Equilibria: A New Growth Engine and a New Era for Pendle and the IRS Track

After Pendle achieves a tenfold increase in TVL/coin price, the flywheel growth is about to start. As a token using ve-tokenomics, it still lacks a Convex to fully realize its potential. Equilibria is a project born for this purpose. This article Its mechanism and its value to Pendle and the interest rate swap track will be analyzed.

If you want to understand the interest rate swap track and pendle first, you can read this firstarticle。

vePendle enjoys the following benefits:

Voting to determine incentive distribution

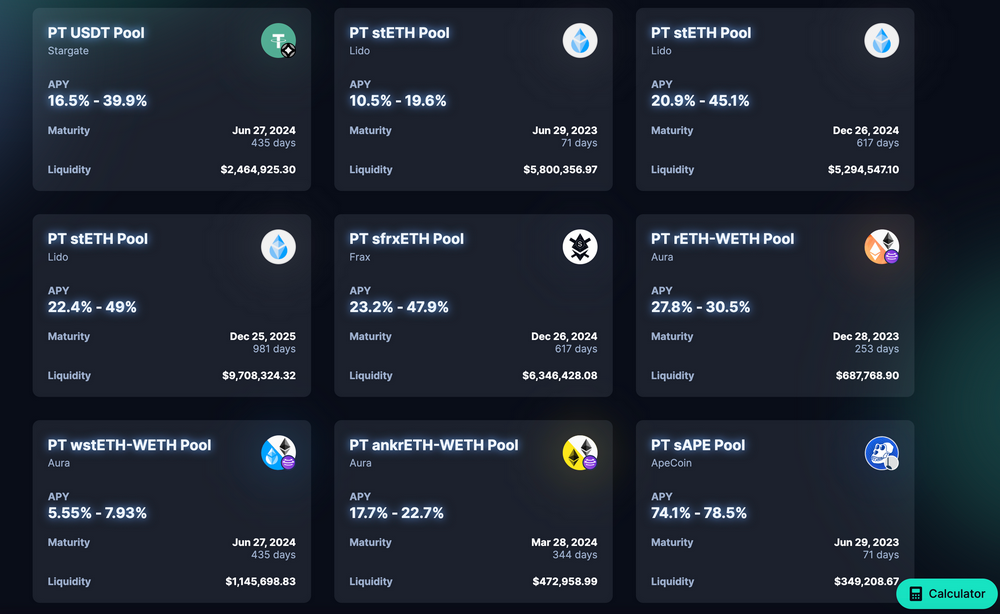

The income of Boost PT/SY pool, see the figure below

3% YT interest yield

80% of AMM Swap Fee

These rights are comparable to the current benchmark veCRV, and are of high value.

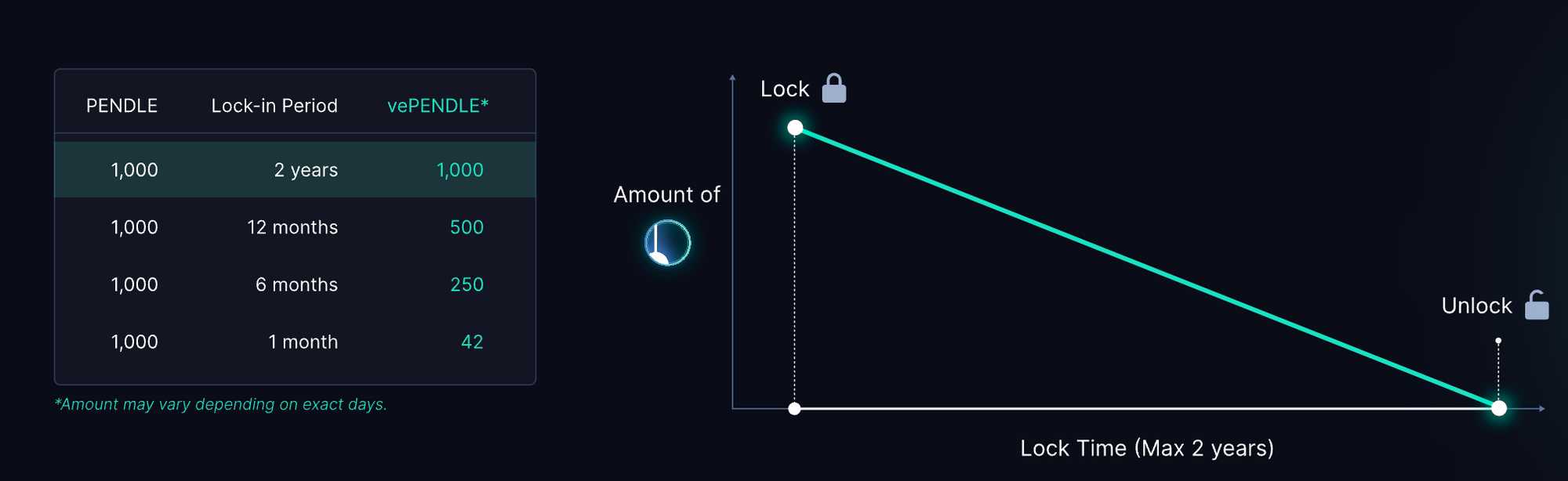

The two-year top lock-up period has brought a lot of problems to its liquidity, so Equilibria is very similar to Convex. It will also permanently lock vePendle to users' ePendle tokens to help Pendle's AMM LP Boost income. Then share part of Boost's revenue with ePendle and vlEQB, and vlEQB will enjoy the bribery revenue.

This round of Pendle, one is due to the update of its own mechanism brought about by V2, and the other is largely due to the rise of LSD and derivatives, two sectors that can generate long-term returns, so that Pendle has a relatively stable source of assets.

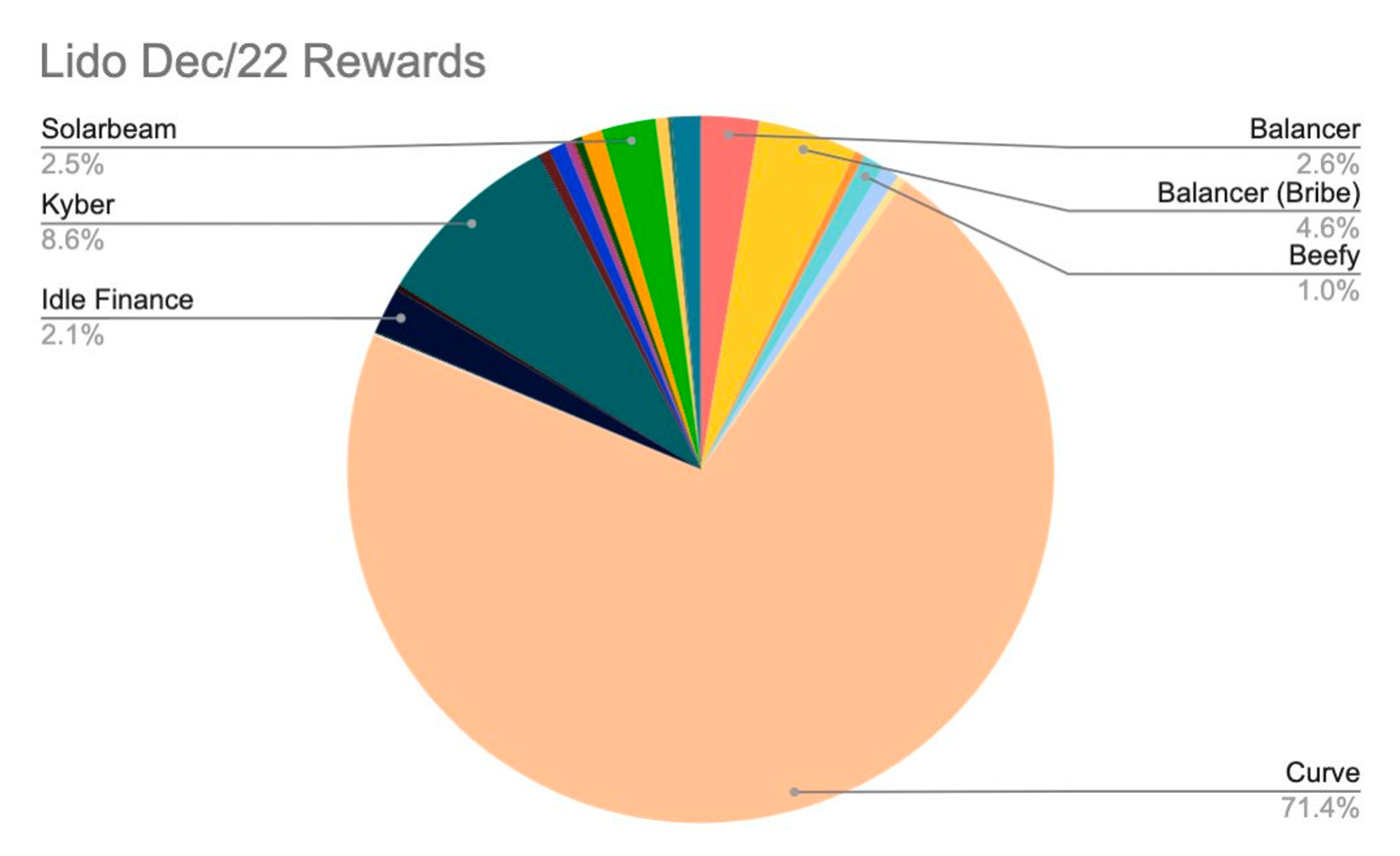

But in fact, there is still a part of Pendle's untapped potential, which is its potential in Bribe. Professional institutions occupy a large share of LSD, and these institutions have a very strong demand for regular subscriptions. Then, in order to meet the needs of these institutions, the LSD protocol theoretically has room for Pendle bribes.

LSD encourages the distribution of cakes. I don't know how much Pendle can get under the blessing of Equilibria.

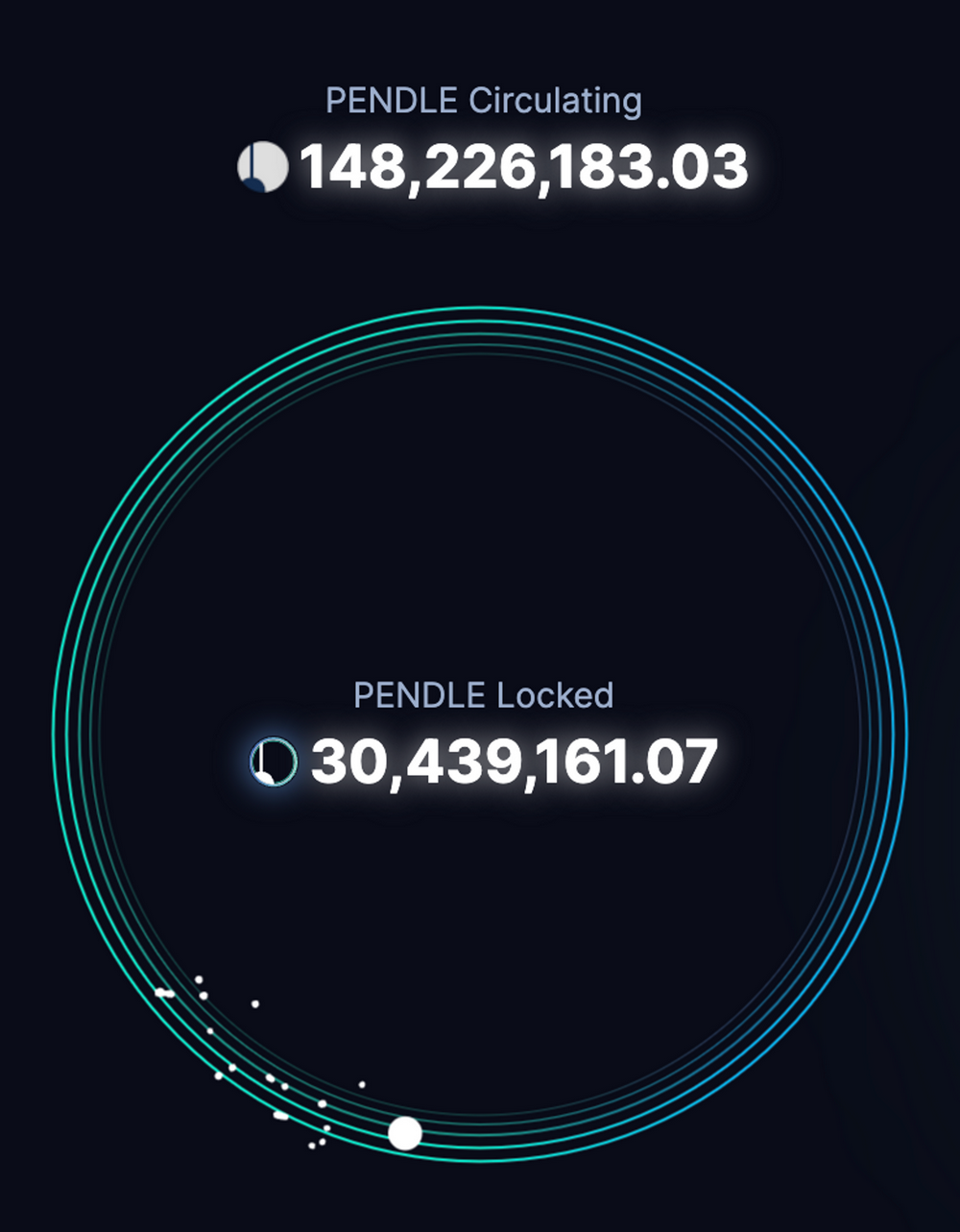

Although Pendle is a two-year-old project, only 30 M of the 150 M pendles in circulation are currently locked, and there are still 120 M in circulation, which also leaves some room for Equilibria's initial growth.

Equilibria recently issued a statement that it will launch a launch event in May, airdropping 2% of the total amount of $EQB tokens based on the number of Pendles stored by users. It is estimated that a large number of Pendles still in circulation will be locked, and the core members of the Pendle team are also multi-signatures. One of the managers, Pendle held by the treasury and the team is estimated to flow in a lot, and the overall lock-up ratio of Pendle is expected to further increase.

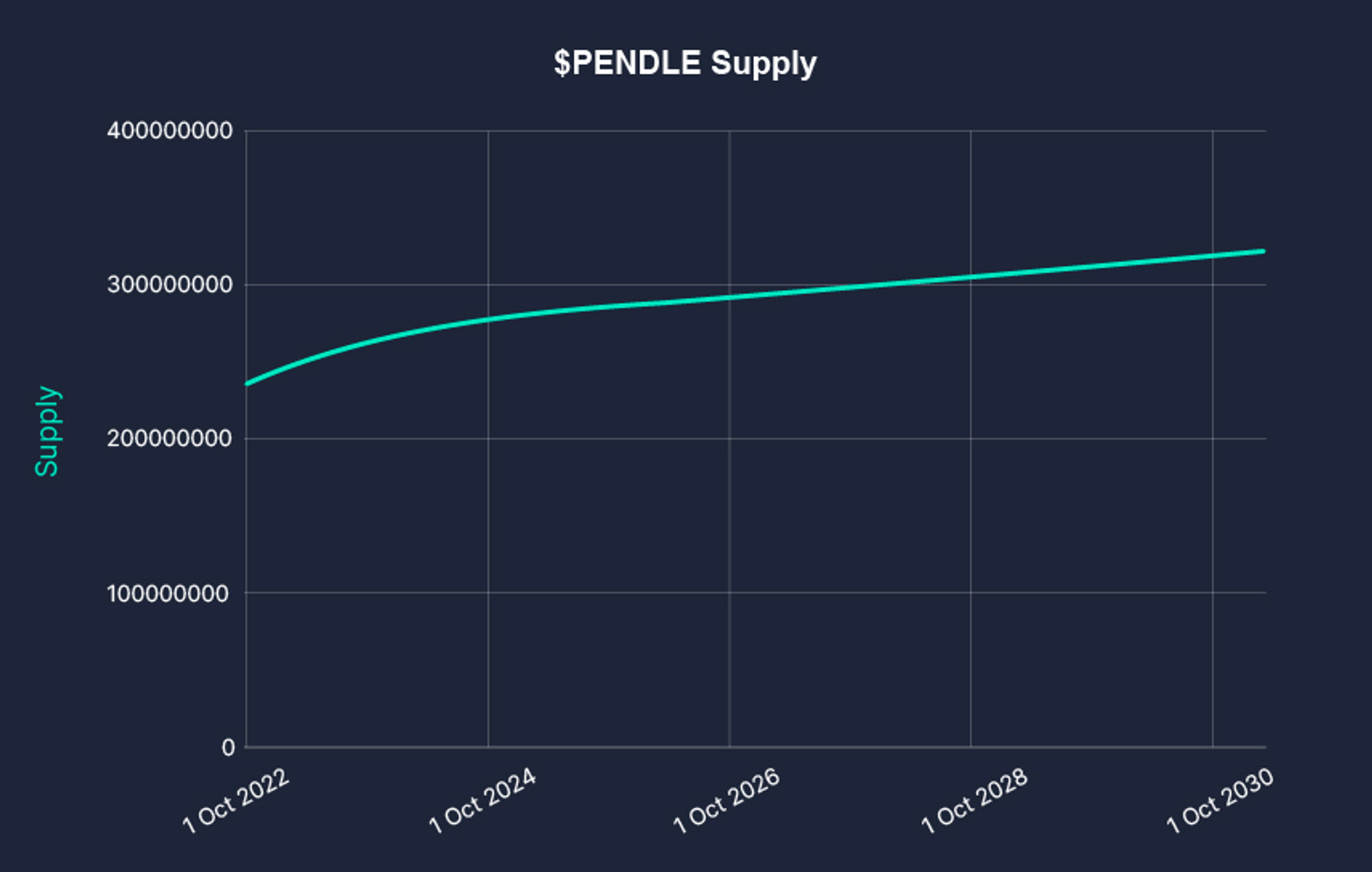

In addition, Pendle's Tokenomics has planned to implement a perpetual 2% incentive inflation after the rapid inflation period ends in 2026, which means that vePendle/vlEQB will have the opportunity to continue to benefit from bribes.

Since ePendle and vlEQB are also interest-earning assets, theoretically, they can also be combined with Pendle to build their own YT/PT to achieve fixed interest rates and better service institutions. Flywheel growth. Even after Equilibria bubbles through this path, other ve-token wrappers may learn to access the Pendle ecosystem and help Pendle develop another market.

Summary: Equilibria is the Convex of Pendle. Its appearance will further release the potential of Pendle, help it achieve flywheel growth, and revitalize the ecology of the interest rate swap track.