A “Native Bond Market” Outlook for the Crypto World

Author: Colin Li, Researcher at Mint Ventures

This article is part of the Mint Clips series by Mint Ventures. Mint Clips are some of our thoughts on industry events after internal and external exchanges. Compared to our #进入研究报and #运车进入 series of articles, Mint Clips does not discuss specific projects, but mainly presents "phased insights" on specific issues.

How to define the native benchmark interest rate in the encrypted world?How to define the native benchmark interest rate in the encrypted world?first level title

secondary title

Supply: The cycle is not conducive to long-term low-risk investors

In the traditional financial field, the risk appetite of bond investors is generally lower than that of stock investors. It is the goal of bond investors to take relatively low risk and obtain more stable returns.

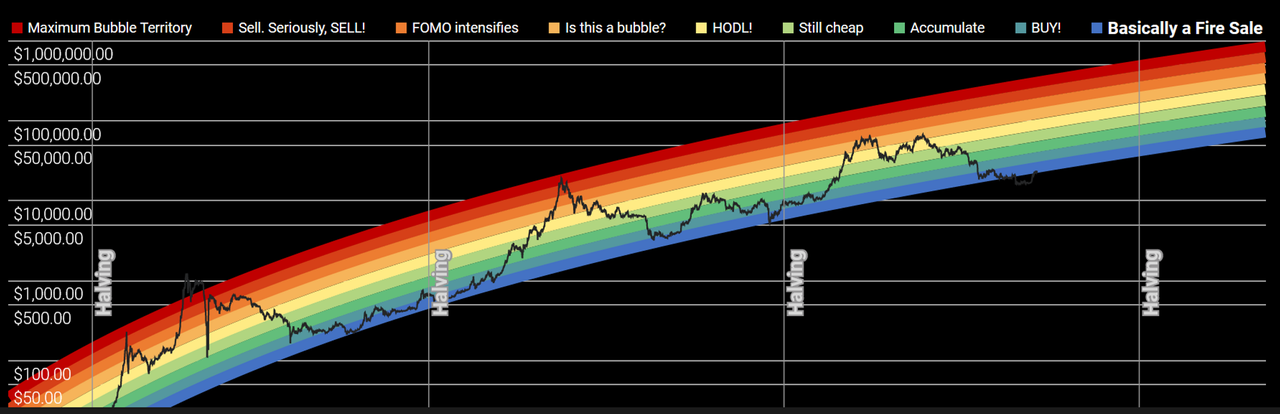

The Crypto market has grown to the present and has become a huge market with a total market value of more than 1 trillion US dollars. However, under the background of BTC's "4-year halving" and the rapid birth and death of bubbles brought about by the brutal growth of the industry, the market has shown extremely strong volatility. Taking Bitcoin as an example, the bull market has dozens or even hundreds of times of income at the peak, but soon after turning bearish, there will be an 80% or even greater decline. Other coins have been more exaggerated in bull and bear markets. This high volatility results in approximately90% of traderssource:

source:https://coinstats.app/bitcoin-rainbow-chart/

secondary title

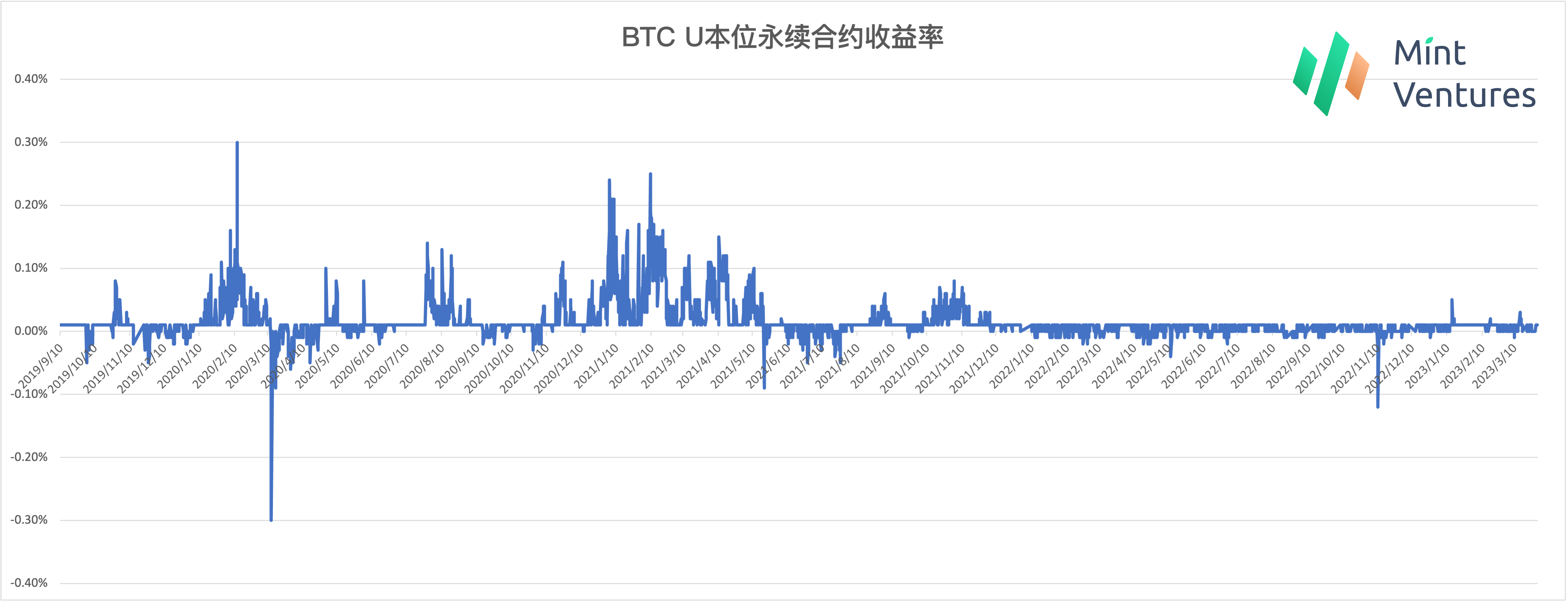

source:https://www.binance.com/zh-CN/futures/funding-history/perpetual/1

Demand: The Narrative of Institutional Mass Entry and DAO Treasury Has Not Been Fulfilled

In the recent round of bull market, the entry of "institutions" and DAO Treasury are the themes that have been repeatedly mentioned. This is also the original intention of some projects, such as the DeFi project for market makers. However, with the collapse of Luna in May 2022 and the subsequent impact on Sanjian and FTX, a large number of institutional investors were hit. This not only affects the use of existing funds in the market by institutions, but also causes regulators to pay more attention to the supervision of the crypto field. Coupled with the recent bankruptcy or exit of the few U.S. crypto-friendly banks, the mass entry of institutional funds may take longer and restore confidence.

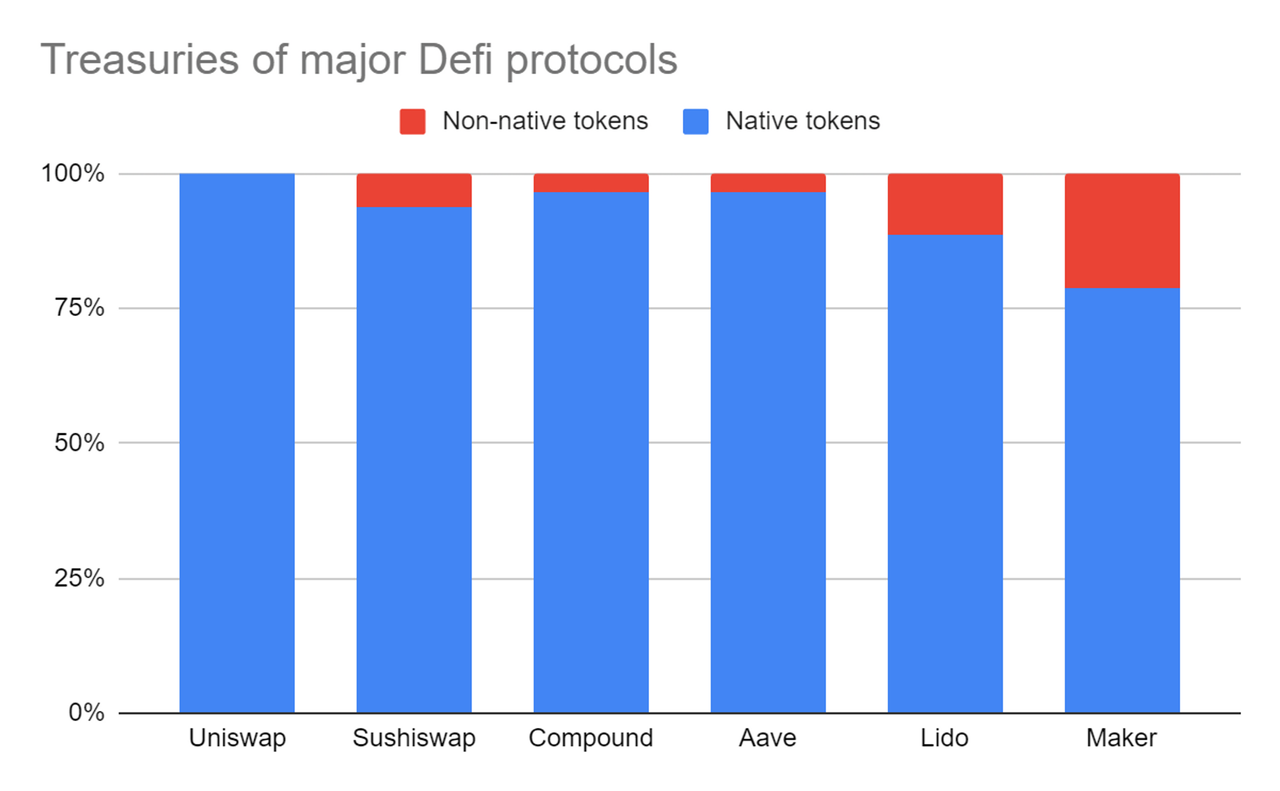

There are also a lot of discussions in the market about the narrative of DAO Treasury's financial management. but,HasuIn 2021, the distribution of funds in the Treasury at that time was analyzed. Most assets are tokens of the project itself. And even if you look at it now, high-quality projects, such asLidoimage description

source:https://uncommoncore.co/a-new-mental-model-for-defi-treasuries/

source:https://deepdao.io/organization/fd991dca-141d-4e23-a23b-5d908110c337/organization_data/finance

Source: https://deepdao.io/organization/c41f87df-35a6-4a37-82c4-62cd5a3a8c08/organization_data/finance

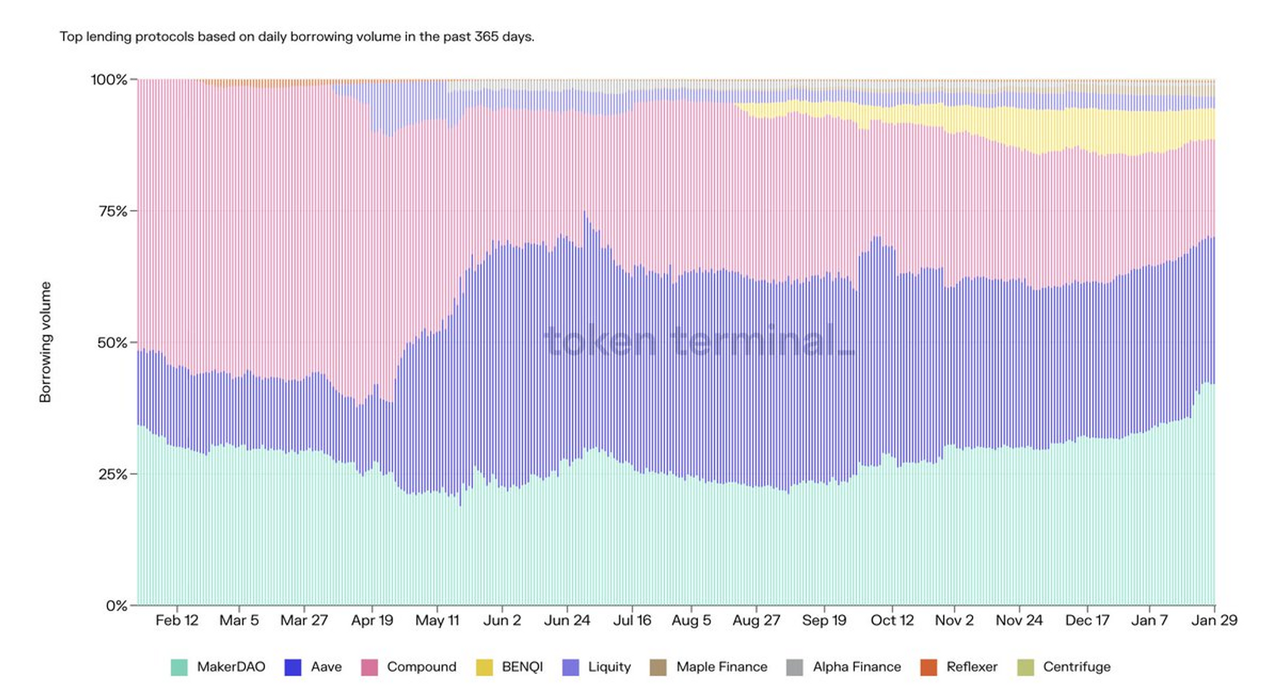

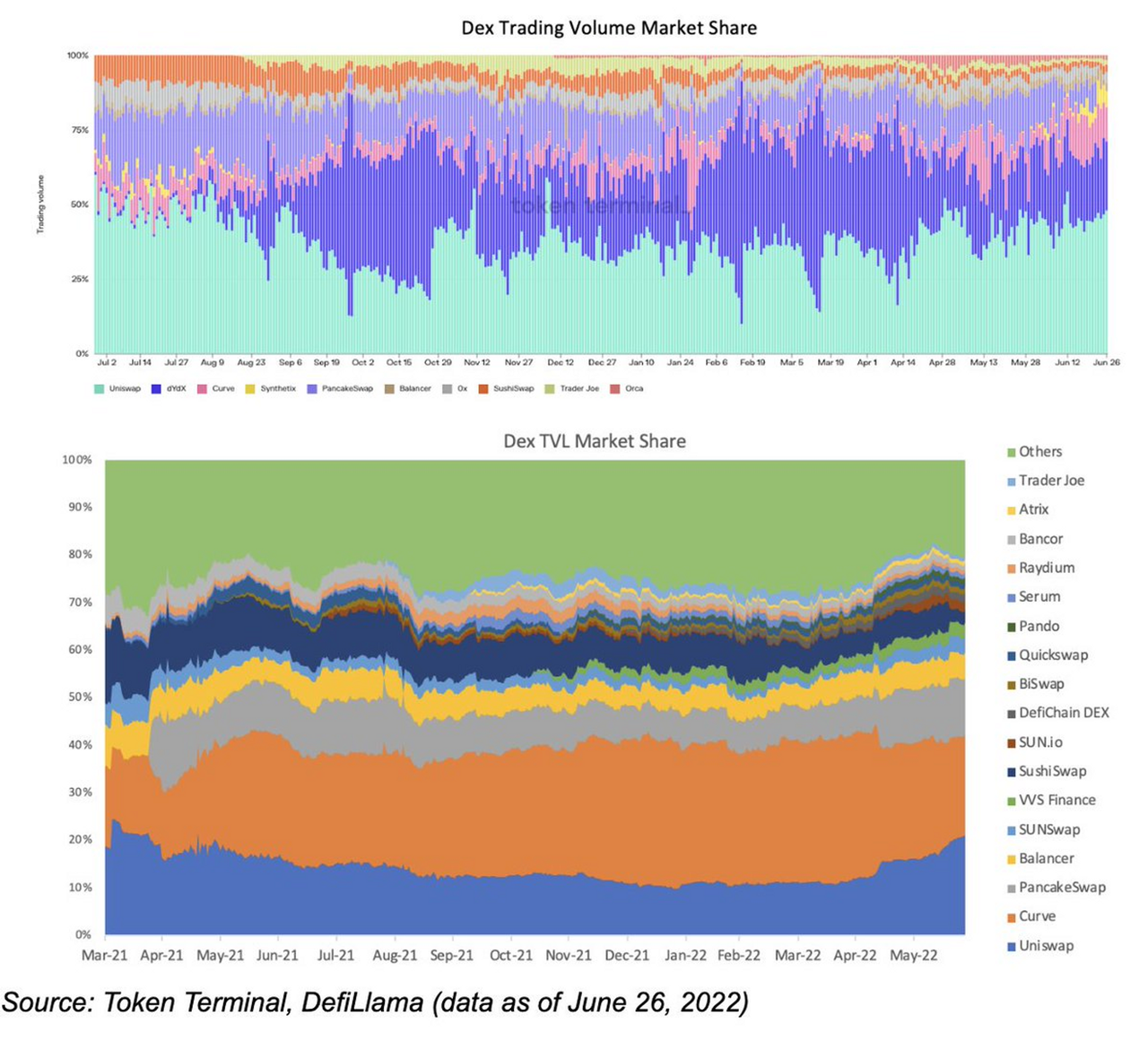

Even if we don't consider the status quo and look forward to the future of DAO, perhaps most projects may not have enough other assets stored in the Treasury. This may be related to the properties of the crypto industry itself. Since the crypto industry is developing across the globe, the regulation between countries has not been unified or even has not yet appeared, which has led to a situation where the Matthew effect is extremely strong in the crypto industry. This phenomenon is more obvious in the most mature decentralized exchange (DEX) and lending industry (lending) in DeFi at this stage. The reason for this situation is that the crypto market is a market that links global liquidity and is not fully regulated.

DeFi is a type of finance, and it also has some natural attributes of finance. For example, for investors, what they look forward to is the project with the lowest cost, the highest return, and the best security. Because there is no customer management involved, only differentiation is made in the product dimension, but it is an open source project, so it is not difficult to copy code or product functions from each other. However, because DeFi has a natural preference for liquidity, transaction costs, etc., users' liquidity cannot be copied. Therefore, the Matthew effect is relatively strong, and projects launched first have a greater probability of becoming the leader.

In the traditional market, some regulatory policies have the purpose of anti-monopoly. It is hoped that there will be enough market participants, and they will also review mutual mergers and acquisitions. In a sense, it is to suppress the Matthew effect. Looking back at DeFi, there is no supervision, no customer service, etc., and there is no artificial suppression of monopoly from the regulators, so the Matthew effect is stronger than in traditional fields.

source:

source:https://twitter.com/tokenterminal/status/1487736136600535044

source:https://twitter.com/marcus_wwwwww/status/1542783032008261632

secondary title

Token has the dual characteristics of stock and debt

Going back to the token itself, the token itself has dual attributes of stock and debt:

From the perspective of equity, holding tokens can participate in community voting, deeply participate in project governance, and may also share commissions such as handling fees earned by the project itself because of the value capture attribute.

From the perspective of debt, token has its special features. In the traditional business world, if a business expands with equity financing, it can get cash. In order to gain a larger market share, the obtained funds will be used for marketing at this time, such as advertisements, in-kind rewards, discount rewards, etc. At this time, the company gave out equity in exchange for cash.

first level title

Future Development Forecast

From the above three points, it can be seen that whether it is from the strong cyclicality of the market itself or from the supply and demand sides of fixed-income products, there is no development soil similar to the traditional bond market for the time being. What kind of bond market might be more suitable for the development of the crypto industry?

From the perspective of interest rate benchmarks, the POS rate of return based on the public chain may be the best choice. This rate of return is based on a larger ecological existence, and the volatility of its business development is often smaller than that of a single Dapp project. Secondly, this rate of return anchors the growth of the ecology and is more easily accepted by participants in that chain. Moreover, a Dapp's control over user incentives is in the hands of the project party, and not every user has to buy the token of the Dapp; for the public chain, as long as the user needs to carry out substantial activities on the chain, it needs Purchase public chain tokens to pay fees, relatively speaking, public chain tokens may be more dispersed. Moreover, under the influence of the fat protocol theory, a large number of investors tend to buy public chain tokens to earn beta income. Therefore, the PoS rate of return is not affected by a single Dapp project party for a long time, and it is more stable.

From the perspective of the audience, it is more appropriate for the participants in the bond market to be positioned as high-risk speculators and low-risk arbitrageurs. There is a lack of long-term investors in the current encryption market, so it is difficult to find a large number of stable investors. In addition, the volatility of interest rates still needs to be borne by another counterparty, and the risk can only be transferred and cannot disappear out of thin air, so a high-risk participant who speculates on interest rate fluctuations is required. Although there is a lack of funding sources for institutions and DAOs, there are a large number of arbitrage traders in the market, and these investors can be used as a source of funding for "low-risk investments". At the same time, there are more high-risk speculative traders in the market, and these users can be used as the other end to absorb volatility. For example, Pendle, a revenue tokenization project based on LSD, divides the revenue of LSD into two parts:

Yield token (yield token), the interest rate is floating, and users can buy yield tokens to gain future yield increases. It not only meets the requirements of arbitrageurs and low-risk investors for the rate of return, but also allows high-risk investors to participate in the prediction and speculation of LSD rate of return.

principle token (principal token), a fixed-rate product, can be regarded as a zero-coupon bond;

From the perspective of maturity, the overall cycle of the crypto market is relatively fast, so the maturity of bonds should also be shorter. For example, a bond with a maturity of less than 1 year. The advantage of this design is not only beneficial to low-risk arbitrage traders, but also to high-risk traders: short-term interest rate fluctuations will be more intense and frequent, which can provide more potential trading opportunities for short-term traders.