SignalPlus Volatility Column (20230915): Rate hike expectations lowered to 2%, optimistic for long-term bulk trading.

On Thursday night at 8:30 p.m. (UTC+8), the United States released a series of heavyweight data, among which the retail sales monthly rate for August recorded 0.6%, exceeding the expected 0.2%; the PPI monthly rate recorded 0.7%, marking the largest increase in over a year, surpassing the expected 0.4%. Further data analysis shows that the surge in oil prices is the main reason for the rise in the PPI index. Influenced by the strong U.S. data, the U.S. dollar index surged above the 105 level during the pre-market session; U.S. bond yields rose across the board, with the two-year yield returning above 5%.

Source: SignalPlus, Economic Calendar

The three major U.S. stock indexes closed higher yesterday, rising by about 0.8% to 0.9%. Cryptocurrencies followed closely, helping BTC achieve a fourth consecutive day of gains and successfully surpassing the 26,500 level, with a 0.97% increase in closing price. ETH also found support above 1600 and closed at 1628.67 (+0.62%).

Source: Binance & TradingView

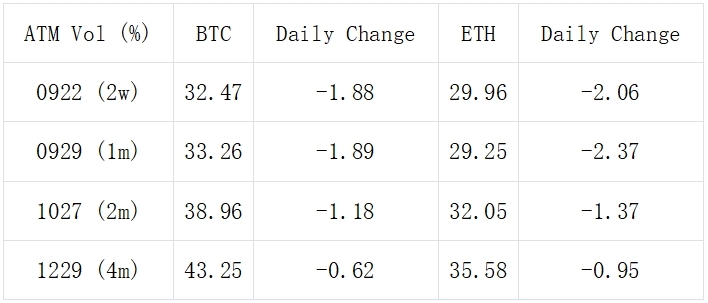

After the release of yesterday's data, the market almost locked in the expectation that the FOMC meeting next week will not raise interest rates (98% probability). Implied volatility has continued to decline, and as of today's settlement, BTC/ETH September IV has dropped by about 2%, and medium to long-term IV has also seen a decline of around 0.5% to 1.2%.

Source: Deribit (as of Sep 15 16:00 UTC+8)

Source: SignalPlus

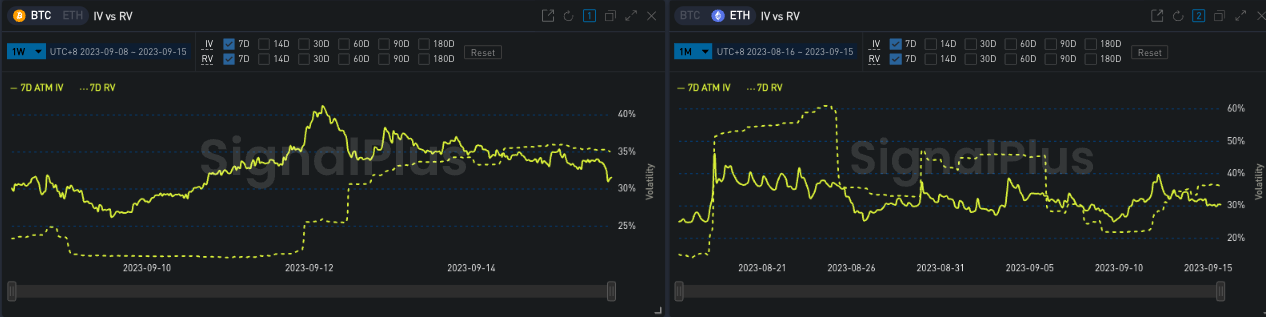

It is worth mentioning that the volatility of cryptocurrencies this week has saved the actual volatility of BTC/ETH (7d) from the bottom of around 20% back to around 30%. Short-term IV is now lower than RV after yesterday's decline.

Source: SignalPlus

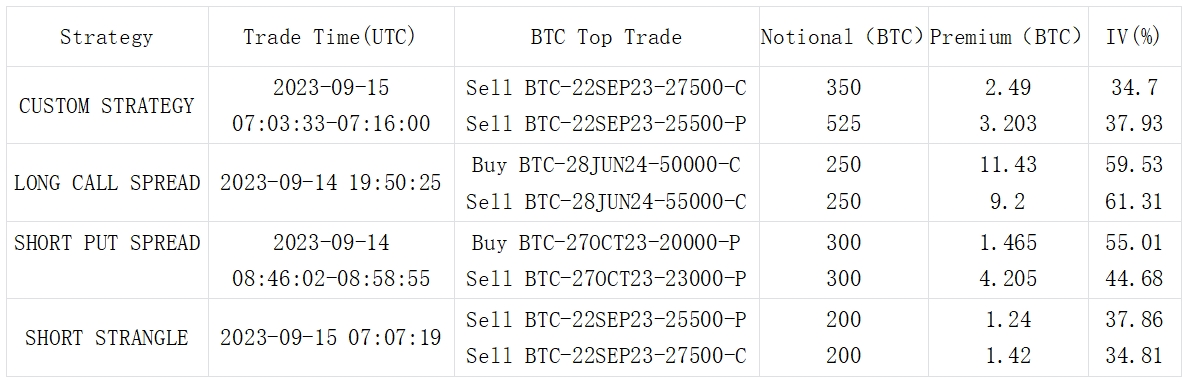

As for the trading aspect, due to the market's expectation of no interest rate hike by the FOMC^, the BTC^ near-term options at the positions of 25500-P^ and 27500-C^ have experienced a significant amount of selling, resulting in almost no IV^ premium for this duration.

On the other hand, the recent stable price increase has strengthened traders' confidence in long-term investments, and the bulk market has seen many far-term Call Spread^ trades represented by BTC-28 Jun 24 50000 vs 55000, ETH-29 Dec 23 2400 vs 2800.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encrypted information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web 3 or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com