Hotairballoon Crypto Market Weekly Report (10.9–10.15)

Hotairballoon has selected important information on the crypto market last week, investment and financing status, as well as on-chain data on current popular tracks such as LSD and RWA. It also counts projects with relatively large unlock volumes in the near future for your reference.

1. Important information about the encryption industry last week

(1) Policy/Supervision

1. Hong Kong Treasury Bureau: intends to consider the appropriate regulatory agencies, forms and regulatory requirements to supervise OTC

According to news on October 9, according to the Economic Times, the Financial Services Committee of the Hong Kong Legislative Council will discuss the regulation of virtual asset trading platforms. Regarding the feasible regulatory forms of OTC, the Hong Kong Financial Services and the Treasury Bureau responded that the government and regulatory agencies will from time to time Review regulatory measures and consider introducing appropriate measures based on market development, including regulating related businesses other than virtual property trading platforms, taking into account appropriate regulatory agencies, forms and regulatory requirements.

2. India will push forward crypto regulatory negotiations at FMCBG final meeting in Morocco

According to Cryptonews, on October 9, finance ministers and central bank governors will hold the last meeting during India’s G20 presidency in Marrakech, Morocco, from October 12 to 13. The cryptocurrency regulatory roadmap is expected to be one of the main agenda items during the meeting. India will seek to ensure that issues in the New Delhi Declaration are implemented, including a cryptocurrency regulatory framework.

3. Coinbase, OKX and Binance are all cooperating with British companies to cope with the new regulations that have just taken effect in the UK

On October 9, The Block reported that Coinbase and OKX have partnered with crypto startup Archax to obtain approval for financial promotions. Meanwhile, Binance said it has partnered with P2P lending company Rebuilding Society. The arrangements are expected to allow exchanges to continue to serve UK clients from overseas despite new marketing rules from the Financial Conduct Authority (FCA) that have just come into effect (which include a cooling-off period for first-time investors).

4. ARK Invest submits an updated version of the Bitcoin spot ETF prospectus

On October 12, Bloomberg senior ETF analyst Eric Balchunas tweeted that ARK Invest had submitted an updated version of the Bitcoin spot ETF prospectus. New additions include content that the NAV calculation does not comply with GAAP, while mentioning that the ETFs assets at the custodian are held in separate blockchain wallets and therefore are not commingled with corporate or other client assets.

5. Several senators wrote to the U.S. Treasury Secretary and the Internal Revenue Service, urging the start date of the crypto transaction information reporting system to be brought forward.

On October 12, according to Bloomberg, a group of U.S. senators represented by Democrat Elizabeth Warren and independent Angus King jointly sent a letter to U.S. Treasury Secretary Yellen and the Internal Revenue Service, urging U.S. tax officials to advance cryptocurrency brokers and transactions. The date on which customer transaction information was reported to the government. Senators Richard Blumenthal, Gary C. Peters, Bernie Sanders, Sheldon Whitehouse and Brian Schatz also signed the letter.

6. Shanghai Huangpu District issued support measures to encourage the clustered development of technology companies such as blockchain and Yuan Universe.

According to news on October 12, the Shanghai Municipal Government issued the Huangpu District Support Measures for Grasping the Trend of Returning Science and Technology Innovation to the City and Accelerating the Level of Science and Technology Innovation Development. It is proposed to encourage the cluster development of various scientific and technological enterprises. Gather a group of companies that have advanced, innovative, breakthrough or disruptive technologies in financial technology, biomedicine, green and low-carbon, new generation information technology and other industrial fields, and have a leading role in the industry. Once identified, the company will be given a The start-up support for sexual scientific research will be RMB 2 million. Attract a group of companies with obvious technical or market advantages in segmented tracks such as blockchain, robotics, chip semiconductors, pharmaceutical outsourcing services (CXO), brain science, metaverse, new materials, etc., and have obtained certain equity investments. After recognition, the company will be given a one-time support of 1 million yuan for scientific research start-up.

7. CoinList is launching a multi-chain pledge fund for US-compliant investors, initially only supporting Ethereum and Near

On October 12, The Block reported that CoinList is launching a fund that will allow U.S.-compliant investors to earn returns from products that generate returns by staking digital assets. Each digital asset will be pooled with similar assets and pledged according to the requirements of the protocol, and investors rewards will be issued in the native tokens in which they originally purchased the funds interest or in accordance with the rules of the protocol, CoinList said. CoinLists new financial tool will initially only support staking on Ethereum and Near, with future plans to add support for staking on other blockchains such as Flow, Sui and Mina.

8. Coinbase sends a letter to the IRS expressing serious concerns about the nature and scope of proposed tax regulations

According to reports on October 13, Coinbase sent a 14-page letter to the IRS on Thursday detailing what it called proposed tax regulations related to total return and underlying reporting of digital asset transactions. serious concerns about the nature and scope of Coinbase said the requirements would create “a new set of reporting requirements that are difficult to understand and overly burdensome.” It also argued that they were overbroad, lacked assurance or were unenforceable.

9. Hong Kong lawmakers urge the establishment of a Web3 and virtual asset development group to allow supervision and development to proceed in parallel

According to reports on October 13, according to Dongwang, in the nearly one month since the JPEX unlicensed operation case occurred, more than 2,500 victims have reported the case, involving an amount of approximately HK$1.57 billion. Hong Kong Legislative Council member Ng Kit-chuang met with the government authorities today and expressed the need to strengthen cross-border cooperation and strengthen regional publicity and education. Law enforcement officials should also strengthen communication with relevant departments such as the Securities and Futures Commission, banks and telecommunications companies. He also pointed out that a major private anti-fraud alliance will be established in the future, and proposed at the Legislative Council House Committee to establish a Web 3.0 and virtual asset development group as soon as possible to achieve dual-track supervision and support for industry development.

10. Reuters: U.S. SEC does not plan to appeal Grayscale ruling

According to news on October 14, Reuters reported that the U.S. SEC does not plan to appeal the Grayscale ruling, which is in line with many industry insiders’ predictions about the situation. It is reported that the SEC must decide whether to challenge the courts ruling by 12 noon Beijing time on Saturday. Reuters said the SEC will let the deadline come naturally without appealing.

11. The governor of California has signed a bill regulating cryptocurrency

According to Bloomberg Law, California Governor Gavin Newsom (Democratic Party) signed a bill on Friday to regulate the cryptocurrency industry in California. California lawmakers want new rules for cryptocurrencies, and blockchain innovation advocate Gavin Newsom has previously vetoed similar legislation, but the issue has become more pressing after last years collapse of the FTX exchange and other market turmoil. With no federal action yet, state lawmakers hope to establish a basic regulatory framework.

12. Reuters: U.S. SEC does not plan to appeal Grayscale ruling

According to news on October 14, Reuters reported that the U.S. SEC does not plan to appeal the Grayscale ruling, which is in line with many industry insiders’ predictions about the situation. It is reported that the SEC must decide whether to challenge the courts ruling by 12 noon Beijing time on Saturday. Reuters said the SEC will let the deadline come naturally without appealing.

13. A U.S. judge requires Binance and the SEC to resubmit a joint status report on October 30

News on October 15th, CoinGape reported that according to documents submitted to the court on October 13th, U.S. District Judge Zia M. Faruqui gave Binance, Binance.US, Binance CEO Changpeng Zhao, and the U.S. SEC more time. He requested that the parties cooperate in required documentary discovery and witness testimony under a previous consent order.

14. The UAE government released a white paper focusing on the regulation of the Metaverse

News on October 15, according to News.Bitcoin, the government of the United Arab Emirates recently published a white paper titled “Responsible Metaverse Autonomy Framework.” According to a statement issued by Omar Sultan Al Olama, the country’s Minister of State for Artificial Intelligence and Digital Economy, the document primarily emphasizes the importance of having globally recognized operating standards. The white paper highlights not only the potential of virtual universes, but also areas where “the international community must increase its preparedness.”

(2) Project information

1. The proposal Activate OP as a borrowable asset in the Aave V3 Optimism pool will be implemented soon

According to news on October 9, the Aave community has passed the on-chain voting for the OP Risk Parameter Update proposal and will be executed within 21 hours. The AIP recommends activating OP as a borrowable asset in the Aave V3 Optimism pool, aiming to adapt to L2 matures and attracts more LPs and borrowers, thereby creating new revenue for the protocol. While the proposed reforms are less conservative, they still maintain tight supply and borrowing caps and a conservative interest rate strategy, the proposal said. This ensures that the DAO can foster growth and new opportunities while remaining risk-averse.

2. The Ethereum Foundation sold 1,700 ETH through Uniswap V3

According to news on October 9, on-chain data showed that at 16:18 Beijing time, the Ethereum Foundation address exchanged 1,700 ETH for approximately 2.74 million USDC through Uniswap V3.

Spot On Chain said that through today’s selling transaction, the Ethereum Foundation has sold a total of 2,262 ETH this year and still holds 326,000 ETH.

3. In response to the unlocking of 100 million DOTs on October 23, the Polkadot community proposed to adjust the ideal staking rate to encourage staking

According to reports on October 9, PolkaWorld reported that on October 23, approximately 100 million DOTs locked in Polkadot’s first batch of Crowdloan will be unlocked. In response to this unlocking, and to better adapt to the future situation of Polkadot 2.0, the community initiated Governance Referendum No. 166, proposing to slightly increase the ideal pledge rate of the Polkadot network, which is expected to be increased from 52.5% to 60%, so that the network can accommodate After unlocking, DOTs newly entered into the staking system will be released without reducing the staking rewards.

4. The Aave community initiated a temperature check proposal to “launch crvUSD in the Aave V3 Ethereum lending pool”

According to news on October 10, the Aave community initiated a temperature check proposal to list crvUSD on the Aave V3 Ethereum lending pool. The supply limit and borrowing limit are 60 million and 50 million crvUSD respectively. If the proposal reaches a consensus, it will be submitted for Snapshot vote.

5. Frax Finance launches sFRAX, a pledged vault that utilizes U.S. Treasury bond proceeds, similar to Maker’s DSR

According to Blockworks reports on October 10, Frax Finance today launched sFRAX (also known as staked FRAX), a pledged vault that utilizes the proceeds of U.S. Treasury bonds, and also launched a bond product that will be converted into FRAX’s stablecoin upon maturity. Fraxs sFrax is similar to MakerDAOs DAI Savings Rate (DSR).

6. Blur may launch Season 2 airdrop on November 20

According to news on October 10, NFT market Blur tweeted Blur Season 2. November 20 with a picture, which may hint that the second season airdrop will start on November 20.

7. OKCoin will gradually be renamed OKX globally, and the two brands will be merged into one

According to news on October 10, OKCoin CEO Fang Hong announced on the X platform that he decided to rename Okcoin globally in the next few months to OKX. Fang Hong said: We have recently canceled the Okcoin brand and products in several regions (Latin America, Middle East and North Africa, South Asia, Hong Kong, etc.) - we will rename Okcoin sequentially in the next few months for OKX, starting in Singapore, then the EU and finally in the US where we are headquartered. Okcoin customers in Singapore, the EU and the US will have access to the same products and services under the same regulatory framework, they will just be under a new brand Interaction. Further details will be shared with customers individually.

8. dYdX founder: The transition to Cosmos is planned to take place this month, when the platform will be completely decentralized

According to Blockworks reports on October 10, dYdX founder Antonio Julio said that the transition to Cosmos is planned to take place this month, when the platform will be “completely decentralized.” Julio said: Currently, dYdX is hybrid decentralized, which is completely unregulated. What happens on the chain is completely transparent. But the main thing that is not decentralized yet is the order book and the matching engine.

9. The founder of ssv.network said he had been drafted into the Israeli army

On October 11, Alon Muroch, founder of the Ethereum staking infrastructure ssv.network, tweeted: “I was drafted into the army, and the actual situation is much worse than described.”

It is reported that Alon Muroch is Israeli. Recently, after the Palestinian-Israeli conflict broke out, Israel recruited hundreds of thousands of reservists.

10. Worldcoin updates the status bridge to support synchronizing the World ID contract status on the EVM compatible chain.

On October 11, according to the official blog, Worldcoin developers updated the state bridge to adopt a modular, permissionless and gas-efficient new architecture, allowing anyone to develop and operate the state bridge on an EVM-compatible chain without permission. Worldcoin’s state bridge is used to share the current state of the World ID contract with other chains, allowing developers to verify proof of identity on top of Layer 2, sidechains, and more.

11. Report: Coinbase’s spot trading volume in Q3 this year dropped 52% compared with the same period in 2022

According to news on October 12, CCData data showed that Coinbase’s spot trading volume in the third quarter of this year was approximately US$76 billion. This was a 52% decrease compared to the quarterly record in the third quarter of 2022. The new figure is the lowest since Coinbase listed on the Nasdaq Stock Market in 2021.

12. The Sui mainnet has been upgraded to version V1.11.2, and the Sui protocol has been upgraded to version 27.

According to the official announcement on October 12, the Sui mainnet has been upgraded to version V1.11.2, and the Sui protocol has been upgraded to version 27. Highlights of the upgrade include: For higher-level transactions, some gas fee settings have been changed to make the gas fee consume faster. These changes do not affect any transactions previously running on the network, but are simply to ensure that when resources start to be heavily used, you are charged for actual usage; the output of the sui client object command has been improved to be an easy-to-understand and browse table. If standard JSON output is required, the --json flag can be used; updated display of constants in disassembled Move bytecode if the constants are valid utf 8-formatted vectors

13. Ethereum’s latest conference: Devnet 9 still needs a lot of testing, and the complexity of the protocol has slowed down the pace of upgrades.

According to news on October 13, Christine Kim, vice president of research at Galaxy, posted a summary of this week’s Ethereum developer conference call. At the meeting, developers discussed the ongoing problems and errors on Devnet #9, and had a long discussion on the advantages of EOF. debate.

The meeting noted that Devnet 9 still requires extensive testing. In addition to troubleshooting various EL/CL combinations, developers are also ramping up testing of MEV-Boost. Devnet 9 has only one relay and builder, which can only handle ordinary transactions and cannot handle blob transactions; the EF test team needs to pay attention to four points before launching Devnet 10: update the trusted settings file of the EIP-4844 KZG ceremony, Improved visibility of blob transactions, MEV pipelines, network stability. Kim said Dencun is a complex upgrade. Additionally, Ethereum’s upgrade protocol has become more complex since the merger. This means testing takes time. Developers may even decide to launch another devnet after Devnet 10 before moving on to a public testnet.

(3) Others

1. Analyst: Ethereum and TRON accounted for 88% of PoS blockchain fee revenue in the past year

According to news on October 9, Bloomberg crypto analyst Jamie Coutts tweeted that in the past year, Ethereum and TRON networks accounted for 88% of all PoS blockchain fee income, of which Ethereum Layer 1 accounted for 57%. TRON accounts for 31%. In addition, in the first half of 2023, the Ethereum network generated a total of approximately $743 million in transaction fees, TRON generated approximately $282 million in transaction fees, while the Bitcoin network fee revenue was only $80 million.

2. Israeli police freeze crypto accounts linked to Palestinian Hamas with help from Binance

According to CoinDesk reports on October 10, Israeli police have frozen cryptocurrency accounts related to the Palestinian militant organization Hamas. Hamass defense minister ordered a comprehensive siege of the Palestinian enclave of Gaza after Hamas launched multiple attacks on Israel over the weekend, leading to an all-out war.

3. Report: Latin America leads the world in preference for centralized exchanges

According to Cointelegraph, according to a recent report by blockchain analysis company Chainaanalysis, compared with other regions in the world, Latin America clearly favors centralized exchanges over decentralized exchanges. Chainaanalysis published an article on October 11 stating that Latin America has the seventh largest crypto economy in the world, following the Middle East and North America (MENA), East Asia and Eastern Europe. In some countries in the region, cryptocurrency activity by platform type significantly exceeds the global average. The global average for centralized exchanges is 48.1%, for decentralized exchanges it is 44%, and for other DeFi activities it is 5.9%.

4. Data: L2 transactions accounted for 61% of all Ethereum transactions in the third quarter

According to news on October 9, according to the Ethereum status report for the third quarter of 2023 released by the encryption analysis company Messari, L2 transactions accounted for 61% of all Ethereum transactions in the third quarter. This growth mainly comes from the launch of Base mainnet and the popularity of decentralized social protocol friend.tech. For a brief period at the end of the quarter, Base alone surpassed Ethereum mainnet in transaction volume.

2. Investment and financing situation last week

(1) Infrastructure

1. Binance Labs announces investment in Initia

According to the official blog, Binance Labs announced its investment in Initia. The funds have not yet been disclosed. The funds raised will be used to support the development of Initia infrastructure and developer tools.

2. Solution provider Wodo Network receives US$3 million investment from VBT Yazilim

Solution provider Wodo Network received a US$3 million investment from VBT Yazilim. Wodo Network provides solutions for developers, mainly serving the gaming, finance, and education fields.

3. Crypto wallet provider Account Labs completed US$7.7 million in financing, with participation from Amber Group and others

Crypto wallet provider Account Labs announced the completion of $7.7 million in financing, with participation from Amber Group, MixMarvel DAO Ventures and Qiming Venture Partners.

4. Metaverse infrastructure developer Hadean completed a new round of financing, with investment from Yuga Labs. The amount of financing has not yet been disclosed.

Metaverse infrastructure developer Hadean has completed a new round of financing, with investment from Yuga Labs. The amount of financing has not yet been disclosed. Yuga Labs said Hadean provides key technology for Yuga’s platform, optimized for high-fidelity virtual experiences that bring creators and players together at scale.

(2) Asset management

1. RWA lending platform Untangled completed US$13.5 million in financing and launched on Celo

Untangled Finance, a tokenized real-world asset (RWA) lending platform, completed $13.5 million in financing and launched on the Celo network. The main investor in this financing is London-based asset management company Fasanara Capital, which has also opened two credit pools on the platform to handle off-chain business and underwrite loans.

2. Environmental asset trading platform Neutral raised US$3.2 million, with North Island Ventures leading the investment and DCG participating.

Neutral announced a $3.2 million funding round led by North Island Ventures, with participation from Redalpine, Digital Currency Group (DCG), Cerulean Ventures, Factor Capital, Very Early Ventures and Rarestone Capital.

3. Alpaca, a stock and crypto trading API service company, received US$15 million in financing from SBI Group

Stock and cryptocurrency trading API services company Alpaca has secured $15 million in financing from SBI Group in the form of convertible notes. Alpaca CEO Yoshi Yokokawa said the strategic investment brings the Y Combinator-backed startups total funding since its inception in 2015 to $120 million and will allow Alpaca to accelerate its expansion in Asia.

(3) DeFi

1. Crypto trading and lending platform Membrane Labs completed US$20 million in Series A financing, with Brevan Howard Digital participating as an investor

Cryptocurrency trading and lending platform Membrane Labs completed $20 million in Series A financing from Brevan Howard Digital, Point 72 Ventures, Jane Street, Flow Traders, QCP Capital, Two Sigma Ventures, Electric Capital, Jump Crypto, QCP Capital, GSR Markets, Belvedere Trading and Framework Ventures participated in the investment.

(4) NFT/chain games

1. OrdinalsBot raised US$1 million, with participation from Kestrel 0X 1. Lightning Ventures and others

OrdinalsBot completed US$1 million in financing. Kestrel 0X 1, Lightning Ventures, Bitcoin Magazine Ecosystem Fund, Bitcoin Frontier Fund, Angsana Investments, Deep Ventures and other institutions participated in the investment. In addition, angel investors Sebastien Borget, Howard Morgan, Micah Spruill, Ivan Brightly, Dillon Healy and others also participated in the investment.

2. Zhang Yimou’s Yuan Universe company “Right Popular Qitian” completed hundreds of millions of yuan in Series C financing

Beijing Danghong Qitian International Cultural Technology Development Group Co., Ltd. (referred to as Danghong Qitian) completed hundreds of millions of yuan in Series C financing, funded by Huakong Fund, China Vision Valley Industrial Fund, NetEase, Guoke BOE, CITIC Century Assets, Jiahesheng Capital and Yecao Venture Capital jointly invested. According to the official website of Danghong Qitian, the famous director Zhang Yimou serves as its co-founder and also serves as the artistic director of Danghong Qitian.

(5) Web3

1. Fake user identification provider Verisoul completed US$3.25 million in financing

Fake user identification provider Verisoul completed $3.25 million in financing, led by BITKRAFT Ventures, with participation from King River Capital, Third Prime, HashKey Capital, and individual investors including AcuityMD CEO Mike Monovoukas.

2. Web3 content platform RepubliK completed US$6 million in financing at a valuation of US$75 million, with OKX Ventures participating in the investment

Web3 content platform RepubliK completed a $6 million seed round of financing at a valuation of $75 million. This round of financing was funded by OKX Ventures, HTX Ventures, 6 MV, Arcane Group, Caroline Makes Statement, Comma 3 Ventures, Enjin, FBG Capital, Mirana Ventures, OIG Capital, Signum Capital, and Sora Ventures participated in the investment.

3. Entertainment technology company KINO completed over US$2 million in financing

Entertainment technology company KINO has completed over US$2 million in financing, with participating investors including Sequoia Capital, Slow Ventures, Metaweb Ventures, Genius Ventures, NEAR, Blockchain Founders Fund, etc. KINO introduces a community-based economic model to the entertainment industry, providing film and television creators with technical tools to attract fans and interact.

4. Privacy technology startup Beldex received $3 million in investment from Web3 market maker Enflux

Privacy technology startup Beldex has received a US$3 million investment from Web3 market maker Enflux, and the two parties have reached a partnership. Enflux will provide Beldex with the strategic advice and support needed to develop DApps and integrate EVM onto the Beldex chain for network expansion.

3. Main track data last week

(1) RWA

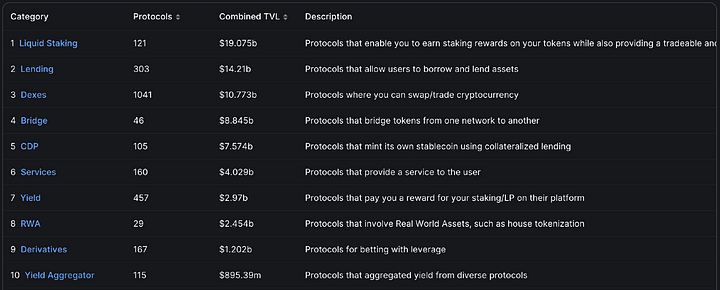

According to statistics from defillama, the current total TVL of the RWA track has reached 2.45 billion US dollars, a slight increase from last week. The total lock-up volume (TVL) ranks 8th. Defillama has included a total of 29 RWA protocols.

Among these RWA (real world asset) tokenization projects include the tokenization of U.S. Treasury bonds and real estate tokenization.

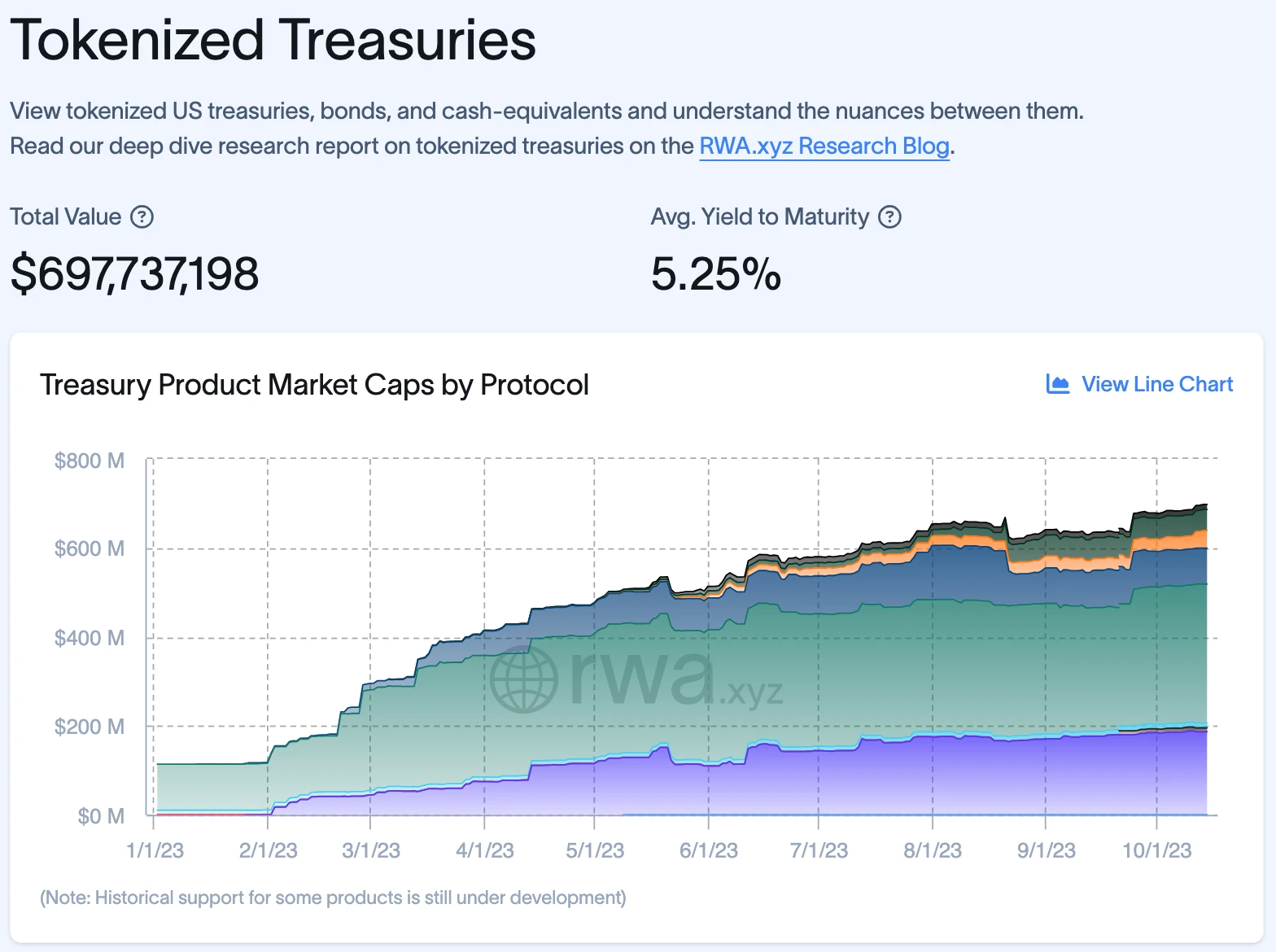

According to statistics from the rwa.xyz platform, the tokenized scale of U.S. Treasury bonds reached US$697 million, a slight increase from last week, and the average yield reached more than 5%.

Among these U.S. debt tokenization projects, Franklin Templeton Benji Investments Market Cap on the Steller chain has the highest market value, reaching $310 million, with a yield of 5.19%.

MakerDAO

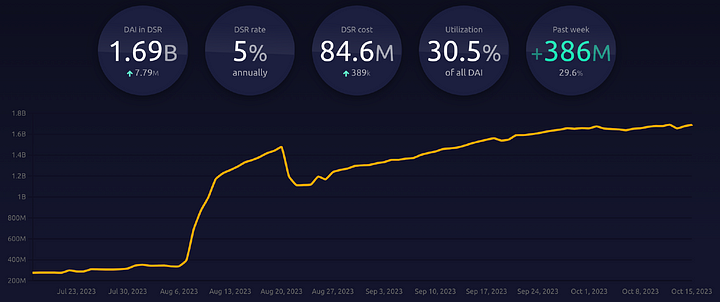

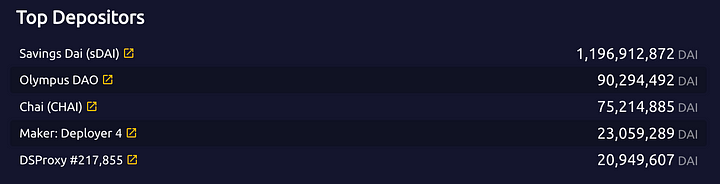

As of the time of writing, the size of Dai in DSR has increased by 386 million from last week, reaching 1.69 billion. The total amount of Dai has increased to 5.54 billion, and the DSR deposit interest rate is 5%.

Among them, sDAI was 1.197 billion, a slight increase from last week.

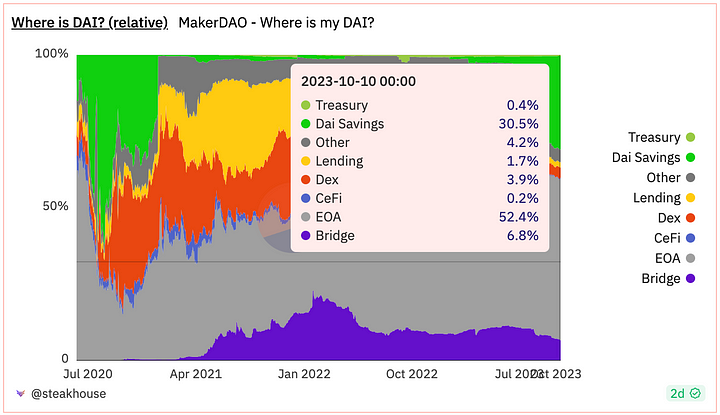

Lets take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising, reaching 52.4%, a slight decrease from last week. Since the DSR adjusted the interest rate, The share of DAI Savings is getting larger and larger, currently reaching 30.5%.

Currently, the ones with the highest proportion are: EOA, DAI Savings and Bridge.

Maker’s own lending protocol Spark’s TVL reached 736 million, a slight increase from last week.

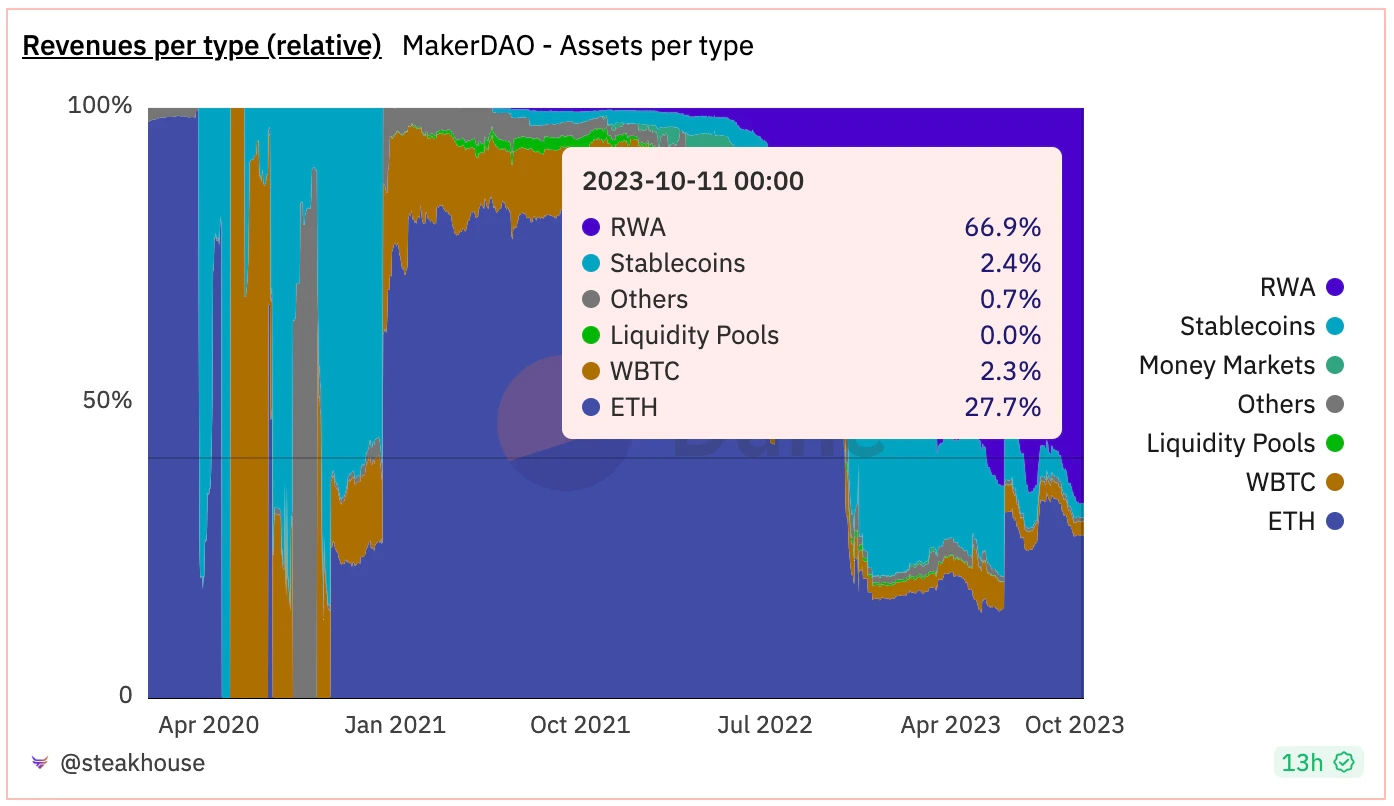

According to statistics from the dune platform, RWA has accounted for 66.9% of MakerDAOs revenue, a slight increase from last week. The high proportion is related to MarerDAOs vigorous layout in the RWA track.

(2) LSD

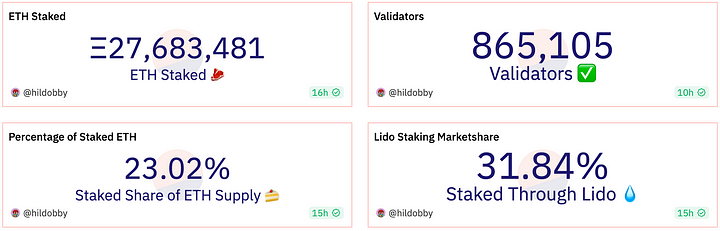

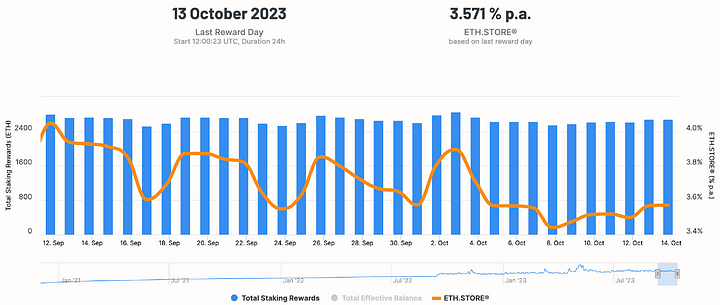

Currently, the amount of ETH pledged in the beacon chain has reached 27.68 million ETH, a slight increase from last week, accounting for 23.02% of the total supply of ETH, and the number of nodes is 860,000.

The current ETH staking yield is approximately 3.57%. As the amount of pledges increases, the yield is declining, and the overall yield has increased compared with last week.

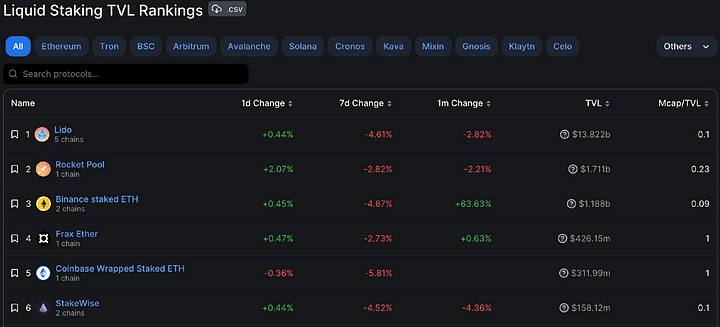

Among the three major protocols, in terms of ETH pledge volume, Lido fell by 4.61% over the week, Rocket Pool increased by 0.13% over the week, and Frax fell by 2.73% over the week.

Judging from the price performance of the three major protocols, LDO increased by 1.05% during the week, RPL increased by 8% during the week, and FXS price fell by 4.57% compared with last week.

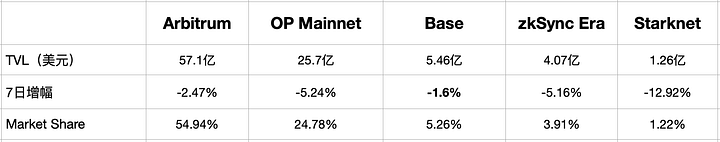

(3) Ethereum L2

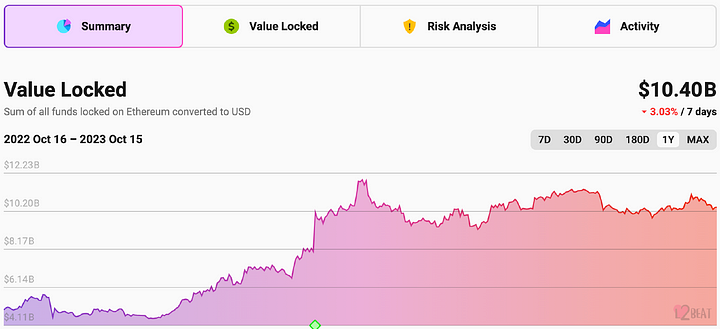

According to statistics from the l2 beat platform, Ethereum Layer 2 TVL has decreased by 3.03% in the past week, and the current TVL is US$10.4 billion.

Among Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 54.94%. Recently, TVL has declined, mainly due to the fall in the price of ETH.

(4) DEX

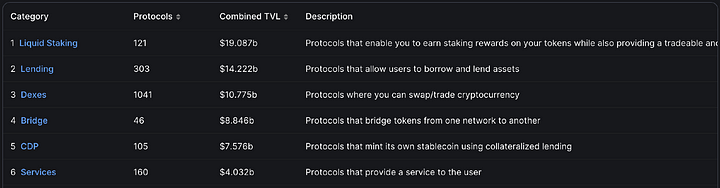

TVL

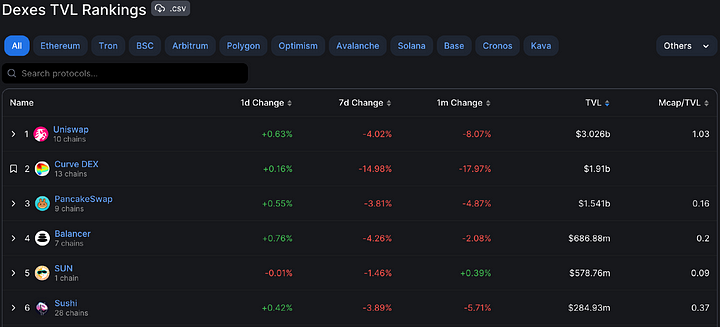

According to statistics from defillama, the total locked-up volume on the DEX track is US$10.78 billion, a slight decrease from last week.

Uniswap ranks highest in lock-up volume, followed by Curve, PancakeSwap, Balancer, SUN and Sushi. The TVL of most DEXs has declined compared with last week.

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi and Loopring.

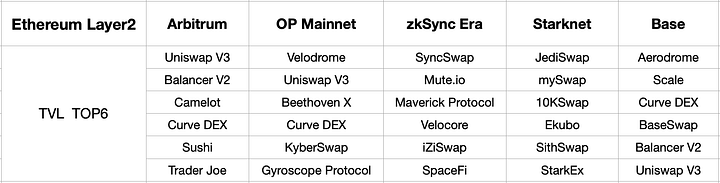

The above are the top 6 TVL DEXs on Arbitrum, OP Mainnet, zkSync Era, Starknet and Base chain.

The above are the top 6 TVL-ranked DEXs on other Layer 1 chains.

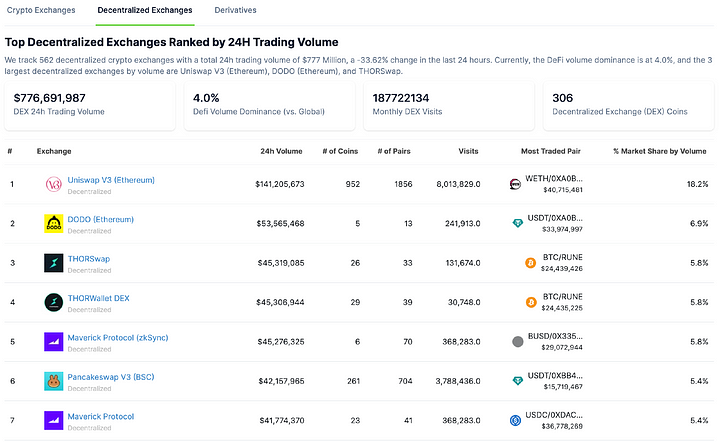

Trading volume

The trading volume of decentralized exchanges (DEX) in the last 24 hours was nearly 780 million U.S. dollars. The trading volume dropped significantly compared with last week. The total trading volume of global cryptocurrency exchanges in the last 24 hours was 19.7 billion U.S. dollars, of which DEX trading volume The proportion is only 4.0%.

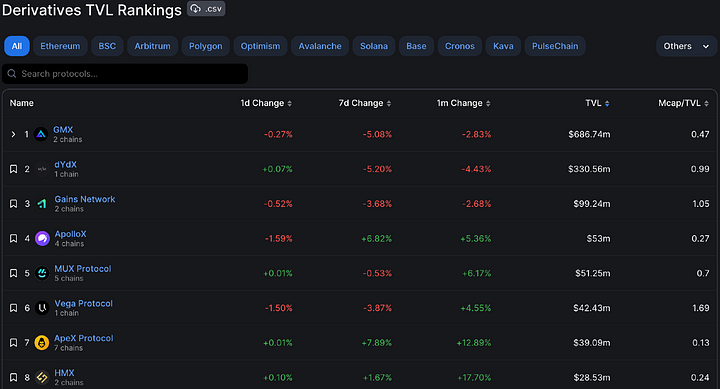

(5) Derivatives DEX

TVL

Judging from the data of defillama, most derivatives DEX TVL have declined recently, mainly due to the decline in token prices.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, ApolloX and MUX Protocol.

Trading volume

According to statistics from the coincko platform, the decentralized derivatives trading platform with the highest trading volume is dYdX. The trading volume in the last 24 hours has reached US$250 million, which is much higher than the trading volume of other decentralized derivatives platforms.

4. Recent token unlocking

The recent token unlocking of 4 projects deserves attention, among which APE and AXS have relatively large unlocking amounts.

Follow hot air balloon @HorairballoonCN on Twitter to explore more industry news:https://twitter.com/HotairballoonCN