Shared by: Charles, researcher at imToken Labs

The topic of this sharing is Intent-Based Swap and how it will affect the DEX market. The following content will first introduce the current mainstream trading model of DEX, then introduce the concept of intent and the principles, advantages and disadvantages of intent-based trading, and then introduce the current main intent-based trading products and their extensions.

Current mainstream trading models

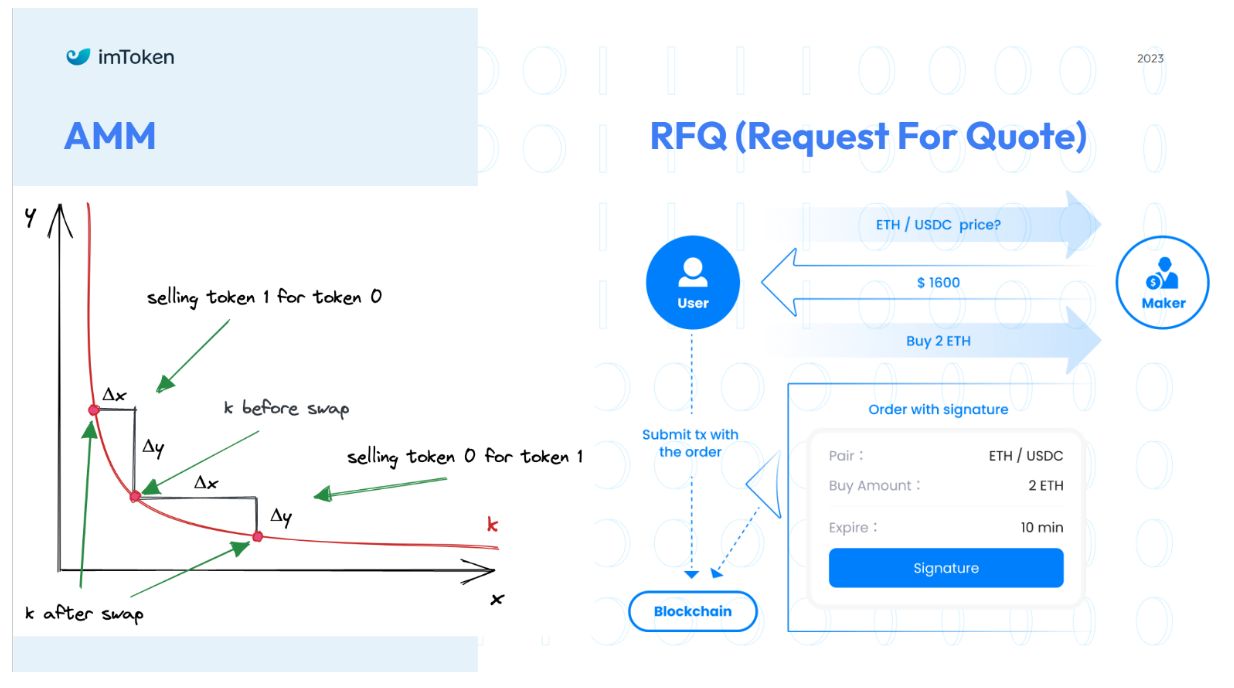

There are currently two types of mainstream trading models. The first type is the common AMM model, with a simple x*y=k design. DEX using this model allows users to trade at any time, but in order to achieve this, AMM chooses a relatively conservative liquidity strategy, like this The strategy makes the capital utilization rate not high, and price fluctuations will cause liquidity providers to lose funds. In addition, on-chain orders may also encounter problems such as transaction front-running or transaction failure due to price changes. The familiar DeFi products based on the AMM model include Uniswap, Curve and Balancer.

The second type is the RFQ model of off-chain matching and on-chain clearing, that is, the user first asks for a quotation, and then a professional market maker provides a quotation, and the transaction is completed after the user confirms. This model is relatively user-friendly, with no slippage issues and no need to worry about being attacked by MEV; however, there are challenges for market makers, who need to take into account price fluctuations, order validity periods, and manage user quotation needs. In short, it is user-friendly but not market-maker-friendly. Therefore, AMM and RFQ are complementary.

What is Intent

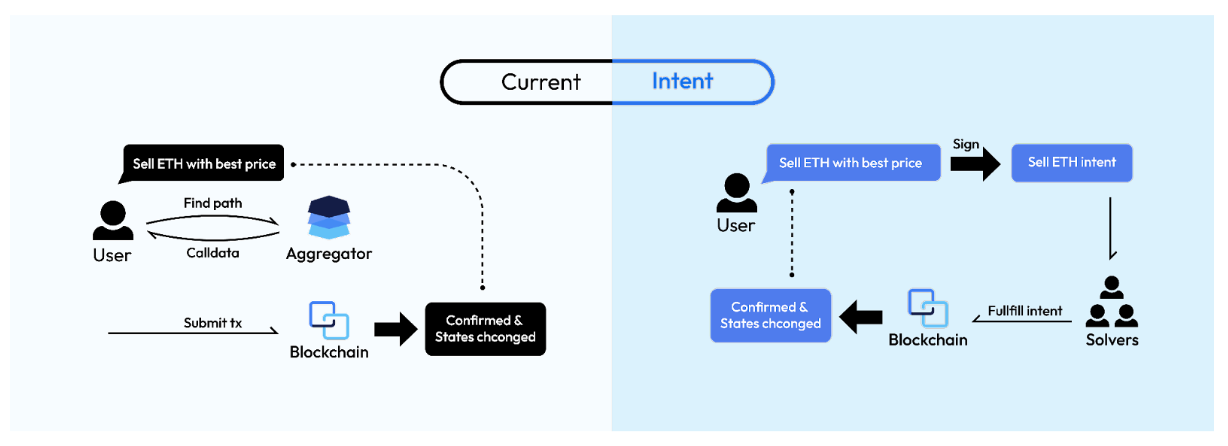

Currently, users need to submit complete transaction information to interact with DApp on the chain, and their Calldata contains all the information required for the execution of the transaction. Intent focuses on the intention (or purpose) of the transaction, and leaves the intermediate steps of how to achieve the intention to the professional Solver role.

As shown in the figure, under the traditional model, users need to clarify the transaction path, purpose and other signature information when initiating a transaction. In Intent mode, users only need to clarify the purpose of the transaction without worrying about more. The transaction content other than the transaction purpose will be supplemented by the Solver and ensure that the supplemented transaction execution results can meet the users transaction purpose.

A new transaction (Swap) model based on Intent

Intent-based Swap only requires users to specify certain conditions when initiating a trading order. This condition can be price, timeliness, counterparty or transaction quantity, etc. Others are filled by the previously mentioned Solver and the transaction orders are uploaded to the chain. Therefore, it can be understood that in Intent-based Swap, the user defines what they want and the Solver completes how to execute it.

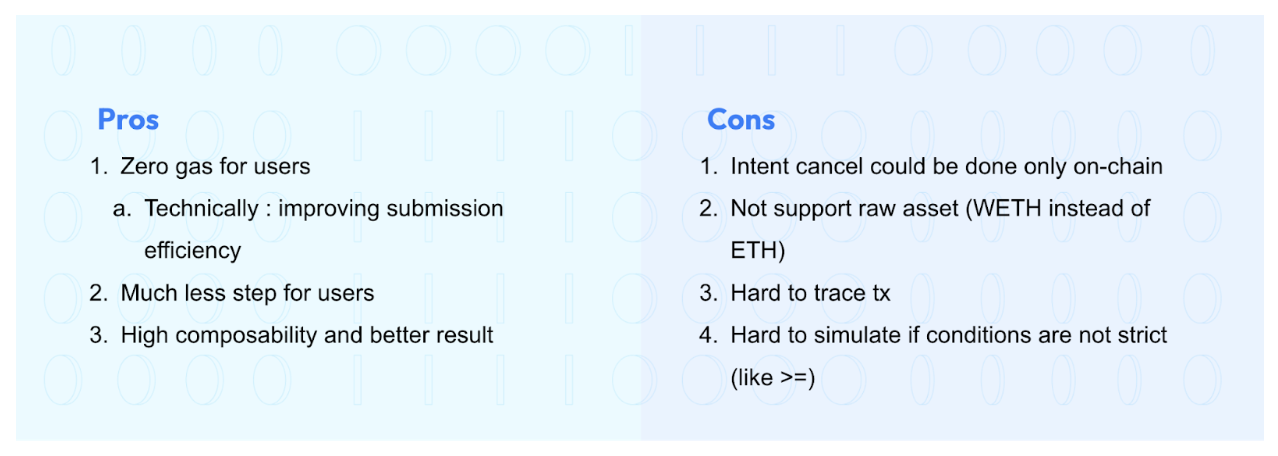

So what are the specific advantages? One is that in Intent-based Swap, users only need to sign information without uploading transactions to the chain, so users do not need to pay miner fees, that is, 0 gas for users. The second is that the order needs to be uploaded to the chain eventually. After the user switches to a more professional Solver for this step, it can not only improve the efficiency of the order uploading, but also help the user avoid potential troubles such as setting Gas Price, Gas Limit, and whether there is ETH. . The third is good combinability. After the user specifies some order conditions, the Solver has more room at its disposal for specific execution. It can combine various liquidity sources, price sources, etc., making it easier to meet the users trading purposes.

Intent-based Swap also needs to be improved. First, if the user regrets after signing, the transaction needs to be canceled on the chain. Second, because this type of Swap adopts the Pull Payment method, it does not support direct selling of the native ETH currency on the Ethereum chain. The third point is that orders are difficult to track. This is mainly because the actual chain time of the transaction depends on the Solver. It is also different from the traditional model where the transaction can be easily tracked through the From and To Address fields. Fourth, because Swap users under this model only define what they want, it is difficult for DEX to simulate the details of transaction execution in advance, and it is difficult to predict the final outcome in advance for some condition definitions (such as selling price >= target price). result.

Application cases and extended exploration based on Intent Swap

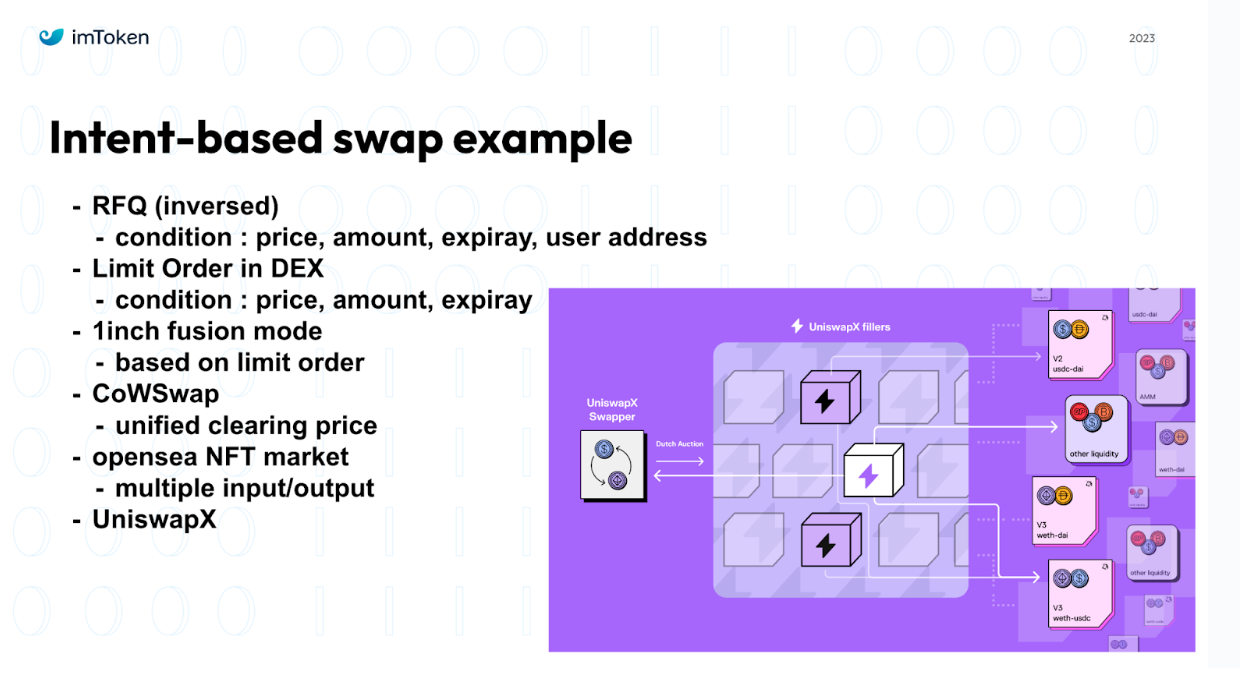

In fact, RFQ and limit orders are actually simple applications of Swap based on Intent. In RFQ, users only need to specify the price, quantity, timeliness and payment address, and other information required for the order is completed by a third party. The limit order pattern is similar.

Currently, the products that everyone is familiar with on the market include 1inch’s fusion mode, CoW Swap, OpenSea’s NFT pending orders and UniswapX.

Intent-based Swap is not limited to iterating traditional transaction models, it also opens up new transaction models and application possibilities. The architecture is quite flexible. In addition to the one-time swap applications listed above, Intent can also be used as a proxy authorization implementation method, such as allowing professional market makers to trade certain assets within a certain time range and price range. Perform specific operations to implement advanced trading applications such as grid trading, large-amount batch buying, TWAP (Time-Weighted Average Price) trading, etc.

How Tokenlon applies Intent design

Tokenlons current RFQ and limit order functions are already Intent-based Swap applications. In addition, Tokenlon is developing new trading products based on the Intent design concept, such as BestBuy, grid trading and other directions. By integrating industry cutting-edge exploration, it expects to bring more value and better trading experience to users.

More about imToken

imTokenIt is a decentralized digital wallet used to carry assets, identities and data in the encrypted digital world. Founded in 2016, imToken has provided security and trustworthiness to more than 15 million users in more than 150 countries and regions around the world. digital asset management services.