Base is a leading ecological fund, what are the highlights of its first batch of investment projects?

Original | Odaily

Author | 0xAyA

Base Ecological Fund has announced the first batch of investment projects for the ecological fund today. The foundation has selected six projects out of over eight hundred applications. These projects are: Avantis, BSX, Onboard, OpenCover, Paragraph, and Truflation.

Base indicates that it will work with the relevant teams to promote the development of the Base ecosystem and bring more builders and users onto the chain. How did these projects stand out from numerous competitors? What highlights are worth paying attention to? The following is a summary of the projects compiled by Odaily.

Avantis

Website: https://www.avantisfi.com/

Description: Avantis is a prophecy-based on-chain perpetual contract product, allowing users to trade cryptocurrencies and real-world assets with leverage of up to 100x and earn profits by providing USDC liquidity as a market maker. Its goal and vision are to enable any trader to obtain leveraged trading of any asset class with low fees, self-custody, and transparent execution; and authorize anyone to become a market maker and earn profits from complex financial products such as derivatives.

It is worth noting that Avantis has not yet launched its token, but there are plans for token launch in the future. The project's token, AVNT, will allow ownership of the protocol through revenue capture and governance. This includes AVNT holders who obtain platform fees through unilateral collateral and incentive measures for traders and liquidity providers.

BSX

Website: https://www.bsx.exchange/

Description: BSX is building a decentralized spot and perpetual contract exchange, BSX Exchange, which operates through off-chain order books and on-chain settlement.

Base Foundation believes that on-chain transactions should be supported by various market structures and is pleased that BSX can combine the best CeFi trading experience with the best DeFi.

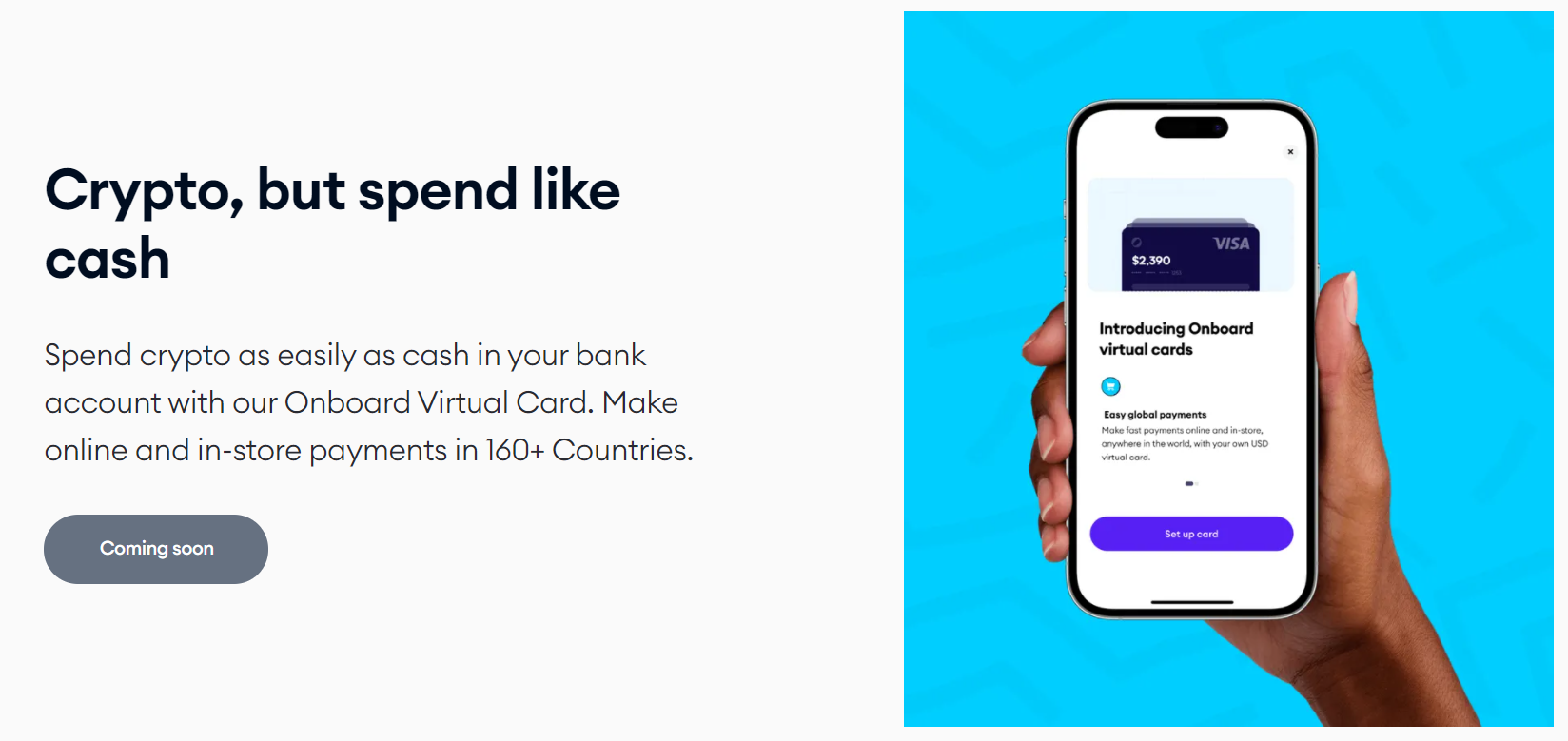

Onboard

Website: https://www.onboard.xyz/

Description: Onboard provides users with self-custodial wallet services and enables wallet-to-wallet transfers and cryptocurrency exchanges in a simple and secure manner. It also supports converting cryptocurrencies into local currencies (currently only Nigerian Naira). Its platform's user-friendly design and self-custodial infrastructure are tailored for the adoption of cryptocurrencies on a large scale in the African market.

Onboard's parent company, Nestcoin, announced a strategic investment of $1.9 million yesterday. In addition to the Base ecosystem fund, institutions such as Hashed Emergent and Adaverse Accelerator participated in this investment. A few months ago, Nestcoin announced a shift in its strategic direction, transitioning from its previous model of incubating multiple products simultaneously to focusing on the development of Onboard.

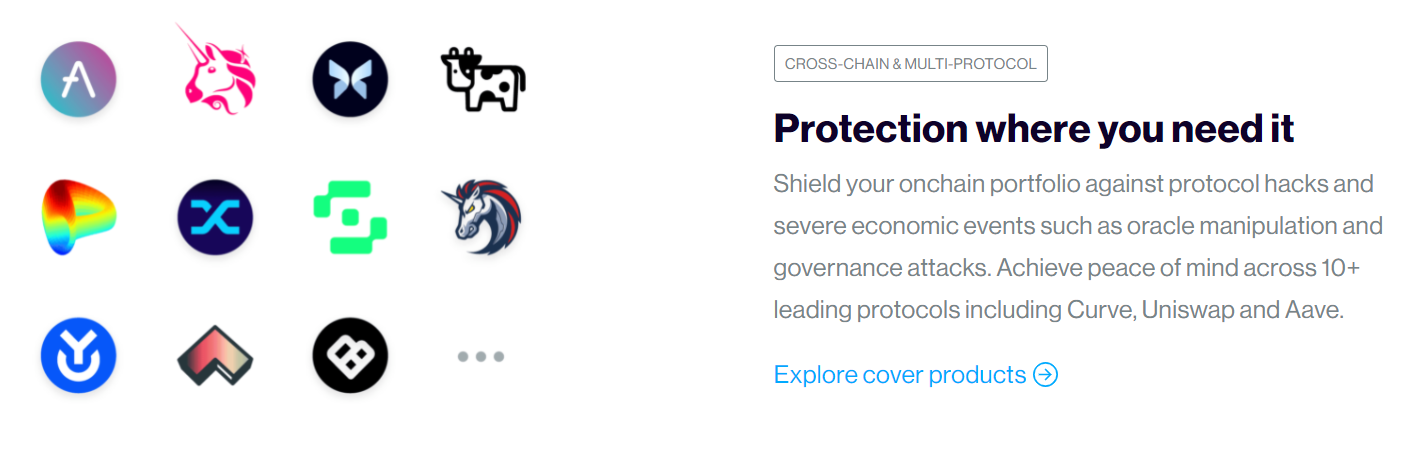

OpenCover

Website: https://opencover.com/

Description: OpenCover is the first L2 insurance aggregator that collaborates with Nexus Mutual and other underwriters. It supports insuring dozens of DeFi protocols, including Aave, Curve, and Uniswap, by selling on-chain insurance. It easily and economically protects retail investors' portfolios from major on-chain risks and provides coverage against smart contract hacks and oracle failures from reviewed on-chain underwriters.

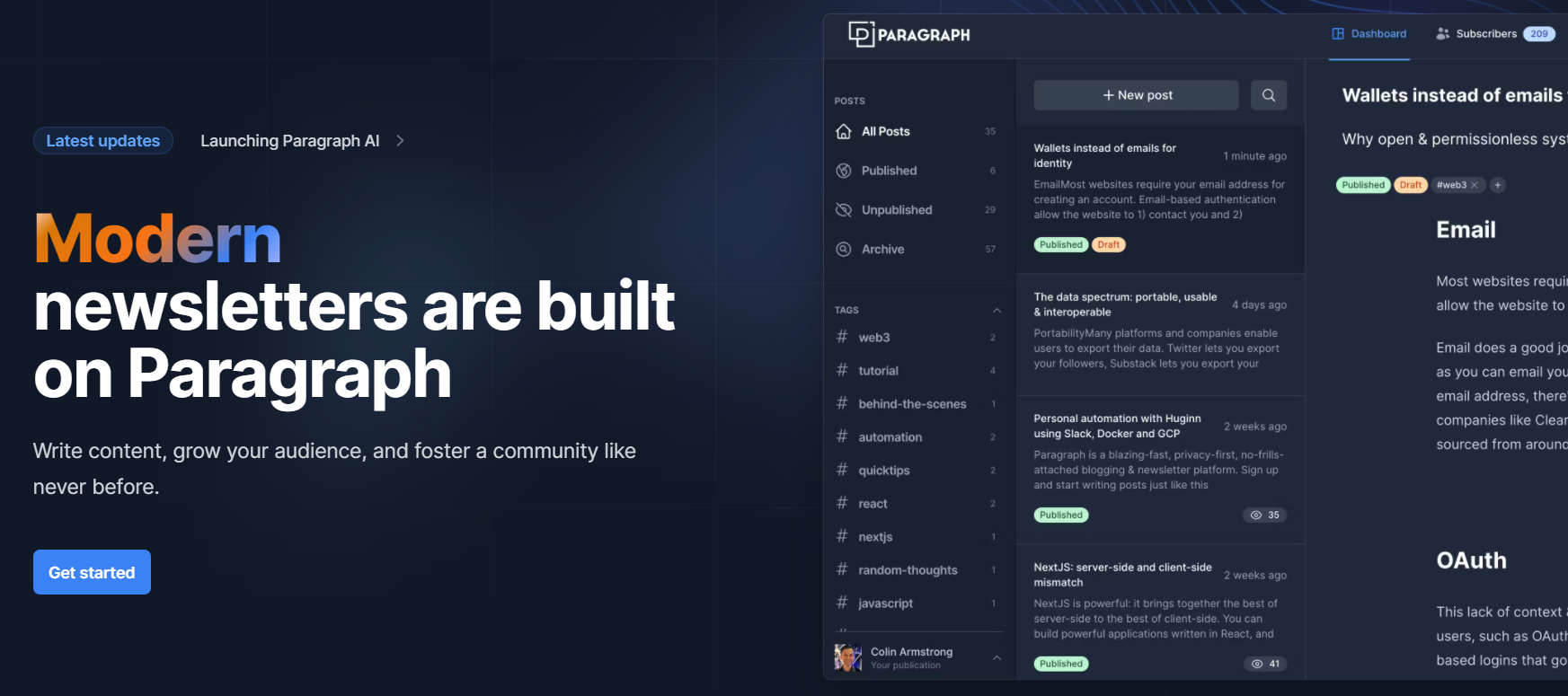

Paragraph

Official website: https://paragraph.xyz/z/ Introduction: Paragraph is an on-chain creator platform that helps creators publish, share, and build business around their content. Articles published on Paragraph are permanently stored on Arweave. Readers can subscribe to their favorite authors using their wallet addresses or email, and also forward content to Web3 social platforms like Farcaster for discussions.

Introduction: Paragraph is an on-chain creator platform that helps creators publish, share, and build business around their content. Articles published on Paragraph are permanently stored on Arweave. Readers can subscribe to their favorite authors using their wallet addresses or email, and also forward content to Web3 social platforms like Farcaster for discussions.

Paragraph provides creators with a range of services, including NFT-based membership customization and the option to store content outside of Arweave. Creators can mint different NFTs on Paragraph with 0 Gas fees and use them to control access permissions to corresponding articles.

Truflation

Official website: https://truflation.com/

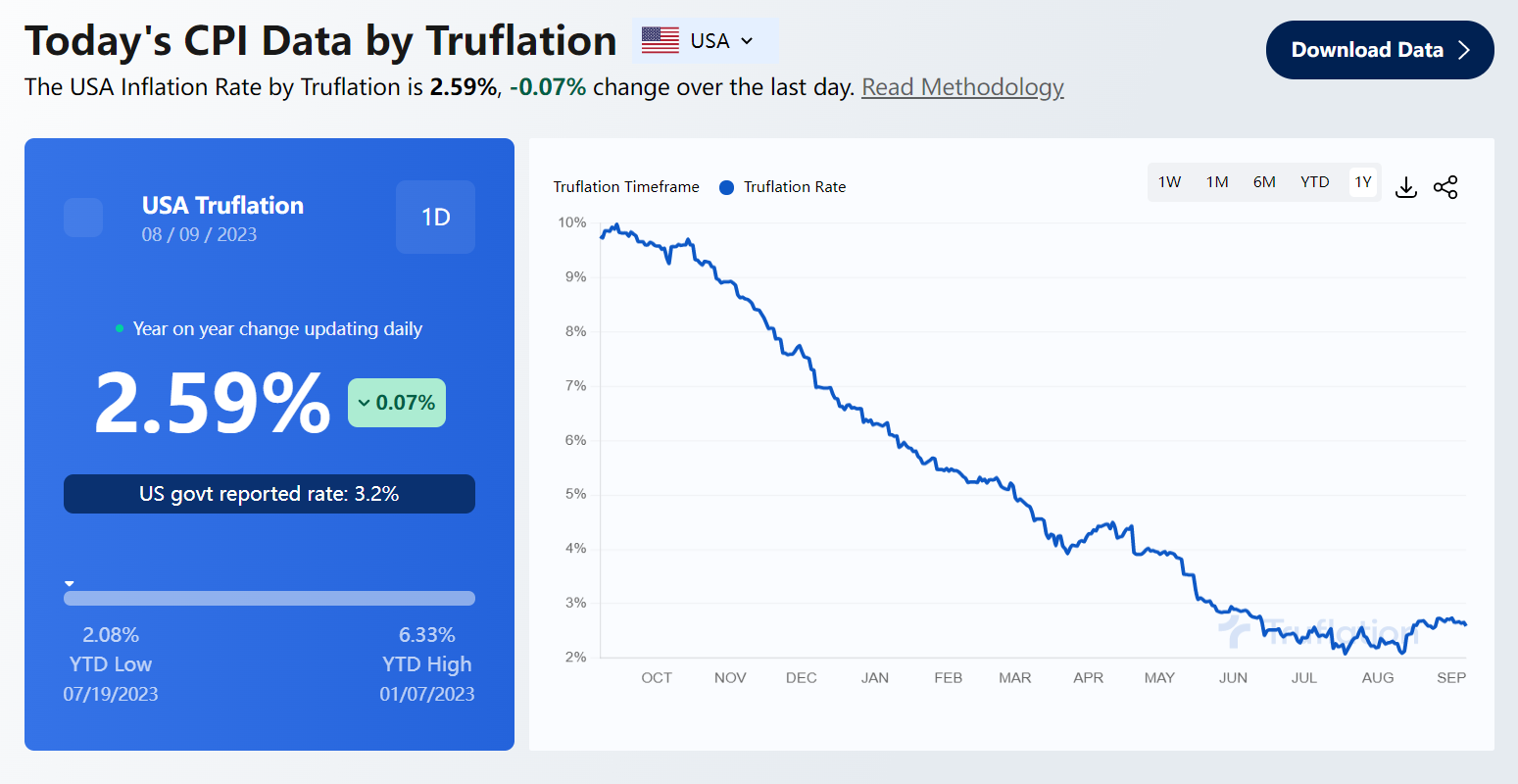

Introduction: Truflation is an on-chain financial oracle that provides automated and independent daily inflation reports, including US CPI data, housing data, labor data, and more, by compiling real-time data from over 18 million data points and more than 40 data sources. It offers more comprehensive and up-to-date information compared to monthly-updated traditional indices. Additionally, Truflation's secure blockchain infrastructure provides fair and verifiable data for business decision-making and sustainability.

Truflation has issued TFI tokens, and token holders can participate in protocol governance by staking and locking their tokens within specified time periods. The longer the tokens are locked, the higher the earned APY. Stake and lock will receive ve tokens. These ve tokens grant holders voting rights in various protocol activities, including decisions on token allocation and rewards, data category selection, market strategies, and more. Additionally, ve token holders receive a portion of protocol fees for active participation and any rewards from reward reductions.