Gryphsis Cryptocurrency Weekly Report: Seamless trading anytime, anywhere, Uniswap wallet launched for Android users for the first time

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Follow ourTwitterandMediumGet deeper research and insights.

Market and Industry Snapshot:

Layer 2 Overview:

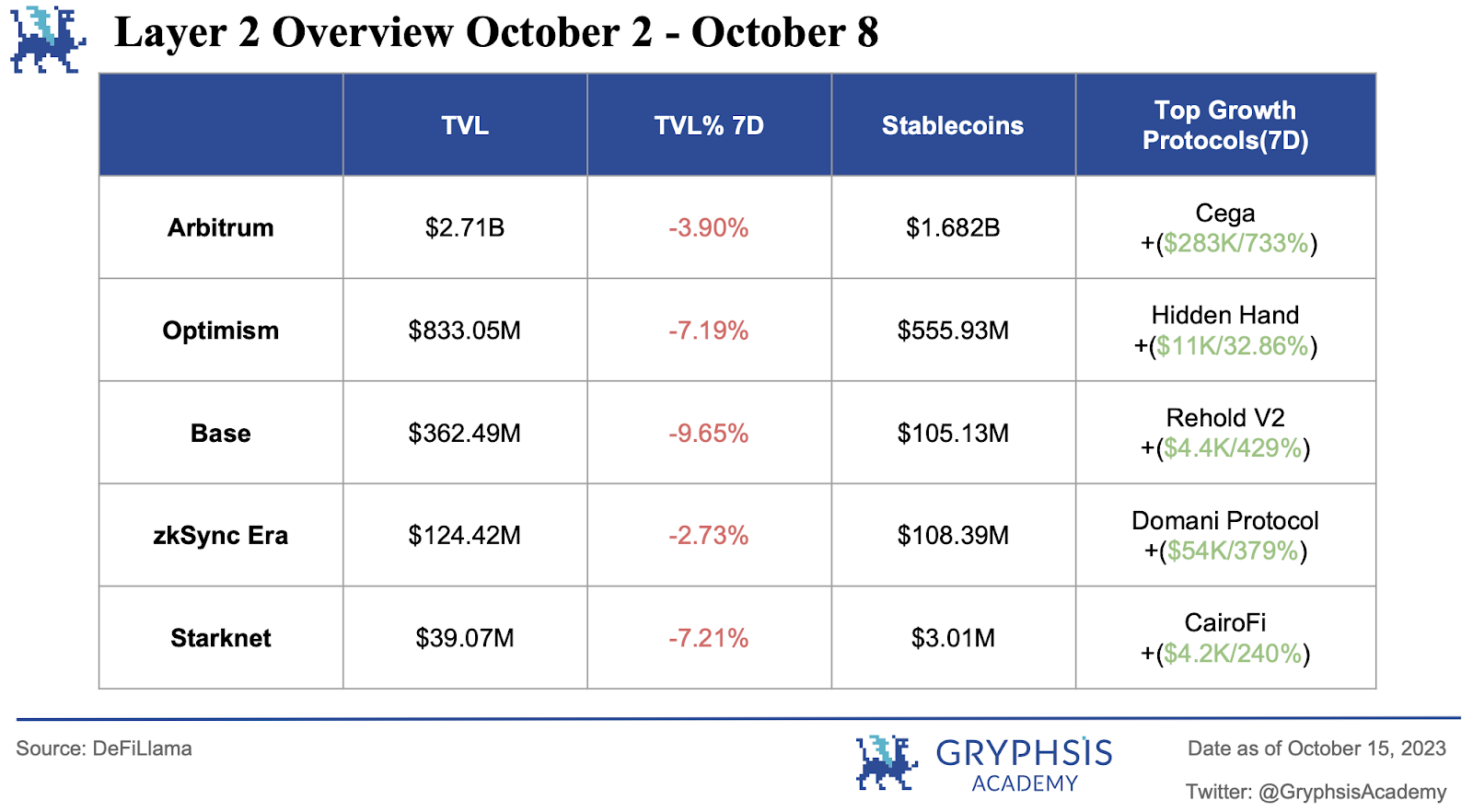

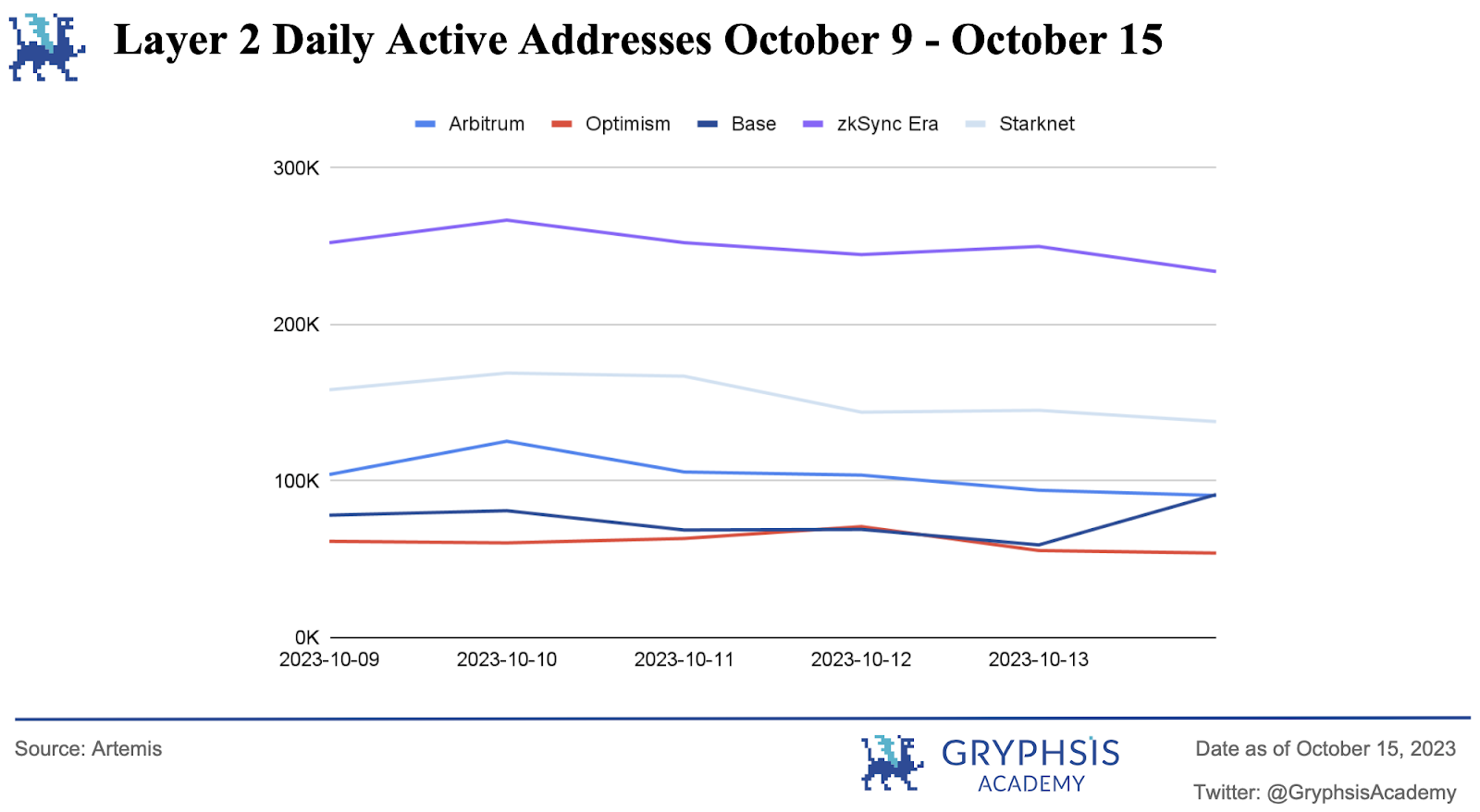

This week, TVL (Total Value Locked) fell across all Tier 2 platforms we track. Optimism, Base, and Starknet experienced the most significant declines, while Arbitrum and zkSync were relatively stable. Standouts like Cega, Hidden Hand, Rehold, Domani, and Cairo experienced significant TVL percentage increases.

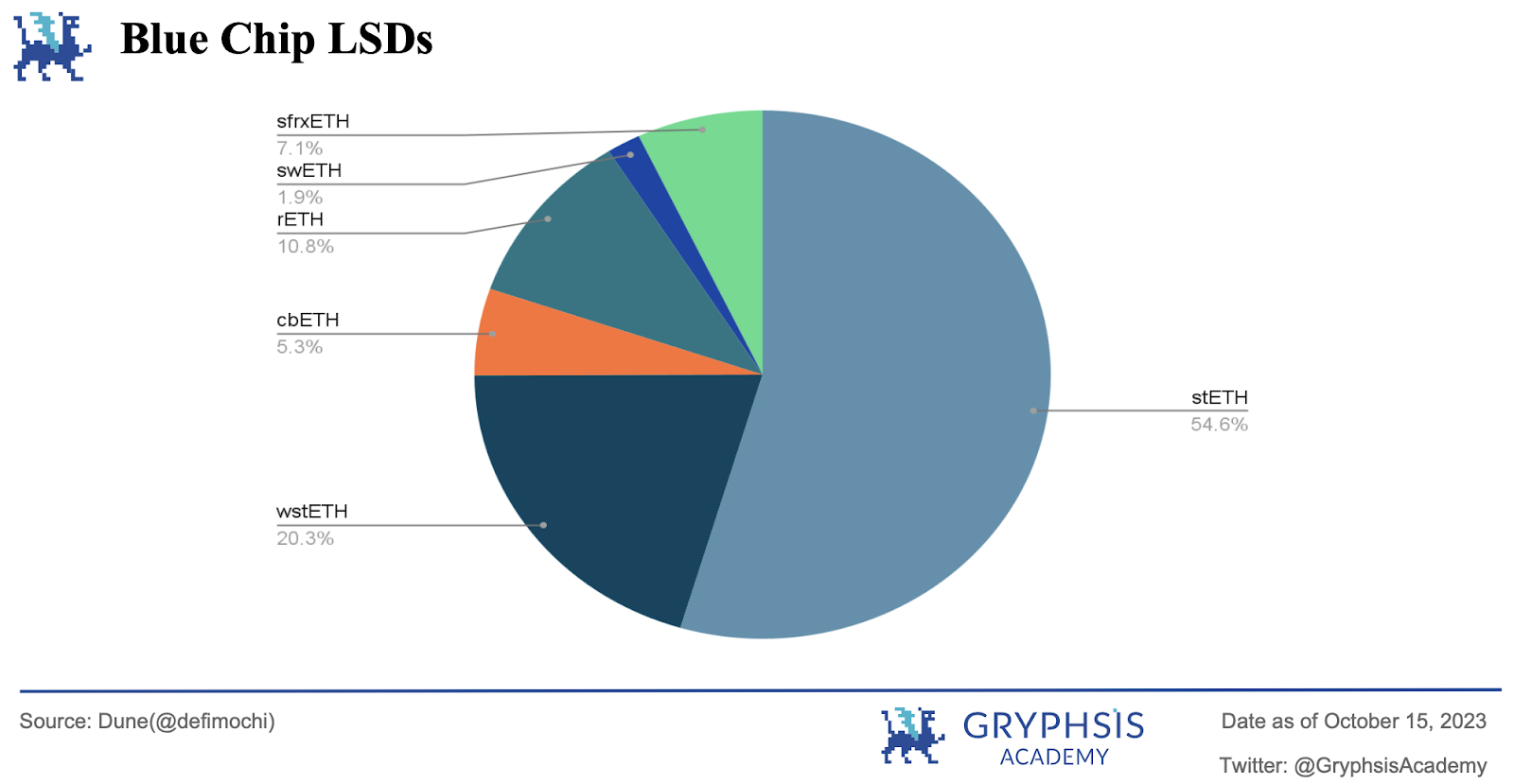

LSD Sector Overview:

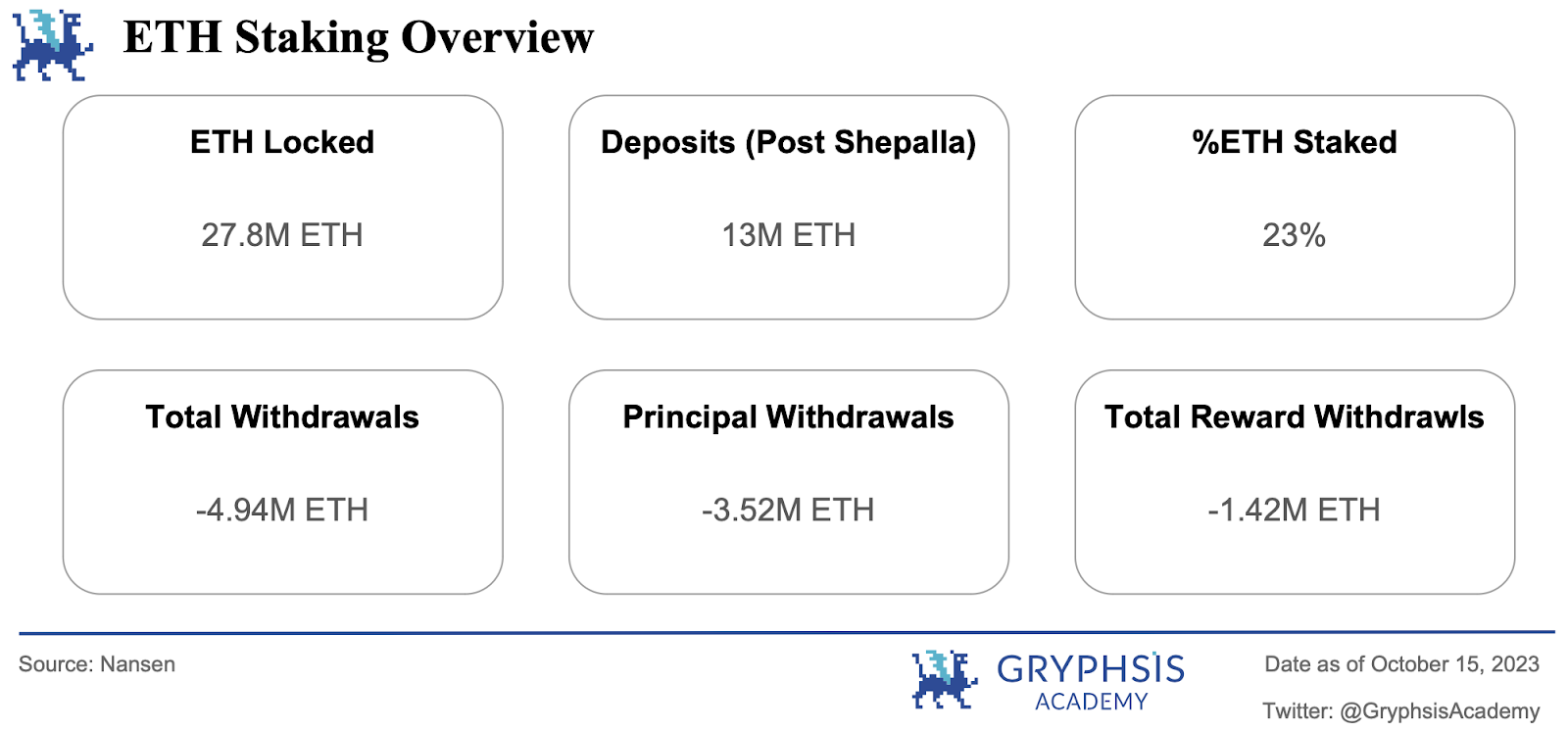

LSD continues to hold steady this week, with ETH staking rising slightly. cbETH’s market share surged from 0.3% last week to an impressive 5.3% this week.

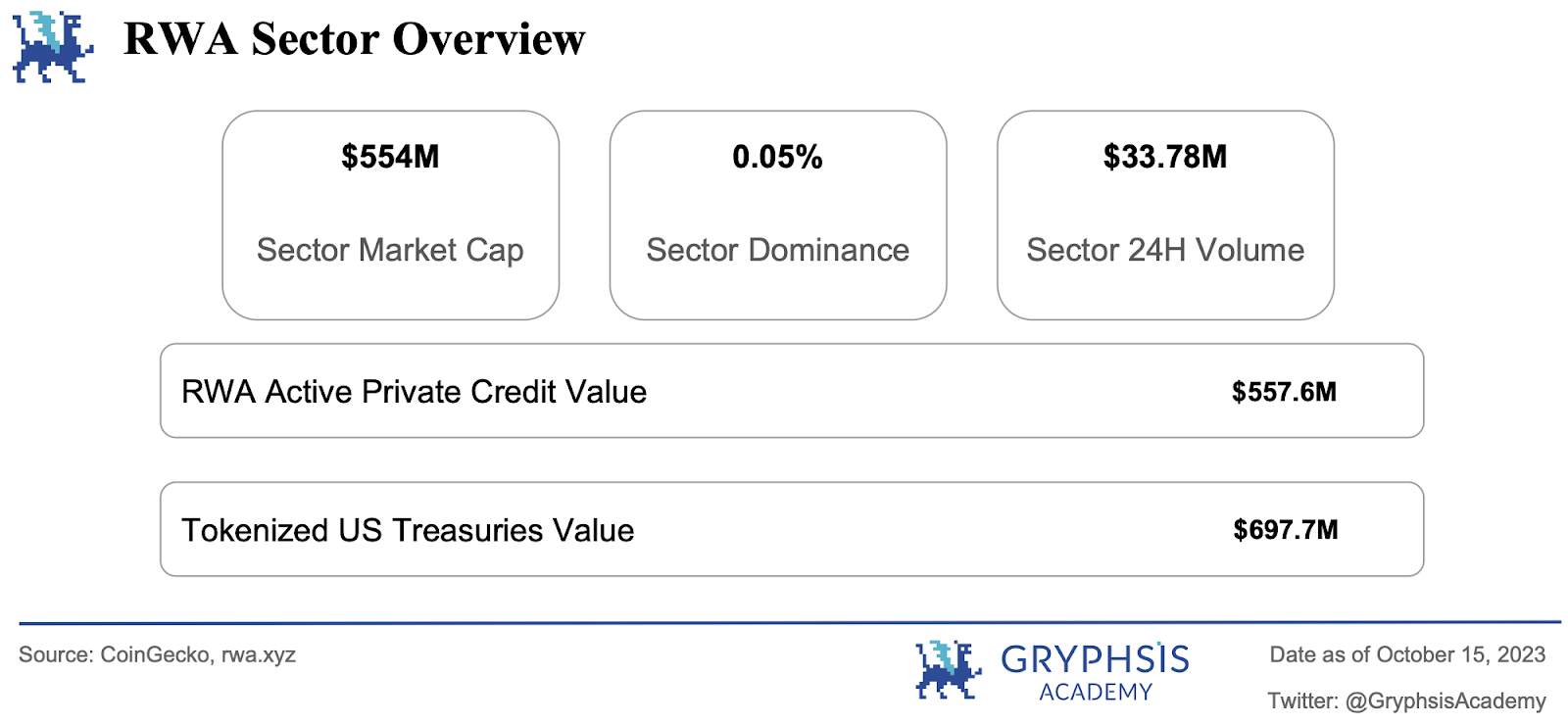

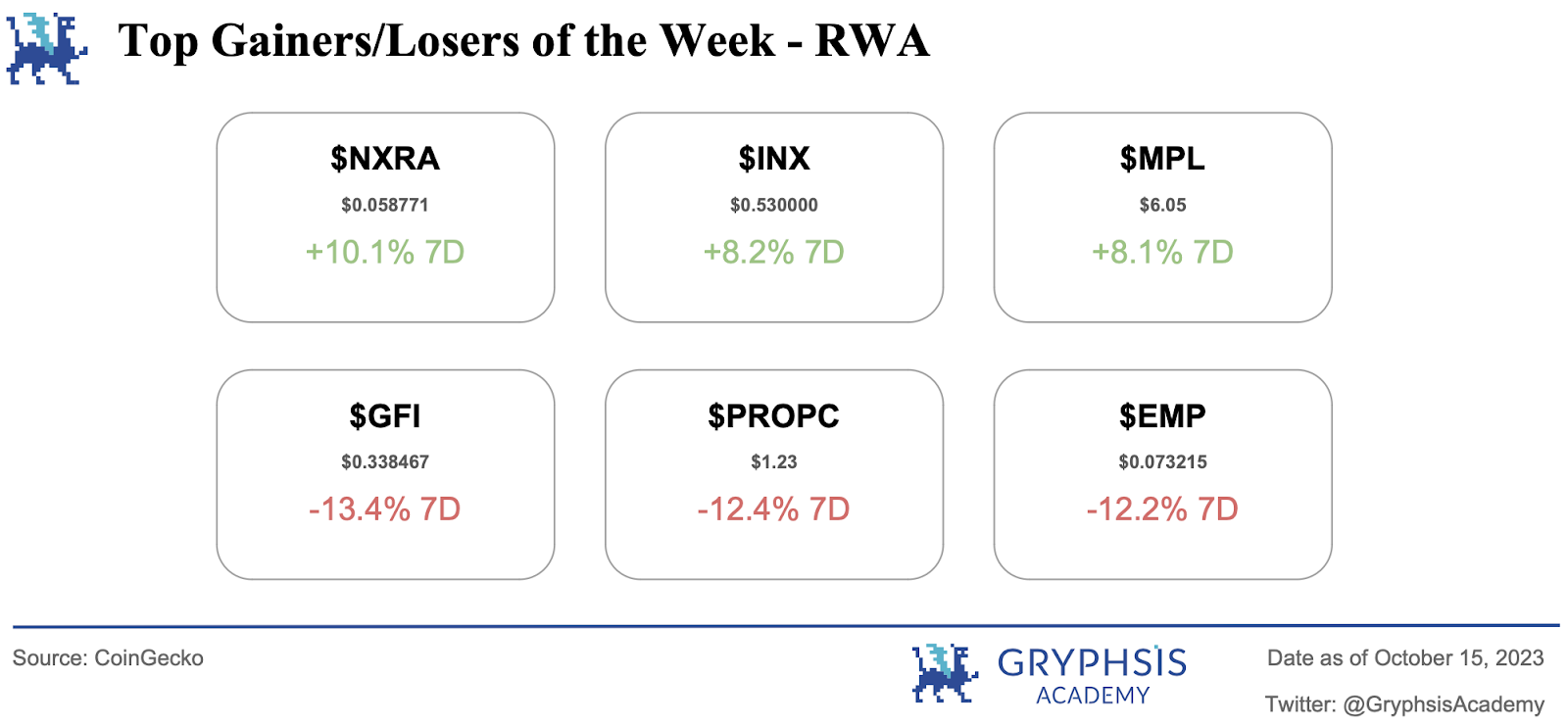

RWA Sector Overview:

The RWA sector held steady, with tokenized US Treasuries recording growth. $NXRA, $INX, and $MPL were the top performers, while $GFI, $PROPC, and $EMP declined.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

Uniswao Android Wallet

Weekly Agreement Recommendations:

Eclipse

Gryphsis Research:

dYdX V4

Weekly VC Investment Focus

Membrane Labs ($ 20 M)

Silks ($ 5 M)

Twitter Alpha:

@thedefiedge on catalyst.

@cyrilXBT 5 tools to use

@TheDeFISaint weekly L2 roundup

@TheDefiDog’s market updates

Macro Overview

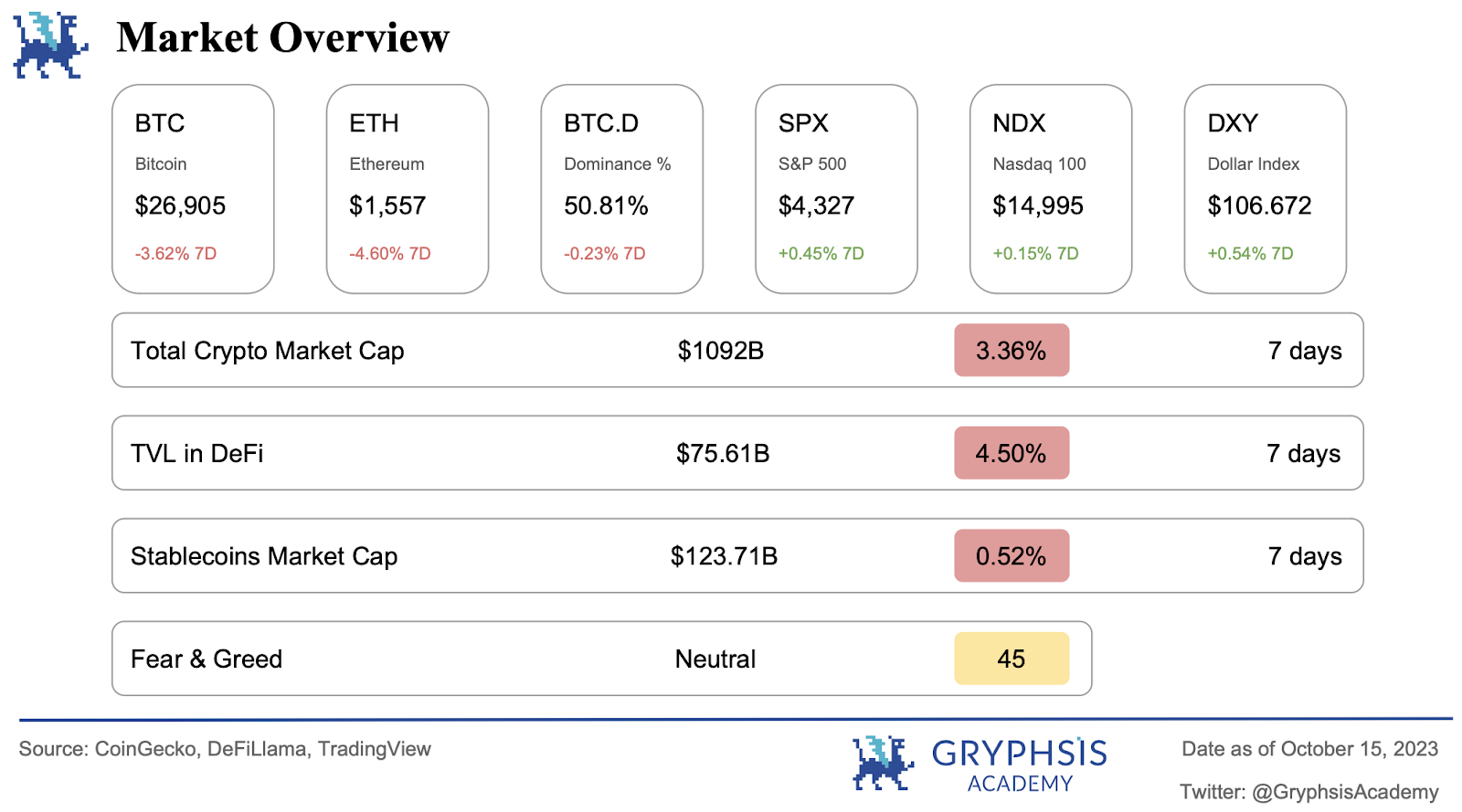

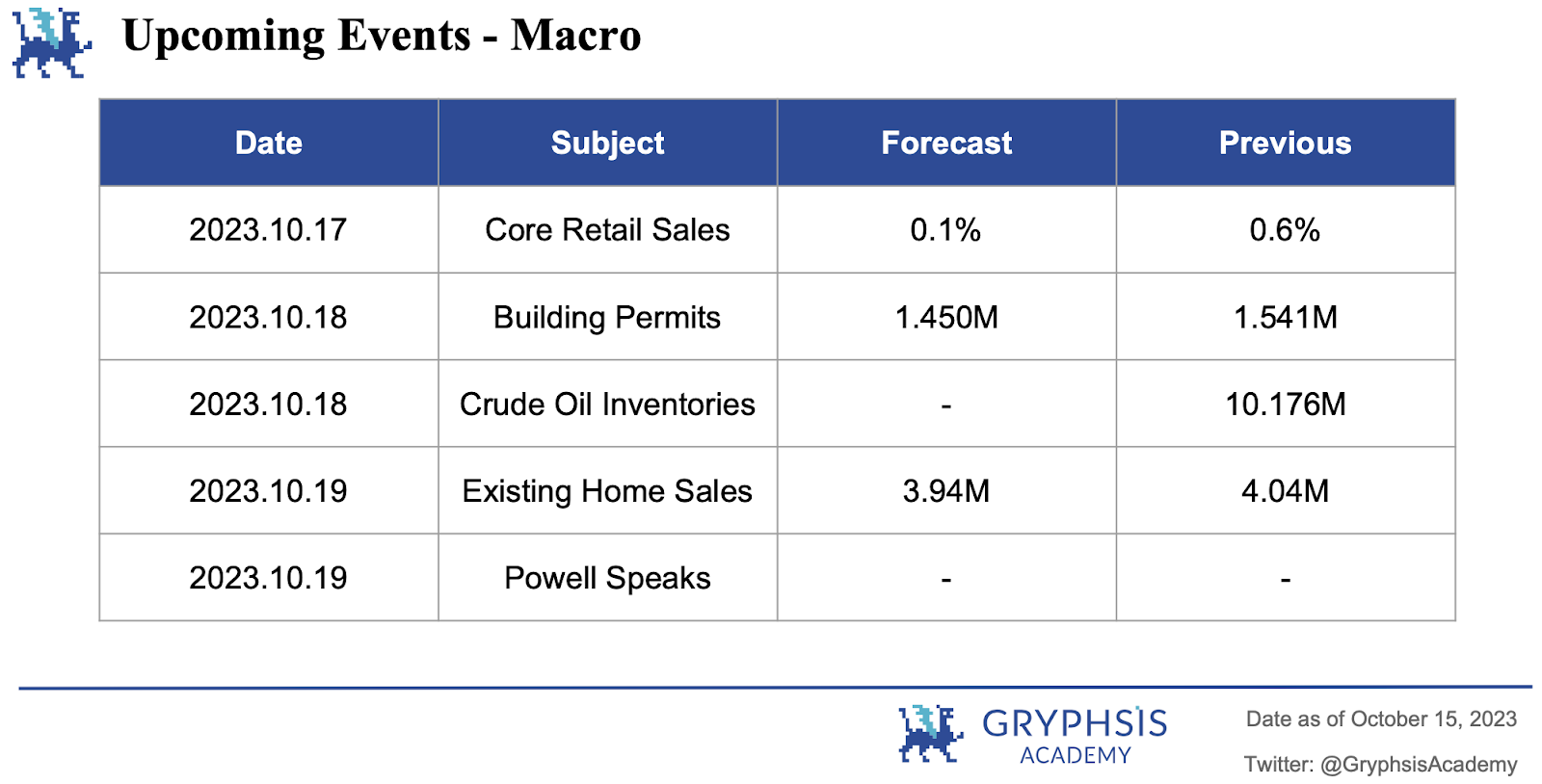

Crypto markets have seen significant losses compared to stocks over the past week, with $BTC and $ETH down 3.6% and 4.6% respectively. In the coming week, keep an eye on core retail sales, building permits, crude oil inventories and comments from Federal Reserve Chairman Powell.

Big news this week

Seamlessly trade anytime, anywhere: Uniswap wallet launched for Android users for the first time

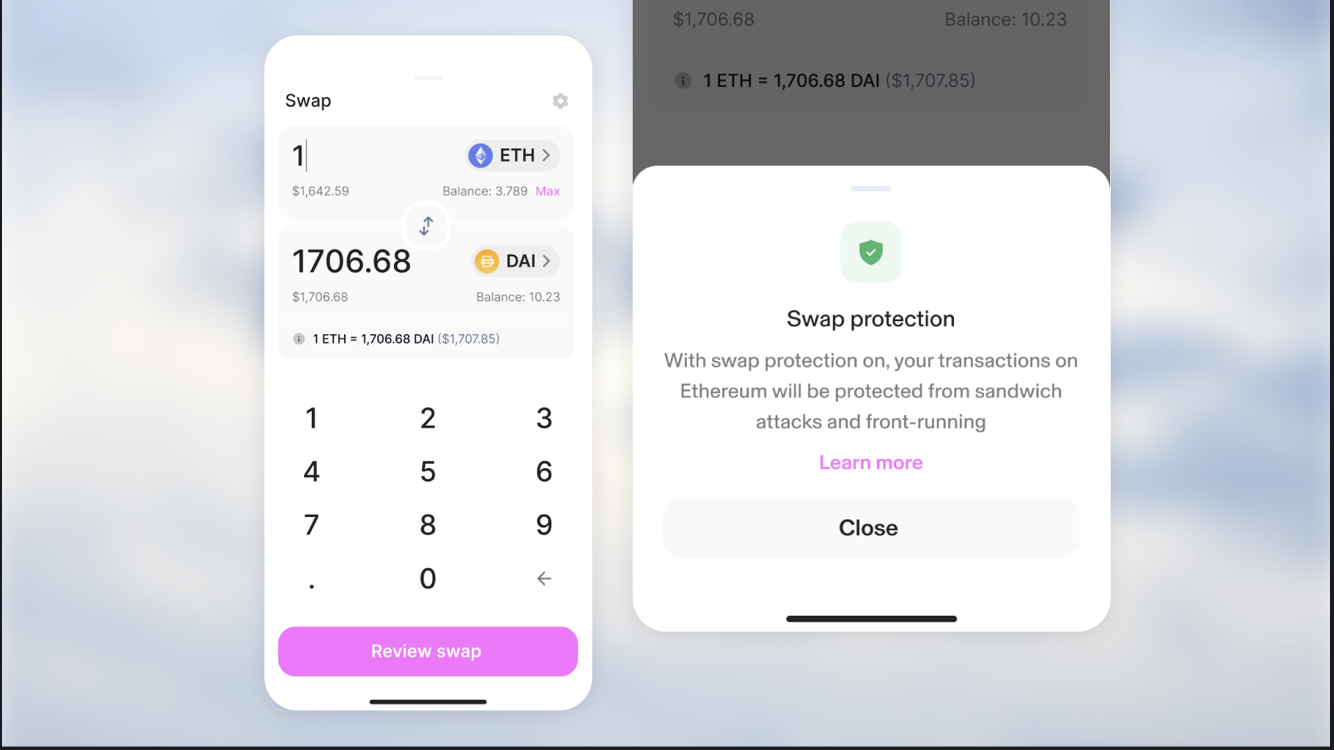

Uniswap, a leading decentralized exchange, has expanded its mobile presence with the launch of Uniswap Wallet for Android users. Prior to this, the Uniswap wallet was successfully launched on iOS in April and quickly became one of the top three wallet downloads. The Android version is currently in beta and is designed to replicate the seamless trading experience that users have come to expect from the Uniswap decentralized exchange (DEX). The team has invited members of the DeFi community to test the wallet to ensure a polished user experience once it is widely released. Already, 35,000 users have expressed interest and joined the waiting list.

The Uniswap wallet is designed with interoperability in mind, allowing users to easily switch between various blockchains. Initially, the wallet will support token swaps between chains such as Polygon, Arbitrum, Optimism, Base, and BNBChain, with plans to integrate more chains in the future. One of the standout features of this wallet is “Swap Protection”. This feature ensures that transactions are directed to private pools by default, protecting users from potential front-running and sandwich attacks. Additionally, the wallet emphasizes a transparent fee structure that displays gas prices upfront and allows users to make informed decisions.

Furthermore, Uniswap wallet not only provides a seamless user experience; It’s also about promoting trust and transparency in the community. Meanwhile, Uniswap Labs announced plans to open source the wallet code. Additionally, the results of the audits, including those by cybersecurity firm Trail of Bits, will be made public to ensure users are fully aware of the wallet’s security measures.

While the iOS version of the Uniswap wallet has proven its capabilities, the launch of the Android version is also highly anticipated. Uniswap Labs is taking a phased approach, gradually onboarding waitlist users and gathering valuable feedback. Those eager to become early adopters and gain access to upcoming features can register on Uniswap’s official website. As the cryptocurrency space continues to evolve, tools like Uniswap wallets play a key role in enhancing user experience and trust.

Our Take

In the rapidly evolving world of decentralized finance (DeFi), Uniswap has been at the forefront, driving innovation and accessibility. Following the success of its iOS wallet, the platform’s recent launch of an Android version marks an important step in expanding its reach. This move isn’t just about reaching a larger audience; it’s a strategic step toward democratizing finance in a region where mobile connectivity outpaces traditional computing methods. With its user-friendly interface and powerful features, Android wallets are expected to make DeFi trading as common as any other mobile banking operation.

In addition to accessibility, Uniswap’s Android wallet is a testament to the platform’s commitment to seamless and secure cross-chain interactions. In a world where cryptocurrencies are often siled, being able to easily swap tokens between different blockchains like Polygon and Arbitrum is a necessity. This interoperability solves a long-standing challenge, ensuring users are not limited to one blockchain but can easily navigate the entire crypto ecosystem. Additionally, security is a critical issue in the DeFi space that has been adequately addressed. wallet"exchange protection"The feature is a groundbreaking effort to protect users from potential trading threats and demonstrates Uniswap’s commitment to creating a secure trading environment.

Transparency is another cornerstone of Uniswap’s approach. Uniswap’s approach not only fosters trust but also encourages a culture of openness and accountability throughout the DeFi community. In essence, Uniswap’s Android wallet contributes to the future of DeFi – a future that is both accessible, secure and transparent, ensuring that the benefits of decentralized finance are available to everyone.

Weekly Agreement Recommendations

Orange Finance is an innovative protocol designed to optimize the benefits of centralized liquidity types of decentralized exchanges (DEXes). At its core, Orange Finance integrates a range of advanced strategies and features to improve the capital efficiency of Liquidity Providers (LPs).

The operation of this protocol is based on the following characteristics:

1. Delta hedging strategy: This approach is designed to protect liquidity providers from potential losses due to asset price fluctuations. In traditional finance, delta hedging is used to neutralize price fluctuations in the underlying asset, and Orange Finance has cleverly adapted this strategy to the DeFi space.

2. Smart Liquidity: Smart Liquidity is a dynamic mechanism used to determine the best price range to provide liquidity. It also adjusts fee tiers based on current market conditions. By simulating the volatility of models such as the GARCH model, and referencing parameters such as implied volatility and historical volatility, Smart Liquidity ensures that liquidity providers operate within the most capital efficient range.

3. Automatic rebalancing: Orange Finance recognizes the importance of maintaining an optimal liquidity position. To this end, the protocol has an automatic rebalancing mechanism. This ensures that accumulated fees are automatically compounded and liquidity positions are adjusted to remain optimal. If the asset price exceeds the set range, the rebalancing strategy will be triggered, liquidating the position and re-depositing liquidity within the newly simulated range.

4. Fungible Liquidity Locations: To enhance flexibility and practicality, Orange Finance introduces fungible liquidity locations. Orange LP tokens can be minted by following the ERC 20 token standard. These tokens can then be used for liquidity mining, incentivizing holders to provide concentrated liquidity within a specific price range.

5. L2 native and multi-chain support: In the DeFi ecosystem, scalability and interoperability are crucial. Orange Finance is designed to be L2 native, which means it is ready to support frequent rebalancing operations without incurring high gas fees. Additionally, the protocol’s multi-chain support ensures that it can cater for a large number of trading pairs across multiple networks.

6. Dynamic fee settings: Orange Finance adjusts fees based on traditional financial markets. In the event of increased market volatility, the protocol may set higher fees for liquid pairs. This dynamic fee setting is achieved by actively monitoring market conditions and adjusting fee tiers accordingly.

Essentially, Orange Finance has created an ecosystem that combines advanced financial strategies with blockchain technology, aiming to redefine the standards of liquidity provision in the decentralized space.

Our Insight

Orange Finance stands out in the DeFi space by maximizing returns on users’ trading fees while minimizing risk exposure. Central to this is its delta hedging strategy, which protects liquidity providers (LPs) from losses caused by asset volatility. With its “intelligent liquidity” feature, the protocol automatically adjusts price ranges to optimize capital efficiency for limited partners. Additionally, it employs a dynamic rebalancing strategy that weighs potential fee returns against potential rebalancing losses. This ensures that capital is only allocated when the returns justify the risk.

Another innovation is Oranges adoption of fungible liquidity positions via the ERC 20 token standard. This allows Orange LP tokens to be used for liquidity mining. As the DeFi ecosystem develops, especially with the rise of L2 solutions, Orange Finance is preparing to broaden its horizons and aims to provide professional LP services on various networks while catering to diverse liquidity pairs.

The DeFi space is flooded with protocols leveraging CLMM LP positions, ushering in the “LPDfi” narrative. This trend covers a wide range of applications, from perpetual contracts and options to vaults and liquidity platforms. These protocols mark a new wave of DeFi creativity, with Orange Finance becoming a particularly compelling player due to its tailored approach to yield and liquidity management. As “LPDfi” gains traction, we recommend enthusiasts explore these avant-garde protocols.

Gryphsis Research Spotlight

Welcome to this week’s Gryphsis Research Spotlight, where we share our team’s latest insights with you. Our dedicated research team continuously explores cutting-edge trends, developments and breakthroughs in the crypto space. This week, we’re excited to share with you our research, titled A Deep Dive into dYdX v4: Improved Token Economics and Valuation Outlook, designed to deepen your understanding of the evolving crypto world and inspire your curiosity.

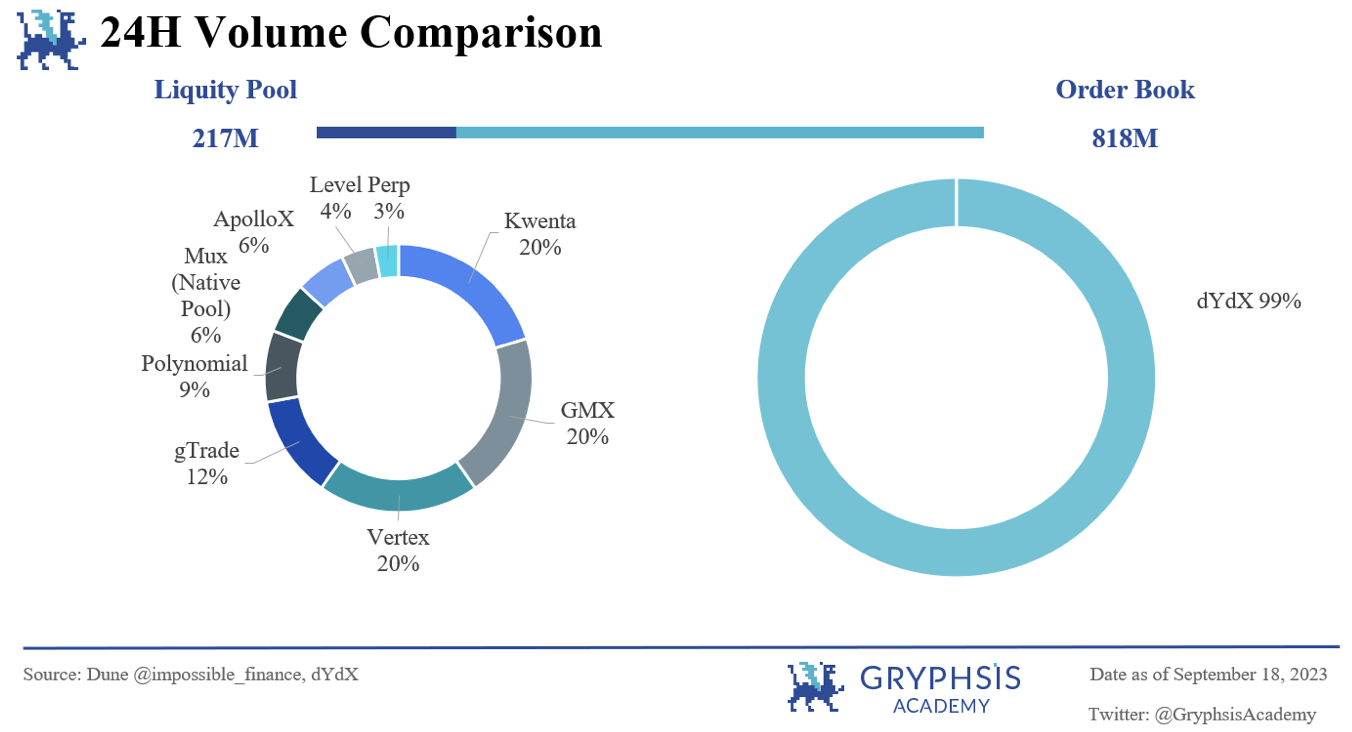

Founded in 2017, dYdX is a decentralized perpetual exchange that seamlessly integrates lending, margin trading, and perpetual contracts. In 2021, after the dYdX strategy was migrated to Starkware, it cleverly solved the challenges related to TPS and Gas fees. The move propelled the platform to a staggering 24-hour trading volume of over $800 million, making it the permanent Dex market leader.

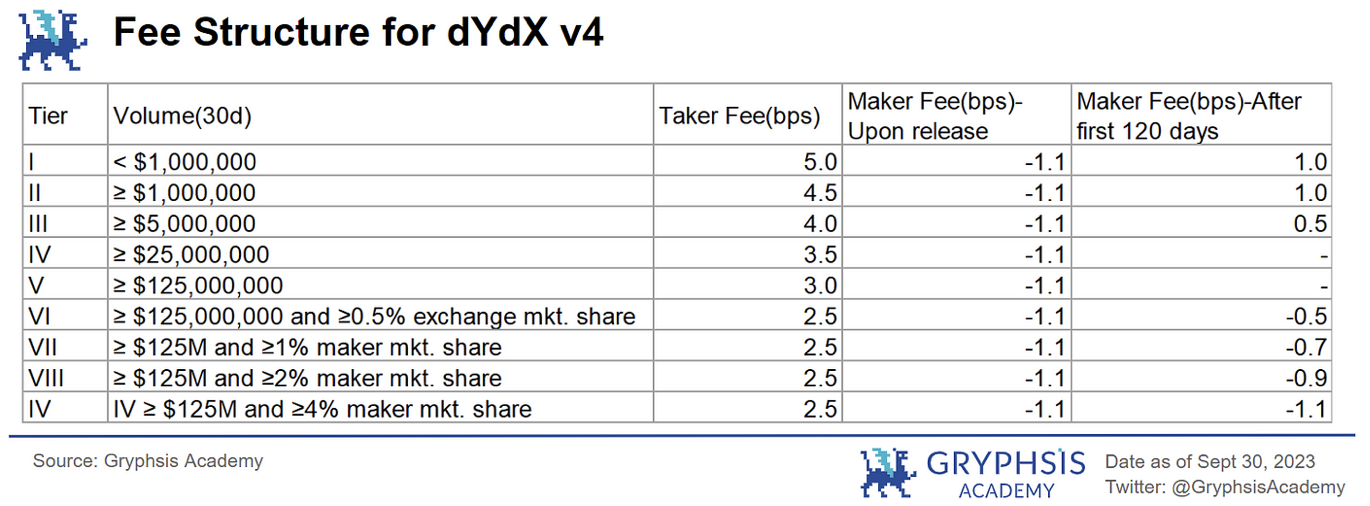

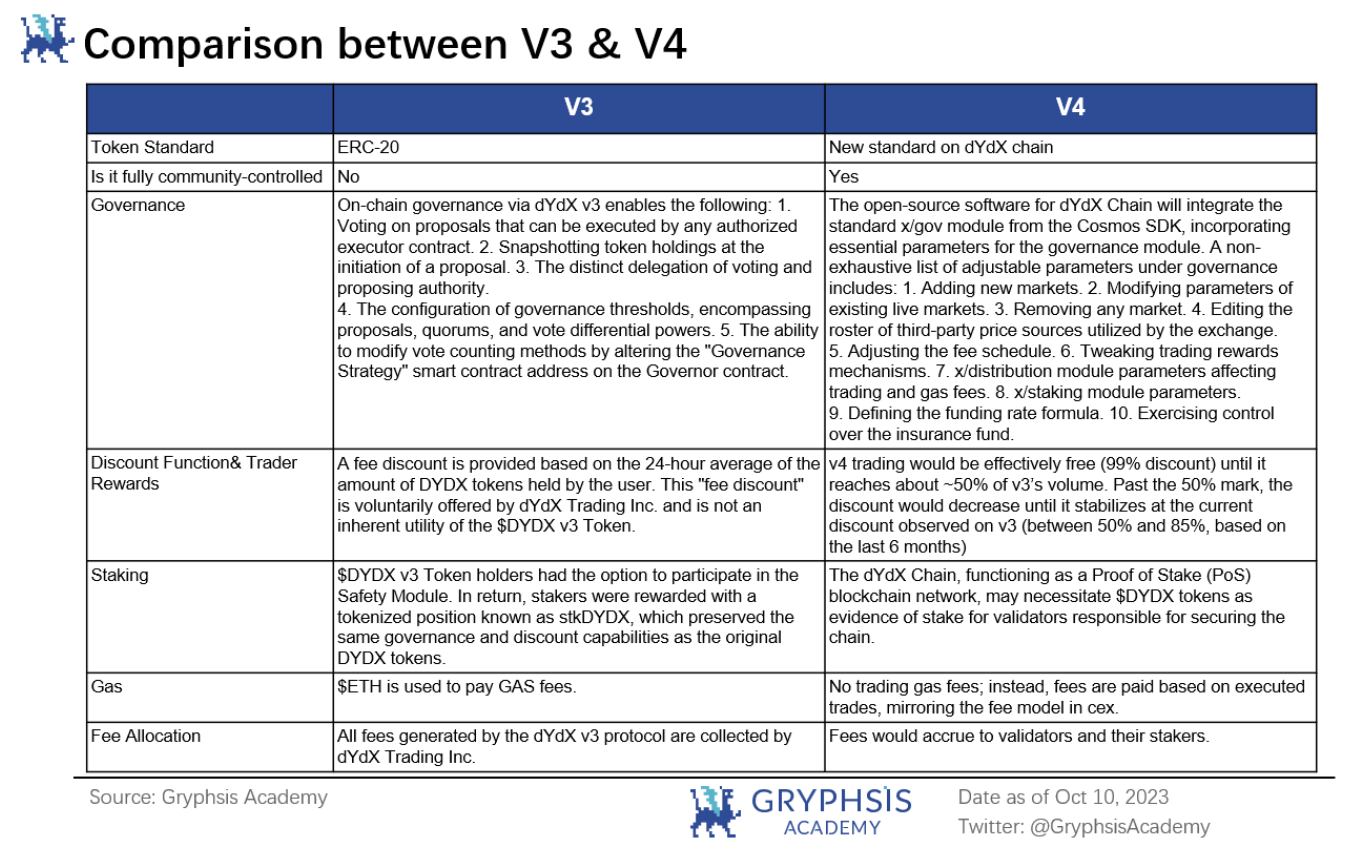

With the launch of v4 version, dYdX embarks on a journey of change. The platform has transitioned to a Layer 1 chain based on the Cosmos SDK. This shift provides the dual benefits of off-chain matching combined with on-chain consensus. Notably, this shift eliminates gas fees for placing and canceling orders, and is only charged when a transaction is completed. Additionally, dYdX implements its vision of complete decentralization in its governance structure.

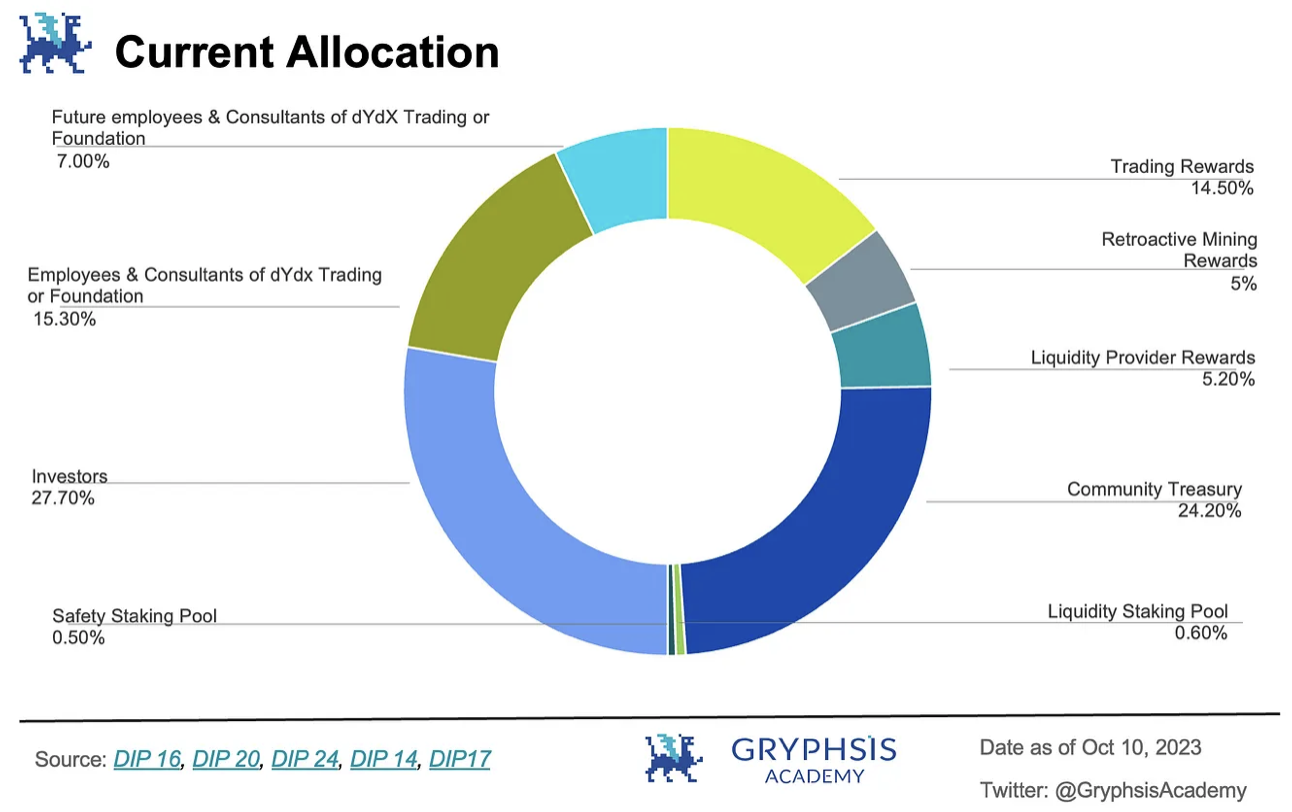

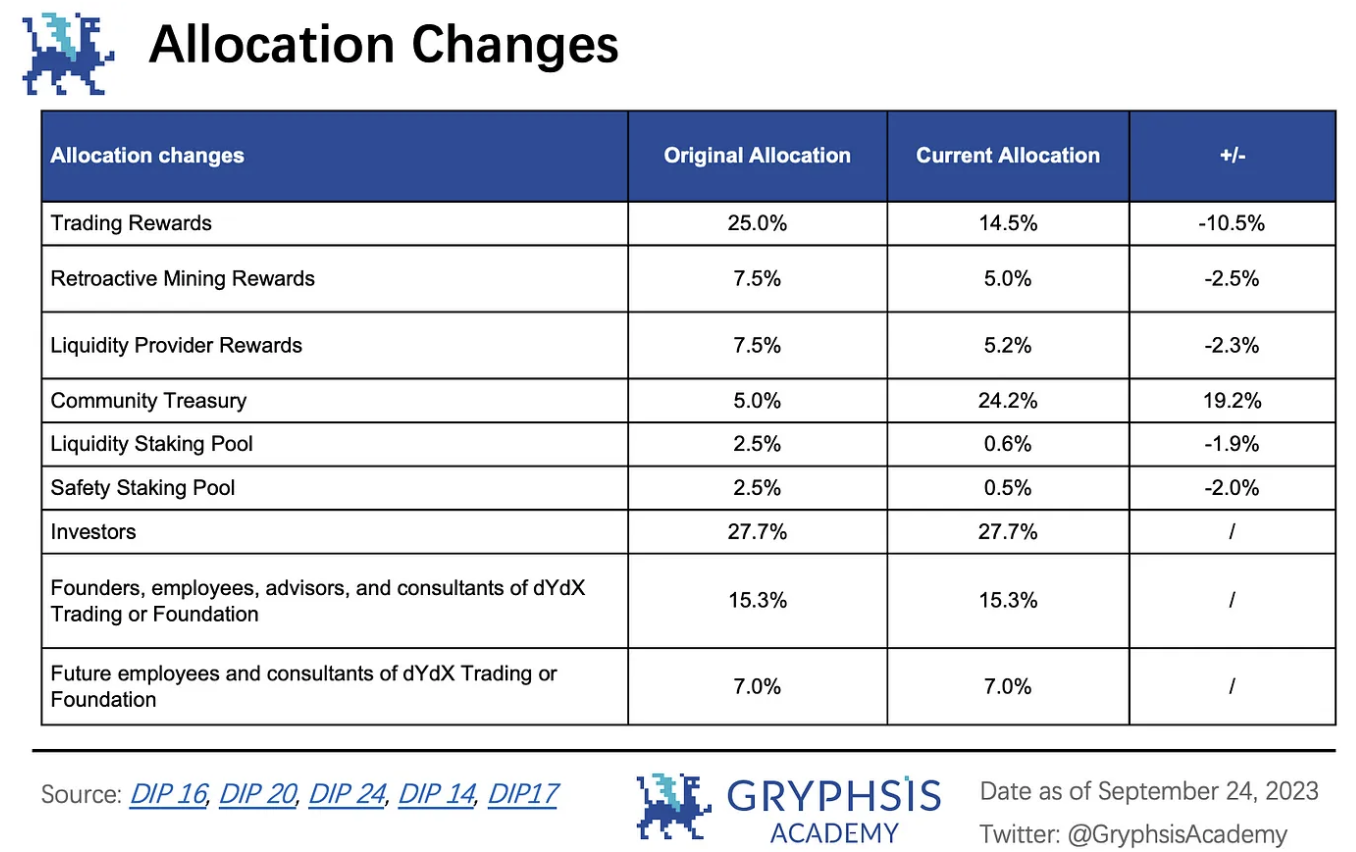

When it comes to token economics, v4 stands out compared to its predecessor. It proposes complete token standards, a stronger governance framework, enhanced discount features, generous trader rewards, strategic staking, and optimized Gas and fee allocation methods, all of which together amplify the intrinsic value of the token.

The platforms decision to align with Cosmos on its v4 was driven by several strategic considerations. Cosmos is known for its decentralization and high performance. Additionally, its structure provides the ability to withstand potential regulatory scrutiny. The availability of USDC on Cosmos is a game changer, significantly increasing dYdX’s liquidity. Additionally, Cosmos promises to provide dYdX with better scalability and composability, making it a top choice.

This article provides a comprehensive overview of dYdX’s protocol evolution, illuminating its team, funding trajectory, business units, and token economics. It highlights the marginal improvements v4 brings over v3, highlighting features such as the transition from Layer 2 to an alternative Layer 1, innovative order mechanisms, strategic elimination of transaction gas fees, and a fully decentralized governance model.

While the move to Cosmos offers many advantages, including increased decentralization, superior performance, regulatory resiliency, and enhanced asset security through native USDC, it is not without its challenges. The main focus revolves around security, as users will now need to trust a new set of validators on the dYdX chain.

All in all, dYdX v4 promises to empower the $DYDX token and bring a host of benefits. However, potential investors and users must exercise caution and be aware of the inherent risks that come with staying away from Ethereum. As with any investment, thorough research and expert consultation are crucial.

This section provides a concise preview of our detailed study on dYdX v4. We encourage readers to read furtherfull report, for complete understanding and expert analysis of this fascinating topic!

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Membrane Labs

Membrane Labs, a cryptocurrency trading and lending platform, has raised $20 million in a Series A funding round that includes contributions from prominent firms including Brevan Howard Digital, Point 72 Ventures, and Jane Street. Following past platform missteps and amid growing regulatory pressure on transparency in the crypto sector, Membrane Labs aims to develop a robust trading infrastructure. CEO Carson Cook describes the company as a"settlement network", focusing on improving transparency and risk management by integrating various trading components. While many advocate a complete shift to decentralized finance (DeFi), Membrane Labs offers classic and smart settlement options for a variety of institutional preferences.

https://x.com/Membrane_Labs/status/1712118472010801536?s=20

Silks

Game of Silks, a blockchain gaming platform that simulates thoroughbred horse racing, has raised $5 million in its Seed 2 round of funding, marking significant progress in the blockchain fantasy sports space. Led by CEO Dan Nissanoff, Silks combines digital collectibles with real-world horse racing dynamics, establishing partnerships with entities such as NYRA and FOX Sports. Launched in June 2021 by Nissanoff and Troy Levy, with over $10 million in funding and backed by investors including Taylor Made, the platform is quickly reshaping the intersection of blockchain gaming and horse racing. With community membership reaching 25,000 and continuing to grow, Silks continues to attract attention in both the blockchain and horse racing worlds.

https://x.com/gameofsilks/status/1712107411782140028?s=20

Protocol update

Polygon Labs proposes Layer 2 'ApeChain' to power ApeCoin ecosystem

Sei Labs uses Plaid's KYC solutions shortly after Layer 1's launch

BarnBridge DAO votes over response to SEC probe

Platypus Finance suffers more than $ 2 million exploit on Avalanche

Instadapp introduces lending protocol Fluid in testing phase, aiming for January release

Scroll appears to have gone live on mainnet, $ 500, 000 bridged so far

THORswap resumes with updated terms to exclude users from sanctioned countries

GMX to receive largest share of Arbitrum's $ 40 million grant, Lido misses out

Industry events

Ferrari to accept crypto for luxury car purchases

FTX estate stakes $ 122 million of Solana

MetaMask appears to have been removed from the Apple App Store

Tether promotes Paolo Ardoino to CEO role

Mastercard successfully wraps up CBDC pilot with Reserve Bank of Australia

CoinList launches multi-chain staking fund for U.S. accredited investors

Trezor unveils new crypto hardware wallets and backup solution

Galxe announces $ 396, 000 refund to affected users following DNS attack

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/thedefiedge/status/1712074649121529949?s=20

https://x.com/cyrilXBT/status/1713302394358948224?s=20

https://x.com/TheDefiDog/status/1713305584114491775?s=20

https://x.com/TheDeFISaint/status/1713281633791492152?s=20

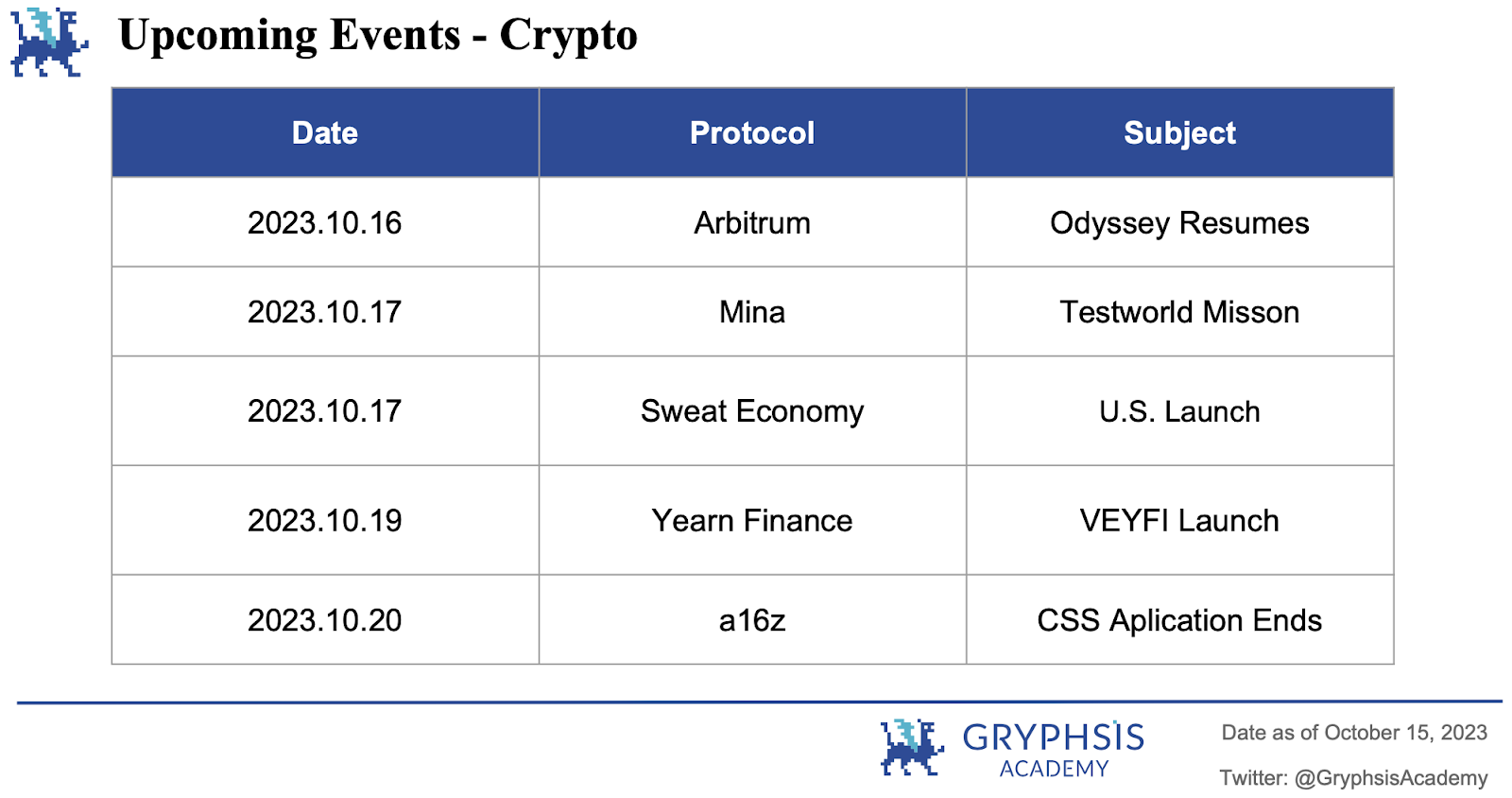

next week events

News sources/references:

https://blog.uniswap.org/uniswap-wallet-android

https://www.theblock.co/post/256095/layer-2-zkevm-scroll-appears-to-have-gone-live-on-mainnet-500000-bridged-so-far

https://decrypt.co/201327/uniswap-launches-mobile-ethereum-wallet-android

https://blockworks.co/news/uniswap-wallet-ios-android

https://blockster.com/game-of-silks-raises-5m-in-second-financing-round

https://www.nasdaq.com/articles/game-of-silks-crypto-powered-horse-racing-startup-raises-$5m-despite-industry-funding-at-a

https://www.businesswire.com/news/home/20231011150909/en/Game-of-Silks-Raises-5M-in-Second-Financing-Round-Moving-Blockchain-Gaming-Investors-Off-The-Sidelines

https://www.coindesk.com/business/2023/10/11/crypto-prime-broker-membrane-labs-raises-20m-from-brevan-howard-point72-and-jane-street/

https://coinstation.vn/membrane-labs-raises-20m-in-series-a-fundraising-round/

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.