LD Capital: A quick overview of the major global regulatory development patterns of virtual assets in one article

Author: Alfred, LD Capital

The ideal state of the Crypto world is a decentralized, permissionless system that runs on digital rules. This sounds somewhat contradictory to traditional regulation, but the current development of the crypto industry is rapidly integrating with regulatory bodies around the world. Perhaps many crypto natives I don’t like it, but bills are coming out frequently in various countries, and regulatory dynamics have become the absolute focus of industry development.

We believe that sovereign freedom and mathematical order will still be the core of the industry in the future. However, if new things want to be integrated into the existing world order on a large scale and be promoted and developed rapidly on a global scale, competition and integration with supervision are inevitable. Through the road. This article will sort out the current progress of the most important trends in 2023 from the perspective of industry observers (*In view of the common regulatory habits of various countries, this article uses virtual assets to refer to generalized crypto assets and digital assets).

1. Singapore—a leader in virtual asset regulation

After the bankruptcy of Three Arrows Capital and FTX, Singapores regulations have become more cautious and strict, and its development speed has slowed down. However, because of its stable policies and open environment, Singapore is still the first choice for Web3 companies and entrepreneurs around the world. one.

1. MAS’s regulatory framework for three categories of virtual assets

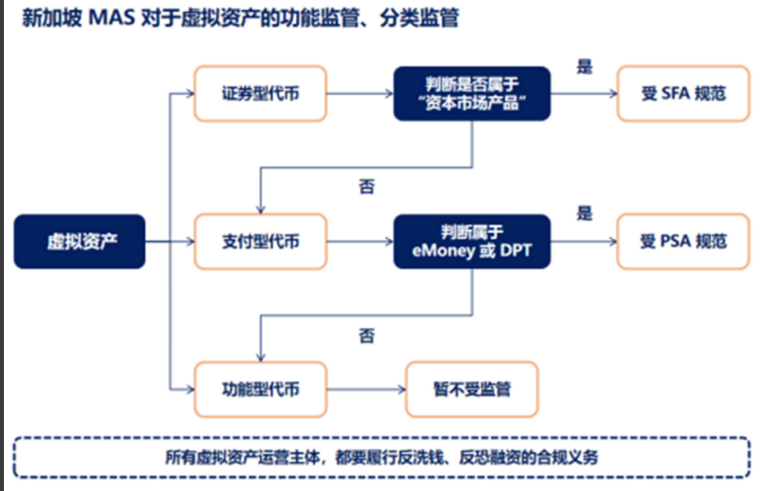

The Monetary Authority of Singapore (*MAS) is Singapores central bank and comprehensive financial regulator, and is also responsible for regulating the Web3 industry. MAS adopts the idea of functional supervision and classified supervision of virtual assets to carry out legalized supervision.

According to the Digital Token Issuance Guidelines revised and released by MAS in May 2020, the functions and characteristics of virtual assets are divided into three categories: Security Tokens (*Security Token); Payment Tokens (*Payment Token) ;Utility token (*Utility Token). Among them, eMoney is an electronic currency among payment tokens, and DPT is a digital payment token, which is a cryptocurrency for the purpose of payment (*such as BTC, ETH).

Source: Web3 Xiaolu

If they are classified as security tokens, they are regulated by the Securities and Futures Act (*SFA). Payment tokens are regulated by the Payment Services Act (*PSA). There are no clear regulatory regulations for functional tokens. To be included in the SFA, assets under the supervision of PSA need to obtain regulatory approval from MAS and obtain the corresponding access license to operate in compliance. At the same time, all virtual asset activities, like other financial activities, are subject to anti-money laundering and anti-terrorist financing compliance and supervision.

2. Launch the final regulatory framework for stablecoins

On August 15, 2023, MAS announced the final version of the regulatory framework for stablecoins, aiming to ensure that stablecoins regulated in Singapore have a high degree of value stability, becoming one of the first jurisdictions in the world to incorporate stablecoins into the local regulatory system.

As defined by the regulatory framework, stablecoins are digital payment tokens (*DPT), applicable to single-currency stablecoins (*SCS) issued in Singapore that are pegged to the Singapore dollar or any G 10 currency and maintain a relatively constant value. Issuers of such SCS must meet four key requirements: value stability; capital requirements; redemption at par value; and information disclosure.

When well regulated to maintain this value stability, stablecoins can serve as a trusted medium of exchange to support innovation, including the “on-chain” purchase and sale of digital assets. At the same time, only stablecoin issuers that meet all requirements under the framework can apply to MAS for their stablecoins to be recognized and labeled as MAS-regulated stablecoins. The label will allow users to easily distinguish MAS-regulated stablecoins from other digital payment tokens, including “stablecoins” that are not subject to the MAS stablecoin regulatory framework. If users choose to trade stablecoins that are not regulated by the MAS framework, they should make their own informed decision regarding the attendant risks.

2. Hong Kong, China—developing virtual assets at the greatest acceleration

After several years of silence, starting from the Hong Kong Virtual Asset Development Policy Declaration issued by the Hong Kong Treasury Bureau on October 31, 2022, the embrace of the virtual asset industry has been accelerated again, and policies will be frequently implemented in 2023 to show determination. In the 2022/23 annual report released by the Hong Kong Financial Services Development Council, Hong Kong is positioning itself as a global leader in developing complementary virtual assets and technologies.

1. Hong Kong’s unique dual license system

Hong Kong’s current licensing system for virtual asset trading platform operators is a “dual license” system. One type of license is for security tokens and is applicable to the supervision and licensing system of the Securities and Futures Ordinance. The other type of license is for non-security tokens and is applicable to the licensing system of the Anti-Money Laundering Ordinance. The Hong Kong Securities and Futures Commission has previously stated that the terms and characteristics of virtual assets may evolve over time, and the definition standards of security tokens and non-security tokens may also change. Therefore, in order to ensure compliance, virtual asset platforms should hold Dual license plates.

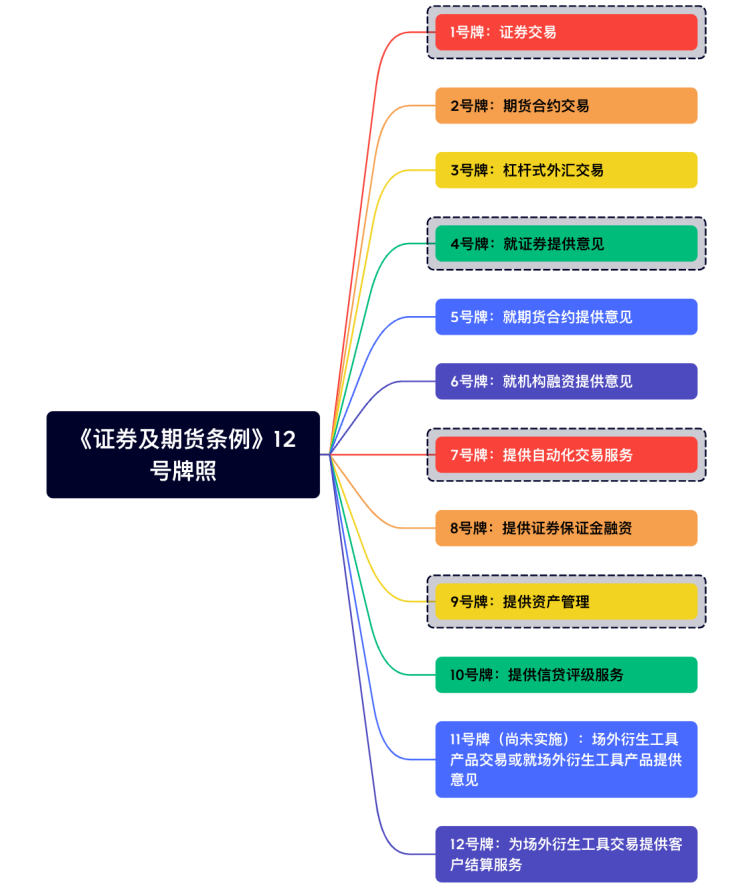

(1) License No. 12 of the Securities and Futures Ordinance

Hong Kong has previously had a relatively complete license access system. If virtual assets are classified as security tokens, they need to apply for securities-related access licenses. Currently, there are three types of licenses that must be applied for to operate virtual asset business, namely No. 1 license, No. 7 license and VASP license. In addition, depending on actual business needs, No. 4 license and No. 9 license may also need to be applied for.

(2) VASP license

The virtual asset service provider (*VASP) licensing system comes from the new regulations of the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance. In December 2022, the Hong Kong Legislative Council passed the third reading and gazetted the bill, becoming Hong Kong’s first bill involving the regulation of virtual assets.

According to the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Regulations 2022, virtual assets are defined as follows: Virtual assets are cryptographically protected digital values expressed in terms of units of calculation or stored economic value; they can be used as a medium of exchange for Payment for goods or services, repayment of debts, investment; or used to vote on the management, operation, or changes in terms of virtual asset-related matters; can be transferred, stored, or bought and sold electronically; the Securities and Futures Commission or the Treasurer may expand it by gazetting or narrow the scope of virtual assets. The definition of VA in the Regulations on Combating Money Laundering will cover most virtual currencies on the market, including BTC, ETH, stable coins (*Stablecoin), utility tokens (*Utility Token) and governance tokens (*Governance Token), etc. .

Virtual asset trading platforms that currently hold licenses No. 1 and 7 also need to apply for a VASP license from the China Securities Regulatory Commission, but a simplified application procedure applies. On August 3, HashKey and OSL applied for license upgrades to No. 1 and No. 7 through simplified procedures and received approval for retail services within a short period of time, expanding their business scope from only professional investors to retail users.

At the same time, the Anti-Money Laundering Regulations provide transitional arrangements for original virtual asset exchanges, stipulating that June 1, 2024 will be the transition period. For virtual asset trading platforms that already hold licenses 1 and 7 but have not yet obtained a VASP license, the China Securities Regulatory Commission recommends the implementation of a 12-month transition period. Those who do not intend to apply for a license should make preparations to wind down their business in Hong Kong in an orderly manner. The deadline for winding up is May 31, 2024. To put it simply, starting from June 1, 2024, virtual asset exchanges without a VASP license will not be able to operate in compliance.

2. Accelerate the development of stable coins

Regarding stablecoins, the SFC also made it clear in the Consultation Summary: The Hong Kong Monetary Authority has issued the Consultation Summary on Crypto-Assets and Stablecoins Discussion Paper in January 2023, stating that it will implement stablecoins in 2023/24. Supervisory arrangements will establish a licensing and licensing system for stablecoin-related activities. Until stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading. On May 18, the Hong Kong Monetary Authority announced the launch of the Digital Hong Kong Dollar pilot program, with a total of 16 companies from the financial, payment and technology industries selected to participate in the first round of trials in 2023. The pilot project conducts in-depth research into six categories of potential use cases, including comprehensive payment, programmable payment, offline payment, Token deposit, Web3 transaction settlement and Token asset settlement. At Wanxiang Blockchain Week on September 19 this year, Hong Kong Legislative Council member Qiu Dagen said that Hong Kong dollar stable currency regulatory regulations may be launched in June next year.

3. United Arab Emirates - Establishing the first tailor-made virtual asset system

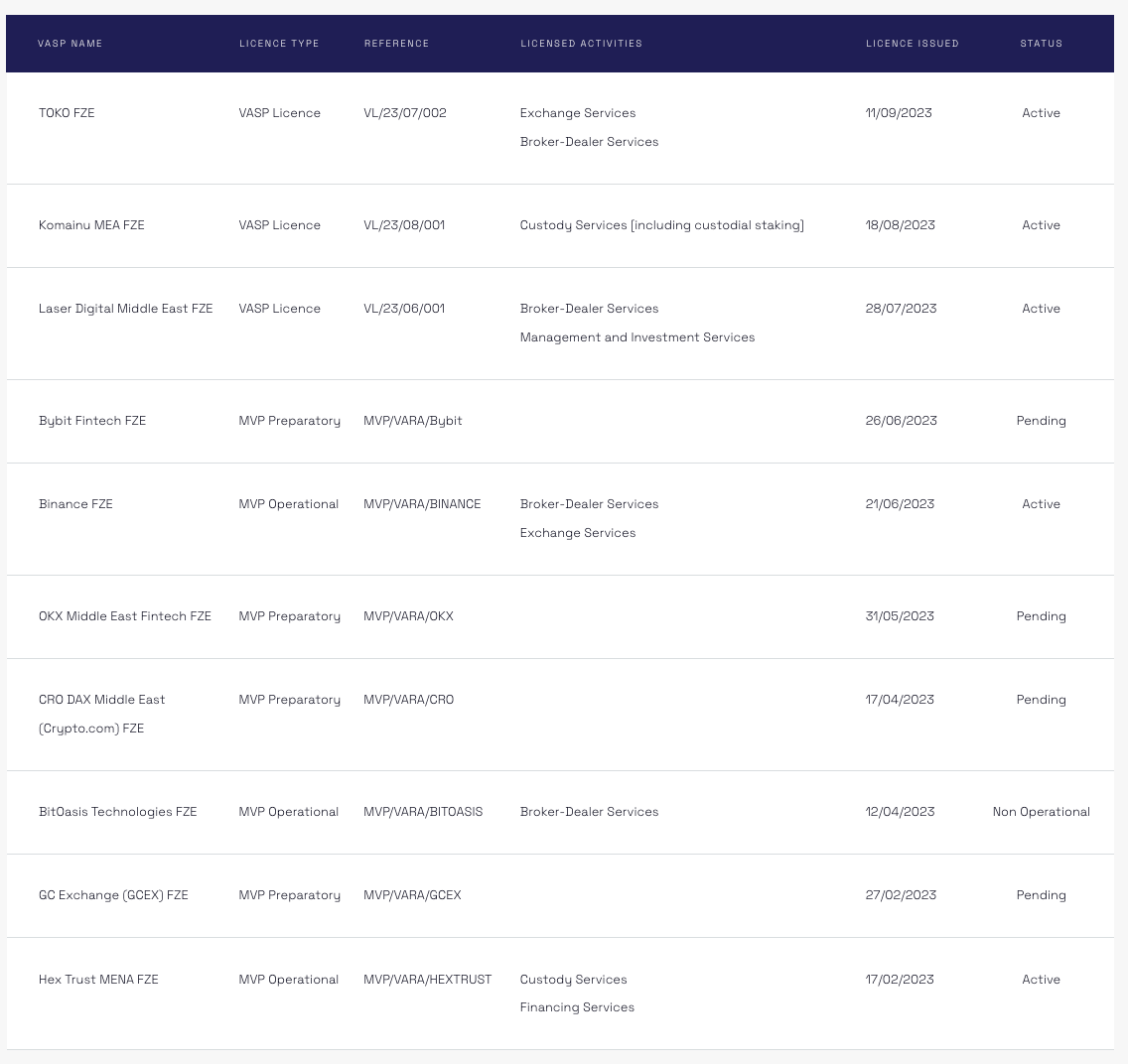

The Dubai Virtual Asset Regulatory Authority (*VARA) was established in March 2022. It is the worlds first government agency specifically established to regulate the virtual asset industry. It is designed to manage and supervise Dubai (*including special development zones and free zones, but not Activities related to the virtual asset field including Dubai International Financial Center). Previously, Binance, Okx, crypto.com, Bybit, etc. all obtained MVP licenses and opened companies in Dubai. On February 7, 2023, in accordance with the Virtual Assets Regulation Law No. (4) of 2022 in the Emirate of Dubai, with final approval by the Board of Directors, the Dubai Virtual Assets Regulatory Authority (*VARA) issued the Virtual Assets and Regulated Activities Regulations 2023. Once the Regulations were released Effective immediately, all market participants conducting virtual asset business or providing services in the UAE (*except for the two financial free zones ADGM, DIFC) must obtain approval from the UAE Securities and Commodities Authority (*SCA) or VARA and license.

VARA identifies seven different virtual asset (*VA) activities, covering advisory services, broker-dealer services, custody services, exchange services, lending services, management and investment services, and transfer and settlement services. The licensing process is divided into four phases: Interim License, Ready and Operate Minimum Viable Product (*MVP) License, and the so-called Full Market Product (*FMP) License, prior to approval of the Phased (4) FMP License MVP License Holders are not allowed to provide services to mass retail consumers (*Related virtual asset services are allowed to qualified retail and institutional investors in Dubai). Currently, three companies have officially obtained VASP licenses for relevant licensed activities, Binance, OKX , Bybit, etc. are in different stages of MVP.

Source: VARA Public Register

The Dubai government has adopted the boldest and most proactive attitude towards the development of virtual assets. It not only promotes the establishment of independent regulatory agencies and policies, but also vigorously develops artificial intelligence and the metaverse. It has quickly become an influential international player in the field of virtual assets.

4. Europe - The European Union has launched the most complete unified virtual asset regulatory framework currently

1. European Union

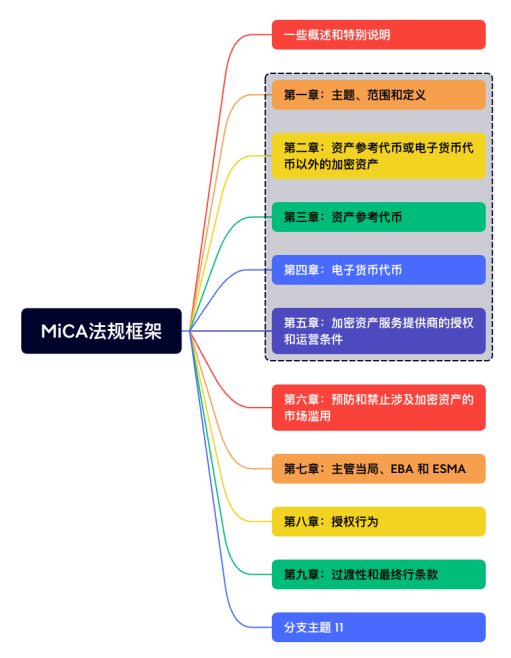

The European Union officially signed a landmark regulation on May 31, 2023 - the Cryptoasset Market Regulation Act (*MiCA), which was published in the Official Journal of the European Union (*OJEU) on June 9. This marks the emergence of the worlds first unified virtual asset regulatory framework with the most complete supervision and clearest framework. The bill will provide a common virtual asset regulatory system for the 27 EU member states and create a unified market covering 450 million people.

The bill totals 150 pages and provides a complete regulatory framework (*which is also very complex) for companies and individuals to check the specific regulations in the corresponding chapters, mainly including the scope and definition of supervision, the classification of crypto assets and related regulations, and crypto asset service providers regulatory regulations, regulatory authorities, etc. Under this bill, any company offering crypto assets to the public would be required to publish a fair and clear white paper that warns of risks without misleading potential buyers, register with regulatory authorities and maintain appropriate bank-style reserves for stablecoins.

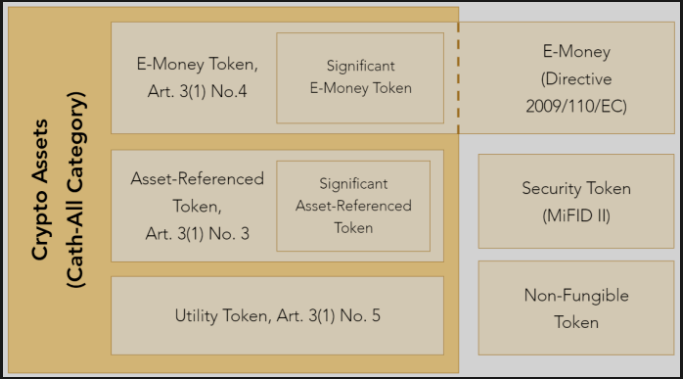

MiCA defines cryptoassets as: digital representations of value or rights that are transferred and stored electronically using distributed ledger technology or similar technologies. In terms of encrypted asset classification, MiCA divides assets into electronic currency tokens, asset reference tokens and encrypted assets other than the two. Electronic currency refers to encrypted assets that maintain a stable value by referring to the value of an official currency. Mainly related to Chapter 4 of the regulations; asset reference tokens refer to cryptoassets that are not electronic currency tokens and are designed to maintain a stable value by reference to another value, right or combination, including one or more official currencies, mainly Involves Chapter 3 of the Regulations; Utility token refers to a crypto-asset used only to provide access to goods or services provided by the issuer, mainly involving Chapter 5 of the Regulations. According to the existing bill, MiCA does not provide a clear regulatory approach to security tokens and NFTs, and the specific division of existing tokens in the current encryption market also requires more practical use cases to explain.

Source: Mayer Brown LLP

MiCA will be officially implemented on December 30, 2024, after an 18-month transition period, and by mid-2025, the committee will report whether further laws are needed to meet the needs of NFTs and decentralized finance.

2. United Kingdom

After the introduction of the EUs MiCA bill, the UK is also accelerating the legislation of virtual assets. On June 19, 2023, the British House of Lords approved the Financial Services and Markets Bill (*FSMB). On June 29, the bill passed the British King Charles’s approval, while royal assent is a procedural step after lawmakers agree to bring cryptocurrencies within the scope of legal regulation by the FSMB, also adds measures to oversee cryptocurrency promotions.

UK Financial Services Minister Andrew Griffith said in a statement that after the UK leaves the EU, the UK will be able to control its own financial services rulebook so that the regulation of cryptocurrency assets can support their safe adoption in the UK. On July 28, the UK and Singapore have agreed to jointly develop and implement global regulatory standards for cryptocurrencies and digital assets.

5. The United States—the key to the development of the virtual asset world

The U.S. Securities and Exchange Commission (*SEC) has been attacking everywhere in recent years, making the United States the most stringent regulator in the world. However, traditional financial and crypto companies in the United States are also working hard to promote industry development and regulatory integration. Since 2022, U.S. lawmakers have Submit more than 50 digital asset bills to Congress. Currently, U.S. regulation is both a key obstacle to development and an important accelerator for future development, as it is related to the flow of the U.S. dollar, the current most important source of liquidity in the crypto world.

1. SEC and CFTC

(1) SEC and Howey Test

The U.S. Securities and Exchange Commission (*SEC) is an independent agency and quasi-judicial agency established under the Securities Exchange Act of 1934 and directly subordinate to the U.S. federal government. It is responsible for the supervision and management of U.S. securities and is the highest regulatory authority for the U.S. securities industry. The SEC exercises powers granted by Congress. Ensure that public companies do not commit financial fraud, provide misleading information, insider trading or other violations of various securities and exchange laws, otherwise they will face civil lawsuits.

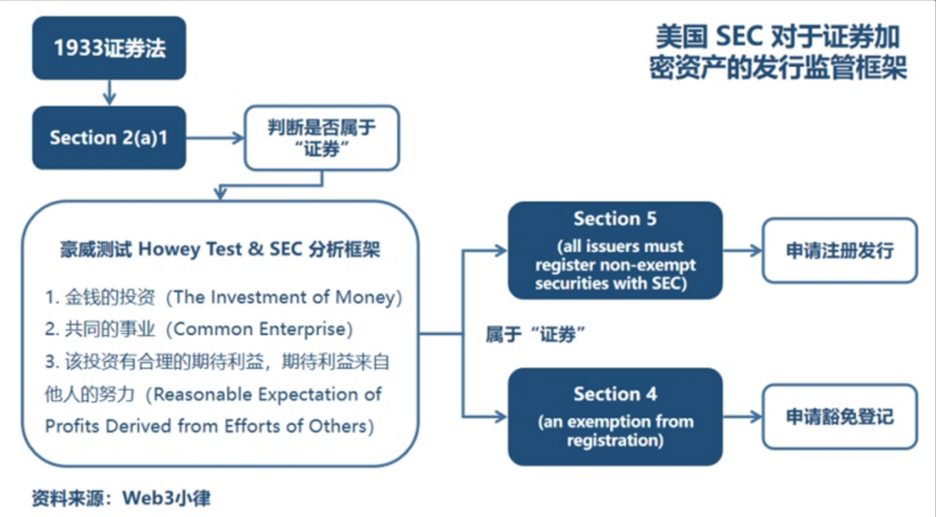

With the development of crypto-assets with financial attributes, the SEC will analyze whether a certain crypto-asset is a security through an analytical framework titled Whether Virtual Assets Belong to Investment Contracts released on April 3, 2019, and then determine whether Whether it is regulated and restricted by the Securities Act of 1933 and the Securities Exchange Act of 1934, an important method to determine is the Howey Test: Is it an investment of money? Is it a common cause between the issuer and investors? Is there a reasonable expectation of benefit from the investment, and is the expected benefit coming from the efforts of others? Both the SEC and the federal court have emphasized that the Howey test is flexible (and highly subjective). If a crypto asset passes the SEC Howey test, it will be defined as a security and will be included in the regulation.

(2) SEC regulation’s troubles in the encryption world

Gary Gensler, the current chairman of the Securities Regulatory Commission, has stated in public on many occasions that with the exception of absolutely decentralized virtual currencies such as Bitcoin, the vast majority of cryptographic tokens meet the investment contract test and should be regarded as “securities.” is required to register the offer and sale of its investment contracts with the SEC or satisfy exemption requirements. At the same time, given that most crypto tokens are subject to securities laws, most crypto intermediaries must also comply with securities laws.

Tokens being defined as securities will mean that crypto asset issuers or trading platforms will have to pay high costs and fees to adapt to the current relatively complete and strict regulatory standards in the United States. At the same time, they will continue to be regularly reviewed and legally enforced by regulatory authorities. . The most important thing is that regulatory constraints based on existing regulations (* without adaptive revisions) will fundamentally change the way the existing crypto-asset industry operates, hindering current operations and future innovation exploration.

(3) CFTC embraces encryption but remains strict

The U.S. Commodity Futures Trading Commission (*CFTC) is an independent agency established by the U.S. government in 1974. The U.S. Congress authorized the CFTC to manage and enforce the U.S. Commodity Exchange Act of 1936 (*CEA) and the regulations promulgated by it. Mainly responsible for supervising the U.S. commodity futures, options and financial futures and options markets.

Rostin Behnam, the current chairman of the U.S. CFTC, said in an interview that there are obvious differences between the CFTC and the SEC led by Gary Gensler in the regulatory approach to cryptocurrency. He believes that many current crypto assets are commodities rather than securities, such as BTC and ETH, and also criticized SEC’s approach to cryptocurrency regulation: “I strongly oppose enforcement regulation. I have done everything I can to be transparent.” He also called financial innovation in the national interest and compared crypto innovation to other “landmark moments in market structure.” , such as “the shift from floor trading to electronic trading 20 years ago.”

But recently, the CFTC has demonstrated its strict supervision to the market. It has successively enforced three DeFi projects involving derivatives, and has imposed sanctions on three U.S.-based blockchain companies: Opyn, Inc., ZeroEx, Inc., and Deridex, Inc. The company imposed penalties and eventually accepted the penalty and settled the matter. In the past, everyone may have thought that the CFTC was a moderate and friendly agency because of the SECs enforcement and the CFTCs positive attitude, but now everyone will realize that the CFTCs supervision will even be more stringent in some areas.

2. Bitcoin Spot ETF

(1) ETF and Bitcoin spot ETF

ETF is an open-end investment fund, the full name is exchange-traded open-end index fund, also known as exchange-traded fund. An ETF portfolio is held by the company that issues the shares (*fractional ownership) of the fund. As an index investment product, it is an investment fund that can track a broad index and sub-sectors or industry sectors of the index. ETFs form investment portfolios based on the compilation methods of each index. By trading ETFs, you can complete transactions on a series of underlying asset portfolios, thereby achieving the purpose of risk diversification. Common ETFs include financial stocks, energy stocks, or commodities.

Bitcoin Spot ETF mainly invests in spot assets related to Bitcoin. Bitcoin Spot ETF follows the price of Bitcoin, allowing investors to buy and sell fund shares on regular exchanges, allowing investors to buy and sell fund shares without actually holding cryptocurrency. Get exposure to Bitcoin price fluctuations below.

(2) Why Bitcoin spot ETF is so important

ETFs will simplify the investment process for investors and lower the threshold, prompting more investors to use ETFs to invest in Bitcoin; in addition, the adoption of Bitcoin spot ETFs will provide new legal investment products in the traditional financial market, with the help of the powerful fund giants With its sales force and revenue expectations, trillions of funds will be introduced into the market; as the largest cryptocurrency, the adoption of Bitcoin spot ETF will drive the birth of more crypto-asset compliant products and capital inflows, thereby promoting the entire development of the industry.

(3) Current progress of ETF

Currently, many U.S. fund giants have submitted applications for Bitcoin spot ETFs, including BlackRock, Fidelity, ARK, Bitwise, WisdomTree, Valkyrie, etc. The SEC needs to respond to the application documents before four deadlines (*including Deny, approve or defer). The SEC did not approve any applications during the first deadline. In mid-October, there will be a second time point for many applications to make relevant decisions.

Source: Bloomberg,

Former U.S. SEC Chairman Jay Clayton, Wintermute co-founder Evgeny Gaevoy and other U.S. financial tycoons have said that approval of a spot Bitcoin ETF is inevitable and is only a matter of time. Although there have been many voices recently saying that there will be good news about a Bitcoin ETF in October, the author believes that formal approval is likely to occur next year.

3. Others

(1) Stable currency

This year, Republicans on the U.S. House Financial Services Committee proposed a new stablecoin regulatory draft, which aims to transfer the jurisdiction of stablecoins from the U.S. Securities and Exchange Commission (*SEC) to federal and state bank and credit union regulators, but in the Democratic Party The majority Senate did not pass it; in August, the global payment giant PayPal announced the launch of the US dollar stable currency PYUSD for transfer and payment. The stable currency is issued by Paxos Trust Co. and is supported by the US dollar, short-term treasury bonds and cash equivalents; at the same time, On August 16, Dante Disparte, chief strategy officer of USDC issuer Circle, called for stablecoin legislation in the United States as soon as possible in an interview.

(2)RWA

RWA is one of the fastest growing areas in the United States, and RWA related to U.S. Treasury bonds has become an important asset in the crypto world; in a working paper on tokenization by the Federal Reserve on September 8, it was considered that tokenization is an important factor in cryptography. A new and rapidly growing financial innovation in the market, analyzed from three perspectives: scale, advantages and risks, demonstrates the Federal Reserves increasing emphasis on asset tokenization. On September 7, industry leaders from the crypto world announced the formation of the Tokenization Alliance (*TAC), with founding members including industry leaders Aave Companies, Centrifuge, Circle, Coinbase, Base, Credix, Goldfinch, and RWA.xyz. Together, these companies are committed to bringing the next trillion-dollar assets on-chain through real-world asset tokenization, education, and advocacy.

(3) DeFi and NFT

Recently, DeFi and NFT have been the focus of enforcement by U.S. regulatory agencies. As mentioned above, the CFTC enforced three DeFi protocols, and the three companies eventually pleaded guilty and settled; in August and September this year, the SEC separately prosecuted Impact, an LA-based entertainment company. Theory, LLC and Stoner Cats 2 LLC took regulatory enforcement actions for selling unregistered securities, and Impact Theory, LLC reached a settlement with the SEC for launching an investor compensation policy.

The United States has always had the most complete financial system and extremely high regulatory standards. However, the reason why the United States has been criticized by the industry this year is that compared with the formal introduction of new legislation in other countries and regions, the current characteristic of American regulatory agencies is that virtual Incorporating assets into the existing system for supervision and enforcement without formally introducing new regulations suitable for industry development will hinder the development and innovation of the encryption industry in the United States. Despite this, the United States still has highly innovative companies and large traditional interest groups involved in Web3, which will continue to promote regulatory changes. Perhaps external regulatory developments and next years US election will be key nodes.

6. Japan and South Korea—important players in the world of virtual assets

1. Japan

Japan was an early adopter of cryptocurrencies, but in 2014 it experienced one of the industrys worst setbacks when Mt. Gox, the worlds largest Bitcoin exchange, was hacked and shut down. The incident caused retail investors to lose up to 850,000 Bitcoins, and the debt repayment triggered by the incident has not been resolved for nine years. Not long ago, on September 21, the trustee in charge of the Mt Gox bankruptcy case decided to postpone creditor payments for another year. The original payment date of October 31, 2023 will be postponed to the new October 31, 2024 date. Since the Mt. Gox incident, Japan has begun to implement stricter supervision of the cryptocurrency industry and adopt clearer and clearer control policies than other countries such as the United States. In 2017, Japan revised the Payment Services Law to include cryptocurrency. The exchange is included in the regulatory scope and implements a licensing system supervised by the Financial Services Authority (*FSA).

With the rapid development of the encryption industry in recent years, Japan has also accelerated a series of positive policies starting in 2022. On June 1, 2022, Japanese Prime Minister Fumio Kishida issued a statement in the House of Representatives, stating that the arrival of the Web3 era may lead Japans economic growth, and I strongly believe that Japan must resolutely promote this environment from a political perspective. Soon afterwards, Japan established the Web3 Policy Office of the Ministry of Economy, Trade and Industry, the Web3 Project Team of the Liberal Democratic Party and other policy agencies to vigorously promote the development of Web3 in Japan.

In April 2023, Japans ruling partys Web 3.0 project team released a white paper proposing recommendations to promote the development of Japans encryption industry. In June 2023, Japans Amendment to the Final Accounts Act was voted through by the House of Lords, becoming the first country in the world to enact a stable currency bill. The Ethereum Developer Conference EDCON 2024 will also be held in Japan.

2. South Korea

South Korea is one of the countries most enthusiastic about trading cryptocurrencies. In 2017, the transaction volume of this country with a population of more than 50 million accounted for 20% of all Bitcoin transactions and became the largest market for Ethereum. In the following years, the South Korean government restricted Cryptocurrency trading has implemented a series of policies to combat speculative behavior, such as trader access and exchange regulatory registration. However, at present, crypto trading is still hot. If a token gains the Korean trader population and is listed on a Korean exchange, It often happens that the price of the token on Korean exchanges is much higher than other exchanges around the world, a phenomenon known as the kimchi premium.

In the hot atmosphere of encryption, regulation in South Korea, like other countries and regions, has accelerated in recent years. In June this year, the plenary session of the Korean National Assembly passed the Virtual Asset User Protection Act, which introduced a regulatory system for virtual assets and is expected to help protect users of the virtual asset market and establish a sound, standardized, and transparent market order. . South Korea’s Financial Services Commission will prepare for the second phase of legislation for virtual assets. The bill will be implemented one year after the government issuance process, expected in July 2024.

Recently, South Koreas blockchain industry has also been actively deploying at the infrastructure level. On September 12, three large securities companies, Shinhan Investment Securities, KB Securities and NH Investment Securities, will form the Token Securities (*ST) Security Token Alliance. and began to jointly build infrastructure. On September 21, Busan City, South Korea passed the Busan Digital Asset Exchange Establishment Promotion Plan and Future Schedule plan. The exchange is planned to be established in November and officially open in the first half of 2024. In addition, Busan City has also proposed a plan to build Busan City into a blockchain city centered on the Busan Digital Asset Trading Platform, and to establish a 100 billion won (*approximately US$75 million) blockchain innovation fund.

7. G20 - Advocate of the global virtual asset regulatory framework

The current regulation of virtual assets is characterized by inconsistent standards and specific regulations in various countries and regions, which makes the operation and development of projects and companies more difficult and costly, and also provides speculators with room for regulatory arbitrage. As an economic cooperation forum organization that accounts for 85% of the worlds total GDP, 80% of the total trade volume, and 2/3 of the total population, the G20 is also actively advocating a global unified virtual asset regulatory framework.

On September 9, 2023, the leaders of the G20 member states agreed with the previous recommendations of the Financial Stability Board (*FSB) and the International Monetary Fund (*IMF) on crypto asset activities and markets, as well as the regulation and supervision of global stablecoins. The October meeting will discuss advancing the FSB and IMFs proposed roadmap. At the New Delhi Summit on September 11, leaders of G20 member states reached a consensus on the rapid implementation of a cross-border framework for crypto assets. The framework will facilitate the global exchange of crypto-asset information starting in 2027, with countries automatically exchanging crypto trading information between different jurisdictions on an annual basis, including transactions conducted on unregulated cryptocurrency exchanges and wallet providers. (*G20 consists of 20 parties including China, Argentina, Australia, Brazil, Canada, France, Germany, India, Indonesia, Italy, Japan, South Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States, and the European Union)

The G20s promotion of virtual assets is positive, but the G20 is characterized by the integration of multiple political ideologies and complex interests. It is also currently in a de-globalization cycle of great power competition. In the future, the G20 may be able to promote policies that are substantively implemented. Progress will be slow.

8. Summary

1. The current cost of regulatory applications for encryption companies is still high. Although various countries and regions have introduced bills, each country has different definitions, classifications, and regulatory methods of virtual assets. For crypto companies and individual investments, different rules need to be adapted in different regions to comply with compliance.

2. Virtual assets are innovative and special, and are more suitable for establishing new regulations for supervision. The life cycle of virtual assets runs through multiple stages, such as mining, staking, issuance, trading, transfer, payment, lending, derivatives, etc. Asset categories are also complex, for example, a token has payment, security, and utility attributes at the same time , if supervision classifies virtual assets into the existing unrevised regulatory framework, it will be difficult to adapt to the current industry development. New regulations and supervisory methods should be adopted based on the widely recognized characteristics of virtual assets. How to balance supervision and development will test the wisdom of the game between the government and the industry.

3. The regulatory route of integration and change is the only way to go. In 2024, more virtual asset supervision bills will officially begin to be implemented, and the process of adapting to supervision will be relatively long and difficult. However, the current market wants to inject new liquidity and large-scale applications, and it is necessary to integrate supervision while changing the existing system and existing regulations. Become the only way.