first level titleA brief introduction to the USDC storm

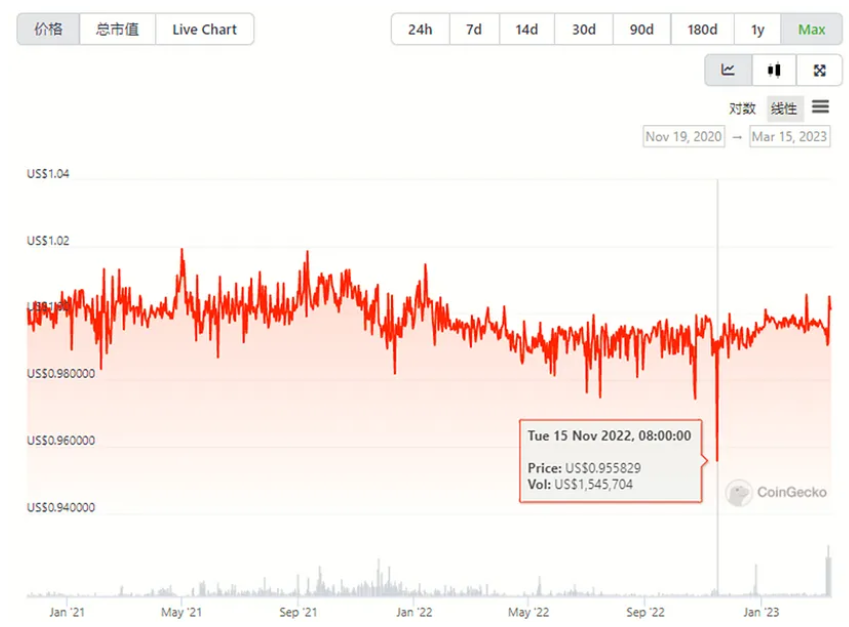

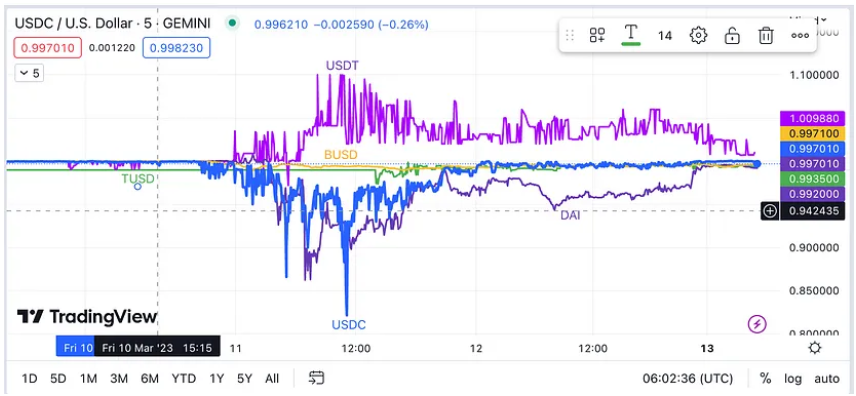

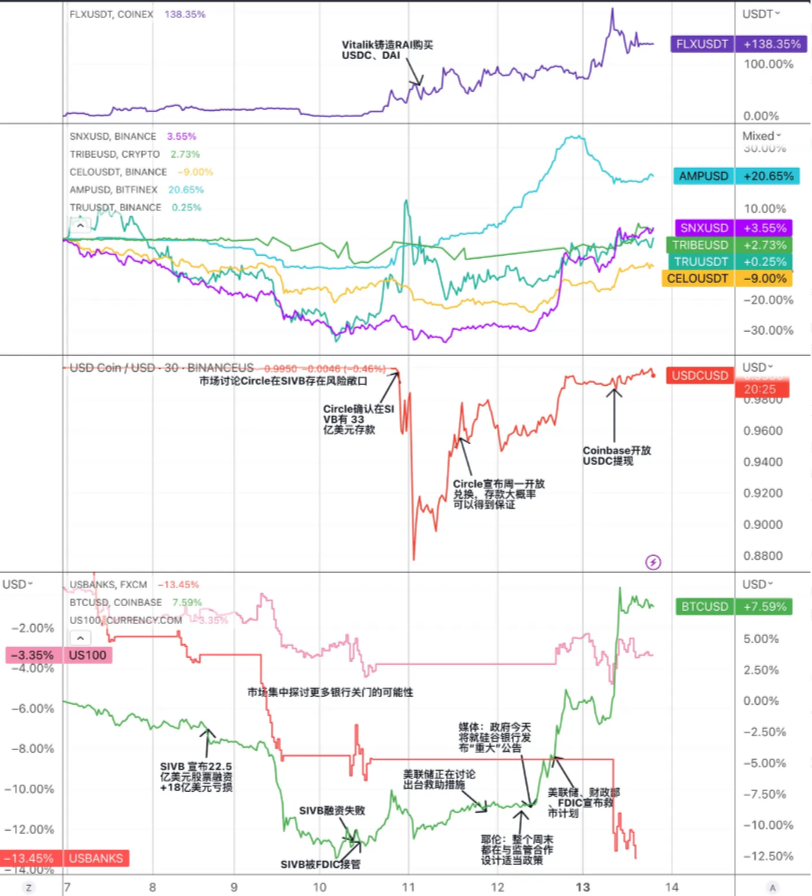

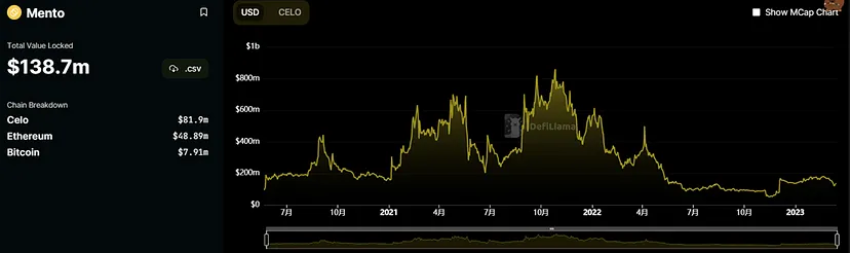

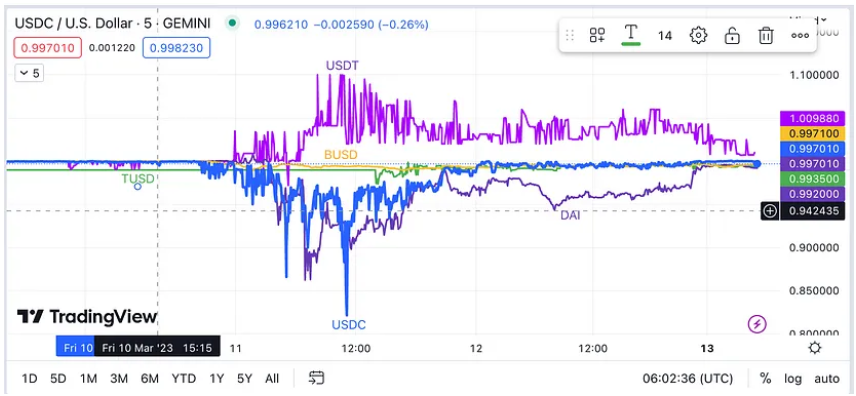

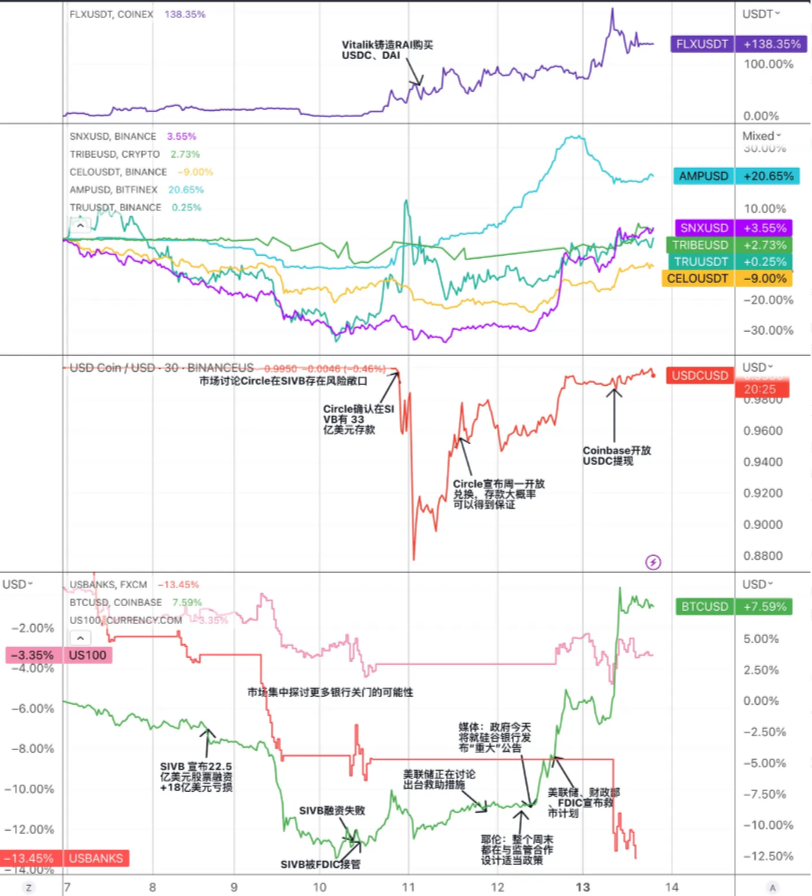

USDC is a centralized stablecoin pegged to the U.S. dollar issued by Circle and Coinbase. On March 11, 2023, as Silicon Valley Bank (SVB) filed for bankruptcy, part of Circle's cash reserves in the bank were frozen, which caused a decline in market trust in USDC, resulting in large-scale runs and sell-offs. The price of USDC dropped from $1 to $0.878, and it also saw wide spreads with other stablecoins such as DAI and BUSD. Subsequently, on March 13, due to the introduction of the Federal Reserve, the Ministry of Finance, and the FDIC's joint rescue plan, the market panic gradually dissipated, and the price of USDC returned to a level close to the usual level.

image description

image description

Source: Trend Research, Tradingview

To address this crisis, Circle has taken the following steps:

Negotiate with SVB to unfreeze some funds and transfer them to other banks.

Reduce circulation by destroying some USDC and increase market confidence in its reserve adequacy.

Cooperate with other stable currency issuers and open 1: 1 exchange channels to relieve market pressure.

Cooperate with centralized exchanges to suspend or limit USDC deposit and withdrawal services to prevent malicious arbitrage.

During the whole USDC unanchoring process, it caused panic and volatility in the cryptocurrency market, affecting investor confidence and trading activity. Among them, the centralized stable currency market, decentralized stable currency, on-chain lending, DEX and other track projects have encountered certain risks:

Centralized stablecoin market: USDC de-pegging may damage its position and reputation in the centralized stablecoin market, first causing the market to question and panic sell all stablecoins, but then making other competitors (such as TUSD, USDP etc.) have the opportunity to seize its share. At the same time, during the panic, the decline in stablecoins such as BUSD and USDP, which have not issued risks, actually provided low-risk arbitrage opportunities.

Decentralized stablecoins: The unanchoring of USDC has affected those decentralized stablecoins (such as DAI, FRAX, MIM, etc.) that use USDC as reserves or collaterals. Arbitrage opportunity. At the same time, it may also stimulate the innovation and development of decentralized stablecoins (such as sUSD, LUSD, RAI, etc.) that do not rely on fiat currency reserves or collateral.

DEX: USDC unpegging may affect those on-chain dexes (such as Uniswap, Curve, etc.) that use USDC as trading pairs or liquidity pool assets, causing them to have price slippage or arbitrage opportunities. At the same time, it may also promote the dex on the chain to improve its transaction efficiency and flexibility to adapt to market changes.

Implications and opportunities for stablecoin systems

Synthetix

secondary title

Synthetix was launched in 2018. It was a synthetic asset agreement in the early stage, and then gradually transformed into a decentralized liquidity supply agreement built on Ethereum and Optimistic.

The user pledge agreement governance token SNX can generate stable currency sUSD, and the size of sUSD is currently about 55 million US dollars. The mortgage rate of sUSD minted by SNX is 400%, and the liquidation line is 160%. This is a relatively high mortgage rate, and the capital utilization efficiency is low. The main reason for this is that SNX is the governance token of the protocol itself, and its price fluctuates greatly. The higher mortgage rate can cope with extreme risks in the market and maintain the stability of the system.

sUSD maintains the price anchor through an arbitrage mechanism. The minting price of sUSD is always $1. When the market price is higher than the minting price, arbitrageurs can mint new sUSD and sell them at the market price to make a profit. The market supply increases and the price falls. When the market price is lower than the minting price, arbitrageurs can buy back sUSD from the market, and then destroy sUSD to reduce debt.

The application scenario of sUSD is based on the "debt pool" formed by SNX pledge. Debt pools are unique to synthetix. All users who pledge SNX to mint sUSD share a debt pool. When a user mints sUSD, the amount of minted sUSD to all sUSD is the ratio of the user to the entire debt pool, and all minted sUSD is the debt of the entire system. If a user's investment strategy achieves asset appreciation (such as sUSD buying sETH, and the price of sETH rises), it will lead to an increase in the debt of other users.

The debt pool can provide liquidity, zero slippage, can act as a counterparty, provide liquidity services for various agreements, and has good composability.

On the basis of this debt pool, SNX builds its own ecology. Synthetix does not directly provide any front-end, but acts as a back-end liquidity provider for some DeFi protocols. The current ecology includes Curve, contract exchange Kwenta, options exchange Lyra, etc.

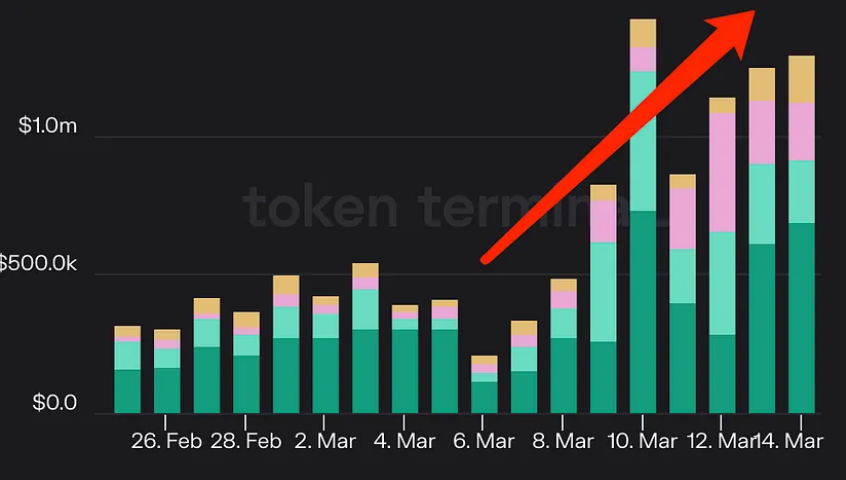

sUSD has its own relatively stable application scenarios. Recently, Kwenta's transaction data and revenue data have increased significantly.

In this USDC panic, although the underlying assets of sUSD do not have USDC, the price has also been affected to a certain extent. The lowest fell to around 0.96. However, it was soon equalized by arbitrageurs. The related panic selling is mainly dominated by emotions, because the Synthetix system does not have direct risk exposure to USDC, and the decline in the price of non-sUSD synthetic assets during the same period will actually reduce the liabilities (risk of liquidation) of sUSD creators, so sUSD is more Compared with other stable currency projects with a large amount of USDC on the balance sheet, the certainty of anchoring is higher.

image description

Source: Trend Research, CMC

Synthetix is undergoing a V3 revision. In V3, new types of pledged assets will be added. In addition to SNX, other encrypted tokens such as ETH can also be pledged to generate sUSD. Previously, the scale of sUSD was limited by the market value of SNX. After the implementation of the V3 version, it will no longer be limited by this, and the scalability of sUSD will be enhanced. With the growth of funds flowing into Optimistic, it is expected to establish a richer ecology and obtain a larger market size.

MakerDAO

secondary title

MakerDAO is a smart contract system built on Ethereum in 2014. It adopts the form of DAO (Decentralized Autonomous Organization) to issue a decentralized stablecoin DAI that maintains a 1: 1 anchor with the US dollar.

The protocol mortgages various types of encrypted assets and issues the stable currency DAI according to a certain mortgage ratio, which is essentially a trustless over-collateralized loan. When the collateral value is lower than the minimum collateral ratio (150%), the user's collateral may be liquidated (forcibly sold collateral to return DAI), so as to ensure that the Maker system will not have a debt gap to the greatest extent.

The goal of DAI is to minimize the volatility of cryptocurrencies, but market behavior often causes DAI to deviate from the initial design price of $1. Therefore, the main goal of the Maker system is to maintain the price stability of DAI.

One of the means for the Maker system to regulate the price of DAI is to adjust the stable interest rate. Because the stable interest rate represents the borrowing rate that users need to pay for borrowing DAI, it can affect users' lending behavior by increasing or reducing the borrowing rate. However, the adjustment of the stable interest rate is changed by MKR holders through voting, and the governance cycle is relatively long, so the price regulation cycle will also be lengthened. Moreover, the actual market situation faced by DAI is that as ETH rises, the demand for DAI will fall, and as ETH falls, the demand for DAI will rise, but the market supply rule is the opposite.

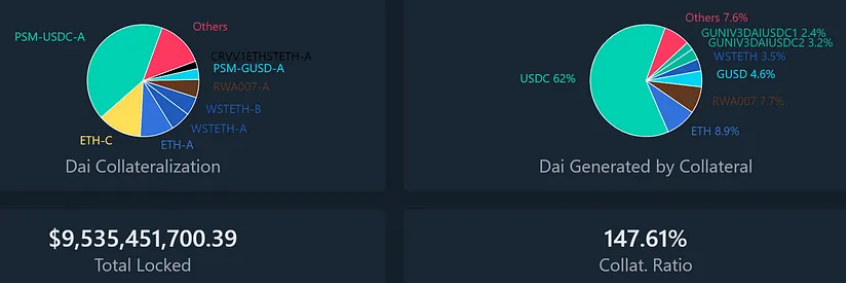

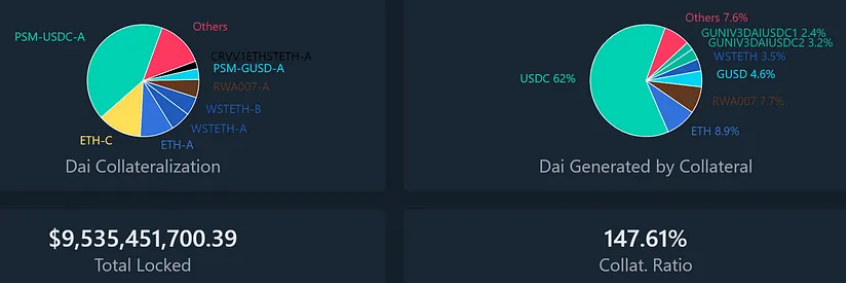

Therefore, in order to solve the above two problems, Maker designed the anchor stabilization module (PSM). The first implementation of PSM is USDC PSM, which means that users who deposit USDC can exchange DAI at a 1:1 exchange rate, and the transaction fee is only 0.1%. This module is a currency swap agreement based on the fixed price of DAI, similar to a rigid payment with a certain amount, which can provide bilateral buffer protection for the price of DAI.

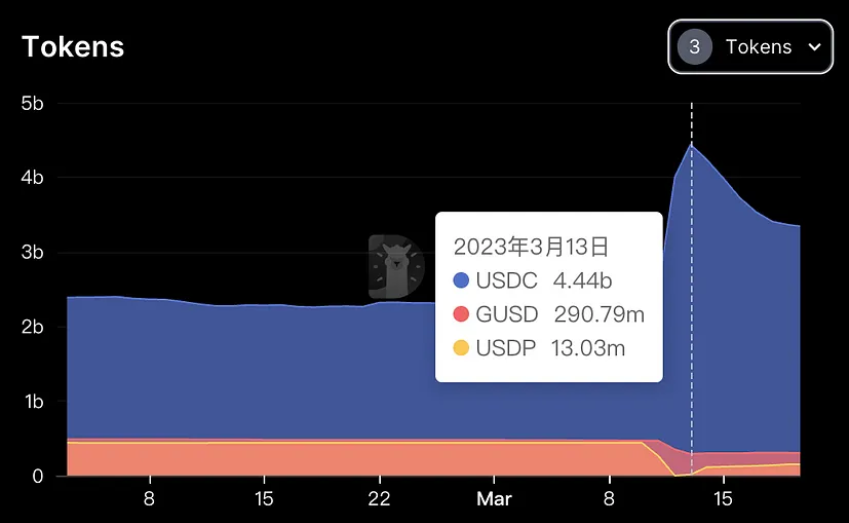

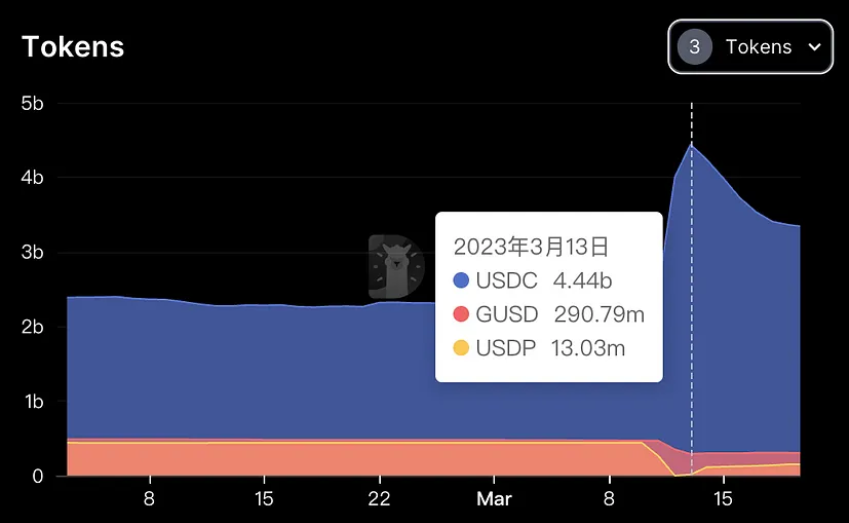

PSM solves the stability problem of DAI price to a large extent, and can make the Maker system not need to frequently adjust its borrowing rate, so as to ensure the controllability of the borrowing cost of the borrower. PSM's capital scale expanded very rapidly, causing USDC to become the largest source of collateral for DAI. And it is precisely this silky exchange mechanism that made USDC quickly dumped into PSM in this panic. At present, the amount of USDC PSM minted DAI has reached the debt ceiling, and other volatile assets (such as MATIC) have undergone relatively large redemptions. Therefore, the proportion of USDC PSM minted DAI has increased from 40% to the current 62%.

image description

Source: Trend Research, Daistas.com

When most of the collateral falls in price due to the stablecoin panic

On March 12, 2020, the price of Ethereum plummeted 43% in one day, resulting in a severe shortfall for many users who used cryptocurrencies such as Ethereum as collateral to generate DAI (known as Maker Vault). These deficient Vaults were forced into liquidation and their collateral was auctioned off to pay debts and penalties. However, due to market panic, network congestion, and system failures, some auctions had zero bids, that is, someone won a large amount of collateral with 0 DAI. This resulted in a loss of approximately 5.4 million DAI from the MakerDAO system and a significant reduction in the supply of DAI.

As the demand for DAI far exceeds the supply, the anchoring relationship between DAI and the US dollar has been destroyed, and DAI has a premium of about 10%. At this time, the risk-benefit ratio of shorting DAI and waiting for its price to return or even further drop is very high. high.

When Only USDC Continues to Discount

That is, the first USDC unanchoring crisis in history is a huge risk for the DAI system, because half of the current DAI is generated by USDC as collateral. If USDC loses its anchor, DAI will also be affected, causing its price to fluctuate or become irredeemable. To prevent this from happening, the MakerDAO community passed a series of emergency proposals to reduce the debt ceiling of several liquidity pools, including USDC, to zero DAI, meaning they cannot continue to issue new tokens.

In addition, in the part of the so-called "stable module" (PSM) exposed to USDC risk, the daily issuance limit was reduced from 950 million DAI to only 250 million DAI, while the transaction fee was increased from 0 to 1%.

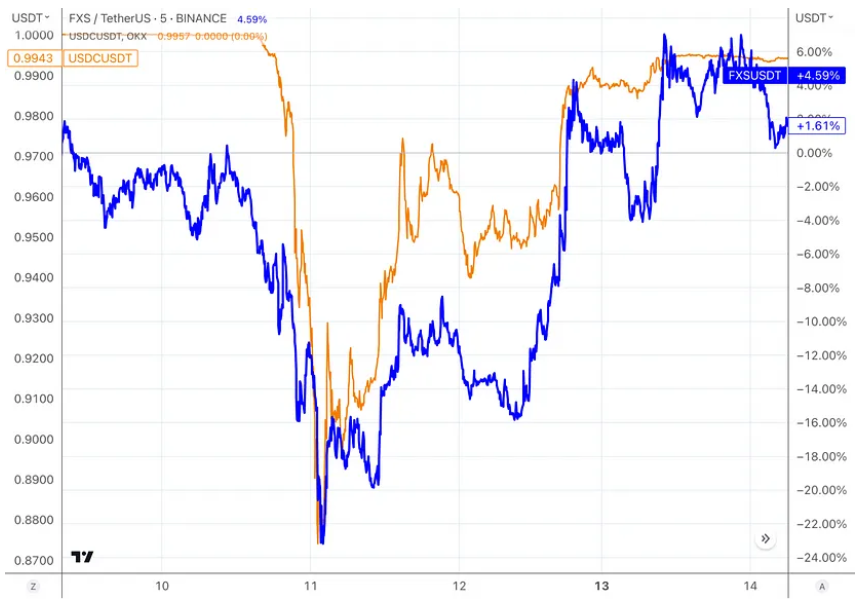

USDC minting DAI is not over-collateralized, so Vault liquidation cannot be performed. If the price of USDC falls below $1, users who use USDC as collateral to generate DAI will have a deficit, i.e. they will need to pay more DAI to redeem their USDC. In this way, they will face the risk of loss or being unable to withdraw, and the entire system may be paralyzed, so there may be a risk of re-auctioning the system governance token $MKR to make up for the shortfall, which is why the price of $MKR once fell during the crisis. It fell more than 30%, but then after the USDC crisis was lifted, the price of $MKR quickly rebounded to the level before the crisis.

image description

Source: Trend Research, Tradingview

In addition to the trading opportunities of MKR's value restoration, there are also trading opportunities in the price of DAI itself. Because the comprehensive mortgage rate of the assets behind DAI is higher than 150% most of the time, DAI can be understood as an enhanced version of USDC. When the price is lower than USDC, and after the USDC risk is confirmed to be eliminated, the price should rebound faster , the figure below shows that when the No. 11 crisis was gradually digested by the market, the price of DAI was always slightly higher than USDC.

image description

It is also worth noting that during this crisis, the stablecoin minting module PSM poured in a large amount of 950 million USDC, while the unrisked GUSD deposits flowed out substantially, and other collateral pools also flowed out more or less, showing the "inferiority". How to deal with the effect of “money drives out good money” and how to deal with similar structural risks deserves more attention and discussion.

Liquity

secondary title

Launched in April 2021, Liquity is a decentralized stablecoin lending platform based on Ethereum. Users can and can only generate USD-pegged stablecoin LUSD by staking ETH. Liquity does not charge borrowing interest, but only charges a one-time minting fee and redemption fee, encouraging users to hold LUSD for a long time. Liquity is managed by a smart contract. After the protocol is deployed, it cannot be modified. It is not responsible for running the front-end. User interaction needs to go through a third-party front-end, which has the characteristics of strong decentralization and anti-censorship.

At present, the circulation of $LUSD is about 243 m, the TVL is $572 m, the number of ETH pledged is 388 k, and the total mortgage rate is 235.1%.

Liquity's minimum mortgage rate is 110%. When it is lower than 150%, it will enter the recovery mode, and when it is lower than 110%, it will trigger liquidation. In recovery mode, vaults with a mortgage rate below 150% may also be liquidated, and further reductions in the total mortgage rate are prohibited by the system. The purpose of the recovery mode is to quickly increase the overall mortgage rate of the system to more than 150% to reduce system risk.

Liquity adopts a hierarchical liquidation mechanism to maintain system stability. The stable pool incentivizes users to store LUSD through liquidity mining, and destroys debts and obtains ETH during liquidation. When the stable pool is exhausted, the system will redistribute the debt, and distribute the remaining debt and ETH to other vault holders in proportion.

Stable pool providers and front-end operators can be rewarded with the governance token LQTY. LQTY represents a claim on protocol benefits (minting and redemption fees) and governance rights (voting rights).

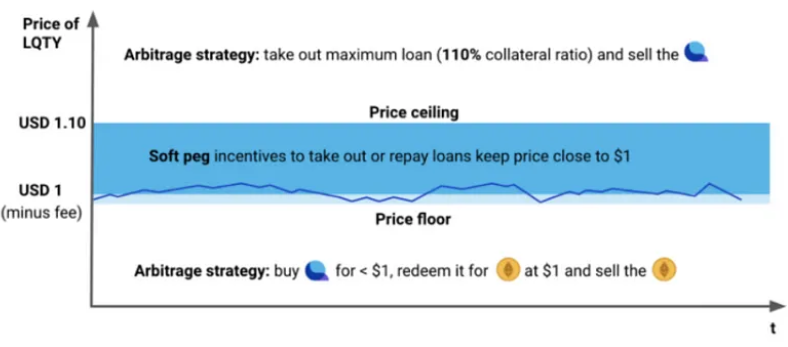

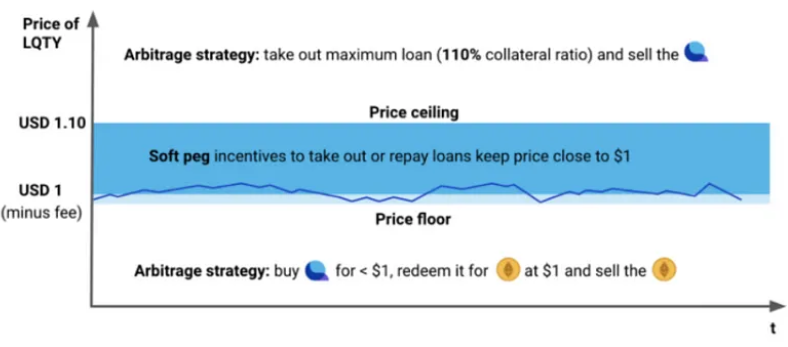

When the price of LUSD is lower than $1, users can buy LUSD at a low price from the market, then redeem ETH and make a profit. When the price of LUSD is higher than $1 (for example, 1.1), users can mortgage ETH to mint LUSD, and then sell LUSD at a high price in the market and make a profit. In this way, the price of LUSD will fluctuate between (1 - redemption fee, 1.1 ) and tend towards $1. This is the hard peg mechanism for LUSD. At the same time, since users can mint and destroy LUSD at a price of 1 USD at any time, users will form a psychological expectation (Schelling point) that 1 LUSD = 1 USD.

image description

Source: Trend Research, Liquidity

On May 19, 2021, the price of ETH dropped rapidly from $3,400 to $1,800, and more than 300 addresses were liquidated. Liquity launched two recovery modes, but due to too fast recovery (mortgage ratio quickly fell below 150%) regression) resulting in dune data not being captured. During this period, a total of 93.5 M LUSD debts were liquidated, and 48,668 ETH were distributed to the depositors of the stable pool. The above liquidation was completed by the stable pool. The participants of the stable pool were equivalent to discounting ETH, and the above process did not trigger redistribution mode, this stress test demonstrates the robustness of the Liquity model.

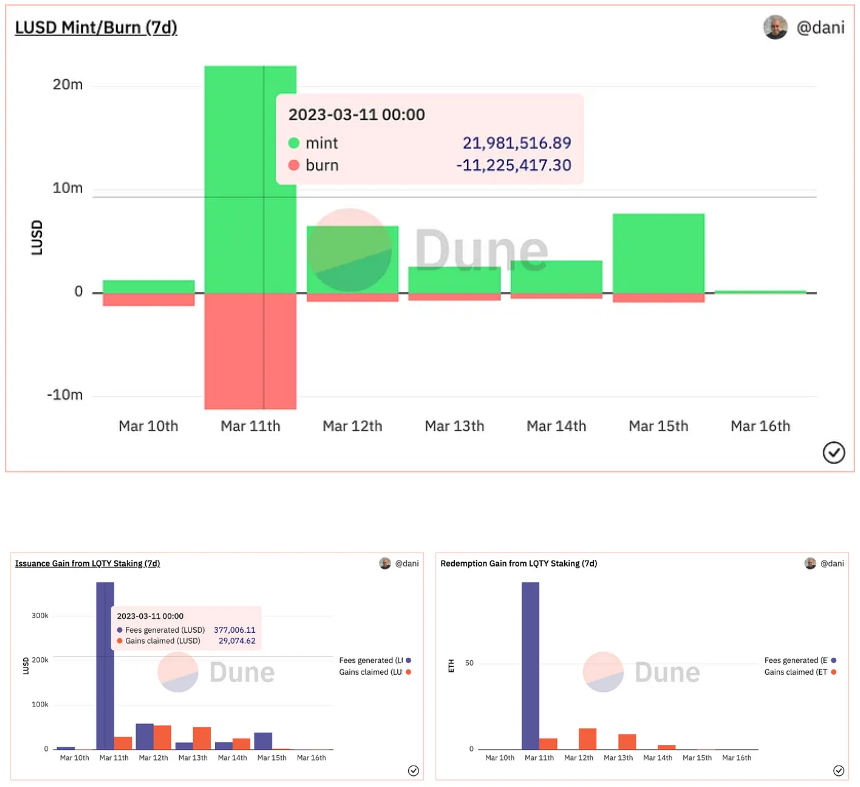

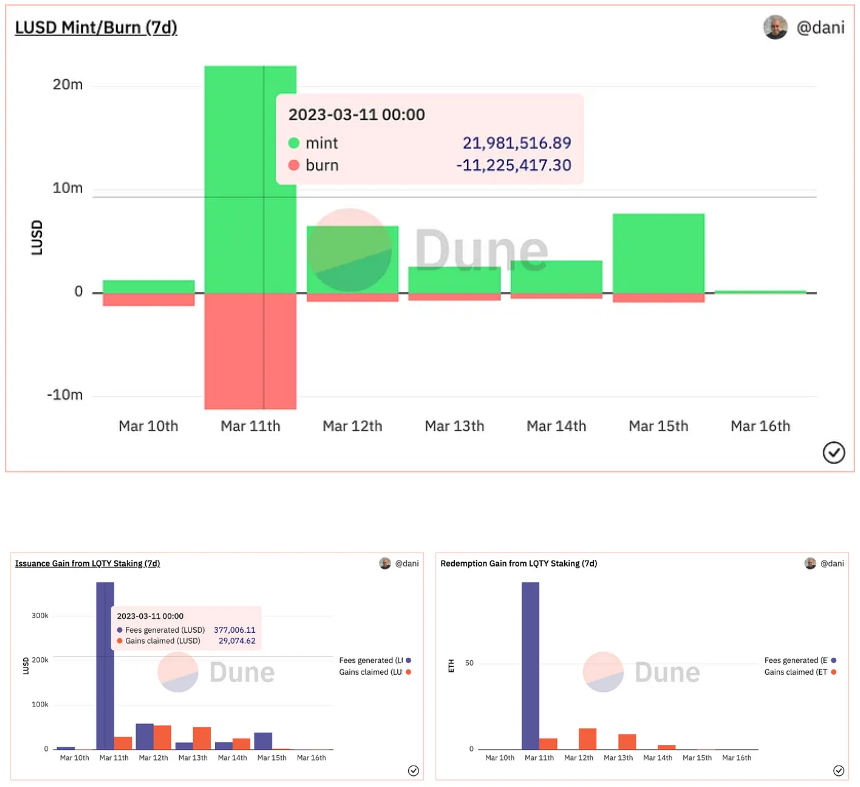

image description

Source: Trend Research, Dune

image description

Source: Trend Research, Dune

The reason for the rise of LUSD when the market is in crisis is that some users need to repay LUSD to close their positions in order to avoid being liquidated. Existing users will have the motivation to deposit LUSD into the stability pool and hope to obtain liquidated discounted ETH at a lower cost. Both components constitute demand for LUSD. In addition, the USDC holders who fled in a hurry from the LUSD pair USDC liquidity pool also helped to passively increase the price of LUSD.

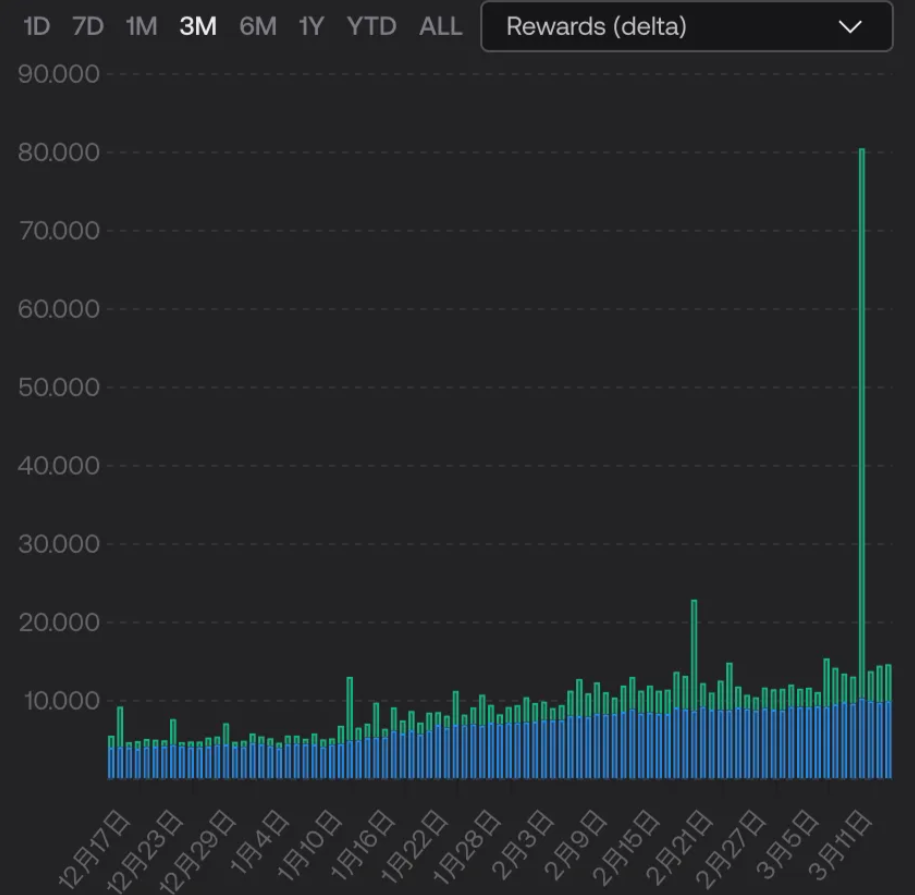

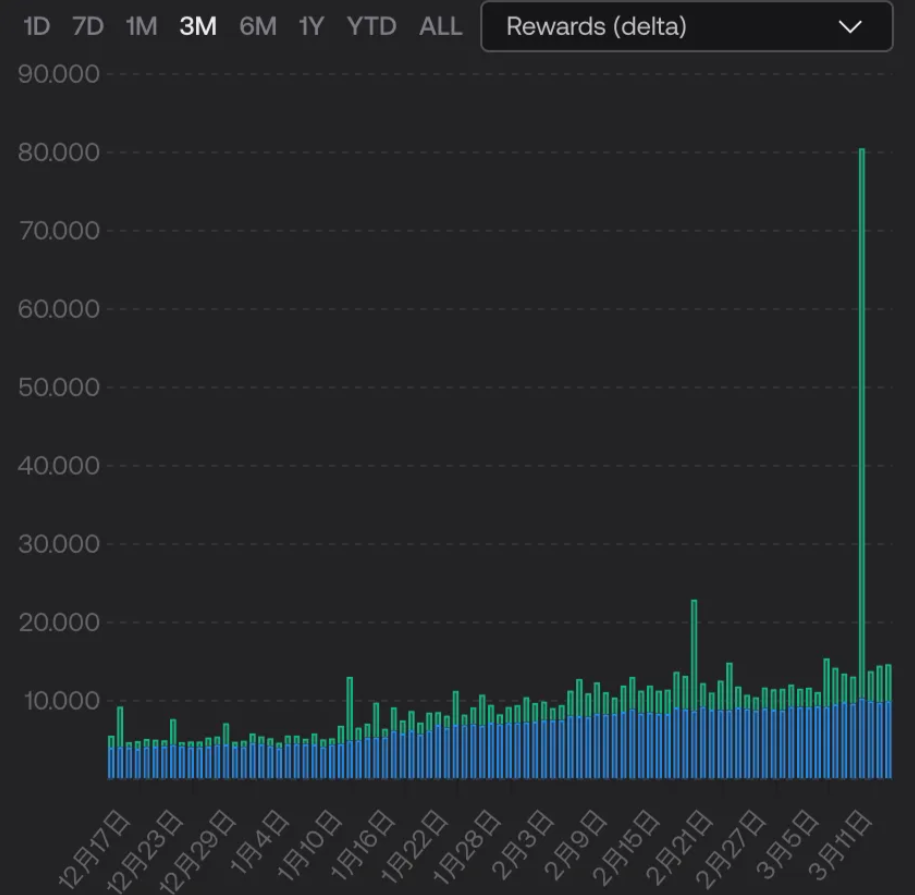

On the day of USDC’s panic, arbitrage opportunities were created due to price fluctuations, and the number of lusd mint and burn increased significantly. The number of new mints was 21.98 m, and the amount of burns was 11.22 m. 4%, which led to a sharp increase in the income of the agreement on March 11. The casting process obtained 377,000 lusd, and the redemption process obtained 97.4 ETH. This part of the income is fully attributable to LQTY stakers, resulting in a short-term sharp increase in LQTY yield. At the same time, it was observed that the usdc panic raised the market's attention to the strong decentralized stable currency lusd, and the supply of lusd and the number of troves showed an upward trend. From March 11 to 16, the total supply of lusd increased by about 12%.

Source: Trend Research, Dune

Reflexer

secondary title

Reflexer is an over-collateralized decentralized stablecoin platform. Users can use ETH as collateral to generate RAI, a stablecoin that is not anchored to any legal currency or assets.

The redemption price of RAI is automatically adjusted by market supply and demand and a PID controller-based algorithm to achieve low volatility. Users over-mortgage ETH to generate RAI, pay 2% annual interest, and repay RAI to redeem ETH. The liquidation line is 145%, but the current over-mortgage rate is 300%-400%. Reflexer has a triple liquidation mechanism to ensure system security, and charges a 2% stability fee as a surplus buffer. FLX is Reflexer's governance token and the system's lender of last resort.

When the market supply and demand are out of balance, Reflexer will actively adjust the redemption price of RAI, and guide the market price back to the redemption price by incentivizing users to arbitrage. The RAI system adopts a mechanism based on PID control (proportional-integral-derivative controller), using a series of parameters to adjust the above-mentioned control process.

Liquidation is triggered when the value of a user's collateral relative to the value of the loan falls below a certain threshold. The liquidator obtains the ETH collateral of the liquidated party through a fixed discount auction and repays the RAI debt for the liquidated party. When the surplus buffer is not enough to deal with bad debts, the agreement will enter the "debt auction" process, and the system will issue additional FLX in exchange for RAI in the market to complete the debt treatment.

Use cases for RAI

currency market

That is, the redemption price of reflexer will be adjusted according to the market demand for RAI. When the market price is higher than the redemption price, users will choose to mortgage ETH and lend RAI, and then sell it in the market.

Other use cases include Stacked funding rates; Yield aggregator- leverage positive/negative redemption rate (when the redemption rate is positive, you can optimize the yield on the lending agreement) and Sophisicated arbers arbitrage tool.

In general, Reflexer has the advantages of complete decentralization and eventually no governance. Collateral is not anchored to fiat currencies. Vitalik has positive comments and support from the Ethereum community. At the same time, it lacks passive requirements and use cases, and is currently over-collateralized The rate is 300% -400% ( 357%) , low capital efficiency, low token value capture, and insufficient tokens for incentives (the FLX reserved for incentives may be insufficient for subsequent promotion of use cases) is Reflexer's current Defects.

In terms of capital efficiency, Liquity is superior to Reflexer (Liquity 260% mortgage rate vs. Reflexer 357%),

In terms of borrowing volume, Liquity’s borrowing volume is several times that of Reflexer, and in terms of P/S valuation, FLX is undervalued compared to LQTY.

In addition, Vitalik put forward suggestions for improving Reflexer's mortgage mechanism in January this year. He believes that ETH holders need more incentives to lend RAI by over-collateralizing ETH on the Reflexer platform, because staking ETH can get a risk-free 5% reward, while This part of the arbitrage floating income of the redemption rate obtained by Reflexer is not very attractive unless it exceeds 5%. However, due to the consideration of an additional layer of contract risk, the community currently rejects the proposal to use pledged ETH as collateral.

Celo

secondary title

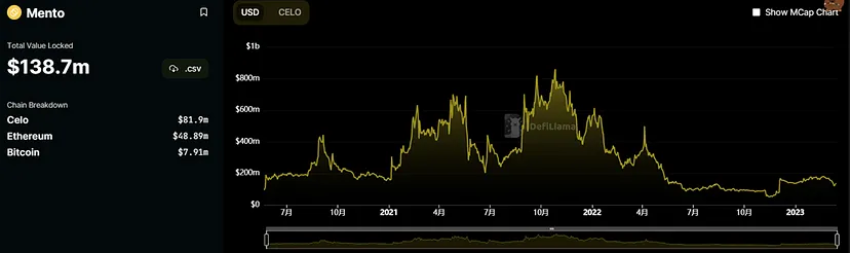

Celo is an open source payment network that focuses on mobile terminals. Its main network was officially launched in April 2020. The network combines the characteristics of PoS consensus mechanism and EVM compatibility, and has built a variety of DeFi services for users. , cross-border payment and other trading media, support multiple tokens to pay Gas fees, map phone numbers to wallet addresses to simplify transfer operations, etc. And launched its on-chain stablecoins CUSD, CEUR and CREAL.

image description

Source: Trend Research, Defillama

The difference between the Celo mechanism and the mechanism between LUNA and UST is that the capital endorsement of Cusd, cEUR, and cREAL includes ETH and BTC in addition to CELO tokens, so when the price of CELO tokens fluctuates greatly, as long as the storage pool’s ETH and BTC The asset size can be greater than the circulating market value of the stablecoin, which is still the way of overcollateralization, so there is no risk of breaking the anchor in these stablecoin theories. Of course, if the market value of CELO shrinks rapidly, causing the market value of Ethereum and BTC in the storage pool to fail to cover the market value of the stablecoin in circulation, then the stablecoin may be unanchored.

Therefore, as long as Celo does not experience a drop of more than 50%, the possibility of stablecoin de-anchoring is low. In the future, if the scale of stablecoins continues to grow, but the scale of BTC and ETH in the storage pool does not increase accordingly, the risk of its unanchoring will increase.

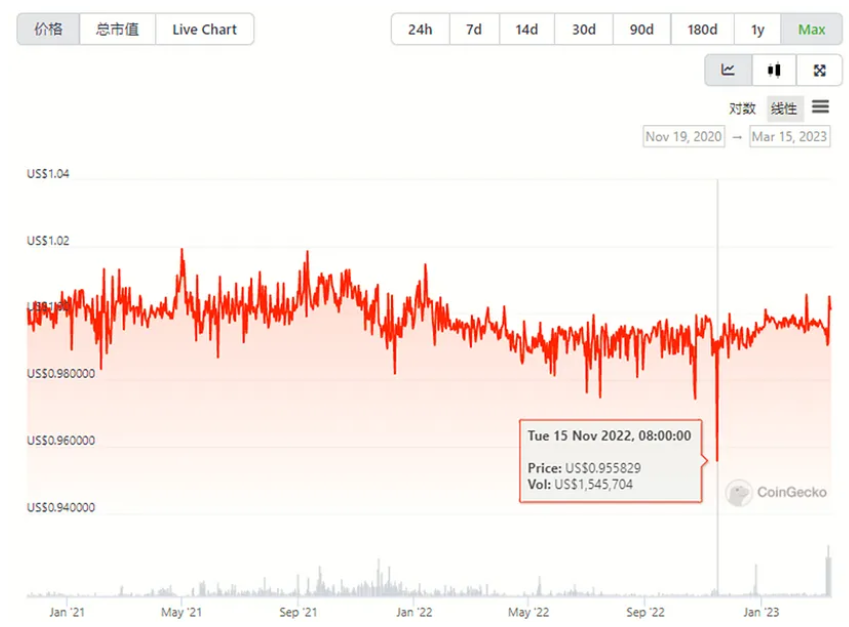

image description

Source: Trend Research, CMC

Frax Finance

In general, for CELO's stable currency mechanism, there are not many factors that can be affected by the external environment. The core lies in the asset size of ETH and BTC in the reserve pool. The unanchoring of USDC has no direct impact on CUSD, and because CUSD is mainly circulated on the Celo chain at present, it has a low degree of correlation with USDC.

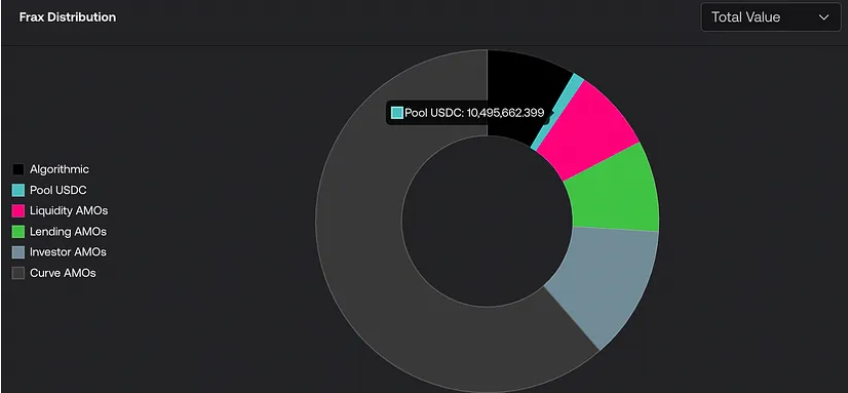

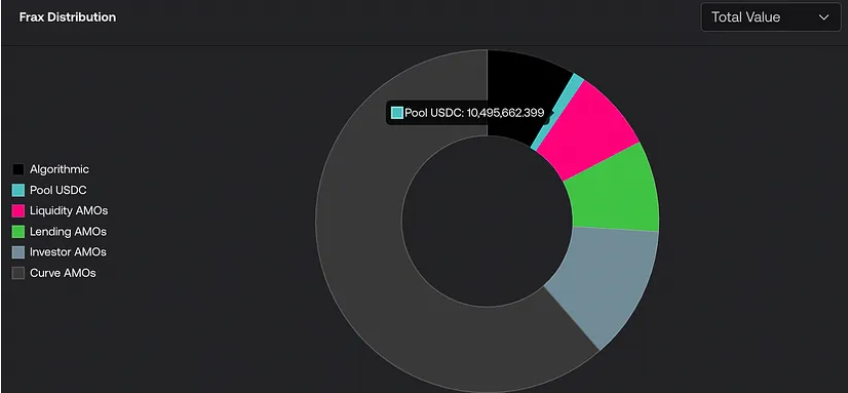

The FRAX stablecoin system was launched in December 2020, currently in version v2, and the core mechanism is AMO (Algorithmic Market Operation Controller).

The FRAX token was originally designed to use 100% USDC as collateral, and then mixed USDC and FXS as collateral to continuously reduce the pledge ratio of USDC.

In February 2023, the community voted and passed the proposal of "permanently setting the mortgage rate to 100%", which will suspend the FXS repurchase until the agreement income is sufficient to increase the pledge rate to 100%. The current agreement pledge rate remains at 92%. In addition, Frax Finance will launch the lending market Fraxlend in September 2022, which supports users to mortgage their assets to lend FRAX. This part of FRAX is over-collateralized, and the mechanism is similar to MakerDAO. The difference is that users who hold FRAX can deposit FRAX in the loan pool to earn borrowing fees.

AMO aims to arbitrarily formulate FRAX monetary policy and invest reserve assets without reducing the mortgage ratio or changing the price of FRAX, so as to improve capital efficiency and bring more value capture to FXS holders. After the launch of the AMO mechanism, the scale expansion of stablecoins is mainly controlled by AMO. At present, the core AMO pools are Liquidity AMOs (multi-chain DEX provides liquidity), Lending AMOs (loan pool), investor AMOs (investment), Curve AMO (Curve ecology) . Among them, the total amount of FRAX tokens controlled by the protocol is nearly 800 million.

image description

Source: facts.frax.finance

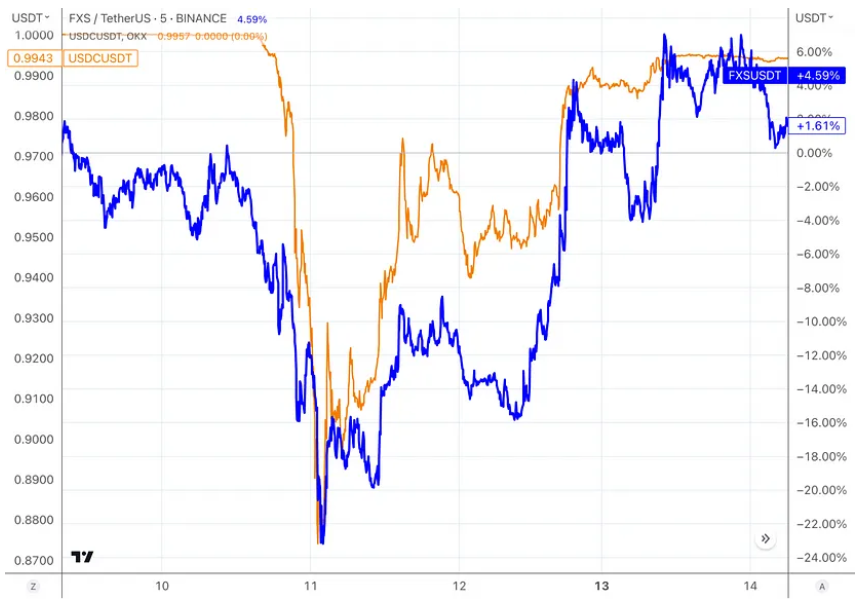

In this USDC incident, the price of FRAX was greatly impacted, and the price fell to as low as $0.87. The main reason is:

The FRAX algorithm stable currency part is collateralized by USDC+FXS, of which USDC accounts for 92%. After the community voted to increase the collateral rate to 100%, 100% USDC is used as collateral, so the actual value is equivalent to USDC.

In Curve AMO, the amount of FRAX used as LP in Curve is 270 million, and the core pools are FRAX/USDC and FRAXBP (FRAX/USDC/USDT/Dai).

The Frax Finance team has no public remedial measures in this incident, but the team stated in the community that the long-term plan is to solve this type of risk problem by opening FMA).

Since the collateral is a stable currency and the future mortgage rate will gradually increase to 100%, it is impossible to improve the user's capital efficiency. The main ecological cooperation of FRAX is Curve and Convex, and there are currently no other FRAX application scenarios in the market. Overall, the market demand for FRAX is not high.

Since FRAX tokens are not widely used in other dapps, the main arbitrage behavior occurs on Fraxlend, that is, users who have lent FRAX tokens in Fraxlend can buy FRAX at a discount in the market to repay the loan in advance.

image description

Source: Trend Research, CMC

However, due to the uncertainty brought about by the collateral crisis, its governance tokens also suffered a sell-off during the crisis and fell by more than 20%. The reason for the sell-off may be similar to that of MKR tokens, and there are potential system imbalances and the risk of additional token issuance to fill holes . However, when the USDC crisis was lifted, the price of FXS, like MKR, rebounded rapidly by more than 40%.

image description

Source: Trend Research, Tradingview

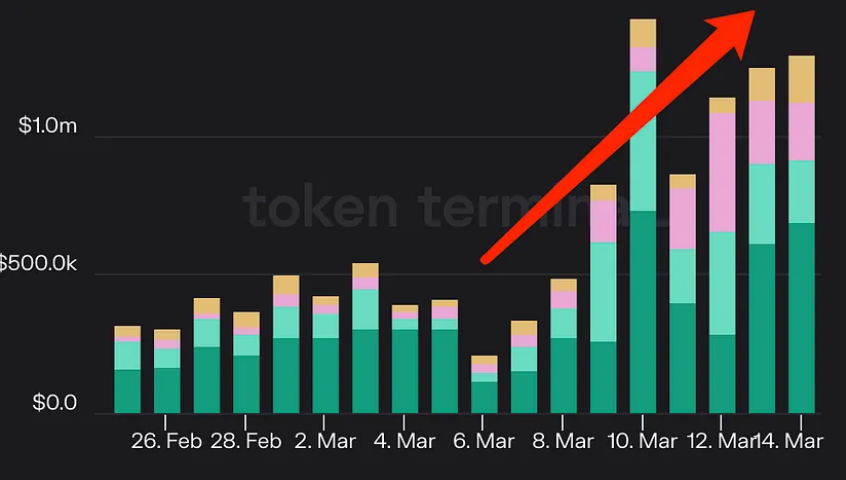

In addition, the Frax system has an ETH 2.0 liquidity staking service. When the market was turbulent, due to the increase in front-running transactions, the revenue of nodes around March 10 increased by more than five times.

image description

For example, on March 10, when a USDC user exchanged the 2 million USDC he held into USDT on the chain, he was accidentally paid by an MEV robot for a gas fee of 45 US dollars and a gas fee of 39,000 US dollars because no slippage was set. MEV made a net profit of 2.045 million USD after bribing money, while the user traded 2.08 million USDC but only received 0.05 USDT.

GHO

secondary title

Aave is a general-purpose lending protocol that supports arbitrary inter-borrowing between multiple encrypted assets. Its team announced in July 2022 a plan to issue the stablecoin GHO. The overall generation mechanism of GHO is similar to that of DAI, both of which are based on over-collateralization The loan maintains a 1:1 anchor with the US dollar. The core logic is that the user deposits the supported collateral type into the vault and obtains the stable currency GHO according to a certain mortgage ratio. After repayment or liquidation, this part of the stable currency will be destroyed.

Aave launched the stable currency business mainly to obtain more income, because the minting fee of stable currency is usually higher than the loan spread income obtained by the general lending business, which can capture additional income for Aave. And, this part of the income will flow directly into Aave's Treasury.

Aave's current lending business is basically relatively mature. Compared with the difficulty of promoting stablecoins with other newer protocols, Aave has a certain degree of market credit endorsement. Secondly, Aave’s current protocol version has been iterated to V3, and the V3 upgrade plan has not yet been fully deployed. V3 will also greatly help the application use cases of stablecoins.

One of the unfinished plans is about efficient lending market (e-Mode), which allows the same type of collateral to be borrowed at a higher LTV. The first is that 90% LTV loans can be realized between ETH (WETH, wstETH) assets, that is, the original mortgage value of $ 2,000 WETH can lend up to $ 1,600 wstETH, and now $ 2,000 WETH can lend up to $ 1 , 800 wstETH, more efficient use of funds. The next step is to realize e-Mod lending between stablecoin assets (L2 has been deployed, the Ethereum mainnet has not yet been deployed), and the LTV may reach 93%. This implementation has greatly improved the efficiency of the use of funds for stablecoin assets. After the launch of GHO in the future, it will also have a positive effect on stabilizing the price and promotion of GHO. However, it faces the same problem as MakerDAO PSM, that is, the center of the module Regulatory issues facing stablecoins.

The second unfinished plan is cross-chain deployment. Although Aave has been deployed on multiple chains and maintains the advantages of the leading DeFi lending agreement, it has not achieved real cross-chain liquidity. After the implementation of Aave V3 cross-chain deployment, it will also have certain advantages for the scale expansion of GHO. The Aave V3 "portal" function allows assets to flow seamlessly between V3 markets through different networks, that is, through the whitelist cross-chain bridge protocol, Aave's "aTokens" are minted on the target chain and destroyed on the source chain to achieve liquidity The purpose of transferring from the source chain to the target chain.

image description

Now that the V3 cross-chain portal whitelist proposal has been voted on, Aave will utilize Wormhole’s universal messaging for communication between source and target chains, and Hashflow’s cross-chain DEX to fetch quotes from market makers , and execute trades with zero slippage and MEV protection.

CRVUSD

secondary title

Curve will release the white paper of its protocol stablecoin in October 2022, launching its stablecoin Curve.Fi USD Stablecoin, referred to as crvUSD. Curve has designed a collateral LLAMMA model with continuous liquidation and buying. Users can over-collateralize crvUSD in LLAMMA and avoid the risk of the user's assets being liquidated at one time. At the same time, combined with the automatic issuance and destruction mechanism of Pegkeepers, to Stabilize the supply and demand relationship of crvUSD in the market.

At present, crvUSD has not been officially launched yet, but if mainstream stablecoins such as USDC are unanchored again in the future, relying on its currently announced design mechanism, the possible situations are as follows (assuming USDC is unanchored again):

1) In theory, crvUSD is minted by over-collateralization of mainstream assets such as ETH and BTC, so if mainstream stablecoins are de-anchored and the price of collateral assets is not affected, theoretically there will be no direct value fluctuations in crvUSD;

2) Although crvUSD is minted in an over-collateralized manner, its price stability still depends on the liquidity depth of the market liquidity pool. As Curve's official stable currency, crvUSD may enter the 3 pool in the future. And the Curve team holds a large amount of veCRV, which can give crvUSD a large amount of liquidity incentives in the early stage, so the early cold start should be relatively smooth.

However, if crvUSD, USDC, and USDT are all in the 3 pools, and USDC is unanchored, users are in a risk aversion mood and may convert a large amount of USDC into USDT and crvCRV, then the price of crvUSD may exceed 1 in the short term. Dollar. In order to maintain the stability of crvUSD, pegkeeper will issue a large amount of crvUSD and put them into the liquidity pool to restore the price. Therefore, compared with other stablecoins, the mechanism of crvUSD may not be suitable for slippage arbitrage, because the automatic issuance function of pegKeeper will quickly smooth out the arbitrage space of users;

3) If there is a large amount of unanchoring of mainstream stablecoins, the market panic will be heavy, resulting in a large number of liquidations in the encrypted market, including LLAMMA will also start to liquidate, and the user's collateral will be converted into crvUSD, and because of emotional panic, crvUSD will also start If the price is unanchored, if the user believes that pegkeeper has the funds to buy crvUSD in the market to destroy it, so as to restore the price, that is, when the crvUSD is lower than $1, there is a potential arbitrage opportunity;

The above 4 points are inferred based on the existing mechanism announced by Curve, and the crvUSD has not received market testing this time, and the official effect still needs to be known after it goes online.

first level title

Implications and opportunities for lending, trading agreements

4D review USDC unanchored storm: crisis and opportunity in the DeFi ecological giant earthquake

The price performance of BUSD and TUSD, which Binance has recently increased its trading pairs, is relatively stable, and there is no price fluctuation greater than 1%.

secondary title

Initiatives under different agreements

Agreement: MakerDao Date: 2023.03.12

Countermeasures: The MakerDAO community voted on the "Emergency Parameter Change" proposal, which will be implemented on March 14. The proposal includes: reducing the debt ceiling of UNI V2 USDCETH-A, UNIV 2D AIUSDC-A, GUNIV 3D AIUSDC 1-A, GUNIV 3D AIUSDC 2-A to 0 DAI; reducing the maximum debt ceiling of PSM-USDP-A from 450 million DAI is increased to 1 billion DAI; in USDC-PSM, the USDC → DAI exchange fee (tin) is increased to 1%, and the maximum daily casting amount (gap) is reduced to 250 million DAI; in USDP-PSM, Reduce the USDP → DAI exchange fee (tin) to 0%, increase the DAI → USDP exchange fee (tout) to 1%, and increase the maximum daily casting amount (gap) to 250 million DAI; in GUSD-PSM, set Reduced maximum daily minting (gap) to 10 million DAI; reduced Compound v2 D 3 M and Aave v2 D 3 M target lending rates (bar) to 0% to eliminate exposure; finally, the proposal decided to suspend GSM Reduced delay from 48 hours to 16 hours to improve governance decision agility, this change is a temporary change and will increase the GSM pause delay again when circumstances permit.

Agreement: Aave Date: 2023.03.12

Response: Aave tweeted that necessary action was taken quickly to limit the risk. Given the current volatility surrounding stablecoins, Aave DAO has frozen USDC, USDT, DAI, FRAX, and MAI on Aave v3 Avalanche to prevent new positions from adding risk to the protocol, ie LTV-0.

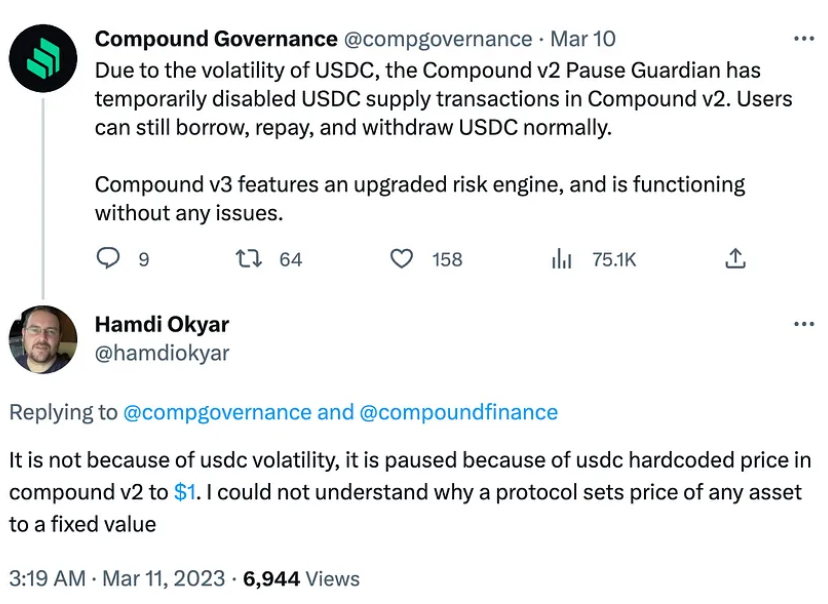

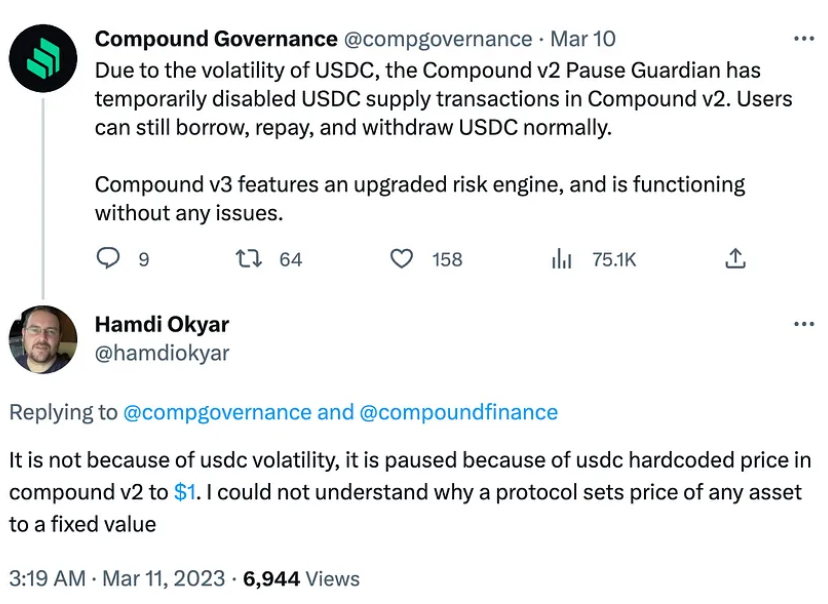

Agreement: Compound Date: 2023.03.11

Countermeasures: Compound v2 has disabled USDC deposits. Compound stated on Twitter that due to USDC price fluctuations, Compound v2 Pause Guardian temporarily disabled the USDC deposit function in Compound v2, and users can still borrow, return, and withdraw USDC normally. Also, Compound v3 has an upgraded risk engine, so it runs without any issues.

Agreement: Compound Date: 2023.03.12

Countermeasures: The Compound community initiated a new proposal to resume minting cUSDC in Compound v2. Voting will begin in two days.

Agreement: dYdX Date: 2023.03.11

In this USDC unanchoring incident, in addition to a large number of people "running poison" to reduce losses, there are also a group of arbitrageurs who have a deep understanding of the mechanism of mainstream DeFi projects. The core is to use the project to anchor the value of USDC to 1 US dollar, and exchange USDC lower than 1 US dollar for other stable coins or digital currencies of higher value, and successfully make a profit. This event will also bring thoughts to current and future projects, whether the prices of all transaction targets can be replaced by fixed values in the actual market value. A few cases are shown below for reference.

secondary title

MakerDAO's PSM

PSM (Peg Stability Module) is a mechanism to help maintain the price stability of DAI. PSM allows users to exchange other tokens for DAI without going through auctions, but through fixed exchange rates. USDP issues stable currency for PAXOS, which has not been affected by this bank payment crisis. When USDC and DAI are discounted, use the price mechanism of PSM: 1 USDC= 1 USDP for arbitrage.

Arbitrage path: Use assets to borrow USDC at AAVE, and then convert USDC 1: 1 to USDP at PSM. When USDC price declines, convert USDP to USDC, and repay the USDC loan at the same time, and the remaining USDC is net profit. From the figure below, it can be seen that during the USDC unanchoring crisis, USDC inflowed sharply, while GUSD and USDP flowed out rapidly, and the stock of USDP was almost zero at one point.

Curve

4D review USDC unanchored storm: crisis and opportunity in the DeFi ecological giant earthquake

Since the Curve price curve formula provides transactions for stablecoins, the exchange between large amounts of stablecoins has lower slippage. When this model is used for non-stable coins, compared with UNI, it will provide greater trading depth at the current market position, resulting in a price difference with other markets. Curve's USDC/USDT price > UNI's USDC/USDT price.

AAVE

The same as the traditional way of moving bricks, buy USDC from UNI and sell it on Curve to earn the difference, but face the risk of a rapid decline in USDC prices in the middle.

The specific path is: use assets to borrow USDC (loan USDT, and then trade as USDC through DEX), pledge USDC to borrow USDT, USDT to purchase USDC, and use USDC to borrow USDT again for a cycle.

secondary title

Centralized exchange arbitrage

Binance supports USDC recharge, and at the same time, USDC will be converted to BUSD at a 1: 1 ratio, thereby completing the conversion of low-value USDC to high-value BUSD.

Coinbase users use Coinbase to withdraw USDC 1: 1 to USD into their bank accounts to complete the arbitrage process. However, the two exchanges responded quickly, and the arbitrage process lasted for a short time before being closed.

If there is a problem with the collateral behind USDC and USDC returns less than $1, then different types of DeFi applications may have the following risks:

Risks faced by lending apps

Lending protocols Aave and Compound are two of the largest on-chain lending platforms that allow users to borrow and lend different cryptocurrencies and earn interest or pay interest fees. USDC is one of the commonly used assets on these platforms.

If users use USDC as a loan or collateral, they may face the risk of being unable to repay or be liquidated. The oracle used by Aave for USDC value calculation is Chainlink, and the backup oracle is Uniswap. The impact on users who deposit ETH to borrow USDC is limited, and they can take the opportunity to repurchase USDC to redeem the original collateral with less capital. Compound, on the other hand, uses a fixed $1 value, which can lead to risk.

Specifically, when the price of USDC falls, the lending agreement may face the following risks:

Loan-to-value (LTV) ratios of collateralized USDC borrowers may exceed liquidation thresholds, causing their collateral to be liquidated.

Liquidators may not be able to make enough profit to cover their transaction costs and risks.

Aave's Security Module (SM) may not be able to cover potentially distressed debt, causing the value of the Aave Token (AAVE) to decline. (Note: AAVE token holders can stake AAVE in the security module in exchange for stkAAVE tokens and receive AAVE rewards. If the Aave protocol suffers a loss of funds, the security module can be activated to deduct from the stkAAVE holder Up to 30% of funds to cover losses)

More valuable stablecoins such as USDT on the lending platform may be borrowed out, causing depositors to have the risk of not being able to recover the full amount of USDT.

4D review USDC unanchored storm: crisis and opportunity in the DeFi ecological giant earthquake

These risks can be mitigated by:

Pause the USDC market or set the LTV ratio to zero to prevent further lending activity.

Increase USDC’s liquidation rewards or use a dynamic price mechanism to incentivize liquidators to participate in the market.

Use ecosystem reserves or other assets to increase the capital adequacy and resilience of the security fund.

Trading applications: If users use USDC as a trading pair or liquidity provider, they may face the risk of loss or lock-in. For example, on the Uniswap platform, users can trade between any two cryptocurrencies or provide liquidity to earn fees. If users use USDC as a trading pair or as a currency in a liquidity pool, when the price of USDC falls, they may lose funds because the exchange rate deteriorates or they cannot exit. In addition, some applications in derivatives trading applications that default USDC to 1 also bring opportunities for arbitrage.

secondary title

Take the derivatives agreement GMX as an example

GMX is a decentralized perpetual exchange built on Arbitrum. In GMX's trading mechanism, users do long and close positions to obtain the subject matter of the transaction, not the margin itself, and the subject matter of the transaction is priced in USD. Arbitrageurs use the discounted USDC to open positions and pay at the standard USD price.

After this incident, GMX and its similar mechanism agreements may optimize the price curve of stablecoins in the future. When stablecoins are used as margins, the actual value of stablecoins used by users when placing orders is used for calculation.

In GMX’s Swap, the price of USDC/ETH is the price of ETH/USD, so there is also room for arbitrage in Swap.

In addition, due to market turmoil, this type of leveraged trading platform has also brought a large amount of fee income, which has reached 2 to 3 times that of normal days.

image description

first level title

Summarize

Summarize

image description

image description