LD Capital: The September 25 weekly report bet on the wrong FOMC, institutions retreated, and the US government shut down over the weekend?

Market Overview

Stock and bond markets

The Feds hawkish stance, soaring Treasury yields and a looming government shutdown are risks that have heightened investor panic and clouded the outlook for U.S. stocks.

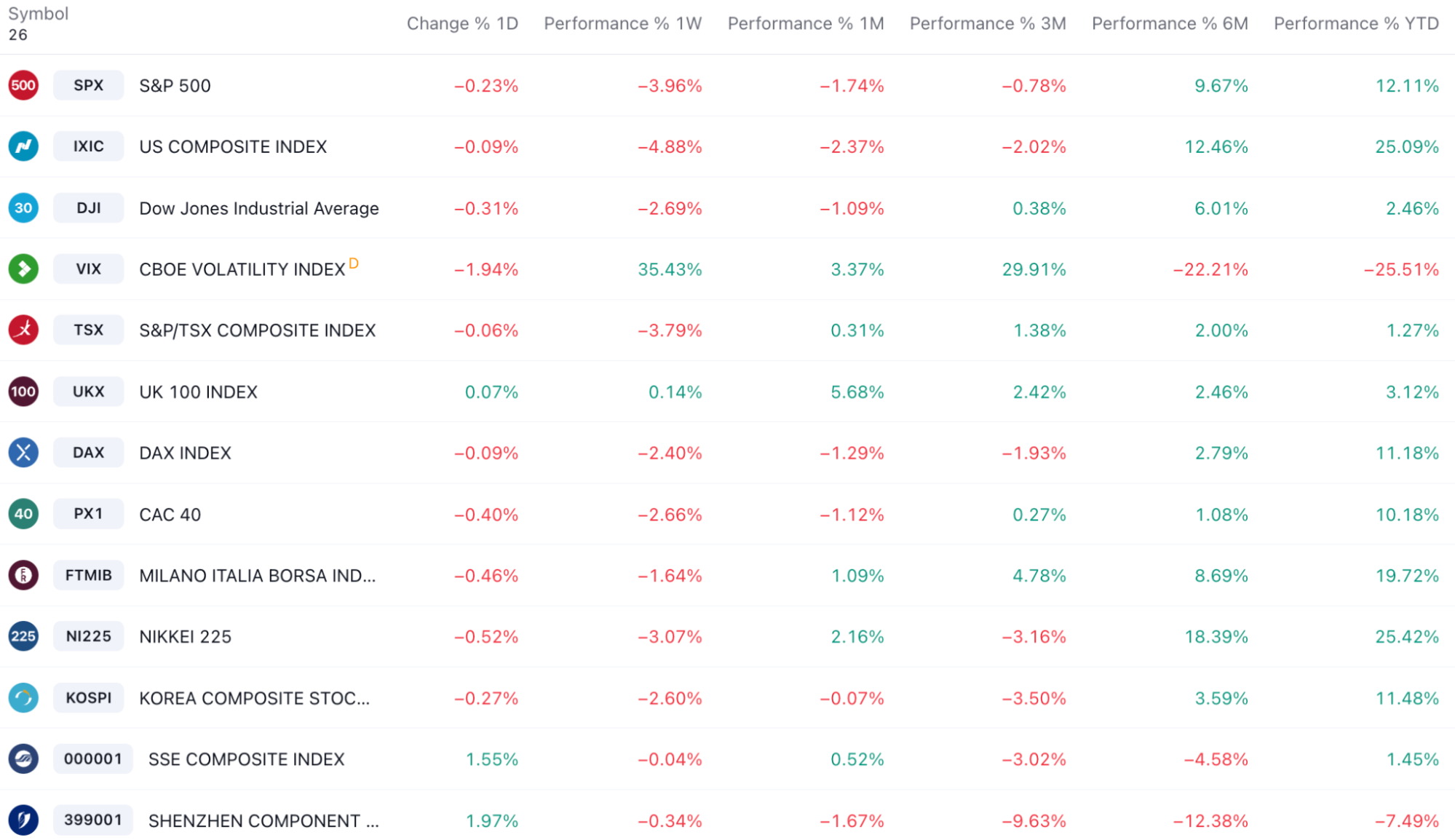

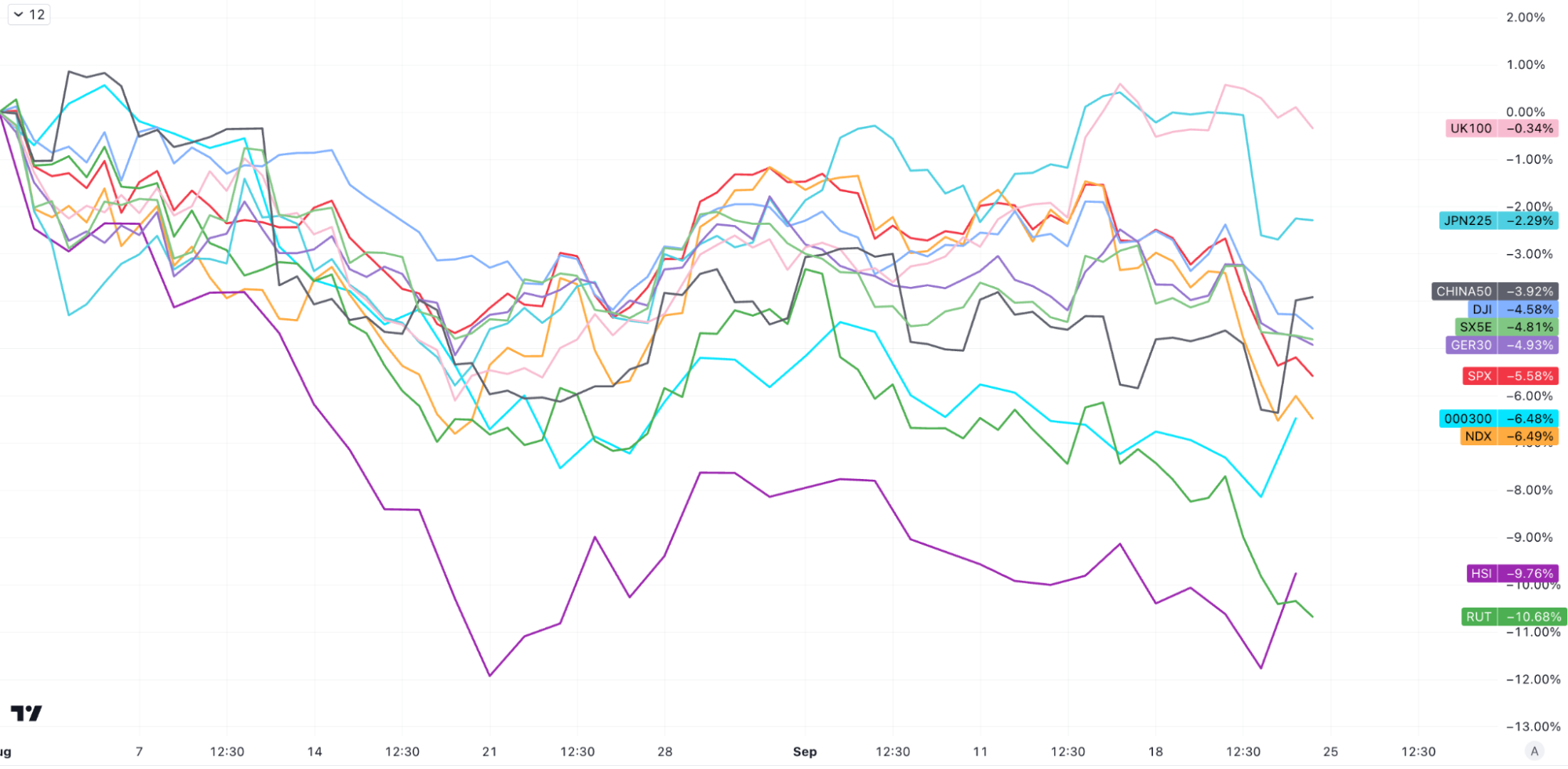

The SP 500 (SPX) fell 2.9% last week and is still up 12.8% for the year, with a long way to go before giving back all of its 2023 gains. The Nasdaq 100 fell nearly 3.5%; the Russell 2000 performed even worse, falling nearly 4%.

The largest declines among industries were consumer discretionary goods and real estate, with smaller declines in medical care and utilities:

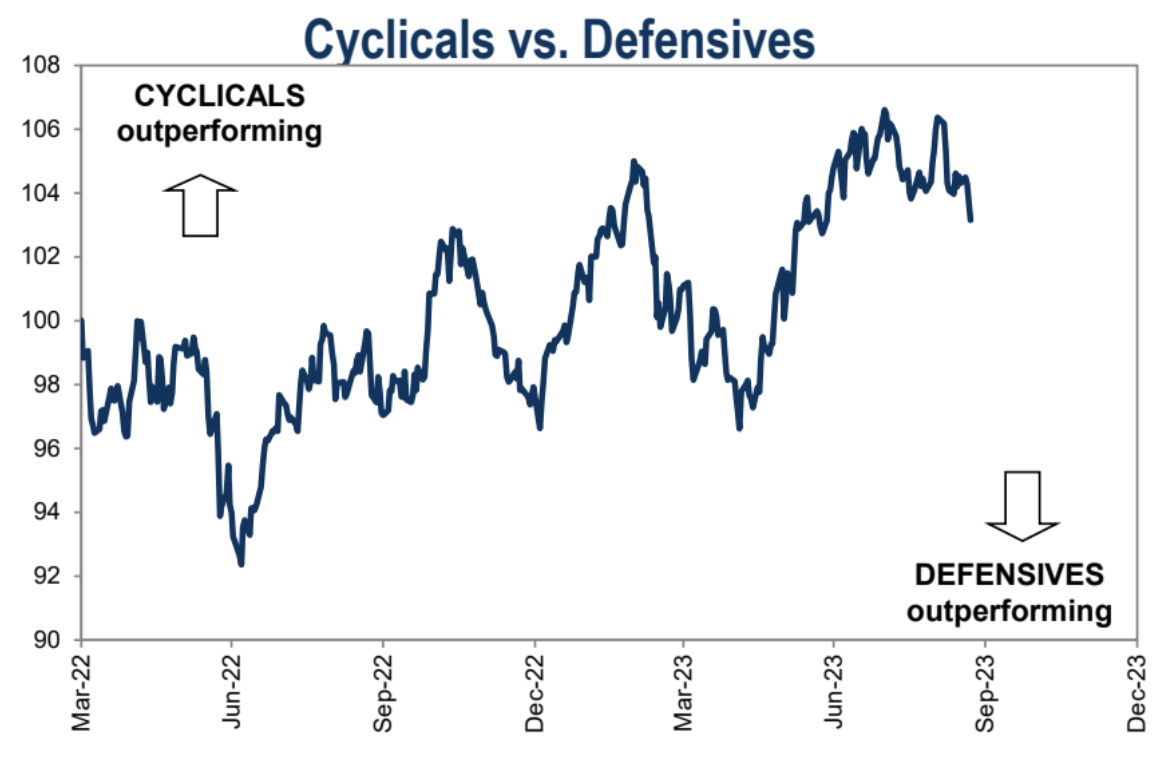

The cyclical category continues to be weak compared to the defensive category:

With both the SP 500 and Nasdaq 100 down more than 6% from their peaks in late July, the past week has been particularly troubling for investors, marking the worst week since the collapse of Silicon Valley Bank on March 10. The sell-off in U.S. stocks and bonds was triggered by the Federal Reserves expectation that it will keep interest rates at a higher level for longer than expected.

EPFR data showed that investors were selling off global stocks at the fastest pace this year, with a net sell-off of US$16.9 billion in stocks in the week ended last Wednesday. During the same period, investors purchased US$2.5 billion in bonds, marking 26 consecutive weeks of capital inflows.

European stock markets have experienced capital outflows for 28 consecutive weeks, with investors losing $3.1 billion in the latest week.

Energy stocks recorded their biggest weekly inflows since March, totaling $600 million, as oil prices soared.

Investors also withdrew $300 million from gold and $4.3 billion from money funds, which have invested $1 trillion in cash so far this year.

Meanwhile, they have poured $147 billion into U.S. Treasuries so far this year.

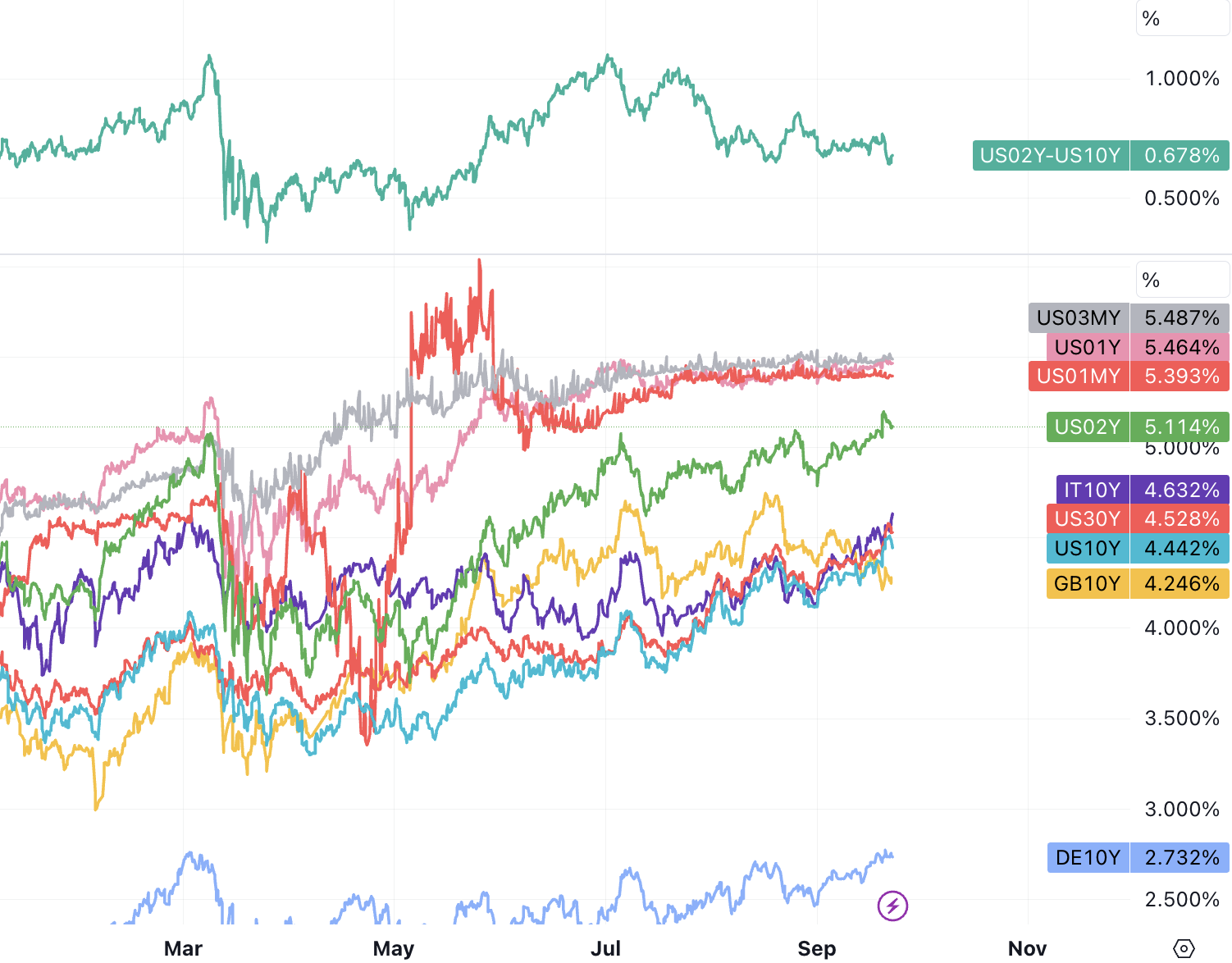

U.S. 10-year Treasury yields move inversely with prices and are near 16-year highs. High Treasury yields offer investors an attractive return on an investment that is seen as virtually risk-free, undermining the appeal of stocks. The inversion in the 2-year-10-year Treasury bond interest rate spread has eased, and last week it hit the lowest level since May, mainly because long-term bond yields rose more:

A more hawkish Federal Reserve was the biggest driver of the market last week, with other risks focused on including high oil prices, the resumption of student loan payments in October, a wave of worker strikes and the governments start if Congress fails to pass a budget by September 30. closure.

Seasonality is also a headwind. According to Bank of America statistics, on September 18, the SP 500 Index historically fell 1.66% during a period of below-average performance in the first 10 days of the month, and the same is true this year. Seasonal factors indicate that the stock market will experience a severe decline in the early days of October. However, this would also provide an opportunity for bargain hunters, as historical data also shows that 9 out of 10 times over the past 70 years the SPX has declined at least 1% in both August and September. ended higher in October.

A drop to 4,200 for the SP 500 (about 3% below current levels) would put the index at a price-to-earnings ratio of 17.5, in line with the 10-year average and potentially attract buyers.

Technically, SPX fell below the 100-day moving average of 4380 points last Thursday and fell below the 23.6% Fibonacci retracement level, but it is still higher than the 200-day moving average of 4191 points, where the 200-day moving average is currently. It coincides with the 38.2% retracement level of the rebound since the end of last year, which makes the price at 4200 a line or become a strong technical support level. Given that the economy has not flashed any danger signals, a continuous sharp decline seems unforeseen, and short-term consolidation has become a more likely scenario.

The sharp market decline after this FOMC decision is in line with historical patterns, with the market falling an average of 1% the day after the meeting in 10 of the past 14 meetings. The market was mostly volatile over the next week, with the average unable to fully recover the initial decline.

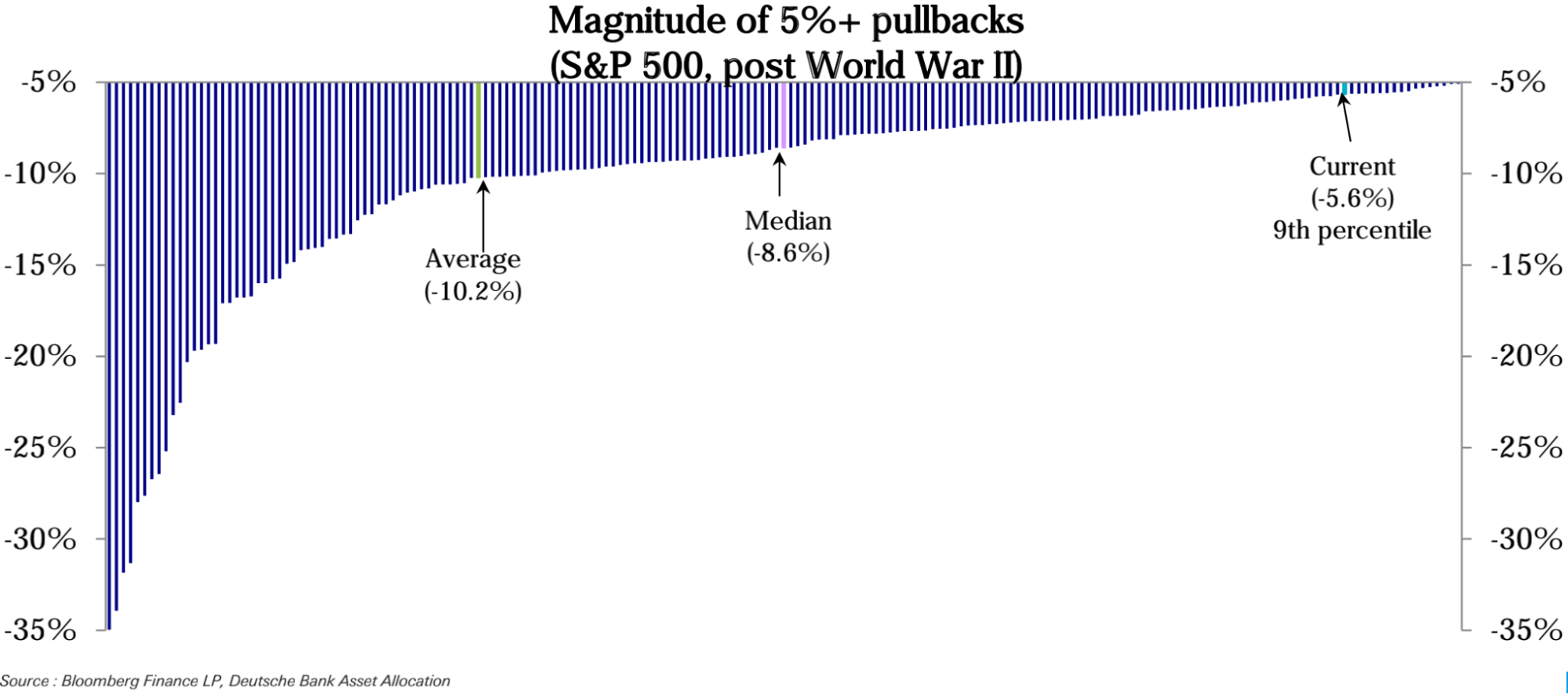

Historically, the SPXs pullbacks of over 5% have averaged an 8-10% decline from the high, lasting 4 weeks. Today, the duration of the correction (38 days) has exceeded the historical average, but the decline has not yet occurred.

Slumps in small-cap stocks may signal expectations of slower growth

fell below Wall Street expectations

Chinese stock market fights back

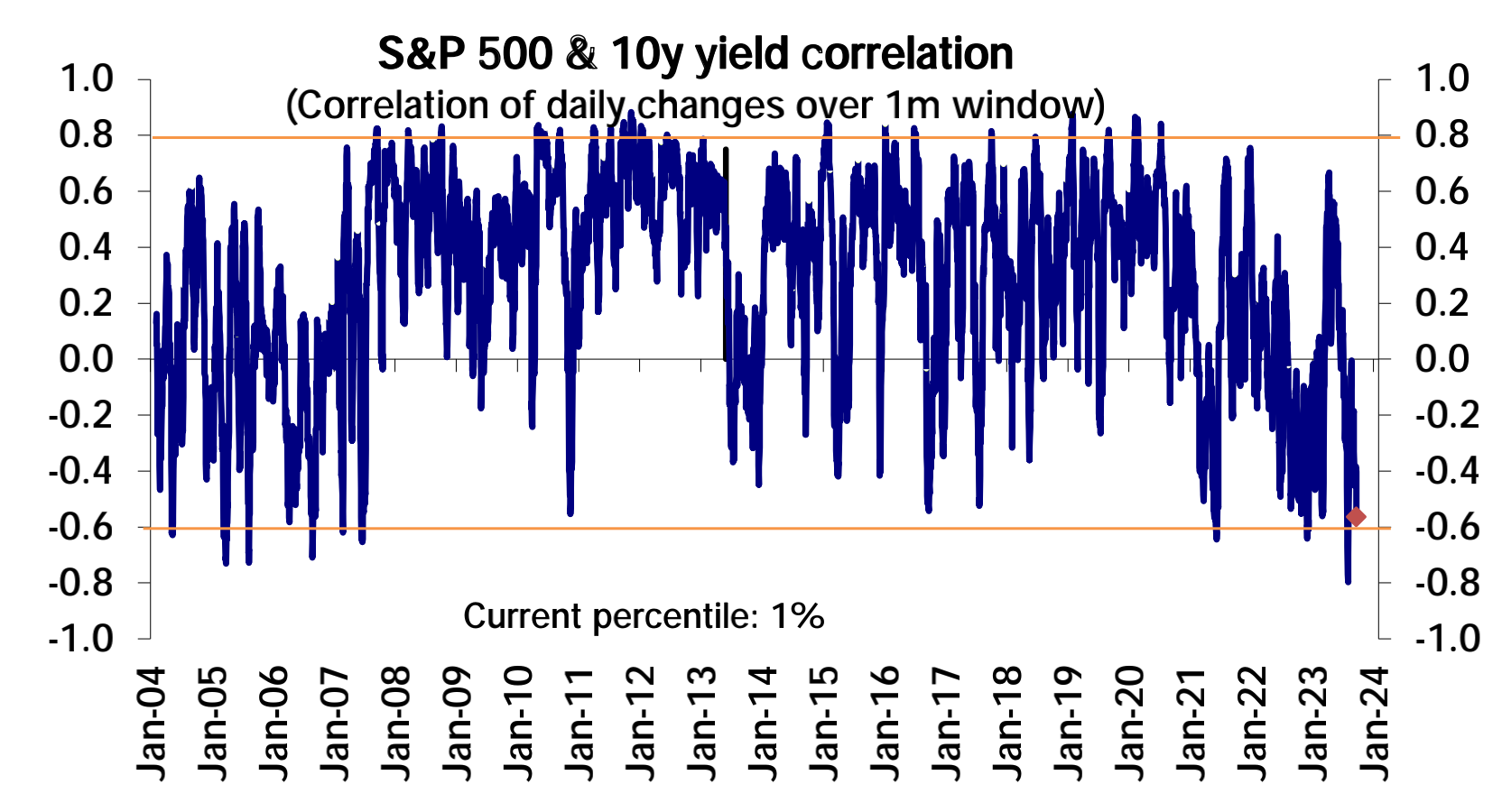

Has stock-bond correlation bottomed?

The small-cap Russell 2000 index is down more than 11% from its closing high on July 31, roughly double the SP 500s decline during the same period. The SP 500 Industrial Index peaked on August 1 and has since fallen about 8%. When the economy enters a recession, small-cap and industrial stocks typically decline sharply.

These companies, which have historically been among the first to hit bottom before broader market rallies, are closely tied to the domestic economy and tend to be less diversified than their larger peers, making them riskier bets in times of economic uncertainty. .

U.S. small-cap and industrial stocks are falling, typically a sign of a recession, but in a year in which stocks have beaten expectations, some investors are temporarily dismissing those moves as little more than noise.

Bloomberg survey data shows that the market expects corporate profits to fall by only 1.1% in the third quarter, followed by positive profits next year.

The SP 500 closed last week at 4,321 points, already exceeding Wall Street sellers average 2023 forecast of 4,366 points for the index. Analysts were still mostly bearish in the first six months of this year, but with various better-than-expected data, analysts have begun to intensively raise their year-end expectations for U.S. stocks in the past two months. Moreover, investors are more concerned about the recovery of corporate earnings than interest rates. This is not only one of the main driving forces for the rise of the U.S. stock market in the past, but also a key factor for further gains in the future.

As the United States and China announced the establishment of a bilateral economic working group and a financial working group on the 22nd, and the terms used by the two sides were quite similar, showing positive signs of US-China relations, Chinese concept stocks in mainland China, Hong Kong, and the United States surged across the board.

The statement said that under the guidance of U.S. Treasury Secretary Janet Yellen and Chinese Vice Premier He Lifeng, the United States and China established an economic working group and a financial working group respectively. The two working groups will provide ongoing structured channels for frank and substantive discussions on economic and financial policy issues and the exchange of information on macroeconomic and financial developments.

The formation of the two organizations also marks the first time the two countries have resumed regular economic dialogue since the Trump administration abandoned structural engagement in 2018.

An important node for possible positive developments next will be whether the Chinese president will attend the Asia-Pacific Leaders Summit (APEC) in San Francisco in November. Because the two sides are currently at war with each other, and the APEC meeting is held in San Francisco, this can be regarded as the U.S.’s home diplomacy. If China’s top leader goes to the United States to attend the meeting, it will inevitably give some people the impression of “going to visit the dock.” But now it is clear that China does not want to stay Unilaterally pursuing the impression of the United States, both sides are equal.

The stock-bond correlation has become extremely negative (i.e., interest rates rise and stocks fall). The correlation has hit all-time lows This is usually when you would expect a correlation reversal.

Foreign exchange market

The dollar rose for the tenth consecutive week, with DXY rising 0.3% to 105.6. Although the price has only returned to the level at the end of November last year, it was also the longest continuous rise in the past decade.

The yen fell, with USDJPY hitting a near 11-month high of 148.46 after the Bank of Japan kept its ultra-loose monetary policy unchanged. The Bank of Japan has also pledged not to hesitate to step up stimulus if necessary, a pledge that provides justification for continuing to bet against the yen. But with the exchange rate approaching the 150 mark, there is speculation that the Japanese government may intervene to support the yen exchange rate. Japanese Finance Minister Shuni Suzuki said on Friday he would not rule out any options and warned that a sell-off in the yen would hurt the trade-reliant economy. (But we feel that the depreciation of the exchange rate is actually importing inflation to Japan which is BOJ long for)

The rapid price growth in the UK unexpectedly slowed down, the Bank of England stopped raising interest rates, and GBPUSD hit a six-month low of 1.22305 last week.

The Canadian dollar strengthened against the U.S. dollar last week on rising oil prices and expectations of further interest rate hikes by the Bank of Canada. Data showed Canadas annual inflation rate jumped to 4.0% in August from 3.3% in July as gasoline prices rose.

Despite Chinas central bank intervention, the yuan weakened slightly last week, from 7.27 ➡️ 7.29, briefly breaking through the 7.3 mark on Thursday. It is conceivable that if not for the intervention, USDCNY might be higher than it is now. A good sign, however, was that Chinese stocks surged on Friday, with the CNY rebounding following the optimism.

Commodities and Cryptocurrencies

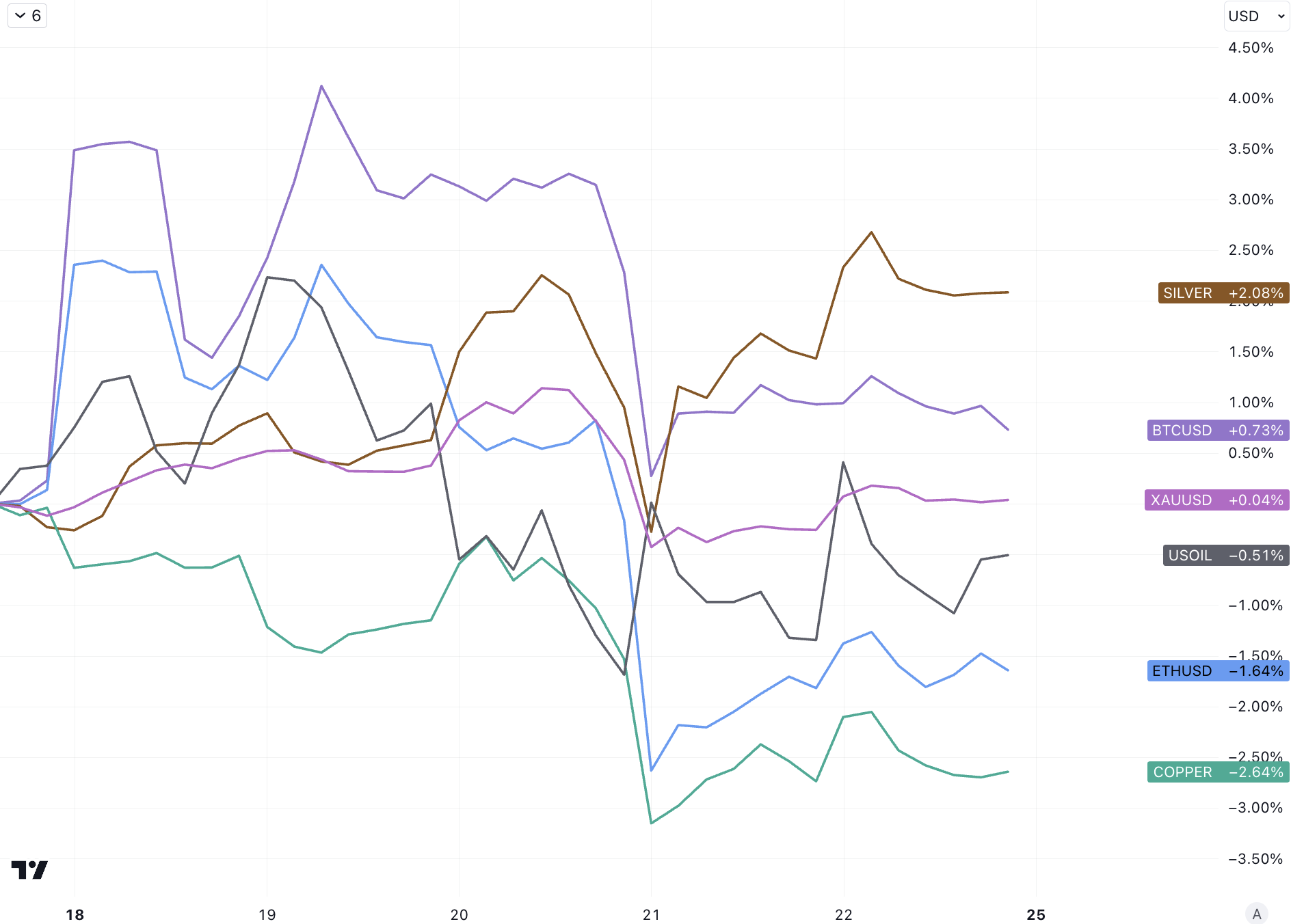

A hawkish Federal Reserve temporarily cooled oil price gains even as Russia announced a temporary ban on gasoline and diesel exports, tightening already tense global fuel markets. Crude oil prices fell for the first time in a month after reaching their highest level this year, but the decline was modest. Overall, there are still signs of tightness in the spot market, with U.S. inventories falling again (rising in only three of the past 12 weeks). Gold was also hit by the Fed, but overall showed resilience and almost ended the week flat.

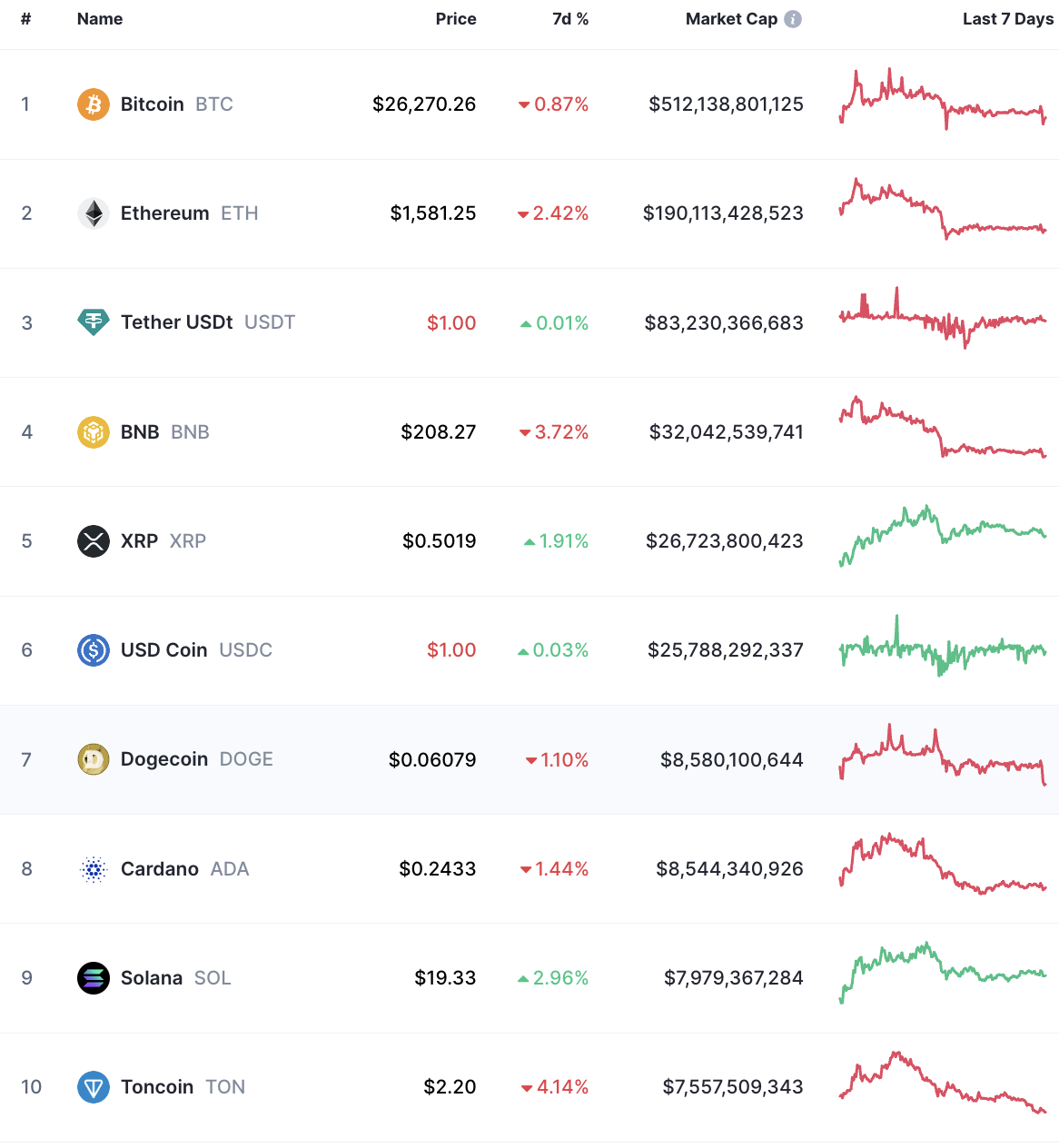

Cryptocurrencies experienced significant fluctuations last week, rising at the beginning of the week and diving over the weekend. BTC fell 0.9% on the 7th, Ethereum fell 2.4%, and BTC dominance rose slightly from 48.9% to 49.1%.

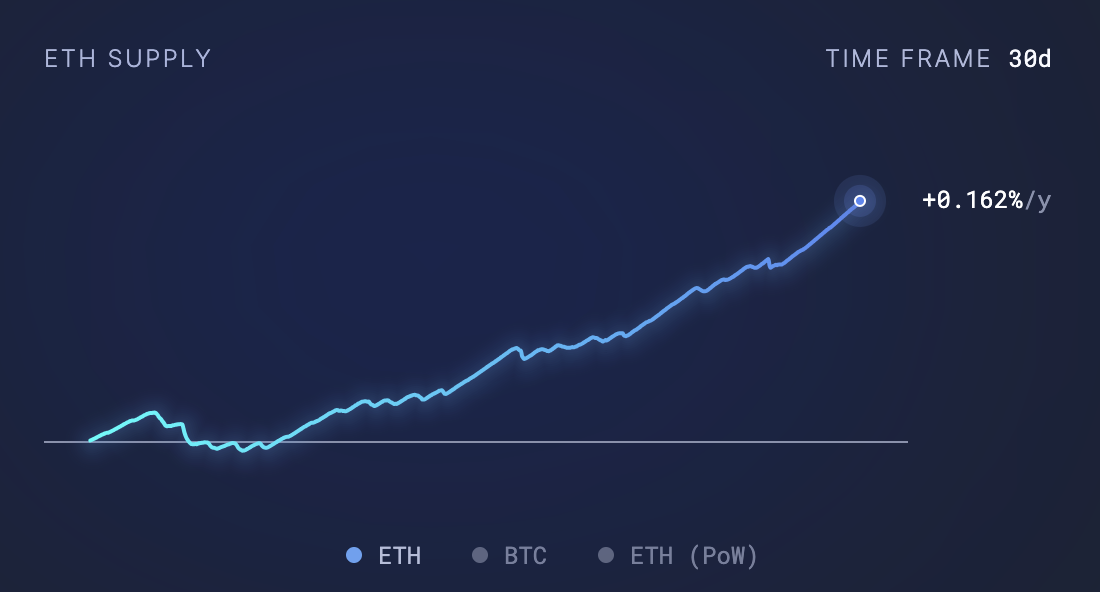

Ethereum has fallen 5% in the past month, and BTC has almost remained flat. The reason for the formers poor performance may be related to the return to inflation. ETH network fees plummeted by more than 9% last week to $22.1 million, the lowest level in nine months. Ultrasound.money data shows that the supply of ETH has been increasing because fewer tokens are being destroyed (burned) to validate transactions than are being created. Some analysts believe that the widespread use of Layer 2 has led to the decrease in congestion on the ETH mainnet. Matrixport reiterated its negative outlook for crypto assets outside of BTC in an analysis on Friday, citing surprisingly low revenues and a lack of market attention surrounding the next protocol update. The company predicted earlier this month that ETH could fall to $1,000 if this trend continues.

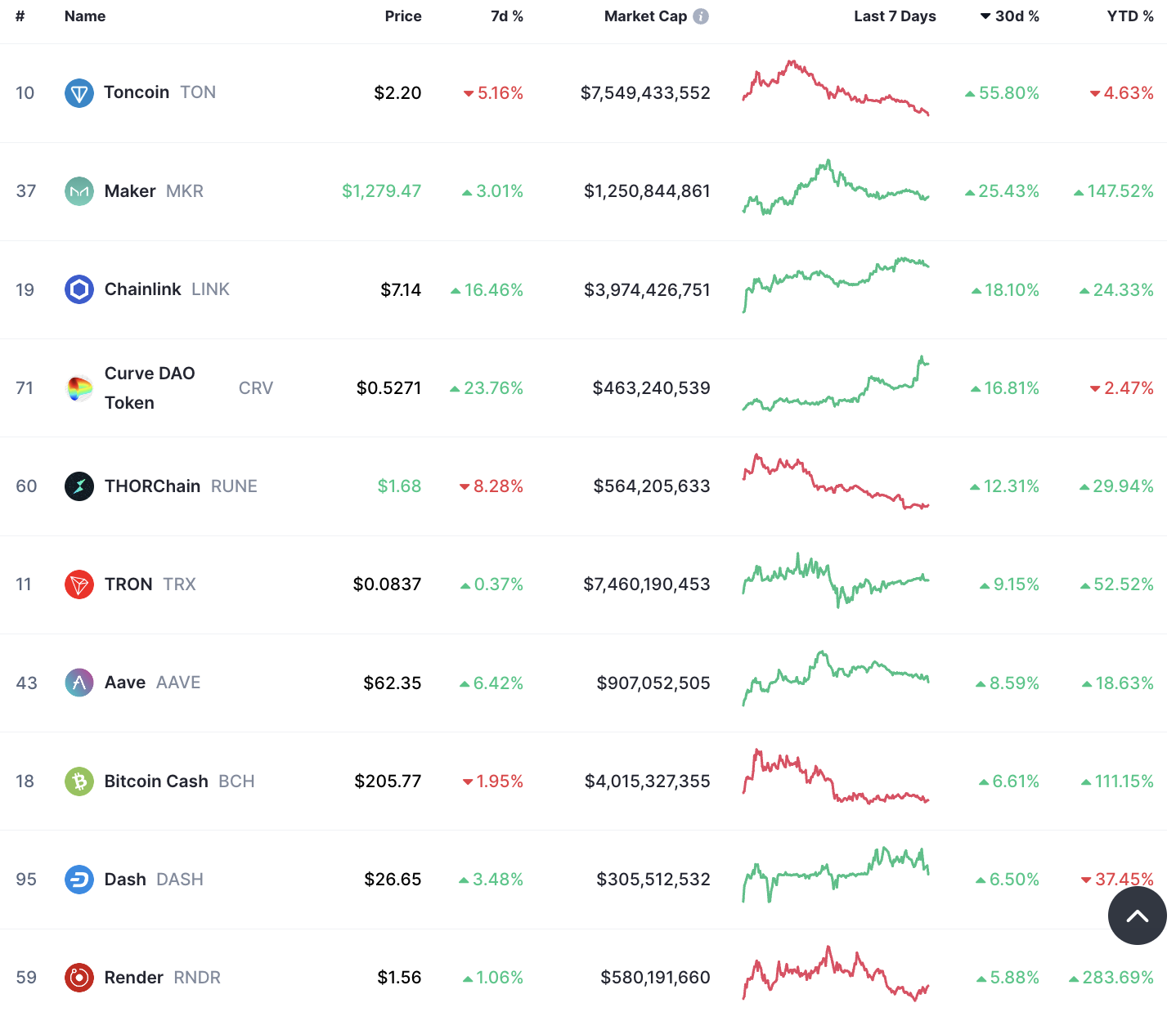

Ranking of the top 100 tokens by market capitalization by gain in the past 30 days:

Investors have pulled nearly $500 million from publicly traded cryptocurrency products in the past nine weeks, despite XRP and Grayscale beating the SEC and seeing some funds file new Bitcoin and Ethereum spot ETF filings . According to CoinShares’ weekly report, outflows from publicly listed cryptocurrency products totaled $54 million last week, marking the fifth consecutive week of sell-offs.

Matt Maley, chief market strategist at Miller Tabak + Co., said in a report: Many investors are worried that the crypto market has seen some good news in recent months, which has not helped Bitcoin and other currencies rise at all... When institutions As investors look for asset classes that will help them perform in the last three to four months of the year, they won’t be thinking twice about cryptocurrencies.”

Hot news events

[Fed Bowman hints she supports more than one interest rate hike, Daly says not ready to declare victory over inflation]

Federal Reserve Governor Michelle Bowman said she favors raising interest rates again, and possibly more than once, a sign she will act more aggressively than her Fed colleagues to curb inflation.

I continue to expect that further rate hikes may be needed to return inflation to 2% in a timely manner, Bowman said on Friday, using the term hikes to describe her interest rate expectations.

I see ongoing risks that energy prices could rise further and reverse the inflation progress of recent months, she said.

Fed governors also noted that the impact of monetary policy on lending appears to be smaller than expected.

She said: “Despite the tightening of bank lending standards, we have yet to see signs of a significant contraction in credit, leading to a significant slowdown in economic activity.

Bowmans comments suggest she may have made her highest forecast for rates in 2024, when one official predicted the federal funds rate would be between 6% and 6.25%.

San Francisco Fed President Daly said on Friday she wasnt ready to declare victory in the fight against inflation, saying that until people are more confident that inflation is returning to price stability, we wont be satisfied with where we need to be.

[Morgan Stanley: The Federal Reserve has completed raising interest rates]

Ellen Zentner, chief U.S. economist at Morgan Stanley, said: Cooling inflation should keep central banks on hold until they are ready to cut interest rates next year. In the short term, Republicans could lead to a government shutdown, which would strengthen the Feds case for maintaining the status quo at its November meeting. She explained that a government shutdown would deprive policymakers of all the economic data they need to make decisions.

In order for the Fed to continue raising interest rates in November and December, two conditions need to be met.

The first condition is that the Fed is comfortable with more labor market loosening and slower job growth. The Fed mentioned this in its statement. The 3-month moving average of job growth is about 150,000. If this number starts to accelerate again, then the trend of slower job growth looks unsustainable.

The second condition is that core services inflation (excluding persistently deflationary consumer durables prices, which account for only 25% of the core inflation bucket) is also accelerating again. Services inflation is the most important part here. For core services inflation to accelerate again, it would need to rise sharply by about 0.6 percentage points, which is somewhat difficult.

The Fed predicts that real interest rates will rise further from around 1.9% at the end of this year to 2.5% next year. If you plug this into any macro model, you will find that the Fed does not really want to achieve a soft landing. Or it can be speculated that the Fed will soon Disagreements arise.

[Ackman reiterates bond short, bond forecast 30 Y should be 5.5%]

Bill Ackman remains short on bonds and expects long-term rates to rise further as government debt rises, energy prices rise and the cost of switching to green electricity increases.

Long-term inflation plus real interest rates plus term premium suggest that 5.5% is the appropriate yield on the 30-year Treasury note, said Ackman, founder of Pershing Square Capital Management.

The current 30-year Treasury bond yield is 4.58%, which last week refreshed the highest level since 2011. In early August, he publicly stated that he was shorting the 30-period Treasury bonds. At that time, the yield was only about 4.1%. Judging from the futures price, it was 122 on August 1 and 117 on September 22.

Ackman added that with expectations for a recession extending beyond 2024 as the economy outperforms expectations and infrastructure spending supports growth and debt supply, inflation is unlikely to fall back as much as the Fed chairman hopes.

No matter how many times Chairman Powell reiterates his goal, long-term inflation will not return to 2%. In the aftermath of the financial crisis, in a world very different from the one we live in now, that number was arbitrarily set at 2% .

[The Prime Minister of Thailand said that Tesla, Google, and Microsoft are expected to invest US$5 billion]

Thailand expects to receive at least $5 billion in investment from Tesla (TSLA.O), Google (GOOGL.O) and Microsoft (MSFT.O), Prime Minister Srettha Thavisin said on Sunday.

Tesla will be looking at electric vehicle manufacturing facilities, and Microsoft and Google are looking at data centers, he said, without elaborating on whether the $5 billion is expected to be a joint investment or a separate investment by each company. He also held talks with the companys executives earlier last week.

[The United States says it cannot exclude China from the critical mineral supply chain]

U.S. Under Secretary of State for Economic Growth and Environment Jose Fernandez said on Friday that the United States cannot exclude China from critical mineral supply chains even as it seeks to diversify its sources of raw materials for products ranging from electric vehicle batteries to solar panels. outside.

He said China plays a key role in the processing of raw minerals, which means it will remain an important partner for the United States, especially since these minerals are an important component of electric vehicle batteries. Wider use of electric vehicles is a core tenet of the governments climate change efforts.

Why is the fight for critical minerals heating up?

Although many critical minerals are abundant worldwide, extracting and refining them into usable forms can be costly, technically difficult, energy-intensive, and polluting. China dominates the entire value chain for many of these products, accounting for more than half of global production of battery metals, including lithium, cobalt and manganese, and nearly 100% of rare earth production.

Approximately 50 metallic elements and minerals currently meet US and EU critical standards. Because of their role in building the infrastructure needed to reduce carbon emissions from climate change, some are also used in semiconductors for civilian and military communications.

Lithium, graphite, cobalt, nickel and manganese – mainly used in electric vehicle batteries

Silicon and tin – for electric vehicles, smart grids, electricity meters and other electronics

Rare earths—turbine magnets, electric vehicles

Copper - power grids, wind farms, electric vehicles

Gallium and germanium – solar panels, electric vehicles, wireless base stations, defense radars, weapons targeting systems, lasers

Positions and funds

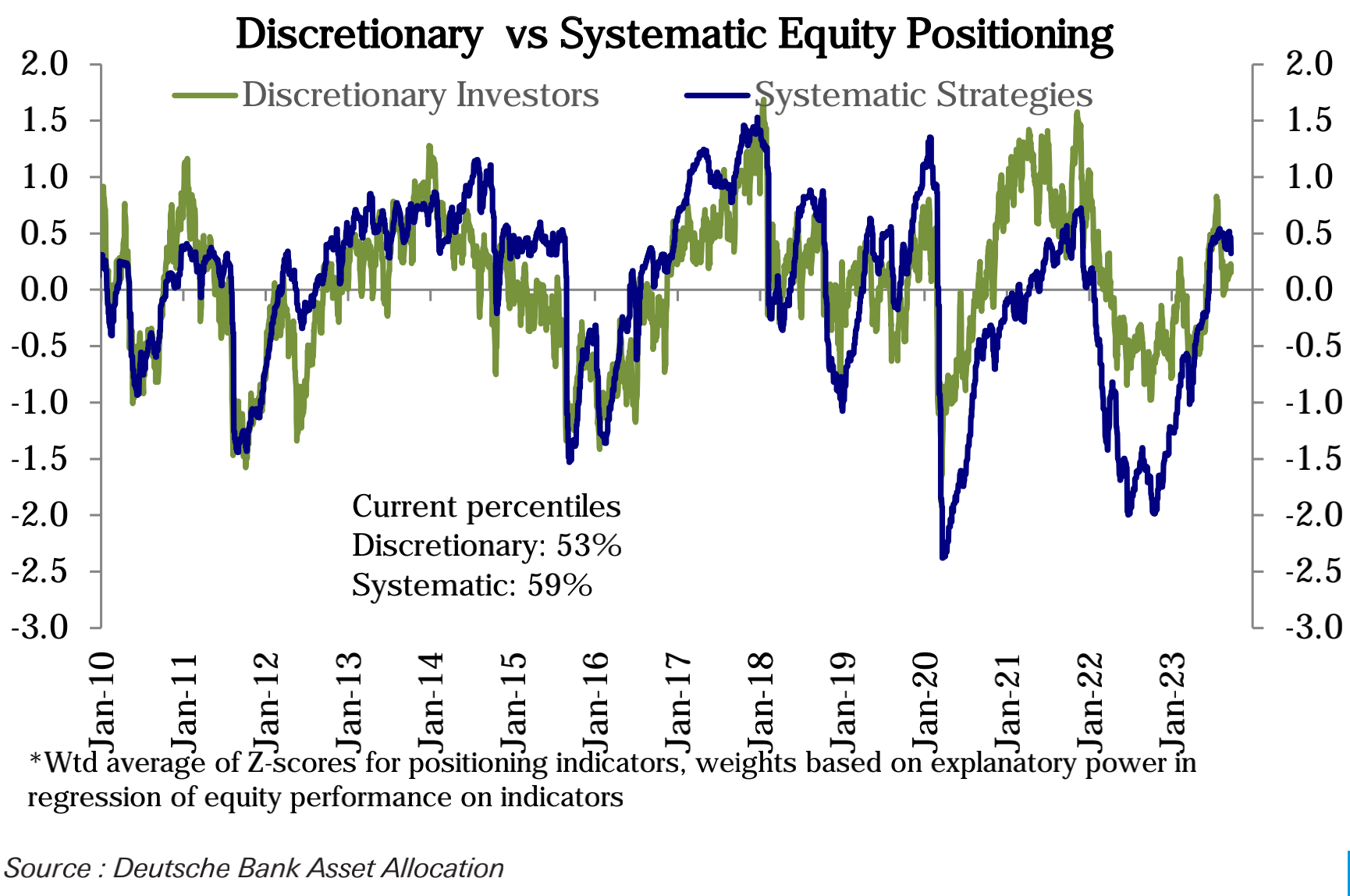

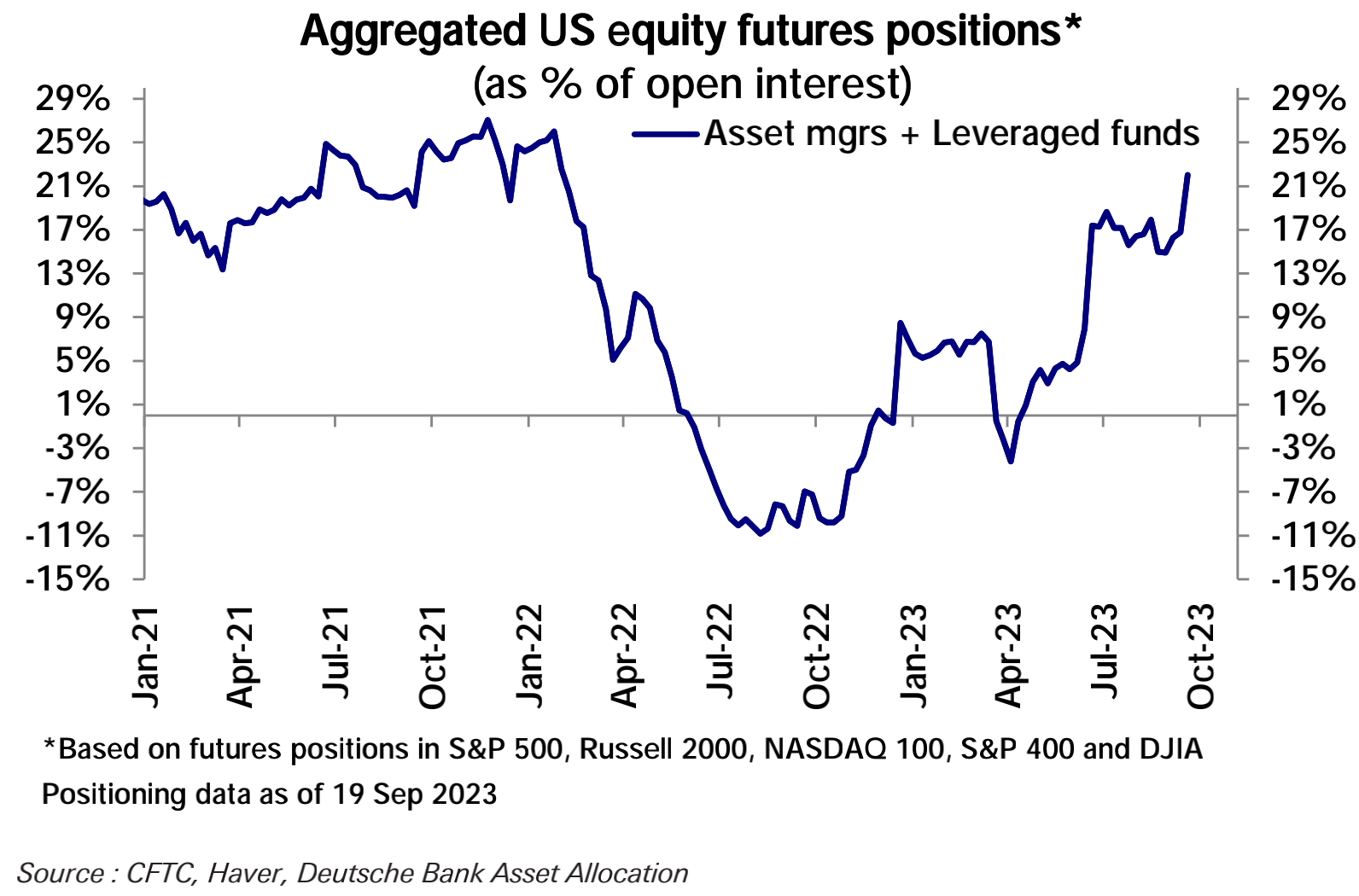

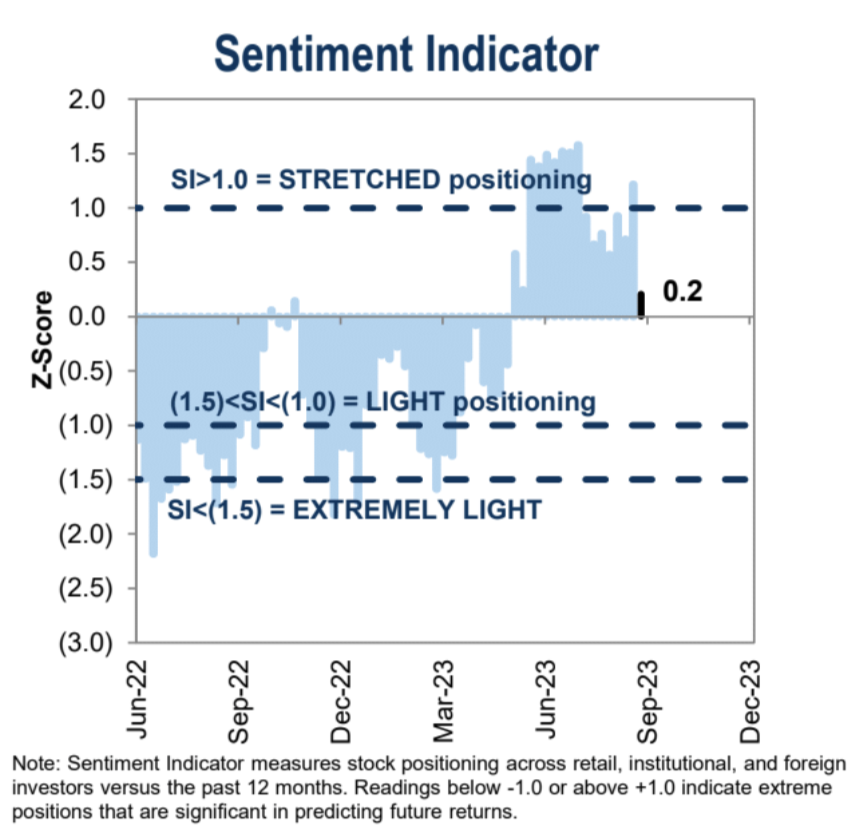

There was almost no change in subjective investor positions last week (maintaining the historical percentile 53), while systematic strategy positions dropped significantly (percentile 72 ➡️ 59):

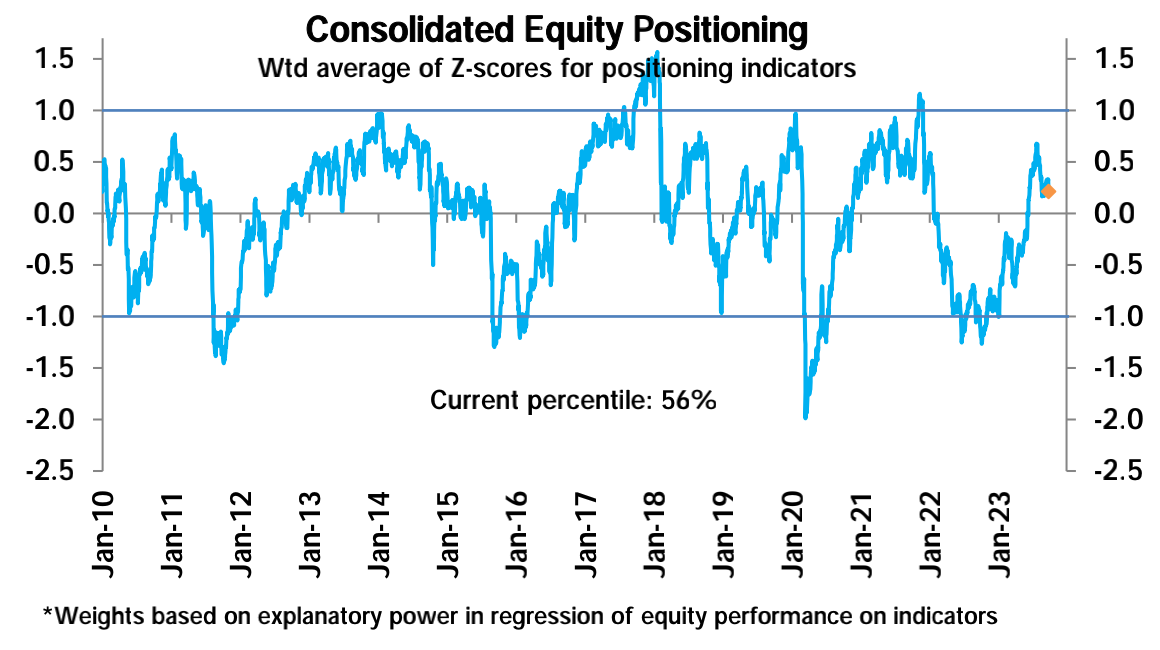

The overall US stock position fell slightly by 61 ➡️ 59 and entered the neutral range:

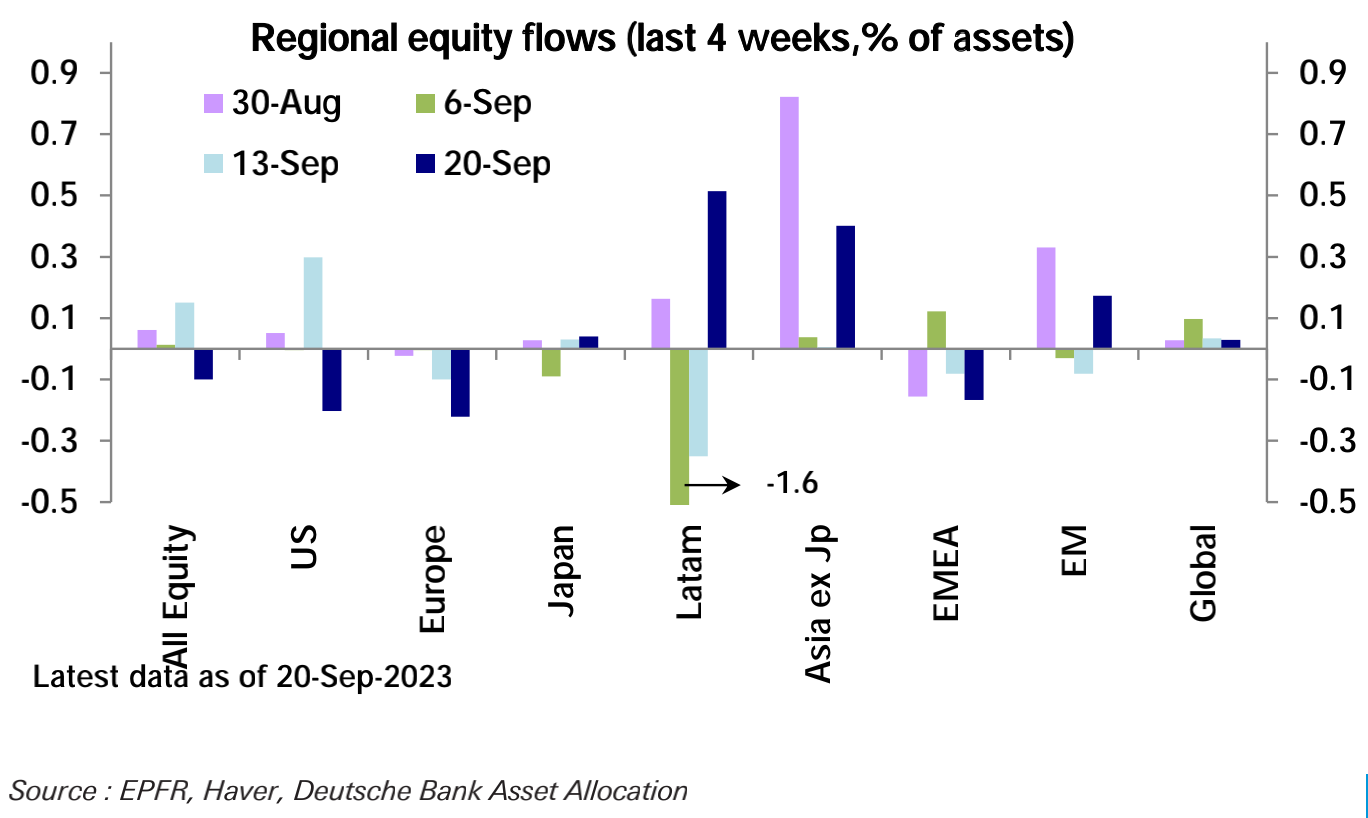

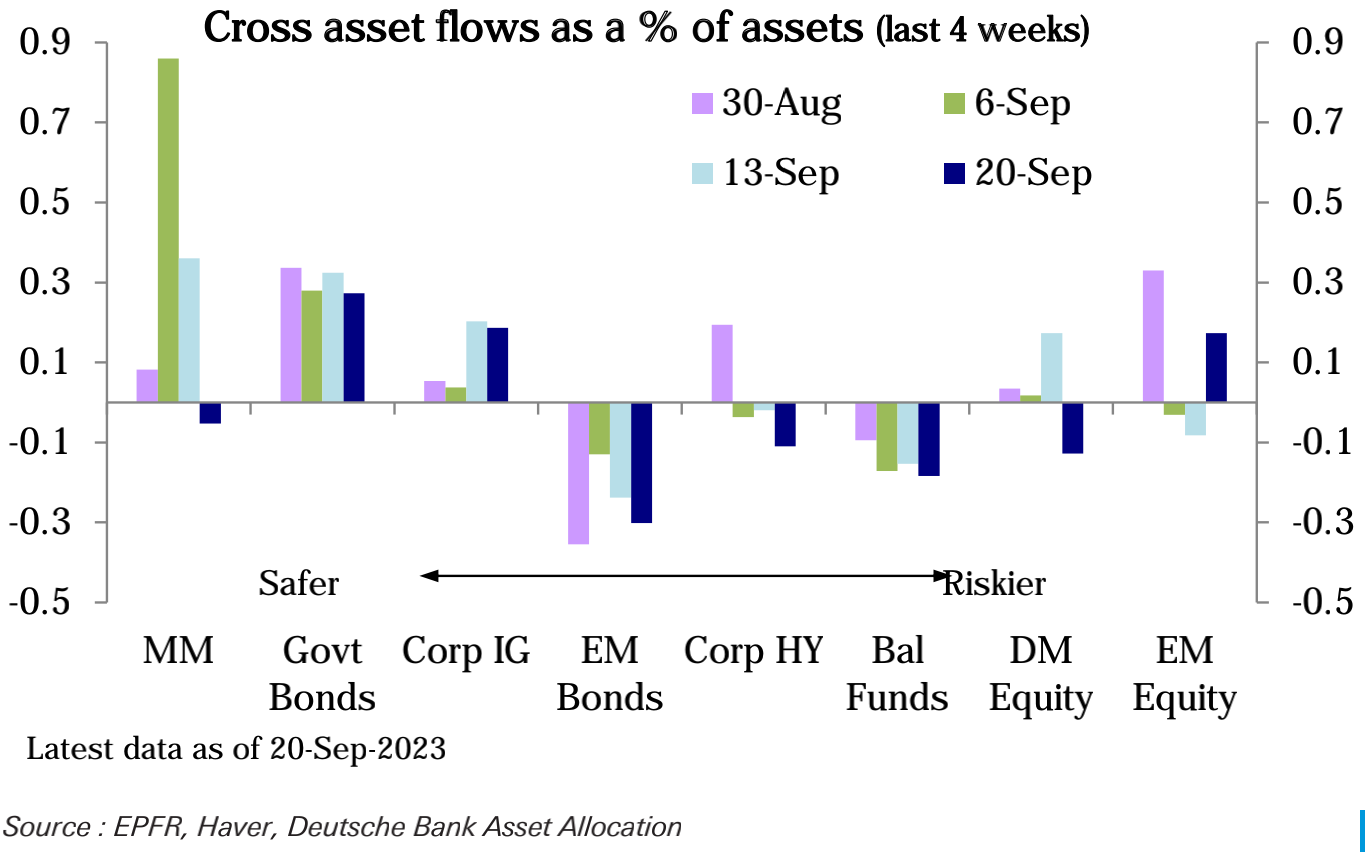

Equity funds posted large net outflows ($16.9 billion) last week, nearly erasing the previous weeks highest 18-month inflows. The United States (-$17.9 billion) had its largest weekly net outflow of the year, and Europe ($3.1 billion) also surged to a 6-week high, continuing 28 weeks of net outflows. Emerging markets ($2.6 billion) turned to net inflows after two weeks of net outflows, with Latin American and Japanese equities also seeing net inflows. However, foreign investors sold a net 1.58 trillion yen ($10.7 billion) of Japanese stocks last week, nearly double the previous week and the most since March 2019, according to Japans Finance Ministry.

Net inflows into bond funds slowed this week ($2.5 billion) from the previous two weeks, with outflows from emerging market debt (-$1.4 billion). Money market funds posted small net outflows this week (-$4.3 billion), following strong inflows in the previous two weeks. The United States (-$7.2 billion) led outflows, with minor outflows from Japan (-$200 million).

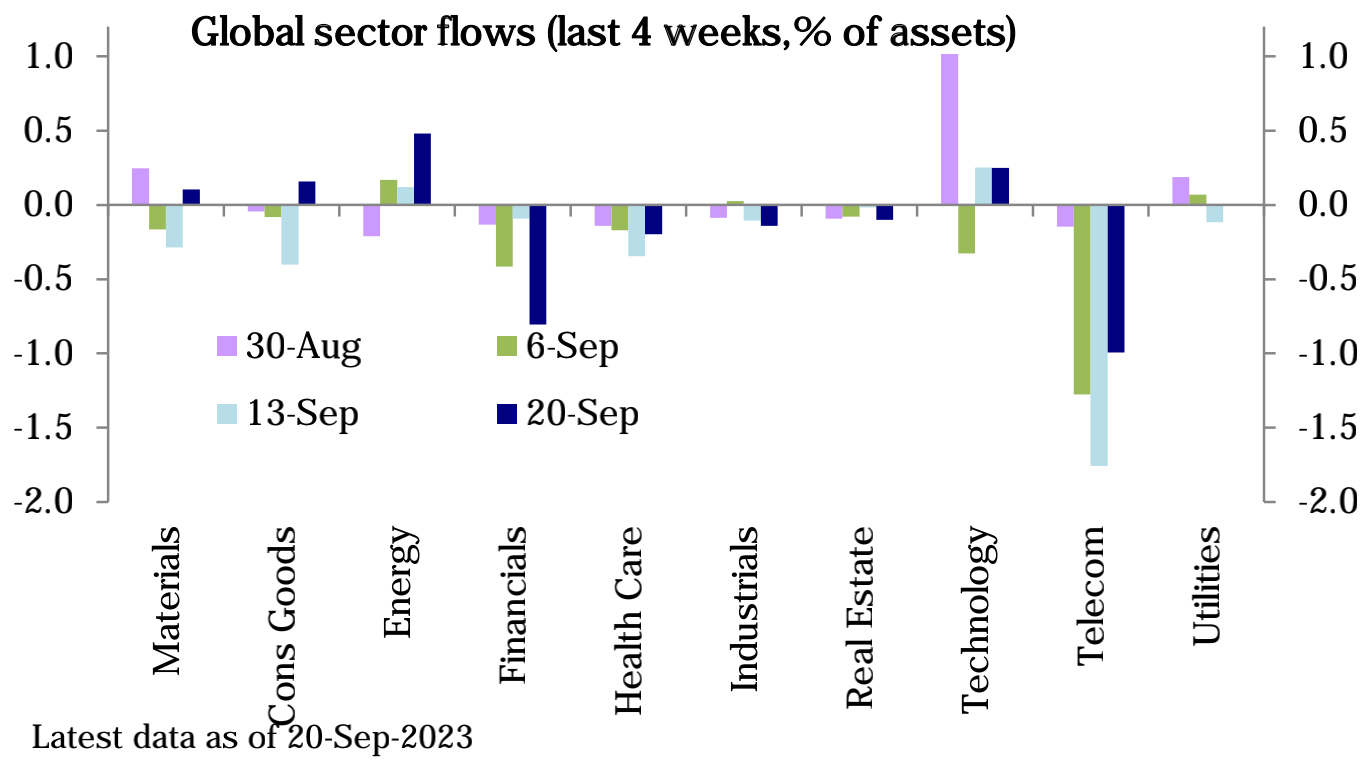

By sector, technology ($1.3 billion) continued to see inflows, and energy ($800 million) also saw significant inflows. Financial outflows ($1.4 billion) accelerated and have been outflows for 8 consecutive weeks. Healthcare ($500 million) and real estate ($400 million) also saw outflows, with smaller flows in other sectors.

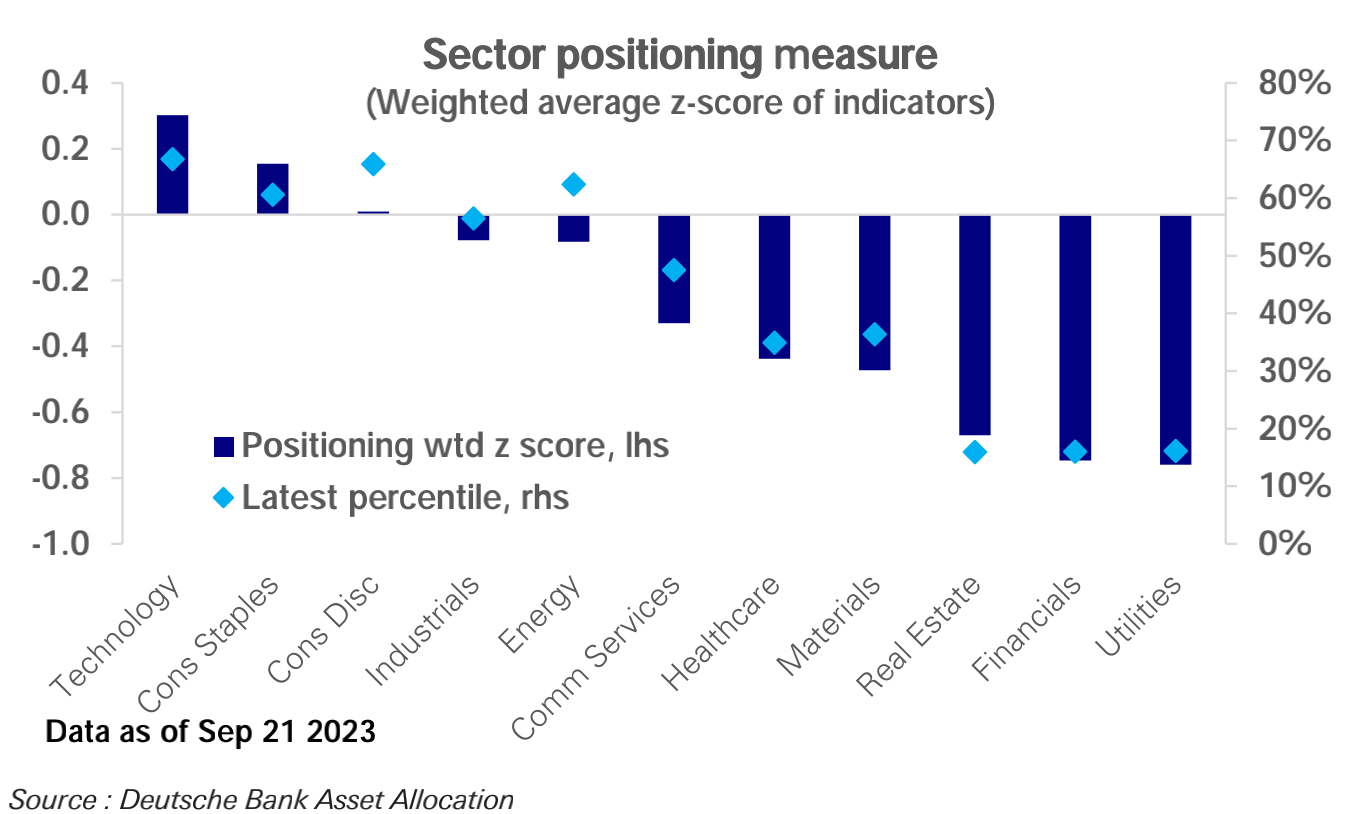

Looking at position levels by sector, only technology (z value 0.30, 67th percentile) is still the only sector that is slightly overweighted, but only slightly above the neutral level. Consumer staples (z-score 0.15, 61st percentile) has been trimmed to neutral, similar to consumer discretionary (z-score 0.01, 66th percentile). Industrials (z-score -0.08, 57th percentile) and energy (z-score -0.08, 62nd percentile) are just below neutral. Information technology (z value -0.33, 48th percentile), health care (z value -0.44, 35th percentile) and raw materials (z value -0.47, 36th percentile) remain significantly underweight, while real estate (z-score -0.67, 16th percentile), Financials (z-score -0.75, 16th percentile), and Utilities (z-score -0.76, 16th percentile) are even more empty.

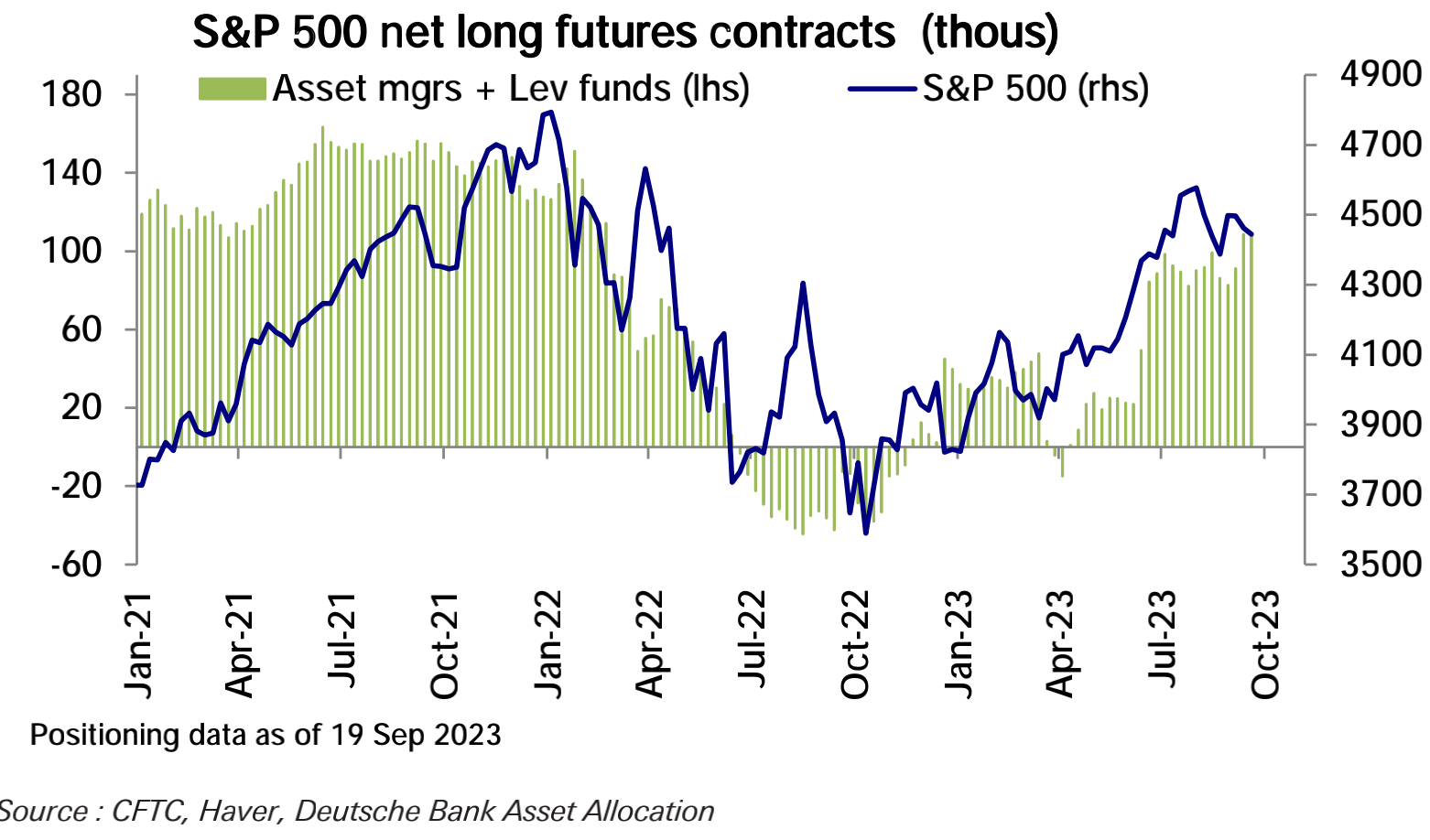

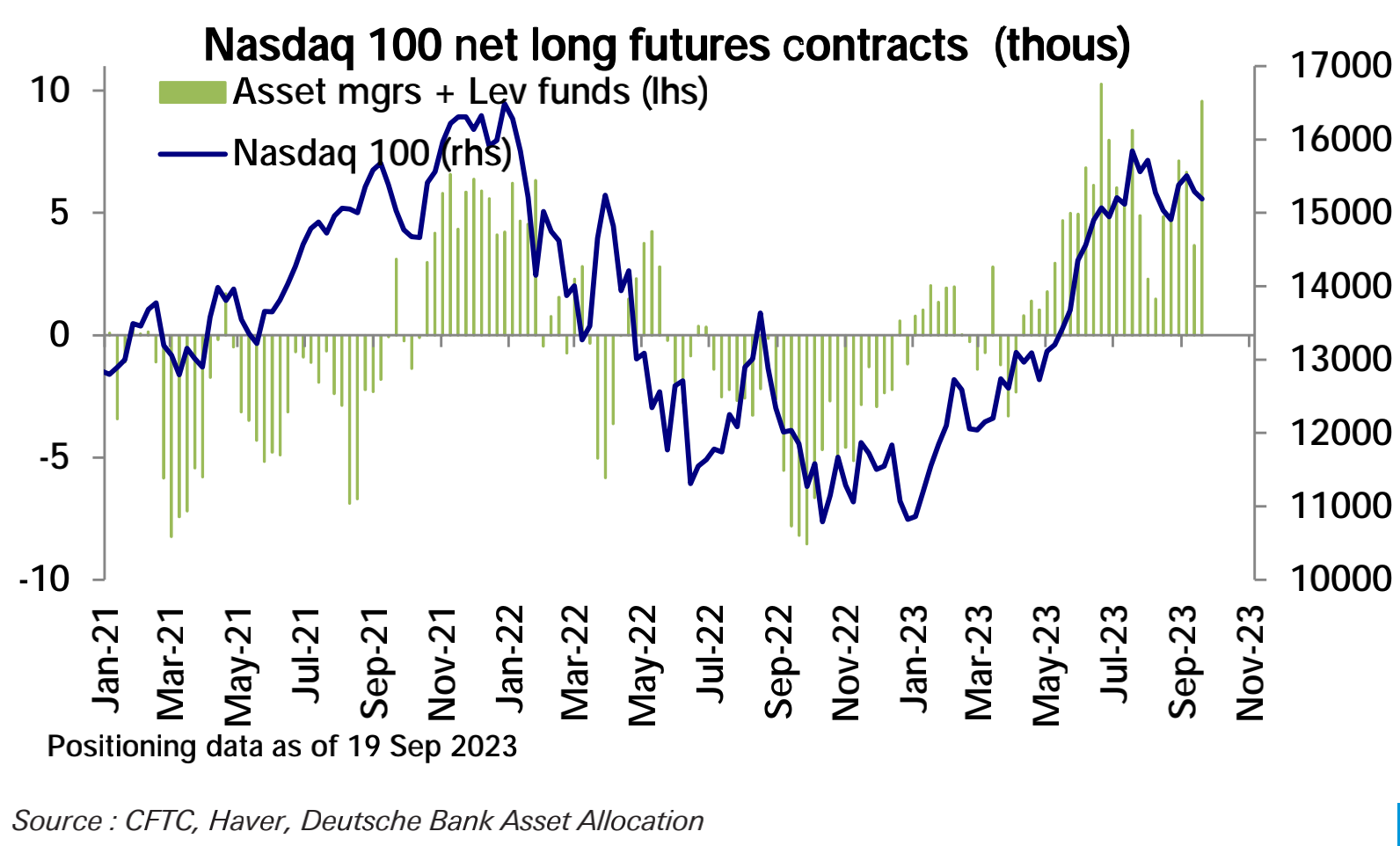

In the futures market, the SP net long position fell slightly, and the Nasdaq net long position jumped to the highest level since May:

This has brought the overall position level of the U.S. stock futures market to the highest level since the beginning of last year, but this is mostly due to the fact that this data only ends on Tuesday and does not include post-FOMC data. This data shows that speculators before the meeting tend to bet on the market rising. But it turns out they were wrong, and the data is expected to drop significantly with the next update:

market sentiment

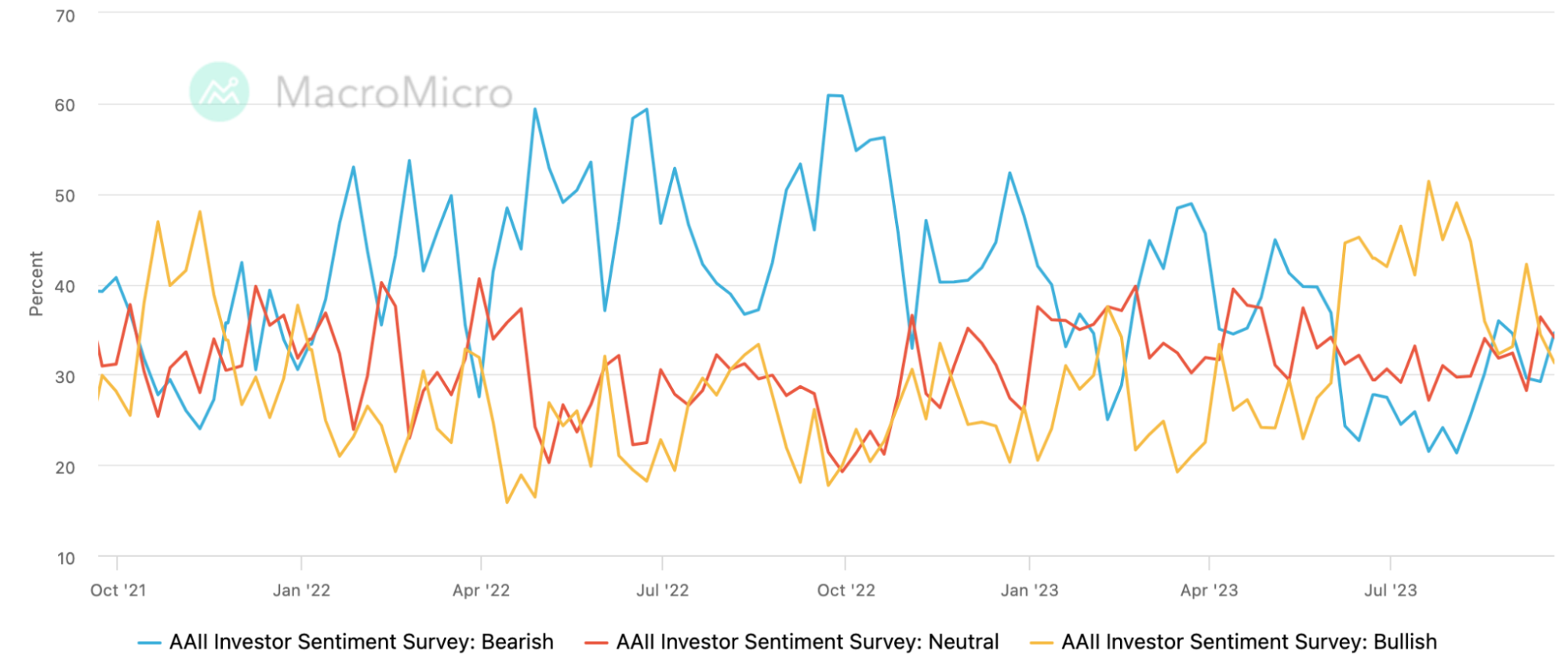

The proportion of bullish views in the AAII investor survey fell to 31.3% last week, the lowest since June 1, and the proportion of bearish and neutral views was close to around 34%:

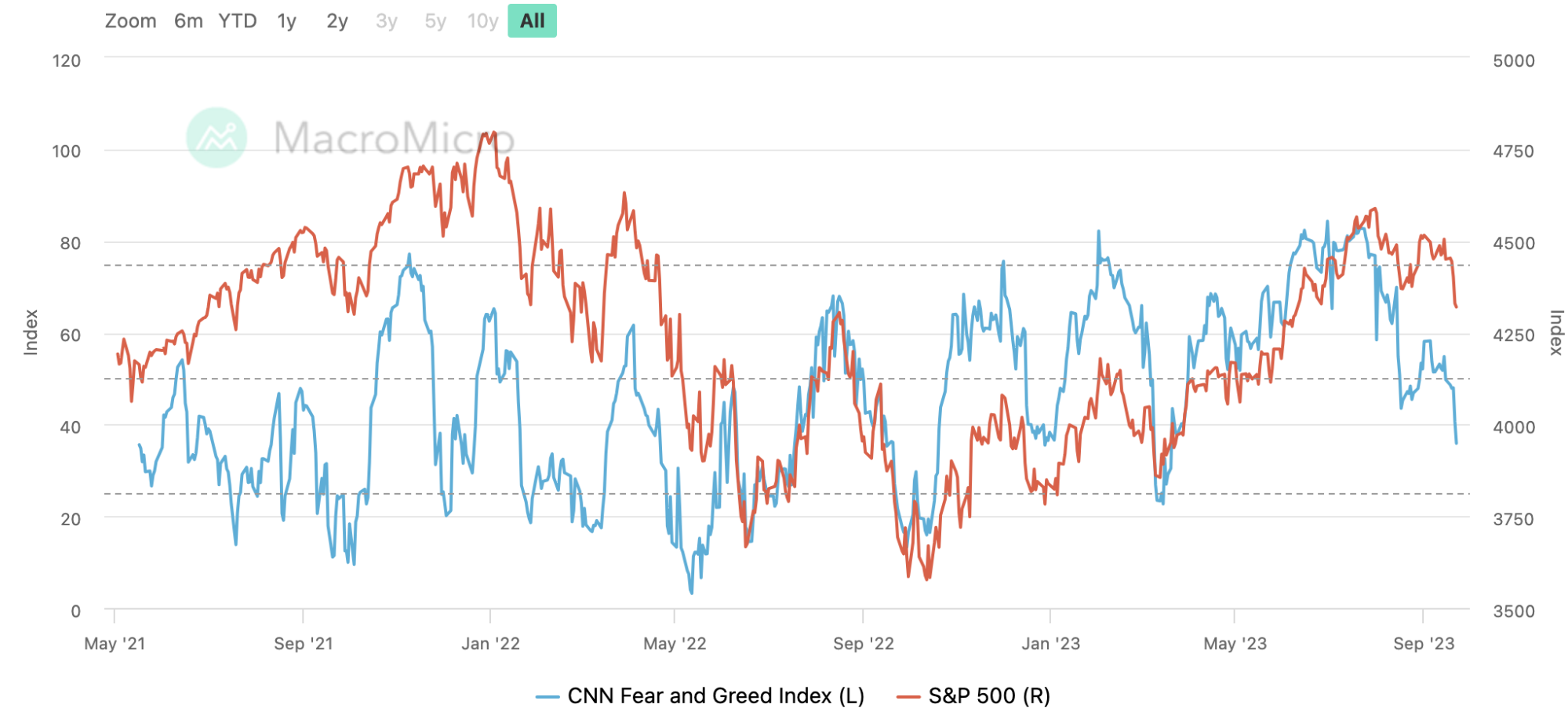

The CNN Fear and Greed Index fell to 35.9, its lowest level since March:

Goldman Sachs institutional sentiment indicator plunged sharply, from the excessive range of 1.2 to the neutral range of 0.2. This mutually corroborated the indicator calculated by Deutsche Bank, showing that institutions have significantly reduced their positions:

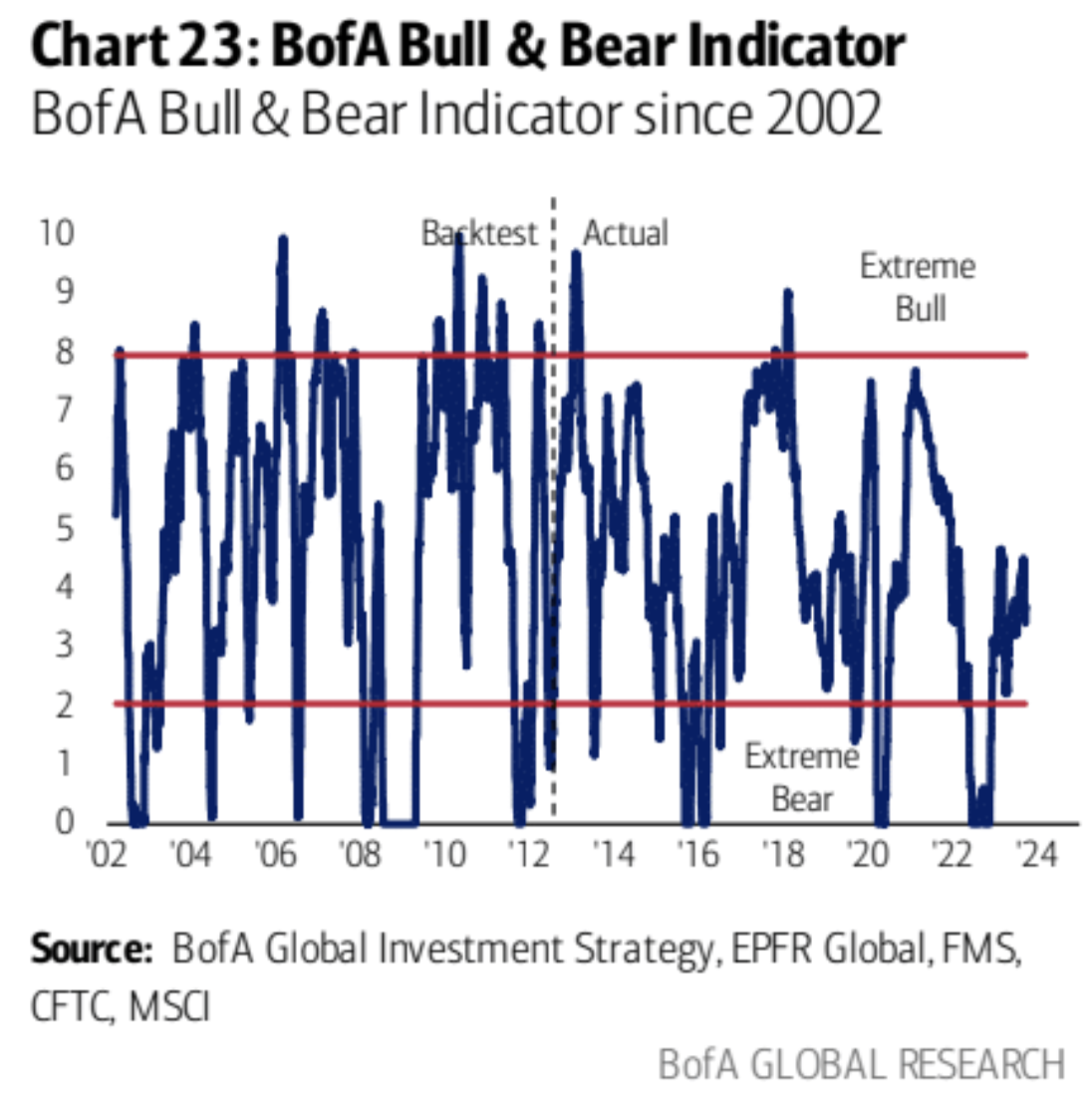

Bank of America Merrill Lynchs bull/bear indicator fell back to 3.4 from 3.6 last week:

next week

We are in the week between the FOMC meeting and the next non-farm payrolls report.

The data focuses on the Feds favorite inflation indicator - the U.S. core PCE price index in August, U.S. durable goods orders in August, the final value of U.S. real GDP in the second quarter, Chinas September PMI data, and Chinas August profits of industrial enterprises above designated size year-on-year. Eurozone CPI inflation data.

On the central bank front, Federal Reserve Chairman Powell will attend the meeting and answer questions, and the Bank of Japan will release the minutes of its July monetary policy meeting.

The government is concerned about the U.S. government shutdown. Nearly 4 million (2 million military) U.S. federal employees will feel the impact immediately. Essential workers will continue to work, but others will be furloughed until the shutdown ends. No fees will be paid during the impasse.

The average annual salary for members of the American Federation of Government Employees is $55,000 to $65,000, and the average annual salary for temporary workers is $45,000, which can create a financial strain for these individuals.

Separately, if the government shuts down, the Bureau of Labor Statistics said it would stop releasing data, including key figures on inflation and unemployment. The lack of important government data will make it difficult for investors and the Federal Reserve to interpret the U.S. economy.

Goldman Sachs estimates that a week-long government shutdown will reduce economic growth by 0.2%, but that economic growth will rebound after the government reopens.

Hard-line Republicans say any stopgap spending bill is out of the question for them. They are pushing for a government shutdown until Congress negotiates all 12 bills to fund the government, a historically difficult task with no hope of resolution until December.