Voyager has sold over $40 million in tokens, how will the remaining positions affect the market?

In recent days, Voyager Digital, a crypto lending company that has disappeared from people’s sight for a long time, is regaining attention. On August 12, Voyager began the token sale process, and tokens in its wallet have been continuously transferred since then.

To date, Voyager has transferred more than $40 million worth of cryptocurrency in less than five days. Likewise, its address also received approximately 51 million USDC. How much money has Voyager made back after the ongoing sell-off? How many tokens are left for sale? What is the impact on the market?

Voyager sells coins to pay off debt

According to previous reports, Voyager has been actively selling coins to repay debts, and is currently transferring its holdings to CEX and selling them into legal currency.

In mid-May of this year, a judge approved Voyagers liquidation plan. Under its liquidation plan, Voyager Digital will return approximately $1.33 billion in crypto assets to customers, albeit only 35% of total customer deposits.

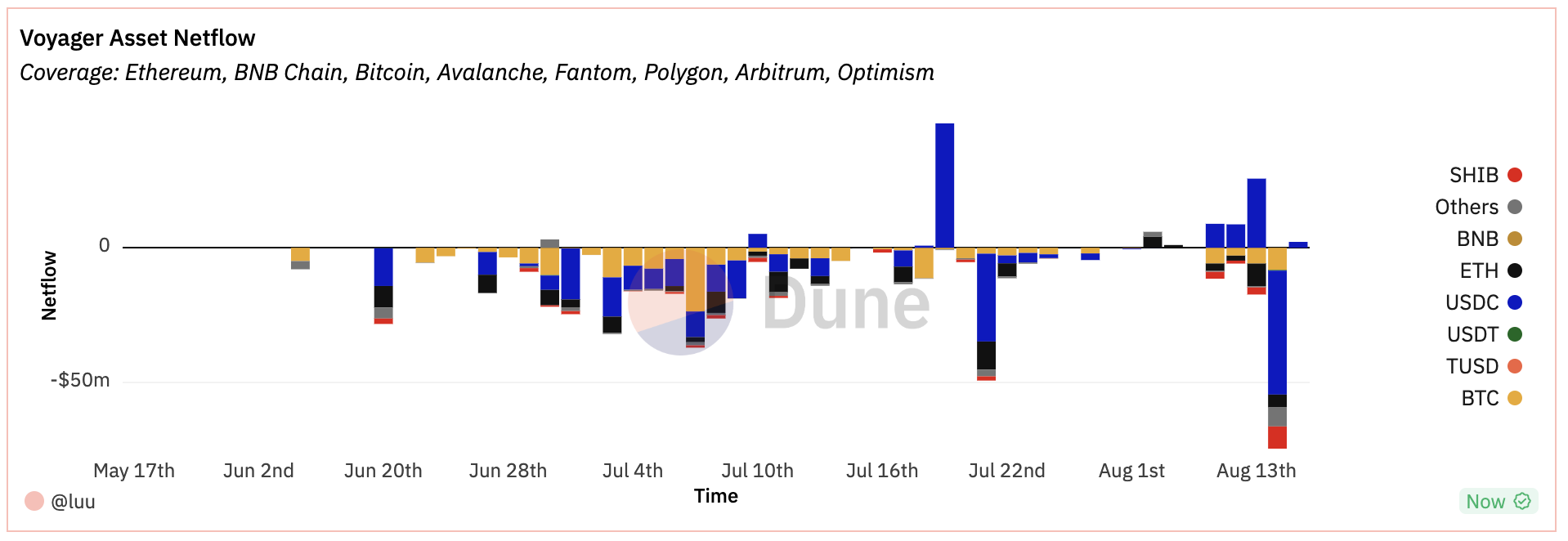

According to Voyager’s repayment plan, June 20th to July 5th is the cryptocurrency compensation cycle, and customers can choose to withdraw 35.72% of the tokens. You can also not mention making a crypto deposit, but wait for Voyager to sell the cryptocurrencies after the process is completed and receive compensation in US dollars. On-chain data shows a rapid outflow of Voyager’s tokens after withdrawals began.

With the cessation of token compensation, Voyager’s actions have entered the next stage. Beginning on August 12, its claimed cryptocurrency began to be transferred and sold.

On-chain data shows that Voyager has transferred more than 30 tokens to Coinbase, totaling more than $40 million. Among them, the ones worth more than 1 million US dollars include: BTC, ETH, SHIB, LINK, MATIC.

Specifically including: approximately $17.5 million in BTC, approximately $12.9 million in ETH, and approximately $8 million in SHIB. In addition, BAT, SAND, MANA, and APE tokens total approximately US$2 million. The massive sales also brought Voyager a considerable amount of cash. On-chain data shows that Voyager withdrew approximately $82.37 million in USDC from Coinbase, transferred it to Circle, and converted it into U.S. dollars.

On August 14, the single-day net outflow was as high as US$74.4 million, including US$46.18 million worth of stablecoins.

How much money does Voyager still have?

How many assets does Voyager have left to sell off after continued large outflows? Query Voyagers EVMwallet address, we can take a quick look at the holdings that this former giant still has.

Zerion data shows that the current net asset value of the Voyager wallet address has decreased by 70% compared with a week ago.

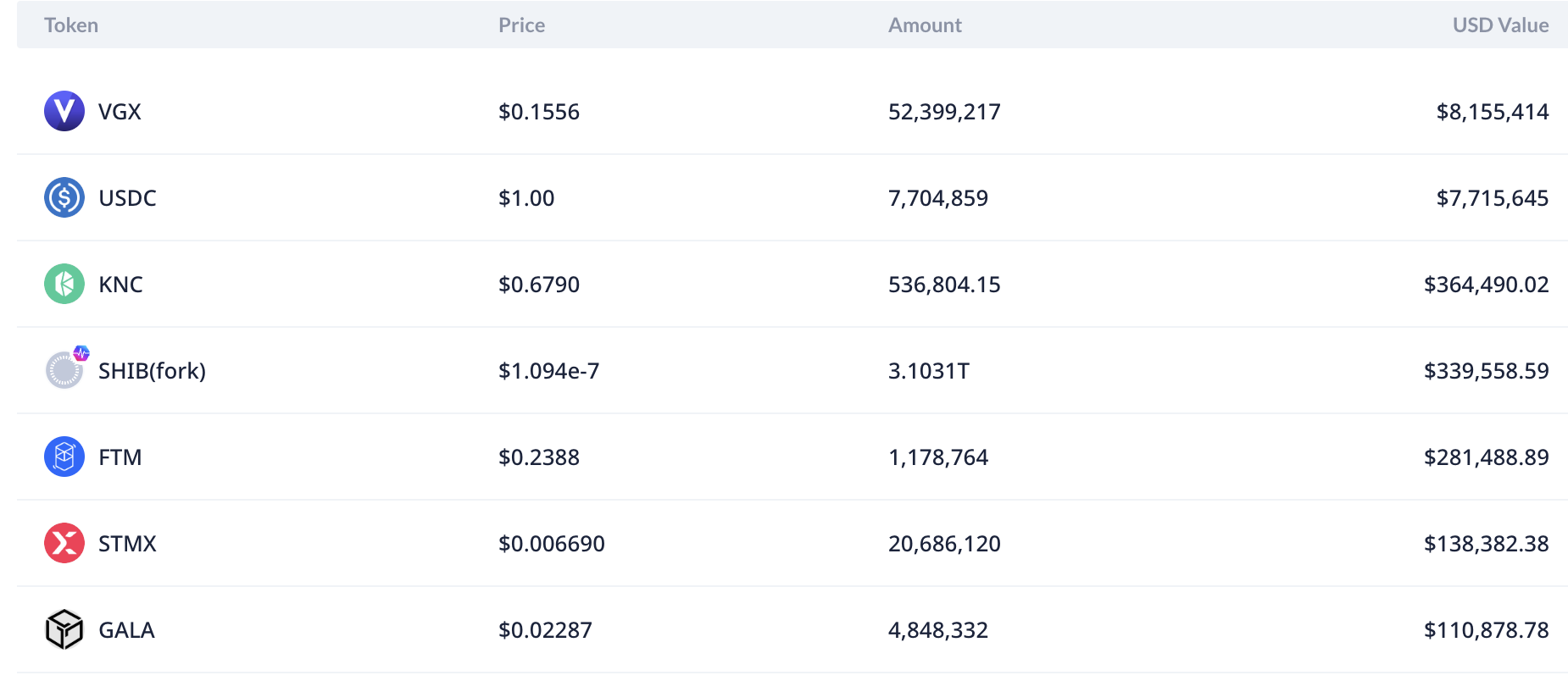

Voyager currently has more than $8 million worth of VGXs waiting to be sold. Non-stable holdings worth over $100,000 include: VGX, KNC, SHIB, FTM, STMX, GALA.

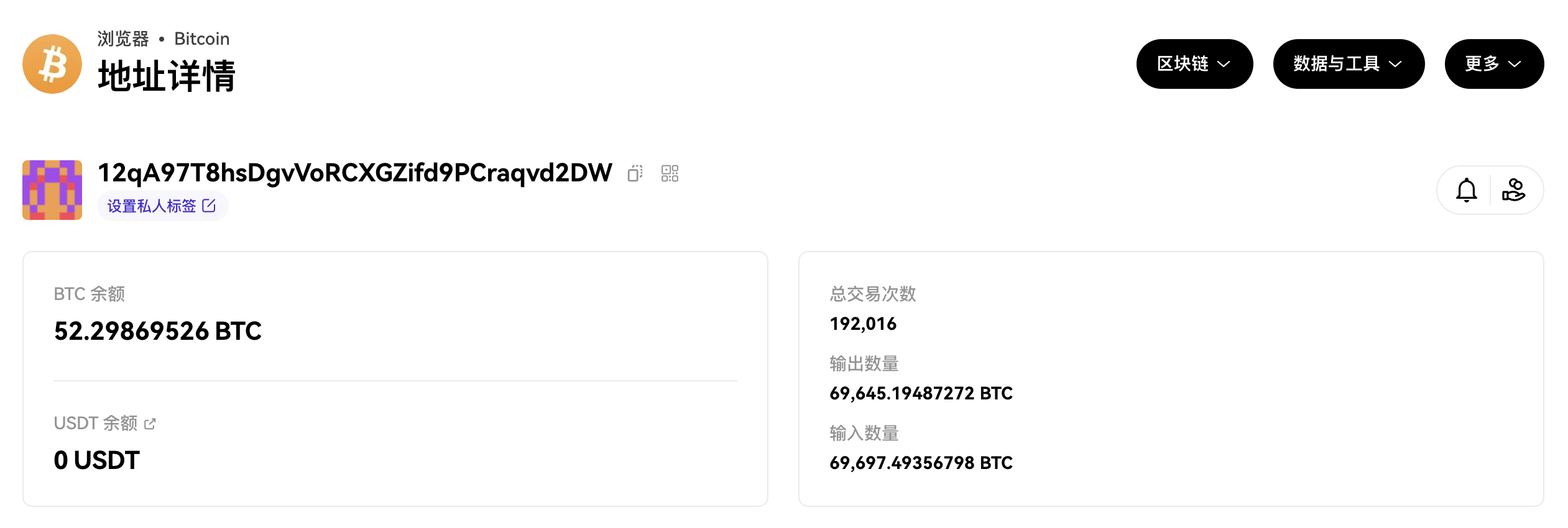

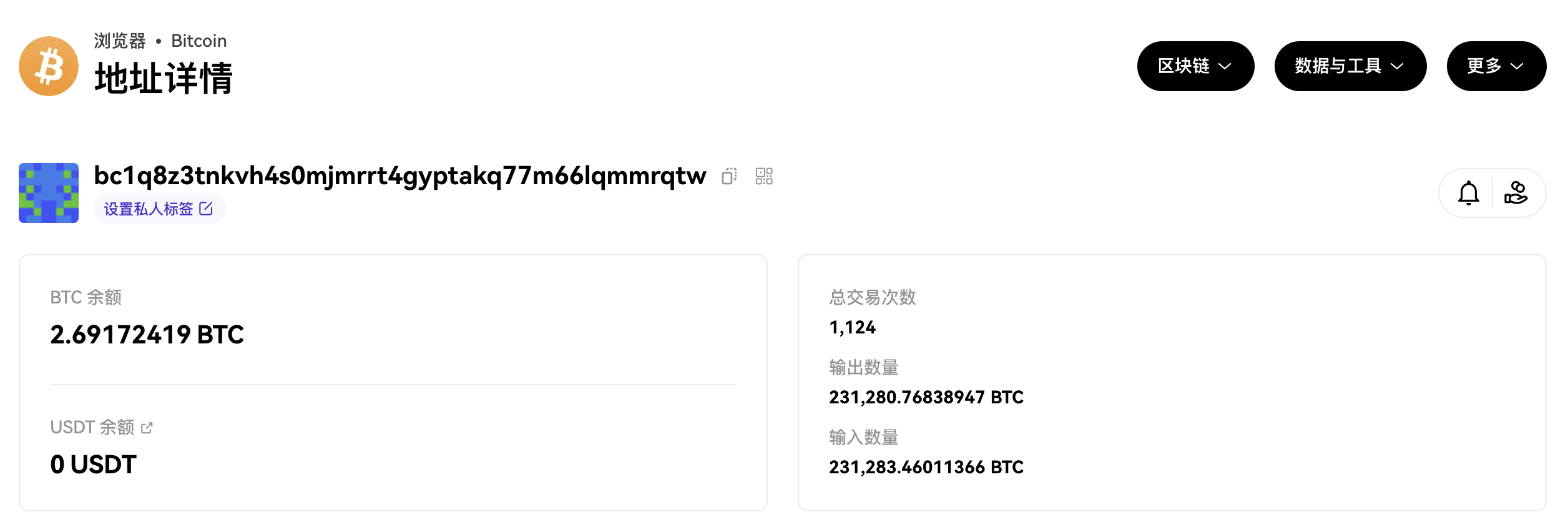

Voyagers two Bitcoin addresses still have some positions, holding a total of about 55 Bitcoins, with a current price of about $1.62 million.

How will it affect the market?

In July 2022, Voyager Digital filed for bankruptcy protection in the United States, becoming another giant to fall in the bear market. Previously, Three Arrows Capital had borrowed a large amount of assets from Voyager. With the bankruptcy of Three Arrows Capital and the decline of the crypto market, Voyager Digital was also hit by a chain reaction, and then ushered in bankruptcy.

Voyagers collapse comes less than a week after the company suspended trading and stopped customers fund withdrawals. After Voyager went bankrupt, it attempted to sell its assets to FTX for $1.42 billion, but the deal fell through due to FTXs collapse.

Voyagers ultimate goal is to fully reimburse all of its customers (although only a portion of the losses will be reimbursed). At present, with the progress of compensation, this process has gradually come to an end.

Naturally, what we are most concerned about is the sell-off of Voyager. Will it affect the market? The depth of mainstream tokens can be taken on. Taking SHIB as an example, Voyager has dumped millions of dollars of SHIB in the past few days. SHIB’s trading volume in the last 24 hours reached $280 million.

But other small currencies are not optimistic, especially VGX issued by Voyager itself. Coingecko data shows that the current market value of VGX is only US$45.81 million, and the 24-hour trading volume is only US$4.86 million. Voyager still has $8.15 million worth of VGX in his wallet waiting to be sold.

Currently, Voyager’s asset sale is still in progress, and how it will be handled remains to be seen. For the majority of investors (or speculators), there are still certain market opportunities in this sell-off.