Foresight Ventures Weekly Market Report: Wait and see in market volatility, BTC ecological frenzy

A. Market View

first level title

Monetary liquidity improved. Due to the strong U.S. economy, the market expects high interest rates to remain after June. Historically, the average time between a rate cut and no rate hike is 6 months. The U.S. dollar index rebounded to a seven-week high, but did not change its bearish trend. U.S. stocks rose, and the overall first-quarter report was better than expected. The U.S. debt ceiling crisis is expected to be lifted, and the market believes that more money will be printed to pay off debts, which will eventually lead to capital inflows into riskier encrypted assets.

Second, the whole market

The top 100 gainers by market capitalization:

secondary title

Second, the whole market

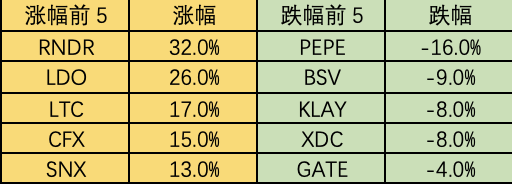

The top 100 gainers by market capitalization:

The market has fluctuated within a narrow range this week. Many altcoins have a tendency to rebound, especially the current BTC price is relatively stable, and Meme hotspots are gradually ebbing, so funds are gradually shifting to altcoins. Market hotspots mainly revolve around BTC ecology, liquidity staking, and the concept of Hong Kong.

OP: Bedrock will be upgraded on June 6, and the gas fee will be reduced by 50%. WorldCoin is built on the OP and currently has over 1.3 million registered users, so it may be good for the OP if WorldCoin can be successful.

3. BTC market

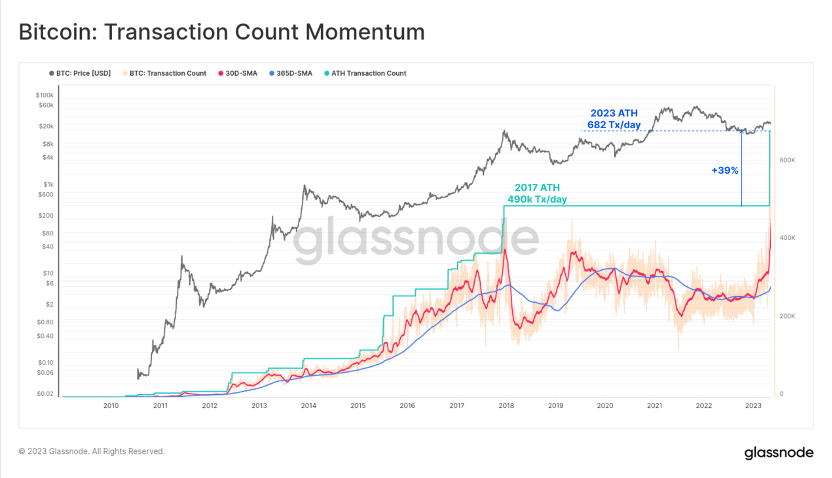

1) Data on the chain

secondary title

3. BTC market

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top interval; when the indicator is less than 2, it is the bottom interval. MVRV fell below the key level 1 and holders were overall in the red. The current indicator is 0.54, entering the recovery phase.

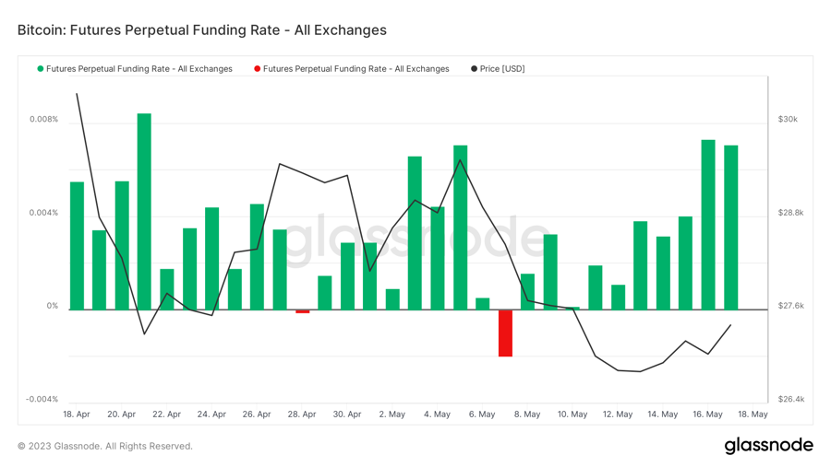

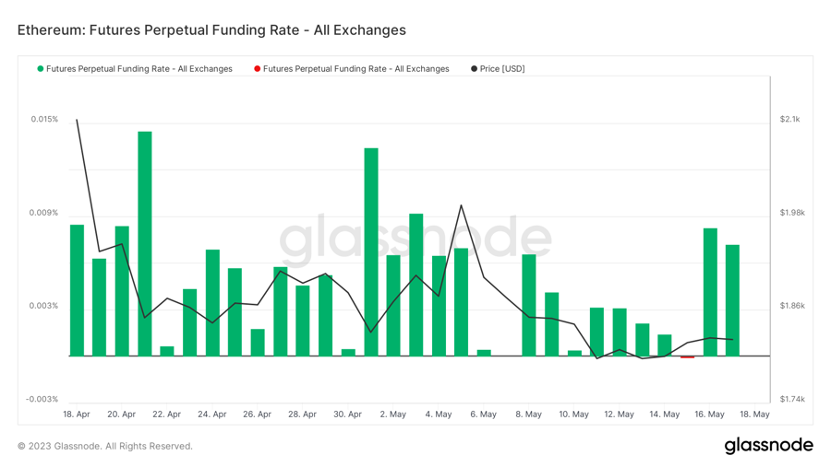

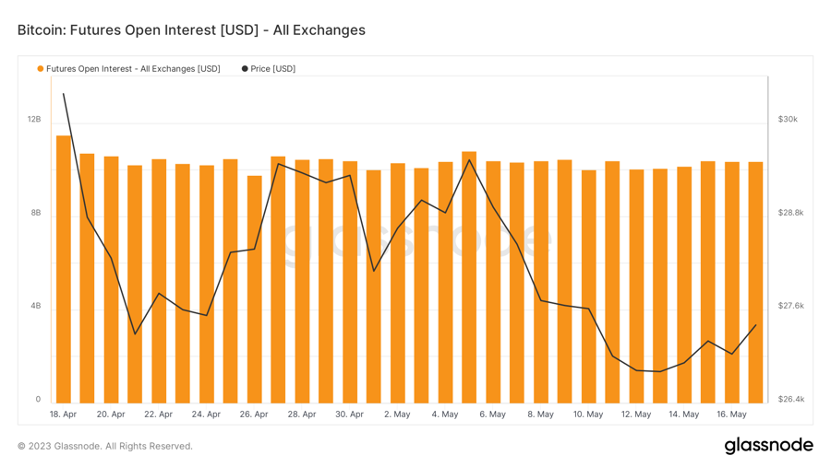

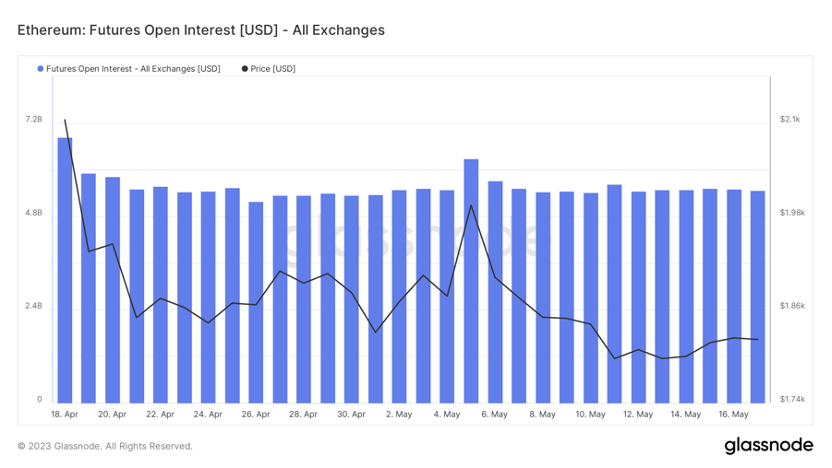

2) Futures market

Futures funding rate: The rate is neutral this week, and the market sentiment is stable. The fee rate is 0.05-0.1%, and the long leverage is more, which is the short-term top of the market; the fee rate is -0.1-0%, and the short leverage is more, which is the short-term bottom of the market.

Futures funding rate: The rate is neutral this week, and the market sentiment is stable. The fee rate is 0.05-0.1%, and the long leverage is more, which is the short-term top of the market; the fee rate is -0.1-0%, and the short leverage is more, which is the short-term bottom of the market.

Futures long-short ratio: 1.3. Market sentiment is neutral. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, and above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3) Spot market

secondary title

B. Market Data:

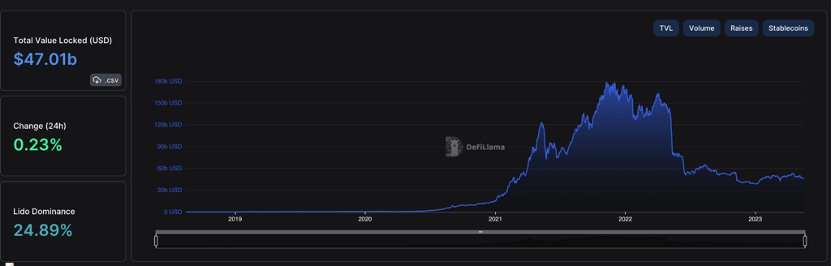

1. The total lock-up volume of the public chain

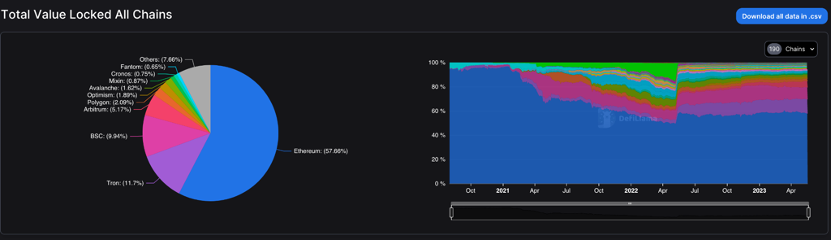

2. Proportion of TVL of each public chain

1. The total lock-up volume of the public chain

6) Arbitrum lock-up volume

3. The lock-up volume of each chain agreement

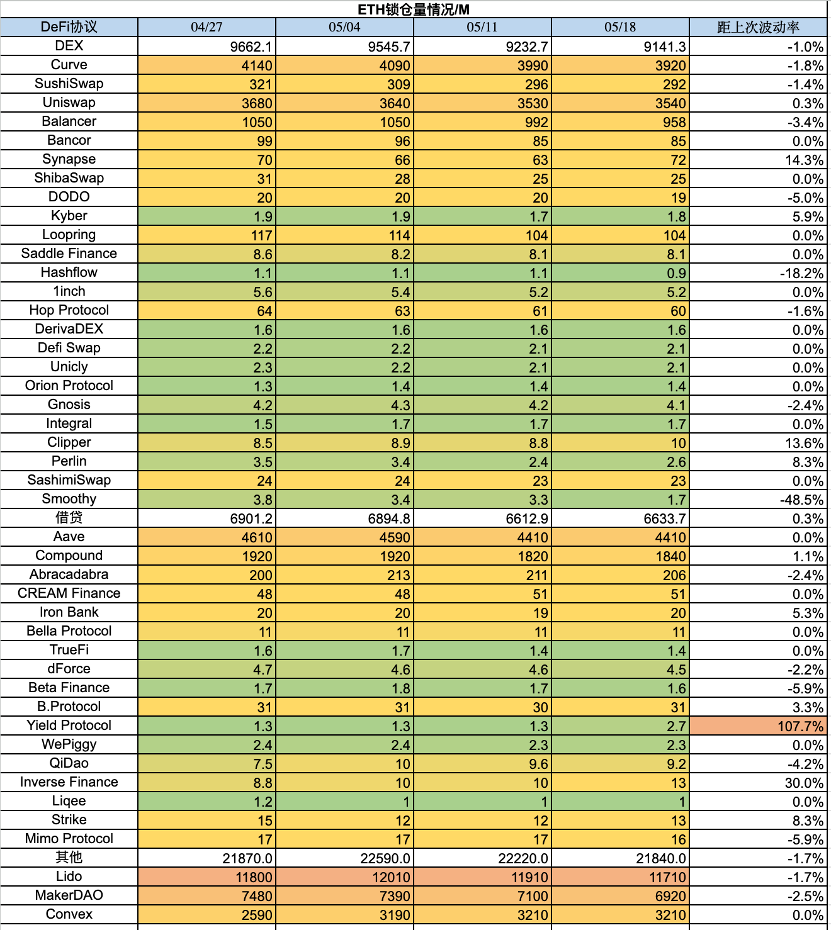

1) ETH locked position situation

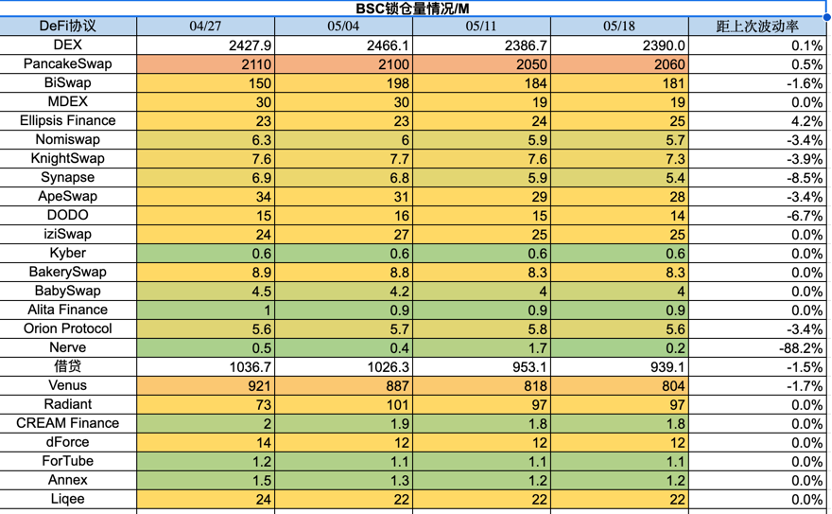

2) BSC locked position situation

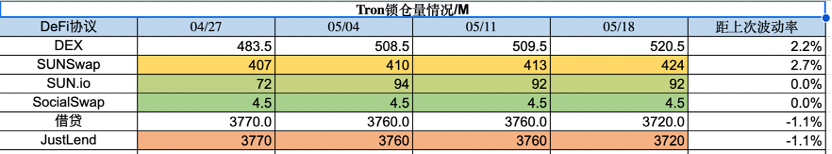

3) Tron lock-up volume

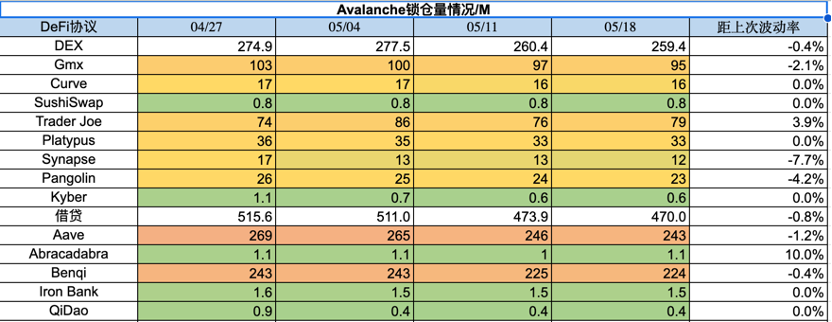

4) Avalanche lock-up volume

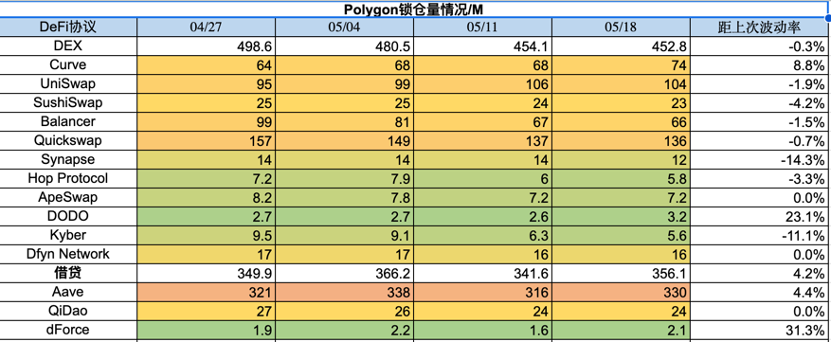

5) Polygon lock-up volume

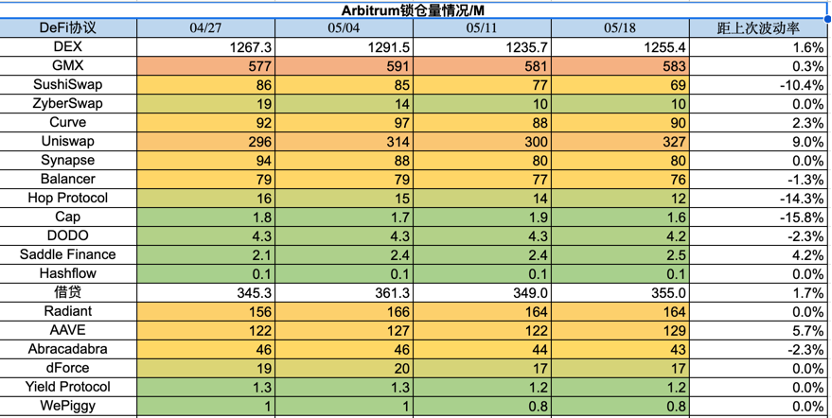

6) Arbitrum lock-up volume

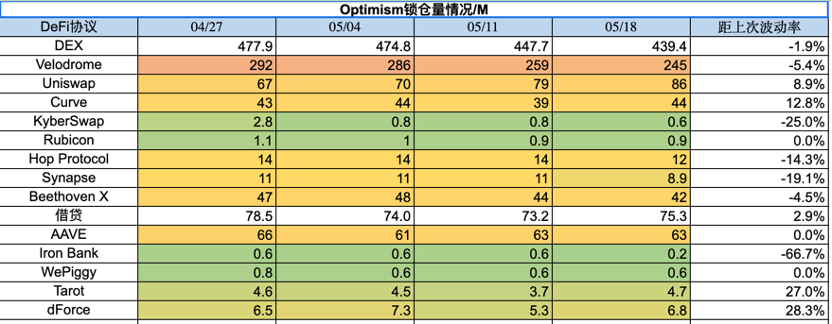

7) Optimism lock-up volume

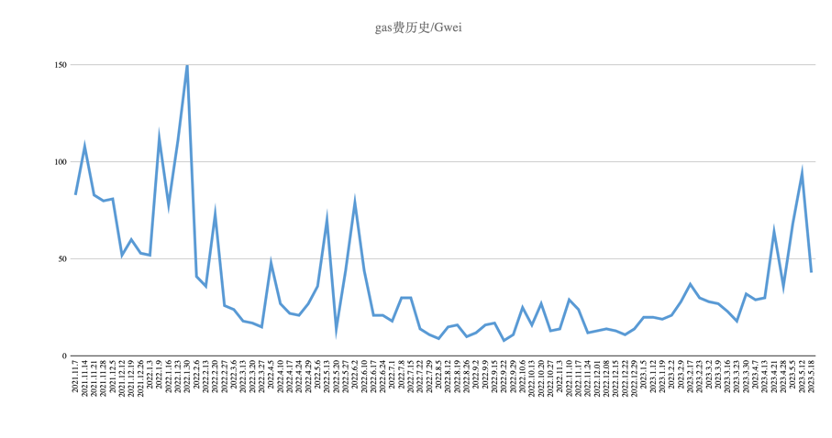

4. History of ETH Gas fee

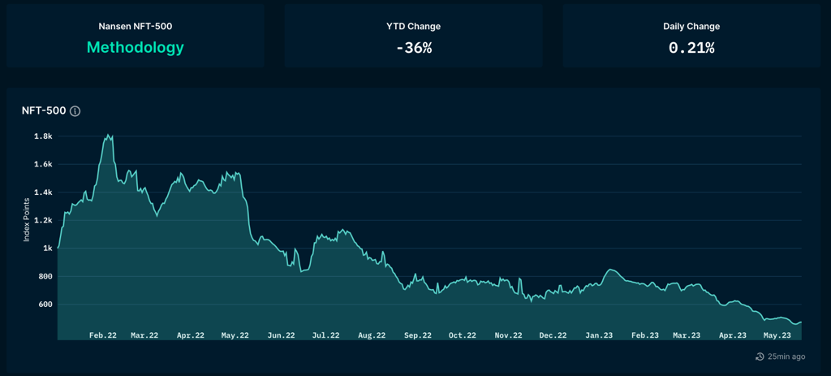

1) NFT-500 index:

5. Changes in NFT market data

1) NFT-500 index:

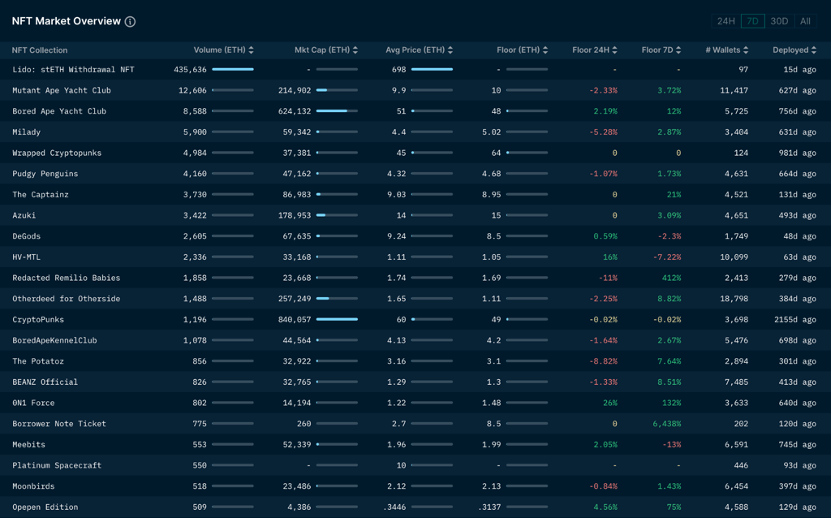

2) NFT market conditions:

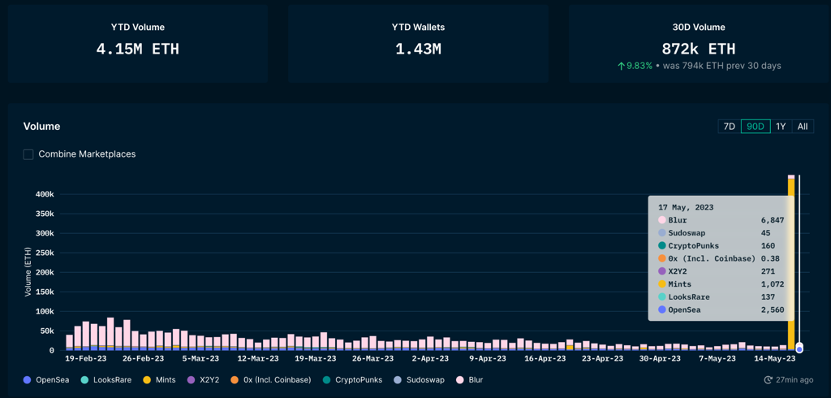

3) NFT trading market share:

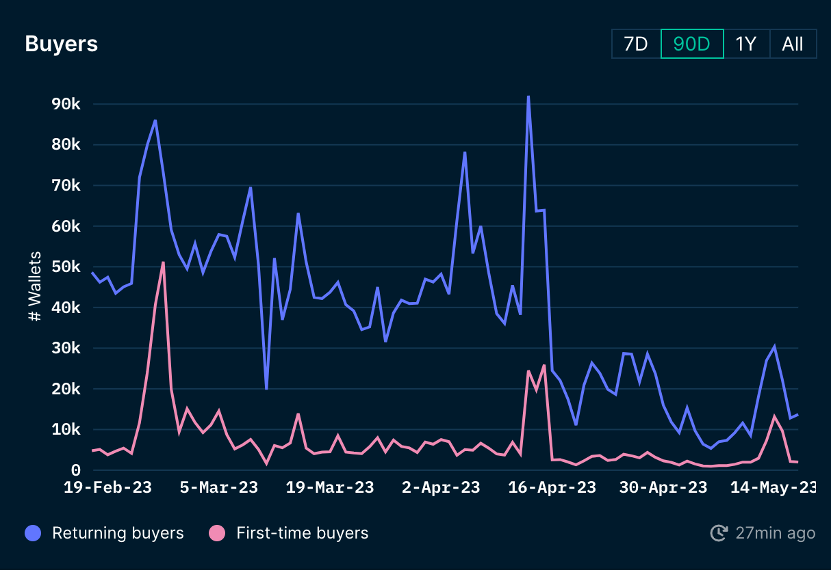

4) Analysis of NFT buyers:

2) NFT market conditions:

3) NFT trading market share:

first level title

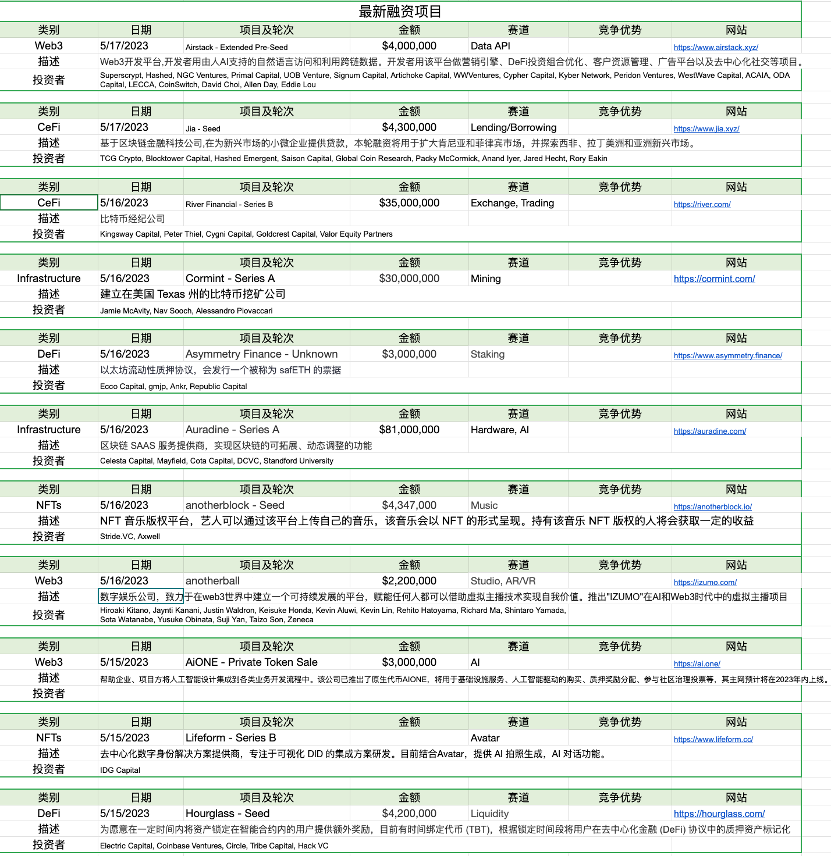

6. The latest financing situation of the project

About Foresight Ventures

Foresight Ventures bets on the innovation of cryptocurrency in the next few decades. It manages multiple funds: VC fund, secondary active management fund, multi-strategy FOF, special purpose S fund "Foresight Secondary Fund l", with a total asset management scale of more than 4 One hundred million U.S. dollars. Foresight Ventures adheres to the concept of "Unique, Independent, Aggressive, Long-term" and provides extensive support for projects through strong ecological forces. Its team comes from senior personnel from top financial and technology companies including Sequoia China, CICC, Google, Bitmain, etc.

Website: https://www.foresightventures.com/

Disclaimer: All Foresight Ventures articles are not intended as investment advice. Investment is risky, please assess your personal risk tolerance and make investment decisions prudently.