Parcl is an RWA platform on the Solana blockchain: How does RWA change real estate investment? Attached is a comprehensive guide on how to use the entire process.

This article was published by Long "Leo" Pham@CASTELIAN on Solana Superteam Substack Blog, and won the prize in the Solana Superteam Reward Research Report Submission Activity. Follow Solana Superteam Blog for the original information.

Parcl is a Web 3 real estate investment platform that allows anyone to invest in real estate assets with as little as $1. Through this platform, users are allowed to access investment opportunities in the entire US housing market by investing in a similar way to REITs.

This article attempts to explore the market background and feasibility of Parcl's business model, and introduces the Parcl v2 product. This article is from The Superteam Blog and translated by Odaily.

Market Background

REITs

REITs (Real Estate Investment Trusts) have been around for a long time. According to the definition by Investopedia, REITs are companies that own, operate, or finance income-generating real estate. Similar to mutual funds, REITs pool capital from multiple investors, allowing individual investors to invest in the real estate sector without having to buy, manage, or finance any properties.

REITs can be invested in through public or private channels, and can be invested in through equity and/or mortgage loans. However, for retail investors, investing in REITs through public equity is the most common way to access real estate investment opportunities.

Fragmented Ownership

In addition to owning properties outright, individual investors can also gain exposure to real estate assets through fractional real estate investments. This allows multiple investors to collectively share the costs of owning real estate. Fractional ownership gives them a stake in the real estate and makes them partial owners.

Fractional real estate investments come in different forms. Sometimes investors receive contracts and shares of the property; other times, people can purchase shares of the property and have it managed by a management company. In some cases, fractional ownership rights allow its investors to stay at the property for a portion of the year as a vacation home. In other cases, investors can invest in properties without actually occupying them and benefit from renting them out through platforms like Airbnb.

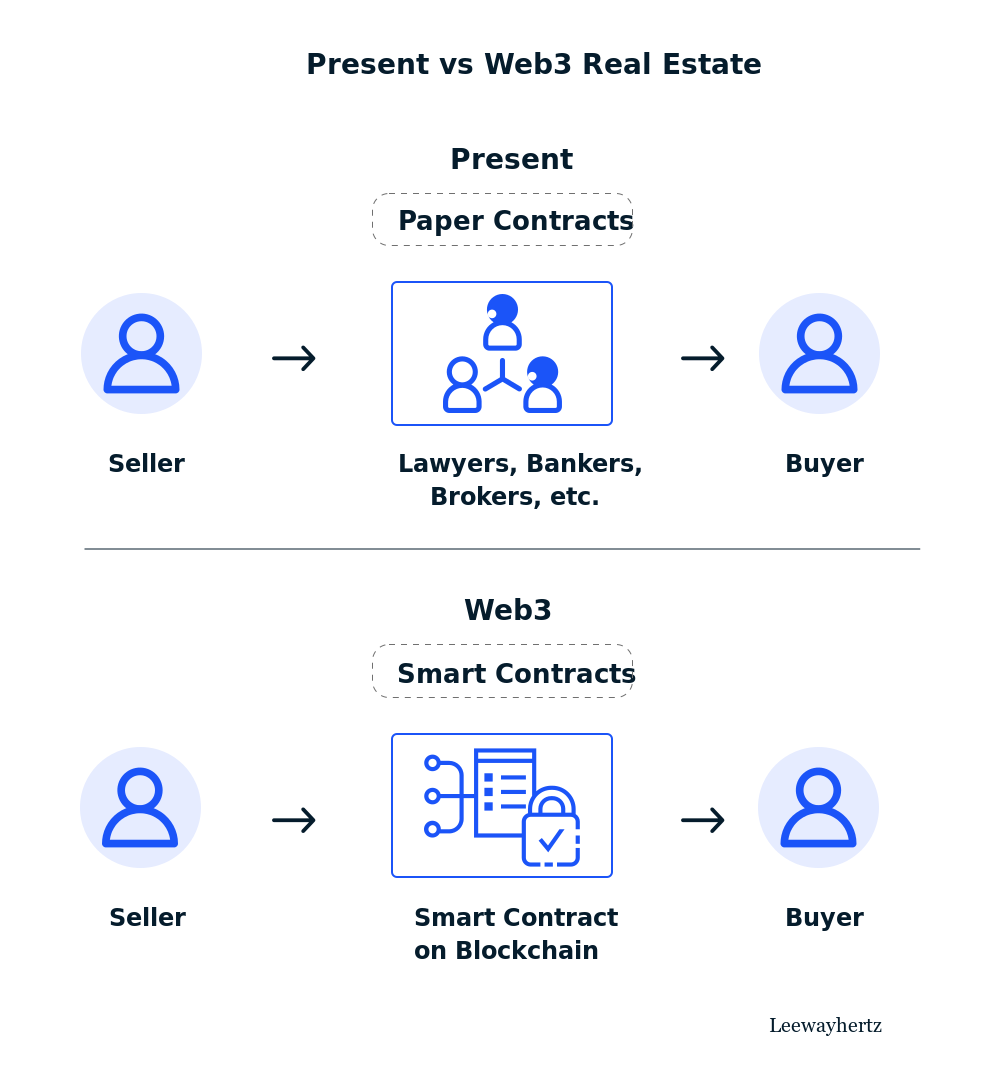

Blockchain Investment

Expanding from the concepts of REITs and fractional ownership, many web 3 companies are attempting to provide access to real-world assets (RWAs), particularly in real estate, by leveraging blockchain technology.

Here are some basic use cases of blockchain in real estate investment:

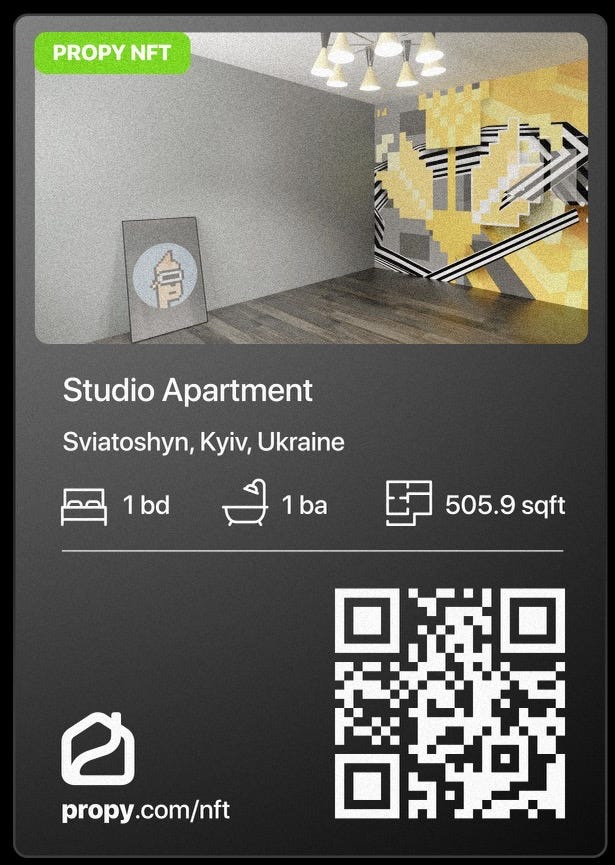

Propy is one of the early companies that attempted to use blockchain for real estate auctions. In 2021, Michael Arrington, co-founder of TechCrunch and Arrington XRP Capital, tokenized his apartment near Kiev, Ukraine into an NFT and sold it at an auction for 36 ETH.

Fraction is another example, where the company allows retail investors to purchase partial ownership of specific properties at a predetermined price. The offered real-world assets range from beachfront villas, top-floor apartments, electric vehicle charging stations to luxury yachts, which means it's not limited to real estate alone. Currently, the company operates only in Thailand and does not allow access to its products for U.S. citizens.

Another example is HomebaseDAO, a tokenization platform for real estate contracts on Solana. It allows individuals to tokenize their properties on Solana and purchase partial ownership as NFTs using smart contracts tied to NFTs. They have successfully tokenized the ownership of a house in South Texas. The property is valued at $235,000, but Homebase managed to raise $246,800 (in terms of USDC) for the property.

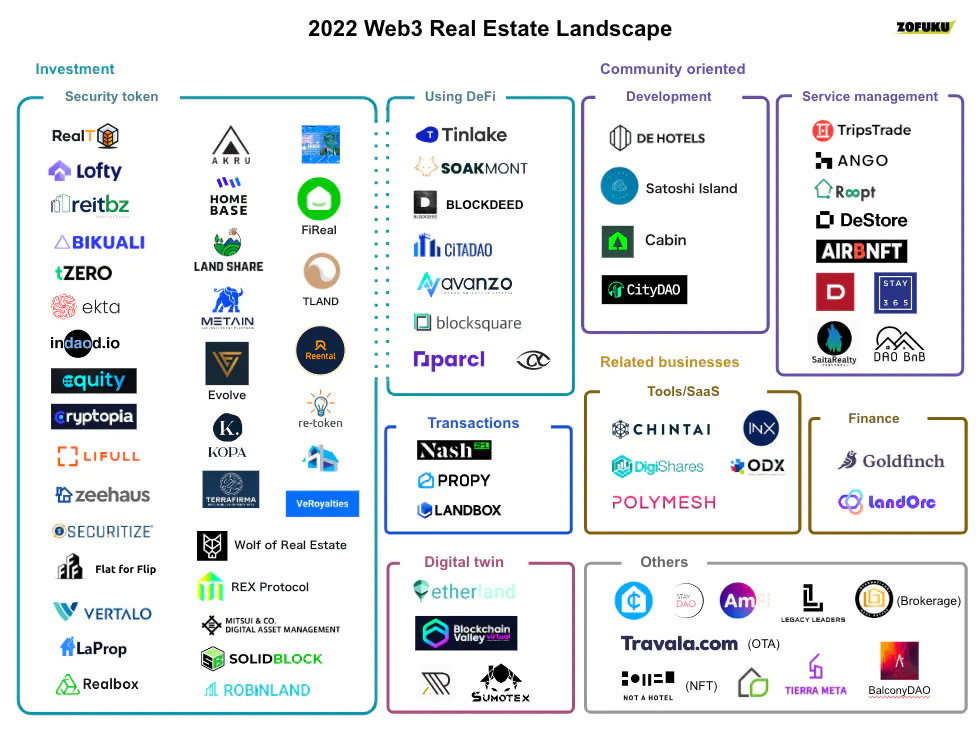

These are some recent and related examples of Web 3 real estate companies and their practices:

About Parcl

Parcl is a Web 3 real estate investment platform that uses blockchain to address the current bottlenecks in real estate investment and bring the world's most popular real-world assets into the blockchain.

In May 2022, Parcl announced a $7.5 million funding round, with participants including Archetype, Dragonfly Capital, Shima Capital, Solana Ventures, Not Boring Capital, and FJ Labs, among other well-known institutions.

The Parcl Model

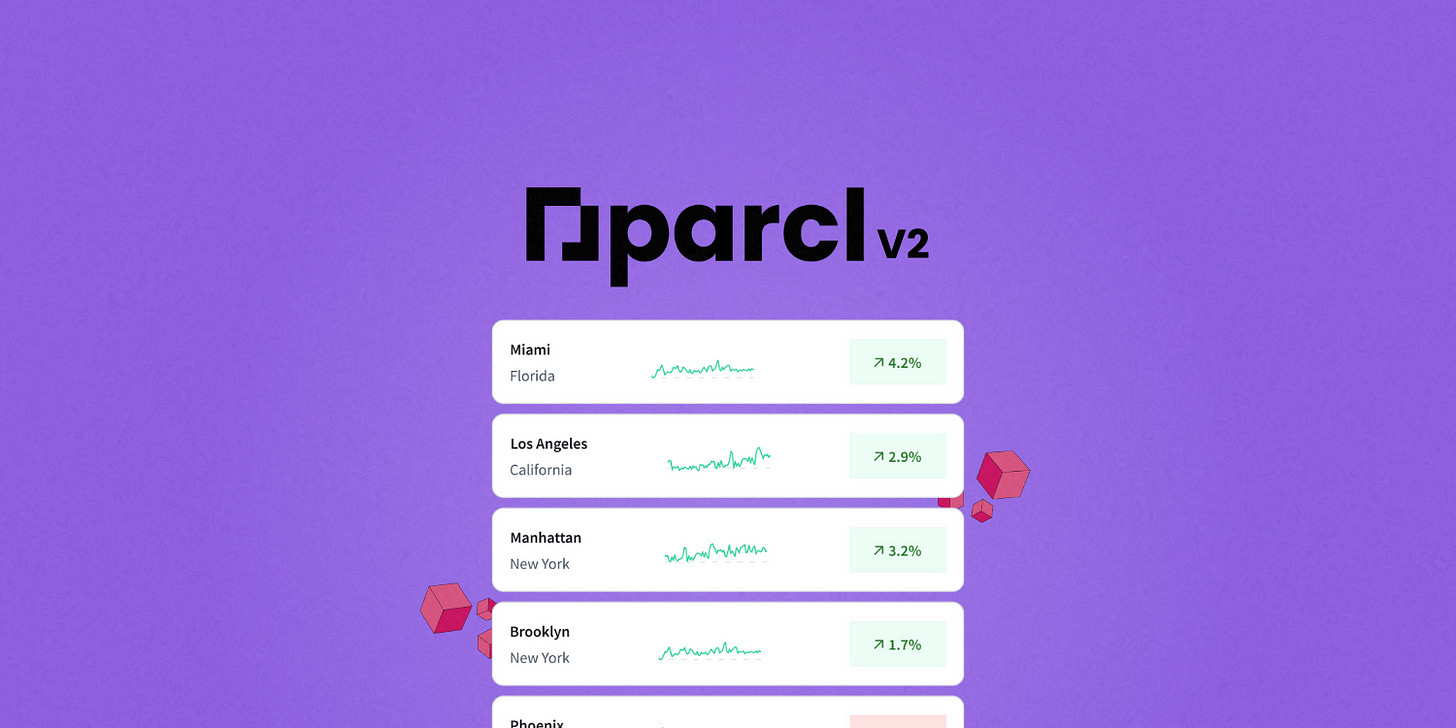

The Parcl model is completely different from other models. Most importantly, Parcl allows users to invest in communities and cities, rather than specific buildings. Its index acts as a REIT-like index system, representing the residential real estate market of a city.

The protocol developed by Parcl allows users to invest in digital square feet of real estate in communities around the world. It achieves this by allowing the creation of synthetic "Parcls" that are associated with the average price per square foot/meter in a specific community. In simple terms, each Parcl index represents the median price per square foot/meter in a specific geographical location and can be freely traded in the platform's liquidity pool. With over 10 million data points collected by Parcl every day to provide accurate pricing, precision can be improved.

In theory, this concept is highly applicable for retail investors seeking high liquidity assets and broad diversification, especially in the real estate field or more broadly, RWA (Real World Assets). It eliminates the specific risks associated with owning real estate in a particular area, which can be troublesome during market downturns, such as the post-COVID period. It also significantly reduces entry and exit times and allows users to actively manage their investment portfolios.

Parcl is also suitable for investors seeking global opportunities. It focuses on entire communities within the best-performing cities in the world, including New York, Miami, and Los Angeles, and will soon offer international markets such as Paris, London, and Singapore. Retail investors can invest in multiple cities simultaneously by predicting market trends in both directions.

Parcl Protocol v2

To understand how Parcl works, it is necessary to understand the protocol that drives it. Here is a brief introduction to it.

Definition

Definition Parcl v 2 is considered an automated market maker (AMM) for perpetual synthetic assets, combining the best features of traditional AMMs and synthetic asset protocols to generate efficient and simple synthetic asset AMMs.

AMMs use algorithmic "money robots" to allow individual traders to buy and sell crypto assets easily. Users do not directly trade with other individuals like in traditional order book exchanges, but instead transact directly through the AMM exchange smart contract protocol, which uses mathematical functions for price discovery.

"Synthetic assets," also known as tokenized derivatives, are records of the relationship between underlying assets and buyers. In traditional finance, derivatives represent stocks or bonds that traders want to trade without actually owning them. Synthetic assets, or tokenized derivatives, further develop this process by adding the record of the derivative to the blockchain and actually creating a cryptocurrency token for it. Synthetic asset protocols generate smart contracts that manage this record and token system.

Key features

Isolation Pool

Ability to Pay

Price Execution

Zero Credit Risk

Optional Liquidity Provision

Skew Management

Delayed Settlement

Detailed information about these features can be found in the whitepaper and applied to the Parcl application we will introduce later.

Advantages

Some benefits of conducting synthetic asset transactions using Parcl v2 include solvency, zero credit risk, capital efficiency, and executing transactions at oracle prices. Furthermore, Parcl v2 ensures solvency and zero credit risk for users through its unique liquidity token accounting model. The model considers pool ownership and position profit and loss accounting, and settlement of all closed positions is conducted using liquidity tokens. This means that all traders become implicit liquidity providers (LPs) when opening positions and explicit LPs when closing positions. This mechanism incentivizes solvency because traders do not receive payment in dollars for every dollar of collateral value.

The Parcl v2 protocol also strives to minimize governance, primarily due to fewer risk parameters compared to other competitors. Pool management can be configured as permissionless, and liquidity provision is always permissionless.

Limitations

Currently, Parcl v2 only supports asset price sources that do not support liquid trading markets. Future development in slippage and other protocol functionalities will allow the protocol to be used with any asset price source.

In terms of governance, there are certain areas that are not configured as permissionless. For example, only the protocol administrator can create new pools if the pool creation is not set as permissionless.

Understanding the Platform

Parcl DApp is built on the Parcl v2 protocol and can be accessed publicly here. In this section, I will try to introduce the functionality of Parcl DApp.

Solana Wallet

When browsing the DApp, there is no need to connect the Solana wallet, especially on the "explore" and "trade" pages. Only when you want to start investing, you need to connect the Solana wallet to Parcl DApp.

Currently, Parcl DApp supports Backpack, Phantom, Solflare, and Ledger wallets.

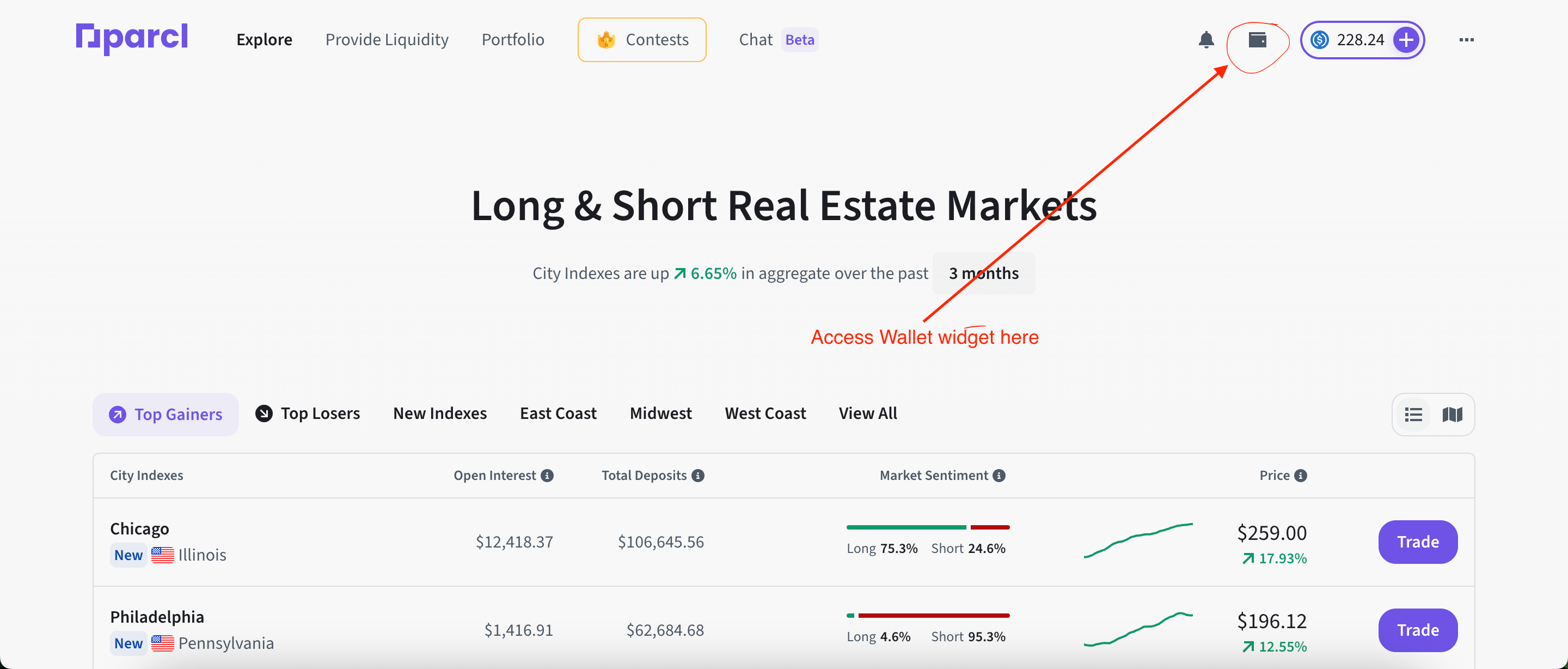

Explore

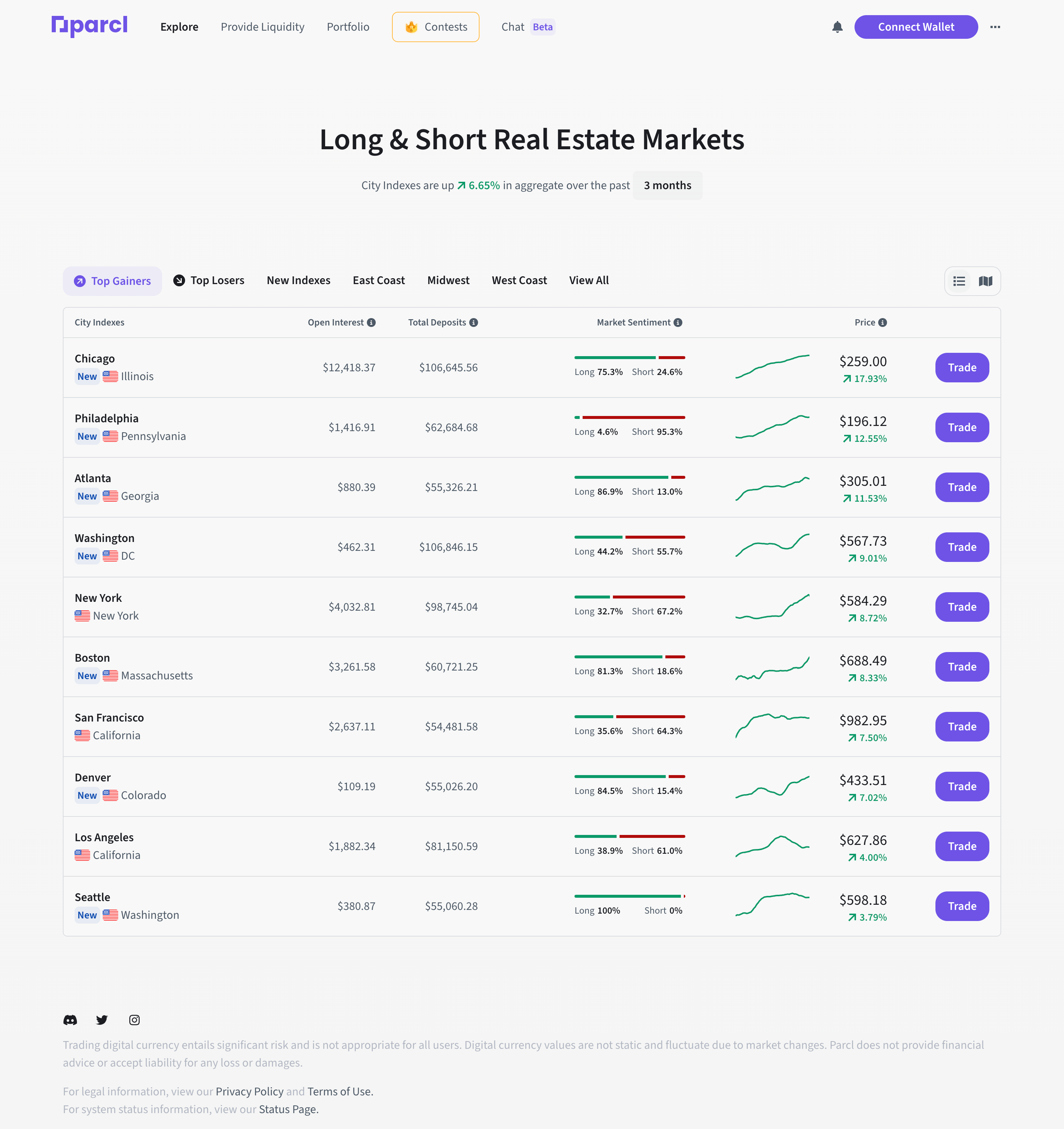

This is the default homepage of the application.

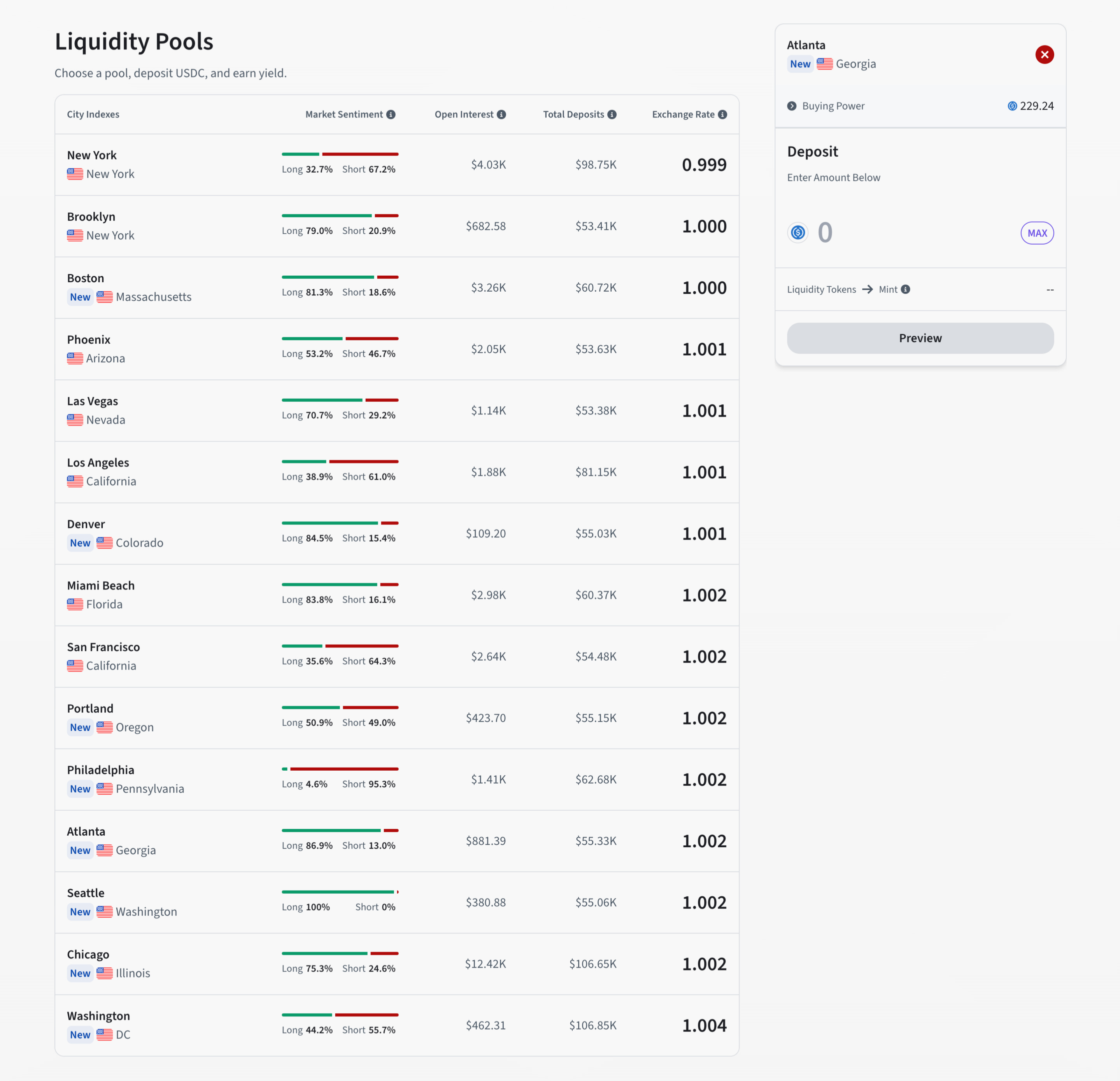

When writing, Parcl provides access to most of the top real estate markets in the United States, including New York, Boston, Philadelphia, San Francisco, Los Angeles, Washington, Chicago, Atlanta, Seattle, Denver, Las Vegas, Miami Beach, and Phoenix.

Users can sort the indices by the largest/smallest percentage change, new indices, and geographic location (East Coast, West Coast, Midwest). Clicking on "View All" allows users to see all indices, not just the few listed in the front.

Each index provides detailed statistical data, including open contract prices, total deposits, market sentiment (ratio of long positions to short positions), and prices. There is also a "trade" button that redirects to the trading page for that particular index.

Trading

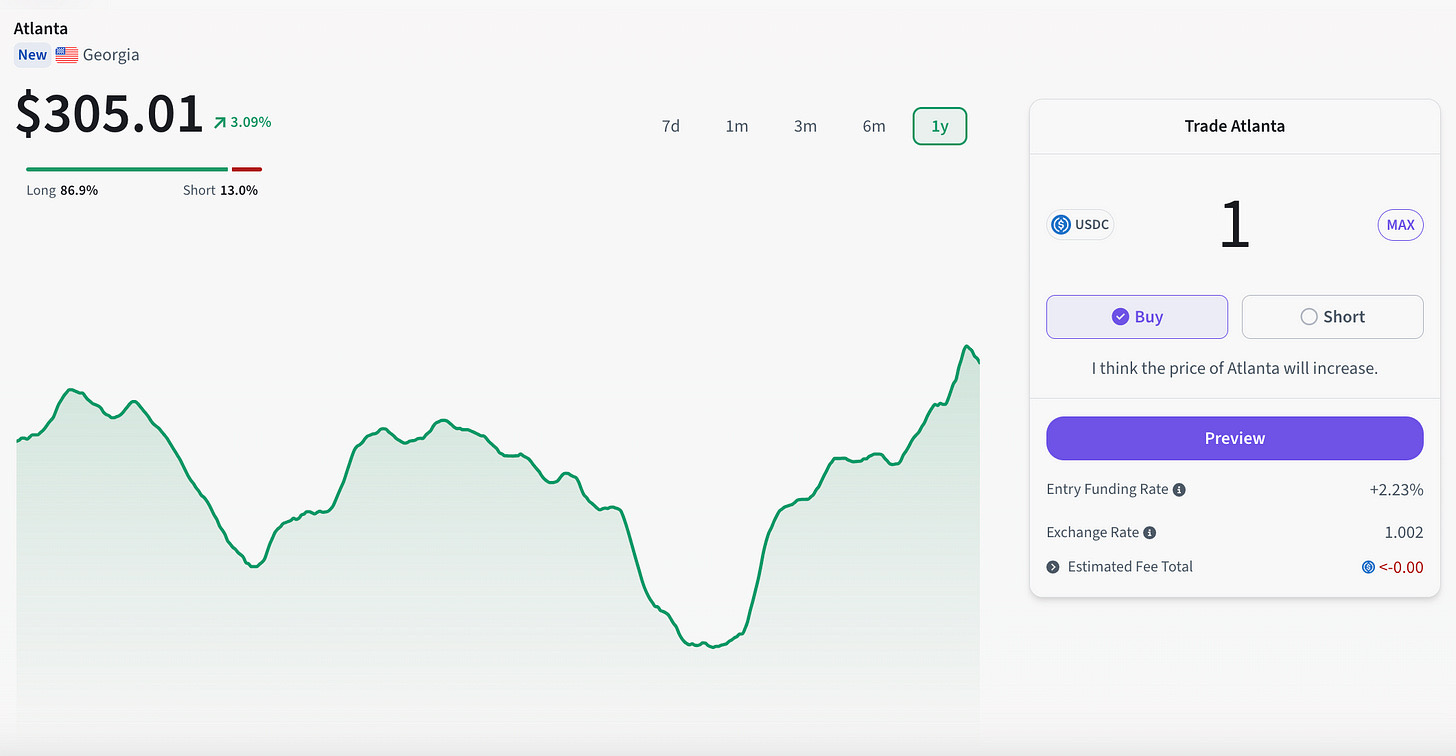

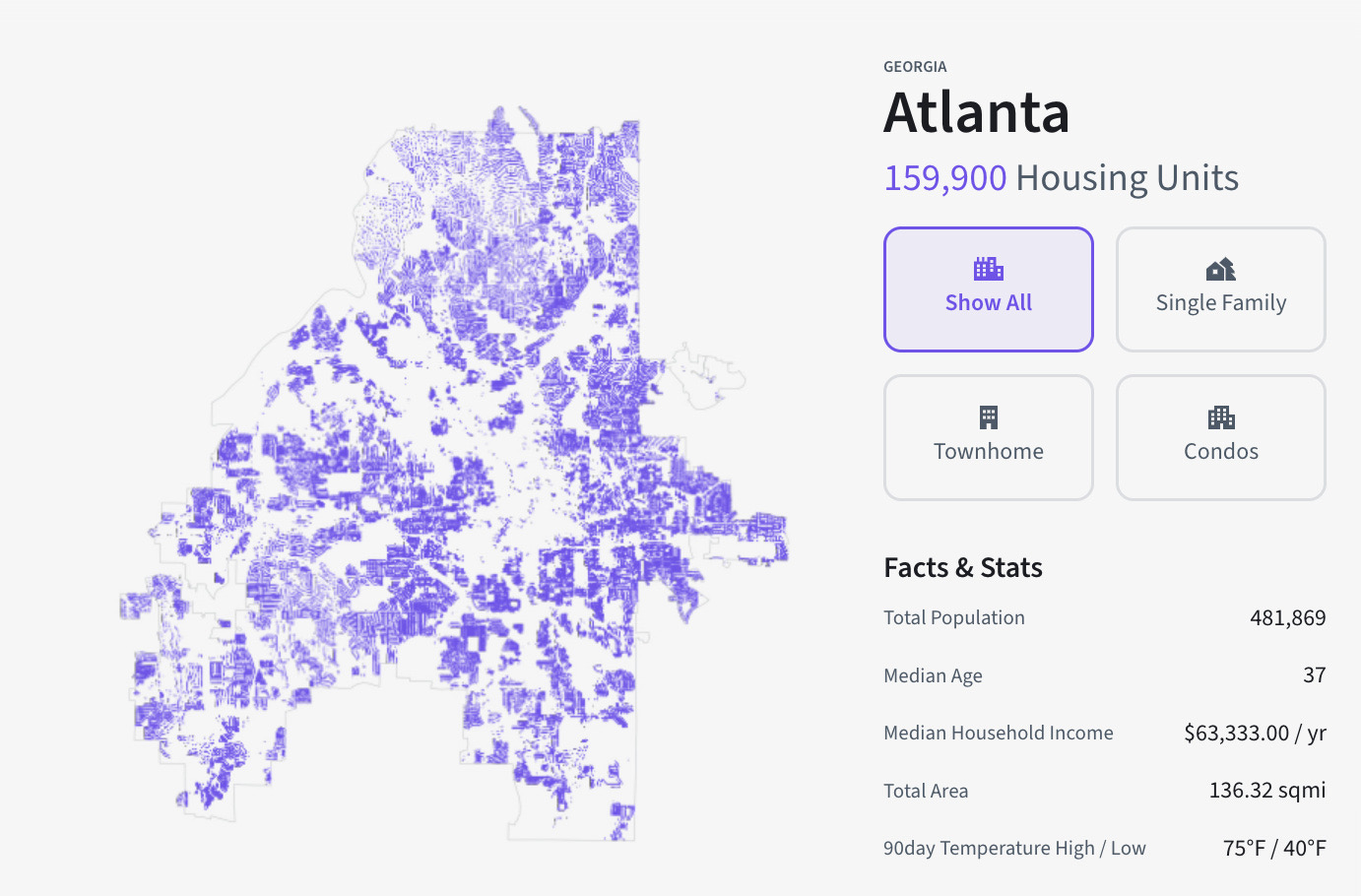

After clicking the "trade" button for any index, users will be directed to the trading page for that index. For example, this is the view in Atlanta:

I set the time period to 1 year, so the chart shows the trend of the Atlanta Index over the past year. Other options include 7 days, 1 month, 3 months, and 6 months. The floating trading widget on the right allows users to make long or short trades, which we will discuss in more detail later.

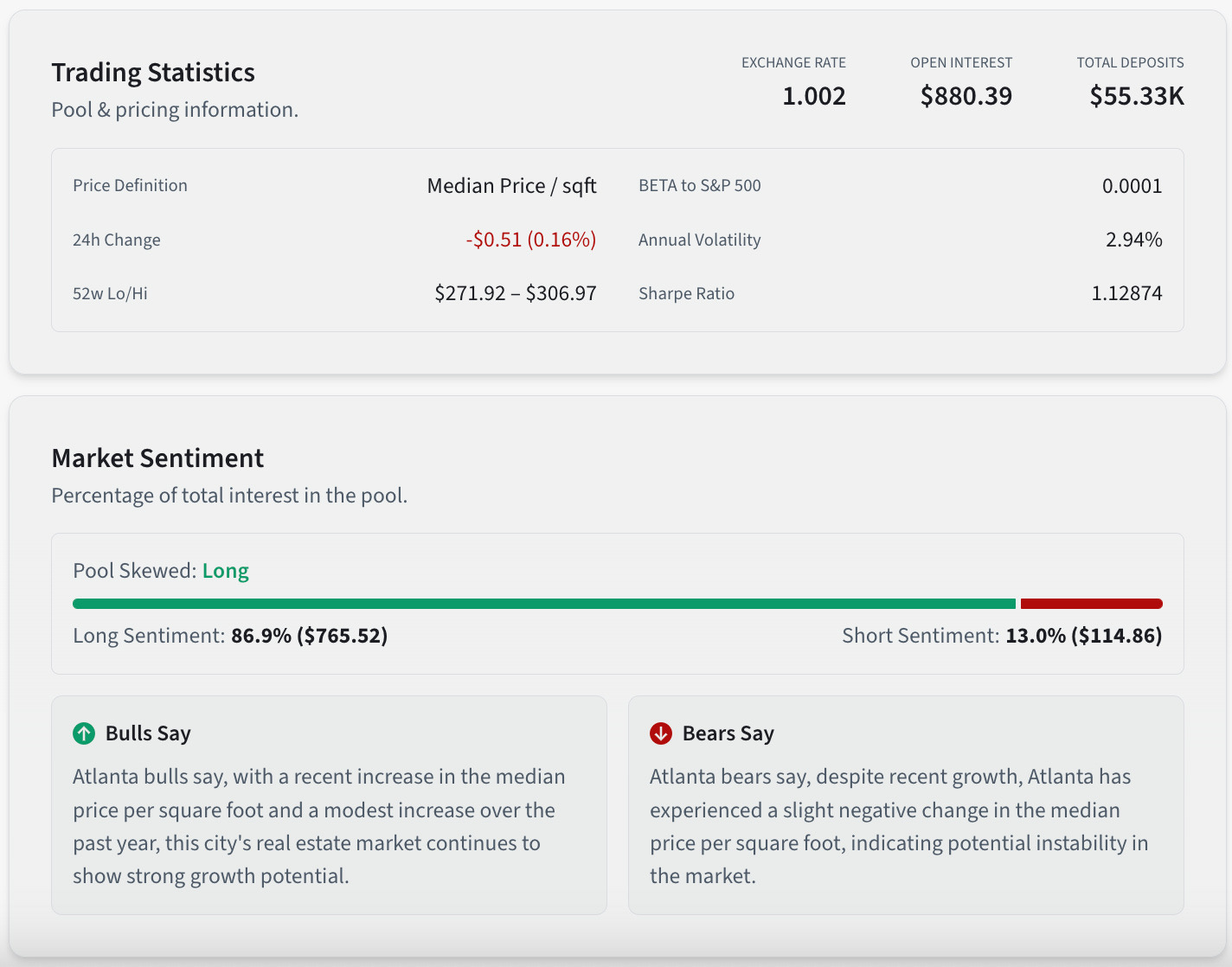

As we scroll down, we can see more data about the index:

The Parcl DApp provides users with all the data related to this index, including key trading statistics (similar to buying real estate investment trust stocks on stock exchanges) and market sentiment. This market sentiment feature is very interesting as it allows users to read arguments from both bullish and bearish perspectives.

Further down, there is a map of the Atlanta metropolitan area showing all housing units as well as basic facts and statistical data about this city.

This heatmap displays a series of properties, and users can filter them by type: single family, townhouse, apartment, or show all. The heatmap changes according to the applied filter conditions.

Key statistical data includes total population, median age, median household income, total area, and even the highest/lowest temperatures in the past 90 days (if you are concerned about the livability factors of a city, this data item may be important).

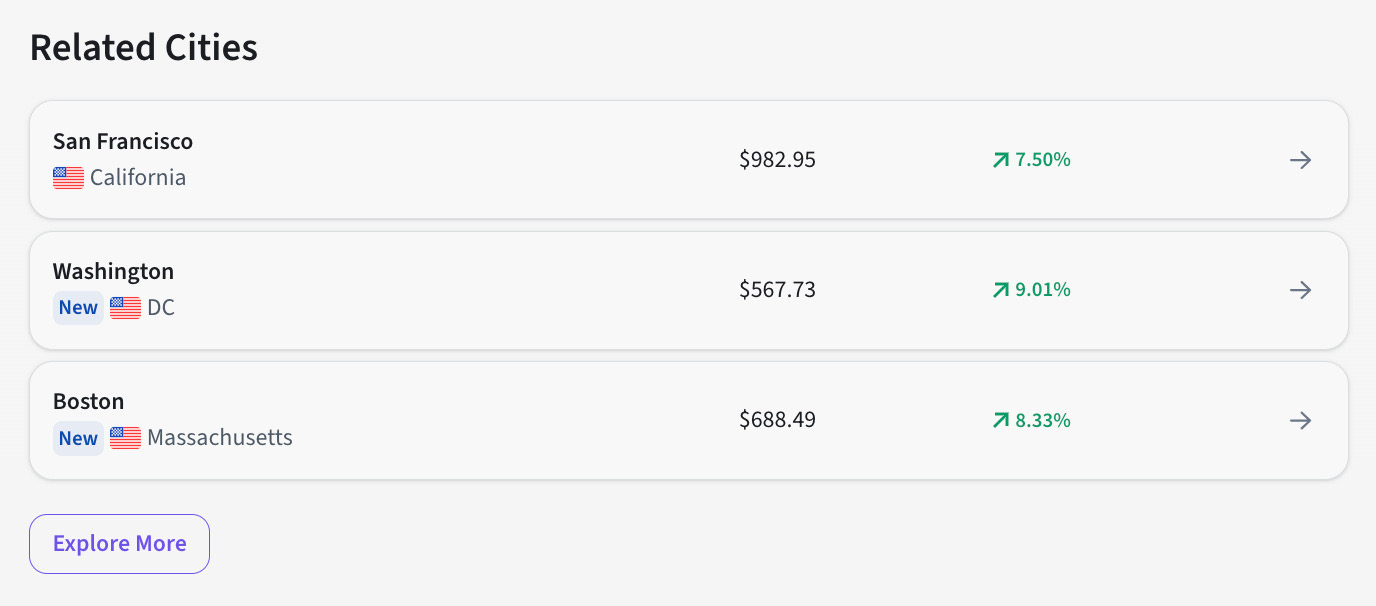

At the bottom, users can also view other related markets:

Geographical reasons are irrelevant to relevance, and the categories under this related entry are at the forefront of the index increase.

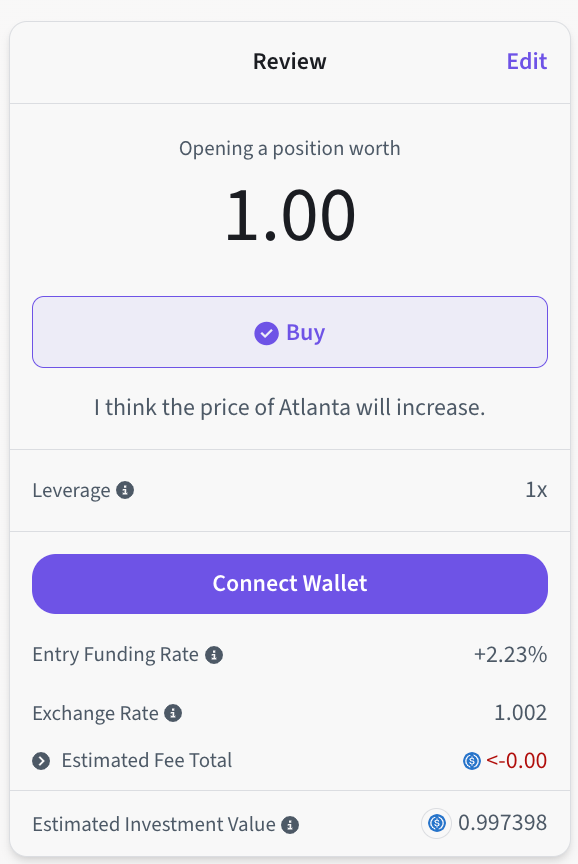

The "explore more" button will take us back to the explore page. Returning to the floating page, when users try to make a transaction, they need to connect their wallet:

There are other data available for viewing, such as leverage, trading fees, exchange rate (USDC-USD+++++++++++++++++++), and estimated costs. The estimated investment value is calculated based on these data.

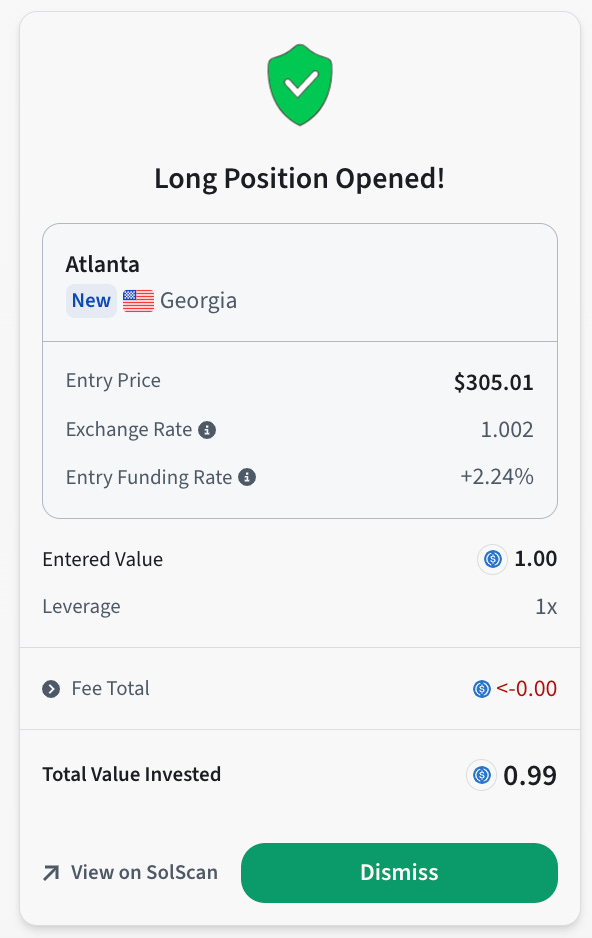

After submitting an order (in this case, a long order), users will be prompted to accept the transaction and pay some SOL as gas in their wallet. Then, the confirmation window will be displayed as follows:

You can use SolScan to view on-chain transfers, or simply close this window. The window will look like this:

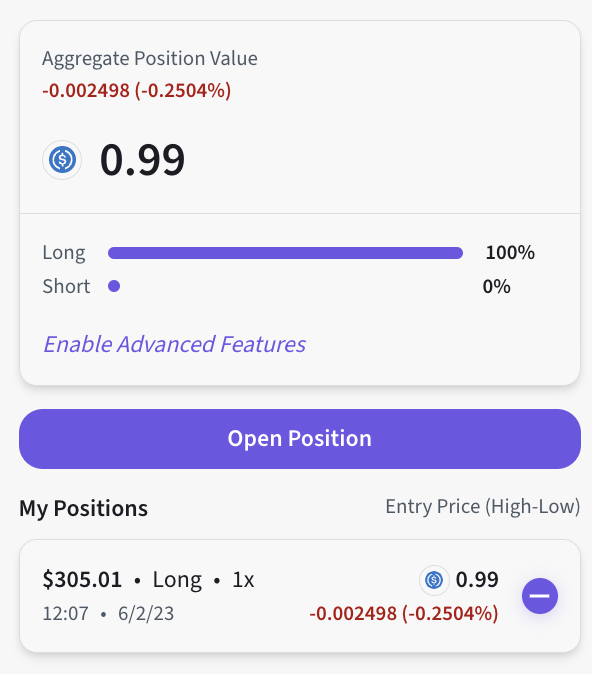

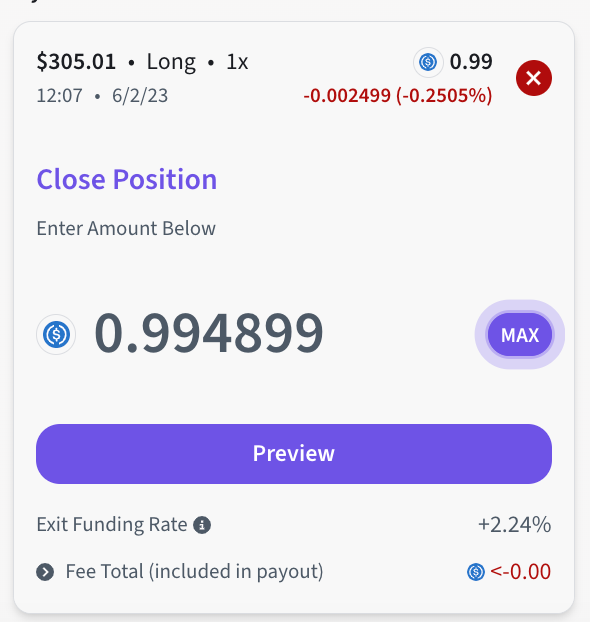

Clicking on "Open Position" will allow users to trade again. On the other hand, clicking on a position under "My Positions" will expand a panel, allowing users to close that position:

Liquidity Pool

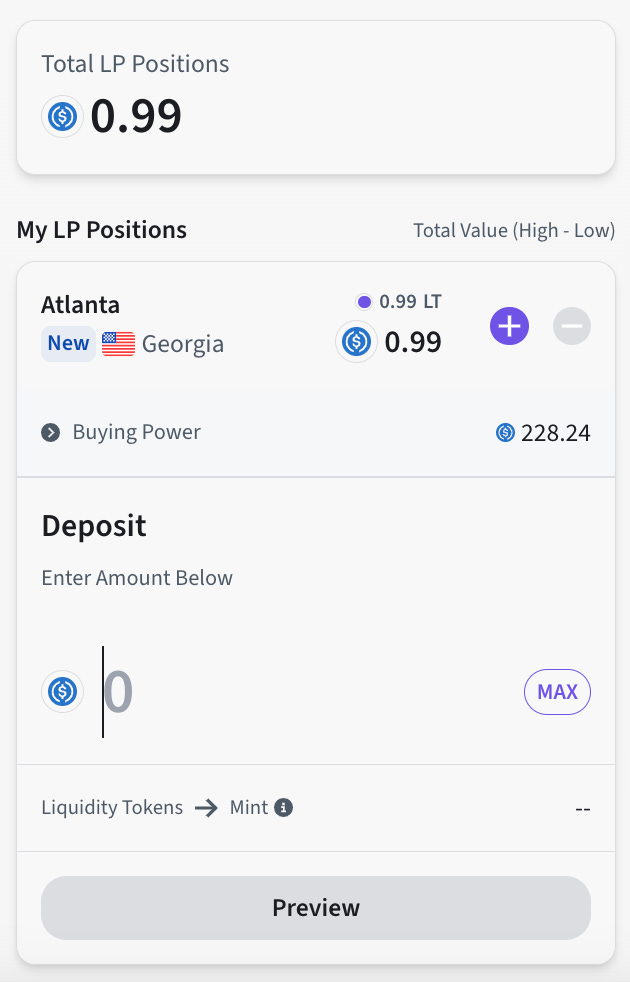

After successfully connecting your wallet and establishing a position, you can navigate to the Liquidity Pools tab. Let's consider Atlanta as an example again:

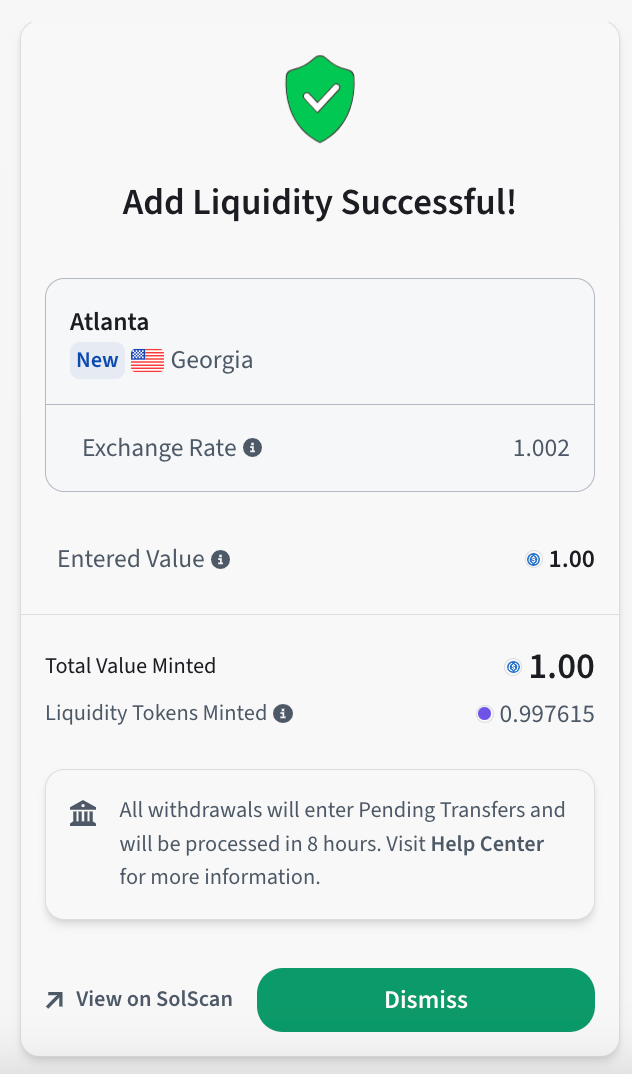

After viewing the order, clicking submit and approve the transaction in the Solana wallet, you will see the confirmation component:

Similar to the trading functionality above, after clicking "close", users will see an updated view where they can add or remove liquidity to/from the pool:

The "+/-" button will allow users to switch between depositing and withdrawing liquidity from the pool.

Portfolio

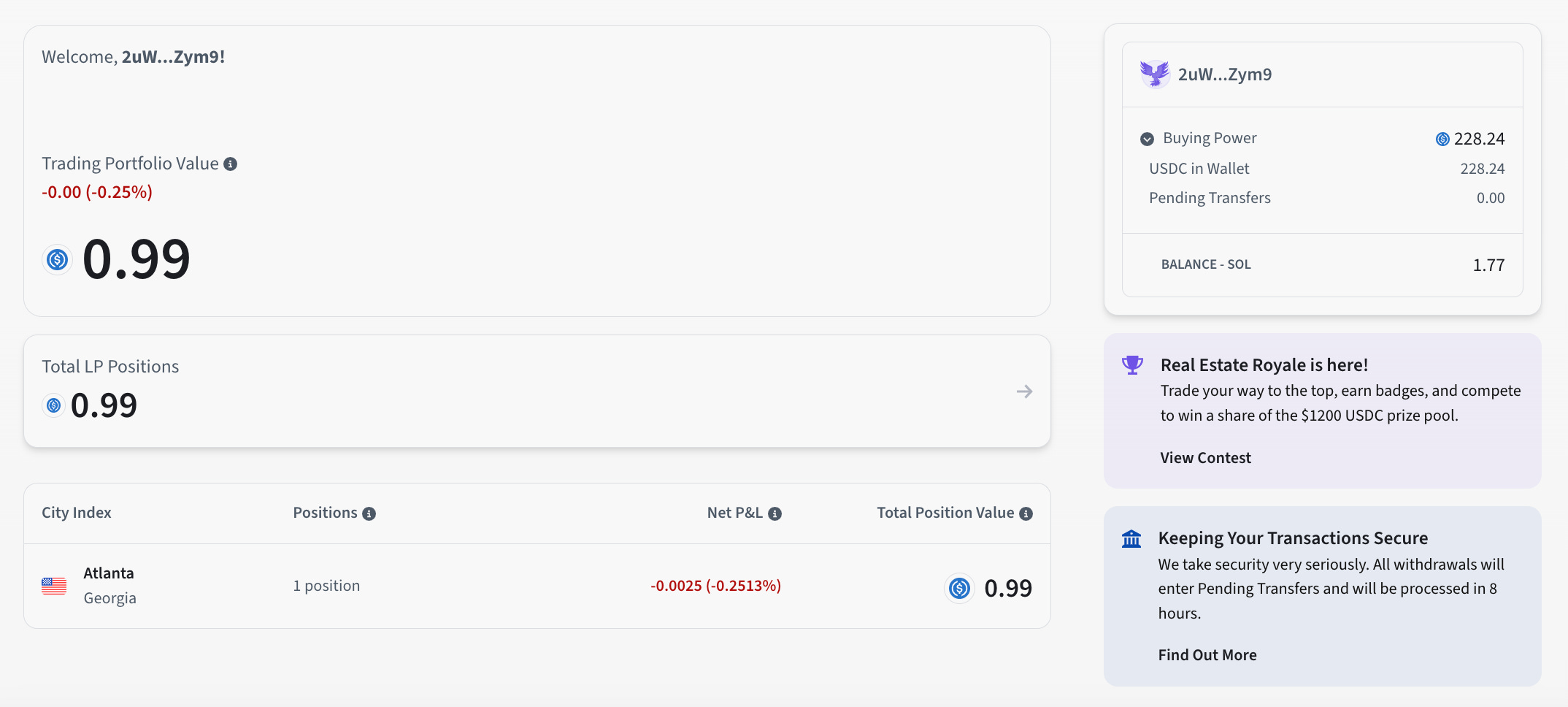

After opening a position and adding some LP, let's go to the portfolio page:

On the left side, users can see the total positions of long and short trades and LP. Clicking on the "Total LP Position" block will take the user back to the liquidity pool page, while clicking on any index's long/short position block will take the user back to the trading page for that index.

On the right side, users can see their buying power, which means the amount of USDC in their connected wallet and their SOL balance (used for trading gas fees).

Other Tools

Wallet Management

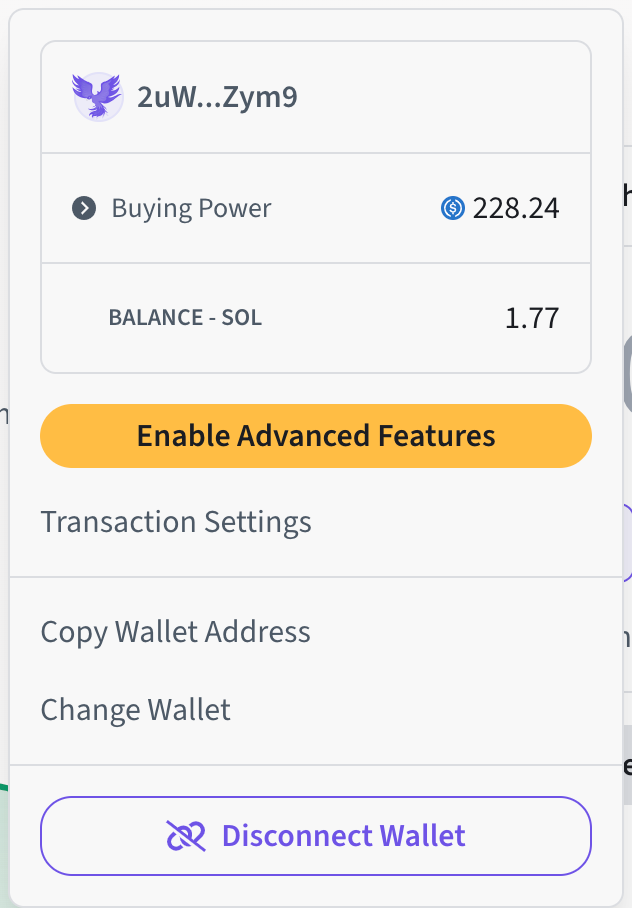

In addition to the portfolio page, users can also access their balances by clicking on the wallet icon in the top right corner of any page:

After clicking the "Wallet" button, the widget will drop down:

Here, you can view your purchasing power just like on the portfolio page. There are other features, including trade settings (for advanced users only), copying wallet address, changing wallet, and disconnecting wallet. Changing/disconnecting the wallet should only be used when you need to replace the currently connected wallet with a new wallet or log out of this wallet.

Deposit USDC

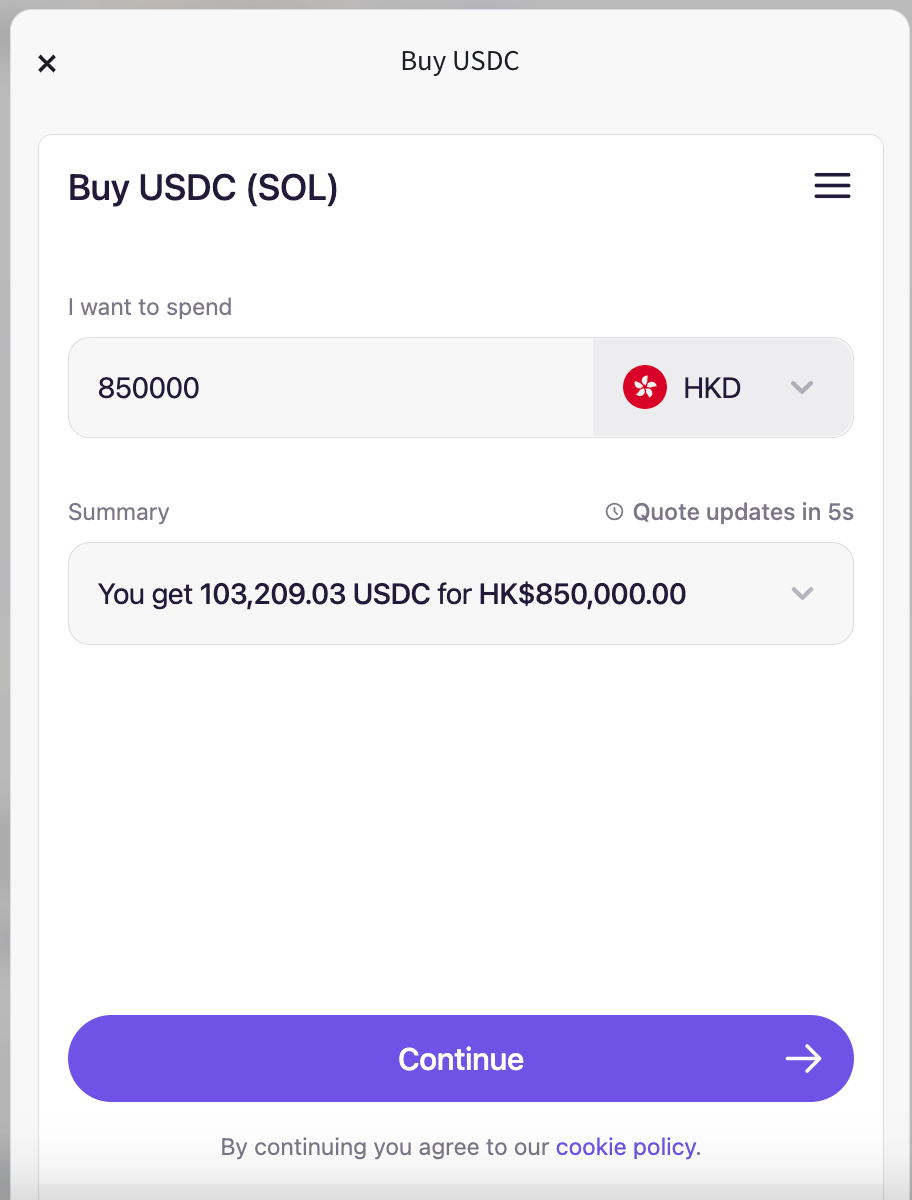

If you want to add USDC to your purchasing power, Parcl DApp allows you to purchase USDC within the DApp by clicking on the balance to the right of the wallet icon. After clicking, a window will pop up:

This feature is supported by MoonPay, a Web3 payment gateway that supports multiple currencies. Users need to undergo email verification and then enter personal details such as name, date of birth, address, and finally payment details (debit/credit card). Once completed, they can easily purchase USDC without having to re-enter this information.

Reminder

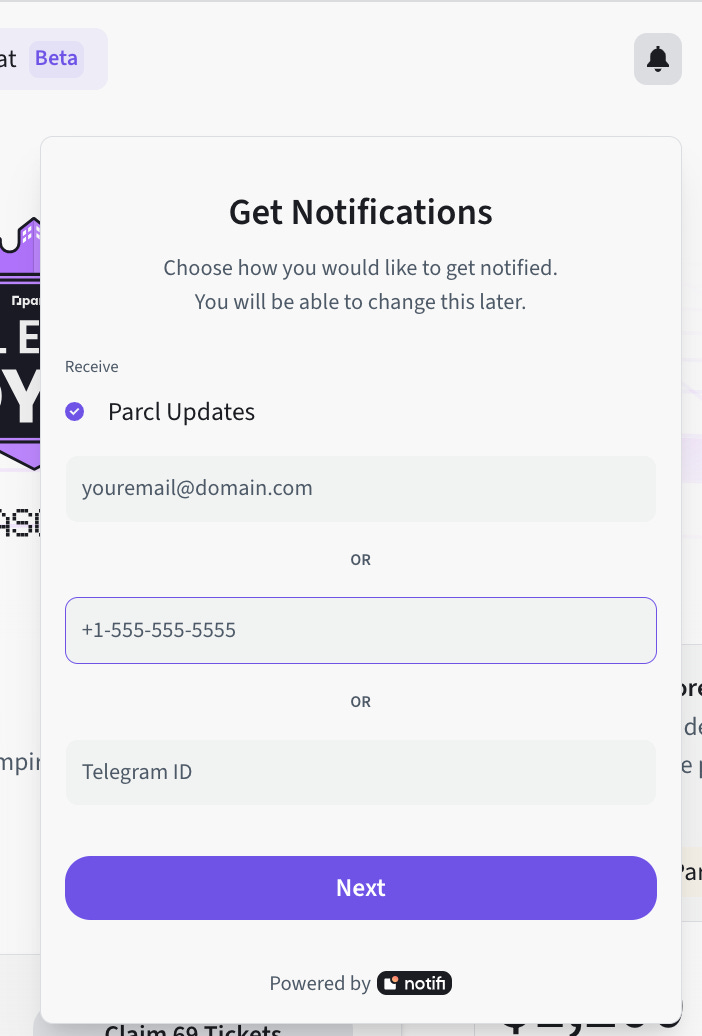

If users wish to receive updates on their personal social accounts, they can also register for notifications. Clicking on the bell icon next to the wallet icon on the right will open a dropdown window. Users need to approve this operation in their wallet before accessing it.

Users can choose to receive notifications via email/phone number/Telegram. After completion, users can return at any time and manage notification settings. (For Telegram, additional authentication steps are required.)

Chat (Beta)

This beta feature is essentially driven by AI assistant ChatGPT, which allows users to query information about Parcl products, features, and general market insights. It currently supports multiple languages such as English, Chinese, Hindi, etc.

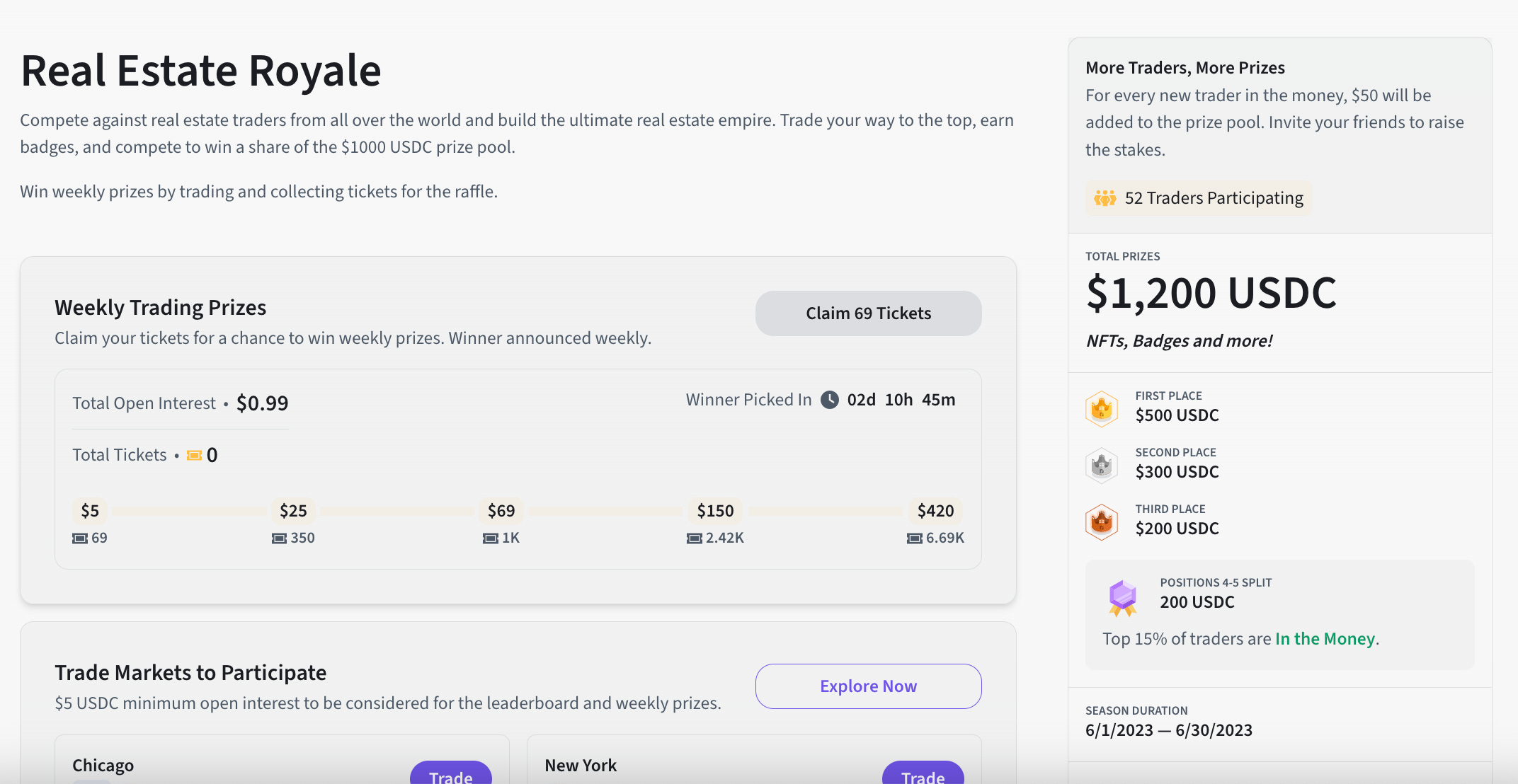

Trading Competitions

Users can also access the competition page and participate in trading activities on Parcl. People can compete with other Parcl users to win prizes including cash (USDC) prizes, NFTs, badges, etc. People can also view competition prizes, time periods, rules, weekly statistics, and leaderboards. However, "Maximize Your Potential" is only applicable to advanced users. At the time of writing, the activities of Real Estate Royale Season 3 are underway.

(Bonus) Advanced Features

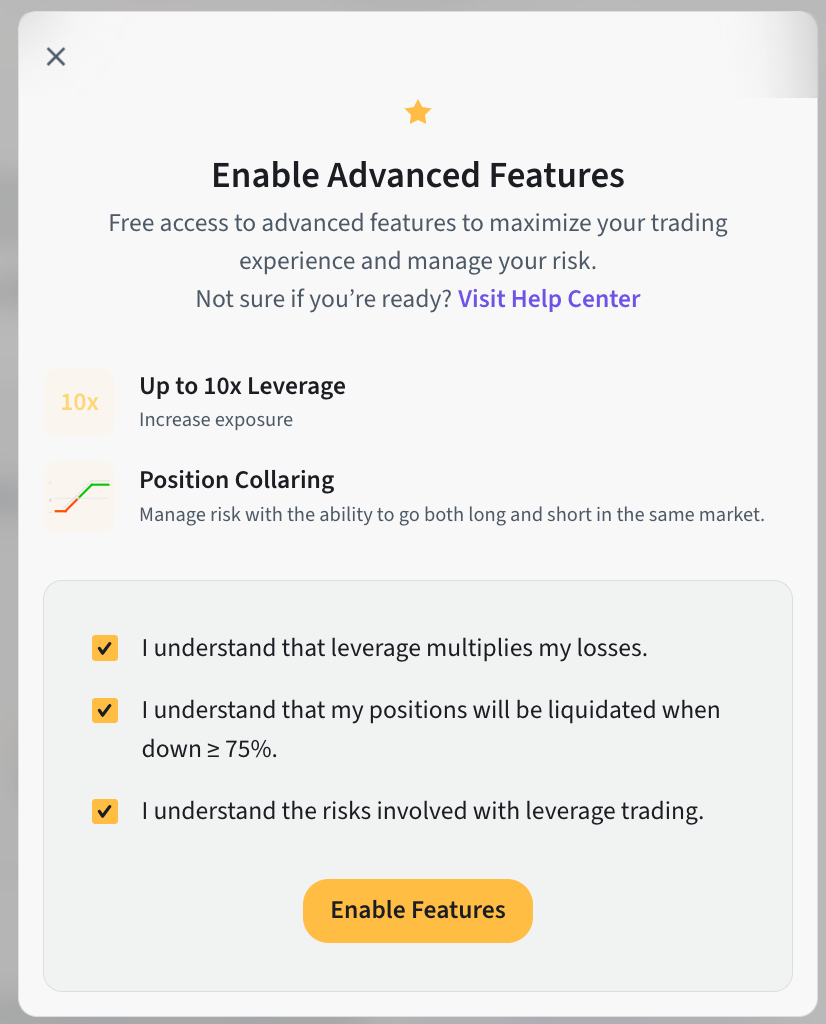

This set of features is only available to advanced users, which means users must have sufficient leverage trading knowledge to choose to join.

Users can join the Advanced Features program on the Parcl DApp through the wallet window displayed above. After confirming the membership, users will be prompted to answer the following form:

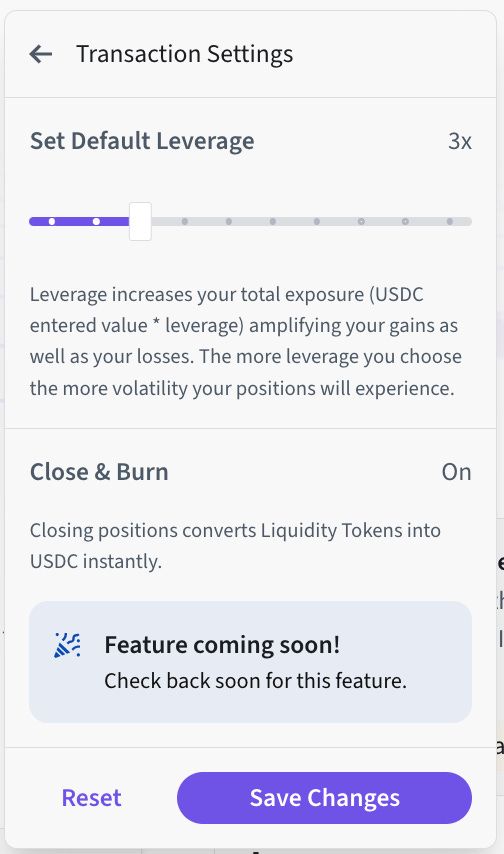

After clicking "Enable Features", users can now access the transaction settings panel in the wallet window. Here, users can set their default leverage for trading. By default, Close and Burn is turned on, which means that long and short positions will be automatically liquidated when they fall to 75% or below.

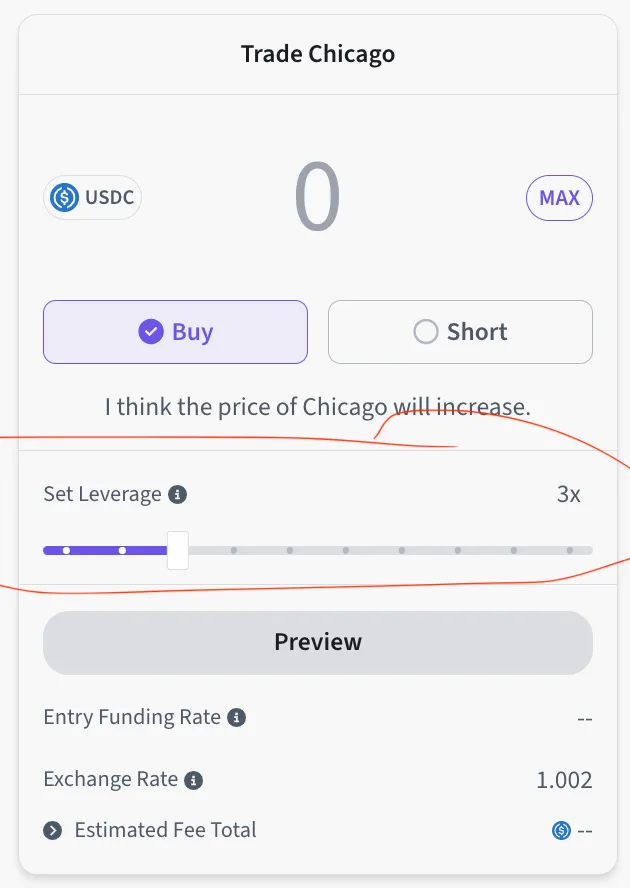

After saving the changes and returning to any index trading page, users may notice a new feature when opening positions. This leverage rate can be adjusted manually.

Additionally, users have the ability to establish multiple long or short positions, meaning they can have a long position in Atlanta and a short position in San Francisco simultaneously.

The Significance of Parcl

By reading the theoretical whitepaper of Parcl v2 and gaining practical experience using the Parcl DApp, I can see the multiple significances that Parcl has for Web 2 and Web 3.

Significance for Cryptocurrency/Web 3 Users

Cryptocurrency users, especially traders, may be familiar with concepts such as leverage, long/short trading, and liquidity pools. Therefore, they can easily understand and utilize Parcl's advanced features. Through both basic and advanced functionalities, traders can explore a whole new asset class with minimal initial capital (just 1 USDC plus a few cents worth of SOL gas fees). They can access all these real estate markets and their returns, as well as the entire city, through indices, minimizing the risk of individual sites.

Other advanced features like leverage, pair trading, and basic functionalities like liquidity pools, borrowing, and research data, also enable traders to better prepare for and hedge against market downturn risks, enabling them to develop better investment strategies and maximize investment returns in ever-changing market environments.

Significance for the Masses (i.e., Web 2 Users)

For regular retail users, Parcl provides a new option for real estate investment and, more broadly, an opportunity for investing in real-world assets. By accessing transparent data sets, hedging risks, and improving liquidity through dynamic liquidity pools, retail users can easily enter the on-chain world of real-world asset indices and liquidity pools with very low initial costs and a seamless user interface.

Significance for Web 2 ⇒Web 3 Beginners

Assuming that after using Parcl, these retail investors can understand the simplicity of Web 3 products and how to apply blockchain technology to traditional investment practices, allowing them to further explore other real-world assets and products in the Web 3 ecosystem. For other DApps built on the Parcl Protocol, this will open up a significant opportunity beyond just dealing with other real-world assets (RWAs).