should seriously think about the role of governance and accountability.”

Proposal details

Moody Salem, founder of Ekubo Protocol and former head of Uniswap development team, launched on the governance platform on October 13proposal,Temperature Check Voting Begins October 23rd at Snapshot. The specific contents of the proposal are as follows:

Investment needs:Ekubo proposed to cooperate with Uniswap DAO, and Uniswap provided 3 million UNI (worth approximately $12 million) in exchange for a 20% share of the future Ekubo protocol governance tokens. Uses primarily include engineering, auditing and legal support. Ekubo will also provide a Creative Commons license to Uniswap;

Token plan:Within 1 month of passing this proposal, deploy a governance contract on Starknet that includes tokens representing voting rights on the Ekubo protocol. Uniswap will receive 20% of the token, which it can reallocate at its discretion;

Background advantages:Moody Salem expressed his belief in Starkwares technical vision and left Uniswap to devote himself to developing AMM (Ekubo) on Starknet. The proposal states that Ekubo accounts for about 75% of Starknets total transaction volume, while TVL only accounts for 5% and also reaches cooperation with Argent, the largest wallet on Starknet.

dissenting voices

Wintermute object

“We would normally support experiments like this and appreciate this opportunity being provided to The DAO. However, in its current state, we are unable to support this proposal due toRequested funding of $12 million and implied valuation of $60 million。”

Wintermute CEO Evgeny Gaevoy said “In this case, I recommend that the voting representatives consider this proposal on the merits of the transaction itself, rather than the label that may be applied to Ekubo Inc. (i.e. regardless of Ekubo’s reputation, status, etc.)

Considering the above:

For the Ekubo token, little or no information beyond the proposed use, plans for the remaining 80% of the token supply, etc. were not provided.

Uniswap DAO has not established a framework for financial diversification and investment decisions.

The above is further amplified by the scale of the investment, which will put Ekubo ahead of similar projects such as Paraswap, IDEX and QuickSwap in the FDV rankings. These protocols exist on highly active chains and already have considerable transaction volumes. (We dont think its correct to compare Ekubo directly to these protocols, but it helps determine approximate market pricing).

Starknets TVL of $152.8 million is 2.5x Ekubos implied FDV.

Ekubo looks to be an “amazing” DEX that has proven capable of capturing the majority of DEX volume market share on Starknet. However, this decision requires the DAOBetting on both Ekubo and Starknet, and based on the implied FDV and lack of information,This seems optimistic and too forward-looking。

Market maker Keyrock objects

Without a framework or committee for more than 2-3 weeks of DD (Due Diligence), we simply cannot justify any use of UNI for venture capital.

Finally, Ekubo should focus on building the DEX rather than holding an additional 2.5 million UNI delegated voting rights, and need to consider becoming an active governance participant. If you need to create and drive forward proposals for future development, there is a pool of representatives with this capability that you can easily contact.

To sum up, the core objections are as follows:

3 million UNI is too high a valuation for the project;

The project is difficult to effectively govern using the voting rights granted by tokens.

Project details

Official documentation: The Ekubo protocol features centralized liquidity, singleton architecture, and scalability. It is designed to take full advantage of the Starknet architecture, with the goal of providing the best Swap execution and liquidity provider benefits.

Project Features

Save Gas:Ekubo adopts a model called till, which means that all pools are managed in a single contract, and when a transaction is made with an Ekubo upper pool, the transfer of tokens is deferred until the end of the transaction. That is, users do not need to transfer tokens, the aggregator can save them in Ekubo for subsequent use, thus completely avoiding expensive token transfers. (Odaily note:Same as the singleton mode that Uniswap V4 will implement.)

As a result users can perform many operations across multiple pools and only make the minimum amount of token transfers required. A highly optimized and capital-efficient design combined with Starknet’s low fees enables the Ekubo protocol to provide the best Gas execution network;

Centralized Liquidity:Users can provide LP within a specific interval; (Reference Uniswap V3)

Scalability:Allows the creation of permissionless pools and implements features such as limit orders, TWAMM, and more. (Reference Uniswap V4)

project data

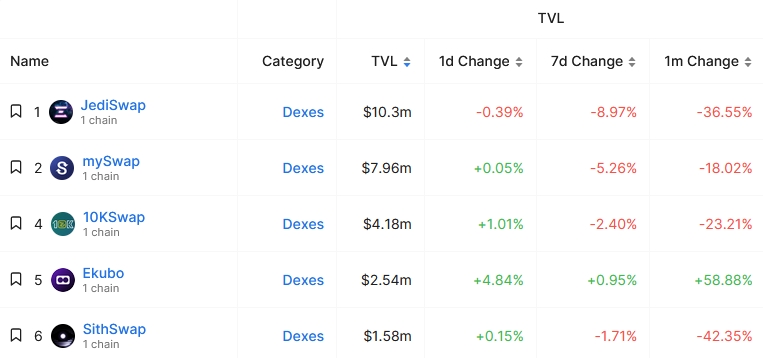

TVL is not dominant:According to DefiLlama data, Ekubo’s TVL is $2.54 million,Ranked 4th among major Starknet DEXs。

Estimated revenue from the agreement:

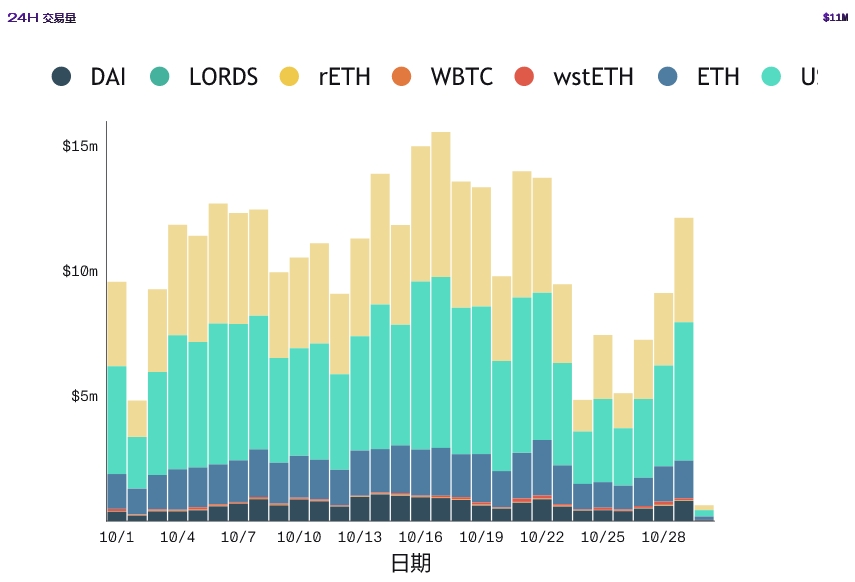

(1) Trading volume: The following is the officially disclosed daily trading volume. The lowest daily trading volume in the past month is US$5 million and the highest is US$15 million. Here we assume that the daily trading volume is US$10 million;

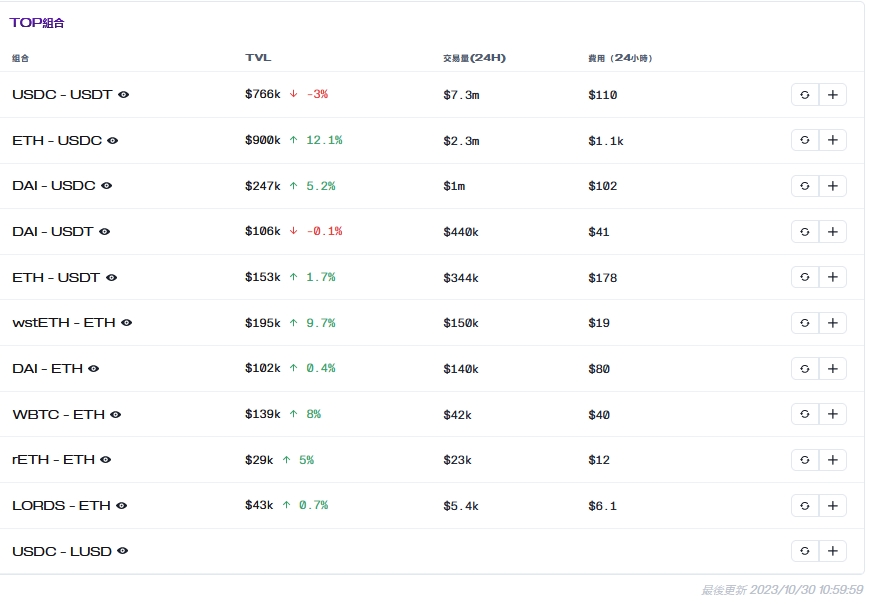

(2) Handling rate: The transaction rate of other DEX on Starknet is 0.3%, including JediSwap, mySwap, 10 KSwap, etc.

Ekubo provides 6 rate levels, including 0%, 0.01%, 0.05%, 0.3%, 1%, and 5%.

Judging from official disclosure data, the fee rate is very low compared to other DEXs. The fee rate for the USDC-USDT trading pair is estimated to be 0.0015%, and the fee rate for the ETH-USDC trading pair is 0.0478%.

(3) Annualized handling fee: Based on the officially disclosed 24-hour trading volume of US$11.739 million in the above figure, andDaily fee income $1,688, based on a daily trading volume of US$10 million, then theDEX annual incomeis 1000 ÷ 1173.9 × 1688 × 365 =$524,800。

(4) External comparison: According to DefiLlama data, the fee income of several DEX mentioned by Wintermute are:

Paraswap: 12 months from November 22 to present,$6.19 million;

QuickSwap: 12 months Nov 22 to date,$5.74 million;

IDEX: Undisclosed.

in conclusion

In summary, although Ekubo’s trading volume is indeed significantly higher than other DEXs on Starknet, it is only attracted users through its extremely low handling fees, rather than the characteristics and usage advantages of the protocol itself.Difficult to bring effective income. The estimated annual revenue of $524,800 is indeed a significant shortfall compared to the investment of $12 million.

Although the opposition rate to this proposal once exceeded 60%, but fromJesse WaldenThe 8 million UNI votes directly reversed the situation (38% of Yes votes, 24% of the total vote). It is reported that Jesse is the co-founder and general partner of Variant.Jesse led the company’s response to Uniswap, Phantom, Mirror, Flashbots, Foundation, etc.invest. However, Jesse’s comments in the governance forum cannot answer the above big questions:

“Directionally, if there was an arrangement that would allow Moody/Ebuku to make core developer contributions to the Uniswap protocol codebase (over a meaningful timeframe), I think it would beworth figuring out。

Details of how this would work in practice are not fully stated in this proposal, but can be found inSubsequent governance proposalsFully fleshed out in more detail.

Also, given the effort/skills required to build on Cairo, Ebuku becomes the “official” Uniswap v4 deployment on StarknetThe idea is also interesting。”

Recently, Uniswaps application for US$46.2 million in working funds and the launch of front-end fees have also caused a lot of community controversy, but they were successfully implemented. The unity and effectiveness of public opinions and project governance may still need to be further considered.