Hotairballoon Crypto Market Weekly Report (9.18–9.24)

Hotairballoon has selected important information on the crypto market last week, investment and financing status, as well as on-chain data on current popular tracks such as LSD and RWA. It also counts projects with relatively large unlock volumes in the near future for your reference.

1. Important information about the encryption industry last week

(1) Policy/Supervision

1. Sichuan Province has officially issued a special policy for the Metaverse and plans to create a “Chinese Metaverse Valley”

According to news on September 18, according to the official website of the Sichuan Provincial Department of Economy and Information Technology, 16 departments including the Sichuan Provincial Department of Economy and Information Technology jointly issued the Sichuan Provincial Yuanshi Industry Development Action Plan (2023-2025). This is the fourth provincial-level Yuanshi special policy after Shanghai City, Henan Province, and Zhejiang Province.

2. Kazakhstan establishes a separate regulatory agency responsible for CBDC development and implementation

According to Cointelegraph reports on September 18, the National Bank of the Republic of Kazakhstan (NPCI) established a separate entity to lead the development and implementation of the central bank digital currency (CBDC) - the digital tenge, namely the National Payments Corporation (NPC). The entity will be formed on the basis of the former Kazakhstan Interbank Payments Center and will be responsible for overseeing the country’s national payments system, including interbank clearing services, remittances and digital identification, as well as being responsible for the development of “digital financial infrastructure”, including the implementation of the digital tenge .

3. The New York State Department of Financial Services released proposed regulatory guidance aimed at guiding crypto companies on how to draft token listing and delisting policies.

New York financial regulators want cryptocurrency companies regulated by the state to be more transparent about how they list and delist cryptocurrencies, the Wall Street Journal reported on September 18. In proposed guidance released on Monday, the New York State Department of Financial Services clarified its expectations for how cryptocurrency companies will evaluate token offerings before adoption, based on previous versions of the framework. The regulator also described its expectations for the steps and criteria that cryptocurrency companies must consider before delisting a coin.

4. Malta plans to revise cryptocurrency regulatory policies to comply with MiCA regulations

On September 18, CoinDesk reported that the Malta Financial Services Authority (MFSA) is soliciting public opinions on proposed changes to the regulatory rules for cryptocurrency companies. The regulator is rewriting rules for exchanges, custodians and portfolio managers to adapt to those set out in the EU’s Market Regulation in Crypto-Assets (MiCA). And wants to require cryptocurrency providers to develop an “orderly phase-out plan for operations.”

5. Qiu Dagen: The Hong Kong Parliament is conducting a second round of consultation on stablecoins and hopes to announce regulatory conditions in the middle of next year.

According to news on September 19, at the 2023 Shanghai Blockchain International Week·The 9th Blockchain Global Summit, Qiu Dagen, a member of the Legislative Council of the Hong Kong Special Administrative Region, delivered a keynote speech titled Steadyly Promoting the Sustainable Development of Web3 in Hong Kong Qiu Dagen said that after Hong Kong starts licensing virtual asset service providers on June 1, the next step to explore will be what types of products can be bought and sold, the development of innovative products, who can buy these products, and who cannot buy those products. Products, these will be differentiated between professional investors and retail investors.

6. Thailand Plans to Tax Cryptocurrency Traders’ Overseas Income

According to BeInCrypto reports on September 19, Thailand is planning to tax the foreign income of crypto traders, and the country has previously billed itself as a crypto-friendly country. The new government is scrambling to find ways to pay for its planned economic stimulus measures, which include airdrops across the country.

7. Head of the U.S. SEC’s Encryption Enforcement Division: Crypto exchanges and DeFi will face more charges

On September 20, according to CoinDesk, David Hirsch, head of the U.S. Securities and Exchange Commission’s (SEC) Crypto Assets and Network Division, said that there may be more enforcement actions against crypto exchanges and DeFi projects. Speaking at the Securities Enforcement Forum in Chicago on Tuesday, Hirsch said the SEC could bring new charges against crypto brokers, traders, exchanges, clearing houses and others that fail to make proper disclosures or register with the SEC. DeFi may also be in the spotlight as the SEC is aware of and investigating companies engaging in similar activity.

8. Fed Chairman Powell: We are firmly committed to reducing the inflation rate to 2% and will further raise interest rates if appropriate.

According to news on September 21, Federal Reserve Chairman Powell stated at the monetary policy press conference that it is resolutely focused on its dual mission. The FOMC is firmly committed to getting inflation down to 2%, and there is still a long way to go to achieve that goal. The current policy stance is restrictive. In light of the progress that has been made, the FOMC decided to keep interest rates on hold.

9. The Financial Services Committee of the U.S. House of Representatives approved a bill banning the issuance of CBDC and will be submitted to the House of Representatives for review.

On September 21, according to CoinDesk, the U.S. House of Representatives Financial Services Committee approved a bill to prevent the U.S. from issuing a central bank digital currency (CBDC) with the support of Republicans and will be submitted to the House of Representatives for consideration. Patrick McHenry, chairman of the committee, said the bill would ensure that “any U.S. CBDC must be expressly authorized by Congress” and “protect Americans’ privacy and our financial system from the risks that a CBDC could pose.”

10. Busan, South Korea plans to establish a municipal blockchain main network and set up a US$75 million blockchain fund

On September 21, according to News 1, Busan City in South Korea passed the Busan Digital Asset Exchange Establishment Promotion Plan and Future Schedule plan, which will promote the development of the blockchain main network as a medium- and long-term issue and plans to establish a municipal block The chain mainnet is compatible with blockchain mainnets such as Ethereum and Cosmos and will be carried out as a separate project.

11. The U.S. SEC seeks public comments on ARK and VanEck’s Ethereum spot ETF

According to news on September 22, the U.S. Securities and Exchange Commission (SEC) is reviewing the Ethereum spot exchange-traded fund (ETF) applications of two asset management companies, ARK Invest and VanEck. Yesterday, the SEC sought public comment on the potential benefits and risks of approving these ETFs. The regulator has opened a 45-day public comment period on both documents.

12. President of the Hong Kong Monetary Authority: Will launch a “minimum viable product” to pave the way for the gradual commercialization of multilateral central bank digital currency bridge projects

According to reports on September 23, according to financial reports, Hong Kong Monetary Authority President Yu Weiman said at the fifth Bund Financial Summit: Soon, we will launch the so-called minimum viable product, aiming to provide mBridge (multilateral central bank Digital Currency Bridge Project) to pave the way for gradual commercialization.”

(2) Project information

1. Optimism has started its third round of airdrops, and 19 million OP will be distributed to more than 31,000 addresses.

According to official news on September 19, Optimism Twitter announced that it has started the third round of airdrops. 19 million OP will be distributed to over 31,000 unique addresses. The airdrop has started at 4:10 Beijing time on September 19, and tokens will be distributed directly to addresses that delegated their OP voting rights between January 20 and July 20, 2023. There is no need to apply for this airdrop, and it will be sent directly to the address that meets the requirements.

2. The dYdX Chain testnet has completed its final reset.

According to news on September 19, the decentralized derivatives exchange dYdX stated on the X platform that the final reset of its dYdX Chain test network has been completed and now has more than 30 markets, conditional orders, spam filtering and other functions.

3. The Lido community has initially passed the proposal of “adding 7 node operators”, and an on-chain vote will be held on October 3

According to news on September 19, the Snapshot page shows that the Lido community has voted to pass the snapshot vote for the proposal of “adding 7 Ethereum operators”, with a support rate of 99.99%. The seven proposed Ethereum operators include a 4 x Inc., Develp GmbH, Ebunker Technology LIMITED, Gateway.fm AS, Numic, ParaFi Technologies LLC, and Rockaway Blockchain GP Ltd. It is reported that Ebunker.io is the only Chinese company shortlisted this time.

4. MakerDAO once again increased RWA assets by US$191 million, and the total assets of RWA under the agreement exceeded US$2.9 billion.

According to news on September 21, makerburn.com data shows that MakerDAO has once again added $191 million in RWA assets through Monetalis Clydesdale and BlockTower Andromeda since September 19. This includes an increase of $97 million in RWA assets through Monetalis Clydesdale and $94 million in RWA assets through BlockTower Andromeda. In addition, current protocol RWA total assets exceed $2.9 billion.

5. The decentralized social protocol friend.tech has launched a web version

According to news on September 21, according to the official X account, the decentralized social protocol friend.tech has launched a web version, and users can use friend.tech in the browser.

6. Tether CTO: Tether’s new global strategy will be fully implemented in 2024

On September 22, Tether Chief Technology Officer Paolo Ardoino tweeted that Tether’s new global strategy will be fully implemented in 2024.

7. Ethereum client Nethermindv releases v1.20.4, and Holesky will restart on September 28

According to news on September 22, Nethermind, a developer of blockchain tools and infrastructure, tweeted that the Nethermind client v1.20.4 version has been launched and Holesky will be restarted at 20:00 on September 28, Beijing time. According to previous news, the Ethereum Holesky testnet failed to start due to a network configuration error, and developers plan to restart it soon.

8. FTX reminder: September 29 is the deadline for customers to submit claim applications.

According to news on September 22, FTX reminded its customers on the Customer Claims Portal begins the claims process. FTX requires customers to provide KYC information during the claims process, and the review and verification process for KYC will continue after the deadline.

9. Polkadot will support 1,000 parachains in the future

According to reports on September 22, Polkadot’s core developers are looking to expand the ecosystem’s current parachain limit to 100, with the goal of eventually expanding the number of parachains in the future following a planned software update called “Async Support.” Join 1,000 parachains. Asynchronous support represents a significant enhancement to Polkadot’s parachain consensus protocol. This update aims to halve the parachain block time from 12 seconds to 6 seconds and increase the block space of each block by 5 – 10 times.

10. Arkham: Coinbase holds Bitcoin reserves worth US$25 billion, making it the largest Bitcoin holding entity.

On September 23, the on-chain data platform Arkham tweeted that it had identified $25 billion worth of Coinbase Bitcoin reserves (approximately 1 million bitcoins) on the chain. This makes Coinbase the largest Bitcoin holding entity in the world, with nearly 5% of all Bitcoins, almost as much as Satoshi Nakamoto. Arkham said it has identified and tagged more than 36 million Bitcoin deposit and holding addresses used by Coinbase, with its largest cold wallet containing about 10,000 BTC. According to their latest financial data, Coinbase may have thousands more Bitcoins that have yet to be tokenized.

11. dYdX will cancel the trader fee discount and resume normal fees on September 30

According to official news on September 21, dYdX announced that it is updating the v3 charging plan and will cancel the fee discounts for all dYdX traders at 1:00 a.m. Beijing time on September 30 and restore normal fees. Starting September 30th, Hedgie holders will be eligible for a 3% discount on fees, with holding multiple Hedgies not increasing the discount percentage.

12. The Aave community’s ARFC proposal on “GHO Liquidity Strategy Upgrade” has been approved

According to the news on September 24, according to the Snapshot voting page, the Aave community’s ARFC proposal on “GHO Liquidity Strategy Upgrade” has been passed, with an approval rate of 99.99%. The proposal aims to improve GHO’s peg and promote diversified liquidity across multiple trading platforms. The strategy covers multiple DeFi platforms, including Maverick, Uniswap, Bunni, Liquis, Balancer, and Aura. Each platform offers different liquidity solutions to meet the different needs of the GHO token.

13. Starkware launches Satoru Starknet, a new synthesis platform that is token-free and completely open source

On September 24th, Starknet tweeted to introduce Satoru Starknet, a new synthesis platform launched by the Starkware exploration team. This project aims to build a decentralized synthesis platform for Starknet based on the Cairo language, inspired by the design of GMX V2 and not limited by Solidity. Its architecture has modular characteristics, and different modules interact with each other. Routing is the main entry point for users.

(3) Others

1. The bidding for SVB Capital, the venture capital arm of Silicon Valley Bank, has entered the final stage, with Tianqiao Capital and other companies participating.

According to Cointelegraph reports on September 18, SVB Financial Group, the original parent company of Silicon Valley Bank, is close to reaching an agreement to sell its venture capital arm SVB Capital. Anthony Scaramucci’s SkyBridge Capital and Atlas Merchant Capital are competing with San Francisco firm Vector Capital in the final stages of the bidding process, people familiar with the matter said.

2. Hong Kong Police: The JPEX case is suspected of conspiracy to defraud, and the amount involved has reached HK$1.2 billion.

According to news on September 19, at the briefing on the virtual asset trading platform JPEX case, Senior Superintendent Kong Qingxun of the Commercial Crime Investigation Bureau of the Hong Kong Police said that the JPEX case was suspected of conspiracy to defraud, using advertising, social media and different platforms to conduct over-the-counter exchanges. Stores and Internet celebrity KOLs actively promote the platforms services and products to the public, advertising low risk and high returns to attract investors. The police attach great importance to this case and have set up a hotline to call on people who are suspected of being deceived to report the case as soon as possible. As of 12 oclock last night, the police had received 1,641 reports, involving a total amount of HK$1.2 billion. After the China Securities Regulatory Commission issued a warning, JPEX still raised the withdrawal limit to 999 USDT, thus making it impossible for users to withdraw funds. Police yesterday arrested eight people, including the owner and director of an OTC exchange shop.

3. Wanxiang Blockchain Xiao Feng: Blockchain is moving towards a new stage of large-scale application, and the next three years will be a critical moment.

According to news on September 19, Xiao Feng, chairman of Wanxiang Blockchain, said in his speech at the 2023 Shanghai Blockchain International Week·9th Blockchain Global Summit that blockchain is moving from the infrastructure construction stage to a large-scale In the new stage of large-scale application, the next three years will be a critical moment for blockchain application. Because in the next three years, the technical framework of blockchain will generally mature. Of course, there will be many details, whether in performance or other aspects, that need to be optimized and polished.

4. Grayscale has submitted its second Ethereum futures ETF application to track Ethereum futures contracts.

On September 20, Be In Crypto reported that Grayscale Investments has submitted an application for its second Ethereum futures ETF, which is designed to track the value of Ethereum futures contracts. The company has previously filed for an Ethereum futures ETF, but this time it did so in a different way.

5. Morgan Creek founder: If approved, the Bitcoin spot ETF will attract US$300 billion in funds to the market

According to Bitcoin Magazine, Mark Yusko, CEO and chief investment officer of Morgan Creek Capital, said in an interview on September 22 that the U.S. Securities and Exchange Commission’s (SEC) approval of a Bitcoin spot ETF may provide a boost to the market. Attract US$300 billion in funding. He emphasized the importance of the U.S. approving a Bitcoin spot ETF, noting that it provides a bridge for institutional investors to enter the Bitcoin market. Eric Balchunas, senior ETF analyst at Bloomberg, said about $150 billion would flow into the market once a Bitcoin spot ETF is approved, but Yusko believes the actual inflows could be much higher. He said: I would further point out that it is more likely to be $300 billion. At that time, the price of Bitcoin will rise significantly.

6. Changpeng Zhao: If the market is predictable, then it is no longer a market and there is no profit.

According to news on September 24, Binance CEO Changpeng Zhao tweeted that if the market is predictable, then it is no longer a market and no longer profitable. If you want to buy low and sell high, you have to act accordingly when prices are low. But it’s easier to invest and hold.

2. Investment and financing situation last week

(1) DeFi

1. Hybrid crypto exchange GRVT completed US$7.1 million in financing at a valuation of US$39 million.

Hybrid crypto exchange GRVT has announced the completion of two rounds of funding totaling $7.1 million at a $39 million valuation. GRVT said the seed round raised $5 million, led by Matrix Partners and Delphi Digital, with participation from Susquehanna Investment Group, CMS Holdings, Hack VC, Matter Labs (zkSync developer) and others.

(2) Web3

1. Web3 social application Orb completed a pre-seed round of financing of US$2.3 million

Orb, a Web3 social application based on Lens Protocol, announced the completion of a $2.3 million pre-seed round of financing, with participation from Superscrypt, Founders, Inc., Foresight Ventures, Aave Companies, Aave Companies, Lens Protocol founder Stani Kulechov and Polygon co-founder Sandeep Nailwal cast.

2. Decentralized information market protocol Freatic completed US$3.6 million in financing, led by a16z Crypto

Decentralized information market protocol Freatic completed US$3.6 million in financing, led by a16z Crypto, with participation from Anagram, Archetype, Not 3 Lau Capital, Robot Ventures, Arweave, Stefano Bernardi, Meltem Demirors, Stephane Gosselin, Jutta Steiner, MacLane Wilkison and others.

3. Decentralized hackathon platform BeWater completed angel round financing of US$1 million, co-led by ABCDE and OKX Ventures

BeWater, a decentralized hackathon platform and global open source developer organization, announced the completion of $1 million in angel round financing. This round of financing was co-led by ABCDE and OKX Ventures, with participation from individual investors such as ScalingX, Galaxy Mercury Asia, Contentos and Blake Gao.

(3) NFT/chain games

1. Chain gaming company Proof of Play completed a $33 million seed round of financing, with Greenoaks and a16z co-leading the investment

Blockchain gaming startup Proof of Play announced the completion of a $33 million seed round of financing, led by Greenoaks and a16z, with participation from Balaji Srinivasan, Twitch founders Justin Kan and Emmett Shear, Mercury, Firebase, Zynga and Alchemy.

(4) Asset management

1. Cryptocurrency startup Bastion completed US$25 million in financing, led by a16z crypto

Crypto startup Bastion completed a $25 million seed round of financing, led by a16z crypto, with participation from Nomura Group’s Laser Digital Ventures, Robot Ventures, Not Boring Capital, etc. It is reported that Bastion provides services such as cryptocurrency custody.

2. Digital asset startup Fuze completed a $14 million seed round of financing, led by Further Ventures

The Middle East digital asset startup announced that Fuze has completed a US$14 million seed round of financing, led by Abu Dhabi venture capital institution Further Ventures, with participation from Liberty City Ventures, an early-stage venture capital firm in New York.

3. Crypto payment company Mesh completed $22 million in Series A financing, led by Money Forward.

Crypto transfer and payment service startup Mesh (formerly Front Finance) completed a $22 million Series A round of financing, led by Money Forward, Galaxy, Samsung Next, Streamlined Ventures, SNR.VC, Hike VC, Heitner Group, Valon Capital, Florida Funders , Altair Capital, Network VC and multiple angel investors participated in the investment.

(5) Infrastructure

1. Privacy Layer 1 network Swisstronik completes $5 million in seed round financing

Swisstronik, a privacy Layer 1 network based on Cosmos, announced the completion of a $5 million seed round of financing. Two investors, Constantin and Anton Polianski, have now joined the team as CEO and senior executives.

2. Intention-based encryption infrastructure company Essential completed a $5.15 million seed round of financing, led by Maven 11

Essential, an intent-based encryption infrastructure company, completed a $5.15 million seed round, led by Maven 11, with participation from Robot Ventures, Karatage, Batuhan Dasgin, Skip, James Prestwich, Brandon Curtis, Eclipse founder Neel Somani, and others.

(6) Others

1. Blockchain data visualization startup Bubblemaps completed a US$3.2 million seed round of financing, led by INCE Capital.

Bubblemaps, a Paris-based startup focusing on blockchain data visualization, completed a US$3.2 million (€3 million) seed round of financing, led by INCE Capital. Other participants include Stake Capital, Momentum 6, Lbank, V3 natures, Ledger’s Nicolas Bacca, Dyma Budorin of Hacken and French influencer and entrepreneur Owen “Hasheur” Simonin.

2. French cyber insurance startup Stoïk raised US$10.7 million, led by Munich Re Ventures

French cyber insurance startup Stoïk has raised $10.7 million in funding led by Munich Re Ventures, with participation from Opera Tech Ventures, investors Andreessen Horowitz and Alven.

3. Blockchain medical data exchange platform Briya completed US$11.5 million in Series A financing, led by Team 8

Briya, a blockchain medical data exchange platform, announced the completion of an $11.5 million Series A round of financing, led by Team 8, with participation from Insight Partners, Amiti Ventures, Innocare Health Investments, and the George Kaiser Family Foundation.

4. Blockchain technology company Jiritsu completed US$10.2 million in financing and launched the asset tokenization platform Tomei RWA

Jiritsu, a blockchain company focusing on verifiable computing, announced the completion of two rounds of financing totaling US$10.2 million, led by gumi Cryptos Capital, with participation from Susquehanna Private Equity Investments, LLLP, Republic Capital and others.

5. Database company MotherDuck completed US$52.5 million in Series B financing, with participation from a16z and others

MotherDuck, a startup commercializing lightweight database platform DuckDB, has announced the completion of a $52.5 million Series B round led by Felicis, with participation from a16z, Madrona, Amplify Partners, Altimeter, Redpoint and Zero Prime.

6. Encrypted data analysis platform CoinScan completed US$6.3 million in financing

Crypto analysis platform CoinScan has completed $6.3 million in financing, with participation from Shalom Meckenzie, the largest individual shareholder of sports betting company DraftKings (DKNG), Mor Weizer, CEO of gaming software development company Playtech (PTEC), and Tectona, a digital company listed on the Tel Aviv Stock Exchange.

7. Fintech company DCS Fintech Holdings received US$10 million in strategic financing from Foresight Ventures

Singaporean fintech company DCS Fintech Holdings has received a $10 million strategic investment from Foresight Ventures to create a crypto-fiat deposit solution. It is reported that DCS Card Center (formerly Diners Club Singapore), a subsidiary of DCS Fintech Holdings, is a credit card issuer regulated by the Monetary Authority of Singapore. It will use the funds to develop new payment solutions to provide seamless connectivity between Web2 and Web3 .

3. Main track data last week

(1) RWA

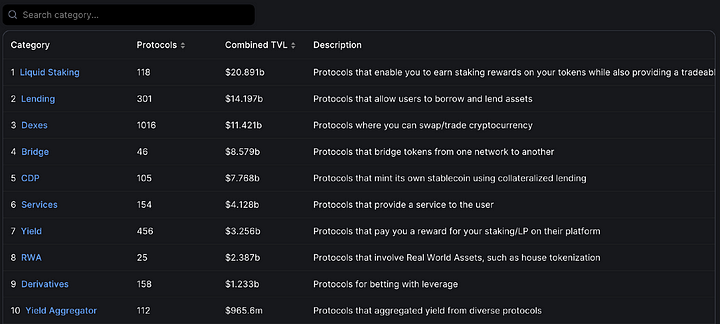

According to statistics from defillama, the current total TVL of the RWA track has reached 2.38 billion US dollars, a slight increase from last week. The total lock-up volume (TVL) ranks 8th. Defillama has included a total of 25 RWA protocols.

Among these RWA (real world asset) tokenization projects include the tokenization of U.S. Treasury bonds and real estate tokenization.

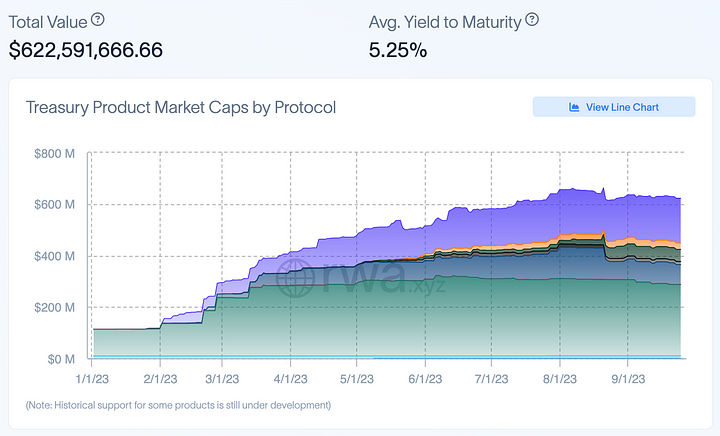

According to statistics from the rwa.xyz platform, the scale of tokenization of U.S. Treasury bonds has reached US$620 million, with an average yield of more than 5%.

Among these U.S. debt tokenization projects, Franklin Templeton Benji Investments Market Cap on Steller has the highest market value, reaching $274 million, with a yield of 5.19%.

MakerDAO

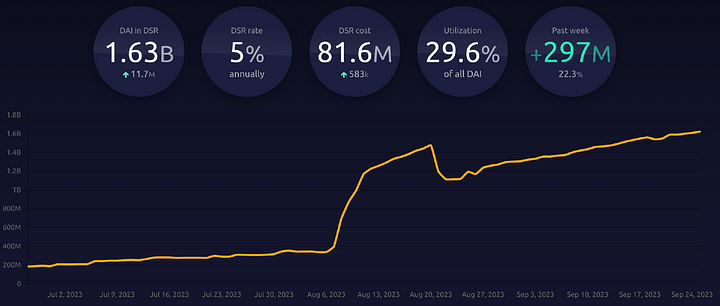

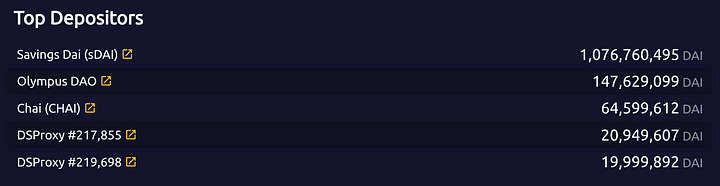

As of the time of writing, the size of Dai in DSR has increased by 297 million from last week to 1.63 billion, which is an increase from the previous week. The total amount of Dai has increased to 5.515 billion, a slight increase from last week. The DSR deposit interest rate is 5%. .

Among them, sDAI was 1.077 billion, a slight increase from last week.

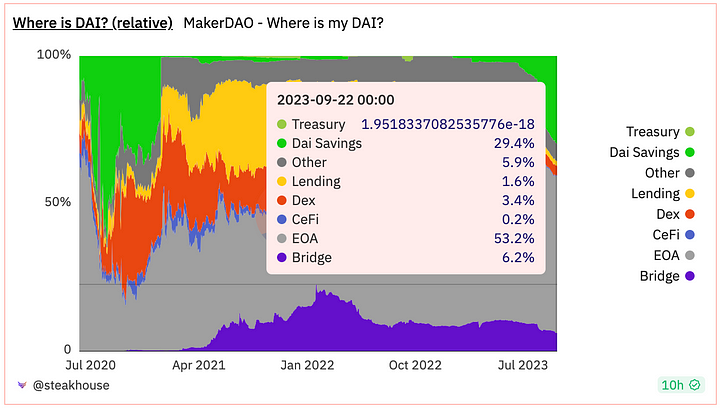

Lets take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising, reaching 53.2%, a slight decrease from last week. Since the DSR adjusted the interest rate, The share of DAI Savings is getting bigger and bigger, now reaching 29.4%, a slight increase from last week.

Currently, the ones with the highest proportion are: EOA, DAI Savings, and Bridge.

Maker’s own lending protocol Spark’s TVL reached 609 million, a slight decrease from last week.

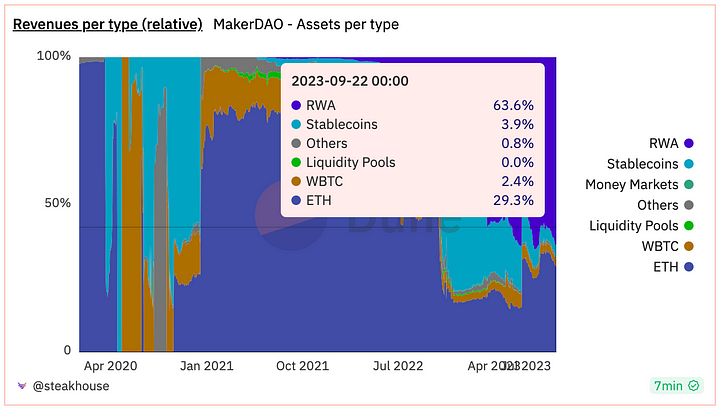

According to statistics from the dune platform, RWA has accounted for 63.6% of MakerDAOs revenue, an increase of two percentage points from last week. The high proportion is related to MarerDAOs vigorous deployment in the RWA track.

(2) LSD

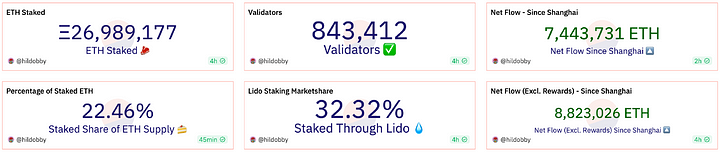

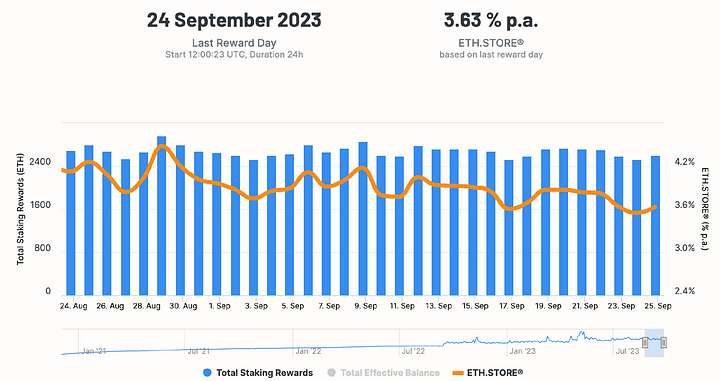

Currently, the amount of ETH pledged in the beacon chain has reached 26.98 million ETH, a slight increase from last week, accounting for 22.46% of the total supply of ETH, and the number of nodes is 843,400.

The current ETH staking yield is about 3.63%. As the quality increases, the yield is declining.

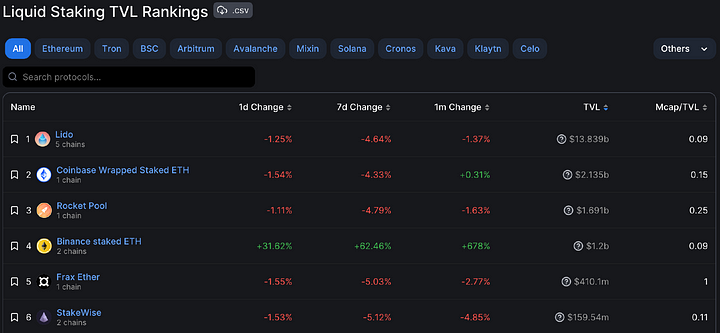

Among the three major protocols, in terms of ETH pledge volume, Lido decreased by 4.64% in a week, Rocket Pool decreased by 4.33% in a week, and Frax decreased by 5.03% in a week.

Judging from the price performance of the three major protocols, LDO fell by 6.35% in the week, RPL fell by 6.48% in the week, and FXS price fell by 4.58% compared with last week.

(3) Ethereum L2

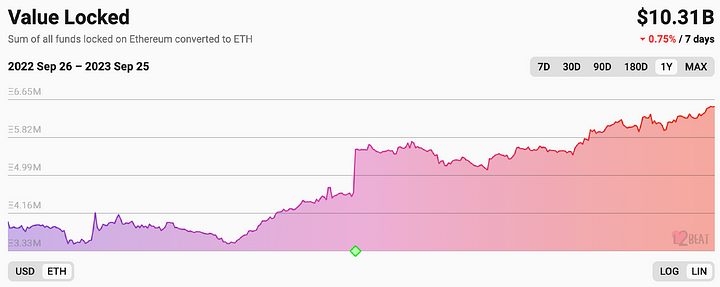

According to statistics from the l 2b eat platform, Ethereum Layer 2 TVL has decreased by 0.75% in the past week, and the current TVL is US$10.31 billion.

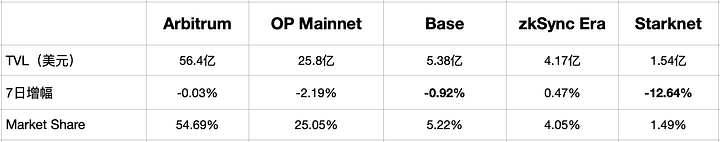

Among Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 54.69%. The fastest growing one recently is of course zkSync. In the past week, TVL increased by 0.47%, reaching $417 million.

(4) DEX

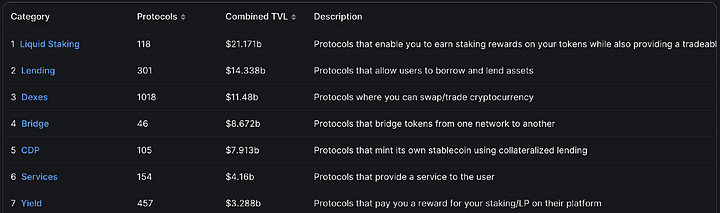

TVL

According to statistics from defillama, the total locked-up volume on the DEX track is US$11.48 billion, a slight decrease from last week.

Uniswap ranks highest in lock-up volume, followed by Curve, PancakeSwap, Balancer, SUN and Sushi. The TVL of most DEXs has declined compared with last week.

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi and Loopring.

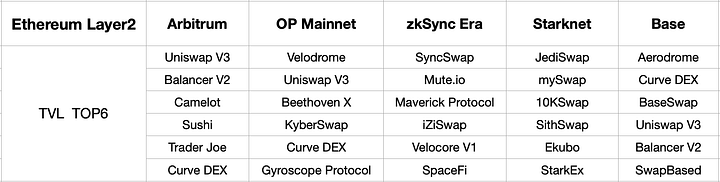

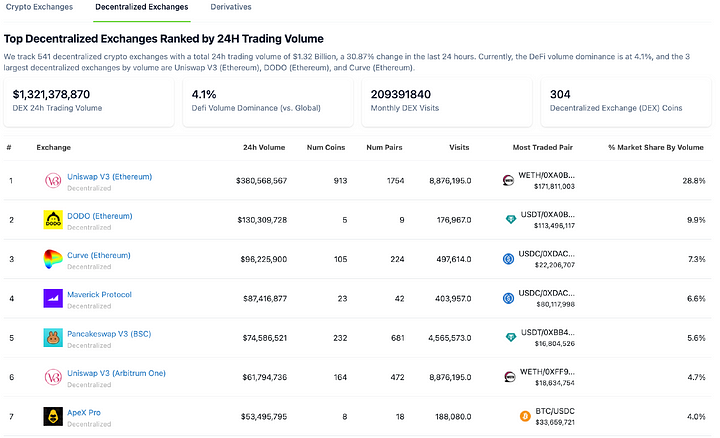

The above are the top 6 TVL DEXs on Arbitrum, OP Mainnet, zkSync Era, Starknet and Base chain.

The above are the top 6 TVL-ranked DEXs on other Layer 1 chains.

Trading volume

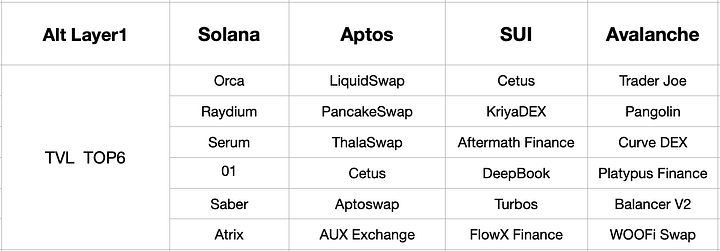

The trading volume of decentralized exchanges (DEX) in the last 24 hours was nearly 1.32 billion U.S. dollars, and the trading volume increased from last week. The total trading volume of global cryptocurrency exchanges in the last 24 hours was 32.5 billion U.S. dollars, of which DEX trading volume accounted for Only 4.1%.

In DEX, the top exchanges in trading volume include Uniswap, ApeX, Pancakeswap and Ferro.

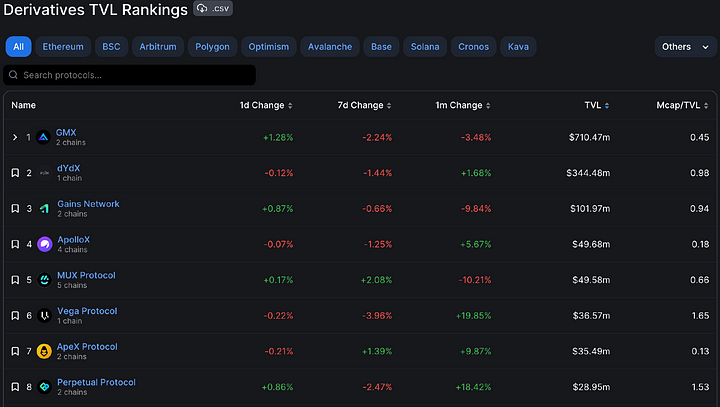

(5) Derivatives DEX

TVL

Judging from the data of defillama, most of the DEX TVL of derivatives has been declining recently. On the one hand, it is due to the decline in token prices, and on the other hand, it is because the overall trading volume of the derivatives track is declining.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, ApolloX and NUX Protocol.

Trading volume

According to statistics from the coincko platform, the decentralized derivatives trading platform with the highest trading volume is dYdX. The trading volume in the last 24 hours has reached US$290 million, which is much higher than the trading volume of other decentralized derivatives platforms.

4. Recent token unlocking

The recent token unlocking of 8 projects deserves attention. Among them, Optimism and Sui have relatively large unlocking amounts and deserve everyones attention.

Follow hot air balloon @HorairballoonCN on Twitter to explore more industry news:https://twitter.com/HotairballoonCN