a16z partner: 4 basic theories that will affect the economic development of creators in the future

Original author: Andrew Chen, general partner of a16z, fund manager of Games Fund One

Original compilation: Luffy, Foresight News

Over the past few years, as social media platforms have taken off and content creators have become the focus of consumer engagement, there has been a wave of creator economy startups. These startups promise creators that they can help them better monetize their audiences on social media as long as they promote their products. So we often see: Creators promote a startup’s new product through links in the profile, videos, etc., and then attract their fans to a landing page that allows the creator to use some new interactions or features. Initially, these products almost all started as a tip model, but over the years, many creative products have been born, from e-commerce to newsletters to QA and more. These products all promise a win-win for creators, so when their fans spend money, the company only takes a percentage of the revenue (usually around 10%), while the creators keep the rest.

Some creator economy companies have been wildly successful, paying billions of dollars in revenue to creators, while others have struggled. Successful startups have strong moats that make it difficult for new entrants to break through. A few years on, what new insights have we gained about the dynamics of the industry? Why do some creator economy startups succeed while others fail?

Here are some of my theoretical summaries:

Creator Power Law: A few creators own the vast majority of the audience, leading to potential vulnerability and dependency for creator economy startups

The battle of bio links (links included in profiles on social platforms): Creator economy companies capture audiences from larger social media platforms, which often only have one place (the bio link) to promote a company. This is a winner-takes-all zero-sum game.

Graduation question: Startups often charge a percentage of the fee, and if the creator acquires their own clients, they will put pressure on you to lower your costs. The biggest creators often graduate from one platform and then build their own.

Algorithmic Feast: Creator traffic is driven by social feedback algorithms, which causes traffic to spike and then disappear—the opposite of the steady, sustained growth startups seek.

These are all concepts I’ve learned from communicating with dozens of creator economy companies over the past few years. As the next generation of creator economy startups emerges, they must figure out how to navigate these dynamics. Let’s go ahead and take a closer look.

creator power law

Do you want to start a creator economy company? The biggest motivator you have to grasp is the power law of audience and revenue for the creator class itself.

The chart below shows the percentage of revenue earned by the top-ranked creators on a platform like Patron, while the revenue of creators ranked second, third, and fourth all the way down (source:Power Laws in Culture)。

Imagine if you plotted all the millions of creators on this axis, you would see that it would eventually flatten out, closer to 0%. There are many reasons for this phenomenon. The first is that these creator platforms build themselves on social media, and social media itself records a power-law distribution of fans and content participants. In turn, as algorithms discover that social media platforms have a power-law curve, a handful of social butterflies know more people than even the power-law curve has to offer.

Therefore, any creator economy product built on a social platform will inherit these power law curves. OnlyFans creators offer free content on many social platforms and then drive traffic to their landing pages. Below is a chart of creator earnings showing a similar curvilinear distribution. While some creators earn as much as $100,000 per month, the median is only $180 per month.

While power laws appear naturally in social media platforms, they also appear in other creative endeavors, including television, film, music, and more. The picture below is an example from television (from Power Laws in Culture):

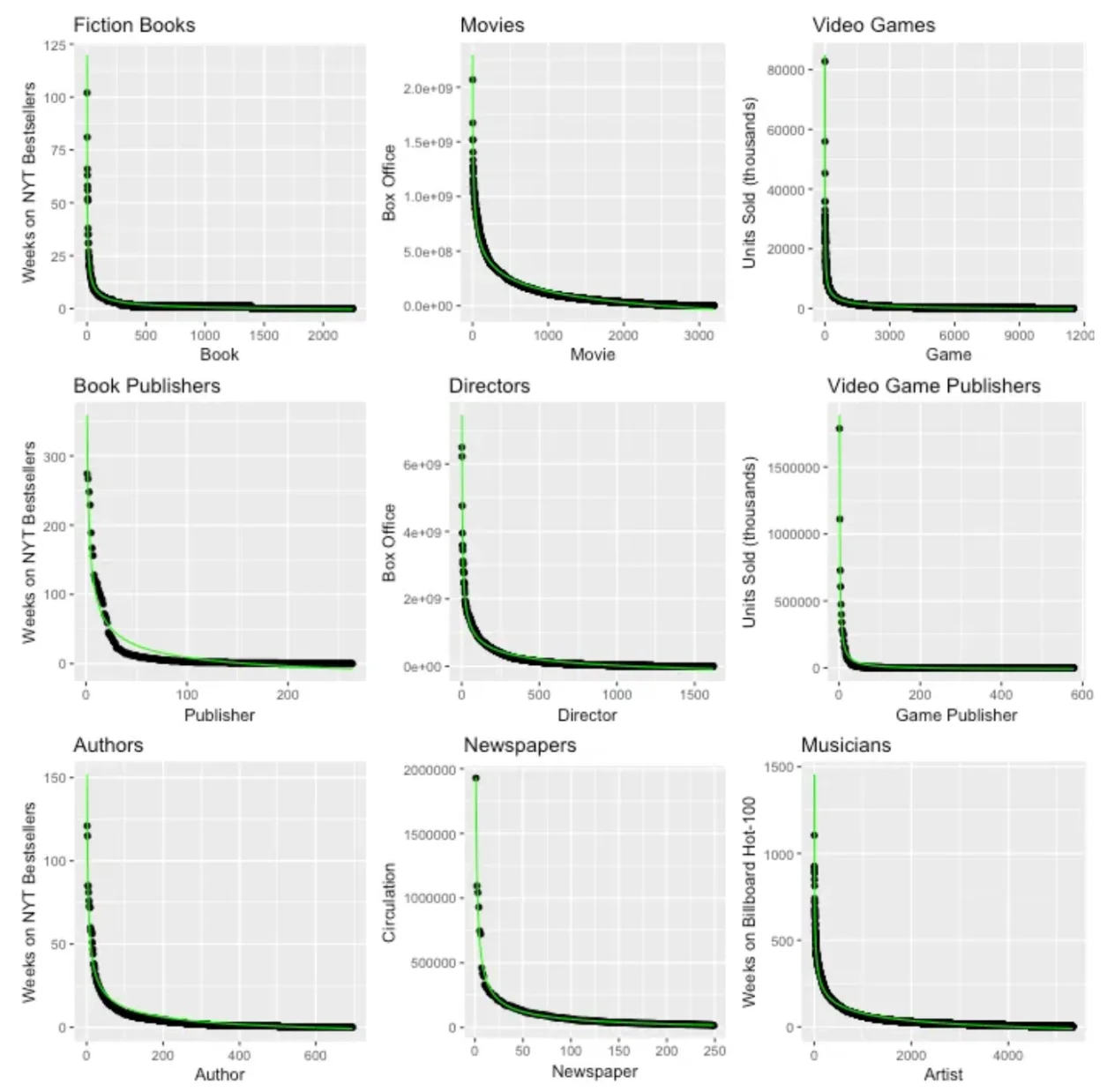

A handful of popular shows appeal to all audiences. The same phenomenon occurs in video games, movies, novels, directors, writers, etc.:

Power laws are universal, so a core problem is that creative skills are not evenly distributed in the world. The top writer or film director is indeed much better than the 100th one.

So, what does this mean for creator economy companies?

When creator economy companies first launched, they initially attracted little in the way of long-tail creators

To scale, platforms need to attract top creators

Even if you have a large number of creators on your platform, revenue is often concentrated among a small group of people - so if top creators are lost, there could be a significant negative financial impact

These dynamics all mean that the initial stages of a startup launch can be risky. The best companies can amass so many small creators that numbers come into play, or organically attract large/medium creators. If a startup acquires/owns many creators on its own, thats a sign that the product may not be solving a big enough problem to solve on its own.

bio link battle

Social media platforms like Instagram and TikTok have advertising business models, so they don’t want to give people “too much” organic traffic. What they prefer is that you pay for sponsored posts, creators, and ads. One way they accomplish this is by providing a single link to drive organic traffic, the infamous ink in bio link.

For creator economy startups, bio link means a lot. If you can convince creators to put your startup in this link, organic traffic will follow. Combined with some monetization mechanisms, startups can get a share of it. Early in the creator economic cycle, startups are competing with non-commercial links—either links to other social media profiles or links to personal websites. But over time, people started filling their bios with highly profitable links from Patreon, Substack, Twitch, etc., and the competition intensified further.

Now, replacing another startups biolink is a zero-sum battle. The only way to get organic traffic from creator profiles is to monetize better than other older, more established competitors. Its not enough if youre simply matching what the incumbent might bring you. You have to find something different, whether its within the creator content itself, whether its video, text, or something else. Either way, new entrants will find a major hurdle, and while they may initially be tempted to use investor money to subsidize earnings to achieve growth, this may not be enough to achieve meaningful scale.

Graduation issues

The graduation problem is what happens when your best creators scale and eventually “graduate”—they and their fans leave your platform all together. Why does this happen? Creators provide obvious value to startups, driving traffic, creating content, and monetizing users. But as creators grow in influence, they often start to think theyre too attractive. They start thinking, they did all the work, why share the profits with you? This problem is especially acute due to the effects of power law curves, where a small number of whales tend to dominate revenue. If whales start asking, will they be able to replicate your product by hiring an agency to build a website. They will eventually want to “graduate” from your platform and build their own.

The creator economy is often compared to marketplace startups. In this area, companies like Airbnb or Uber independently aggregate the supply and demand sides of the network. These markets achieve their best results when both parties are highly fragmented, which is why the biggest results are C2C or consumer-to-SME markets, not B2B. In their initial formation, creator economy startups look more like B2B networks, maybe even SaaS platforms - their customer base (creators) is highly concentrated, and creators bring consumers.

To solve the graduation problem, creator economy startups must provide much higher value than the utility of payments and other monetization technologies. They need to have a moat, not just for outside companies, but for creators who want to graduate over time. The best way is to create the network effect yourself and bring it to every creator, forming a two-way network with all the usual advantages. The additional features a startup creates should ideally be proprietary. If an AI-enabled creator economy company develops a very good basic model that allows creators to monetize 10 times more than before, then creators will be less likely to leave.

Algorithm Feast

Creator economy startups often find themselves highly reliant on social media platforms for blockbuster content. If a video goes viral on TikTok, the creator economy platform could experience a massive increase in user acquisition. But startups are always trying to achieve steady growth, and unlike SEO, referral programs, or paid marketing, its hard to consistently achieve 20% month-over-month growth. In contrast, marketplace startups add value by aggregating market parties—often spending billions of dollars building systems of buyers and sellers. In the years of Ubers rapid growth, its annual marketing budget for acquiring passengers was US$1 billion and that of drivers was close to US$2 billion. In addition, it also achieved diversification in SEO, brand marketing, payment, referral programs, partnerships, etc. This adds a lot of value and connects buyers and sellers.

Creator economy startups are different in that they leverage creators to find consumers, but in doing so, they rely heavily on a single channel. Reliance on a single marketing channel is always dangerous, as we have seen in previous years when SEO algorithm changes wiped out many content sites that relied on SEO. Reliance on social media is more vulnerable because content is naturally more ephemeral and subtle. I think this is one of the reasons why subscriptions have become the dominant business model for successful creator economy companies – it allows creators to generate a long-term, lasting revenue stream from each fan.

Algorithmic recommendations are also a competing factor. In recent years, we’ve also seen YouTube, Twitch, Twitter, and other underlying platforms attempt to pay creators directly and play a more vertically integrated role in the creator economy.

Of course, the best solution is to build additional marketing channels to increase predictability. Combine social media channels with traffic from referrals, SEO, mobile installs, and more, and the growth curve becomes more durable. But in the early stages of creator economy startups, they tend to go all-in on social, and only after success can they choose to invest in other channels.

The Strengths and Future of Creator Economy Companies

Creator economy companies have grown into their second and third generations. The bar has become higher, with startups no longer offering something akin to gimmicky tipping features, but building full-fledged products that support multiple platforms, new forms of interaction, and provide creators with new features for interacting with their fans. Rather than launching a product fronted by a celebrity and expecting it to be successful, startups are building real technology combined with a broad go-to-market strategy.

The advantage of the creator economy industry is that the use of mobile devices and social media platforms continues to grow at an alarming rate, reducing the amount of time people spend watching TV:

Of course, this movement is largely driven by the younger generation:

By the way, can you believe that most people over 18 still watch 4-5 hours of TV a day?

The point is, social media continues to play a huge role and creators are ultimately new players in the economy, and they continue to gain power, both culturally and economically. The products and tools they use to achieve their goals will continue to be attractive. Because at the end of the day, creators themselves don’t want to be dependent on a social platform. If theyre strong in video, they want to create podcasts and have a huge Instagram presence. Startups can always be more creator-friendly than larger social platforms.

So I think the future of the creator economy is still promising, but the path has definitely changed and the standards have been raised. Startups need to offer new capabilities, create new forms of commercialization, and adopt new technologies to make them more resilient to competition. Personally, Im more interested in AI or video-first creator economy startups that behave more like markets and provide highly managed solutions for both parties. Im more bullish on startups that can collect $1,000 from a smaller user base than companies that charge $2 per tip. We will see more actionable changes in the coming years, and given the underlying consumer trends, I think the creator economy will remain the cradle of high-value startups.