Why is the CFTC suing Binance? How will it affect the market?

This evening, the news that Binance was sued by the CFTC swept the encryption world.

secondary title

Who is being prosecuted?

This regulatory move is different from previous ones.

secondary title

Why is the CFTC suing?

According to the lawsuit documents released by the CFTC, Binance is involved in providing trading services to US investors and its compliance issues, and mainly makes four specific allegations:

1. Binance provided trading services to U.S. investors without CFTC registration;

The CFTC pointed out that Binance relies on customers located in the United States to generate revenue and provide liquidity for its various markets, but Binance has never registered with the CFTC in any form and disregards federal regulations that are critical to the integrity and vitality of the US financial market. Laws, including laws requiring the implementation of controls designed to prevent and detect money laundering and terrorist financing. This is a violation of Commodity Exchange Act (“Act” or “CEA”) 7 USC §§ 1-26 and CFTC Regulations (“Regulations”) 17 CFR pts. 1-190 (2022 ).

image description

(Image courtesy of CFTC)

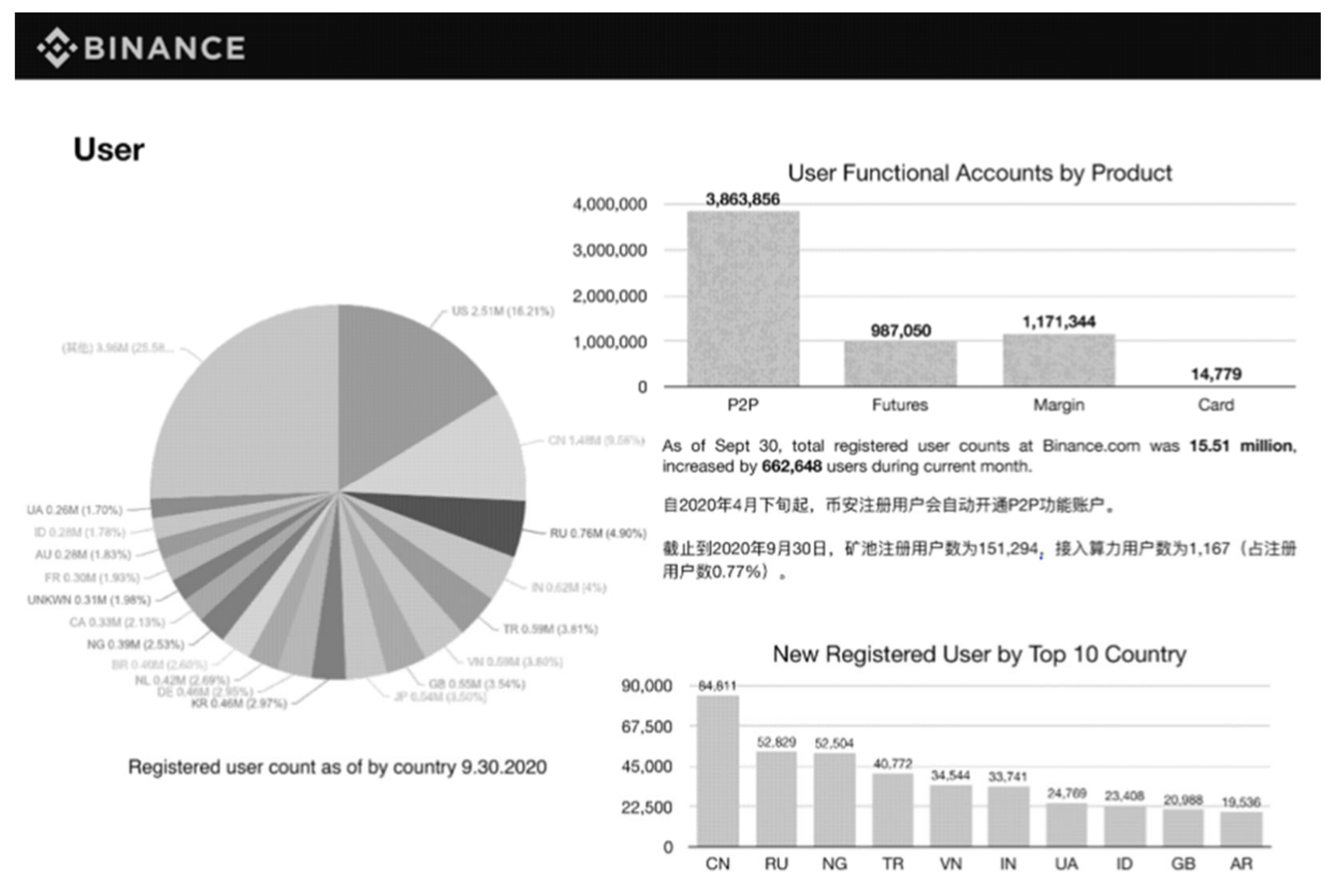

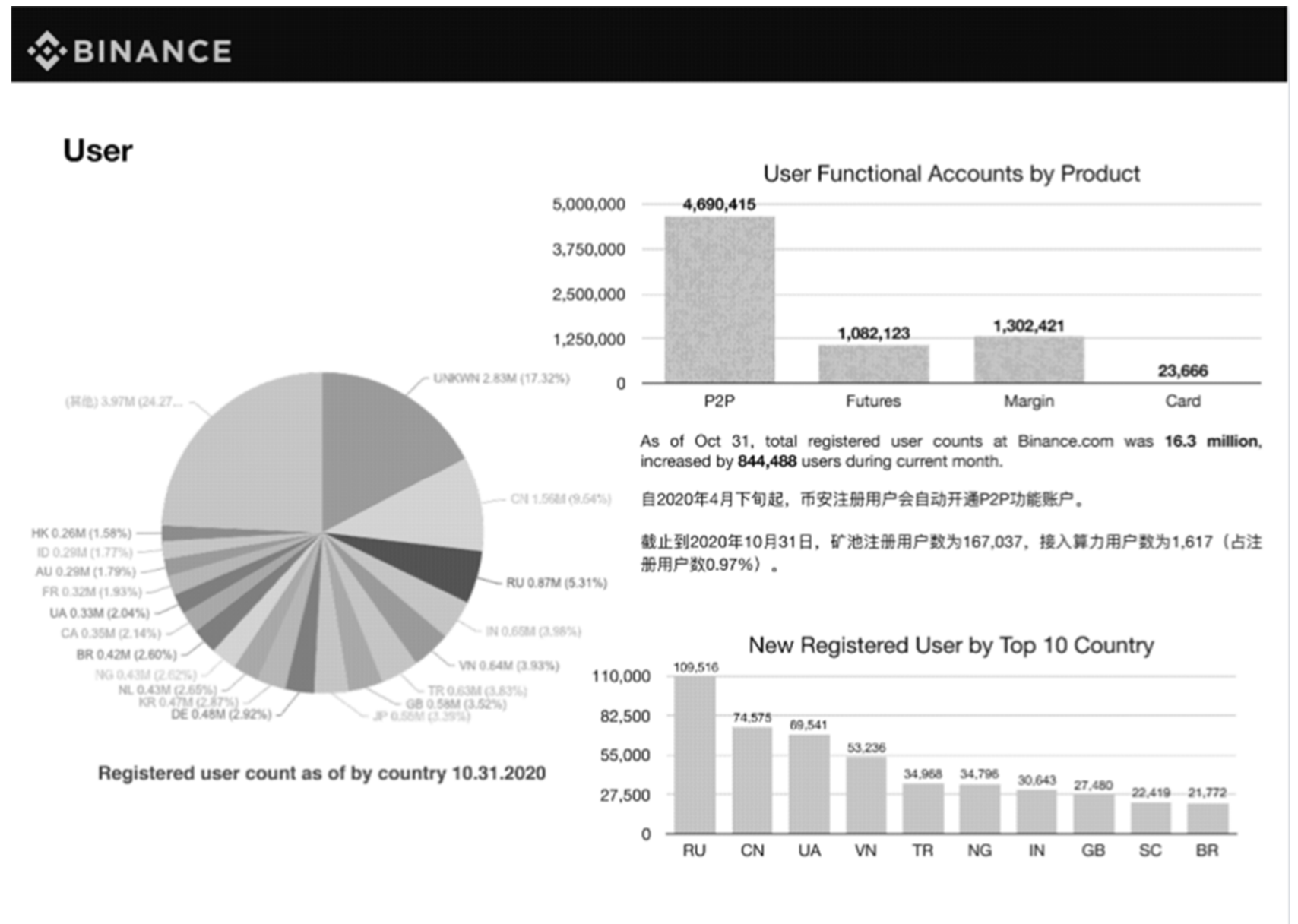

The CFTC noted that in October 2020, CZ directed Binance personnel to replace “United States” with “UNKWN” in certain data fields in Binance’s internal database. Therefore, in Binance's monthly revenue report for October 2020, about 2.83 million "unknown" users should actually be US users.

It can be concluded that customers located in the United States provided Binance with a considerable amount of revenue during certain time periods in the past.

2. Binance’s exchange platform allows US investors to conduct leveraged trading and futures trading;

The CFTC believes that under the direction and control of CZ, and with the deliberate and substantial assistance of Lim, Binance has solicited and accepted multiple types of orders from U.S. persons involving cross-border digital asset spot and derivative transactions of commodities, including Futures, options, swaps and leveraged retail commodity trading. These digital assets include Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC). Therefore, it can be concluded that Binance’s exchange platform allows leveraged trading and futures trading for US investors.

3. The CFTC believes that Binance violated the regulations of the US Commodity Futures Trading Commission, failed to issue necessary risk disclosures to customers, and failed to meet other requirements of the regulations;

Once Binance settles down to provide trading services for U.S. customers, it will be difficult to be exempted from supervision. The CFTC alleges that Binance violated U.S. Commodity Futures Trading Commission (CFTC) regulations by failing to issue required risk disclosures to customers and by failing to meet other requirements of the regulations. Specifically, Binance failed to comply with the CFTC’s Anti-Money Laundering and Counter-Terrorism Financing regulations and was not registered as a derivatives dealer.

4. The CFTC wants the court to order Binance to stop the violation and require Binance to pay a fine.

The CFTC hopes that the court will order Binance to cease the violations and require Binance to pay civil monetary penalties and remedial ancillary relief measures, including but not limited to trading and registration injunctions, restitution of ill-gotten gains, pre-judgment and post-judgment interest, and any other damages the court deems necessary and appropriate. other remedies.

secondary title

non-compliance chief compliance officer

In this CFTC prosecution, only two natural persons were named as defendants. One is CZ, and the other is Samuel Lim, Binance’s first Chief Compliance Officer.

The CFTC said that Samuel Lim was the chief compliance officer (CCO) hired by Binance in April 2018 and will hold the position until at least January 2022. During his tenure as CCO, Lim directed, directed, and assisted Binance employees and customers to circumvent compliance controls designed to detect and prevent breaches.

But the involvement of the compliance officer did not save Binance from prosecution. The CFTC believes that Changpeng Zhao and Samuel Lim played a key role in Binance’s violations.

Lim provided willful and substantial assistance in Binance’s illegal activities. Specifically, Lim did not monitor Binance’s activities and instead actively facilitated violations of U.S. law. And guide Binance to avoid supervision.

The CFTC believes that Binance has a series of ways to circumvent regulation. For example, at a management meeting in June 2019, CZ stated that if serving the United States or countries subject to US sanctions (about 28), all relevant documents of customers need to be reviewed. But this is not a good fit for Binance’s corporate structure. Therefore, Binance decided to "not have US users". Binance took various measures to “keep clean in various countries” by setting up various entities in multiple jurisdictions, and Lim also provided Binance with deliberate and substantial assistance in a series of illegal activities.

secondary title

Binance Responds, Market Drops

After being sued, CZ once again gave the classic response-4.

This response has been used by him many times. It means "Ignore FUD, fake news, attacks, etc.", that is, ignore FUD news, fake news, malicious attacks, etc.

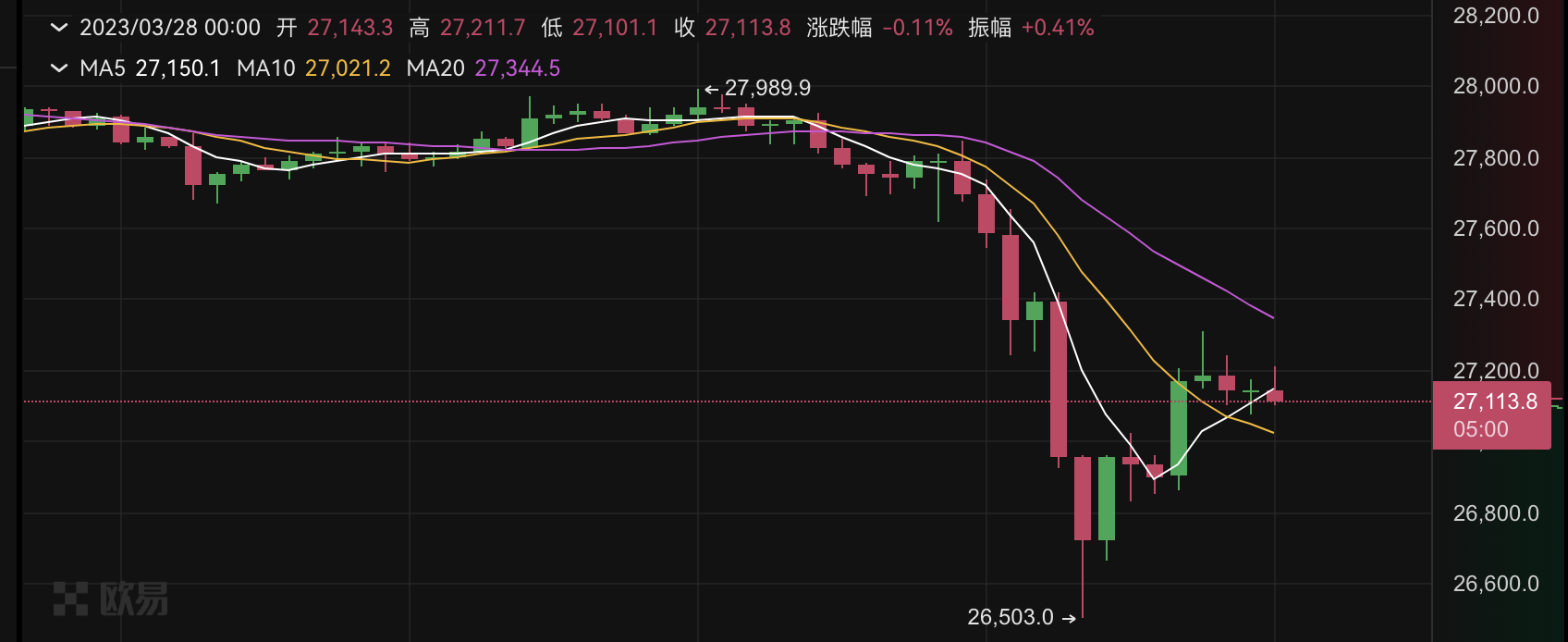

The market's panic about this regulatory action quickly reflected in the market. Ouyi OKX market shows that after the prosecution incident fermented, BTC fell rapidly, once falling to around 26,500 US dollars, and the intraday decline was close to 5%. The current price has stopped falling for a short time and is currently reported at 27110 USDT.

In this prosecution, a small detail triggered extensive discussions in the community-the CFTC obtained some of the Signal chat records within Binance.

According to the CFTC, CZ communicated with numerous Binance executives, employees, and agents through Signal with automatic deletion functions. It is currently impossible to confirm how the CFTC obtained CZ’s Signal-related chat records, and this information leak has also sparked widespread discussion in the community. Signal is loved by the crypto community for its security of communication, and SBF had previously applied to the court to use the chat software after he was released on bail.

At present, the regulatory battle between CFTC and Binance has just kicked off, and Odaily will continue to follow up and report on this incident.