Binance Research: In-depth interpretation of decentralized sorter

Original title: Ethereums Rollups are Centralized: A Look Into Decentralized Sequencers

Original source: Binance Research

1. Key points

❖ Transaction ordering has become the second layer ("L2") field is a growing problem. The main role of the second layer rollup is to provide a safe place for cheap transactions. L2 rollup provides users with an execution layer, and then submits their transaction data to the upper layer 1 ("L1"), that is, Arbitrum, Optimism, zkSync, etc. of Ethereum.

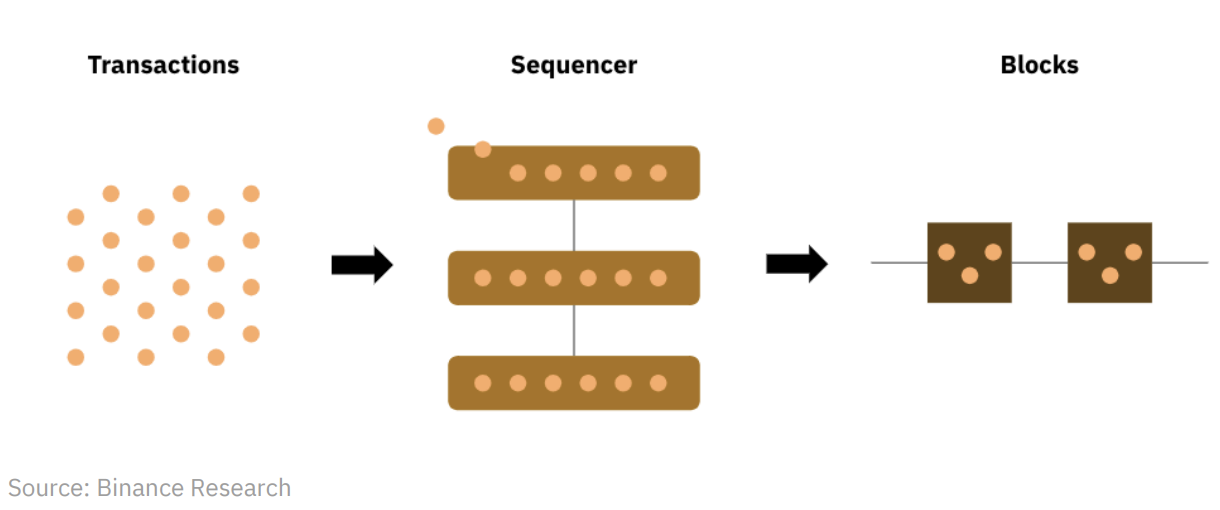

❖ A sequencer is an entity that has the authority to sequence these transactions into groups. A sorter takes unordered transactions from users, processes them into groups off-chain, and produces a compressed batch of ordered transactions. These transactions can then be put into a block and sent to the parent L1.

❖ Rollups dont actually need a sequencer; its just a design choice to give users a better experience with lower fees and faster transaction confirmation. For example, just like most rollups use the Ethereum base layer for data availability, they can also use the base layer for ordering. However, Ethereums base layer can be relatively inefficient and expensive. This means that every major L2 rollup project to date has found it more convenient, cheaper, and user-friendly to run a centralized sequencer.

❖ Since the orderer controls the ordering of transactions, it has the power to censor user transactions (although full censorship is unlikely since users can submit transactions directly to L1). The sorter can also extract the maximum extractable value ("MEV"), which could cause financial loss to the user base. Also, availability can be a big issue, i.e. if the only centralized sorter goes down, then users wont be able to use that sorter and the whole rollup will suffer.

❖ The solution to the problem is a shared, decentralized sorter. The shared orderer essentially provides a decentralized service for rollup. In addition to addressing issues of censorship, MEV extraction, and validity, the shared sequencer introduces cross-rollup functionality, opening up a variety of new possibilities. Espresso, Astria, and Radius are developing innovative shared sequencing solutions with various unique capabilities within their respective architectures. Espresso is trying to leverage EigenLayer to bootstrap its network, while Astria is closely tied to Celestia, a modular data availability network. Radius brings its unique encrypted mempool to the conversation.

2. Introduction

As the Ethereum L2 loop ecosystem continues to grow in popularity, an often overlooked aspect is the orderer. The sorter is responsible for the ordering of transactions. Using the sorter through rollup can provide better user experience, lower fees, and faster transaction confirmation. The problem, however, is that, to date, all major Ethereum L2 companies have found it most convenient, user-friendly, and less expensive to run their own sole centralized orderer. Given the power orderers have over transaction vetting, MEV extraction, and creating single points of failure (i.e. validity issues), this may be seen as an undesirable outcome and not in the spirit of cryptocurrencies.

While most cryptocurrency companies have addressed decentralization of their respective orderers as part of their roadmap, there is no real consensus on how to achieve decentralization. We should also note that both Arbitrum and Optimism have launched their solutions since the second half of 2021, and arguably have yet to make substantial progress towards a decentralized orderer.

In this report, we take a closer look at the role of collators and the current state of the Ethereum rollup space. We then took a deep dive into a project that is working on a solution, a decentralized shared ordering network. We will detail what makes these projects and their solutions unique. We also thought about what this might mean for the future of the Ethereum L2 rollup space.

3. What is a sorter?

Taking a step back, a blockchain is a distributed data ledger consisting of time-stamped transaction data sorted by blocks. Initially, this transactional data was unordered and unorganized. Once ordered, they can be organized into blocks and executed to create a new state of the blockchain. For a layer 1 like Ethereum ("L1") blockchain, this ordering of transactions happens in the Ethereum base layer itself.

The most popular scalability solution in Ethereum - Layer-2 ("L2") in the rollup layer, transaction ordering has become a growing problem. Remember, the main role of rollups is to provide users with a safe place to trade cheaply. In simple terms, L2 rollup provides users with an execution layer, and then submits their transaction data to the upper level L1, namely Ethereums Arbitrum, Optimism, zkSync, etc. A single batch of transactions submitted to L1 typically contains hundreds or thousands of compressed L2 transactions, reducing the cost of sending data to L1.

In the L2 rollup world, an orderer is an entity that has the power to order transactions into groups. A sorter takes unordered transactions from users, processes them into groups off-chain, and produces a compressed batch of ordered transactions. These transactions can then be put into a block and sent to the parent L1. Batched transactions can also be subject to data availability ("DA") layer (usually Ethereum, used for most current rollups). It also provides the user with a soft promise that upon receipt of the users transaction, the orderer will provide a near-instant receipt as"Soft confirmation"(1). and"Hard confirmation"is received after the transaction has been sent to the L1 layer.

Figure 1: Where is the sequencer applied?

Why does Rollups use a sorter, and why is it a problem?

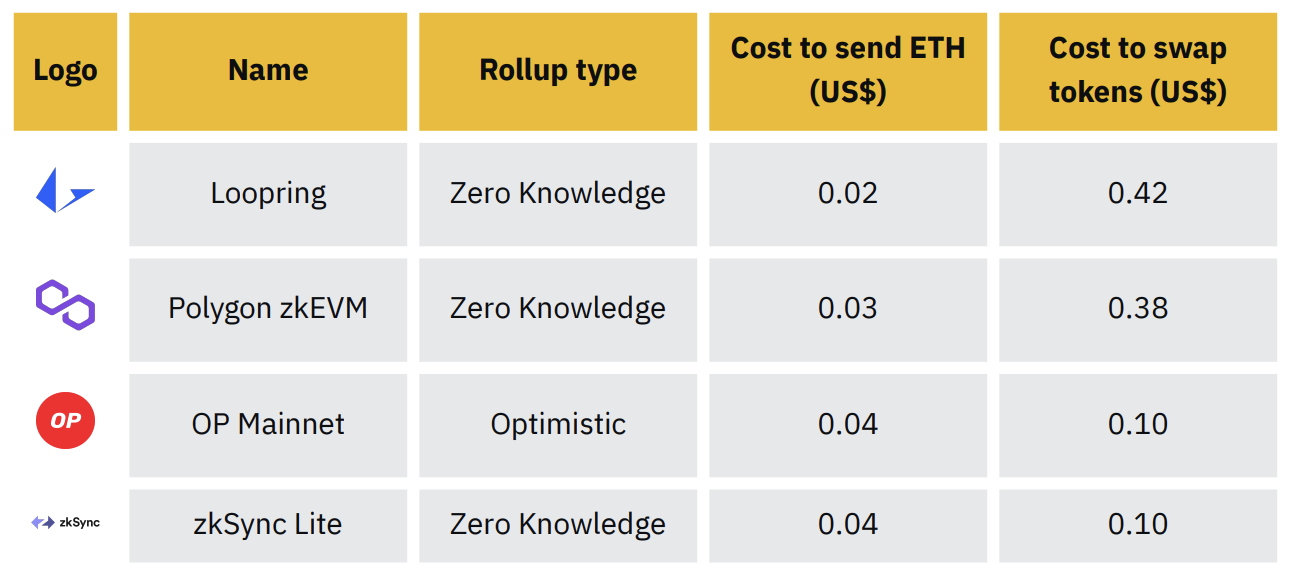

Fundamentally, Sequencers have a very clear goal: to improve the user experience. Using a sequencer for L2 transactions is similar to using"fast lane", which means lower fees and faster transaction confirmation. In fact, the sequencer can batch compress hundreds or thousands (2) of L2 transactions into a single L1 transaction, saving gas fees. In addition, the soft confirmations provided by the sequencer mean that rollup transactions can provide users with fast block confirmations. This combination helps improve the user experience using the L2 loop.

Its important to remember that rollup doesnt require a sorter; its just a design choice for a better user experience. For example, just like most rollups use Ethereum L1 for data availability, they can also use it for ordering. Justin Drake of the Ethereum Foundation recently called these"Based on rollup"(3). However, Ethereums base layer is likely to be relatively inefficient and expensive, especially given the high volume of L2 transactions. Essentially, rollups transaction throughput will be limited by Ethereums L1 data sorting rate. Users will also experience the same transaction confirmation delays as trading on Ethereum. This means that every major L2 scaling project to date has found that running a centralized sequencer is more convenient, cheaper, and easier for users to use. While L2 users can submit transactions directly to L1 to bypass the sequencer, they must pay transaction gas fees to L1, and transactions may take longer to finalize. This largely defeats the purpose of using L2 rollup to execute transactions.

Figure 2: Sequencers help aggregate multiple transactions into a single L1 transaction, making transactions on L2 several times cheaper than on Ethereum L1.

Given that the orderer controls the ordering of transactions, it theoretically has the right not to include user transactions (although users can also submit transactions directly to L1 if they are able and willing to pay the gas fee). Sorters can also extract MEV from transaction groups (more on that later), which can be economically damaging to the user base. If there is only one orderer, as is currently the case with all major rollup transactions, the risk of centralization is greater. Validity can become an issue in this case, i.e. if the only sequencer fails, the entire rollup is affected. A multi-sorter setup can reduce this risk.

With this setup, the orderer can be considered a semi-trusted party to the user. While the orderer cannot prevent users from using L2, it can delay users transactions, cause users to pay additional gas fees, and capture value from users transactions.

Relevance of MEV

MEV is especially important here. MEV refers to the value gained from block production, beyond first-order mining (or staking) block rewards and gas fees. It is the value extracted by manipulating transactions within a block, i.e. by including, excluding and changing the order of transactions. For example, common forms of MEV extraction include front-running and sandwich attacks.

Given the role sequencers play in L2 rollup, they have visibility into all user transactions outside of the chain. Furthermore, since these sequencers are often run by the projects themselves or by affiliated teams, such as OP Mainnets Optimistic Foundation (4) and Arbitrum One and Novas Arbitrum Foundation (5), many users are concerned that they will not be able to see potential MEV decimation . Even without these concerns, the lack of trust and decentralization of these protocols will have an impact on users as projects run their own centralized orderers. The trustworthiness and decentralization of these protocols will certainly be questioned.

Sorter market status

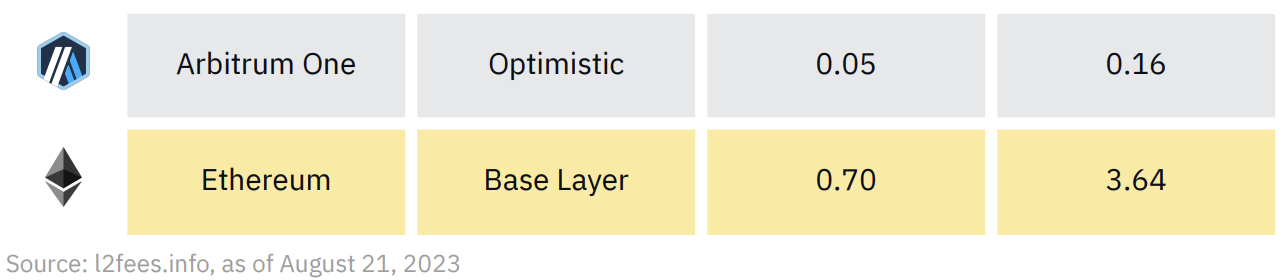

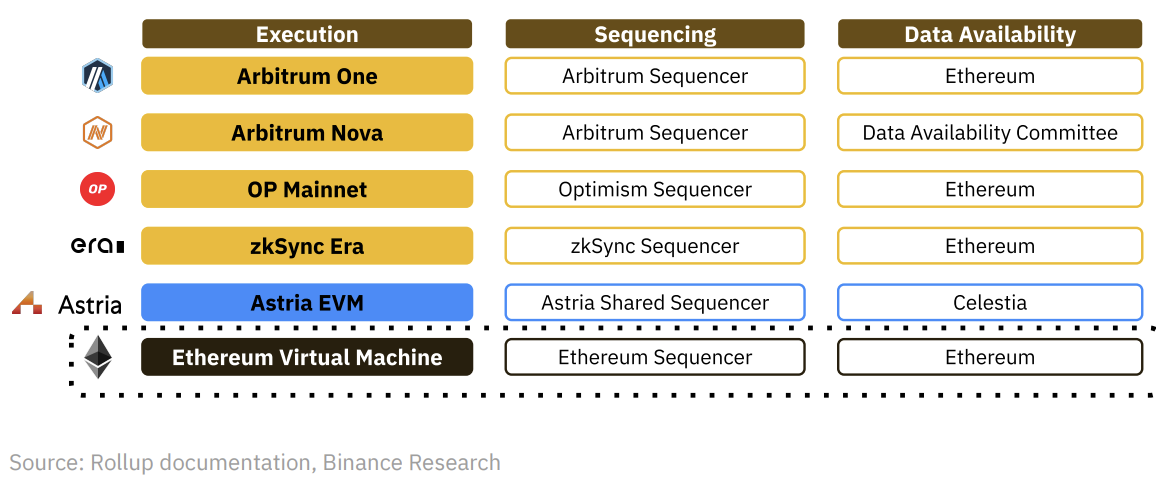

At the time of writing, all major Ethereum L2 versions rely on centralized orderers. As more and more Ethereum transactions are moved to L2 solutions, it seems that a large number of transactions (i.e. those on L2) will be uniquely ordered, even though Ethereums validator set is itself decentralized. The impact of centralized power in the form of a device.

Figure 3: All top Ethereum L2 rollups use a proprietary centralized orderer

Unsurprisingly, most of these companies have already addressed decentralization of their respective orderers as part of their roadmaps. While this is a positive sign that decentralization is part of the L2 vision, we should note that Arbitrum and Optimism have launched their own solutions since late 2021 and are arguably better at decentralizing the orderer Substantial progress has not been made.

Figure 4: All top rollups handle sorter decentralization in their files

Most top companies appear to be directing resources toward improving their core products and features rather than focusing on decentralization. This is not entirely a criticism, as in a highly competitive environment it is somewhat understandable that focusing on decentralization before having a competitive product is not in the best interest of any company of. However, as web companies mature, this perspective is changing, and the discussion is quickly turning to sequencer decentralization and increased trustworthiness.

other problems

It’s worth highlighting that there is some discussion about the level of risk associated with relying on a centralized orderer.

As mentioned above, since sequencers control the ordering of transactions, they can exclude user transactions and also extract MEV. However, the sequencer ultimately cannot completely exclude users from rollup transactions. Users can bypass the sequencer and submit transactions directly to L1 (as long as they are happy and willing to pay the increased gas cost). While a misbehaving sequencer may cause transaction delays and users to incur additional fees, it ultimately cannot be fully audited. Prior to this, no large L2 company had been extremely focused on decentralizing its sequencers, which is likely one reason why. Still, the sequencer reordering transactions to extract MEV is still an issue, especially with private mempools like OP Mainnet(6).

Perhaps, the bigger problem is real-time. Given that the main rollup programs are all running a single centralized sequencer, if there is a problem with these sequencers, the entire rollup program will be adversely affected. While users can still complete transactions by accessing L1 directly, this is not a particularly durable method and is unlikely to work for most transactions. Remember, the whole point of using L2 rollup is to save transaction costs. Given that one of the fundamental ideas behind cryptocurrencies is to prevent dependence on a single centralized provider (as in traditional finance), sequencer centralization is clearly an important problem to solve, and one where shared sequencers will provide the necessary support for the L2 rollup market. Brings one of the key unlocks.

4. Solution: Decentralized Shared Sequencer

overview

A new solution to the above problems is a decentralized shared sequencer. While the solutions vary from project to project, the basic idea of replacing a single centralized sequencer is the same. here"shared"Refers to the fact that multiple different rollups can use the same network, that is, transactions from multiple rollups will be aggregated in a memory pool before sorting (helping to reduce the possibility of MEV extraction and censorship). here"decentralized"Refers to the concept of leader rotation, whereby it is not always a single actor that orders all transactions, but a leader is selected from a decentralized set of actors. This helps prevent censorship and provides assurance of validity.

This is very similar to how various L1s operate using a leader rotation mechanism. In fact, building a decentralized ranking layer is similar to building a decentralized L1, which requires building a validator set. As we will see later in this section, different projects have taken different approaches to meeting this requirement.

The shared sorter is designed to alleviate MEV extraction issues, provide censorship resistance, and improve rollup validity guarantees, i.e. solving the problems faced by centralized sorters (as mentioned above). In addition, there are two points worth noting:

Decentralization as a Service: The shared sequencer solution is designed to provide sequencer decentralization for any number of rollups. All of these rollups will then benefit from the censorship resistance and real-time capabilities that a decentralized network can provide without having to build the network themselves. Given that this can be a very expensive and time-consuming process, this is a major selling point for shared sequencer networks. Keep in mind that no company is decentralizing their sorters yet, and most of them have enough money (7)(8)(9) to do so, which means this is not a Completely trivial question. If companies like Astria or Espresso can provide sorter decentralization out of the box, then rollup companies can continue to focus on differentiation and optimizing performance to better serve different users.

Cross-rollup composability: Since these shared orderer solutions are designed to handle transaction ordering for multiple rollups, they are able to provide unique interoperability guarantees not currently available. For example, users should be able to specify that a transaction on Rollup 1 should be included in a block if and only if a different transaction on Rollup 2 is also included in the same block. By enabling such conditional transaction inclusion, shared orderers can unlock new possibilities, including atomic cross-rollup arbitrage.

Many projects are working on shared sorting solutions. We’ll highlight a few and their strategies below.

Espresso

Espresso Systems is a company dedicated to building tools to bring Web3 into the mainstream, with a particular focus on L2 rollup and the Ethereum ecosystem. Prior to developing the shared sequencer, they had been working on improving blockchain privacy, developing the CAPE (10) application. They have also contributed to open source developer tools through other initiatives such as the Jellyfish (11) cryptography library and Hyperplonk (12).

In November 2022, Espresso began sharing their work on the Espresso Sequencer.

overview

The Espresso Orderer is a decentralized shared ordering network designed to decentralize rollups while providing secure, high-throughput, low-latency transaction order and data availability.

It is designed to handle decentralized ordering and data availability of rollups, acting as a middleware network between rollups and the underlying L1.

Espresso Sequencers design and virtual machine ("VM") independent, that is, it can be used with non-Ethereum virtual machines and also with zero-knowledge ("zk") virtual machine and optimistic virtual machine.

How does it work?

At the core of the sequencer is the consensus protocol HotShot. HotShot is based on the HotStuff (13) consensus protocol and combines the latest developments in multiple different fields (14) (pacemakers, verifiable information release ("VID")wait).

HotShot is open and permissionless and will participate in the decentralization of the sequencer network, providing high throughput and fast final results while also guaranteeing security and effectiveness. HotShot uses Proof of Ingestion ("PoS") security model, one of the key requirements for it by the Espresso team was to achieve strong performance without compromising the size of the validator set. Specifically, HotShot should at least be able to scale to include participation from all Ethereum validators (currently over 700,000 (15)).

Espresso Systems attempts to achieve Ethereum-level security for its orderers by using Ethereum’s existing set of validators. There are two key reasons for this setup:

Security: Launching a decentralized PoS consensus protocol is extremely costly and requires a lot of energy. Even so, obtaining a sufficient number of network participants can be a huge challenge. By using the same validators as Ethereum, sequencers can achieve levels of security, validity, and decentralization that would be difficult to achieve on their own. Espresso orderers can benefit from sharing cryptoeconomic security with what is recognized as the second largest decentralized cryptocurrency after Bitcoin.

Alignment of incentives: Conceptually, it makes sense to have Ethereum L1 validators participating in running the same protocol that Ethereum L2 rollups run on. In practice, in a centralized sorter setup, almost all fees and MEV generated by rollups are likely to be captured by the sorter. If none (or very little) of these values are shared with L1 validators, then there is reason to be concerned about whether this affects rollup security. For example, L1 validators could be bribed to fork a rollup, making more profit than honestly managing the rollup contract. Decentralizing the orderer and working with L1 validators to secure it is a great way to reduce such concerns.

Espresso will seek to establish this partnership through a reset contract, specifically with EigenLayer. With EigenLayer repricing, users can stake their Ethereum and Ethereum Liquidity Staking Tokens across multiple protocols ("LST"), thereby extending economic security beyond Ethereum itself. They earn fees in return for doing so, but they also agree to additional cuts. Re-staking is an effective way of subsidizing access to the system, as stakers do not need to deploy additional capital, but simply use their previously staked ETH. This reduces the capital cost of securing other protocols and means that Espresso Sequencer can gain access to Ethereums staked capital base and decentralized validator set without needing to launch its own validator set.

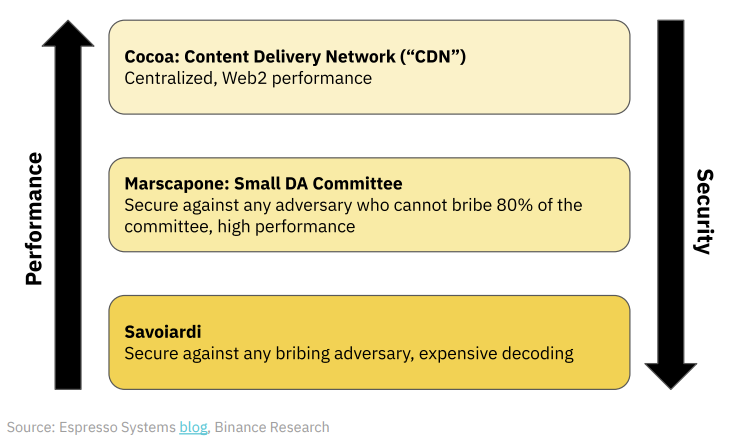

Tiramisu Data Availability (16)

As highlighted earlier, most rollups rely on L1 blockchains (such as Ethereum) to provide data. However, this is not ideal because block space on L1 blockchains such as Ethereum is scarce and very expensive, thus incurring high transaction fees for users - an undesirable outcome. Espresso Systems solves this problem with its efficient Tiramisu data availability solution.

Just like the classic Italian dessert, the tiramisu solution has three novel layers. Together, they ensure that data is available to all parties that need it—in our case, the individual rollups ordering transactions from the sequencer.

The base layer of tiramisu is called Savoiardi. This is an anti-bribery layer (similar to Ethereums darksharding proposal) that provides the highest level of security. However, due to this feature, it is the least user-friendly of the three layers. To solve this problem, Espresso added two layers to its solution.

Mascarpone is the middle layer that ensures efficient data recovery by electing a small data management committee.

Cocoa is aptly named the system-wide"Top floor sprinkler". Cocoa helps Tiramisu provide"Web2 level performance". This facilitates efficient data recovery and significantly speeds up data dissemination. Given that this layer is centralized in nature (17), it is completely optional and Tiramisu works perfectly without it. It helps speed up data availability and can be easily changed or deleted.

We should note that Espresso Systems designed their protocol with flexibility and modularity in mind, and rollup devices using their sequencer can use any other data availability solution if they dont want to use Tiramisu.

Figure 5: Three levels of Tiramisu data availability solution

Famous Partners(18)

The Espresso Systems team has been announcing partnerships since July. EigenLayer is the first to announce such a partnership, and given its importance in the Espresso Sequencer architecture, its worth keeping an eye on its development. EigenLayer itself launched the first phase of its mainnet on June 14.

Along with announcing the Doppio testnet, Espresso also announced a partnership with the Polygon zkEVM. This collaboration represents the first end-to-end integration of the Espresso sequencer with full-featured zk-rollup, a fork of Polygon’s zkEVM. The testnet allows users to submit transactions to the fork, which are then routed and ordered by nodes running Espressos HotShot protocol.

Espresso supports Injective with the IBC(19) Cosmos SDK chain enabled to integrate its sequencer into Cascade. Cascade is the IBC ecosystem’s first interchain Solana SVM rollup, allowing for the first time the deployment of Solana contracts on Injective and the broader IBC ecosystem. The testnet integration with Cascade is expected to be completed by the end of 2023, and the mainnet is expected to be completed in 2024.

AltLayer has also joined the Espresso Systems ecosystem. AltLayer is a rollup-as-a-service platform that allows developers to spin up highly scalable rollups that support multiple virtual machines. Through this partnership, developers will be able to decide whether to use AltLayers solution and/or Espresso Sequencer for their launchers. The teams will also work together to develop other integrated products to see how their designs complement each other.

Espresso Systems is working with Caldera to deploy an optimistic rollup based on OP Stack that uses Espresso Sequencer and Tiramisu. Caldera enables developers to deploy custom rollups for their applications. After this extension is deployed, future L2s built on top of Caldera will be able to easily choose to use Espresso Sequencer and Tiramisu as plug-in components for their extensions.

the third floor("L3") as a service company Spire announced that it will integrate with Espresso Sequencer and Tiramisu. Spires infrastructure allows developers to easily deploy their own L3 application chains on top of zkEVM L2. Spire will work with the Espresso team to integrate their solution into the Spire L3 framework. The test network is expected to be completed in 2024.

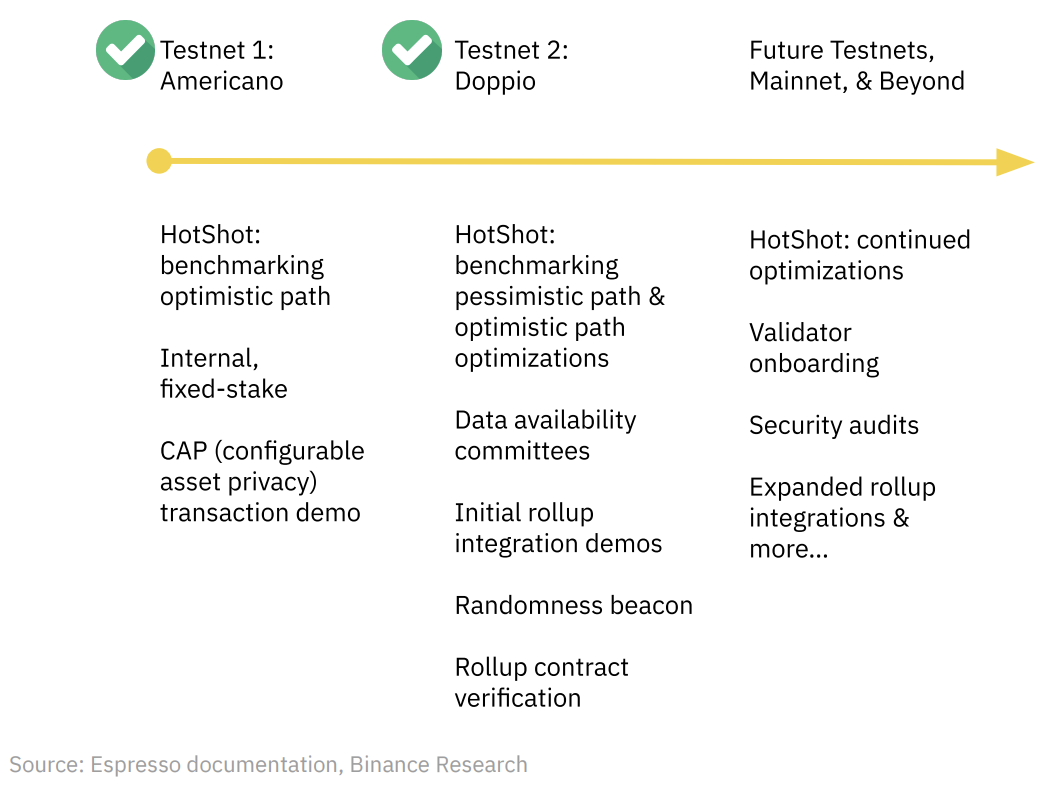

the latest update

November 28, 2022: Americano is the first test network for Espresso Sequencer and HotShot. The initial post contains more technical details; however, it is important to note that this is an internal test network and is not intended for the public.

Figure 6: Project roadmap released with Americano testnet and initial announcement

July 20, 2023: Doppio is the second major milestone and testnet for HotShot and Espresso Sequencer. At the same time, Espresso Systems released a white paper for the entire project. Doppio brings many efficiency improvements to HotShot, including decentralization of verifiable information ("VID"), a new view synchronization subprotocol and signature aggregation of quorum certificates (20). Doppio also implemented the first two layers of Tiramisu, with future testnets expected to include the third and final layers. Espresso Systems also announced the first end-to-end integration of its sequencer with full-featured zk-rollup, specifically a fork of Polygons zkEVM.

August 4, 2023: The Doppio testnet is officially open to the public. Documentation on how users can submit transactions to zkEVM forks has also been released. Performance benchmarks (21) were also released, along with expected next steps. Specifically, they announced that they are starting to include a number of rollup and rollup-as-a-service companies into their sequencers. They also announced that they will contribute to the OP Stack through Optimism leader election proof-of-concept work (following the recently accepted RFP (22)).

Astria

Astria is building a network of shared sorters and is one of the first major companies to phase out centralized sorters. At the same time, they are also developing the Astria EVM, which will be the first rollup powered by their shared sequencer network. The project will have fast, censorship-resistant transaction ordering from its network and will utilize Celestia for data availability. Celestia is a modular blockchain network and DA layer, which Astria is very familiar with. Founder Josh Bowen previously worked at Celestia, and Astrias introductory blog mentions the project and its ecosystem several times.

overview

Astrias shared sequencer network allows multiple different rollups to share a single, permissionless, decentralized sequencer network. With this network, Astria provides an out-of-the-box solution for making rollups censorship resistant, fast block confirmation, and atomic cross-rollup composition.

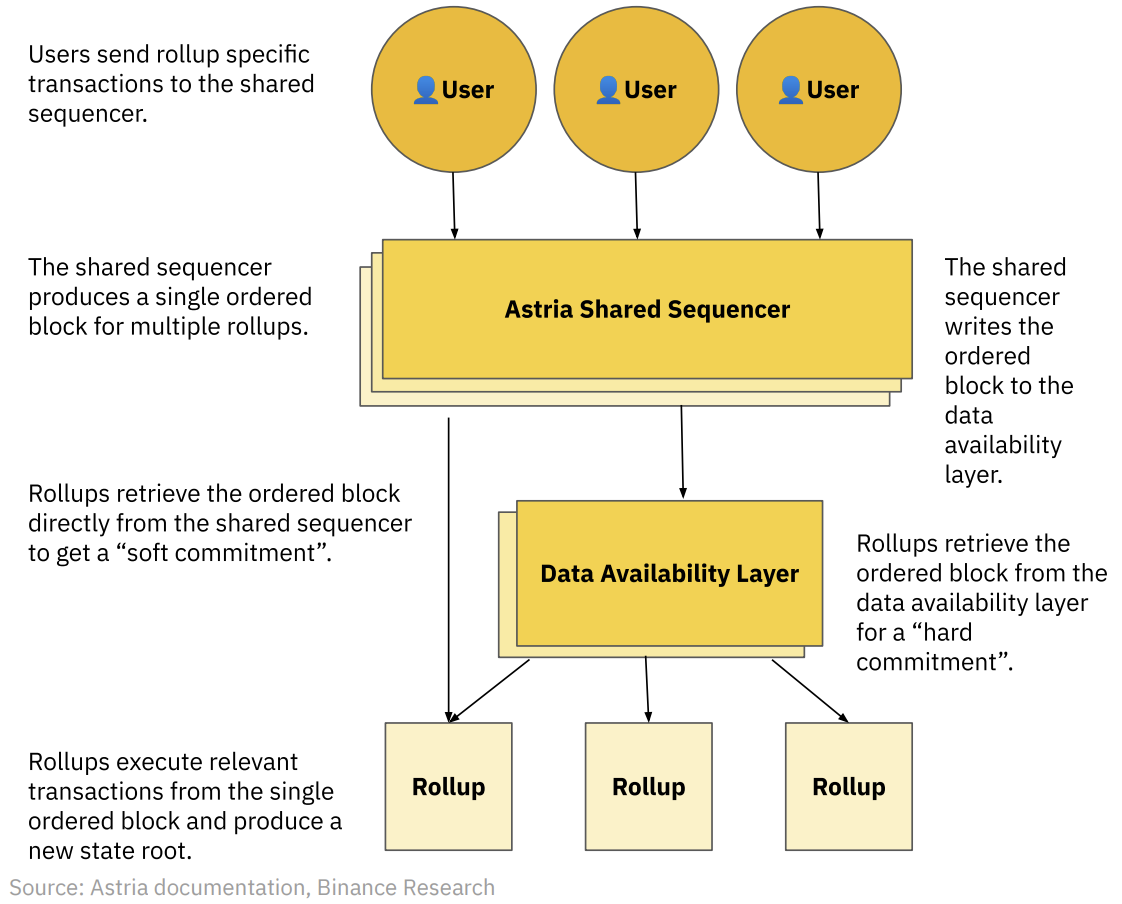

How does it work?

Astrias shared orderer network is itself a middleware blockchain that leverages CometBFT (23) (a fork of Tendermint Core) to reach consensus on an ordered set of transactions. The network is designed to accept transactions from multiple rollups and then order them into a block and write it to the DA layer.

Rollup can obtain sorted blocks from Astria immediately after creating the block, by"soft commitment"Provide users with fast block confirmations. Alternatively, rollup can retrieve ordered blocks from the DA layer to obtain"hard promise", because once written to the DA layer, a trade order is considered final. This provides the strictest finality for the user and can be very useful in situations such as high value transactions.

Figure 7: Astria’s shared sequencer network

Astria EVM

As mentioned above, the Astria EVM will be the first cryptocurrency powered by the Astria shared orderer network.

Currently, most rollup projects perform transactions and ordering themselves, and use Ethereum as a digital-to-analog conversion layer. The Astria EVM will focus on execution while using Astiras shared sorter for sorting and Celestia for DA.

Figure 8: Focusing on the three key layers of the L2 process, we can see how rollups tend to leverage their own proprietary sorters and Ethereums DA capabilities (we also show Ethereum L1 itself for comparison)

Astrias EVM aims to help launch Celestias rollup ecosystem by acting as a liquidity and bridge hub. It also meant that the Astria team had a live test case of how rollup would best integrate with their network of shared sequencers.

vision

Astrias future vision includes thousands of decentralized sovereign rollups. In their vision, each rollup is tailored to a unique use case and application.

Their network of shared sequencers played a key role in their vision, helping to simplify the rollup development process. Their solution means rollup developers can focus on innovative use cases while being able to easily integrate with decentralized networks, giving them fast, censorship-resistant transaction ordering and synthesibility across rollups.

Astria Development Cluster

On August 16th, Astria released its development cluster (24), which contains all the different components needed to start a rollup on Astrias shared sequencer network. The goal of this cluster is to make developing and testing the Astria network and integrating with Astria as easy as possible.

Components include:

Astria collator: block generation node for transaction ordering. The development cluster relies on a single node. In the mainnet, a decentralized set of nodes will be used.

Data Availability Layer: Local Celestia network, providing hard termination.

Rollup: Geth (25) rollup nodes for executing tasks and storing state.

Composer: Retrieve pending transactions from rollups mempool and submit them to Astrias CometBFT mempool.

Conductor: After receiving individual chunks, filter them for each rollup. These filtered chunks are then passed to rollup for execution.

Repeater: Sends sequentially ordered chunks of data to wire and data availability layer Celestia.

Recently, Astria announced that it will deploy rollup technology on its development cluster, and we will pay attention to which companies decide to deploy rollup technology.

Figure 9: The different components of the Astria Development Cluster

the latest update

In April 2023, Astria announced a $5.5 million seed round of investment (26).

As mentioned above, in August 2023, the team announced their development cluster.

The Astria team is also developing a Devnet to kick off related work. Completion is expected in the next few weeks.

Their code is open source and further documentation is also available on their official GitHub page.

Radius

Radius is building a trustless shared ordering layer that uses cryptography to decentralize the orderer, prevent censorship, and minimize harmful MEVs. Their solution is blockchain agnostic and can be used for various types of rollups.

How does it work?

Radius uses an encrypted memory pool to achieve its goals. Essentially, the content of every user transaction is encrypted upon submission. When the sorter sorts a group of transactions, the contents of each transaction cannot be seen, preventing the sorter from extracting the MEV or conducting review.

Figure 10: Radius transaction process

This ultimately means that Radius solution can solve both MEV and censorship issues with only one sequencer. Since transaction content is encrypted, even a single orderer cannot act maliciously. This means that there is no need to introduce a consensus mechanism, which can be advantageous from a speed and scalability perspective. This is how the Radius solution differs from the Astria and Espresso solutions, which both rely on a consensus mechanism to order transactions.

While an encrypted mempool on a single sorter solves two key problems of centralized sorters: MEV and censorship, it still presents a single point of failure. In order to ensure real-time performance, Radius uses a decentralized sorter network, and multiple sorters run simultaneously. Choose one of these sorters to run as the sorting layer. There are various proposals (27) on how to choose a single sorter, including secret election mechanism, sorter group sharding, etc.

Practical Verifiable Delayed Encryption ("PVDE)

Radius uses the zk-based encryption scheme PVDE (28) to create encrypted memory pools.

User transactions are temporarily encrypted based on a time-locked puzzle. Then, the sorter sorts the encrypted transactions. The sequencer needs to unlock the timelock puzzle to get the decryption key. This takes time and computational resources, and prevents the orderer from decrypting the transaction prematurely (i.e. before the transaction is sorted).

To prevent attacks, users generate ZK proofs to attest to the validity of their transactions and decryption keys. The sorter can verify these proofs before sorting, thus effectively preventing meaningless decryption (that is, attacks) and resource waste.

MEV market

Radius also proposes an optimized block space design. They attempted to create an auction-based marketplace (29) for traders to submit bundles of cross-rollup MEV transactions. The transaction of the highest bidder will be included in a block by the orderer, thereby helping to maximize the rollup profit of cross-region arbitrage, while creating a more efficient rollup market.

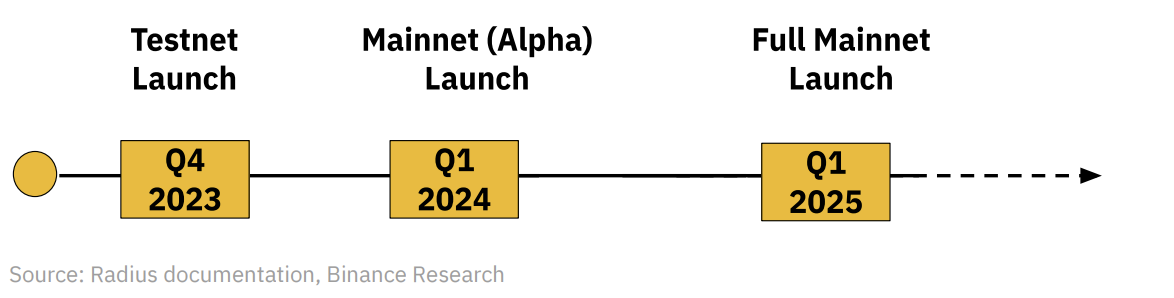

the latest update

In June 2023, Radius announced the completion of a $1.7 million seed round of financing.

route map:

other

While weve covered some of the larger and most well-known projects in the shared ranking space, there are others that are developing similar or closely related solutions.

NodeKit: The NodeKit team is building NodeKit SEQ, a decentralized shared sequencer built into custom L1 blockchains.

They are also building NodeKit Chain, an EVM based rollup.

Their Twitter page also reveals that their solution will be available on the Avalanche subnet (30).

AltLayer: AltLayer is a"rollup as a service"Platform that allows developers to launch highly scalable L2 rollups with support for multiple virtual machines.

Although"rollup as a service"Corporations are a separate field that falls outside the scope of our report, but AltLayers decentralized ranker network (31) is worth mentioning.

AltLayers network of shared orderers is called the Beacon Layer, which is a permissionless middleware blockchain. Nodes in the blockchain are called validators (similar to any PoS network).

When users wish to create a rollup using Altlayers platform, they can specify the number of orderers required to run the rollup, the minimum amount of collateral required for each orderer, and the set of tokens that the collateral can be denominated in. AltLayer recommends at least five different sorters per rollup item.

Once validators join the beacon layer and provide minimal collateral, they can act as orderers in different rollups. The beacon layer will select validators to be the orderers of each rollup project based on the validators pledge and some randomness. Similar to any PoS blockchain, validators are at risk of having their stake slashed if misconduct occurs.

This process means developers can use AltLayers infrastructure to deploy an encrypted rollup relatively quickly, then use the beacon layer to ensure its decentralized. If you buy into the idea of a rollup-centric future, services like AltLayer are definitely worth keeping a close eye on.

5. Outlook

Existing L2 rollups seem to have to make a choice. On the one hand, they can maintain the status quo and continue to use the only centralized orderer. On the other hand, they can start integrating with third-party shared ordering networks, or develop their own in-house solutions.

1. Continue to use the only centralized sorter as usual:

a. This is the simplest course of action and probably the most financially prudent. Monetization of sequencers is an important revenue source for all major extensions (32) and is undoubtedly an important part of the business model. In fact, newly formed L2 promotion company Base recently confirmed its intention to monetize sequencers during Coinbase’s Q2 earnings call (33).

b. Maintaining a centralized orderer creates issues such as censorship, MEV extraction, and single point of failure risks, among other things, and goes against the fundamental spirit of cryptocurrency. Imagine a scenario in which a key member of a major crypto organization mysteriously disappears or gets into serious trouble. If they are running a centralized orderer, this will likely impact their crypto rollups, day-to-day operations, and user experience. If this happens, it is likely that many other players in the industry will start working seriously on decentralized sequencers, following their roadmaps. This is a simple example of why sequencer decentralization may be more important than it initially seems.

2. Integration with third-party shared ranking network:

a. With the continuous development of shared sorting networks such as Espresso and Astria and the launch of the main network, this will become a major option for existing networks. In fact, given Espressos integration with the Polygon zkEVM fork, some major networking companies appear to be actively exploring this option.

b. Compared to the risks of centrally managing a sequencer or the effort and cost required to develop an in-house solution, outsourcing the sequencing work to experts is a sensible option for many companies.

c. One of the most important factors to consider here is sample library interoperability. with those in their own proprietary"the silo"This is probably one of the most obvious advantages of L2 running on a shared sequencer compared to L2 running on a shared sequencer. As highlighted earlier in this report, running on a shared sequencer and the interoperability it brings can unlock a variety of new possibilities, including cross-rollup arbitrage, conditional transaction inclusion, and more.

3. Develop in-house proprietary solutions:

a. Since this is probably the most time-consuming and expensive of the three options, it will be interesting to see which companies decide to go this route.

b. One of the key issues we have seen with large cryptocurrencies so far is the accumulation of token value. Most of the top Ethereum L2 companies already use ETH as the token for gas fees, which prevents their own native tokens from accumulating value. One possible solution is for rollup companies to develop in-house ordering solutions that are staked by token holders; for example, users could stake their native rollup tokens to become orderers and charge fees for their services.

c. The disadvantage of this approach is that it affects interoperability. Rollup systems running on a shared sequencer have better interoperability than systems running their own proprietary sequencing solutions.

d. Optimism announced its"chain rule"(Law of Chains), this is a recent development worth considering. The Chain Law is a set of guiding principles for chains in the OP Stack super chain ecosystem. The essence is to establish a framework for these chains to work in a more unified way. This will most likely extend to a shared ordering solution for OP Stack based chains, which could be a solution to the interoperability issues discussed above (at least for OP Stack chains).

As secondary cryptocurrencies continue to emerge in the cryptocurrency world, growing in size and transaction volume, issues surrounding centralization and interoperability will continue to arise. This topic has been in the spotlight over the past year, and we expect it to continue to grow as the one- and two-year anniversaries of major cryptocurrency issuers approach, and more are launched. Continue to expand.

We believe that at least some companies will choose to integrate with third-party sequencer networks like Espresso and Astria, but we also see others choosing to develop their own in-house solutions. Some larger companies, especially those that have launched native tokens, may well see value in developing their own solutions to both maximize profits and increase the utility of their tokens. Whatever happens, this is a very important aspect for us to focus on and we will be watching closely with interest.

6. Conclusion

Users want and prefer faster transaction confirmations and cheaper fees. While centralized orderers have been the solution for major L2 companies so far, companies and users should ideally have the option to use the best decentralized version of this technology. This is where companies like Espresso Systems, Astria, Radius and others play a key role in the L2 story.

The two key drivers here are decentralization and rollup interoperability. Decentralization is crucial for many reasons. Decentralization is the philosophical foundation of cryptocurrency, and this is just one of them. On a more practical level, a centralized sequencer represents a single point of failure that affects the effectiveness of cryptographic rollups and poses a threat to the resilience of cryptographic rollups. This is in addition to the possibility of extracting a large number of MEVs, some of which may be hidden from the user and extracted in a private mempool. The possibility of scrutiny (even temporarily) and delays to transactions is also an issue that must be kept in mind, especially when considering the industrys strong growth aspirations. Crypto rollup interoperability is also critical, especially when one takes a crypto rollup-centric view of the future of the crypto industry. If there are more and more crypto rollups on the market, whether for specific applications or other applications, then these crypto rollups should be able to communicate with each other and work seamlessly together. Otherwise, how do we achieve a Web2 type of user experience?

There will certainly be challenges ahead, and some large companies may be tempted to create their own proprietary solutions rather than use a shared sequencing network. One way to solve this problem is to use a shared sorting network to solve the problem of value accumulation and income distribution through economic mechanisms, because if many companies share a sorter, a strong network effect will eventually be achieved.

This topic will continue to become more intense in the coming months, and we believe that there will be many new players joining the market, both in the rollup space and in the shared sequencer space. It will be very interesting to observe the selection of different items. We look forward to keeping a close eye on this development.