Solana Q2 report: Average trading volume of DEX has tripled YoY, with 300,000 daily active addresses.

Original Source: Step Finance

Translation: Odaily

Recently, DeFi position manager and aggregator Step Finance released the "Solana Q2 2023 Quarterly Report".

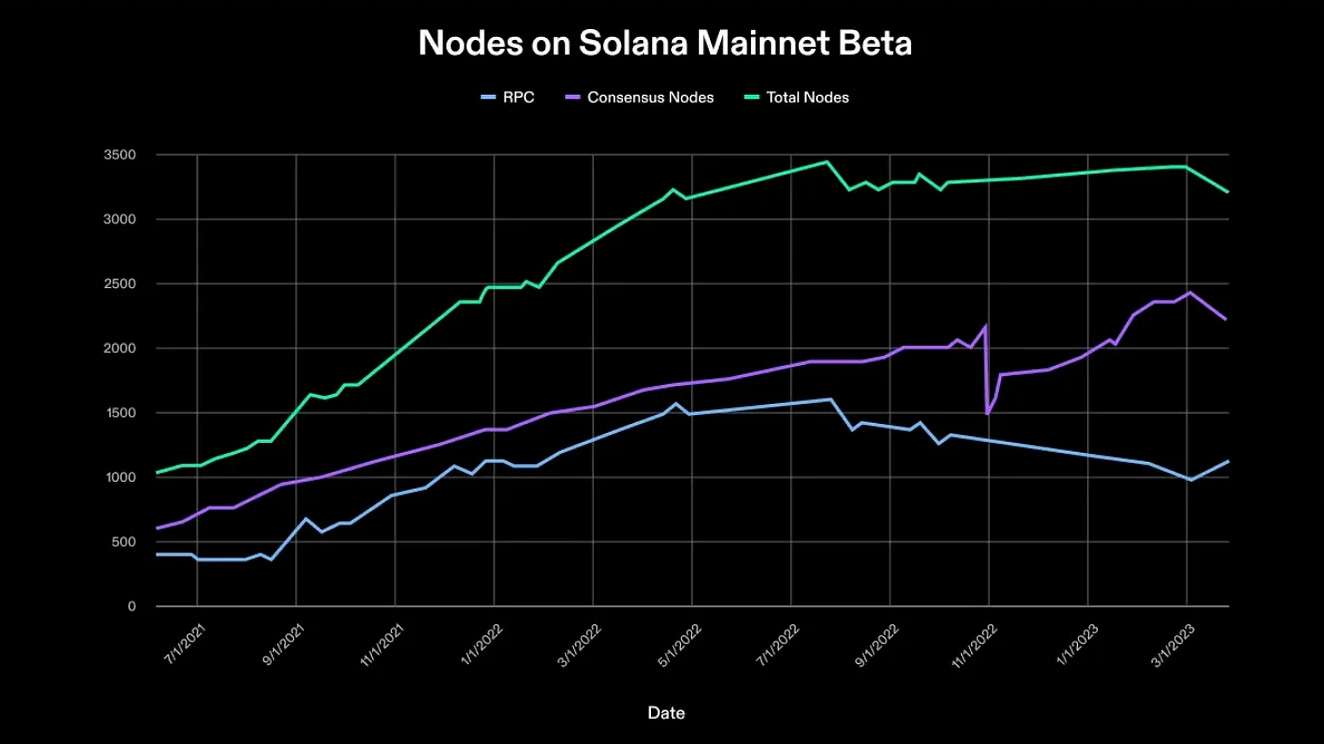

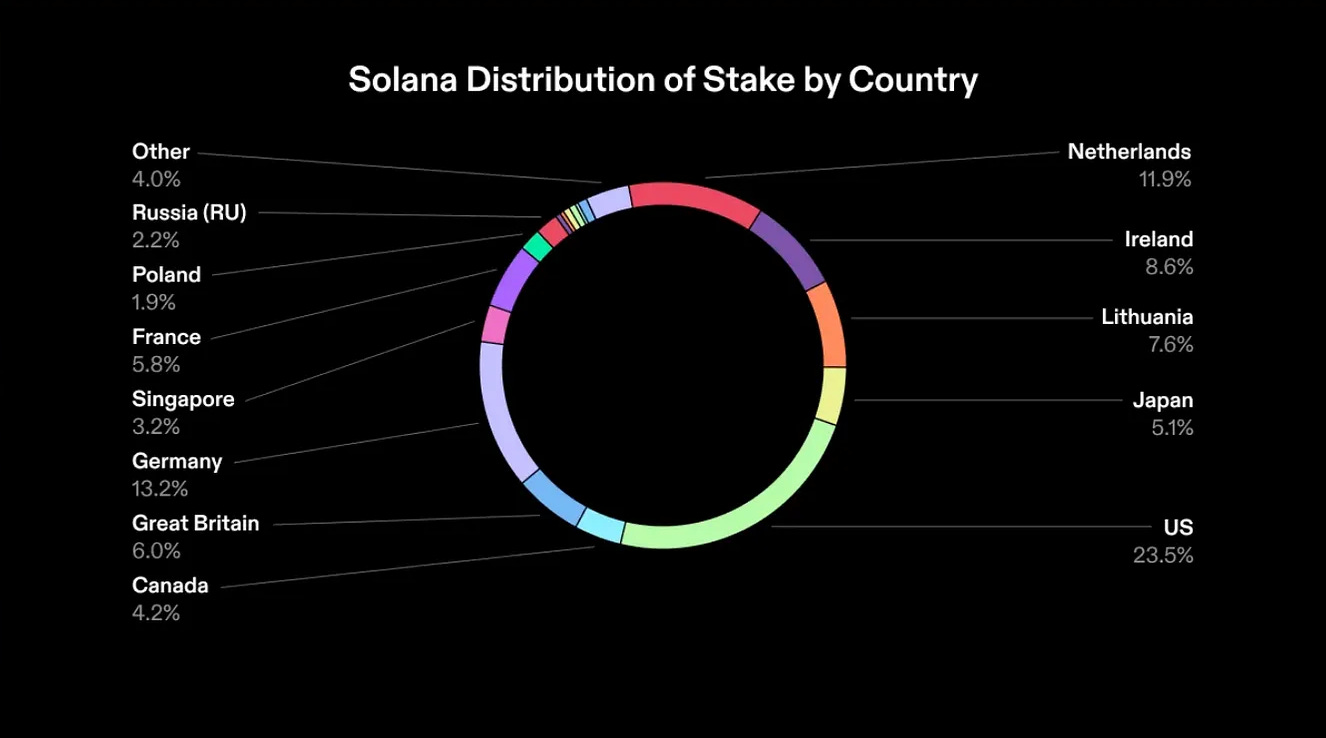

The report shows that since the mainnet launch, Solana has expanded to over 3,400 validators and has over 2,400 consensus nodes - significantly higher than other POS blockchains. The distribution of Solana's staking is as follows by country: United States 23.5%, United Kingdom 13.2%, Ireland 11.9%.

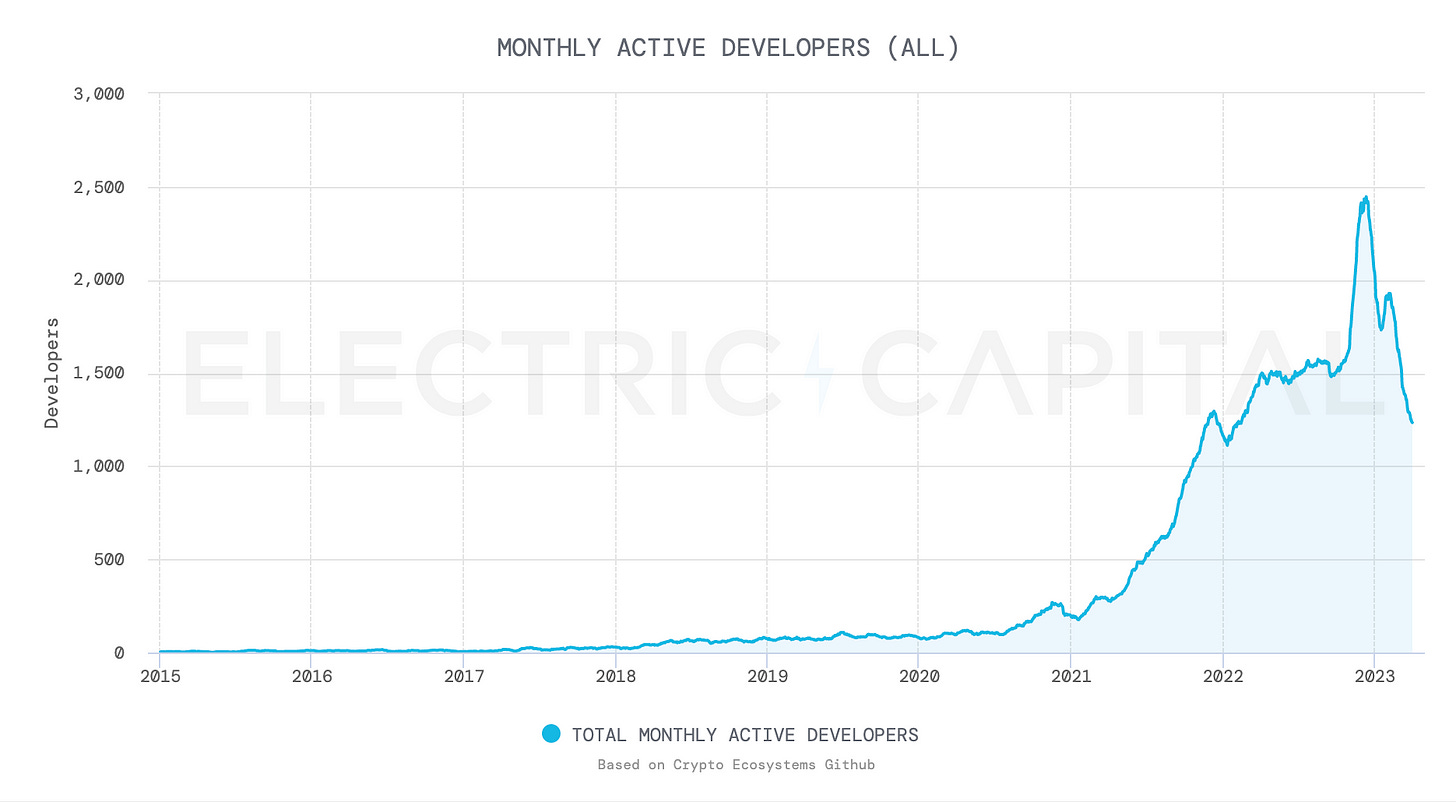

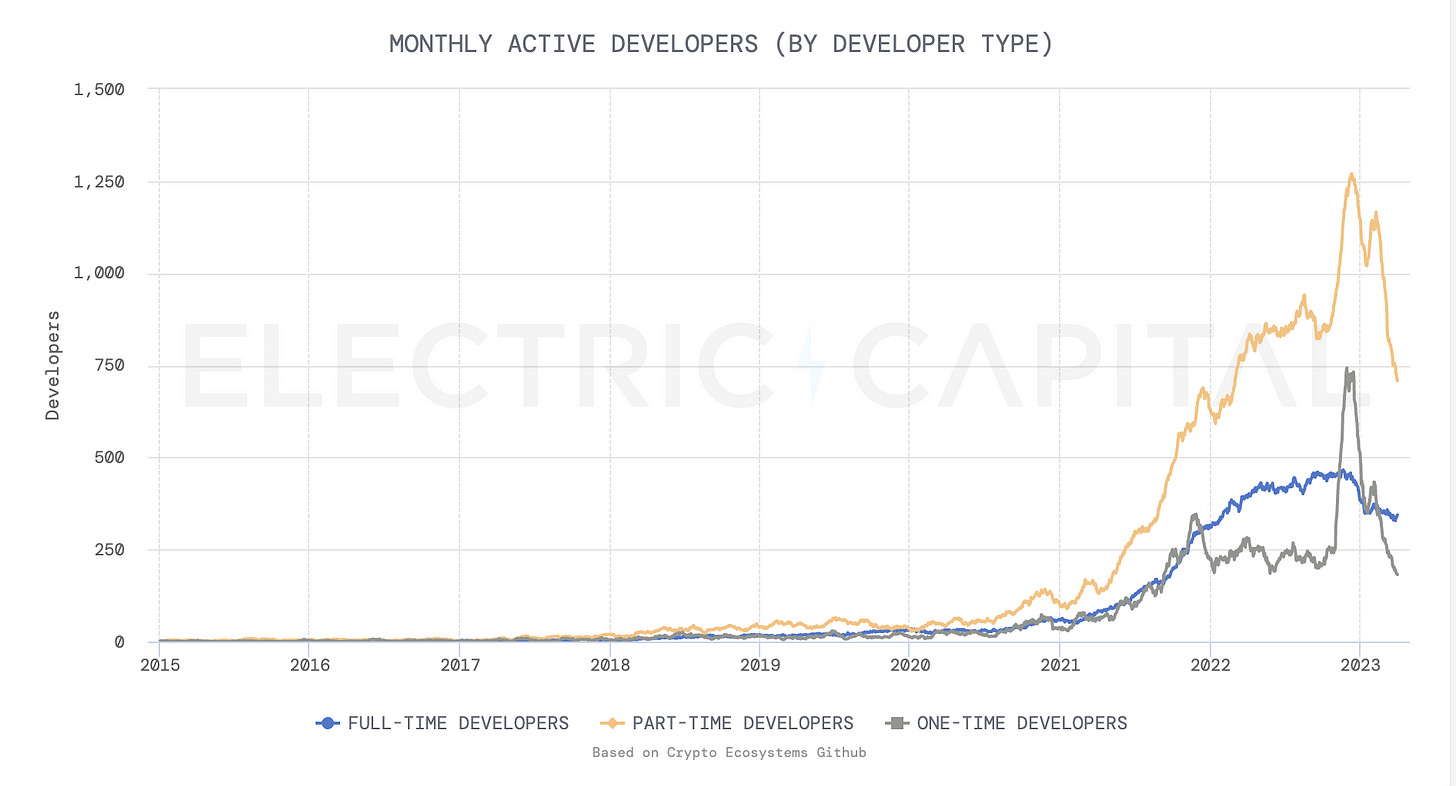

In terms of developers, as of April 2023, Solana has 1,234 active developers; a decrease of 12% compared to the previous year, but this number has increased by 339% compared to two years ago. The decrease in the number of monthly active developers in 2023 is mainly due to a decrease in one-time developers and part-time developers.

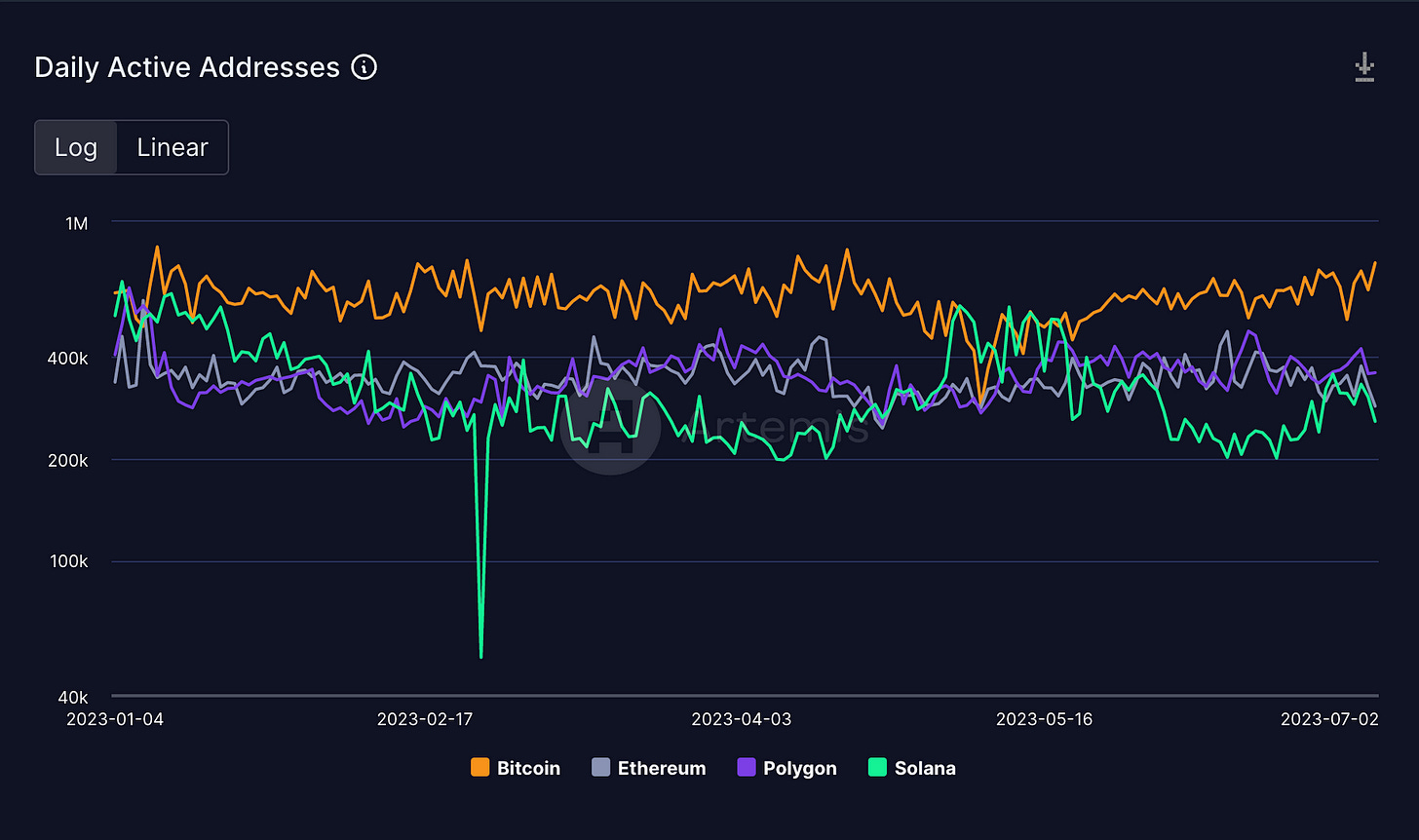

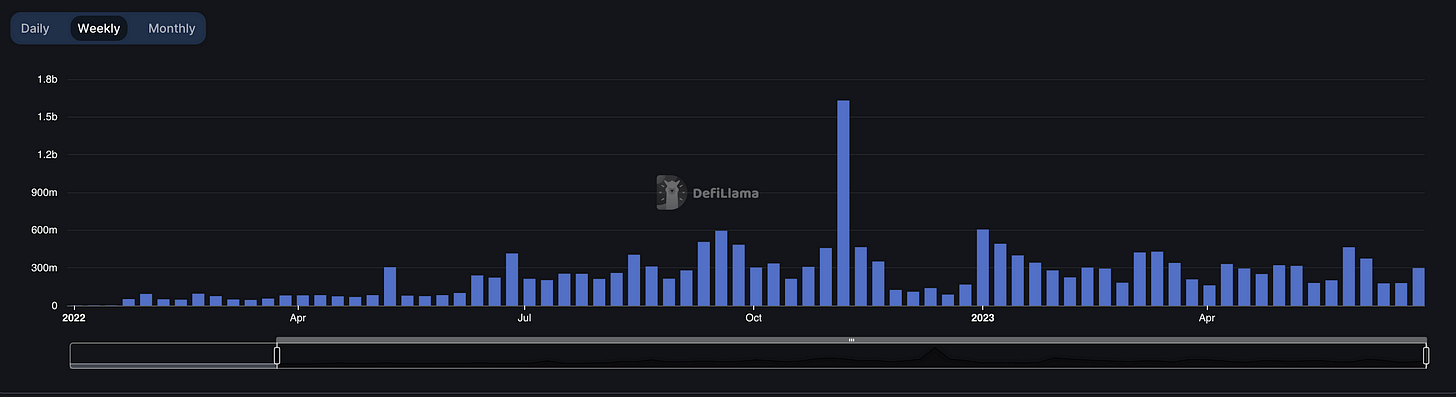

In terms of on-chain transactions, Solana has an average of 300,000 daily active addresses in the first six months of 2023. Solana's active addresses are comparable to Ethereum and Polygon, slightly lower than the average level of Bitcoin. The total locked value (TVL) of the Solana ecosystem in the second quarter of 2023 did not show significant growth. The average trading volume of DEX in the first six months of this year is 4 times the volume of the same period last year, thanks to investments and development in DEX and perpetual trading DEX.

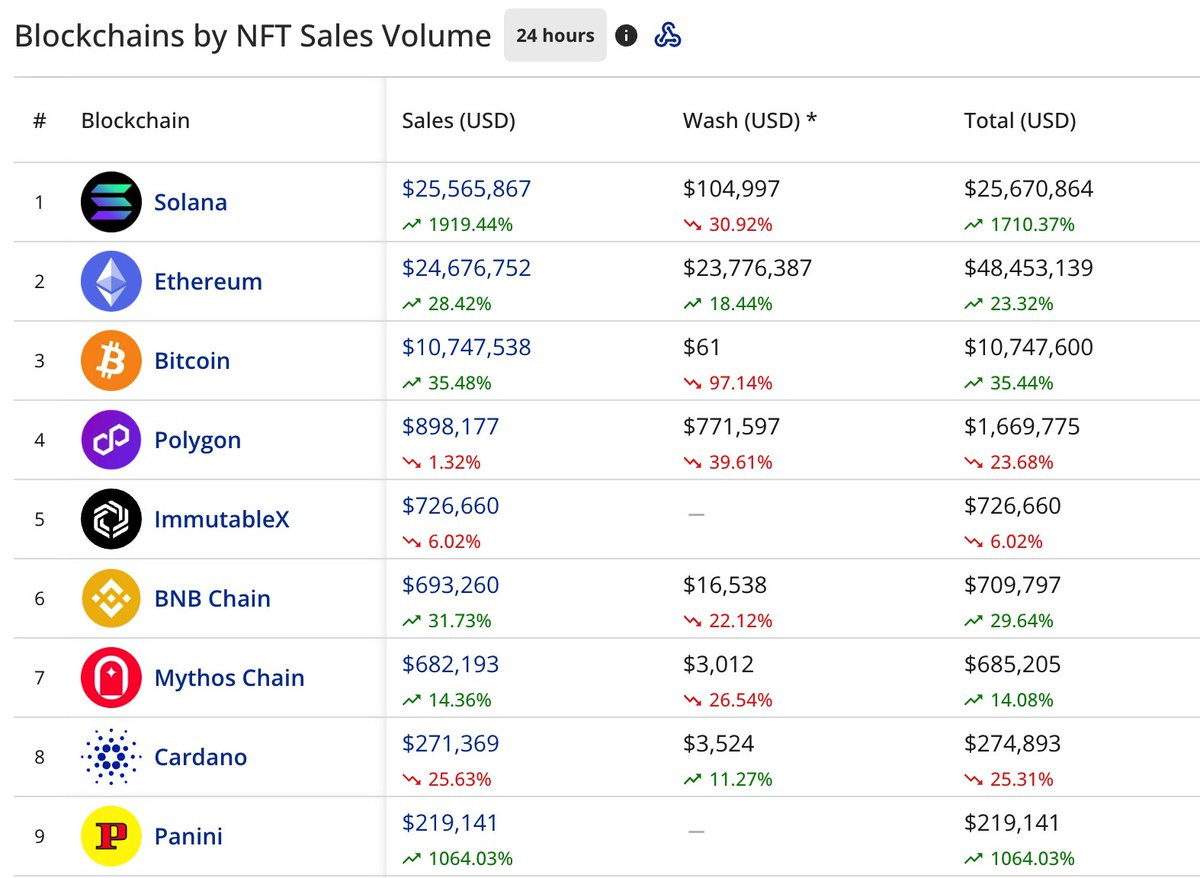

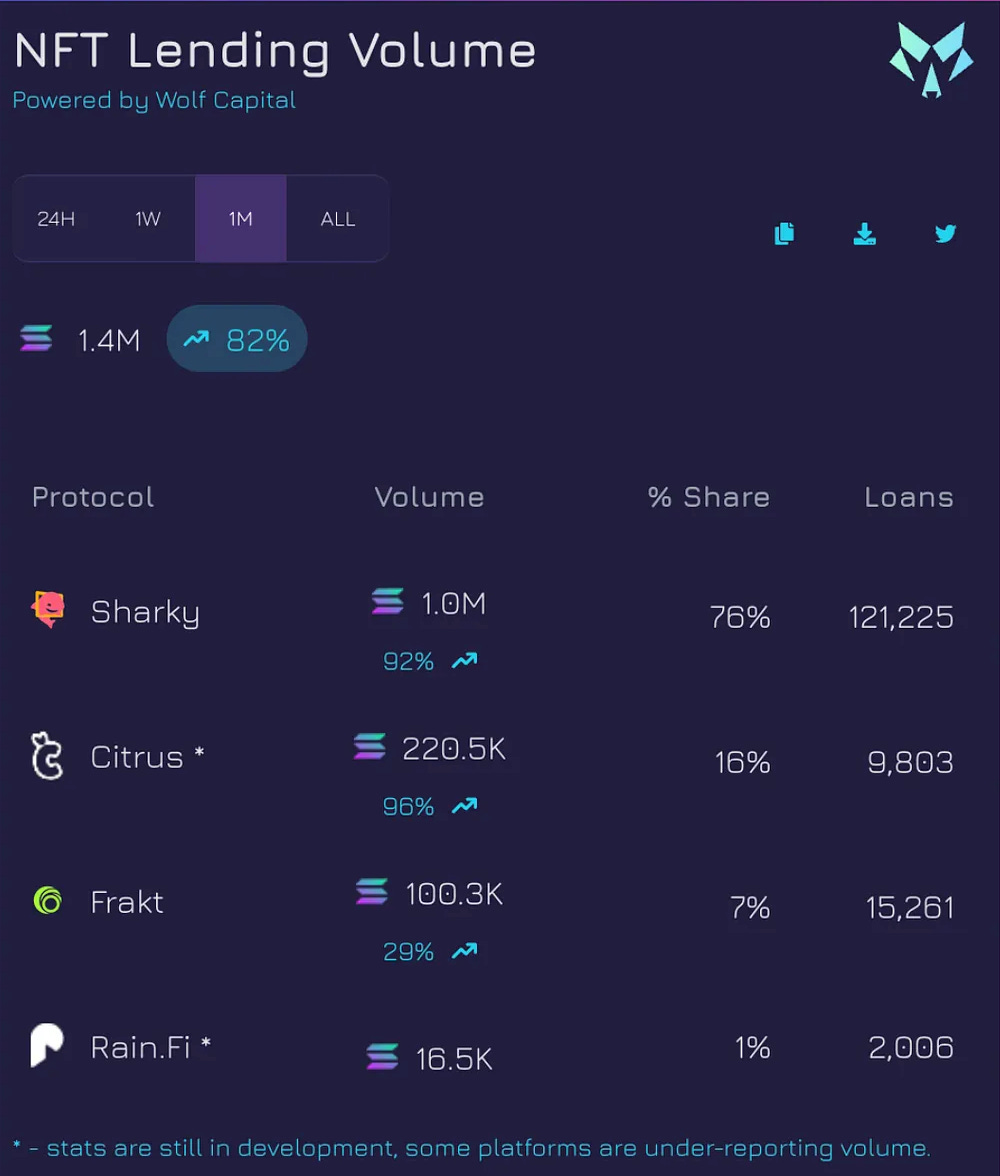

In terms of NFTs, in late June, Solana's NFT trading volume surpassed Ethereum for the first time, with a daily trading volume of up to $25.5 million, compared to Ethereum's $24.7 million. In addition, the Solana NFT lending ecosystem is growing rapidly, with loan volume in the past 30 days equivalent to 50% of Solana NFT trading volume. The main lending platforms on Solana are Sharky, Citrus, Frakt, and RainFi. Sharky occupies 76% of the lending market, followed by Citrus (16%), Frakt (7%), and RainFi (1%).

The following is the original report, translated by Odaily.

Introduction

In this report, we will introduce key events and developments that have facilitated the growth of the Solana ecosystem. We will also explore various use cases of the Solana blockchain in 2023, covering areas such as finance, gaming, NFTs, and decentralized physical infrastructure networks. Data on active addresses, developer activity, on-chain transactions, and liquidity are key indicators we use to demonstrate the continuous growth and adoption of the Solana ecosystem.

This report will also focus on the highlights of the previous quarter in the Solana ecosystem.

1. Macroeconomic Outlook

In the first half of the year, the world economy faced many challenges, with both emerging and developed markets experiencing volatility. One of the most important factors causing this uncertainty is the sharp increase in interest rates, which has led to a significant decrease in market liquidity and put enormous pressure on businesses and consumers. Additionally, the impact of rate hikes is now fully evident.

Several banks in Europe and the United States are on the verge of collapse or suffering significant financial losses. This development has intensified concerns about the stability of the global financial system and its potential impact on the broader economy.

Due to the substantial rate hikes by the Federal Reserve, the inflation rate has been experiencing a significant decline, while the unemployment rate remains surprisingly low.

SEC declares Solana as a security

In early June, the U.S. Securities and Exchange Commission (SEC) caused a stir in the crypto world by filing a lawsuit against the crypto exchange giant Binance. Of interest to the crypto community is the SEC's assertion that certain altcoins, including Solana, Polygon, and Cardano, are classified as securities.

The list of tokens suspected of being securities also includes Binance's own BNB, the stablecoin BUSD, and several other large-cap tokens. The direct impact of the SEC's enforcement action is a significant drop in the prices of these tokens. For example, Solana experienced a drop of over 6% within one hour of the announcement, and the prices of tokens like Algorand, Polygon, and Polkadot also plummeted. Less than 24 hours after suing Binance, the SEC filed a lawsuit against Coinbase, stating that Solana and other altcoins are securities.

BlackRock plans to launch a spot Bitcoin ETF

In June of this year, BlackRock, the world's largest asset management company, applied for the establishment of a Bitcoin exchange-traded fund (ETF) that would allow investors to invest in spot BTC, as this asset class is subject to strict regulatory scrutiny.

According to a document submitted to the SEC, BlackRock's iShares Bitcoin Trust will use Coinbase Custody as its custodian. So far, U.S. regulatory agencies have rejected over 30 applications and have yet to approve any spot Bitcoin ETF applications. However, investors and analysts remain optimistic, as historical data shows that out of BlackRock's 576 ETF applications, 575 have been approved.

Solana Price Trend

Over the past three months, the price of Solana token (SOL) has experienced a period of high volatility. At the end of last year, SOL dropped to $8.90, hitting a low point since February 2021. In the following two months, the price of SOL skyrocketed to a high of $27. However, due to the collapse of two US banks supporting cryptocurrencies, as well as other regional banks and more European banks, market uncertainty increased, and the SOL price stabilized in the $19-21 range.

After several months of consolidation, when the SEC sued Coinbase and Binance and classified SOL as a security, the price of SOL began to collapse, falling to around $12 at one point. However, recently SOL has almost fully recovered from the SEC attack as Solana has gained more support, and the new narrative seems to have a positive impact on the price.

Is FTX Still Hindering Solana's Growth?

It has been almost a year since the second-largest cryptocurrency exchange, FTX, collapsed. Although many members of the crypto community, KOLs, and analysts abandoned Solana because of the FTX incident, the Solana community remains steadfast. The Solana ecosystem continues to evolve, with over 1000 developers at the forefront of blockchain innovation.

II. Decentralized Development on Solana

The Solana Foundation has released a report focusing on the latest developments in the ecosystem, with an emphasis on decentralization and validator data.

In March 2020, the mainnet was launched and has now expanded to over 3,400 validators with more than 2,400 consensus nodes - significantly higher than other POS blockchains. The foundation is now focused on the quality of nodes, not just quantity.

Solana's Nakamoto coefficient is 33, and has remained unchanged since August 2022, which means that there must be a minimum of 31 validators required for collusion-resistant network. From the network launch in March 2020 to September 2022, the coefficient steadily increased and then stabilized. (Note: The Nakamoto coefficient is an accurate measure of decentralization.)

The Solana Foundation is exploring ways to attract more high-quality validators, which could lead to an increase in the Nakamoto coefficient as users have an incentive to stake with larger validator pools.

(Nakamoto coefficients of various chains, note that Ethereum's Nakamoto coefficient is 20, not 2, the statistics are incorrect)

The distribution of Solana's staking by country is as follows: United States 23.5%, United Kingdom 13.2%, Ireland 11.9%, Lithuania 8.6%, Japan 7.6%, Canada 6.0%, Singapore 5.8%, Poland 5.1%, Netherlands 4.2%, Germany 3.2%, France 1.9%, and Russia 2.2%. The remaining 4% is from other countries. As shown below:

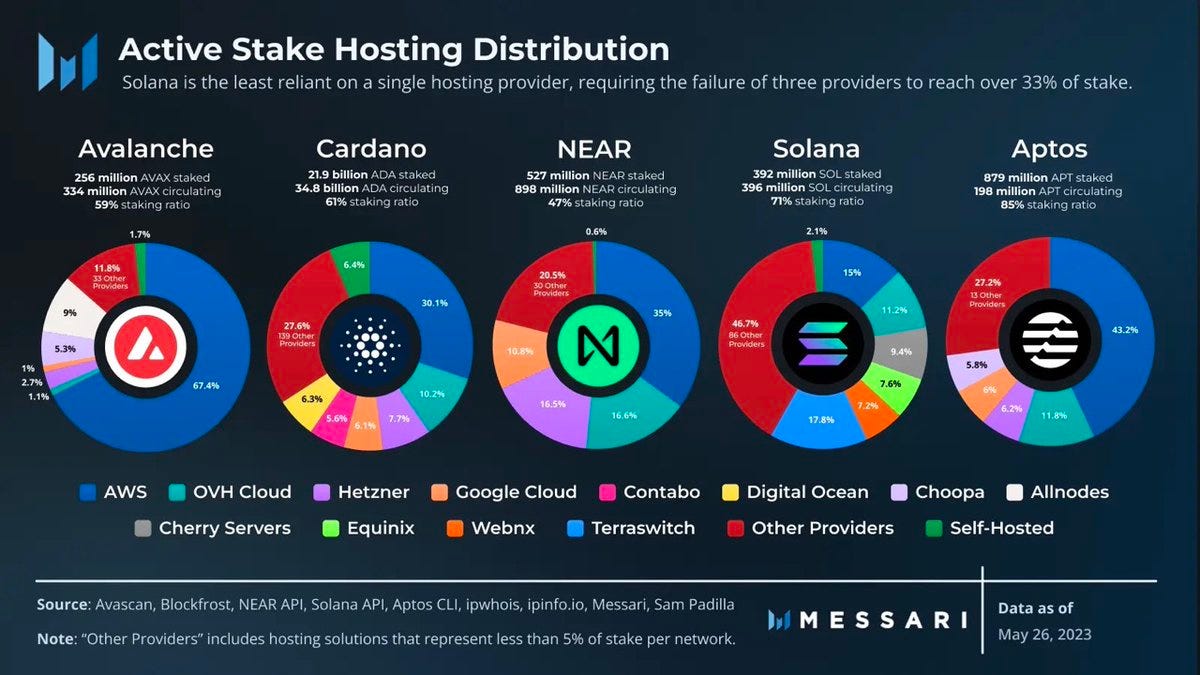

Solana is not only decentralized but also more decentralized than most blockchains like Avalanche, Cardano, NEAR, and Aptos. The distribution of active stake hosting is one of the most balanced distributions, further proving the resilience and decentralization of Solana.

Developer Activities

According to the latest data from the Electric Capital Developer Report, as of April 2023, Solana has 1,234 active developers; a 12% decrease in active developers compared to last year, but this number has increased by 339% compared to two years ago.

Measuring developer activity on the blockchain is a crucial task. It is worth noting that there is currently no standardized method for calculating this metric.

The number of monthly active developers has decreased in 2023, mainly due to a decrease in one-time developers and part-time developers. One-time developers refer to developers who contribute code once within a rolling three-month period, while part-time developers contribute code for less than 10 days per month.

Although the data shows a slight decrease in the number of full-time developers in the Solana ecosystem, the decrease is not significant, while one-time and part-time developers have decreased significantly compared to the end of 2022. This sharp decline can be attributed to the bankruptcy of FTX and the bear market. Not only do many Solana-based projects have reserves on the FTX exchange, but FTX can be considered the largest investor in Solana projects.

Recently, the Solana Foundation has established multiple grants and has been actively investing in the ecosystem.

Solana DeFi Ecosystem

TVL Growth Situation

Data shows that the total locked value (TVL) of the Solana ecosystem did not significantly increase in the second quarter. Solana TVL has remained stagnant between $200 million and $300 million throughout 2023. However, with the growth of projects like Marinade and mrgnfi, the Solana DeFi ecosystem is expanding, and these projects have been offering incentives for DeFi adoption.

Active Addresses

Solana has exhibited resilience in the first six months of 2023, with an average of 300,000 daily active addresses. Solana's active addresses are comparable to Ethereum and Polygon, slightly lower than the average level of Bitcoin. It should be noted that the FTX crash occurred at the end of 2022, and the data above indicates that the Solana user base did not decrease as expected.

The stability of daily active addresses indicates that the Solana network and its user base are resilient.

DEX Trading Volume

One of the main narratives of Solana is decentralized trading, as Solana offers low transaction fees and fast speeds. The average trading volume of DEX in the first 6 months of this year is 4 times higher than the same period last year. The significant growth is due to investments and developments in DEX and perpetual trading DEX, such as Drift Protocol, Jupiter Aggregator, and Zeta Markets.

The collapse of FTX triggered the highest weekly trading volume in Solana DEX's history, followed by a month-long stagnation. Since then, the DEX story has been attracting users and attracting new capital.

Since the collapse of FTX, except for December, the monthly trading volume has not slowed down.

Liquidity Staking

On Ethereum, there is a large market for liquidity staking, and key participants have already been identified. Marinade Finance is a major liquidity staking participant on Solana, and its non-custodial liquidity staking protocol allows users to stake their SOL tokens using automated staking strategies and receive "marinated SOL" tokens (mSOL); users can then use mSOL tokens to participate in various DeFi activities.

Marinade has a Total Value Locked (TVL) of $125 million, making it the largest DeFi application on Solana with a 45% market share. Its token mSOL has 73,877 holders and a market capitalization of $120 million.

Solana NFT Ecosystem

Data and sentiment indicate that one of Solana's most powerful narratives is NFT. The growth of NFTs on Solana has brought rapid innovation, as the ecosystem needs to explore new use cases and open up new pathways.

One of the key narratives is NFT DeFi, which is the fusion of DeFi rules and NFT gamification. Solana's NFT ecosystem has undergone a unique transformation. The team has developed successful products before releasing the NFT series, which is different from what happened in the previous bull market cycle.

It is clear that the Solana NFT community has matured, and most members will not mint collections that demand too much and support too little. Instead, they are willing to pay a premium for established projects.

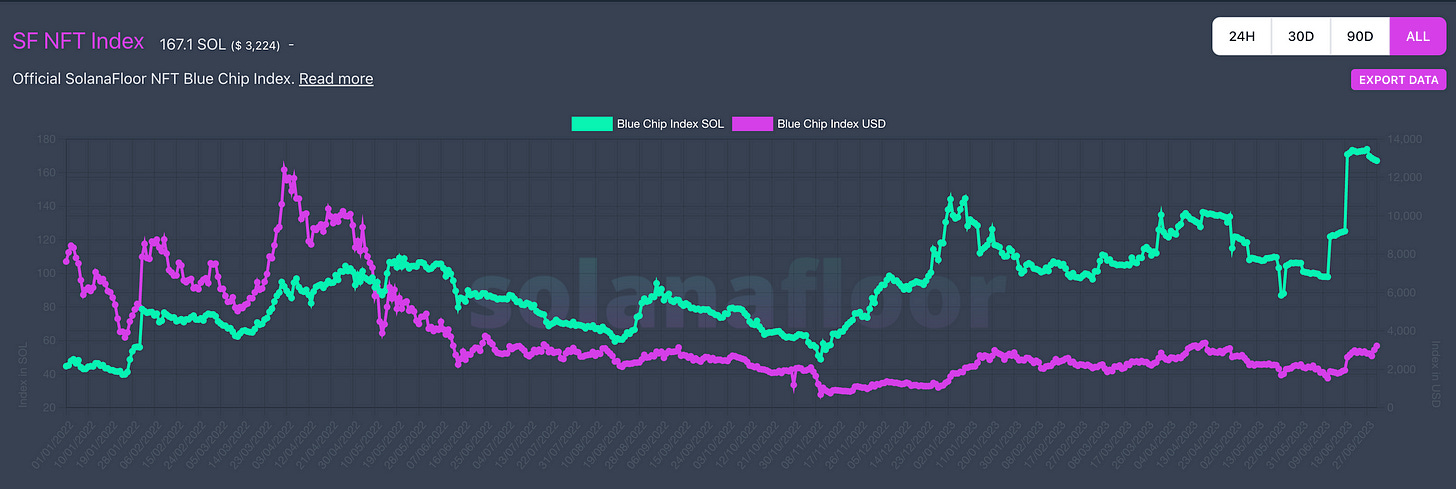

Solana NFT Index

The SolanaFloor NFT Index is composed of a carefully selected basket of blue-chip combinations, which are based on multiple weighted criteria: transaction volume, social trends, age, and other statistical data. The SolanaFloor chart represents the index in SOL (green) and USD (purple).

This index is a valuable tool for any long-term investor, trader, or researcher of NFTs. Although technical analysis may be considered inaccurate for most NFT projects that have been around for less than 4 months, this chart provides a long enough time frame (year-to-date) for effective analysis.

The chart below shows that the USD index reached a quarterly high of $3,227; the SOL index is at an all-time high, totaling 167 SOL.

Solana's NFT trading volume surpasses Ethereum for the first time

In late June, Solana's NFT trading volume surpassed Ethereum for the first time. Within 24 hours, Solana's trading volume reached $25.5 million, while Ethereum's trading volume was $24.7 million. The main reason for this achievement was the launch of SMBs.

Compared to most other blockchains, Solana has faced more challenges in the past 365 days, giving this achievement additional significance.

NFT Lending

NFT lending is a growing trend where individuals use their NFTs as collateral to obtain loans on platforms like Sharky. This form of lending allows investors or lenders to earn interest from their investments. Compared to collateralized and traditional cryptocurrency-based loans, NFT lending has the potential for higher returns. In NFT lending, borrowers secure loans by locking NFT assets as collateral.

NFT lending can be facilitated through DeFi applications. DeFi platforms use smart contracts to manage the loan terms and interest rates of NFT loans. As NFT lending is a relatively new trend, it is expected to further develop with more individuals and capital participation, as well as potential regulatory measures.

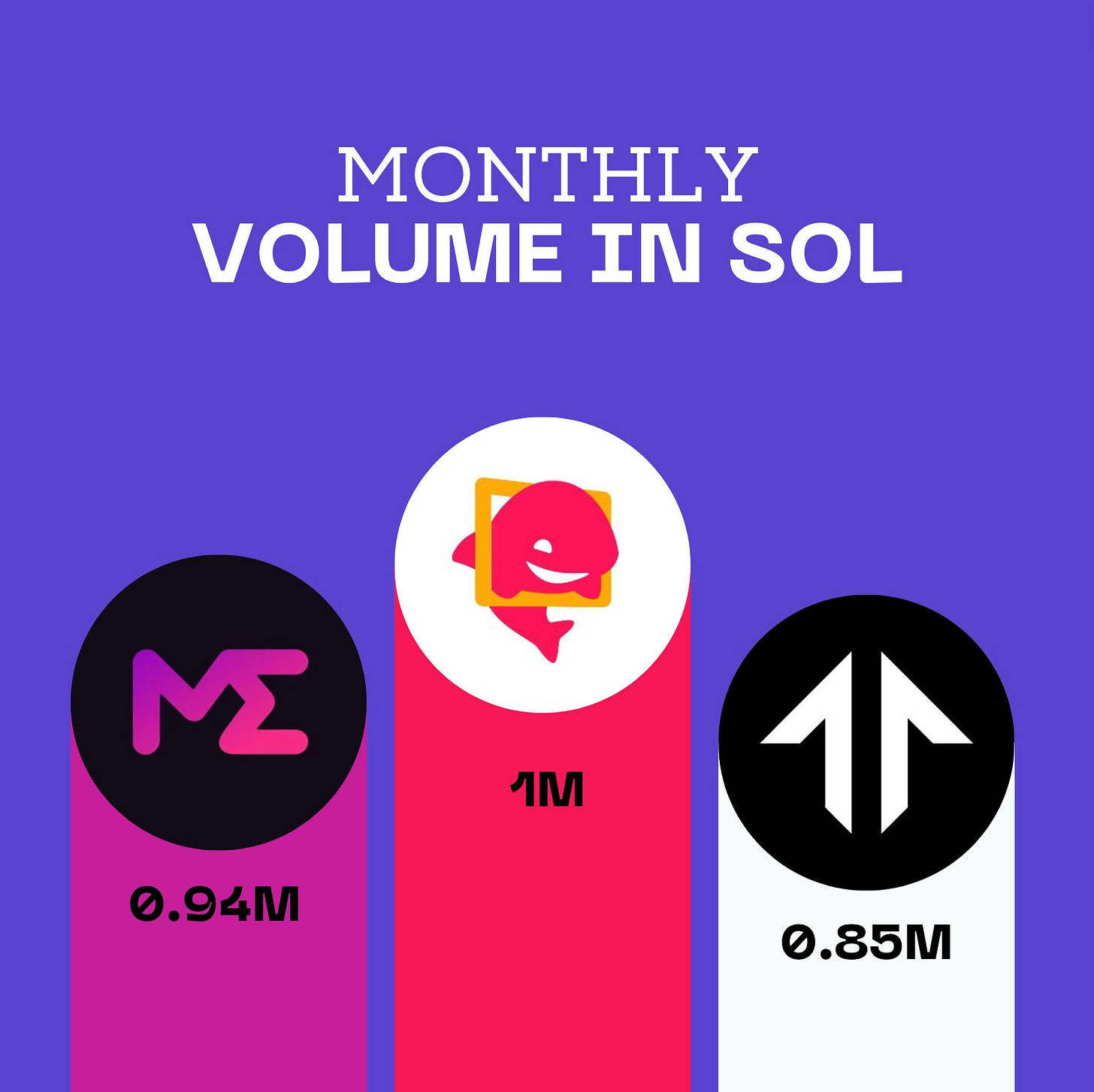

Loan Volume Surges

The Solana NFT lending ecosystem is growing rapidly. In the past 30 days, the loan volume accounted for 50% of Solana NFT trading volume. The major lending platforms on Solana include Sharky, Citrus, Frakt, and RainFi. Sharky dominates the lending market with a 76% market share, followed by Citrus (16%), Frakt (7%), and RainFi (1%).

As the largest NFT lending platform on Solana, Sharky's monthly trading volume exceeds that of Magic Eden and Tensor. Sharky's monthly trading volume exceeds 1 million SOL, followed by Magic Eden with 940,000 SOL and Tensor with 850,000 SOL. The data shows that the NFT market is maturing and evolving beyond trading.

3. Increasing Narratives of Solana

Games

Web 3 games/blockchain games have several advantages compared to traditional gaming platforms like Steam.

In Web 3 games, players have actual ownership of in-game assets and can trade or sell them outside of the game. These assets are stored on a fully transparent and secure blockchain. In traditional games, players do not truly own their in-game items as their value is limited to the game's ecosystem. In Web 3, due to interoperability between different games and platforms, players can use their assets across multiple games - theoretically without any limitations. This is interesting because even if a game shuts down, the assets do not disappear and may still hold value in other games, which is significantly different from traditional gaming.

Blockchains are typically decentralized and not controlled by a single entity. Their decentralized nature reduces power imbalances between players and game developers, promoting fairness and transparency in gameplay. Additionally, Web 3 games empower players through the concept of "play-to-earn," where players can earn real-world value by playing games and acquiring rare assets. These assets can be traded or sold, allowing players to monetize their gaming skills and time invested. In traditional games, only less than 1% of players can earn money through streaming, video editing, or becoming professional players. Web 3 games cater to 99% of users.

Star Atlas - Game on Solana

Star Atlas is an immersive role-playing game set in the vast universe. With the support of the Solana network, this game ventures into uncharted territory, introducing an innovative play-to-earn experience.

As a player, you can choose your own path and join one of the three renowned factions in Star Atlas.

Star Atlas has a marketplace where players can buy and sell resources and services both in-game and outside the game. Players can acquire items for ship missions and ownership of land for mining operations in the virtual world. The goal of Star Atlas is not only to create an immersive gaming experience but also to create a thriving economy built on blockchain technology.

Star Atlas accounts for over 5% of the daily trading volume on the entire Solana blockchain. Considering the current bearish trend in the cryptocurrency industry, the number of new participants is limited, making this achievement even more remarkable. Star Atlas has already cultivated a strong and dedicated community, which could experience significant growth in the next bull market cycle. The established core community holds immense value as a crucial asset for the game's future expansion and success.

Artificial Intelligence

Artificial intelligence systems can store and share data on the blockchain because it provides better data security and privacy. The blockchain creates a necessary environment for transparency and accountability, making the output of artificial intelligence more trustworthy. Additionally, blockchain can incentivize data sharing and collaboration through tokenization and reward mechanisms, just like it already exists in other use cases.

Although artificial intelligence has the potential to become one of the main driving factors for blockchain adoption, most blockchains are either too expensive, lack the scalable infrastructure to support strong demands and activities, or both.

Due to the abundance of available tools, libraries, and mature ecosystems, languages such as Python and R have gained wider usage in the artificial intelligence community. On the other hand, Rust's high performance and interoperability may make it more suitable for intensive tasks. Additionally, Rust's ecosystem is rapidly evolving.

Among existing blockchains, Solana is the largest network built using the Rust language. Moreover, Solana is the fastest blockchain in the crypto ecosystem, making it highly attractive for high-intensity use cases. Interestingly, projects like Helium and Render have migrated their ecosystems to Solana due to its speed, low cost, and good composability, and the DePIN story is thriving on Solana.

Solana is laying the foundation for artificial intelligence

Solana possesses scalability, low transaction fees, and quick confirmations. It is the most powerful blockchain while also being the most cost-effective. Solana has a rapidly growing developer ecosystem, and certain use cases are only possible on Solana. Furthermore, it is one of the most active and resilient ecosystems in the cryptocurrency space, having weathered the FTX crash and bear market thus far.

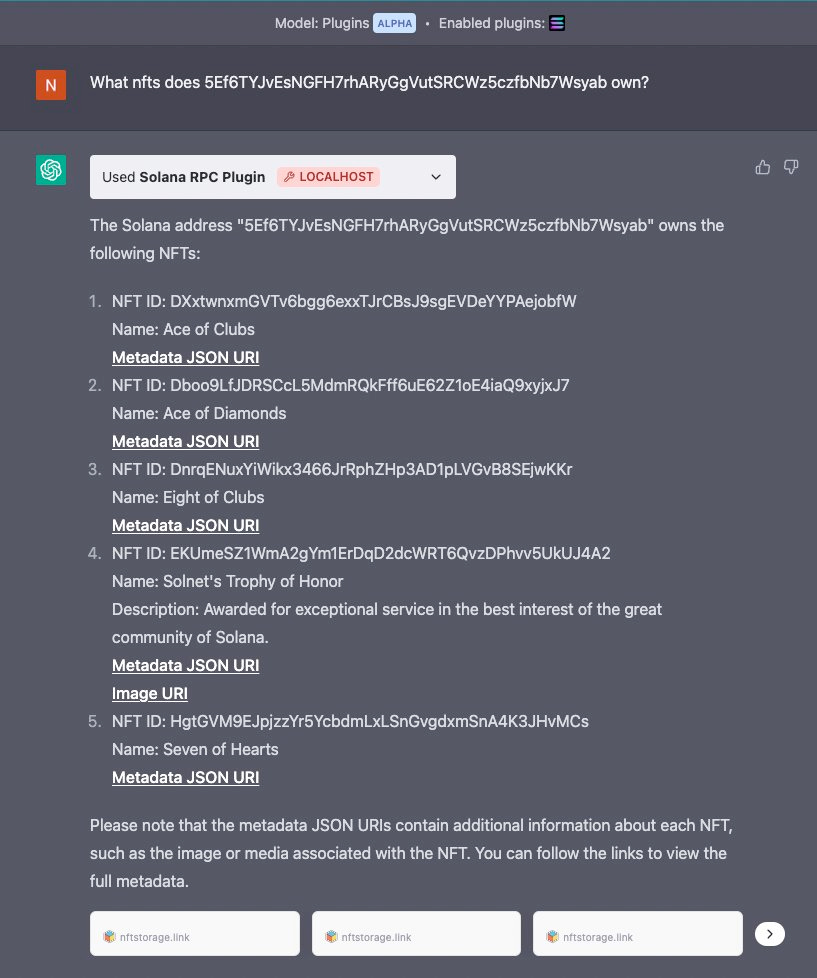

ChatGPT Plugin

The Solana Foundation is laying the groundwork for the development of artificial intelligence. Recently, @solanalabs introduced the ChatGPT plugin to enhance user interactions. Users can view wallet balances, make transfers, and purchase NFTs using the plugin.

Artificial Intelligence Funding Program

Solana Foundation has created a $10 million funding program for artificial intelligence to encourage the development of blockchain and AI integration on Solana. The program received over 50 applications in its first week. Additionally, a three-month accelerator program has been established for university students, with a focus on blockchain and AI experiments.

Hivemapper, a DePIN project based on Solana, has launched AI Trainers which convert real-world images into digital maps, enabling 5.7 million AI training reviews and consensus on 500,000 objects.

Render Moves Key Technology from Polygon to Solana

As the narrative around artificial intelligence strengthens, developers are increasingly seeking an ideal ecosystem to build upon. In May, as a result of governance voting, Render (RNDR) moved its Burn-and-Mint mechanism from Polygon to Solana. Render has been the top-performing project of 2023 so far, largely due to advancements in artificial intelligence.

RNDR, developed by OTOY, is a blockchain-based project aimed at transforming cloud rendering and distributed computing through the creation of a decentralized rendering node network.

The increased demand for graphics rendering solutions coupled with the global GPU shortage has exacerbated the complexity of the supply chain. In this context, Render emerged as a decentralized computing solution, providing a cheaper and faster alternative to traditional rendering methods. By leveraging distributed computing power, Render democratizes high-quality rendering and holds particular value in the context of the growing Metaverse vision. For these reasons, many consider Render to be the most important AI token.

IV. Ecosystem News

Helium completes migration to Solana

Helium, a leading decentralized IoT connectivity provider, has completed its migration to the Solana blockchain. This transition is expected to leverage the powerful capabilities of Solana's lightning-fast and low-cost infrastructure, providing the Helium ecosystem with enhanced performance, scalability, and security.

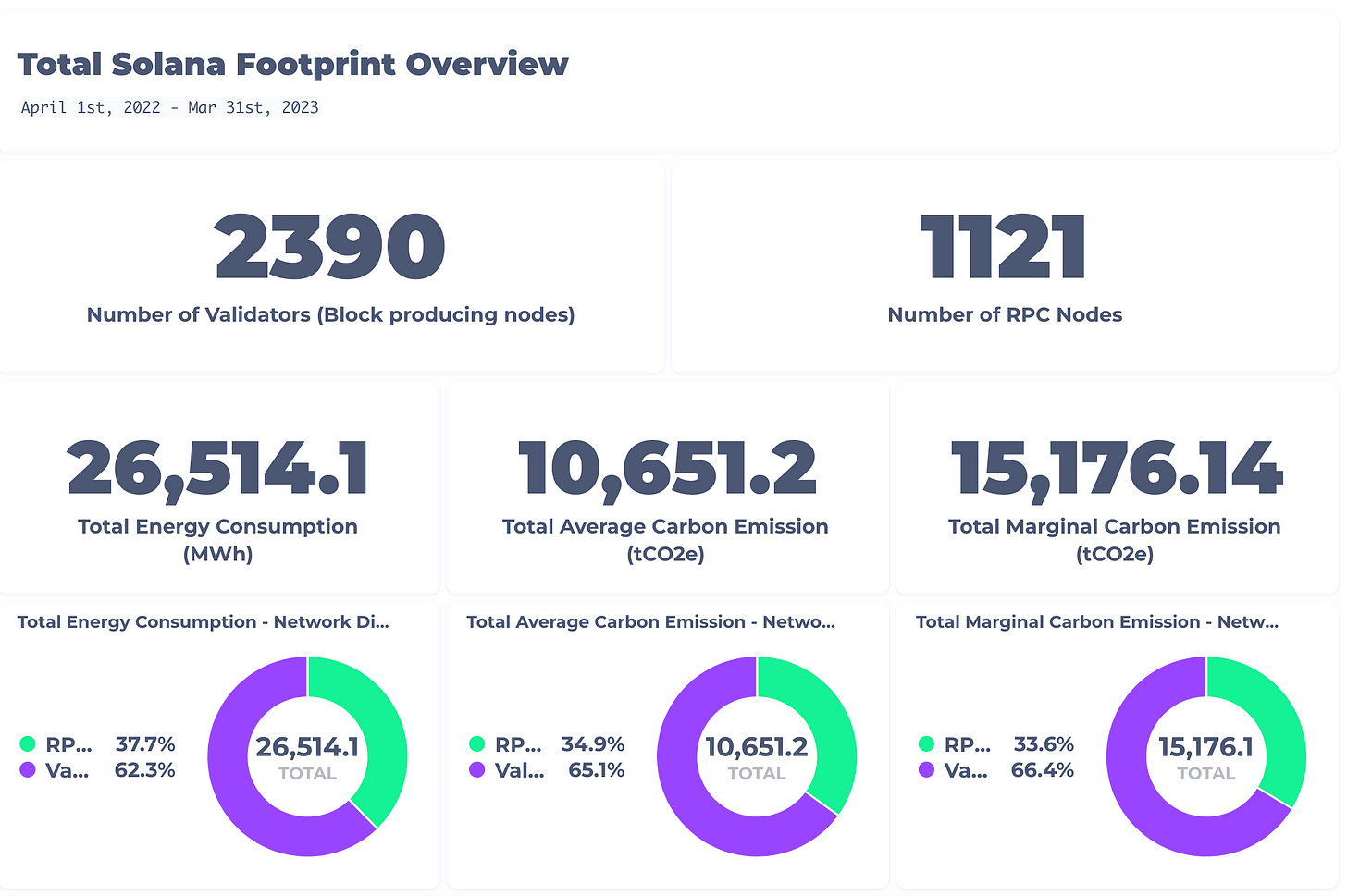

Solana releases dashboard to track real-time emissions

Solana Foundation leads the way by making Solana the first smart contract blockchain to track real-time carbon emissions.

This emissions monitoring system was created in collaboration with the carbon data platform Trycarbonara and integrated directly into Solana nodes, providing the most detailed and accurate measurement of blockchain carbon footprint to date. The measurement fluctuates based on the throughput of each validator, their online and offline status, and changes in validator composition.

Grayscale Launches Solana Trust GSOL

Grayscale has launched the Solana Trust, with the code GSOL.

Since November 2021, the trust fund has been offered privately to qualified investors. As of April 14, 2023, the number of GSOL shares issued is 304,427. As per Section 144 of the Securities Act of 1933, shares issued through private placement will be eligible for sale on the public market after a mandatory holding period of one year.

Like other securities, investors with the right to purchase U.S. securities can freely trade GSOL shares through their investment accounts. Grayscale's launch of GSOL brings several advantages to the Solana ecosystem. The visibility and credibility of the Solana network have been enhanced, attracting a wider range of investors, including institutional investors. Additionally, it can be reasonably expected that market liquidity will improve, potentially leading to better performance and reduced volatility.

World's Largest NFT PFP Series Launches on Solana

Drip is a Solana-based project that aims to provide digital gifts from renowned creators for free. It is a key participant in the largest NFT PFP series launched on Solana, with a total of 350,000 NFTs airdropped to users.

The "The Faceless" series has achieved success in the Solana ecosystem. The secondary market for this series has seen thousands of unique buyers making nearly 100,000 purchases, highlighting its appeal to both experienced Solana users and new users.

Conclusion

As Helium, Hivemapper, Render, and other projects consolidate their presence on Solana, the development of DePIN is gaining momentum. The Solana ecosystem remains firmly committed to the NFT-DeFi narrative, which has proven to be a significant driving force, accounting for 40% of daily transaction volume in the NFT ecosystem. Overall, the Solana ecosystem continues to push the boundaries of innovation, and its community has become one of the most resilient communities in the crypto ecosystem.