How did Solana, who has gone through hardships, win the heart of Visa?

Source: "A deep dive on Solana, a high performance blockchain network"

Authors: Mustafa Bedawala, Arjuna Wijeyekoon

Translation: OdailyHow

With the FTX incident continuing to ferment, Solana occasionally returns to the public's attention.

Data shows that although the number of daily active addresses on the Solana network hit a new low for the year, the TVL has grown by over 150% since the beginning of the year. At the same time, MakerDao is also migrating to Solana, and last week Visa chose Solana as its pilot public chain for trading USDC. Solana, which has gone through hardships, seems to be rejuvenating.

Of course, the above does not mean that Solana already has the ability to compete with the "Ethereum-centric multi-L2 universe", but perhaps everyone's patience with the "king of public chains" is also more limited. Visa, which has piloted both Ethereum and Solana, recently released a research report on Solana, interpreting its high throughput, low cost, and strong node foundation.

Odaily now compiles the essence of the paper as follows.

Blockchain networks have long been proposed as innovative payment channels. However, over the years, they have faced difficulties in scaling, unable to meet consumer expectations for secure, high-throughput, low-cost transactions. Over the past year, our Visa team has been closely monitoring the technical innovations behind blockchain scalability and has been encouraged by the significant progress made on new L2 networks on Ethereum and alternative blockchain networks built from scratch.

Our goal is to gain a deep understanding of the technical properties of blockchain and attempt to leverage them to enhance our existing networks and build new products for business and financial transactions.

While we believe that the payment ecosystem may utilize multiple blockchain networks, we see the potential for the Solana blockchain network to become one of the networks driving mainstream payment processes. With its speed, scalability, and low transaction costs, Solana has the potential to meet payment demands and serve as a viable choice for efficient blockchain settlement channels using stablecoins like USDC. The Solana blockchain network combines many key features and innovative advancements that are worth exploring for anyone interested in payment technology.

Visa-scale transaction throughput

As a global payment network, Visa is capable of executing over 65,000 transactions per second. While Solana is not yet processing transactions at the scale of Visa, Solana averages processing 400 user-generated transactions per second (TPS), which can spike to over 2,000 user-generated TPS during peak demand periods. This is a significant level of throughput that enables support for testing and piloting payment use cases. In comparison, Ethereum averages around 12 TPS and Bitcoin is around 7 TPS.

Parallel transaction processing

As a foundational design for its high transaction throughput, Solana is capable of parallel transaction processing, greatly improving network efficiency. Transactions that impact different accounts can be executed simultaneously, allowing Solana to effectively support payment and settlement scenarios where many other parties pay between two main parties or in a single direction.

In Solana, smart contracts can also execute in parallel. Transactions specify the state or accounts they interact with., allowing validators to simultaneously run non-conflicting transactions. Unlike other chains like Ethereum that use a single-threaded model, Solana uses a multi-threaded approach to achieve parallel transaction execution. In simple terms, while Bitcoin and Ethereum process transactions sequentially, Solana's architecture allows for the simultaneous processing of multiple transactions. This design helps prevent congestion in one part of the network from affecting overall network performance.

Low and predictable transaction costs contribute to payment efficiency

In terms of cost, Solana offers not only affordable transaction fees (typically below $0.001), but also predictability. This low cost and predictability make it an attractive network that enhances the efficiency and cost savings of existing payment operations.

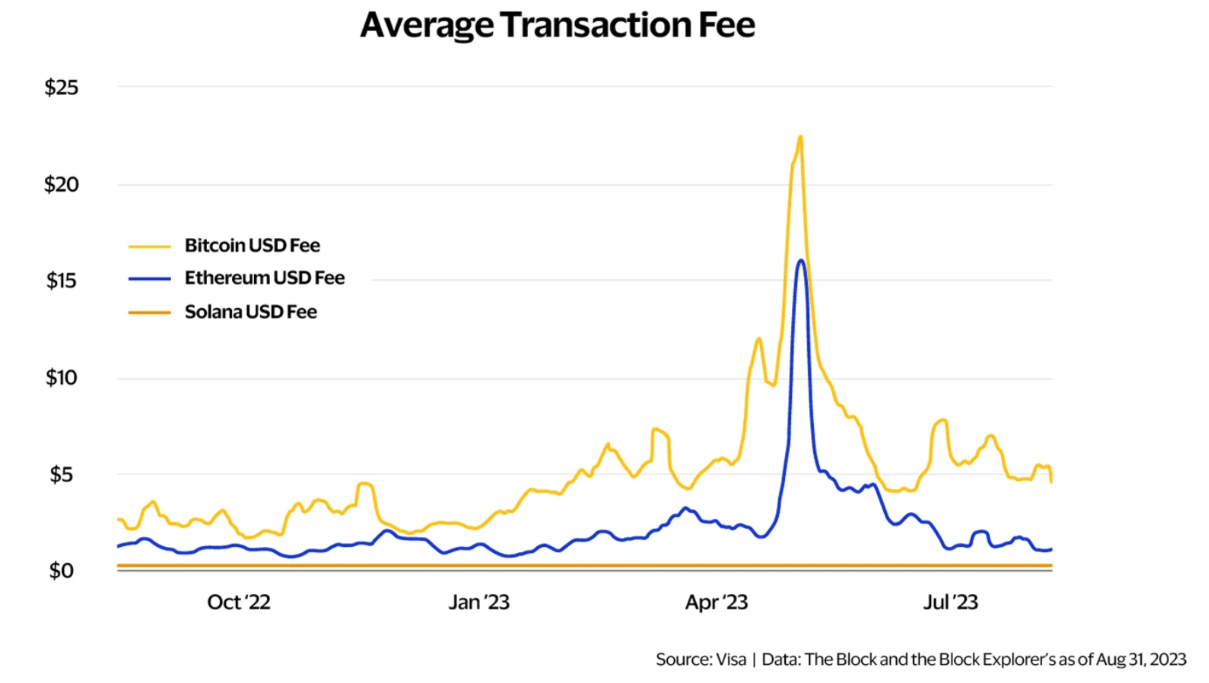

In the diagram below, from a cost perspective, Solana appears to be more prominent compared to Bitcoin and Ethereum, whose transaction fees may fluctuate unpredictably based on the transaction demand on the network. Unpredictable transaction costs in a network can pose challenges for payment companies to manage in their products and potentially lead to a confusing consumer experience.

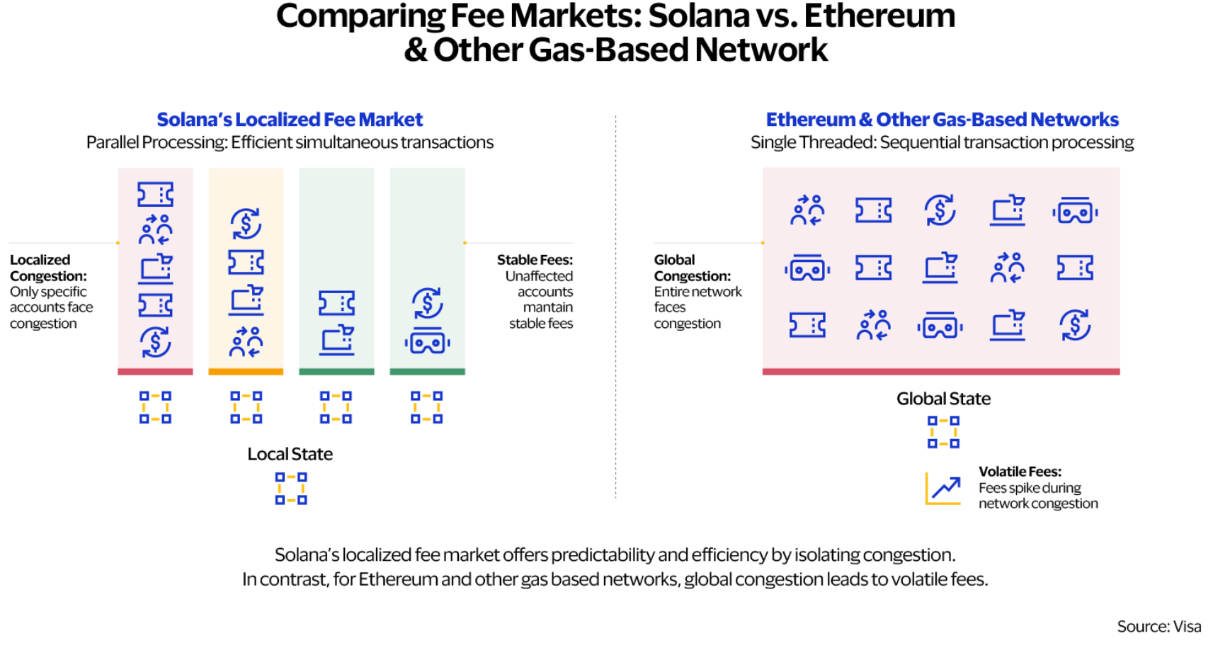

Achieving Cost Predictability through Localized Fee Markets

Solana's localized fee market is unique in the blockchain world. This innovation is closely tied to Solana's parallel processing capabilities, where non-overlapping transactions are executed on different threads, much like vehicles moving on separate roads. Network congestion is a significant factor in cost increase for other blockchain networks, which can have detrimental effects on the entire system. A surge in popularity of an NFT release may increase network congestion, making consumer-to-consumer P2P transactions happening simultaneously more expensive or even economically infeasible. The image below compares fee markets of Solana with Ethereum and other gas-based networks.

Solana's approach ensures that congestion in one account (e.g., Alice's USDC balance) does not affect other accounts (e.g., Bob's USDC balance). If an account becomes busy due to high demand for a specific asset (e.g., NFT), only the fees of that specific account will increase. The fees for other accounts remain unaffected, maintaining stability. This creates a fee market that responds to use case demands. When demand for a specific asset surges, the transaction fees for that asset temporarily increase. Meanwhile, the cost of other transactions on the chain is not affected. By allowing the parallel execution of computations in different states, Solana can create a fee market based on "state contention" regions instead of a single global fee market.

Consumer Expectations of Transaction Finality

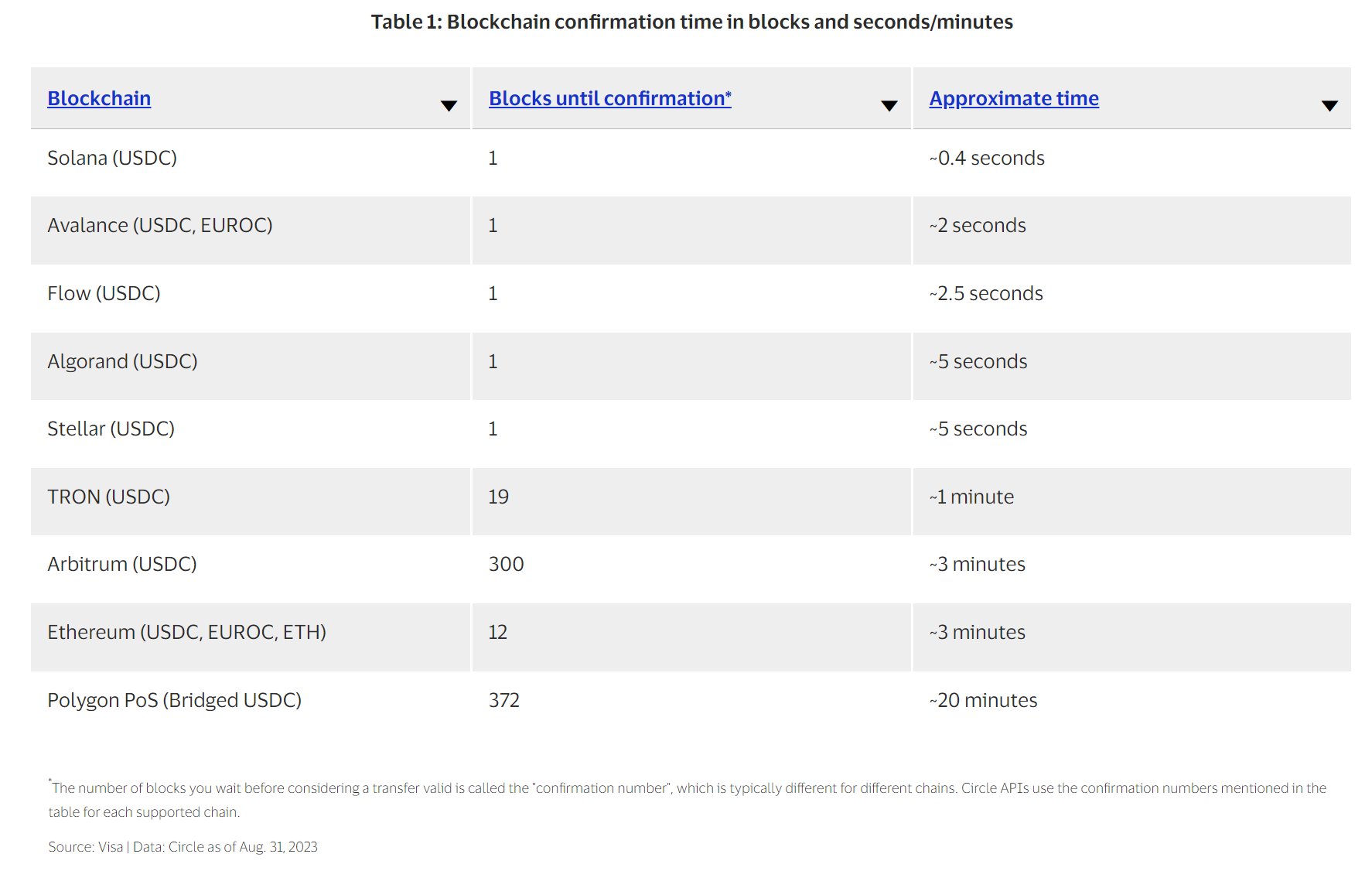

Transaction finality measures the speed at which users can expect their operations to be confirmed on the blockchain network. For payments, transaction confirmation time is equally important as network throughput. For example, Ethereum processes an average of about 12 transactions per second, but during congested periods, users may have to wait several minutes for transaction confirmation due to gas limits and smart contract demands. Solana aims for a time period of approximately 400 milliseconds, which can actually be achieved between 500 and 600 milliseconds.

Most applications on Solana achieve finality using "optimistic confirmation." Optimistic confirmation is a mechanism employed on the Solana blockchain that achieves finality before all validators (or entities responsible for generating blocks) vote. Through optimistic confirmation, if validators representing over two-thirds of the delegated stake vote on a block and no optimistically confirmed blocks are rolled back or fail to be finalized, then that block can be considered finalized.

This mechanism allows Solana to achieve finality faster than many other blockchains. FastSpeeding up transactions can provide a better payment experience. In contrast, Bitcoin may take up to 60 minutes to create six additional blocks before a transaction can be considered secure and final. The following image illustrates the block generation time of different chains.

Availability: A large number of nodes and multiple validator clients

A payment network can only be effective if it is always available when users need to make payments. For a blockchain network, availability is best measured by the number of independent participants or nodes running the network for consumers to initiate transactions.

As of July 2023, the Solana network has an impressive 1,893 active validators – entities responsible for generating and voting on blocks. Additionally, there are 925 nodes called RPCs that may not create blocks themselves but maintain local records of transactions.

Having a large number of nodes in a blockchain network enhances its resilience and redundancy. Even if some nodes encounter issues or go offline, as long as there are enough nodes running, the network can still function properly without losing data. The Solana community also focuses on the diversity of node geographic locations and infrastructure providers to make the network more resilient against events like natural disasters or changes in provider access policies. The Solana network has nodes in over 40 different countries and hundreds of unique hosting arrangements and locations. This helps ensure the smooth and reliable operation of the network, even in the face of technical challenges.

Validator clients are software tools that allow node operators to act as validators on a proof-of-stake blockchain. The diversity of validator clients improves the network's resilience. While one client may have an error or vulnerability, another client may not. This ultimately reduces the likelihood of a single software flaw debilitating the network.

Initially, Solana only used a validator client provided by Solana Labs. In August 2022, Jito Labs launched a second mainnet validator client, Jito-Solana. Shortly after, Jump Crypto introduced its own validator client called &nFiredancer (in testing phase) is a standalone C++ validator client. Firedancer stands out for its potential to bring significant performance improvements, which can be demonstrated by achieving a real-time demo of 600,000 TPS. The goal of having different validator clients is to maintain network stability. Except for Ethereum, Solana is one of the few chains with multiple completely independent validator clients.

Meeting Modern Demands

Solana's unique technological advantages, including high throughput with parallel processing, low-cost localized fee market, and high resilience with a large number of nodes and multiple node clients, collectively create an appealing value proposition of a scalable blockchain platform for payments. These are some of the reasons why we decided to expand our stablecoin settlement pilot project to the Solana network. When piloting our stablecoin settlement functionality on Solana, we plan to test if Solana has the capability to meet the financial operational needs of modern enterprises.