Is every time MicroStrategy announces its purchase of BTC a signal of decline?

Original - Odaily

Author - Nan Zhi

From August 2020 to now, MicroStrategy has announced a total of 28 BTC purchases, with a total of 158,245 Bitcoins purchased, and the total average position price is 29,582 USDT.

Every time a purchase is announced, the following voices often appear on social media:

① The average purchase price of each MicroStrategy purchase is higher than the market price at the time of announcement (multiple rescue);

② As soon as MicroStrategy announces its purchase of BTC, the market will begin to fall.

Odaily reviewed MicroStrategy’s 28 BTC purchases to explore whether there is some connection between MicroStrategy’s announcement of BTC purchases and the market price.

MicroStrategy Official Spread Analysis

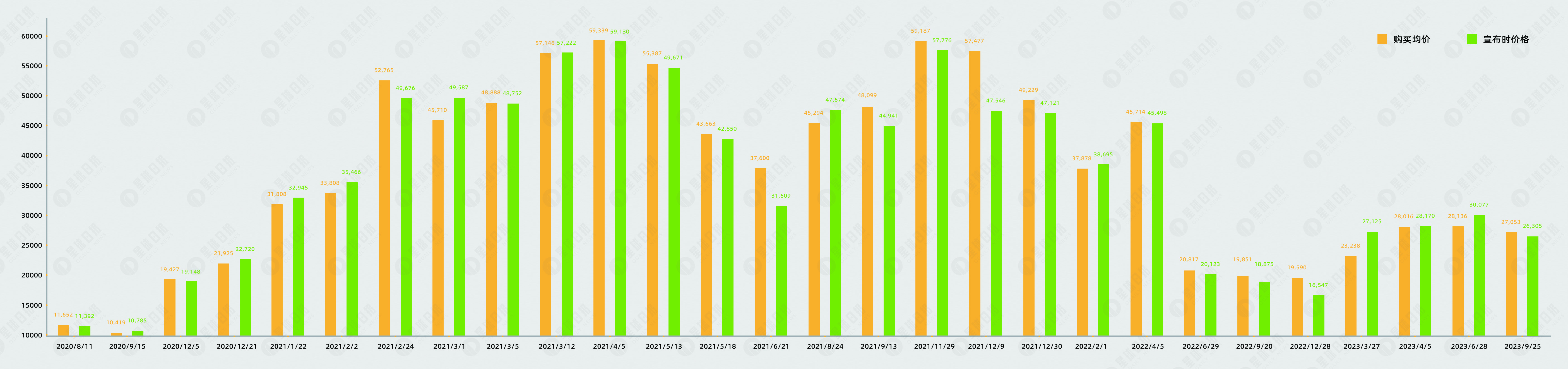

The price situation of MicroStrategys 28 BTC purchases is as follows. It can be seen that there is a significant price difference between the market price at the time of announcement and the purchase price for a certain period of time.

The proportion of market price at the time of announcement is greater than the purchase price reaches 60.7%, and the average price difference is -1.43%, which means that MicroStrategy does have a certain tendency during the announcement period, with an average decline of 1.43% before the purchase is announced.

The details of the price difference (absolute value) are as follows:

50% spread within 1000 USDT;

39% spread between 1000 USDT and 5000 USDT;

There were three other times where the price difference exceeded 5,000 USDT, namely -5716 USDT, -5991 USDT, and -9931 USDT.

The conclusion is more significant when measured by the spread rate:

25% spread rate range 0% -2%;

39% spread rate range 2% -5%;

21% spread rate range 5% -15%;

The spread rate exceeded 15% 4 times, namely -15.53%, -15.93%, 16.73%, and -17.28%.

MicroStrategy official announcement market situation analysis

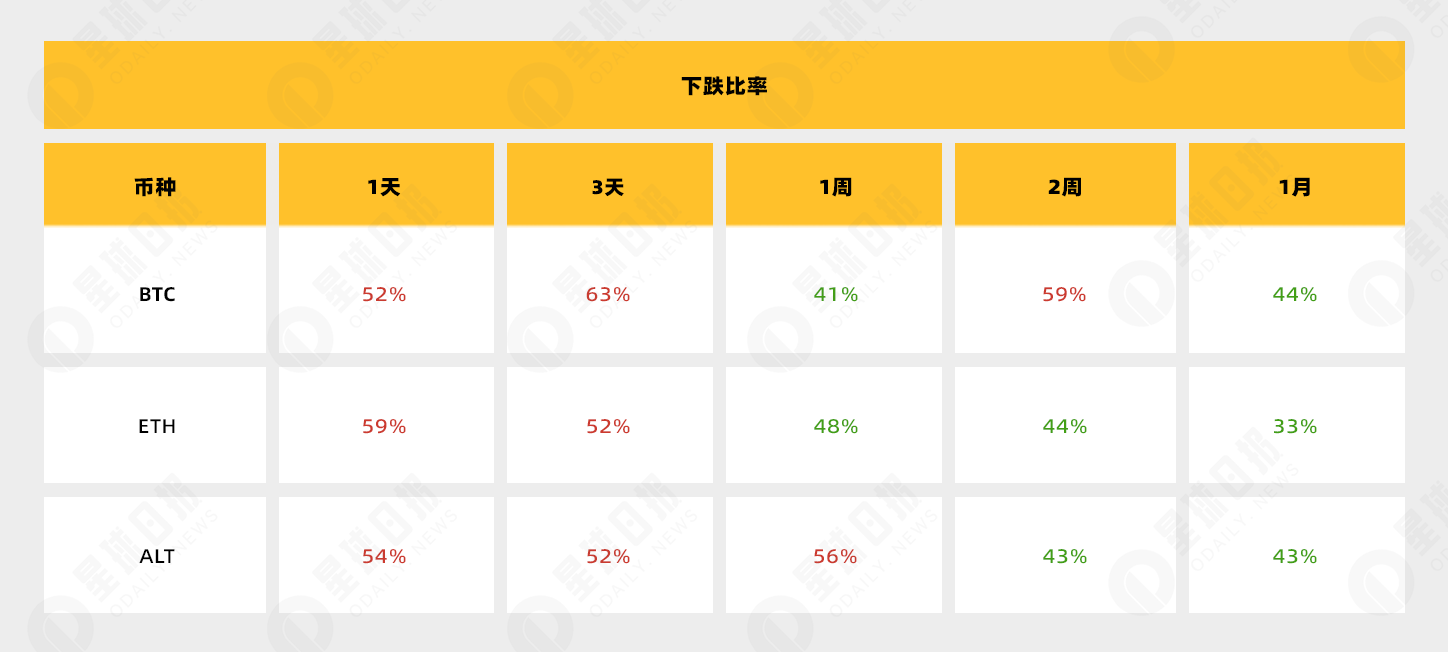

We analyzed the market conditions in each period after MicroStrategy’s official announcement, excluding purchases on September 25, including:

Time: Select length dimensions such as 1 day, 3 days, 1 week, 2 weeks, 1 month, etc. for comparison;

Market: Select BTC, ETH, mainstream altcoin average (CoinGecko’s top 20 non-stable coins by market capitalization, including BNB, XRP, ADA, DOGE, SOL, TRX, DOT, MATIC, LTC, BCH, LINK);

Price: Based on the closing price of each time period.

The comprehensive results are as follows:

It can be seen that the statement that the market will start to fall as soon as MicroStrategy announces its purchase of BTC is not groundless. In the short term, the three types of markets all tended to decline, but after the time expanded to a week, the probability of rising began to rise, and the ETH market law was the most obvious.

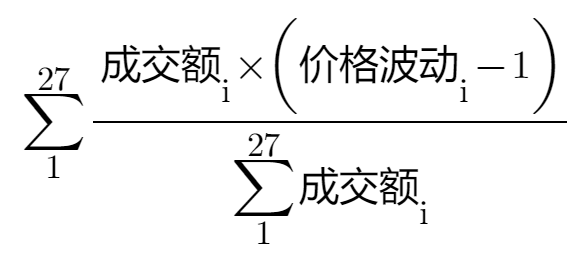

On the other hand, each MicroStrategy purchase volume (or amount) is different. Using the amount as the weight for weighted calculation can better highlight MicroStrategys judgment. The calculation formula is as follows:

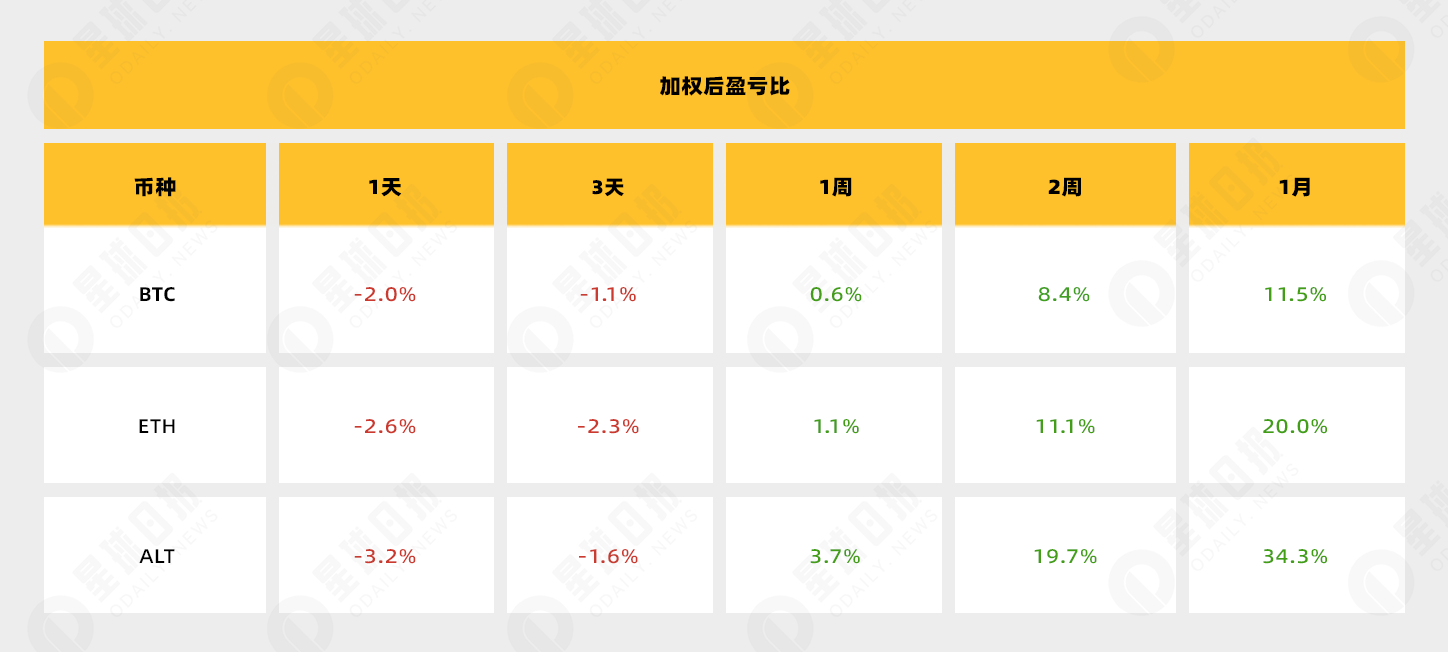

The weighted calculation results are as follows. The decline in the first three days has remained unchanged, but the magnitude has reduced. Then the profit-loss ratio began to rise significantly, indicating that MicroStrategy has a higher probability of long-term rise when making heavy bets.

in conclusion

The markets two general conclusions about MicroStrategy are indeed consistent with the statistical results, and asFirst Nasdaq-listed company to buy Bitcoin, most of MicroStrategys positions with a heavy BTC position were established at the end of 2020, and the profit was considerable, but its profits have been considerable so far.Only sold Bitcoin once, although it has a short-term counter-indexing constitution, it has proved its confidence in the bull market with its positions.