Hotairballoo Crypto Market Weekly Report (9.11–9.17)

Hotairballoon has selected important information on the crypto market last week, investment and financing status, as well as on-chain data on current popular tracks such as LSD and RWA. It also counts projects with relatively large unlock volumes in the near future for your reference.

1. Important information about the encryption industry last week

(1) Policy/Supervision

1. G20 countries have reached a consensus on the rapid implementation of a cross-border framework for crypto assets and plan to automatically exchange crypto transaction information between countries starting in 2027.

According to Cointelegraph, G20 leaders recently held a summit in New Delhi, the capital of India, to reach a consensus on the rapid implementation of a cross-border framework for encrypted assets. The framework will facilitate the exchange of crypto-asset information between countries starting in 2027. Under the proposed framework, countries will automatically exchange information on crypto transactions between different jurisdictions on an annual basis, including those conducted on unregulated cryptocurrency exchanges and wallet providers.

2. Chairman of the U.S. SEC: The encryption industry generally does not comply with securities laws, and many cryptocurrencies fall under the jurisdiction of the SEC

According to news on September 12, The Block reported that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler will attend a hearing of the U.S. Senate Banking Committee on Tuesday morning. He still maintains that cryptocurrencies must comply with the same laws as other securities such as stocks, and many cryptocurrencies fall under the jurisdiction of the SEC.

3. Coinbase will promote “global consensus” on cryptocurrency rules through Brazil’s G20

According to The Block, Coinbase views Brazil’s G20 as a forum through which to push global cryptocurrency operators to develop a unified set of rules. Nana Murugesan, Coinbase’s vice president of international and business development, said it hopes to work with finance ministries, central banks and regulators to promote “certain principles shared by countries.”

4. U.S. SEC Chairman: Under review of Grayscale ruling and Bitcoin ETF application

According to news on September 12, U.S. SEC Chairman Gary Gensler stated at the hearing that the SEC is reviewing the Grayscale ruling and the Bitcoin ETF application. He also said that artificial intelligence and new technologies will pose challenges to SEC regulations. Counterfeiting and artificial intelligence are real risks to the market.

5. The U.S. House of Representatives will hold a hearing on Supervision of the SEC Investment Management Department on September 19.

According to news on September 13, Patrick McHenry, chairman of the U.S. House of Representatives Financial Services Committee, announced that the House Capital Markets Subcommittee will hold a hearing titled Oversight of the SEC Investment Management Department at 22:00 on September 19, Beijing time.

6. Deloitte and Bitwave established a strategic alliance to provide enterprises with digital asset compliance solutions

On September 13, according to PR Newswire, Deloitte, one of the Big Four accounting firms, announced the establishment of a strategic alliance with the digital asset accounting platform Bitwave. The alliance combines Bitwave’s software platform with Deloitte’s innovative accounting, tax and governance, risk and controls advisory services. Bitwave’s software platform automates the incorporation of data flows from more than 70 blockchain and decentralized finance (DeFi) ecosystems into ERP systems, such as Oracle NetSuite and Sage Intacct. The partnership will help businesses using digital assets improve speed and process efficiency, save costs and enhance compliance.

7. The U.S. SEC accuses the creator of the Stoner Cats series of NFTs of providing NFTs without registration

According to news on September 13, the U.S. Securities and Exchange Commission (SEC) today accused Stoner Cats 2 LLC (SC 2) of conducting an unregistered crypto-asset securities offering in the form of so-called NFTs, raising approximately $8 million from investors. To fund the animated web series Cats called Stoner.

8. Coinbase CEO: The U.S. CFTC should not enforce law against DeFi protocols and hopes that DeFi protocols will take the CFTC to court.

According to news on September 14, Coinbase CEO Brian Armstrong tweeted that the U.S. Commodity Futures Trading Commission (CFTC) should not implement enforcement actions against decentralized (DeFi) protocols. DeFi protocols are not financial services businesses and the Commodity Exchange Act is unlikely to apply to them. Hopefully these DeFi protocols will take the CFTC to court and set a precedent.

9. Monetary Authority of Singapore imposes 9-year ban on Three Arrows Capital founders Su Zhu and Kyle Davies

According to Bloomberg News, Singapore’s financial regulator issued a statement on Thursday saying that the country’s central bank has imposed a nine-year ban on Su Zhu and Kyle Davies, who were blamed for the collapse of crypto hedge fund Three Arrows Capital. The pair are prohibited from engaging in any regulated activity. The pair are also prohibited from managing, serving or being a director or substantial shareholder of any capital markets services company under the Securities and Futures Act.

10. Officials from the Russian Ministry of Finance: Russia is studying how to legalize and regulate DAOs

According to CryptoPotato reports on September 14, Ivan Chebeskov, Director of the Financial Policy Department of the Russian Ministry of Finance, said at the 2023 Crypto Summit that Russia is studying how to legalize and regulate decentralized financial organizations (DAOs) so that Bring more liquidity to the local digital financial asset market.

11. U.S. SEC Commissioners Hester Peirce and Mark Uyeda oppose the SEC’s enforcement action against the Stoner Cats

According to news on September 14, U.S. Securities and Exchange Commission (SEC) Commissioners Hester Peirce and Mark Uyeda once again stated their opposition to the SEC’s enforcement action regarding Stoner Cats NFT sales as securities, and stated that the application of the Howey test in this case lacks any meaningful restrictions. in principle.

12. The chairman of the U.S. Senate Banking Committee urges the SEC and CFTC to use existing powers to increase transparency in the crypto market

September 15 news, according to The Block, U.S. Senate Banking Committee Chairman Sherrod Brown, Ohio Democratic Congressman, sent a letter to U.S. Treasury Secretary Yellen, U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler and the Commodity Futures Trading Commission (CFTC) on Thursday. ) Chairman Rostin Behnam, urging it to use existing tools to increase transparency in the crypto market and hold bad actors accountable to help protect consumers.

13. Hong Kong MPs responded to Vitalik: Hong Kong policies and laws will not change overnight. Welcome to come to Hong Kong to learn about the situation.

According to news on September 15, Hong Kong Legislative Council member Wu Jiezhuang said on the Understand and do not know the situation in Hong Kong. I sincerely invite Mr. Vitalik to come to Hong Kong to understand the situation. I am willing to coordinate with relevant institutions and enterprises to share the situation in Hong Kong with them. Hong Kong is a special administrative region with complete procedures for formulating policies and laws. In Under one country, two systems, Hong Kong has legislative power.

14. Dubai and Hong Kong and Dubai jointly establish financial services cooperation, covering areas such as virtual assets.

On September 15, according to the Hong Kong Financial Times, the Dubai Economy and Tourism Authority and the Financial Services and the Treasury Bureau of the Government of the Hong Kong Special Administrative Region of China signed a memorandum of understanding aimed at strengthening financial cooperation between Dubai and Hong Kong. The memorandum was signed at the Belt and Road Summit Forum in Hong Kong, China, by Hadi Badri, CEO of the Dubai Economic Development Corporation of the Dubai Economic and Tourism Authority, and Chen Haolian, Deputy Director of the Financial Affairs and the Treasury Bureau of the Hong Kong Special Administrative Region Government of the Peoples Republic of China. .

15. Director of the National Tax Service of South Korea: Will strengthen the crackdown on tax evasion using virtual assets and other methods

According to news on September 15, according to the Seoul Economic Daily report, Kim Chang-ki, Director of the Korean National Tax Service, said in his speech at the 2023 National Tax Management Forum: We will take severe actions against malicious taxation, including new tax evasion based on online platforms. .To deal with tax evasion using virtual assets, we must strengthen our scientific research foundation.

16. The Japanese government has relaxed financing regulations and will allow start-ups to raise funds in cryptocurrency.

On September 15, according to Nikkei reports, the Japanese government will relax regulations on financing for start-ups. Start-ups can obtain cryptocurrency investment from VCs. The new regulations will cover funds called investment limited partnerships (LPS).

(2) Project information

1. The founder of dYdX plans to let DYDX continue to use the existing token distribution model after the dYdX Chain is launched.

According to news on September 12, dYdX founder Antonio Juliano stated on the Inflation has been cut by more than 60%). It won’t be long before dYdX Chain becomes the Layer 1 closest to Ethereum in terms of sustainability of the token economic model.

2. Court documents show: FTX has a total of approximately US$7 billion in assets, including US$3.4 billion in cryptocurrency.

According to news on September 11, court documents show that the estate of bankrupt FTX has sorted out approximately US$7 billion in assets, including US$1.16 billion in solana (SOL) tokens and US$560 million in Bitcoin (BTC). In addition to the $1.1 billion held on November 11, the company also received $1.5 billion in cash and held cryptocurrency holdings valued at $3.4 billion as of August 31, the filing said.

3. PayPal launches cryptocurrency exchange service for U.S. dollars

PayPal has launched a new cryptocurrency exchange service for U.S. dollars, The Block reports, after the company launched a service that allows customers to buy cryptocurrencies. PayPal said in a statement that U.S. crypto wallet users can convert their cryptocurrencies directly into U.S. dollars and have them added to their PayPal balance, which can then be used for purchases or transfers to cards.

4. Coinbase Prime launches Web3 wallet for institutional and corporate customers

On September 12, according to the official blog, Coinbase announced that its prime brokerage platform Coinbase Prime has launched an institutional-grade Web3 wallet. Institutional and corporate customers can use the MPC technology of this non-custodial wallet to store any token from a supported network ( Including assets not yet available on Prime Custody), instant access to funds, interact directly with dApps and smart contracts, leverage decentralized liquidity to trade a large number of assets, vote on DAO governance, lend assets or equity, direct access to DeFi, Buy/sell/mint/manage NFT collections and manage Web3 social accounts.

5. Bitget launches $100 million EmpowerX fund to fund ecosystem development

According to reports on September 12, Bitget Managing Director Gracy Chen announced the launch of the US$100 million EmpowerX Fund at the Singapore Web3 Summit Bitget EmpowerX. The fund will seek to invest in regional exchanges, data analysis companies, media organizations and others. entity. As the CEX space continues to evolve under the influence of regulatory tightening, Layer 2 and the rapid development of DeFi technology, we expect more investments, mergers and acquisitions to occur in the coming months, Chen said.

6. The target selection for the FTX 2.0 bidding will be conducted on October 16, and the restart plan will be confirmed in Q2 next year

According to news on September 12, according to the FTX 2.0 restart plan shared by FTX creditor @sunil_trades on the A call for proposals will take place in the first or second quarter, with program confirmation in the second quarter of 2024.

7. MakerDAO once again increased its RWA assets by US$100 million, bringing the total RWA assets of the agreement to US$2.713 billion.

According to news on September 15, makerburn.com data shows that MakerDAO has once again added $100 million in RWA assets through BlockTower Andromeda yesterday, mainly investing in short-term U.S. Treasury bonds, with an annualized interest rate of 4.5%. Additionally, total current agreement RWA assets reach $2.713 billion.

8. Hong Kong digital asset platform OSL cooperates with Harvest International to expand STO business

According to reports on September 12, Harvest International, an active asset management company, and OSL, a digital asset business subsidiary of BC Technology Group, announced the establishment of a strategic partnership to jointly explore and develop tokenization-related businesses in Hong Kong. The two parties hope to provide a unique and regulated investment method for the capital market through security tokens (STO) through cooperation. At the same time, it was emphasized that it will develop with the most stringent compliance, security and information transparency standards.

9. LayerZero has reached a cooperation with Google Cloud. Google Cloud will serve as LayerZero’s default oracle.

According to news on September 12, LayerZero Labs, the team behind the cross-chain messaging protocol LayerZero, today announced a new cooperation with Google Cloud to enhance the security of its cross-chain environment in a high-performance and reliable cloud infrastructure and help accelerate Web3 The future of interoperability.

10. The Ethereum Holesky testnet is expected to be relaunched from September 22 to September 28

Ethereum research and engineering group Nethermind said developers will relaunch Holesky within a week. It looks like the next attempt will be on September 22nd. Meanwhile, Ethereum contributor and Sigma Prime member Michael Sproul suggested in a GitHub pull request that Holesky should be relaunched on September 28. The date comes nearly two weeks after the networks first launch attempt.

11. MetaMask launches Snaps function, which will be compatible with non-EVM blockchains

On September 12, according to The Block, MetaMask announced the launch of a new feature called Snaps, aiming to expand its use on blockchain networks that are incompatible with the Ethereum Virtual Machine (EVM) itself. Snap is a software module that can be integrated with MetaMask, allowing the wallet to be used across chains, including Cosmos, Solana, and Starknet.

12. The parent company of 21 Shares launched a series of encapsulated tokens, including BTC, XRP and Solana, etc.

On September 12, according to The Block, 21.co, the parent company of crypto ETP issuer 21 Shares, launched eight encapsulated tokens, including BTC, BNB, XRP, ADA, and Solana, aiming to expand the adoption of DeFi.

13. Paxos releases the first PYUSD transparency report, stating that all transactions are over-collateralized

On September 13, Paxos released the first transparency report of PayPal’s U.S. dollar stablecoin PYUSD. As of August 31, Eastern Time, the total number of outstanding tokens was approximately $44.37 million. The market value of the collateral in the U.S. Treasury collateralized reverse repurchase agreement is US$43.86 million, and the notional position value is US$43 million; the market value of the collateral deposited in other cash deposits of insured depository institutions is approximately US$1.5 million; the total net assets of the collateral are The market cap is $45.36 million and the notional position is worth $44.5 million.

14. opBNB mainnet officially launched

According to news on September 13, the opBNB mainnet based on OP Stack has been officially launched. In the future, it will focus on Proof Enhancement, account abstraction, data availability of BNB Greenfield, interoperability with BNB Greenfield, decentralized sorter, etc. Enhance network resiliency and decentralization.

15. Justin Sun: Huobi International brand officially upgraded to HTX to accelerate global expansion

According to news on September 13, TOKEN 2049 platinum sponsor Huobi HTX will host the TOKEN 2049 Afterparty tonight at the largest club in Singapore. At the event, Huobi Global Advisory Board member Justin Sun attended and announced that on the occasion of the 10th anniversary of Huobi HTX, the Huobi International brand was officially upgraded to HTX, taking a key step in global expansion. According to reports, H represents Huobis H, T represents TRON, which indicates the determination of All in TRON, and X represents exchange business.

16. Mauve, a decentralized exchange focusing on RWA, is now online

According to news on September 14, Mauve, a decentralized exchange (DEX) for trading compliant assets and real-world assets (RWA), was officially launched today. Mauve is a subsidiary of Violet, a compliance and identity infrastructure platform for decentralized finance (DeFi) backed by the digital assets arm of hedge fund giant Brevan Howard and the venture capital arm of cryptocurrency exchange Coinbase.

17. Lido Finance selects Axelar and Neutron to launch wstETH on Cosmos

According to reports on September 14, cross-chain smart contract platform Neutron and interoperability protocol Axelar have been selected by liquidity staking project Lido Finance to launch its wrapped liquidity staking Ethereum (wstETH) tokens in the Cosmos ecosystem. . Once wstETH is deployed on Cosmos and cross-chain governance is established, Axelar and Neutron are expected to hand over control of cross-chain deployment to Lido DAO.

18. ssv.network launches partner mainnet focusing on distributed validator technology

According to reports on September 14, the decentralized Ethereum staking infrastructure ssv.network launched a mainnet focusing on distributed validator technology, which connects users to jointly manage Ethereum validator nodes. operator network to achieve decentralized staking.

(3) Others

1. Hashdex has submitted an application for spot Ethereum ETF

According to news on September 12, Bloomberg analyst James Seyffart tweeted that the crypto asset management company Hashdex has applied for a spot Ethereum ETF Hashdex Nasdaq Ethereum ETF.

2. Decentralized exchange DigiFT announced the launch of the compliant Ethereum pledge token dETH 0924

According to official news, the decentralized security token exchange DigiFT announced the launch of its first regulatory-compliant Ethereum pledge token dETH 0924 to provide certified institutional investors with safe and compliant Ethereum and its Staking rewards. Investors will be able to subscribe to regulatory-compliant ETH-staking tokens using fiat currencies or stablecoins, with a minimum investment of $5,000. The dETH 024 token has a specific expiration date of September 10, 2024, but is redeemable every day during its 12-month term.

3. Visa: Plans to test whether stablecoin settlement on Solana can meet the needs of modern enterprise financial operations

According to news on September 14, payment giant Visa today released a research report In-depth exploration of high-performance blockchain network Solana. The report stated that Solanas unique technical advantages include high throughput of parallel processing and localized fee market. The low cost and high resiliency of large numbers of nodes and multi-node clients combine to create a scalable blockchain platform with a compelling value proposition for payments, which is why Visa has decided to expand the stablecoin settlement pilot to include on the Solana network. part of the reason for the transaction.

4. Boston Consulting: The tokenized asset market may surge to $16 trillion by 2030

Bank of America recently called RWA tokenization a “key driver of digital asset adoption.” The tokenized gold market has attracted more than $1 billion in investment, according to a Bank of America report. Demand for tokenized U.S. Treasuries is also growing, with the total market value of tokenized money market funds approaching $500 million, according to data compiled by CoinDesk. Global business consulting firm Boston Consulting Group predicts that the market for tokenized assets could surge to $16 trillion by 2030.

2. Investment and financing situation last week

(1) DeFi

1. L2 Network Layer N completed a $5 million seed round of financing, led by Founders Fund and dao 5

According to news on September 13, the Ethereum Layer 2 network Layer N announced the completion of a US$5 million seed round of financing. This round of financing was jointly led by Founders Fund and dao 5, with participation from Kraken Ventures and Spencer Noon. It is reported that Founders Fund’s investment amount in this round of financing is US$1.8 million.

2. Hybrid on-chain exchange Gravity completed its seed round of financing, with ABCDE and others participating in the investment

The hybrid on-chain exchange Gravity completed its seed round of financing, with participating investors including ABCDE, Matrix Partners China, Delphi Digital, C² Ventures, etc. Gravity plans to launch the testnet in the fourth quarter of 2023 and the mainnet in the first quarter of 2024.

3. DeFi revenue aggregator Portals completes US$500,000 in seed round expansion financing

DeFi revenue aggregator Portals completed a $500,000 seed round expansion financing with participation from Bankless Ventures, Digital Currency Group (DCG) and Founderheads.

4. DeFi data analysis platform Octav completed a $2.65 million seed round of financing, with participation from Polymorphic Capital and others.

DeFi data analysis and tax reconciliation platform Octav announced the completion of a US$2.65 million seed round of financing. Investors include Nascent, Polymorphic Capital, Parallel Studio, Spaceship DAO, Investmeows, Possible Ventures, Speedinvest, ACET Capital and other institutions, as well as Aave strategy leader Markc Individual investors such as Zeller and former Sushiswap CEO 0x Maki.

(2) Web3

1. Web3 wallet secure login system 0x Pass completed US$1.8 million in financing, with participation from Alchemy Ventures and others

According to TechCrunch reports on September 11, 0x Pass, a Web3 wallet security infrastructure incubated by the Stanford Blockchain Club, announced the completion of US$1.8 million in financing. Participants include AllianceDAO, Soma Capital, Alchemy Ventures, Blockchain Builders Fund, and Formulate Ventures. , Kommune, Hashed EM, Signum Capital/UOB, Nonce Classic, and individual investors include Balaji Srinivasan and Cory Levy.

2. Blockchain infrastructure Movement Labs completed a $3.4 million Pre-Seed round of financing

According to news on September 13, Movement Labs, a modular blockchain infrastructure based on the Move language, completed a $3.4 million Pre-Seed round of financing. Varys Capital, dao 5, Blizzard The Avalanche Fund, Borderless Capital and its Wormhole ecosystem-focused The cross-chain fund led the investment, with participating investors including Colony, Interop Ventures, Elixir Capital, and BENQI. Individual investors included George Lampeth (dao 5), Calvin Liu (Eigenlayer), Smokey The Bera (Berachain), Anurag Arjun (Avail), Co-founder of CoinFlipCanada (GMX) and Ankr.

3. Web3 financial services company pafin completed a new round of financing, with Sony Innovation Fund and others participating in the investment

Japanese Web3 financial services company pafin has completed a new round of financing, with participation from DG Daiwa Ventures, Sony Innovation Fund and MZ Web3 Fund. pafin is developing financial technology and Web3-related businesses, such as Cryptact, an automatic profit and loss calculation service for crypto assets, and Defitact, a Web3 home ledger tool.

4. Web3 startup Immix completed a $2.7 million seed round of financing, led by MassMutual Ventures

Web3 startup Immix completed a $2.7 million seed round of financing, led by MassMutual Ventures and participated by Ripple. The funds will be used to develop Immixs trading platform and improve the execution capabilities of its market-making products.

5. Web3 incentive platform Cultos Global completed a new round of financing

Dubais Web3 incentive platform Cultos Global announced the completion of a new round of financing, with boAt Lifestyle founder and CEO Sameer Mehta, womens social encryption platform Coto founder and CEO Tarun Katial, Bosch Southeast Asia head Vijay Ratnaparkhe and others participating in the investment. Details The amount of financing has not yet been disclosed.

6. Web3 cross-chain community operating system Club 3 completed a US$3 million seed round of financing, led by LinkVC.

Web3 cross-chain community operating system Club 3 announced the completion of a US$3 million seed round of financing, led by LinkVC, with participation from Yuanwang Capital, BCH Foundation, Digifinex and others. Club 3 has officially launched the first round of US$200,000 community subsidy program, aiming to provide growth subsidies for early-stage high-quality projects. Currently, Club 3 has established traffic and community cooperation with hundreds of platforms such as OKX, BNB Chain, HashKey, zkSync, TPwallet, and Lens.

(3) NFT/chain games

1. Animoca Brands raised US$20 million for its NFT project Mocaverse, led by CMCC Global

Animoca Brands announced a new round of binding financing commitments to accelerate the development of its NFT project Mocaverse.

Specifically, Animoca Brands raised $20 million through the issuance of new ordinary shares at A$4.50 per share. As part of the financing, the company issued free additional utility token warrants to investors based on a 1:1 USD ratio. The financing was led by CMCC Global, with participation from institutional investors including Kingsway Capital, Liberty City Ventures, GameFi Ventures, Aleksander Larsen (founder of Sky Mavis), Gabby Dizon (founder of Yield Guild Games), and Koda Capital. Animoca Brands Yat Siu, executive chairman and co-founder, also participated in the round.

2. Game startup Pahdo Labs completed $15 million in Series A financing, led by a16z

On September 12, according to Decrypt reports, gaming startup Pahdo Labs completed a $15 million Series A round of financing, led by Andreessen Horowitz (a16z). Pahdo did not officially announce other Series A investors, but Crunchbase mentioned the likes of BoxGroup, Long Journey Ventures, PearVC, and 2 Punks Capital as participating in the round.

3. Web3 collaborative entertainment protocol Mythic completed US$6.5 million in financing, led by Shima Capital partners

Web3 collaborative entertainment protocol Mythic Protocol completed a US$6.5 million seed round of financing, led by Shima Capital partner Yida Gao, with participation from Alpha JWC, Saison Capital, GDV Venture, Planetarium Labs, Arcane Group, Presto Labs, MARBLEX, EMURGO Ventures, HYPERITHM, etc. .

Mythic Protocol will use the funding from this round to develop and launch its initial core product.

7. Okapi completed seed round financing, led by Mirana Ventures and Mask Network

Okapi announced the completion of a seed round of financing, led by Mirana Ventures and Mask Network, with participation from GoPlus Security. The financing has not yet been disclosed. It is reported that Okapi is a certification platform that combines content and reputation.

9. Web3 game studio GamePhilos completed $8 million in seed round financing, led by Xterio and others

Web3 game studio GamePhilos has completed an $8 million seed round of financing, co-led by Xterio, Animoca Ventures, SevenX Venture and Chain Hill Capital, with participation from Hashkey Capital, Sanctor Capital, Game 7, Bas 1s, GSR and GSG Ventures.

(4) Asset management

1. Venture capital institution Modular Labs completed Pre-Seed round of financing, led by Hashed and K 300

Venture capital institution Modular Labs completed a Pre-Seed round of financing, led by Hashed and K 300, with participation from GuildFi and GBV. Modular Labs aims to support technologists developing with modular blockchains.

2. French financial technology company Fipto received 15 million euros in seed round financing, led by Serena Capital and Motier Ventures

French financial technology company Fipto received 15 million euros in seed round financing, led by Serena Capital and Motier Ventures. At its core, the Fipto platform is dedicated to harnessing the potential of blockchain technology. Its comprehensive platform serves as an all-in-one payments and finance solution that enables businesses to seamlessly convert and transfer any currency, whether fiat or digital, while leveraging the unique advantages of blockchain.

3. Range Protocol, an on-chain asset management protocol, completed a US$3.75 million seed round of financing, led by HashKey Capital and Nomad Capital.

The on-chain asset management protocol Range Protocol announced the completion of a US$3.75 million seed round of financing. HashKey Capital and Nomad Capital co-led the investment, with participation from Spark Digital Capital, Mirana Ventures, Symbolic Capital, Asymm Ventures and Comma 3 Ventures.

3. Main track data last week

(1) RWA

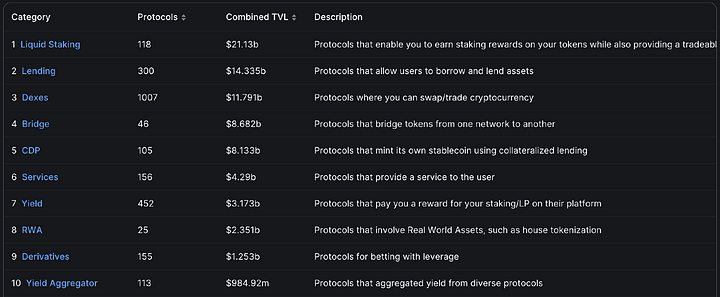

According to statistics from defillama, the current total TVL of the RWA track has reached 2.35 billion US dollars, an increase of nearly 1 billion US dollars from last week. The total lock-up volume (TVL) ranks 8th. Defillama has included a total of 25 RWA protocols.

Among these RWA (real world asset) tokenization projects include the tokenization of U.S. Treasury bonds and real estate tokenization.

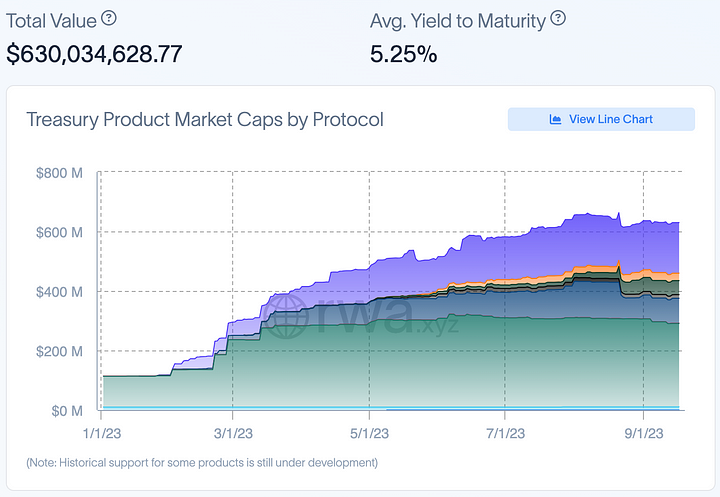

According to statistics from the rwa.xyz platform, the tokenization scale of U.S. Treasury bonds has reached US$630 million, with an average yield of more than 5%.

Among these U.S. debt tokenization projects, Franklin Templeton Benji Investments Market Cap on Steller has the highest market value, reaching $278 million, with a yield of 5.19%.

MakerDAO

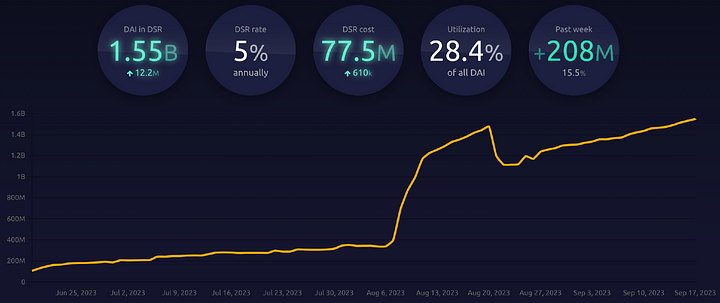

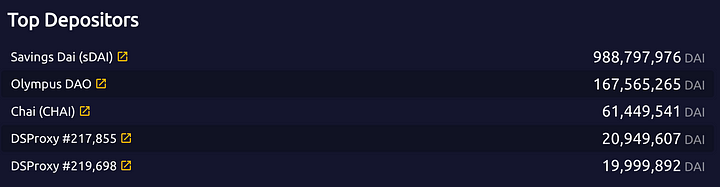

As of the time of writing, the size of Dai in DSR has increased by 208 million from last week, reaching 1.55 billion, which is an increase from the previous week. The total amount of Dai has increased to 5.457 billion, a slight increase from last week. Currently, DSR accounts for the total number of Dai. The volume ratio is 22.7%, and the DSR deposit interest rate is 5%.

Among them, sDAI was 990 million, a slight increase from last week.

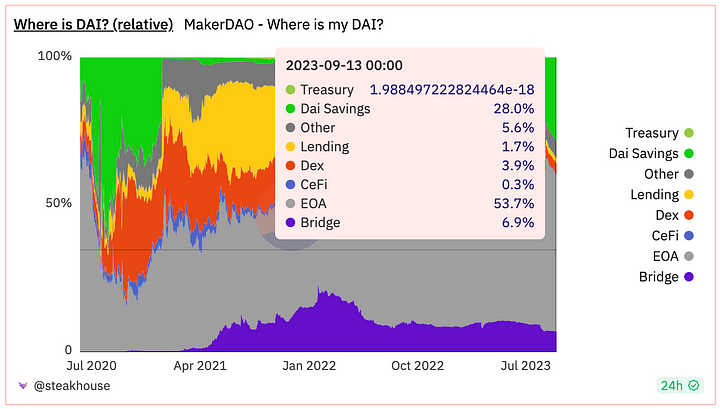

Lets take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising, reaching 53.7%, a slight decrease from last week. Since the DSR adjusted the interest rate, The share of DAI Savings is getting bigger and bigger, now reaching 28.0%, an increase of 6 percentage points from last week.

Currently, the ones with the highest proportion are: EOA, DAI Savings, and Bridge.

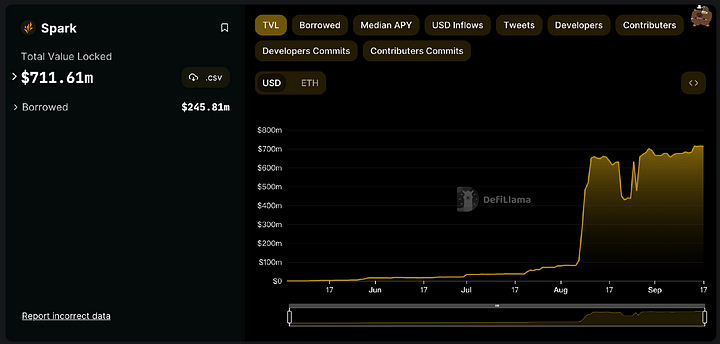

Maker’s own lending protocol Spark’s TVL reached 710 million, a slight increase from last week.

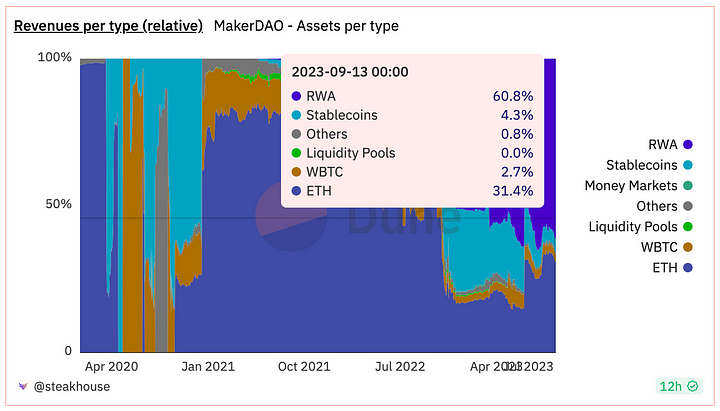

According to statistics from the dune platform, RWA accounts for 60.1% of MakerDAOs revenue, an increase of two percentage points from last week. The high proportion is related to MarerDAOs vigorous deployment in the RWA track.

(2) LSD

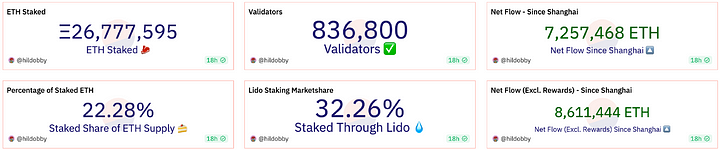

Currently, the amount of ETH pledged in the beacon chain has reached 26.77 million ETH, a slight increase from last week, accounting for 22.28% of the total supply of ETH, and the number of nodes is 836,800.

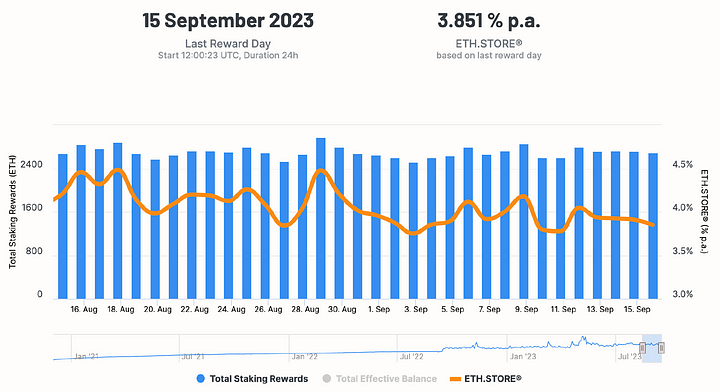

The current ETH staking yield is about 3.85%. As the quality increases, the yield is declining.

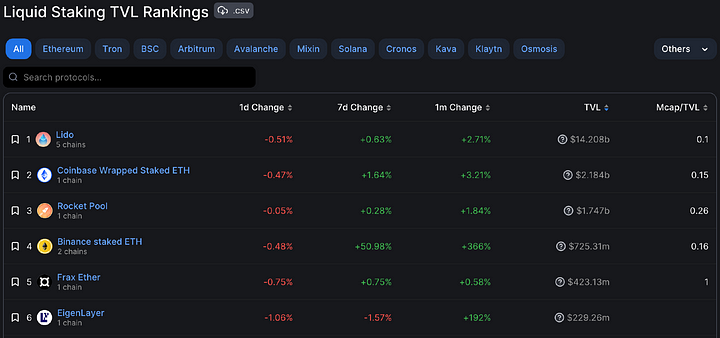

Among the three major protocols, in terms of ETH pledge volume, Lido increased by 0.63% in a week, Rocket Pool increased by 0.28% in a week, and Frax increased by 0.75% in a week.

Judging from the price performance of the three major protocols, LDO increased by 2.45% during the week, RPL fell by 1.81% during the week, and FXS price increased by 0.78% compared with last week.

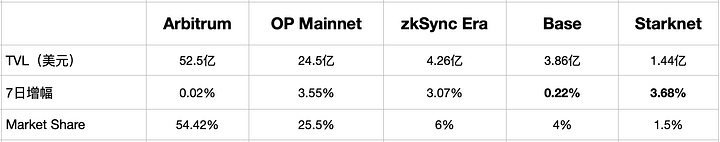

(3) Ethereum L2

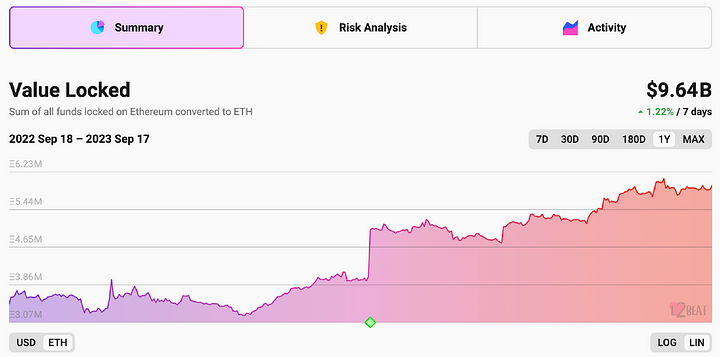

According to statistics from the l 2b eat platform, Ethereum Layer 2 TVL has increased by 1.22% in the past week, and the current TVL is US$9.64 billion.

Among Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 54.42%. The fastest growing one recently is of course Starknet. In the past week, TVL increased by 3.68%, reaching $144 million.

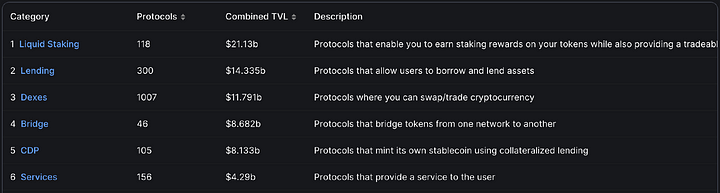

(4) DEX

TVL

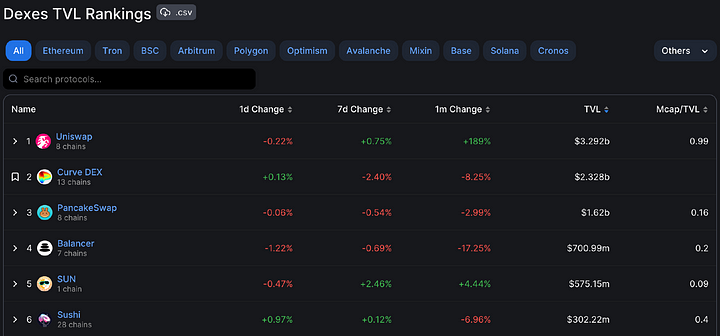

According to statistics from defillama, the total locked-up volume on the DEX track is US$11.79 billion, a slight decrease from last week.

Uniswap ranks highest in lock-up volume, followed by Curve, PancakeSwap, Balancer, SUN and Sushi. The TVL of most DEXs has declined compared with last week.

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi and Loopring.

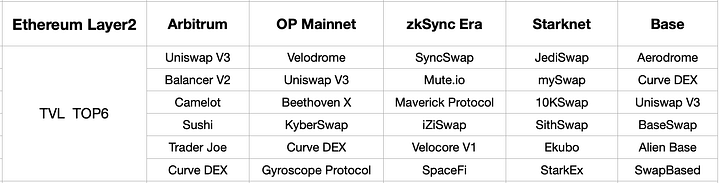

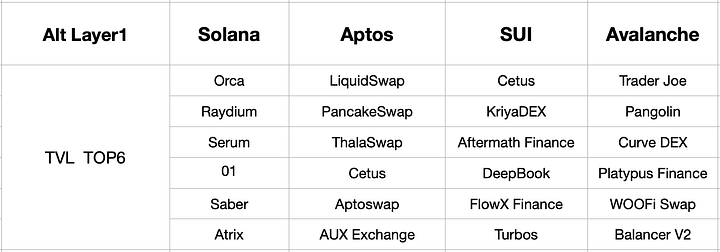

The above are the top 6 TVL DEXs on Arbitrum, OP Mainnet, zkSync Era, Starknet and Base chain.

The above are the top 6 TVL-ranked DEXs on other Layer 1 chains.

Trading volume

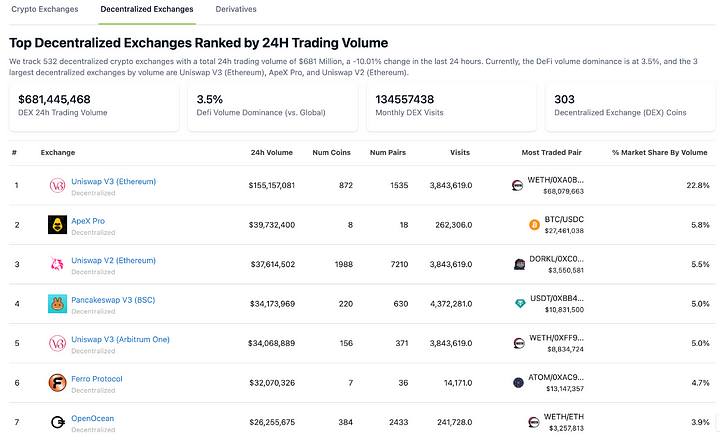

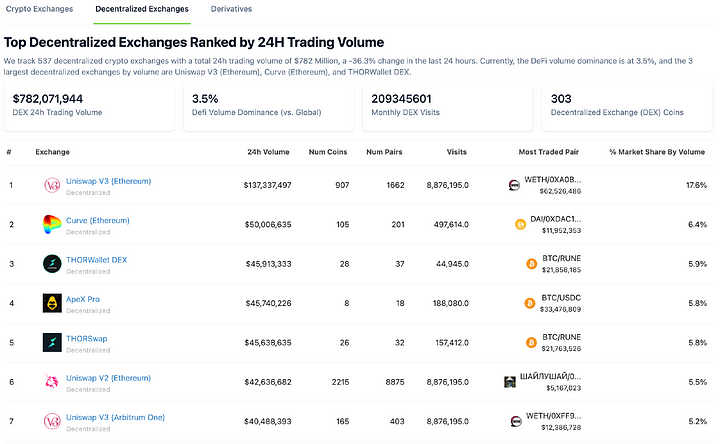

The trading volume of decentralized exchanges (DEX) in the last 24 hours was nearly US$780 million, and the trading volume increased compared with last week. The total trading volume of global cryptocurrency exchanges in the last 24 hours was US$22.4 billion, of which DEX trading volume accounted for Only 3.5%.

In DEX, the exchanges with higher trading volume include Uniswap, ApeX, Pancakeswap, Ferro, etc.

(5) Derivatives DEX

TVL

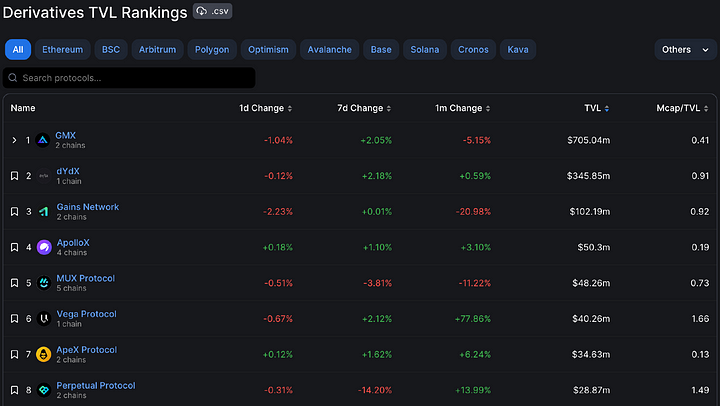

Judging from the data of defillama, most of the DEX TVL of derivatives has been declining recently. On the one hand, it is due to the decline in token prices, and on the other hand, it is because the overall trading volume of the derivatives track is declining.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, ApolloX and NUX Protocol.

Trading volume

According to statistics from the coincko platform, the decentralized derivatives trading platform with the highest trading volume is dYdX. The trading volume in the last 24 hours has reached US$270 million, which is much higher than the trading volume of other decentralized derivatives platforms.

4. Recent token unlocking

Recently, the token unlocking of 2 projects deserves attention. Among them, the Space ID project has a relatively large amount of token ID unlocking. The amount of tokens unlocked this time reached 18.49 million US dollars, accounting for 6.46% of the APE token traffic.

Follow hot air balloon @HorairballoonCN on Twitter to explore more industry news:https://twitter.com/HotairballoonCN