FTX reboot, not on a whim?

In the early hours of April 13, the story about the bankrupt exchange FTX took a dramatic turn.

On Wednesday, attorney Andy Dietderich from the FTX law firm Sullivan Cromwell said at a court hearing in Delaware,FTX Has Recovered $7.3 Billion in Assetsalso,

also,FTX is considering re-opening the exchange business at some point in the future. One possible option is for FTX creditors to convert their claims into shares of the reopened exchange.

Stimulated by this news, FTT went up strongly, breaking through 3 USDT at one point. Although it has fallen back to around 2.5 USDT, the increase is still more than 90%.

About restarting, not for the first time mentioned

Although the incident happened suddenly, this is not the first time that FTX related people have considered restarting matters, but it is only the first time that this potential option has been proposed in court.

According to the Wall Street Journalto report, as early as January this year,In his first public interview, FTX’s new CEO, John J. Ray III, expressed his openness to restarting the exchange business.John J. Ray III mentioned at the time that he had set up a special task force to discuss how to restart FTX. Although the previous management team of the exchange was accused of criminal misconduct, some customers still appreciate FTX’s technology very much. Therefore, it tends to and believes that restarting the exchange is valuable.

Since then, the law firm representing FTX's Official Committee of Unsecured Creditors has also held several discussions on the theme of "restarting the exchange".Some creditors are quite positive about restarting the exchange business。

According to The Block'sto report, Sunil Kavuri, a creditor with seven-figure assets trapped in FTX, once said: "If it is run properly, the underlying business can make money. So for me, it does not make economic sense to dissolve a profitable business. Restarting it will generate income." , thereby compensating users.”

Another anonymous creditor @AFTXcreditor also believes: "FTX is a highly profitable exchange, it was just taken away by a completely unprofitable hedge fund (referring to Alameda). For me, for this profitable business It makes perfect sense to refinance to resume activity and generate profits and equity value that better compensate creditors."

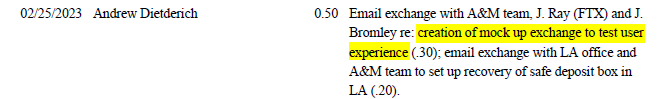

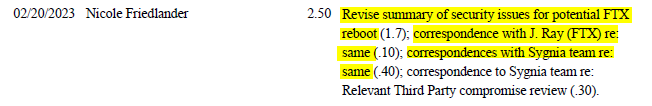

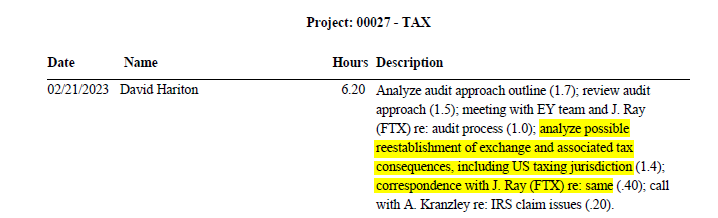

Most importantly, some creditors who are actively tracking FTX’s bankruptcy and liquidation trends found after analyzing the financial details submitted by FTX to the court,The exchange has also had some discussions with the legal team about restarting. Specifically discussed items include:

Create mockups to test user experience;

Restart the security analysis of the exchange;

Restart tax analysis for exchanges.

secondary title

Restart, temporarily only hypothetical

Although in the eyes of many relevant people, restarting FTX may indeed have the opportunity to help creditors recover higher compensation, but judging from the current situation, this is only a hypothesis for the time being.

The first point that needs to be emphasized is that the reason why the restart discussion is brought up at this stage is based on the objective condition that FTX's financial situation improves as it "recovers" more assets. However, the so-called "recovery" is mainly due to the overall rise of the cryptocurrency market (most assets belong to Class A encrypted assets), so the value of 7.3 billion US dollars still has a large possibility of fluctuations, in other words, its financial situation There is also instability.

Secondly, Dietderich has only put forward this proposal so far, and there are still many unresolved questions about whether and how to implement this plan. The two most important issues are-Restarting the exchange business will inevitably require a huge amount of funds. Should these funds be directly used by FTX’s existing assets or should they be raised through third-party capital financing? How should the company's assets, equity, and income after the restart be distributed with creditors?This is also the biggest point of contention within FTX regarding the "restart".

As Dietderich himself said, restarting FTX is only one of the possibilities in the future, and any current choice is far from the final outcome.